Trading expert Jay Soloff claims current economic tensions offer opportunities for untold wealth through an unconventional trading approach.

Is Jay’s strategy really on point? I investigate in this Market Momentum review.

>> Try Market Momentum Now (Special Price) <<

What is Market Momentum?

Market Momentum is a brand-new service led by Jay Soloff and published by Investors Alley.

It takes a different approach to generating wealth than more traditional platforms, using momentum indicators to leverage market moves in either direction.

Soloff shares his recommendations not through a newsletter but through two unique lists designed to continuously roll cash flows into new opportunities.

By foregoing buy-and-hold methodology, Market Momentum opens the door to gains even when market sentiment turns bullish.

I’ll get into the nuances of the service in a bit, but let’s first take a closer look at our guru.

Who is Jay Soloff?

Jay Soloff is a market veteran with more than two decades of experience flinging stocks.

He got his start at the Kansas City Board of Trade in the Wheat Futures pit, quickly moving upward as his skills grew.

The guru was a former pro market maker on the Chicago Board Options Exchange, still the largest options trading exchange in the world.

Beyond that, Soloff spent time with Wall Street firms to design the options market making software that gave these types of exchanges a foothold in the U.S.

To complement his on-the-job experience, Jay holds two Masters degrees: an MBA and Master of Science in Information Management.

Saying he’s qualified to educate the rest of us on options trading feels like an understatement.

Now, he’s lead editor for several of Investors Alley’s premium publications, including Market Momentum.

Is Jay Soloff Legit?

Being an options trader for so long, Soloff has had a number of reportable successes.

During 2019’s volatility, his service won 84% of its trades. In 2020, the COVID-19 crisis sent the win rate even higher.

Those following Soloff’s suggestions could have turned profits on 45 of 47 trades in 2021, and his work still boasted a 70% success rate in 2022.

He saw another uptick last year, with 93% of 65 total trades coming out on top.

More than 10,000 readers follow Jay’s work, watching him trade live through weekly live trading room sessions and monthly webinars.

>> Try Market Momentum TODAY<<

Joy Soloff’s Presentation: Trump’s Economic War

If you’re seeing what I’m seeing, the world certainly feels more chaotic than ever.

To top it all off, President Trump recently instituted an aggressive trade assault that’s completely shaking up our economy.

We’re all left wondering just how it’s going to affect our way of life and our finances.

Even so, Jay Soloff finds excitement amid the chaos.

What if there was a way to use that economic uncertainty to your benefit and actually walk away with some significant profits?

Join me as we explore Soloff’s take on the matter.

Soloff’s Take on Modern Market Moves

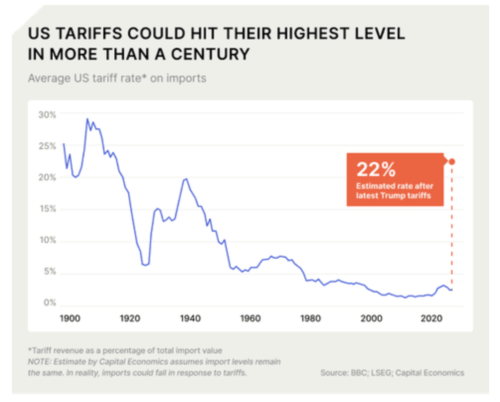

Believe it or not, this isn’t the first time America has instituted some serious tariffs on the rest of the world.

The last two notable eras came just before World Wars I and II, during somewhat similar times of rising international tension with allies and enemies alike.

Truth be told, neither instance disrupted trade with our neighbors despite the markets falling into periods of volatility as war broke out.

We may be seeing war of a different kind unraveling today, but Soloff parallels today’s market with the ups and downs of 2019.

Many folks watched their wealth vanish as the Fed found itself stuck between inflation and recession and the stock market didn’t know what to do.

Soloff believes the issue stemmed from people opting to play it safe instead of taking advantage of market momentum.

How to Play Uncertainty for Profit

Volatility from price movements actually creates opportunities for gains despite the flux market momentum brings.

Jay’s ticket to success are options plays that offer a chance to earn wealth whether those movements are positive or negative.

More specifically, he takes advantage of the increasing number of income ETFs fueled by volatile market conditions.

By rolling income from momentum trading into future plays, Jay is effectively setting up a system of gains without requiring traders to put more money into their brokerage accounts..

The concept is genius, as long as you know where to put your initial investment.

Luckily, Soloff has already done the work and knows which momentum indicators to look for.

You can get immediate access to his findings by signing up for his Market Momentum service, plus a lot more.

Let’s unpack everything you receive when you become a member.

>> Click here to get started <<

Investors Alley Market Momentum Review: What’s Included?

Check out all the features that come with a Market Momentum subscription:

One Year of Market Momentum

To no one’s surprise, you’ll get a full year of Soloff’s Market Momentum service as soon as you sign up.

Unlike many of the other platforms I’ve reviewed, it doesn’t come with a newsletter that can be a bit of a slog to read through.

Instead, it utilizes the power of high-yield income and strategic trades to lay the groundwork for a powerful system.

Through frequently updated key lists, you can eke out opportunities you can take advantage of right away.

Jay remains present throughout the entire process, sharing all the insights you need to maximize your success.

There are some extra goodies mixed in here as well, which I’d like to break down in detail.

The Income List

As part of the Market Momentum package, Jay sends out 3 to 5 of his top income ETF plays each and every month in what he calls “The Income List”.

These aren’t your typical weak dividend payers; instead often turning out yields in the triple-digit range that equate to significant cash flow.

The Income List is the core of Jay’s investment strategy, generating steady monthly income that ultimately fuels your next trade.

Even if you take a conservative approach here, the success Jay typically sees far surpasses similar opportunities I’ve seen that can help curb the damage from increasing costs due to inflation or tariffs.

The Directional List

The Directional List is where Jay’s strategy puts that extra income to work.

It’s here you’ll jump on fast but carefully thought-out ETF trades designed to maximize returns, whether there’s positive momentum, negative momentum, or even something in between.

The guru taps into momentum indicators and volatility signals to keep ahead of profit-generating market moves.

Needless to say, these are high-probability setups thanks to Jay’s ability to understand market momentum.

Because of this, you may not see a trade every week, as Soloff doesn’t want to waste anyone’s time or money.

Monthly Live Strategy Sessions

Once per month, Jay invites his readers into a live strategy session where he delves into the latest market trends, his top trades, and new ETF opportunities.

He leaves nothing out, explains what’s working, areas facing change, and what he forecasts on the horizon.

Each briefing is about an hour long, and you get to see in real time how Jay handles certain situations.

It’s an incredible opportunity to learn from an expert, and there’s even time for questions and answers so you can address issues pertinent to you.

Real-Time Trade Alerts

In addition to having Jay’s lists, you’ll receive alerts via email and text message every time he goes to make a trade.

It’s way more than a notification, as Soloff explains precisely what he’s doing, along with an actionable plan for you to do the same.

As long as you don’t have these messages going into a spam folder, you’ll never miss a trade as long as you’re a Market Momentum member.

After all, Jay built the service for busy folks who don’t have time to watch the computer all the time.

That’s certainly a blessing for a guy like me who has a life outside of my portfolio.

Private Portfolio Page

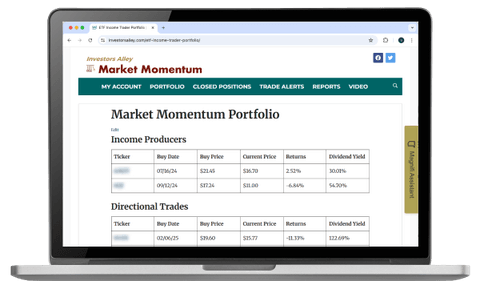

Speaking of portfolios, Jay tracks all his active trades through a personalized webpage on the Market Momentum site.

Logging in allows you to see everything at a glance, so you can see how his recommendations are doing whether you decide to partake or not.

He also captures upcoming trades as well, so you’re prepared in advance of a new list dropping or a real-time alert.

It’s all super easy to follow and has some additional features to help keep your trades organized.

Market Momentum Special Reports

New members get access to the following special reports as an added bonus for joining:

The Top 3 Picks to Profit in America’s Trade War

In this exclusive guide, Soloff showcases three ETFs he feels are best suited to deliver big gains as the trade war escalates.

Each one is hand-picked by the guru himself, and he delivers them alongside a detailed explanation of why they made this list.

I really appreciate that, despite the amount of information here, it’s a surprisingly easy read.

Whether you’re new to ETFs or have been trading them for a while, you’ll walk away with a clear understanding of how you can benefit from these unique plays amid the current economic turmoil.

The Income Engine: How to Collect Massive Monthly Distributions with ETFs

This special report highlights a number of income ETFs Jay’s been using for some time as the power behind his momentum strategy.

He explains how he uses these ETFs to collect nice monthly payouts from major companies without having to own the stocks themselves, helping to reduce your risk at the same time.

You’ll also learn how to decipher good ETF opportunities from the bad, and the technical analysis he uses to unravel which category they fall into.

It’s a powerful read, since these funds could become the core of a successful wealth-building strategy.

>> Tap into the team’s strategy HERE<<

60-Day Satisfaction Guarantee

To lower the barrier to entry, Jay’s letting you play around with Market Momentum for two full months before making a decision on the service.

If there’s something you don’t like, simply reach out and the customer support team will credit you back your membership fee to use on one of the other 25+ available research services.

While it’s not a cash refund, there’s little doubt you’ll find something in the repertoire that resonates with your trading style.

FAQs

Here are answers to the most common questions surrounding Market Momentum right now:

How Is Market Momentum Different From Other Trading or Income Services Out There?

No two services I’ve ever seen are exactly alike, but Market Momentum really stands out by combining two money-making strategies into one game-changing system.

Instead of having to open your piggy bank time and again, the platform lays the groundwork for a compounding system that adapts to any market situation.

In essence, high-yield ETFs work in tandem with quick trades designed to profit from instability.

Can I Still Benefit if I’m Not Able To Follow the Market Every Day?

Yes, it’s certainly possible to put Market Momentum to use even if you’re not watching the market every day.

Most of us are busy, and Jay sends out real-time alerts whenever he’s making a play so you don’t have to research them on your own.

His lists and portfolio often reveal future trades as well, so you can be ready at a moment’s notice without being stuck at a screen.

Does Momentum Trading Really Work?

While I won’t say momentum trading is easy, the system can work incredibly well for those who are well-versed.

Manipulating options takes a keen understanding of the market, which is why having Jay in your back pocket is a huge win here.

Following the example of someone who’s been successful using momentum trading for decades is undoubtedly one of the best ways to win in any market condition.

Does Momentum Investing Work in a Bear Market?

The beauty of momentum investing is that it’s possible to generate wealth whether the market’s in full-on bull mode or in one of the worst bears we’ve ever seen.

The key is volatility and movement, which even downward trends have in spades.

Utilizing options, knowing the direction momentum is heading toward is key for making profits, not how high a stock’s price climbs.

>> Join and Reveal the Market Momentum NOW <<

Pros and Cons

After thoroughly reviewing Market Momentum, here are my top pros and cons:

Pros

- Features a guru with decades of experience in momentum trading

- Includes one year of service

- A two-tiered strategy for compounded gains

- Monthly live sessions

- Real-time trade alerts via text and email

- Two special reports

- 60-day satisfaction guarantee

- Low introductory price

Cons

- Focuses heavily on short-term plays

- No community chat or forum

Market Momentum Reviews by Members

I’m quite impressed with what Market Momentum has been able to do, but don’t just take my word for it.

Here are some reviews by actual members who have also put the service to the test:

As you can see, members really enjoy the trade setups and how easy it is to follow Jay’s plan, so it seems like Market Momentum is legit.

How Much Does Market Momentum Cost?

You can currently pick up a year of Market Momentum for $997, which feels like a steal considering everything you get with your subscriptiont.

It costs less than $20 per week for a number of trade opportunities that could generate long-term gains that grow in time, thanks to the compounding nature of how it all works.

Soloff will honor this price point when it comes time to renew, giving you the same low rate each year as long as you remain a member.

Is Market Momentum Worth It?

I’ve spent quite a bit of time discovering every nook and cranny of Market Momentum, and I’m really excited about what I see.

Market sentiment is at a surprising low, and we’ve seen trillions of dollars fall off the table.

While most are raising the alarm, Jay Soloff has found a way to use the turmoil to his advantage – and ours, if we’re willing to listen.

Jay’s desire to help is apparent in the educational materials he packs into this bundle, along with detailed lists and instructions on how to momentum trade for a shot at big gains.

Few gurus take the time to livestream their thoughts, yet Soloff fearlessly walks his subscribers through trades with his own money.

The bonus materials and money-back guarantee are excellent additional incentives if, for some reason, you’re looking for a little more meat.

Sign up today before this special deal and all it entails disappears forever.

>>Sign up to Market Momentum for 85% off <<

Tags:

Tags: