Mike Rykse claims he’s uncovered a strategy that can turn a few minutes at the end of the trading day into potential gains by the next morning.

Is the guru blowing hot air, or does his straightforward method that aims to capture fast-moving opportunities in the market overnight really stand up under pressure?

Join me as I investigate Mike’s claims in this Overnight Pop Trades review.

>> Join Mike Rykse’s Overnight Pop Trades <<

What is Overnight Pop Trades?

At its core, Overnight Pop Trades is a research service that focuses on short-term options trades.

What makes this system stand out is that trades are designed to be placed in the last 15 minutes before the market closes and exited the next morning.

That means you don’t need to monitor screens all day or have years of trading experience.

Members receive regular actionable options trades that you can put to work right away.

Rykse follows that up with educational info, and a slew of other materials you can utilize to increase your knowledge and efficiency at this particular game.

I’ll cover these features in detail shortly, but I first want to take a closer look at the man behind it all.

>> Claim Two Years of Overnight Pop Trades <<

Who is Mike Rykse?

Mike Rykse has spent more than two decades in the trenches of the options market.

For the past 17 years he has worked with NetPicks, a well‑established trading education company that has been around since 1996.

Over those years, he has trained thousands of students on practical ways to use options without getting lost in complicated theory.

What makes Rykse stand out is his ability to take something as complex as credit spreads and break it down so that everyday people can follow along.

His own trading is rooted in discipline and repeatable rules, and that carries directly into Overnight Pop Trades.

Rather than promising shortcuts or gimmicks, he emphasizes consistency, structure, and risk management.

That blend of experience and teaching ability has made him a trusted name in the trading education space, and it’s the foundation of this service.

Is Mike Rykse Legit?

Yes, Mike Rykse is the real deal.

His background stretches back to 2002 when he began actively trading options and later joined NetPicks.

With nearly 25 years of consistent involvement in the markets, he has seen multiple bull and bear cycles and adjusted his approach along the way.

Beyond personal trading success, his credibility comes from his work with NetPicks, where he has been instrumental in developing options training programs and alert services that have stood the test of time.

His reputation for honesty and the longevity of his career add weight to his legitimacy.

When someone has been showing up for more than 20 years and still has an active following, it’s hard to question whether they’re authentic.

>> Start Trading with Mike Rykse Today <<

What is the “Overnight Pop Trades” Presentation?

Most people assume the only way to succeed in trading is to sit glued to screens all day, chasing every tick of the market.

The truth is, that approach leaves many exhausted and still empty‑handed.

In the presentation, Mike Rykse points out that folks are missing out on short bursts of opportunity that happen at a very specific time of day.

These small windows often get ignored, yet they can be some of the most profitable if you know how to spot them.

The Hidden Power of Market Timing

Rykse explains that toward the end of the trading day, large ETFs like SPY and QQQ often show small but critical inefficiencies.

I’ve seen this play out myself while following the service, entering a position just before the close and closing it within hours of the market opening the next day.

These aren’t wild swings based on hype; they are repeatable setups backed by rules that filter out the noise.

That’s what makes them different from random bets or guesses.

How the System Captures It

Instead of trying to predict every tick, the strategy focuses on defined‑risk option spreads.

The beauty is that it takes less than five minutes to put on a trade. There’s no overthinking, no chasing headlines.

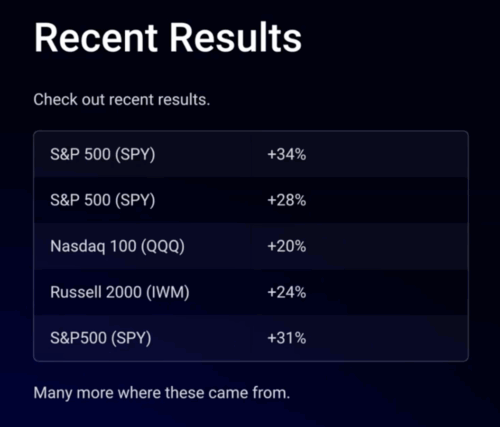

The presentation shows how members have made anywhere from 16% to 34% overnight on these trades, and those kinds of results get your attention quickly.

Why This Matters Now

The entire point of the presentation is that you don’t need to reinvent the wheel or spend endless hours studying.

The opportunity is in piggybacking on a process that’s already proven itself over years of live trading.

If you want to see these trades in action and experience what it feels like to capture profits while the market is closed, then joining the service is the next logical step.

By signing up for Overnight Pop Trades, you position yourself to benefit from the same overnight setups that have been working for members already.

And that’s the perfect lead‑in to what you actually get when you become a member..

>> Access Overnight Pop Trades Now <<

What Comes With Overnight Pop Trades?

Check out all the features that come with Overnight Pop Trades:

Two Years of Overnight Pop Trades

The centerpiece of the membership is the trade alert package.

Normally, this subscription is offered for one year, but right now there’s a special promotion where you receive an extra year at no additional cost.

That means you get two full years of trade alerts for the price of one.

During that time, you’ll receive precise step‑by‑step instructions on every trade Rykse and his team recommend, including which ticker to trade, which strikes to choose, and when to enter and exit.

Having two years of uninterrupted access not only saves money but also gives you plenty of time to master the method, build consistency, and develop confidence without the pressure of a short‑term subscription expiring.

Access Alerts Through Multiple Modes

Not everyone checks email constantly, and that’s why the service delivers alerts through several channels.

This flexibility ensures you never miss a trade, even if you’re away from your computer.

The alerts themselves are timed with precision, and entries are sent out in the final 15 minutes of the trading day, giving you just enough time to get into position before the market closes.

The exits typically come the very next morning, often within the first hour of the market opening.

You don’t need to spend hours glued to charts, and you don’t need advanced software. Everything is designed for speed and simplicity.

In practice, I found the text alerts especially useful because they pop up instantly on your phone, leaving plenty of time to act without stress or delay.

Private Owner’s Club

The Private Owner’s Club is where members connect and get access to additional tools.

If you’re new, it’s reassuring to know you’re not left alone, you can ask questions, share experiences, and get guidance directly from Mike and his team.

It feels more like being part of a tight‑knit group rather than just subscribing to a faceless newsletter.

That sense of community is often what keeps members engaged and motivated.

>> Get Mike Rykse’s Trade Alerts <<

Two to Four Trade Opportunities Every Week

Consistency matters in trading, and the service is designed to deliver just that.

On average, members can expect between two and four new trades each week.

This pace strikes a balance; it’s frequent enough to keep you engaged and compounding results, but not so overwhelming that you can’t keep up.

And since each trade takes only a few minutes to place, it fits neatly into almost any schedule.

Express Quick‑Start Training Bonus

Included with the package is an Express Quick‑Start Training. This training is designed for people who may have never traded an option before.

It cuts out the fluff and focuses on the practical steps: how to open your broker platform, how to enter the trade details from an alert, and how to manage your position until the exit.

By the time you finish the training, you’re prepared to place your very first trade with confidence.

Top Service and Support in the Industry

What really stood out to me is the customer support.

Questions don’t sit unanswered for days; members consistently report quick responses and personal attention.

Whether you’re stuck on a trade setup or confused by your broker’s platform, you can expect clear guidance to help you move forward.

This kind of responsive support makes the difference between a program you actually use and one that collects dust.

>> Unlock Overnight Pop Trades System <<

Refund Policy

Overnight Pop Trades comes with a full 90‑day money‑back performance guarantee, which means you have three months to try the alerts and training without pressure.

That kind of safety net is rare in the trading education space and shows that Mike Rykse and NetPicks are confident enough in the system to let you see the results.

It lowers the barrier to entry and gives you a real chance to see if the service lives up to its claims.

>> Activate Overnight Pop Trades Alerts <<

Pros and Cons

After reviewing all the content here, these are my top pros and cons:

Pros:

- Quick and simple system

- Works with small accounts

- Defined-risk option spreads

- Strong 78% win rate

- Multiple alert delivery options

- Two years for the price of one

- 90-day Performance guarantee

Cons:

- Requires availability at entry/exit times

- Upfront cost feels high

Overnight Pop Trades Reviews by Members

The testimonials from the members highlight some of the biggest strengths of Overnight Pop Trades.

They also show a service that many members find effective and easy to follow, but one that still demands commitment and a willingness to work within its structure.

These reviews did come straight from the Overnight Pop Trades site though, so do take them with a grain of salt.

>> Try Overnight Pop Trades Risk-Free <<

Overnight Pop Trades Track Record/Past Performance

The track record of Overnight Pop Trades is one of its strongest selling points.

The strategy has produced nearly 600 trades over the past four years with a win rate of about 78%.

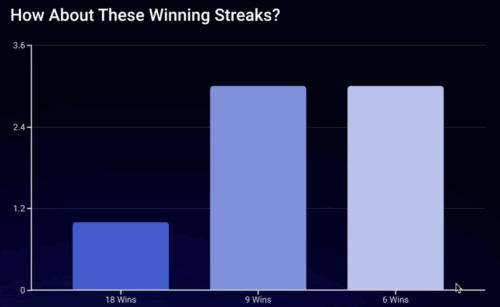

There have even been streaks of more than a dozen winners in a row, including one run of 18 straight profitable trades.

What stands out is how the system has held up in very different market conditions, from bull runs to sharp corrections and even choppy sideways periods.

The approach of using defined-risk credit spreads helps provide consistency, since you know the potential outcome before entering.

While no trading system can promise future results, the documented history shows that this method has delivered steady performance across multiple cycles, giving members confidence that the rules can adapt no matter what the market is doing.

How Much Does Overnight Pop Trades Cost?

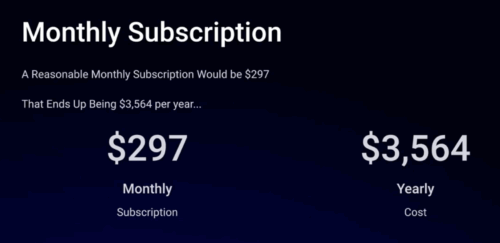

Right now, the cost of joining Overnight Pop Trades is $997, and that covers two full years of access because of the current one‑plus‑one promotion.

After the initial two years are up, the service renews annually at $997.

There’s also a flexible payment option available, allowing you to spread the cost across three monthly installments of $399.

It’s worth noting that this isn’t positioned like the typical monthly subscription many alert services offer.

Instead, you’re locking in multi‑year access at a set price, which breaks down to a far lower monthly cost compared to competitors.

Between the full two years of trade alerts, the training, and the bonuses included, the pricing is structured to give members both value and time to really put the system into practice without feeling rushed.

>> Trade Smarter with Overnight Pop Trades <<

Is Overnight Pop Trades Worth It?

Based on everything covered in this Overnight Pop Trades review, the service does stand out as a compelling option for those who want a structured, rules‑based approach without the heavy time commitment.

Add in the current two‑for‑one subscription deal and the 90‑day refund policy, and it becomes clear why this program has attracted attention.

Don’t forget about the education aspect that’s deeply rooted in all aspects of the system.

You’re not just using it; you’re learning how to make the most of all the tools you’re handed.

It takes consistency to make Overnight Pop Trades work, but in my experience it’s well worth the effort.

Sign up today to start capitalizing on overnight trades and reaping the benefits of the system in your own portfolio.

>> Discover Mike Rykse’s “Overnight Pop Trades” System TODAY <<

Tags:

Tags: