Dividend investing is often misunderstood. Yields can look great on paper, but sustainability is another matter.

That’s why I decided to dig into Oxford Income Letter, a research service that claims to help readers collect safe, growing dividends while tapping into timely growth ideas.

But this Oxford Income Letter review wouldn’t be complete without mentioning Marc Lichtenfeld’s latest angle: a breakthrough opportunity tied to a new “TF3” quantum chip.

From stable dividend strategies to this bold tech play, there’s more to the newsletter than meets the eye. Let’s break it all down.

>> Try Oxford Income Letter Now At A Special Deal <<

What Is Oxford Income Letter?

Oxford Income Letter is a monthly research newsletter led by Marc Lichtenfeld that’s focused on building long-term wealth through income-generating stocks.

It’s published by the widely popular research company The Oxford Club.

Issues come with actionable recommendations to act on, while also giving you the tools to beat the market in any scenario.

Unlike most income newsletters, this one balances traditional blue-chip recommendations with emerging high-growth plays.

There are plenty of standout perks with the service, but the two biggest draws are its distinct focus on dividend payers and multiple model portfolios that cater to different investment philosophies.

Let’s take a moment and unpack the service’s proprietary investing style.

>> Sign up HERE for 80% off <<

What’s the Investing Style of The Oxford Income Letter?

As one of the top services from the Oxford Club, the Oxford Income Letter strives to lay the groundwork for your golden years through smart investments.

Lichtenfeld’s methodology relies heavily on his proprietary “10-11-12 System,” a strategy designed to compound income over time. He also maintains multiple model portfolios tailored to different risk tolerances and income objectives.

The goal is to generate 11% yields in 10 years or 12% average annual returns in 10 years with dividends reinvested, providing a reliable source of income in any type of market.

Imagine the peace of entering retirement with a steady stream of income at your disposal should the Oxford Income Letter play out as advertised.

Who is Marc Lichtenfeld?

Marc Lichtenfeld is a great analyst with a keen eye for dividend stocks. He’s the chief income strategist for The Oxford Club.

Marc eventually moved to the research space to share the same tips he learned with folks on Main Street.

He authored the bestselling book Get Rich with Dividends, which won the Book of the Year award from the Institute for Financial Literacy.

With over two decades of experience, Marc is known for helping everyday readers build portfolios that prioritize both safety and growth.

Many know him for his proprietary 10-11-12 system, the same strategy used to scout out investment ideas for Oxford Letter.

While he might be best known for sharing his insights at the Oxford Club, he also has made appearances on CNBC, Fox Business, and Yahoo Finance.

Next, my Marc Lichtenfeld review continues with a closer look at some of the guru’s accolades.

Is Marc Lichtenfeld Legit?

Marc Lichtenfeld is legit and has an extensive career in the stock market research space.

The Oxford Club’s Chief Income Strategist is a seasoned analyst, making appearances on Fox Business, CNBC, and Bloomberg Radio.

His writings have also made it into Yahoo Finance, The Wall Street Journal, Investor’s Business Daily, Marketwatch, and Forbes.

If that wasn’t enough, his daily column Wealthy Retirement has over 200,000 readers.

If you’re looking for a steady hand in volatile markets, Marc’s track record certainly adds weight to the newsletter’s credibility.

>> Access Marc Lichtenfeld’s stock picks today <<

The “TF3” Chip Opportunity Marc Can’t Stop Talking About

We’ve all heard about AI and crypto, but there’s a new player in town: quantum computing.

And according to Marc Lichtenfeld, a mysterious material called “TF3” could be the backbone of it all.

While the mainstream media remains focused elsewhere, Marc believes a once-overlooked quantum chip is about to unlock the biggest computing leap since the microchip.

Better yet, he’s found a company at the center of it, one trading for less than $20 a share.

If you’re looking to get in early, now’s the moment to pay attention.

The Power of Quantum Computing

I’ve been hearing whispers about quantum computing for a little while now, but its story has been around since 2019.

Google was the first to tap into “quantum supremacy”, using the new technology to solve a complex problem in 200 seconds.

It would have taken the world’s best supercomputers at the time roughly 10,000 years to do the same thing.

A lot can happen in six years, and China’s light-based quantum computers put Google soundly to shame using the power of light.

It’s now clear just what quantum computing can do, and Marc believes science is racing to implement this technology in full force.

To that end, he predicts one material will be at the center of it all.

Why TF3 Could Disrupt Everything

So what is TF3? It’s a high-performance compound that, when used in chips, could make them 10 million times more efficient than current silicon technology.

It completely rewrites the rules of computing, using light instead of electricity to achieve results we never thought possible.

According to Marc, this material could slash data center energy usage by up to 99%. The implications are huge, especially as demand for AI and cloud services skyrockets.

I don’t claim to understand how all this technology works, but the implications here are an absolute game-changer if TF3 achieves even a fraction of what’s possible here.

Imagine also what such an innovation could accomplish. It could crack the most complex problems in multiple fields of study with little to no effort.

If TF3 takes off, the growth potential of companies associated with it could be astronomical.

How to Cash In on Quantum Computing and TF3

Right now, a tiny American company holds the keys to large-scale TF3 production.

They’ve already landed clients like NASA and top medical institutions, and the contracts keep growing.

While everyone else is chasing headlines, this company is quietly positioning itself at the epicenter of a trillion-dollar revolution.

You can get instant access to the full story on this small firm by signing up for the Oxford Income Letter.

As a subscriber, you’ll discover the company’s name, ticker, and why he believes it’s set for a parabolic run.

You’ll also get step-by-step guidance on how to buy and when to consider taking profits.

If you want to access this unique opportunity and a steady stream of additional income ideas, signing up for the service is the next logical move.

Now let’s take a look at what else comes with your subscription.

>> Sign up now to get Mark’s #1 stock pick <<

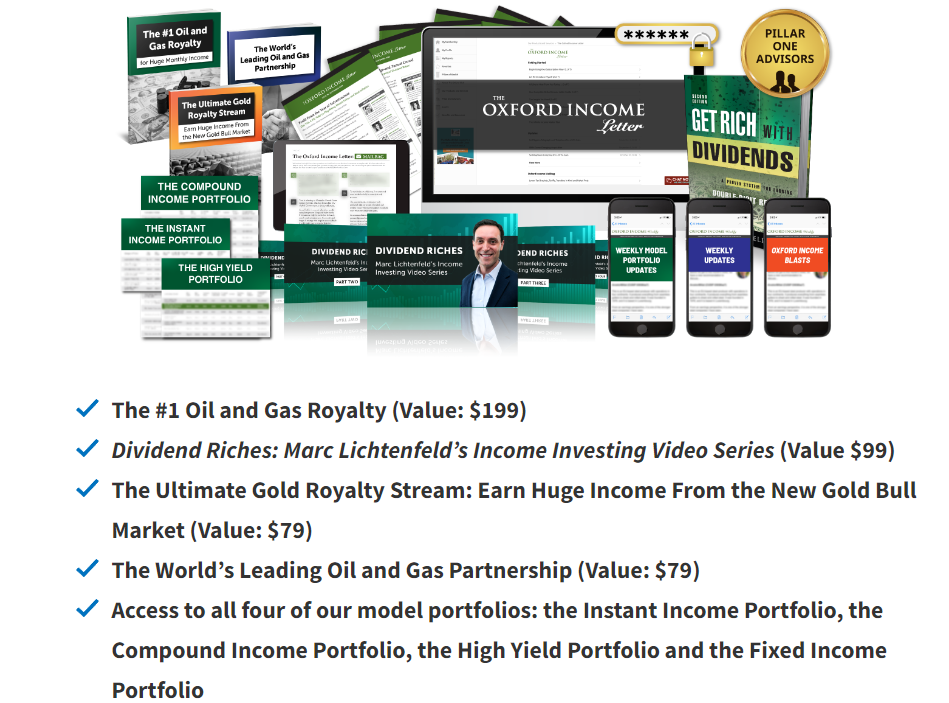

Oxford Income Letter Review: What’s Included With The Deal?

The latest Oxford Income Letter deal is packed to the brim with standout features. Drawing from our experience, we’ve broken each down for you below in our Oxford Income Letter review.

Oxford Income Letter Newsletter

A new issue of Oxford Income Letter drops once a month and offers members a brand-new investment idea.

Members can follow along with analysis and supporting research for the monthly portfolio pick.

Marc and the team’s analysis is thorough, but they do a great job making their trading insights easy to grasp.

Also, while many of the recommendations lean on the long term, there are some short to mid-term plays.

Lichtenfeld also offers recommendations to his readers on whether to keep the stock in a taxable or retirement account, taking into account its predicted growth and the anticipated duration of the position.

This guidance is key in enhancing the potential returns of the investment, given the distinct tax implications. It highlights Lichtenfeld’s all-encompassing approach to investment strategy.

Model Portfolios

The model portfolios track the team’s open positions.

- The Compound Income Portfolio

- The Instant Income Portfolio

- The High-Yield Portfolio

- Fixed Income Portfolio

- Strategic Growth Portfolio

Each portfolio has a different objective, whether you want immediate payouts or long-term compounding. Marc provides clear buy/sell guidance and tracks performance regularly.

I’m going to give the Oxford Income Letter service major credit here.

Most alternatives only offer one model portfolio, but Income Letter members get access to five.

You also get access to several “buy now” stocks as soon as you join.

These immediate recommendations provide an opportunity for quick action in the stock market. These services ensure members are always at the forefront of potential investment opportunities.

Weekly Portfolio Updates

Each week, the team sends out an update on changes to the portfolios and information on the markets in general.

They carefully explain why the market behaves a certain way and whether it’s time to buy or sell your stocks

You’ll always be in the loop thanks to the regular updates. Any time something big is brewing, you’ll be the first to know.

Many services offer portfolio updates, but Oxford’s updates seem to be of higher quality, with more insightful research and analysis.

The Oxford Income Letter updates not only provide a snapshot of the current market conditions but also offer a forward-looking perspective, helping you anticipate potential shifts in the market.

This proactive approach can be instrumental in helping you adjust your investment strategies in a timely manner.

Full Access to the Research Archive

One of the standout benefits of a subscription to Oxford Income Letter is unrestricted access to the complete archive of past issues and research.

This is more than just a look-back tool; it’s a chance to understand the evolution of Marc’s recommendations and investment thinking.

Each archived issue gives insight into how market conditions influenced previous calls and whether they played out as expected.

For someone who likes to do their homework, this depth of transparency builds confidence.

It also allows you to track how Marc adjusts his strategy when markets shift, offering a rare behind-the-scenes view into a proven income system.

Member Portal and Dashboard Tools

Everything in this service is delivered through a secure online portal.

Once you log in, you’ll find a clean dashboard that organizes the portfolios, open positions, archived reports, and new alerts in one place. It’s ideal if you like things to be clear and actionable.

There’s also a section for tracking the performance of your favorite picks and downloading reports for offline reading.

It might seem like a small touch, but the portal makes a big difference in day-to-day usability.

It helps ensure you’re not just reading a newsletter, you’re actively using a system designed to help you grow and manage wealth.

Dedicated Customer Support

Another often overlooked advantage is the dedicated customer service support.

Whether you have a question about your subscription, need help finding a report, or want clarification on something Marc said in a recent alert, the team is available via both phone and email.

This is especially helpful for new subscribers who may not be familiar with how everything works.

Unlike some research services where support feels automated or outsourced, Oxford Income Letter provides real people who know the content and care about helping you navigate it.

This creates a more seamless and user-friendly experience, especially as you begin implementing the advice into your financial life.

>> Join now to access these features and much more! <<

Oxford Income Letter Bonuses

The Oxford Income Letter also comes with the following bonuses at no extra cost:

Bonus 1: The TF3 Revolution

This report centers on the revolutionary investment Marc is so excited about right now, an under-the-radar company positioned at the heart of a quantum computing breakthrough.

Inside this report, Marc lays out why this firm could dominate a trillion-dollar transformation and provides an in-depth analysis of its market potential, financials, and competitive position.

He also shares clear guidance on how to buy, how long to hold, and what kind of returns he realistically sees.

Bonus 2: The Double-Digit AI Income Play

In this report, Marc unveils a closed-end fund focused on AI companies that not only has exposure to cutting-edge innovation but also offers an attractive income stream.

Marc explains how covered-call strategies power this yield and how folks can use this setup to generate regular cash flow while still benefiting from AI’s long-term growth.

This is ideal for anyone looking to earn income now while positioning themselves in tomorrow’s hottest sector.

Bonus 3: The Elon Musk 100X Moonshot

This handy guide zooms in on the lesser-known suppliers behind Tesla’s push into full self-driving technology.

These aren’t just guesses; they’re handpicked businesses that specialize in lidar, battery tech, sensor systems, and advanced software.

Marc provides full write-ups for each, including ticker symbols, financial outlooks, and why they could outperform Tesla itself.

If you believe in the electric and autonomous vehicle boom, this report offers a smarter, more leveraged way to play it.

Bonus 4: The #1 Oil and Gas Royalty for Huge Monthly Income

This featured report contains the lowdown on Marc’s favorite royalty play. It taps into the potential of the most productive oil basin in the United States.

In this report, Marc spotlights a Texas-based oil and gas royalty firm that holds interests in over 550 active wells.

With a history of double-digit monthly payouts and the potential for capital gains when oil prices spike, this idea adds balance to the tech-heavy opportunities covered elsewhere in the service.

All you need is a regular brokerage account to start collecting those portfolio checks.

According to Marc, royalty streams can far outperform oil and gas stocks. Here you can profit from the sector’s growth while enjoying a passive cash flow.

>> Get instant access to these reports when you join now! <<

Bonus 5: Free Hard Copy of Marc’s Best-Selling Book: Get Rich with Dividends

To deck out his service, Marc’s including a free hard copy of his bestselling book, Get Rich with Dividends.

This book is an Amazon bestseller and was named Book of the Year by the Institute for Financial Literacy.

This book showcases years of research on companies known to consistently grow dividends. Marc indicates which trends to look for in a good dividend stock and red flags to run from.

In Marc’s case, the results are steady double-digit returns, and oftentimes his favorite way to multiply money quickly.

To date, the book has sold more than 110,000 copies and has been translated into languages like Polish, Japanese, and Thai.

This hardcover edition is shipped free to select subscribers and serves as a foundational guide to the strategies Marc uses in every issue of Oxford Income Letter. Whether you’re new to income investing or want a refresher, this book is a helpful companion to the monthly research.

Dividend Riches: Marc’s Income Investing Video Series

Dividend Riches is a six-part video series revealing strategies that members could use for the opportunity to bring in more future income.

With each video, you have the flexibility to watch and rewatch as you see fit to get the most out of each one.

>> Sharpen your skills with Marc’s video training series <<

Money-Back Guarantee for a 12 Months

When you sign up for the Oxford Income Letter, you’re privy to a 12-month 100% money-back guarantee. You can check out the newsletter, publications, and bonus materials for an entire year.

>> Sign up under Marc’s guarantee <<

Pros and Cons

The Oxford Income Letter has a lot going for it, but it isn’t perfect. Here in our Oxford Income Letter review, you can take a look at all the pros and cons before making a decision.

Pros

- Contains a mix of stock picks and high-yield dividend stocks

- Unique blend of income and growth ideas

- Five model portfolios for different goals

- Weekly updates and alerts

- Includes four bonus reports on promising opportunities

- Free hardcover copy of Get Rich with Dividends

- Get Mark’s #1 oil and gas income stock when you join

- Impressive 365-day money-back guarantee

Cons

- No community forum

- 80% discount only applies to first year of service

FAQs

Check out answers to some of the top questions regarding the Oxford Income Letter.

Can International Investors Try the Oxford Income Letter?

Yes, international investors can subscribe to and access the Oxford Income Letter and the Oxford Club’s other services.

The publisher makes all its content available worldwide without the need to jump through extra hurdles along the way.

That said, most of the platform’s recommendations come from U.S. markets. Users from other countries should keep in mind currency fluctuations and local regulations when making any sort of investment.

Do They Update the Model Portfolios of the Oxford Income Letter?

The team behind the Oxford Income Letter updates model portfolios on a regular basis to ensure you’re looking at the most accurate numbers possible.

New recommendations are added to the list as they’re shared from the monthly newsletter, allowing you to follow along with any gains it makes in real-time.

Alerts and updates affecting a stock’s standing outside the latest newsletter issue also make their way into the model portfolio in case you miss a crucial notification.

How Do I Cancel My Oxford Club Membership?

Should you decide one of the Oxford Club’s services isn’t for you, contact the member services team between 8 am and 8 pm Eastern time to cancel your subscription.

Since every service is different, you’ll want to read the fine print on the order confirmation email to see if you’re entitled to any sort of refund or credit.

The team typically processes refunds within 14 days of your termination date.

Oxford Income Letter Reviews By Real Members

The reviews for Oxford Income Letter are generally favorable, but like any investment advisory, experiences vary depending on goals and expectations.

Several members highlight the reliability of the dividend strategies.

But like any tool, it works best when used consistently and with realistic expectations.

Investing always comes with risk, and you should never invest more than you can afford to lose.

>> Sign up now and join these satisfied members <<

Is This Service Right for Me?

Based on our Oxford Income Letter review, it is best suited for folks in the market for dividend-paying stocks with a long-term outlook.

Marc looks to find quality investments that could steadily appreciate over time — all while providing the potential to produce regular income.

His sustainable dividend yields strategy could also be a solid fit for someone nearing or in retirement.

Bond recommendations are on the table, as well, so anyone looking for a little more variety is accounted for.

That said, the core focus is stocks.

Lastly, the service offers a great blend of insights and opportunities to communicate with its lead. This could be very helpful for fresh faces on the stock market looking to build a dividend portfolio.

How Much Does The Oxford Income Letter Cost?

The Oxford Income Letter comes in three different subscription plans, designed to meet the needs of various readers.

You’ll receive everything via email and the password-protected member portal, making it ideal for readers who prefer a paperless experience.

For those who want the full suite of materials in both digital and physical format, there’s the Premium Subscription at $99 per year.

This option includes everything from the digital plan plus a print edition of the newsletter mailed to your home, as well as a physical hardcover copy of Marc’s award-winning book Get Rich with Dividends.

It’s the best choice for readers who appreciate having something tangible to reference while building their income strategy.

The top-tier offer is the Two-Year Deluxe Subscription, priced at $129 for 24 months. This provides the best value over time.

You get all digital and print benefits, all bonus reports, ongoing model portfolio updates, and guaranteed access to every alert Marc sends over two full years.

Is Oxford Income Letter Worth It?

After reviewing everything this service offers, it’s fair to say that Oxford Income Letter brings solid value for the price.

Marc Lichtenfeld’s combination of income-focused strategies and bold tech plays gives the service a broader appeal than most dividend newsletters.

Whether you’re chasing growth or just looking for consistent payouts, the tools are here.

This Oxford Income Letter review also shows how the depth of research and risk-free guarantee make the offer even more compelling.

One of the biggest draws is the TF3 chip opportunity, a potential breakthrough Marc believes could redefine quantum computing and deliver massive upside for early movers.

It won’t suit those looking for fast trades, but if you want a plan to grow wealth steadily, it’s well worth a try.

Sign up today to take advantage of TF3 and the quantum computing surge before it’s too late.

Tags:

Tags: