Marc Chaikin’s newsletter and Power Pulse software are building up a bit of buzz online, but are they really worth your time and money? Read my Power Gauge Report review to find out!

What Is The Power Gauge Report?

The Power Gauge Report is a research service that provides members with stock recommendations, bonus reports, a stock rating tool, and other perks.

Wall Street legend Marc Chaikin is the lead editor, and his namesake company, Chaikin Analytics, serves as publisher.

The newsletter’s name comes from the Power Gauge system, a proprietary rating tool that uses cutting-edge analytics to identify stocks and ETFs with considerable profit potential.

I’m going to dig into the entire package, but let’s start with a close look at the ratings software, as it’s the star of the show.

>> Sound like a good fit? Sign up now and SAVE 60% <<

What Is the Chaikin Power Gauge?

The Chaikin Power Gauge is a proprietary stock rating system that leverages 20 fundamental and technical factors to gauge the future outlook of more than 4,000 stocks.

The system’s ratings are the cornerstone of the newsletter’s recommendations. Though, they consider additional factors (more on this later).

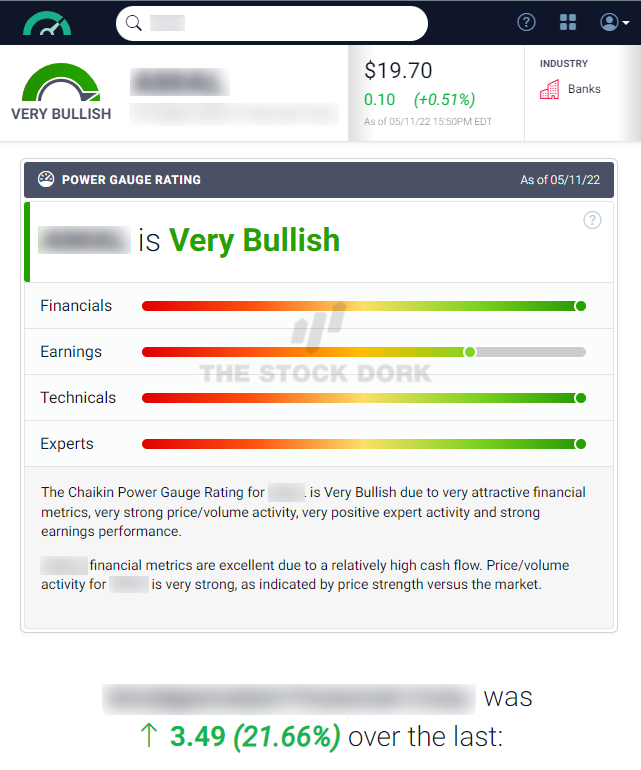

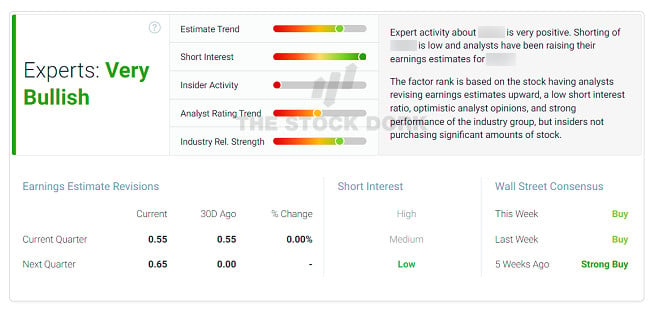

Here’s an example of a Chaikin Power Gauge rating for a stock I was checking out in banking:

Something to keep in mind is that my example pointed to a company that the system views favorably.

However, it could also warn about stocks and ETFs you might want to dodge.

How Does It Work?

Using the Power Gauge is surprisingly simple.

Enter a ticker or company name in the search box, and the software displays a rating based on its findings.

Depending on the stock or ETFs outlook, the system provides a Very Bullish, Bullish, Very Bearish, Bearish, or Neutral rating.

To calculate these ratings, it analyzes a combination of 20 technical and fundamental factors, which are broken down into four easy-to-digest categories: Financials, Earnings, Technicals, and Experts.

Here’s a look at the categories up close.

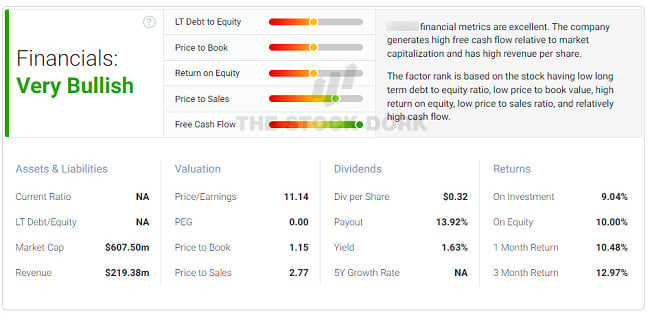

First is Financials:

-

LT Debt to Equity

-

Price to Book

-

Return on Equity

-

Price to Sales

-

Free Cash Flow

>> Already sold? Get the Power Gauge Report here <<

Second up is Earnings:

-

Earnings Growth

-

Earnings Surprise

-

Earnings Trend

-

Projected P/E

-

Earnings Consistency

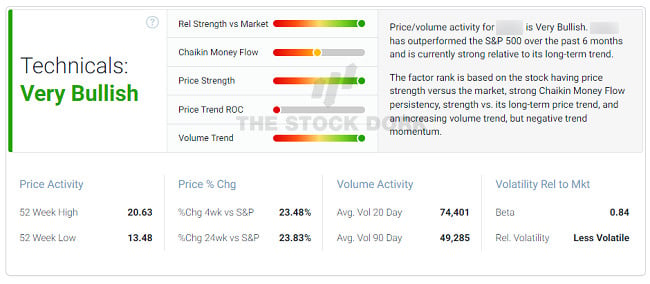

Third on the list is Technicals:

-

Relative Strength vs Market

-

Chaikin Money Flow

-

Price Strength

-

Price Trend ROC

-

Volume Trend

Last but not least is Experts:

-

Estimate Trend

-

Short Interest

-

Insider Activity

-

Analyst Rating Trend

-

Industrial Relative Strength

Chaikin’s software takes all of these factors and calculates a simple rating of buy, sell, or hold. The system allows you to easily identify a stock’s general outlook without digging into complicated analytics.

If you want to know more about each indicator and why they’re included in Chaikin Power Gauge ratings, I recommend checking out the service’s research report, The Power Gauge: How to Double Your Money on the Best Stocks.

Now that you know more about his software, let’s take a look at Marc’s credentials.

>> Calculate ratings for your investments <<

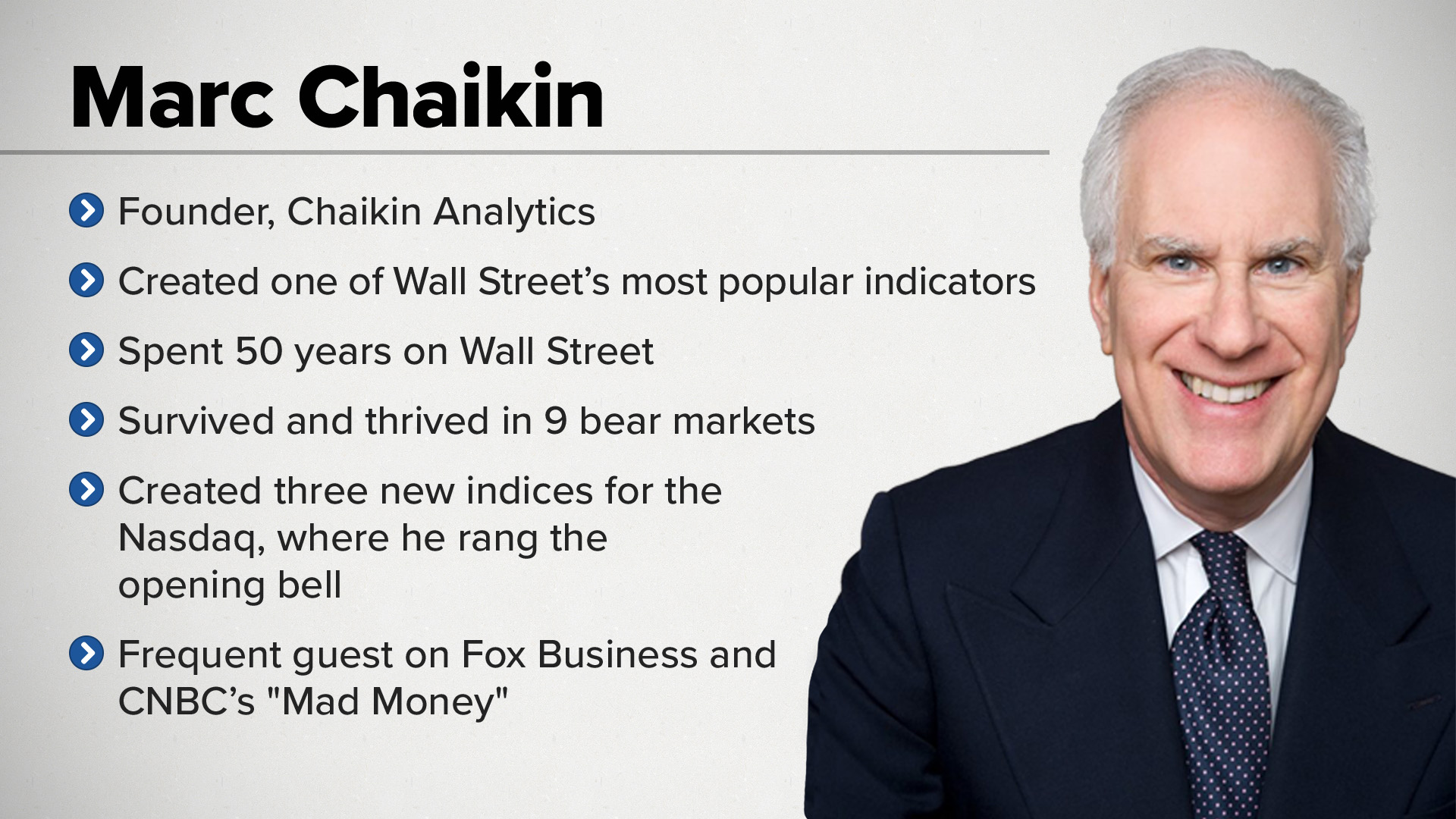

Who Is Marc Chaikin?

Marc Chaikin is an excellent researcher who’s dedicated to technical analysis. In fact, he’s considered one of the world’s foremost experts in applying technical indicators.

Three of his most popular research services include Power Gauge Report, Power Gauge Investor, and the Chaikin Analytics system.

He’s also well-known on The Street for his Chaikin Money Flow indicator and Power Gauge, and he collaborated with Nasdaq and IndexIQ to ETFs based on these popular indicators.

He even rang the Nasdaq opening bell!

All in all, Marc Chaikin is a solid stock picker and a living legend on Wall Street. He’s also one of the few gurus I’ve seen whose technical indicators have seen use in professional finance circle.

Marc isn’t just a retail research guru, either. His indicators, such as the Chaikin Oscillator, are commonly used by professional traders and money managers.

>> Discover Marc’s LATEST recommendation <<

Is Marc Chaikin Legit?

Marc Chaikin is the real deal. He has a deep understanding of the market, and the respect he’s earned on The Street is a testament to his effectiveness.

Chaikin’s ability to develop custom indicators demonstrates a deeper understanding of the market than most gurus can muster.

Even Jim Cramer, host of CNBC’s primetime hit show Mad Money, once raved about Marc’s stock-picking prowess:

“I learned a long time ago not to be on the other side of a Chaikin trade… I want to explain why I love Marc’s stuff. It’s simple, it’s understandable, it’s rational, it’s not emotional, and I use it constantly and I almost never want to go against it.”

— Jim Cramer, host of CNBC’s Mad Money

I’ve reviewed plenty of noteworthy figures in the research space. However, Marc is easily one of the most impressive of the bunch.

He’s developed computerized stock selection models and technical indicators that have become industry standards, and his Power Gauge Ratings are the basis for two Nasdaq ETFs

Marc is one of the most qualified gurus I’ve encountered in the research newsletter space. You can utilize his research with confidence.

Marc Chaikin Track Record

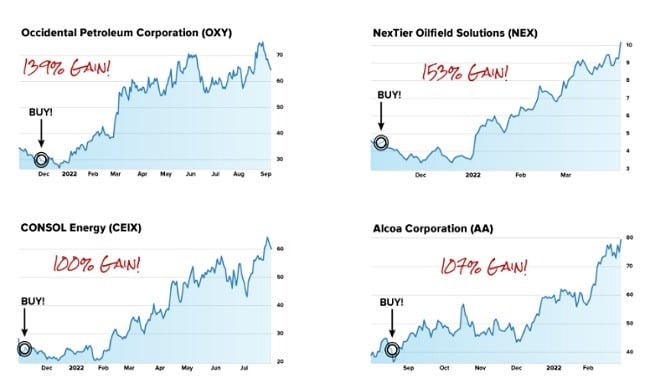

Over the years, Marc and his Power Gauge have spotted several stocks with potential, as well as market-moving events.

While doing the Power Gauge Report review, we found numerous examples of stocks they picked and performed well. Here are some of the opportunities and warnings his program has dialed into.

In 2021, his team’s work identified four separate stocks with the potential to double an investment: Occidental Petroleum, NexTier Oilfield Solutions, CONSOL Energy, and Alcoa Corporation.

>> Explore Marc’s strategies here <<

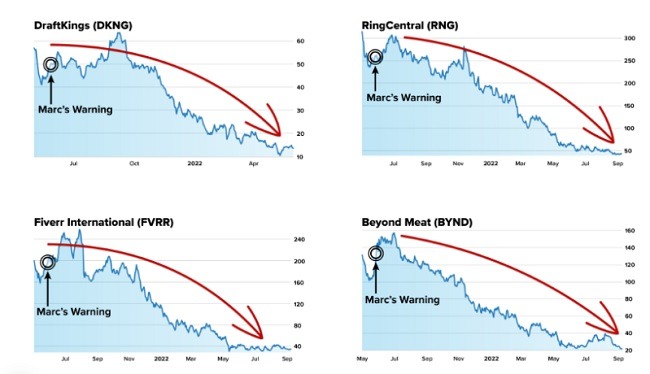

However, gains are only part of the picture. The Power Gauge also warns when it’s time to exit a position.

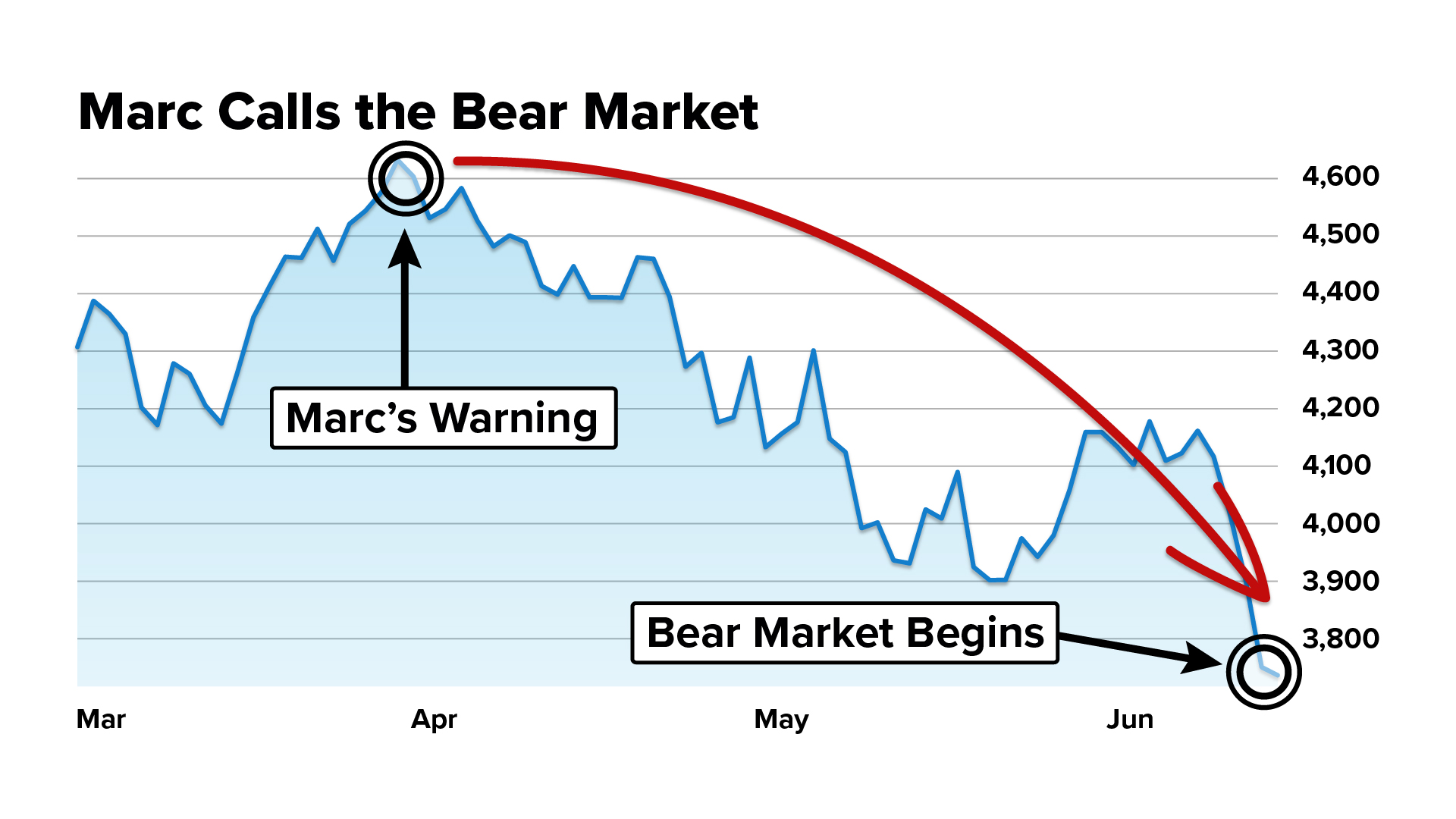

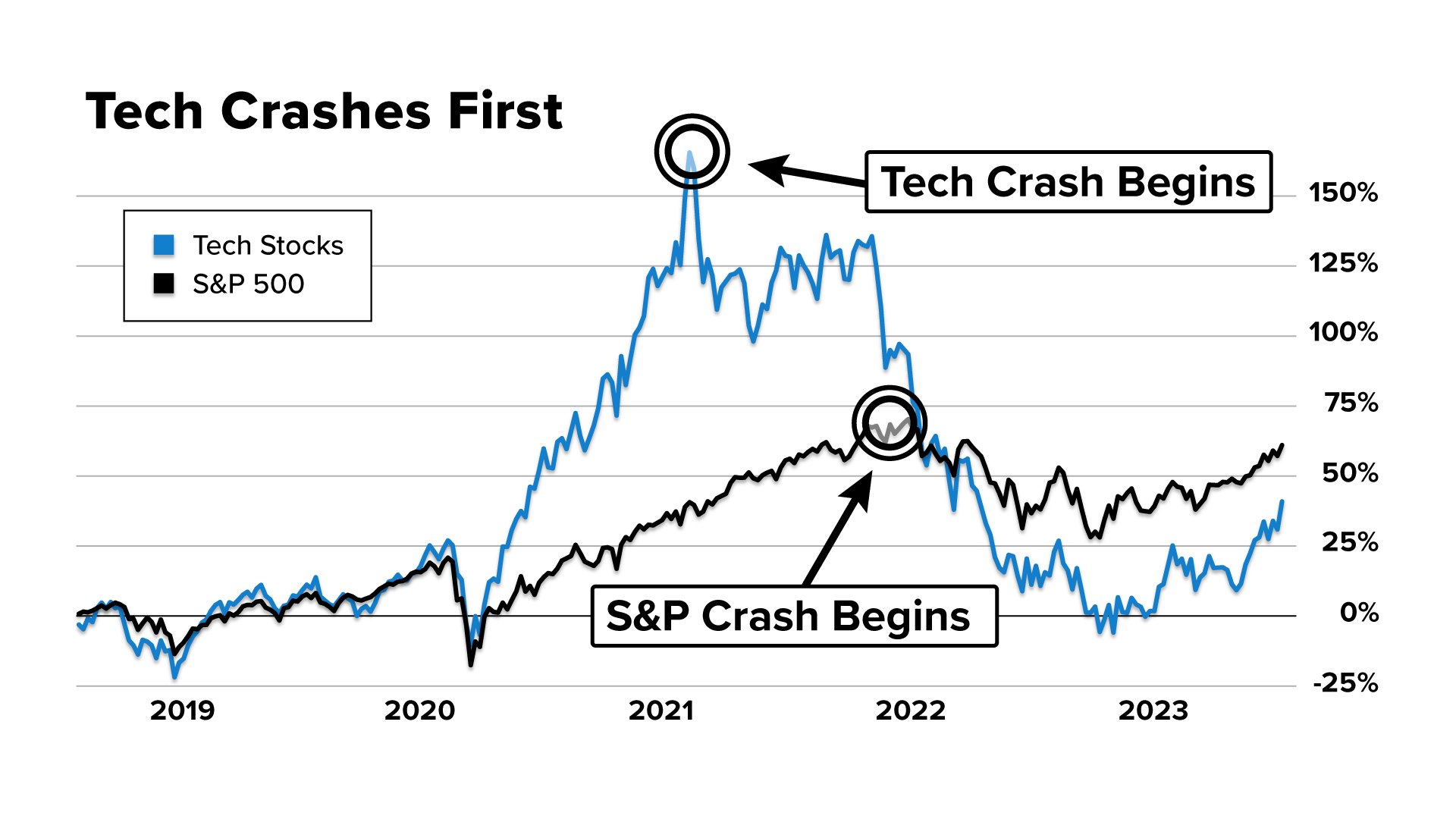

Back in April 2022, Marc Chaikin warned that he identified signs of an upcoming bear market just before the S&P 500 fell by 20%.

He and his team’s research also pointed to the 2020 stock market crash before Covid-19 was widely talked about by the press. This also included a warning around 21 different stocks that later fell by up to 81% in the aftermath.

It’s important to keep in mind that these results are not typical, and past performance is not an indicator of future results.

Still, these examples give an idea of what is potentially at stake with a talented researcher and powerful software in the mix.

What Is Chaikin Analytics?

Chaikin Analytics is a research publisher founded by Marc Chaikin that focuses on developing advanced professional-grade indicators.

Since its inception, the company has earned a strong reputation for its stock and ETF screeners, ratings, and top-tier investment insights.

Chaikin Analytics’ services offer different styles of research to accommodate users with varying investing interests. However, all of them tap into the Power Gauge’s key indicators.

No one can provide a stock market crystal ball, but it’s clear that Chaikin Analytics’ research & indicators have earned the Street’s respect.

>> Access Chaikin Analytics tools <<

Marc Chaikin says “Buy This AI Stock NOW”

Marc Chaikin is excited about AI as the next guy, but he’s coming into the space very cautiously. In fact, he’s relying on his proprietary Power Gauge that’s proven successful so many times to show him where to invest.

He believes he’s found a big winner to make a stake in today’s AI craze, and he’s sharing it free of charge.

Ready for the name and ticker of the stock? Pure Storage Inc (NYSE: PSTG).

Chaikin’s banking on Pure Storage to be one of the top-performing stocks of the next two years.

According to his research, Chaikin is bullish thanks to very strong earnings performance and positive expert activity.

Pure Storage is just the tip of the iceberg for what could be a long list of solid AI picks. In fact, it’s just the beginning of what Chaikin discussed in his latest presentation.

As much as Chaikin likes AI at the moment, he’s issuing a dire warning at the same time. Let’s look at what he’s so concerned about.

>> Learn more about this AI stock pick <<

AI’s Secret Dark Side

AI stocks are the hottest trade on the market right now, but there’s a secret dark side just under the surface. Tons of money is flowing into the sector, but that’s not all good news.

You see, many of these AI startups trying to capitalize on the new trend are destined for failure. Chaikin says the number could be as high as 85%.

The last thing we want is to be caught with our pants down the moment the AI bubble bursts. If you don’t believe me, think back to the dot-com bubble of the late ’90s or what happened with stay-at-home tech stocks just a few years back.

Even energy stocks crashed back to Earth earlier this year. Many people lost a lot of money.

You need to know more than which AI stocks to buy right now. You also have to know when and what to sell so the same thing doesn’t happen to you.

Too many folks held onto stocks for too long, thinking they’d keep growing. Chaikin warns that it never works out that way.

Luckily, he’s got an exit strategy for AI so you can earn your money and keep it too.

Marc’s AI Exit Strategy

AI is a huge opportunity right now. The growth in this market alone could easily surpass what we saw with other big innovations like the internet or the smartphone.

All that growth could lead to crazy profits for folks in the right place at the right time. Chaikin’s Power Gauge System has historically done a great job of announcing bullish stocks.

However, no stock is immune when a bubble bursts. I don’t care how good the company’s sales are or how it looks on paper.

You’ve got to be ready to jump ship before the burst happens. The problem is that most of us don’t have a clue when to do that.

Chaikin’s Power Gauge System is just as good at predicting bearing trends as bullish ones. With his program, folks were able to get into and out of the stay-at-home trend before stocks tanked.

As an adjunct to his recent “AI stocks” presentation, he’s put together a bargain bundle deal to help raise awareness about his Power Gauge Report service.

The deal includes full access to Marc Chaikin’s Power Gauge, and much more. I’ll cover each part of the bundle deal in detail below, so stay tuned to my Power Gauge Report review.

>> Plan your AI exit strategy <<

Power Gauge Report Review: What’s Included?

You can access Marc’s complete research on the AI opportunity when you join Power Gauge Report for one year. As a member, you’ll enjoy these core perks:

Annual Subscription to Power Gauge Report Newsletter

The main entree of your membership is Chaikin’s monthly newsletter, The Power Gauge Report.

This is your source for the latest Power Gauge research updates and stock picks from Marc and his team.

Each issue includes a new mid or large-cap stock recommendation, market analysis, and tons of other insights.

Reading this newsletter regularly will greatly expand your understanding of day-to-day market movements and financial news.

I read several issues as part of my research for my Power Gauge Report review, and I found the writing to be very accessible, even for a beginner.

Marc lays out a compelling bull case for each featured stock, but he’s also very upfront about potential risks as well.

This monthly report is sure to be a valuable addition to your trading toolbox.

Power Pulse System

The Power Pulse system gives you direct access to stock ratings based on Chaikin’s legendary Power Gauge.

You can access ratings and other valuable information for roughly 4,000 companies, and each stock’s rating is clearly explained in the simplest of terms.

Adding Power Pulse to the mix really bumps up the value for this service. I took it for a test drive by searching for several stocks on my radar, and I was impressed with the results.

You can use this tool to evaluate your own trading ideas, so you won’t be limited to Marc’s stock picks.

Power Pulse is a very notable addition to this deal, and it makes a subscription a much more viable option for more experienced readers.

Model Portfolio

Exclusively available to members, t00he model portfolio tracks the every open position featured in Power Gauge Report.

It covers the ticker, reference date, reference price, dividend yield, and much more, with updates every Wednesday.

Model portfolios are a fairly standard feature in the industry. However, this service offers a unique twist.

By clicking on the ticker symbol, the page redirects you to a complete Power Gauge Rating report for the stock.

It’s a small touch, but I really appreciated it. Checking in on the current ratings is much easier thanks to this design.

>> Access these features and more TODAY <<

Marc Chaikin’s #1 AI Stock: Special Reports and Bonuses

If you join under the current deal, you’ll also get these additional reports and bonuses.

Chaikin’s AI Power Picks

Pure Storage Inc (NYSE: PSTG) is just one of a handful of AI picks Chaikin is singing praises about.

As always, he threw every AI stock in the known universe into his Power Gauge and recorded the results. He pulled the ones with the highest profit potential and lowest risk and stuffed them into this handy guide.

You’ll get the inside scoop on each pick – company names, tickers, and all Chaikin’s personal buying instructions.

Any one of these picks could double or triple your money in the next 12 months. Thanks to the Power Gauge, you’ll also know when it’s time to sell and potentially keep all those gains.

The report also makes it clear which AI stocks could fail and cost you everything.

Tomorrow’s 10x Power Trends

Tomorrow’s 10x Power Trends takes a look at factors set to dominate the financial news cycle in the next 6 to 12 months.

These aren’t overt trends. No one’s even talking about them yet.

If they move like Chaikin says they will, that means we’re approaching the perfect time to invest. Getting in before the masses is often where you’ll find the highest potential gains.

That makes this report incredibly valuable. The AI craze will come and go, and we’re already in the midst of that revolution.

There will always be a new trend down the road with incredible profit potential if your timing is right. You’ve got ten of them right here that could be that next big thing.

Chaikin’s Power Gauge has already been finding them for over a decade, across all sectors and in every nook and cranny.

Nothing comes with a guarantee, but I can’t imagine the system’s going to stop working now.

Top 5 Stocks to Avoid During the AI Boom

Playing the market is as much a game of investing in the right stocks as avoiding the wrong ones. It doesn’t matter how much you make if you’re losing more on total duds.

Let’s face it – bad stocks are not going to pan out even in a bull market.

Luckily, Chaikin comes to the rescue yet again. This special report features the names of five tickers he anticipates will be among the biggest losers of the AI boom.

It’s no different than what we saw happen just a few years ago during the stay-at-home stock bust. Back then, folks could have lost up to 75% investing in the big losers Marc warned about then.

Bubble and Bust Updates

It’s not all doom and gloom in 2024. Bubble and bust cycles are par for the course in 2023, but they could also deliver huge gains for early movers.

Fortunately, Chaikin has his finger on the market’s pulse like few others, and he lets his readers know when a significant shift is coming.

Your Power Gauge Report membership also includes updates on developing “bubble” and “bust” from around the market, so you can position yourself accordingly.

Chaikin’s alerts will help you avoid “bust” stocks – and capitalize on “bubble” stocks – for as long as you’re a member.

This is yet another valuable addition to the Power Gauge Report service, and it could be the final piece of the puzzle you need to dominate the market in 2024.

>> Get access to these bonus reports here <<

Marc Chaikin Research Archives

Power Gauge Report members will also get access to an extensive library of Marc Chaikin’s research reports, monthly issues, daily insights, and much more.

You’ll find countless pieces of valuable research in this vast archives of work. Chaikin is a prolific research writer, so there’s no shortage of things to explore.

These resources will show you the market through the eyes of a proven expert, so you can sharpen your trading IQ and learn to navigate the market’s ups and downs more effectively.

Although some of these works are dated, the library is a valuable resource nonetheless, and it makes the “rolling crash” deal even sweeter.

Special Mystery Gift

The latest deal also includes a special mystery gift, and you’ll get this free gift as soon as you sign up.

I can’t reveal the mystery gift in this review, but I can offer a few insights…

Marc says he’ll send the gift in the confirmation email as soon as you join.

If he’s sending it via email, it could be a digital product, like an additional research report or other similar content.

30-Day Money-Back Guarantee

New Power Gauge Report members receive a 30-day money-back guarantee.

So you have about a month to test drive the service with full access to every feature — this includes the Chaikin Power Gauge.

If you decide it’s not a match, simply cancel within the first 30 days to receive a full refund on the subscription cost.

This company stands by its products, and its refund policy is a testament to its commitment to quality service.

>> Sign up under Marc’s guarantee <<

Pros and Cons

Chaikin’s Power Gauge Report is an excellent newsletter, but it does have some drawbacks. In our Power Gauge Report review, we prepared all the pros and cons.

Pros

-

Great price with a 60% discount

-

Comes with a solid stock rating tool

-

Airtight 30-day, 100% money-back guarantee

-

Respected publisher

Cons

-

No options or short trades

-

No community chat room or forum

FAQs

Here are some of the top questions we’ve received about this service.

Is Marc Chaikin a Billionaire?

Marc Chaikin may not be a billionaire, but he has an estimated net worth north of $50 million. While we can’t verify this number unless the guru releases a report, it seems viable.After all, Chaikin has spent 40+ years as a trader and stock analyst, and he’s founded a very successful company, Chaikin Analytics.

Is Chaikin Analytics Free?

The vast majority of Chaikin Analytics products aren’t free. They retail from $499 per year to upwards of $5,000 depending on the content within. The only free option is the Chaikin Analytics PowerFeed, a daily market newsletter featuring insights on big moves, trends, and other actionable ideas.

How Accurate Is Chaikin Money Flow Indicator?

Chaikin’s Money Flow Indicator has been around for more than 40 years, measuring the accumulation vs. distribution of stocks over time. A mainstay even among the elite, it’s an incredible tool for locating the strength of trends or uncovering breakouts. It continues to prove quite accurate in its assessments and has helped many over the years navigate market sentiment.

Power Gauge Report Reviews by Real Users

Stock market veterans are no strangers to Marc Chaikin and his Power Gauge. Chaikin has become one of the most respected names on Wall Street.

Since launching the Power Gauge, countless Chaikin followers have used the tool to tremendous success in the stock market.

The quote featured above is from trading guru John Carter, who’s best known for earning $1 million in two days by trading Tesla. As you can see, he’s an avid fan of the Chaikin Power Gauge, and he’s not alone.

Here are some more notable Chaikin Power Gauge Report reviews from actual users:

Power Gauge user Annie G. jokingly admits becoming “addicted” to Chaikin’s system once she saw what it can do.

Cheryl D. said Chaikin’s Power Gauge gives her the info she needs to trade effectively and saves her from wasting countless hours on scouring the market for promising stocks.

Finally, Bob Lang, a veteran equities trader and a regular on CNBC’s Mad Money, said Chaikin’s system “stands out, head and shoulders, above the rest.”

Clearly, these users were impressed by the value that Marc Chaikin’s Power Gauge Report delivers.

They’ve used the Power Gauge to achieve tremendous success in the market, and there’s no reason to think you can’t do the same.

>> Save 60% with limited time offer! <<

How Much Does the Power Gauge Report Cost?

An annual Power Gauge Report subscription typically costs $499. However, we’ve secured a special deal for our readers that can help you save substantially.

For a limited time, you can join for $199. That discount saves 60% off the full sticker price.

On average, you’ll pay just over $16 for every month of access to the service.

Your purchase is also covered under Chaikin’s money-back guarantee, so you’re covered if you’re not satisfied.

Is Power Gauge Report Worth It?

After a thorough Power Gauge Report review, I believe it’s an excellent service and a bargain at just $199. Plenty of newsletters are priced much higher and don’t offer a fraction of the value.

The Power Gauge alone is worth the sticker price, but Marc and Chaikin Analytics offer even more.

Between the newsletter and special reports, there’s quite a bit of investing insights to explore.

This particular bundle also features Marc Chaikin’s complete in-depth research on his #1 AI stock pick and many other promising opportunities.

You’ll also get access to the Power Pulse software, so you can evaluate your own stock picks using Chaikin’s game-changing Power Gauge ratings database.

Last but not least, your purchase is covered with Chaikin’s rock-solid money-back guarantee, so you can test drive the service with confidence.

Chaikin’s Power Gauge Report is an great service, and I adamantly recommend it for anyone looking to expand their stock market skills.

Tags:

Tags: