One Ticker Trader has built up a bit of buzz online, and many want to know if the service’s lead is really up to the task.

Check out my full Larry Benedict review to get the scoop on his credentials and his latest investment newsletter.

>> Get Access to Trigger Stocks TODAY<<

Who Is Larry Benedict?

Larry Benedict is the CEO of Opportunistic Trader and the mind behind One Ticker Trader.

His area of expertise is options trading, and many of his premium services lean into this strategy.

I’ll dig into his services later, but let’s start with a look at his background.

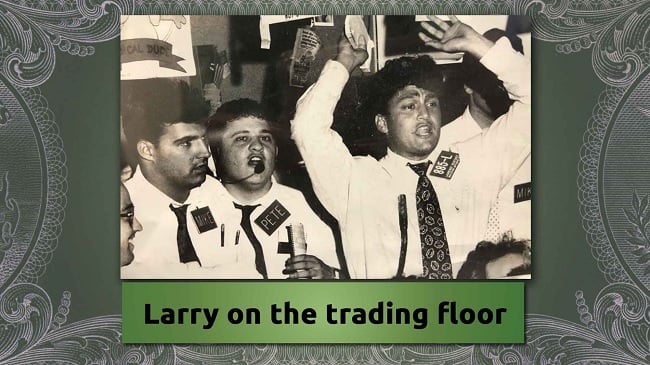

Larry kicked off his trading career back in 1984 at the Chicago Board Options Exchange.

He started on the trading floor as a market maker in equity derivatives products.

He eventually left CBOE and joined up with the American Stock Exchange.

Later on in 1989, Spear Leeds & Kellogg (SLK) tapped him on the shoulder to become its options specialist.

Goldman Sachs bought out SLK in 2000. And Larry took the opportunity to start his own firm, Banyan Equity Management.

His success with Banyan earned him a spot on Barron’s list of the most successful hedge funds. He was also featured in Market Wizards.

>> Sign up to Larry’s One Ticker Trader TODAY<<

Is Larry Benedict Legit?

Larry Benedict is as legit as they come.

His unique investment strategies led him to a perfect run from 1990 to 2010, where he didn’t have a single losing year.

That timeframe includes the big crashes we experienced in 2000 and 2008.

These successes resulted in more than $274 in profits for his clients and put his hedge fund in the top 1% worldwide.

It also led to an international following and top-tier clients such as the Bank of New York, the Royal Bank of Canada, and even the Saudi National Commercial Bank.

Before stepping away from the hedge fund world, Larry had more than $1 billion under his control.

What Is One Ticker Trader?

One Ticker Trader is an options-focused newsletter helmed by Larry Benedict and published by Opportunistic Trader.

Memberships come with a weekly newsletter, bonus reports, trading resources, and more.

As the name suggests, the trade ideas dial in on one ticker at a time.

The biggest draw is the steady stream of recommendations.

Many research services only offer one trade idea. However, the One Ticker team aims for three to five.

Larry can deliver this many trade ideas because they’re tied to one stock or theme. He’s not splitting his attention trying to cover multiple companies at once.

Also, people live busy lives. Not everyone can execute on every trade recommendation. It’s helpful that members can wait until the next idea if they missed timing an entry.

This is just scratching the surface of everything on offer. I’ll cover it in more detail in the next section.

What Is Opportunistic Trader?

Opportunistic Trader is a market research publisher led by Larry Benedict. Unlike many publishers, this one has a very strict focus: options.

I appreciate that Larry sticks to what he knows best instead of chasing the latest investment trends.

Many of his publisher’s newsletters follow the One Ticker Strategy. Each one has its own twist on the formula.

One Ticker Trader is the publisher’s entry-level offering. It’s also the most economical.

So if you’re on the fence about signing up for one of the premium newsletters, One Ticker Trader might be the way to go.

>> Tap into the team’s strategy HERE<<

What is Larry Benedict’s Strategy?

Larry Benedict uses a range of options strategies, but he’s probably best known for his One Ticker Strategy.

It’s a simple approach that targets on one stock at a time. Combined with options, it offers the opportunity to make money off a stock regardless of the direction it moves.

In essence, Larry becomes an expert on one stock or investment theme at a time. He then recommends options contracts based on where he believes the stock could move next.

Once he believes the trade has run its course, he moves over to the next stock or theme.

Unlike buy and hold strategies, this approach provides the opportunity to profit in down markets without waiting for a reversal.

In the latest presentation for One Ticker Trader the newsletter taps into an iteration of Larry Benedict’s strategy called The Single Stock Retirement Plan.

Larry Benedict’s Latest Presentation: The Top 3 Trump Trades for 2025

Larry Benedict’s newest marketing campaign is built around a bold idea: that Trump’s second term could spark a historic wave of market volatility.

In his latest video presentation, he lays out a high-stakes prediction: a coming July 30th Fed meeting could trigger a $194 trillion market event. According to Benedict, this is the moment to act.

His pitch? That smart traders can profit from these swings using a set of leveraged assets he calls Trigger Stocks.

These are central to his “Top 3 Trump Trades” strategy, a timely blueprint built around market reactions to Trump’s policies and public statements.

While he doesn’t reveal the full details upfront, Benedict claims to have identified three specific opportunities poised to surge (or crash) based on predictable political and economic triggers.

Let’s break down the core arguments from his presentation to see what’s behind all the buzz.

The Trump “Trigger” Market: Why Volatility Equals Opportunity

Benedict argues that Trump’s return to the White House has reignited volatility in the markets, and he sees that as a good thing.

He points to the National Bureau of Economic Research, which found that 90% of major market jumps can be tied to clear catalysts like economic policy shifts. Trump, Benedict says, is the ultimate catalyst.

He walks viewers through a handful of examples, including the Lockheed Martin sell-off after a Trump tweet, a $437 billion rally following the Tax Cuts and Jobs Act, and major swings in companies like Tesla, Coinbase, and Strategy (a crypto stock).

To Benedict, these are signs that Trump’s actions don’t just move the news cycle, they move the markets.

He even draws a comparison to Ronald Reagan’s battles with the Fed in the 1980s, which led to a 289% gain in the S&P 500.

Benedict claims a similar situation could be brewing now, pointing to Executive Order #14215, which he says gives Trump influence over typically “independent” agencies like the Fed. Whether that holds up legally is debatable, but it’s a key part of the urgency behind his forecast.

He also notes that the VIX, Wall Street’s “fear index,” surged 80% since Trump’s inauguration, further supporting his idea that volatility is ramping up.

“Trigger Stocks”: The Secret to Doubling Market Returns

“Trigger Stocks”: The Secret to Doubling Market Returns

The centerpiece of Benedict’s strategy is something he calls Trigger Stocks.

These are not traditional investments; they’re actually leveraged ETFs that track the daily performance of individual stocks, but with built-in 2X or 3X leverage.

That means if a stock moves up or down 10%, a Trigger Stock tied to it could swing 20% or 30%.

According to Benedict, these instruments make it easier than ever to trade volatile markets without using margin or borrowing money.

He shows examples of NVIDIA, a popular tech stock, gaining 8.9% in a day, while its associated Trigger Stock jumped 17.3%.

On down days, he claims some Trigger Stocks have flipped a 17% loss into a 34% gain.

The key takeaway is that these leveraged ETFs allow traders to potentially profit in either direction, as long as they select the right ones and time their moves correctly.

Of course, like all leveraged products, Trigger Stocks come with risks. Benedict touches on this but focuses more on the upside, something to keep in mind for anyone considering this strategy.

How to Capture the $194 Trillion Wave with Benedict’s Strategy

At the heart of Benedict’s offer are three stocks he believes are set to move big in Trump’s second term.

For each one, he gives both a bullish and bearish play, meaning you’ll know how to potentially profit whether the stock jumps or tanks.

His recommendations are backed by step-by-step trading instructions, entry and exit points, and detailed timing predictions tied to upcoming policy announcements.

The strategy is designed to take full advantage of volatile sectors, like tech, energy, and crypto, where Trump’s actions tend to spark fast-moving reactions.

Each recommendation comes with risk management guidance and is part of a larger set of reports, including:

- Trump’s Trigger Tickers: 3 Stocks to Watch for Outsized Gains

- How to Boost Your Profits with Leveraged ETFs

- Drill Baby Drill: How to Leverage Your Wealth in the U.S. Energy Market

- The 3X Retirement Accelerator

Members also get real-time trade alerts, a full model portfolio, and access to Larry’s market commentary through the One Ticker Trader platform.

One Ticker Trader Review: What Comes With The Deal?

One Ticker Trader is packed with standout features that let members tap into hedge-fund-level strategies. Let’s start by looking at the newsletter.

One Ticker Trader Weekly Newsletter

One Ticker Trader Weekly Newsletter

One Ticker Trader‘s weekly newsletter is where members receive the latest trade recommendations.

Each recommendation is backed by supporting analysis.

They also take extra care to be informative and succinct. There’s no fluff or needless jargon.

Also, as mentioned, the number of trade ideas varies. The team only issues a rec when they believe there’s an emerging opportunity.

This means that some weekly issues might not have a trade idea.

More doesn’t always equal better, anyways.

Larry’s Open Recommendations

This resource provides a convenient place where members can keep track of all open positions.

It includes the ticker, buy-up-to-prices, and supporting analysis.

You can quickly skim the portfolio to get up to speed with the team’s most recent ideas.

Trade Alerts and Updates

Trade Alerts and Updates

The service makes sure members stay up to date with frequent alerts.

These alerts include sell recommendations, market forecasts, as well as bonus trade ideas.

Given that this is an options-focused newsletter, it’s a critical feature to stay in the know about any market moves that could affect an investment.

Refund Policy

Refund Policy

New members signing up under the One Ticker Trader Retirement Plan package have access to a 60-day money-back guarantee.

This means you have 60 days to test out the service. If you don’t feel like it’s a good fit, you can opt for a full refund.

The industry average for refunds is about 30 days. So this doubles the typical window.

Even if you don’t stick with the service, you can keep the bonus reports.

How Much Does One Ticker Trader: Trigger Stocks Cost?

One Ticker Trader typically retails for $499 a year. This is a solid price, but the team is sweetening the deal with the One Ticker Trader Retirement Plan bundle.

New members can sign up for the introductory rate of $199. This shakes out to an impressive 60% discount on the first year.

And there’s also no trade-off.

New members can tap into all the exclusive trading resources I mentioned earlier. It’s that simple.

You’re locked into that low introductory rate when you re-up your subscription next year, making this a deal that keeps on giving.

Is Larry Benedict’s One-Ticker Trader Worth It?

After a thorough Larry Benedict review, I have to answer “yes.” He’s a proven analyst with an excellent eye for options trades with potential.

His publisher, Opportunistic Trader, has a range of solid newsletters worth checking out, and One-Ticker Trade is probably the best all-around option.

If you get started under the Single-Stock Retirement deal, you’ll also get a bunch of great add-ons.

Plus, you get a steep discount, and your subscription is backed by a 60-day money-back guarantee.

One-Ticker Trader is legit, and I highly recommend it for anyone in the market for an outside-the-box approach to the options market.

>> That’s it for my review. Sign up to One Ticker Trader for 85% off <<

Tags:

Tags: