Jason Bodner warns of a dawning crisis in the financial world that’s set to catch most of us off guard. Does his theory hold any water? Join me in this TradeSmith Investment Report review as we investigate his claims.

What is TradeSmith Investment Report?

TradeSmith Investment Report is a brand-new service published by TradeSmith. Jason Bodner leads it.

At its core is a monthly newsletter tailored toward whatever market trends are hottest at any given time. Issues feature new stock plays based on research from Bodner’s own system that collects more than 1.3 million data points every day.

He then conveys these picks in an easy-to-read format down to the littlest detail of how to invest in each one. The TradeSmith Investment Report itself may be new, but Jason’s system has proven accurate for years.

In addition, Bodner uses his service as a launching pad for new research reports and a means for tracking his model portfolio. For such a busy guy, he’s quite active with updates whenever new market news breaks.

We’ll dive deep into all of the TradeSmith Investment Report’s features in just a moment. First, let’s take a closer look at our guru.

>> Save 75% when you join NOW <<

Who is Jason Bodner?

Jason Bodner is a long-time investor and researcher with decades of experience in finance. After receiving a B.S. in business administration cum laude from Skidmore College, he’s spent his career working among the greats at big Wall Street firms like Cantor Fitzgerald and Jeffries.

In these positions, he’s been the head of equities, ETF trading desks, and derivatives while launching two successful hedge funds.

Over the years, Bodner has become incredibly good at tracking money flows before they move. Many mega investors have bent an ear to Jason over the years, earning him the title of “advisor to the advisors”.

Now, Jason has shifted his focus from Wall Street to the public spotlight in hopes of sharing his skills with the masses. His TradeSmith Investment Report is the result.

>> Get Jason Bodner’s latest analysis and recommendations here <<

Is Jason Bodner Legit?

Bodner is indeed a legit investor and quite good at what he does. Although the guru’s not terribly well-known, his proprietary backtested stock-hunting system beat the market by an incredible 7 to 1.

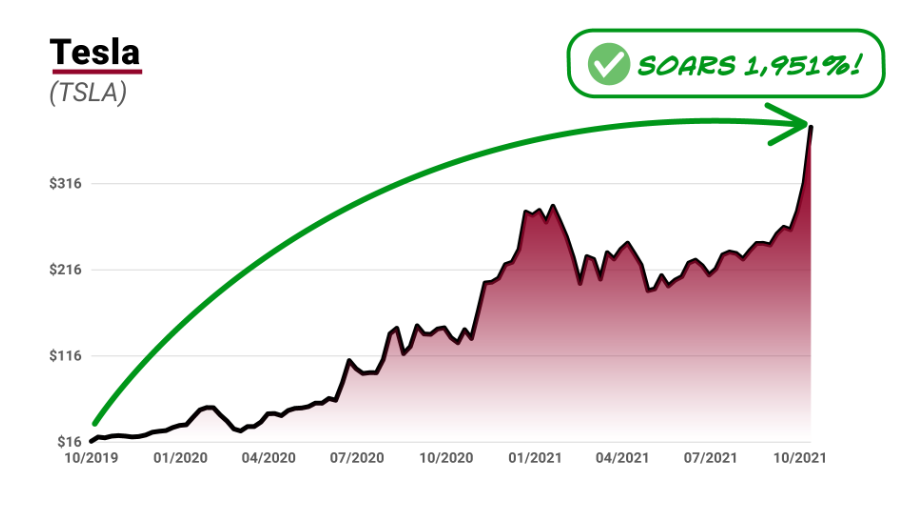

He’s got the data to back up his claims. That same system identified Tesla (NASDAQ: TSLA) back in 2019 before it climbed 1,951%.

Similarly, Advanced Micro Devices (NASDAQ: AMD) saw 377% gains, while SolarEdge Technologies (NASDAQ: SEDG) grew an astounding 2,230%.

It’s this same tech that powers his new TradeSmith Investment Report.

What is America’s Cash Bubble?

Jason Bodner has been watching the flow of money for some time, and he believes we’re right on the cusp of the next big financial bubble burst.

What makes this pending crash so significant is that it’s tied to what many of us consider a safe investment. Most of us have no idea that it’s even coming and will completely blindside a large number of Americans.

It’s not an asset that’s going to fail this time. Bodner claims money market funds are next to go. Truth be told, that’s part of the problem.

>> Get the top picks to “Beat the Bubble” here <<

The Warning Signs

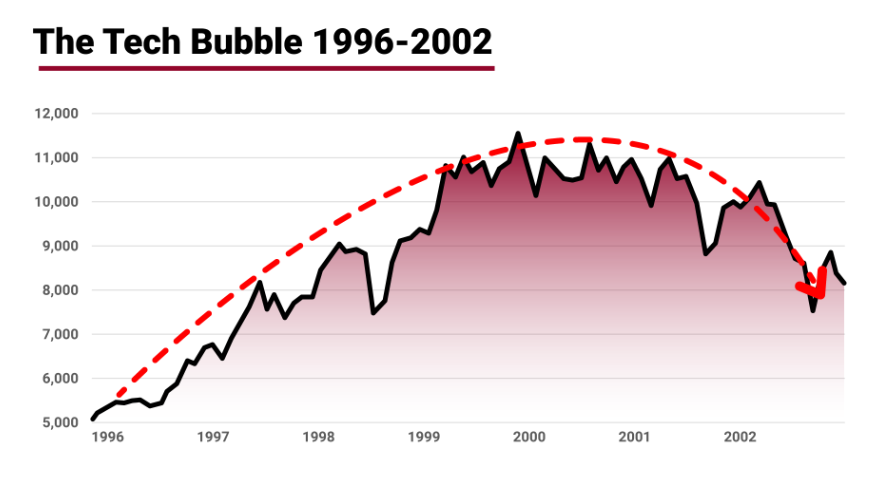

Looking back at the biggest bubble bursts of the last century, the pattern is always the same.

Prior to the Great Depression, folks threw money at the stock market in hopes of tasting even the tiniest piece of all those gains. In the late 90s, everyone wanted to own dot-com stocks.

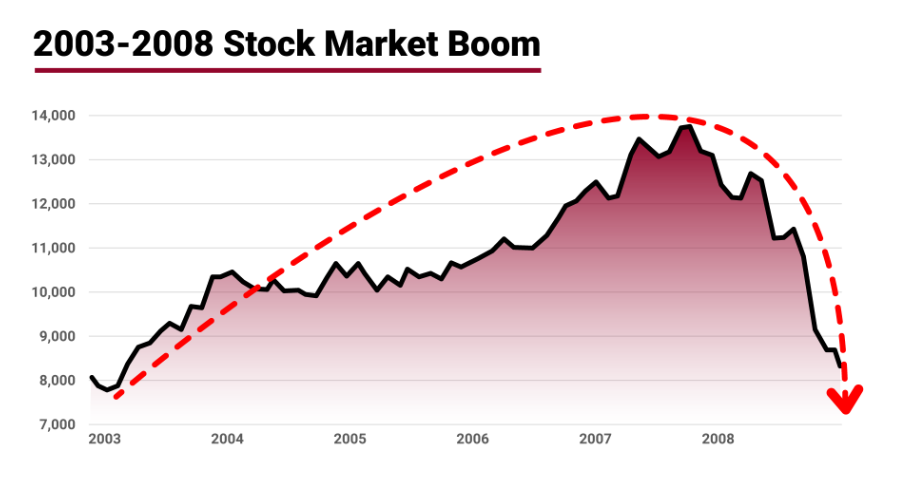

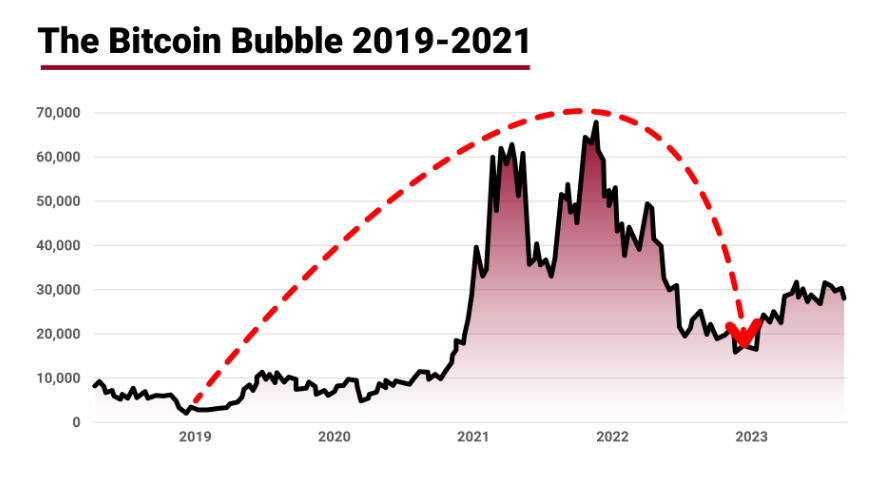

History repeated with the market boom in the mid-2000s and even with Bitcoin just a few years back.

History repeated with the market boom in the mid-2000s and even with Bitcoin just a few years back.

Each of these opportunities looked so good that you’d have been a fool not to jump on board.

Many of these same people were caught completely off guard when each respective bubble blew. They held on too long and lost all the money they dumped into these investments. Some people were left with nothing.

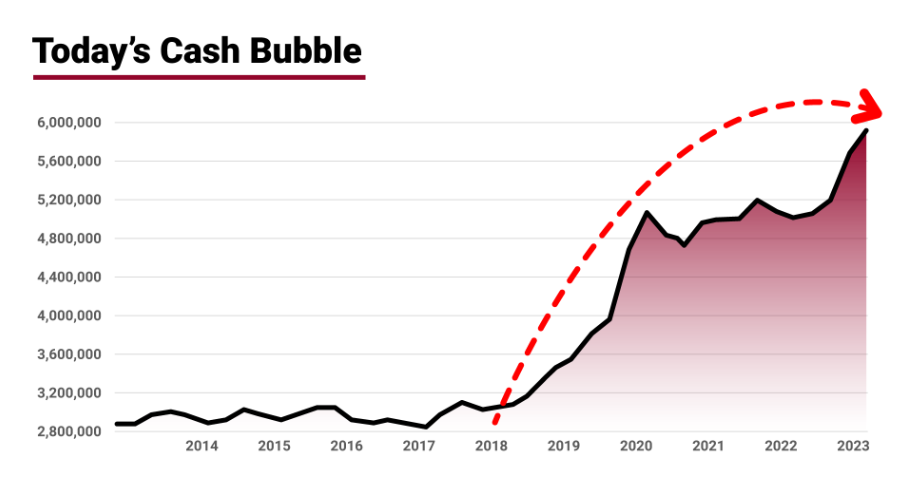

We’re seeing the same trend here with money market funds. Everyone and their grandma is putting money into these funds right now. Interest rates are great, and no one wants to miss out.

In fact, Americans have dumped almost $6 trillion into this asset class.

What goes up must come down. Bodner predicts the crash will happen sooner than we all think.

>> Get the strategies you need to beat the bust here <<

What Happens Next

According to Bodner, the Federal Reserve is responsible for both the renaissance and impending downfall of money market funds. They’ve been raising interest rates so fast that it’s pulled people away from other assets.

However, word on the street is that these rates are about to hit the ceiling. The moment the Fed announces they’re cutting rates, there’s a good chance everyone’s going to jump ship and move back to stocks.

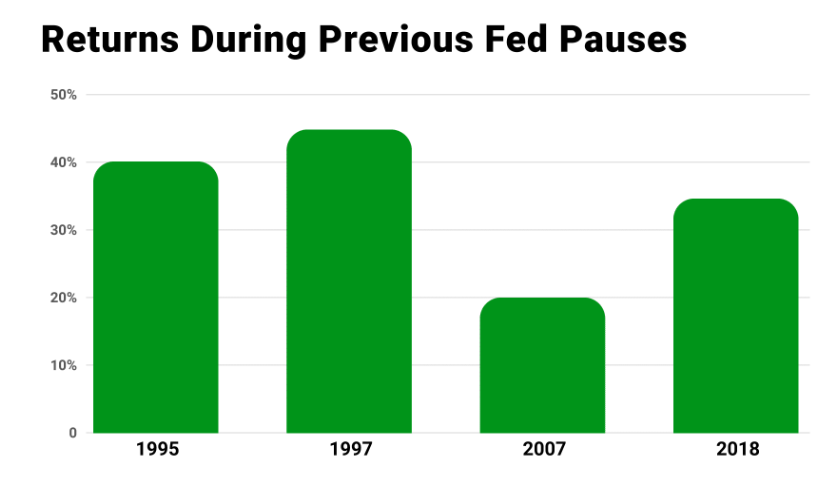

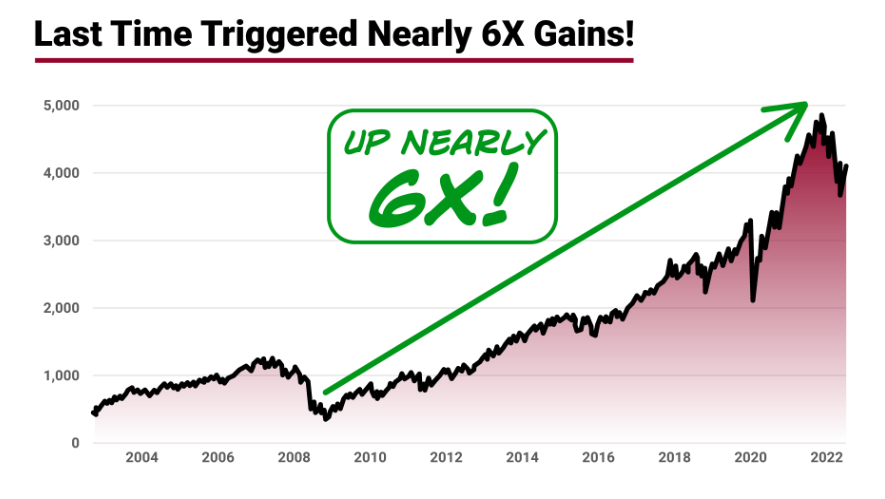

In actuality, simply pausing rate hikes could be enough to scare people away. The last four times this has happened led to big returns in the stock market over the next year.

Folks left holding onto money market funds would be left with nothing but scraps. What’s worse, anyone not on the forefront of the switch back to stocks could miss out on the majority of gains made from the rush.

I tend to lean towards safer investing strategies, but I certainly don’t want to get caught between a rock and a hard place should money market funds come tumbling down.

No one’s going to save us, though, so it’s up to us to ensure we’re ready for what’s to come.

How to Capitalize

We live in a stressful time, and no one likes hearing about threats to their financial future. The good news is that there’s still time to capitalize on the bubble burst before it’s too late.

Events like the Great Depression and market woes of the early 2000s were bad for many, but a savvy few actually made millions from the chaos. They were simply in the know enough in advance to spin each scenario to their advantage.

The cash bubble burst is no different. Getting out in front of the situation can not only save you from financial loss but actually have you come out the other side better than before.

All it takes is the knowledge and foresight to gauge where all that money market cash is flowing into. You and I may not have those answers, but Jason Bodner believes he does.

He’s finally taking his research public for each of us to get our hands on. As part of this latest deal, he’s providing instant access to stock recommendations and research tools you’ll need to stay ahead of the shift. All you have to do is sign up for his TradeSmith Investment Report.

>> Join now to Get Bodner’s top pick and Beat the Bubble! <<

What’s Included with TradeSmith Investment Report?

Here’s what you get when you join now:

One-Year Membership to TradeSmith Investment Report

A subscription comes with a full year of the all-new TradeSmith Investment Report newsletter. That’s 12 monthly issues delivered to your inbox to read through.

Expect to find the following in each new edition:

Monthly Stock Picks

Each new release comes with at least one new stock recommendation for you to sink your teeth into. When the markets are especially hot, you may receive more.

These opportunities aren’t necessarily tied to a certain sector or industry. That means you have a shot at crafting yourself a diversified portfolio from month to month.

I appreciate the practical nature of the newsletter and how easy it is to uncover these new picks. Bodner’s technical analysis provides all the info I need to make an informed decision without being too far over my head.

Model Portfolio

The TradeSmith Investment Report has an online portal accessible by members only. Here, you’ll find a running tab of Bodner’s current recommendations.

He updates his model portfolio regularly so you can see at a glance how each stock is faring. That also means you’ll have a list of opportunities to consider the moment you join.

It’s nice to see Bodner being so transparent with his investment ideas. He seems to be on with his picks, but I tend to steer clear of gurus who hide behind wins and make no mention of losses.

Updates and Alerts

If only the market were a predictable beast. Since it’s not, Jason keeps members informed through frequent updates any time his system flags a new opportunity. He understands full well that waiting until his next TradeSmith Investment Report release may be too late.

Bodner’s also quick to fire off alerts any time one of his current positions takes an interesting turn. That way, you’re able to sell shares for peak gains or jump ship before it starts sinking.

>> Get in line for breaking alerts now <<

America’s Cash Bubble Bonuses

For a limited time, you’ll also get the following bonuses for becoming a member:

5 Places to Get Your Cash Out of NOW

Money market funds are precariously positioned right now and set to topple. From the looks of things, they’re not the only ones in for a fall.

In this special report, Bodner lists a total of five cash investments Americans have been shoving cash into that are in dangerous waters. You’ll learn what these investments are so you can move money away while there’s still time.

Jason also explains in detail what the Fed is doing behind the scenes and why it’s crucial to salvage your cash. Staying ahead of the curve here, just like Wall Street’s big money does, is your ticket to staying afloat in the midst of the upcoming crisis.

Three Stocks To Move Your Cash Into NOW

It’s no surprise that cash flowing out of money market funds will presumably head back into the stock market. The question is, where are the best places to put it?

Bodner has a secret system he’s been refining for the last 30 years that just lit up three stocks like a Christmas Tree. He feels these plays are perfect to get positioned in before the Cash Bubble pops.

You’ll get the full details of each pick inside this bonus report. That includes the company name, ticker, and the reason why Bodner’s system flags them as likely winners.

There are even instructions on how to execute these trade ideas just like the experts do. These aren’t big-name stocks yet but could very well be in short order.

Bonus Access to TradeSmith’s Proprietary Portfolio Analyzer

Founding members of TradeSmith Investment Report immediately receive access to TradeSmith’s Proprietary Portfolio Analyzer at no additional cost.

The analyzer uses quant software to analyze your portfolio, providing a customized report regarding your holdings. You’ll see which stocks are at risk of losing ground and where your investments are the strongest.

I’d argue there’s no better way to stay ahead of any missteps that could cost you tons of money. This tool alone could be worth the admission fee for this bundle.

>> Join now to put the Portfolio Analyzer to work! <<

Money-Back Guarantee

Bodner is so confident in his offerings that he’s extending a full 60-day money-back guarantee to anyone coming on board right now. You’ve got the better part of two months to try everything out and see if the service is right for you.

Should you not like what you see, simply reach out to the TradeSmith Investment Report customer service team to cancel your membership. You’ll receive a full refund of the purchase price, no questions asked.

To sweeten the pot further, you’ll be able to keep any materials you’ve collected up until that point, including the bonus content we covered above.

That’s quite a generous offer, especially since Bodner’s taking on pretty much all the risk here. It speaks volumes that he really believes in the service he’s promoting.

Pros and Cons

In my thorough review of this bundle, these are the top pros and cons I came up with:

Pros

- One year of TradeSmith Investment Report newsletter

- Led by Jason Bodner with decades of financial experience

- Frequent updates and alerts

- Private members-only site with model portfolio

- Two bonus reports

- Special access to TradeSmith’s Proprietary Portfolio Analyzer

- 60-day money-back guarantee

- Heavily discounted price

Cons

- No community chat or forum

- Doesn’t offer short-term trade ideas

>> Get the latest TradeSmith stock picks here <<

How Much is TradeSmith Investment Report?

Bodner plans to put his TradeSmith Investment Report on the shelves for $199, but he’s offering this bundle to founding members for just $49. That’s an incredible 75% off the cover price!

For less than four bucks a month, you can have access to everything in this package deal. You can’t even get a decent cup of coffee for that much.

Bodner doesn’t want anything to stand in the way of your future, so he’s doing everything he can to make his new service accessible to everyone. Besides, a single good stock recommendation can offset that fee.

It’s perhaps even more impressive that he was able to add the portfolio analyzer to his deal for free. That’s a lot of incredible content for such a low price.

Is TradeSmith Investment Report Worth It?

As I reach the end of my thorough review, I’m comfortable saying that TradeSmith Investment Report is a top-tier service.

Jason Bodner commands his platform well, and his connections to Wall Street and big money bring clarity in areas we otherwise have no way of knowing. It’s almost like having a spy on the inside.

Don’t tell Jason, but his $49 price point is a steal considering everything he makes available. Regular stock picks are nice enough, but the information about the money market fund bubble is a huge bonus. How he was able to add in TradeSmith’s Proprietary Portfolio Analyzer as well is beyond me.

All that material sits upon a proprietary system Bodner’s been perfecting for the last few decades. This isn’t information some Greenhorn investor threw together.

The 60-day money-back guarantee is just the icing on the cake. You’re free to try everything out without having to commit to anything.

If you’re looking to stay ahead of market moves before they happen, TradeSmith Investment Report is a great place to start. Sign up before this founder’s deal slides off the table.

Tags:

Tags: