Dr. David Eifrig’s latest research package pinpoints a burgeoning opportunity in the healthcare space. But does it really live up to the hype? Tune into my Retirement Millionaire review for the full story.

What Is Retirement Millionaire?

Retirement Millionaire is a monthly research service led by Dr. David “Doc” Eifrig and published by Stansberry Research.

Subscriptions include stock picks, market commentary, bonus reports, and more.

As the name suggests, the central focus of this newsletter is retirement.

It also dials in conservative investment opportunities for a chance to steadily grow portfolios over time.

And the typical holding period is at least two years or longer.

Doc also offers loads of helpful tips about retirement, including how to live a millionaire lifestyle at a hefty discount, as well as money management.

It’s a unique angle that many services touch on, but don’t really commit to.

I’ll dive deeper into the intricacies as we go, so stick around. Let’s kick things off with a look into the service’s lead.

>> Sign up NOW and SAVE 60%! <<

Who Is Dr. David Eifrig?

Dr. David Eifrig is an excellent analyst with a keen eye for retirement investments.

He graduated from Northwestern University’s prestigious Kellogg School of Management in 1986 with a double-major MBA in finance and international policy.

Shortly after, Doc began his investing career trading derivatives at Goldman Sachs, where he eventually earned a VP title.

He spent more than a decade on Wall Street with Goldman, Chase Manhattan, and other firms.

In 1995, Doc decided to broaden his horizons. So he left Wall Street to attend medical school and pursue his dream of becoming a medical doctor.

Doc joined the University of North Carolina at Chapel Hill School of Medicine in 1997 and graduated with honors to earn a medical doctorate degree in 2001.

In 2002, the newly minted Dr. David Eifrig joined the highly esteemed Duke University medical school as an ophthalmology fellow and remained there until 2004.

Around this time, Doc helped start a small biotech startup. Roche later acquired the company for $125 million in 2008.

Soon after that deal, the trading bug bit Doc again. But he didn’t want to return to Wall Street.

Instead, he wanted to help everyday people take control of their wealth and health.

Doc quickly determined that the best way to share his investment strategies was with Stansberry Research.

Dr. David Eifrig Review: Is He Legit?

Dr. David Eifrig is legit.

He’s been running Retirement Millionaire for over 15 years, so people must be getting some value out of Doc’s unique insights.

As an actual doctor, David also shares some solid tips for maintaining health.

In terms of a resume, you can’t ask for better in a research guru.

Since its launch, more than 100,000 members have followed Doc’s work, and the Retirement Millionaire service is still running strong to this day.

>> Join now for instant access to David’s latest research <<

What Is Stansberry Research?

Stansberry Research is one of the leading names in the retail research industry, and they’re the publisher behind Doc’s Retirement Millionaire.

Porter Stansberry founded the company in 1999, and it exploded in popularity over the next two-plus decades.

Its comparatively affordable research newsletters were a hit with everyday folks, and the company had several specialized research services under its brand before long.

Today, Stansberry Research is one of the most prolific publishers in the investment research industry, but Retirement Millionaire remains one of its most popular research newsletters.

Dr. David Eifrig’s Top Stock for 2024

Dr. David Eifrig recently revealed his favorite retirement stock for 2024 for free to showcase his Retirement Millionaire service.

This pick has twice the returns of Tesla, pays out five times the dividends of poster child Apple, and remains less volatile than Warren Buffett’s Berkshire Hathaway.

Doc believes this company’s past successes are indeed indicative of its continued upward trajectory, thanks to a number of key factors already in place. We could be looking at a very long window for continued growth.

Perhaps best of all, the ongoing conflict between the elephant and the donkey shouldn’t cast any shadow on its potential.

Read on as I unveil Doc’s incredible opportunity and the reasons he’s so bullish about it.

>> Get David’s latest picks for 2025 when you sign up now <<

What is America’s #1 Retirement Stock?

Doc’s top retirement stock is none other than defense sector giant Lockheed Martin (NYSE: LMT).

The guru’s been keeping tabs on it since 2017 and sees the huge competitive advantage it has. None of the other defense stocks hold a candle to it.

If that wasn’t enough, billionaires like Ken Fisher, Paul Tudor Jones, and Steve Cohen have been on board for quite a while. Go where the smart money is.

Numbers-wise, Lockheed Martin brings in several billion in profits each year. It hasn’t missed a quarterly earnings estimate in more than six years.

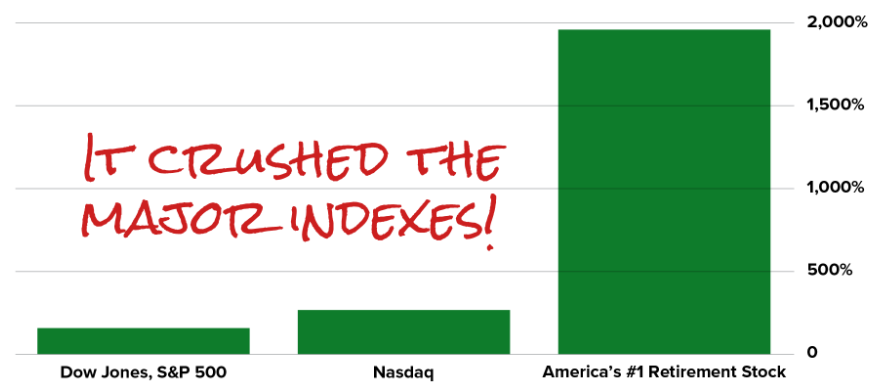

LMT saw a 1,963% return in 2020 when the Dow Jones and Nasdaq barely moved. Shares rose 40% during 2022’s stock market plunge.

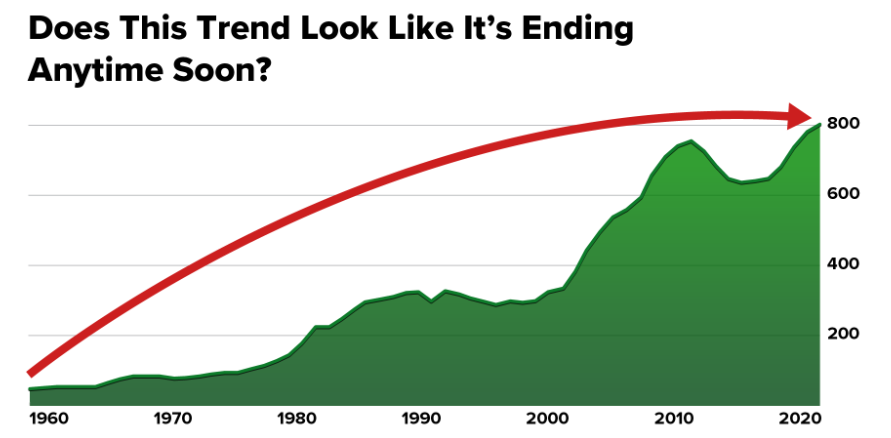

The company also has a long history of dividend growth, increasing on average by 10% annually.

>> Unlock America’s #1 retirement stock now! <<

Doc’s Prediction for the Market

We live in tumultuous times, but the current political and economic climate only has David Eifrig more excited about Lockheed’s growth prospects.

Doc’s research reveals that the markets and the country are feeling the effects of the government’s reckless spending.

The ensuing shortfall adds up to $405,000 for every single person living within our borders, leading many to wonder about how to simply make ends meet.

Amid the chaos, Eifrig predicts the defense sector will continue to outperform. Honestly, business has never been better.

If Doc is right, this lone industry has the chops to grow in normal circumstances but skyrocket if our current trajectory leads us into a crisis.

>> Get the full scoop on Doc’s latest prediction <<

How to Get Doc’s Full Research

As you can probably guess, LMT is just one of Eifrig’s top recommendations right now.

Still, I love how this presentation provides a sneak peek into his research and thought process.

He clearly spells out how he came to his conclusion about Lockheed by connecting a few dots that many of us overlook.

It’s a blessing that he’s feeding us a free pick, but he’s aware of multiple other opportunities with the same future potential – all from the defense sector.

These other companies are rising to the challenge of keeping the industry fresh, and keen individuals can get in on them at the ground floor.

You can get instant access to all Doc’s opportunities if you sign up for Retirement Millionaire under this current deal.

Join me as I investigate everything that comes with a membership.

>> Access Dr. Eifrig’s latest recommendations now! <<

Retirement Millionaire Review: What Comes With The Service?

Here’s what you get when you join Retirement Millionaire under the limited-time reversal window bundle:

One Year of the Retirement Millionaire Newsletter

The monthly newsletter is where members receive the bulk of their research.

Each issue contains one recommendation, supporting research, as well as the ticker symbol.

The targeted investment horizon is in the ballpark of 2 years. So these recommendations are intended to be held for the long haul.

This strategy could be a good fit for folks who prefer steady positions over fast-paced trades.

>> Join now to get the latest issue at special 60% discount <<

Trade Alerts

The team immediately notifies members of market moves that could affect the portfolio.

This includes both buy and sell alerts.

Each alert is backed with reasoning for the recommended action, so it’s easy to follow their methodology.

It’s a handy feature that lets members go about their day knowing the team is keeping a close eye on the markets.

>> Start getting top trade alerts now! <<

Health & Wealth Bulletin

This daily newsletter provides a blend of market commentary and health and wellness tips.

The steady stream of insights could keep members occupied between monthly issues of Retirement Millionaire.

Health & Wealth Bulletin doesn’t offer trade ideas, but this newsletter does spotlight general opportunities worth keeping an eye on.

It also has contributors, so you can get a well-rounded mix of expert analysis.

>> Unlock top stock opportunities now! <<

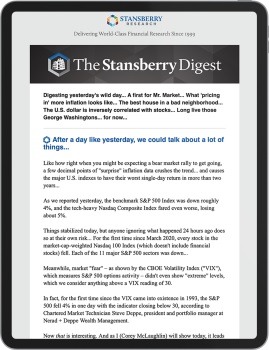

The Stansberry Digest

Similar to the Health & Wealth Bulletin, this daily newsletter offers general market insights.

Each issue is available every weekday after the market closes.

Between The Stansberry Digest and the other resources, members could have their hands full with a steady flow of expert research.

>> Claim your free access when you sign up now! <<

Doc’s Full Library of Newsletter Issues & Special Reports

New members can go back and look at all of Doc’s previous Retirement Millionaire reports and newsletter issues with the service’s sprawling online library.

Inside, you can find stock picks, investing insights, and other gems from Doc and his team.

Although these materials are outdated in some cases, they’re still an incredibly useful educational resource and a source for potential investment ideas.

If you spend just a few minutes perusing the Retirement Millionaire library, you’re sure to learn something new.

Doc is a true master, and just reading his research can help you sharpen your investing skills. The library is one of the most valuable features in this bundle.

>> Sign up now to access these features and much more <<

New Member Bonuses

Your subscription also comes with a boat-load of special reports packed with high-value research & insights from Dr. David Eifrig. Here’s what you get:

America’s #1 Retirement Stock

In this special report, David Eifrig lays bare all his research on Lockheed Martin so you can get first-hand access to how the mind of a financial expert works.

Instead of just being handed a stock and told to invest, Doc explains why he’s so bullish about the defense sector despite an uncertain future.

I’m always trying to learn how to think more like a guru, and America’s #1 Retirement Stock really knocks it out of the park for me here.

You’ll definitely want to read this cover to cover before investing in LMT so you’re equipped to maximize your return potential from such a powerhouse.

>> Get the full report now! <<

Building Your Retirement War Chest in The Era of Big Government

As I mentioned earlier, Lockheed Martin isn’t the only recommendation on Eifrig’s plate.

Building Your Retirement War Chest contains all the other defense stocks slated to go big as government spending continues to rise.

Some may not be names you’ve heard of, showcasing how Doc’s knowledge and connections lead him to opportunities we often can’t locate on our own.

Any one of them could double or triple your money in any market condition, making them excellent retirement secrets for any portfolio.

You’ll get the names and ticker symbols for each one, plus detailed explanations of why they’re on the list in the first place.

>> Unlock names and ticker symbols of top retirement stocks now! <<

How to Hire a Lobbyist for Your Portfolio

It probably won’t surprise you to hear that businesses often lobby with politicians to influence current or future legislation.

The result is often a big win for the company’s performance and, by association, its share price.

Figuring out which corporations lobby the most could give you an inroad to these monumental gains.

I don’t have the means to access a lobbyist, but David Eifrig does.

This special report contains a model portfolio with four of the most lobbied stocks in the world and the impact lobbying has had on shares since they were added.

Doc anticipates plenty of highway ahead for these particular stocks and further details on why each one’s worth a closer look.

>> Get instant access to all bonus reports when you JOIN NOW <<

The Big Book of Retirement Secrets

This monster 672-page to me is Doc Eifrig’s best-selling book. It contains a treasure trove of ways to get more money from the financial markets and secret methods for funding your retirement savings you won’t hear about anywhere else.

Doc picked up all these ideas during his decades as an investor, and he attributes many of them to his successes over the years.

Don’t let the size of this guide scare you; you don’t need to read it all in one setting. I’ve found it’s easier to take it in bite-sized chunks and implement the strategies I like as I go.

>> Uncover Doc’s secret methods to fund retirement savings now! <<

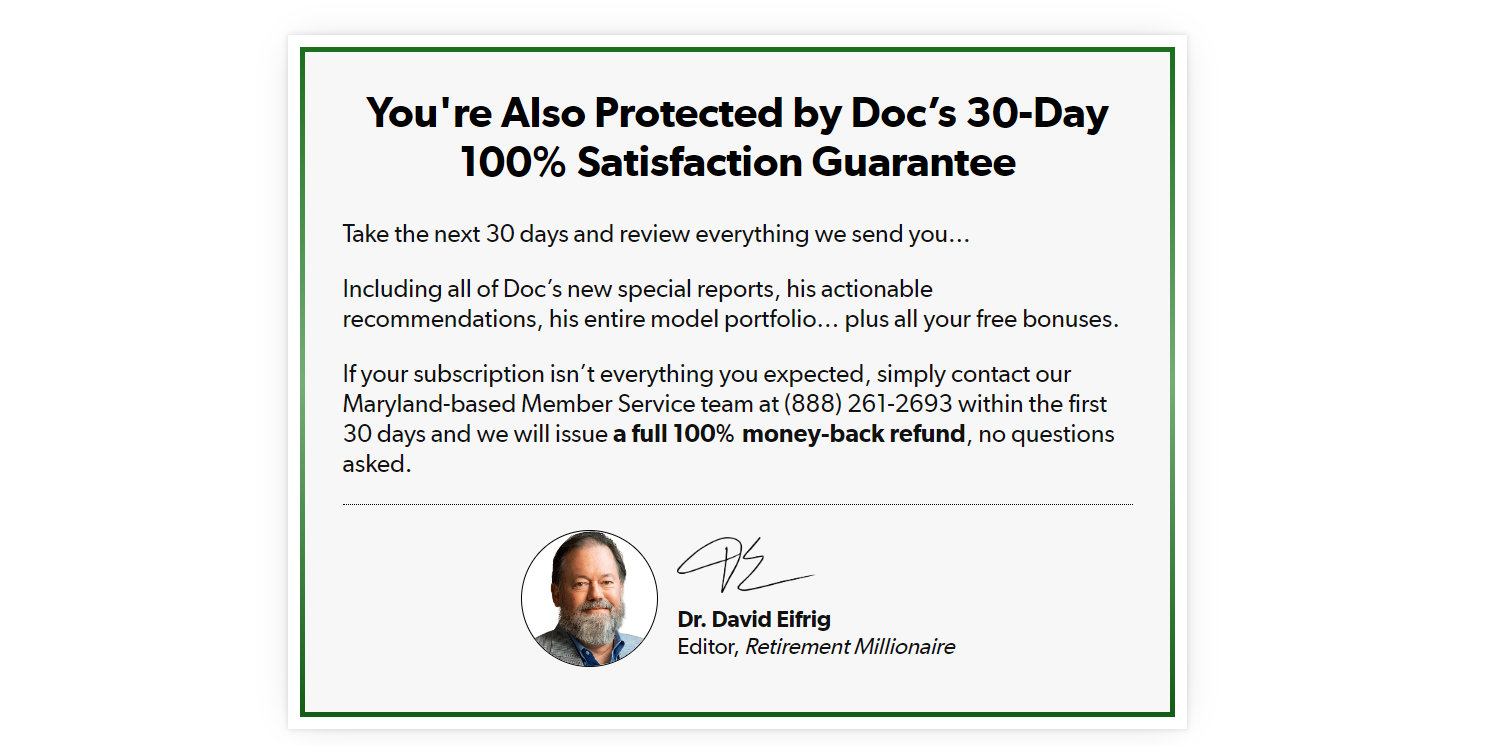

100% Money-Back Guarantee

Retirement Millionaire offers a 30-day 100% money-back guarantee with every new subscription.

This means new members have about a month to take the service for a spin.

If you ultimately decide it’s not a good match, you can request a refund on the cost of the subscription.

The newsletter’s typical holding period is around two years, so this might not be enough time to see a recommendation to its conclusion.

Still, it offers a comfortable window to dive into the team’s analysis and bonus reports.

Also, Doc is a solid analyst, so you could learn some valuable lessons — even if you don’t stick with the service.

>> Join risk-free under David’s iron-clad guarantee <<

Pros and Cons

I found a lot to like in my Retirement Millionaire review, but the service does have a few downsides.

Pros

- Full access to Retirement Millionaire newsletter and model portfolios

- New stock recommendations every month

- Three bonus reports

- Bonus access to two daily publications

- Features cutting-edge retirement strategies

- Excellent price and 60% discount

- 100% money-back guarantee

Cons

- No chat or social features

- No short recommendations

>> Take advantage of these benefits today for 60% off! <<

Retirement Millionaire Reviews by Users

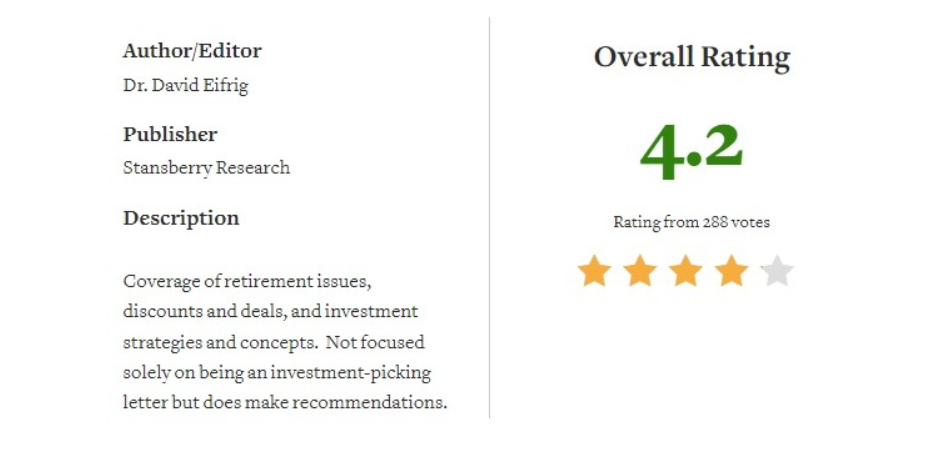

Doc Retirement Millionaire has earned a 4.2 rating over 288 reviews on Stock Gumshoe, an impressive feat given the sample size. .

Something to keep in mind is that I cannot verify which ratings are from real members. Also, keep in mind, Stock Gumshoe is a third-party rating site.

However, I think it all adds up to a generally positive sentiment surrounding .

Doc also highlights a few Retirement Millionaire reviews from actual members in his latest presentation, and they seem to be very satisfied with the service.

Keep in mind, these reports came directly from Doc’s latest presentations, so take them with a grain of salt.

However, they still give you a valuable window into what these members experienced with the service.

From what I can tell, Doc and Retirement Millionaire are the real deal. Both get good marks from the internet and high praise from members.

>> Sign up now and join these satisfied customers <<

How Do Retirement Millionaire Stock Picks Perform?

Doc’s recommendations can be game-changing for your retirement goals, sometimes in as little as 24 hours.

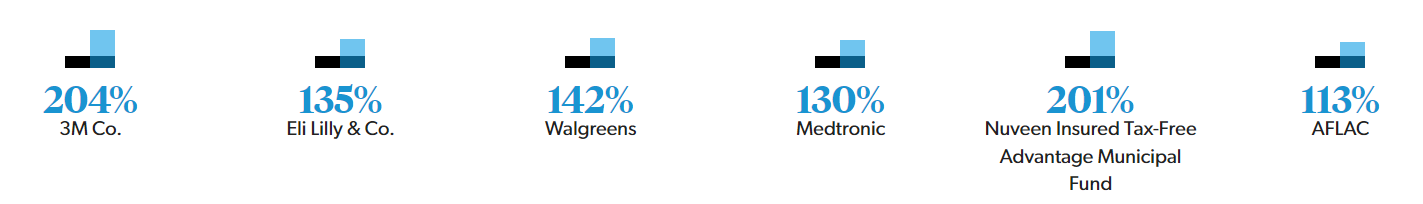

Many of his picks have generated triple-digit gains, such as a a 204% win with 3M Co. (NYSE: MMM), 130% with Medtronic (NYSE: MDT), and 142% with Walgreens (NASDAQ: WBA).

Keep in mind that these results aren’t typical, and investing is inherently uncertain. There’s no guarantee future recommendations will perform this well.

>> Get the latest stock recommendations now! <<

How Much Does Retirement Millionaire Cost?

Typically, an annual Retirement Millionaire subscription costs $499.

However, the team is sweetening the deal and providing new members with an introductory offer of $199 for the first year, equivalent to a 60% discount.

The good news is you’ll lock in this rate if you sign up under this deal. So, if you decide to renew your subscription, you’ll keep your discount and pay the same price.

>> Get started now at 60% off! <<

Is Retirement Millionaire Worth It?

Retirement Millionaire is an excellent research service that provides a wealth of insights into how to make the most out of your retirement savings.

At $199 for your first year, you’re paying just over $16 per month for professional-level research from a proven winner in Dr. David Eifrig.

That’s a minuscule upfront cost when considering the benefits that a Retirement Millionaire subscription could hold for a retirement account.

Think of it as a small investment that could pay off big in the future.

For this low price, you get 12 recommendations throughout your membership, complete access to up to 25 additional stock picks through the model portfolio, and a treasure trove of high-grade research reports.

Plus, it’s all backed by Doc’s 30-day money-back guarantee, and you can lock in your subscription cost at a fraction of the normal rate if you join now.

I highly recommend giving Retirement Millionaire a close look if you’re in the market for quality research from a respected expert.

>> That’s it for my review. Claim your 60% discount BEFORE IT’S GONE! <<

Tags:

Tags: