Eric Fry claims an opportunity to invest in a transformative technology could be just around the corner. But is he really on to something, or is his analysis off the mark?

Get the full story on his investment report (and insights on America’s Final Invention) with my Fry’s Investment Report review.

What Is Fry’s Investment Report?

Fry’s Investment Report is an online newsletter with stock recommendations, bonus reports, and exclusive research archives.

This investment research service is helmed by stock picker Eric Fry and published by InvestorPlace Media.

The newsletter’s trade ideas follow a conservative investment profile and global macro analysis.

It also focuses on tech companies that could deliver long-term returns by zeroing in on trends driving some of the fastest-growing segments of the US economy.

In InvestorPlace’s own words, this newsletter “will prepare you to survive — and thrive — in any market.”

So is Fry’s Investment Report legit?

Let’s find out, starting by looking at the mastermind behind the service.

Who Is Eric Fry?

Eric Fry is an excellent stock analyst, who does a great job understanding the big picture.

He’s a macro investor, and this specialization is essential for identifying market trends, especially in tech.

Eric earned his stripes over the course of a lengthy career in finance trading stocks, options, and more.

Before teaming up with InvestorPlace, he spent time as a broker, entrepreneur, analyst, and professional portfolio manager.

He even helmed a high-powered hedge fund at one point.

His exploits don’t stop there:

“In 2016, Eric won the Portfolios with Purpose competition — Wall Street’s most prestigious investment competition — beating 650 of the biggest names in finance with a 12-month return of 140%.”

— InvestorPlace Media

There are a lot of budding technologies that look like they have potential.

However, it takes someone with sharp focus and decades of experience to filter out the winners from the losers.

Eric says at least 40 of his recommended stocks have yielded opportunities for 1,000x returns.

While this Eric Fry review certainly paints him in a good light, let’s take a look at if the guru is legit.

>> Join now to get Fry’s latest stock recommendations <<

Is Eric Fry Legit?

I am very confident that Eric Fry is legit.

He has an impressive track record, and his picks have consistently outperformed through both bull and bear markets.

Eric has a good eye for stocks. He can read the market like a book, and he’s proven it on several occasions in the past.

These are exactly the types of credentials you want in your corner when scoping out big-picture trends in tech.

All in all, I think Eric is a solid lead for his namesake newsletter, and his background fits the bill.

What Is InvestorPlace Media?

InvestorPlace Media is a publishing company with many solid stock market analysis services in its portfolio.

Founded over 40 years ago, it had a change in ownership in 2017.

It was bought by S&A Holdings, LLC, but still retains the same talent and quality it’s been known for throughout the last four decades.

Essentially, the company is a hub for top-tier investment gurus who target specific niches to help folks corner a new angle of the market.

InvestorPlace is a legit publisher that has been cranking out hit after hit for over 40 years.

And the firm houses some of the brightest minds in the investing space.

“Elon Musk’s Project Apollo 2.0” Presentation

I’m too young to have witnessed the space race, but Eric Fry believes another battle for global supremacy is underway.

This time, all eyes should be looking at artificial intelligence.

Losing this battle could cost us more than we can afford to lose, from economic stability to the value of the dollar.

Fortunately, Fry predicts that Elon Musk has the answer America needs to stay on top, and he’s not far off from releasing his tech to the world.

That’s intriguing on its own, but Eric teases that this AI revolution could make lots of people very wealthy in the process.

Of course, you’ll need to act quickly if you want a piece of the pie.

The Battle for Technological Dominance

China has been hard at work, taking ground from us in emerging trends.

The country now dominates 57 of the 64 key technologies in the world, and its quest for AI should be concerning.

A Chinese company’s secret launch of DeepSeek just a few months back proved that they can already compete with ChatGPT, so we need to step up our game.

This may not seem like a big deal to you, but take a trip through history and I think you’ll understand where I’m coming from.

The Spanish ruled the world through its seafaring operations for more than 300 years but faded when Britain’s Industrial Revolution became the dominant force.

The United States took that right with the advent of the electrical grid and emerging technologies birthed from access to power.

We’re now at the precipice of another massive shift in global trends, and we can’t afford to hand over the reins.

The Future is Now

This is where Elon Musk steps into the picture.

He’s been hard at work developing a superintelligent AI that can actually think like a human.

Eric Fry calls it “Apollo 2.0” as a nod to America’s missions to the moon that solidified our place as the world’s leading superpower decades ago.

The AI revolution will surely cast a longer shadow simply because of all the implications we can use the software for.

This next generation of artificial intelligence could cure diseases, aid our military strategy, power sophisticated robots, and all the while fuel our economy.

I wouldn’t be surprised if those key areas are only the beginning of what AI will really be able to do.

It’s worth noting that aerospace stocks skyrocketed with the Apollo program, leading to an almost giddy excitement for me when I think about what AI can do to my portfolio.

How To Take Advantage of Apollo 2.0 for Personal Gain

I know what you’re thinking; artificial intelligence is already here. It’s too late to get involved.

If Eric’s right, the true AI revolution is happening as we speak.

This could very well be the golden age of this new technology, making now the absolute ideal time to get involved.

Musk’s innovations are fast approaching though, meaning there’s only a small window of time left to make your move.

The good news is that Eric Fry’s expertise in this area has led him to a number of incredible investment opportunities we may not have access to any other way.

You can see all of his top technology stock recommendations and a slew of other goodies by signing up for Fry’s Investment Report.

Next, join me as I unpack all the features you’ll receive.

>> Get Fry’s top stock recommendations NOW <<

Fry’s Investment Report Review: What’s Included?

Here’s everything you get for becoming a member:

6 Months of Fry’s Investment Report Newsletter

A new issue of Eric’s flagship newsletter drops on the second Friday of every month, right after the market closes.

Each issue features a new stock recommendation, along with market commentary and supporting analysis.

On occasion, the team will release up to two recommendations if they are especially bullish on an additional investment idea.

It might be best to view a second stock as a nice bonus rather than expecting them to double up each month.

Eric tends to favor the tech market, but his specialization in international and macro investment events means that members could tap into stocks that capitalize on opportunities outside the US as well.

The newsletter also focuses on multi-year positions, so long-haulers are in good company.

Model Portfolio

All of Fry’s Investment Report‘s open positions are logged into its model portfolio.

This means you don’t have to wait for the next newsletter to drop to get started.

You can hop into the model portfolio as soon as you join and check out the team’s recent entries.

Past issues of the newsletter are also accessible, so you can explore the team’s analysis and why a particular stock made the cut.

The newsletters are straight to the point, which makes staying up to date with all the current recs a breeze.

Access to Eric Fry’s Research Archives

Memberships to Fry’s Investment Report also include access to the team’s past stock picks and research reports.

Some of Eric’s past research reports scope out hidden gems off the beaten path, so it could be a good place to look for investments outside the mold.

Some reports cover ETFs and precious metals.

I recommend checking out these resources if you’re interested in even more recommendations to fill out a portfolio.

Another benefit of the team’s investment style is that it centers around long-term holding periods.

This means that an investment idea from a year back could still hold tremendous value today.

Eric Fry’s Best Ideas Vault

Many of Eric Fry’s investment strategies are just as pertinent today as ever, so he’s created a digital vault to store them all.

Members get special access to this private stash featuring every past issue of Fry’s Investment Report and bonus publications all stacked with investment recommendations you can take to the bank.

I’ve spent a lot of time here catching up on content I’ve missed, and it’s nice to be able to locate and pull out only topics I’m interested in.

It wasn’t too difficult to find some real fruit here, so definitely spend time browsing when you’re waiting for the next newsletter to drop.

Updates & Alerts

Fry and his team keep close tabs on all their active recommendations in between newsletters and will send out periodic updates so you can stay ahead of emerging opportunities before they take place.

When it comes time to buy or sell, they’ll follow up with an instant alert so you can move quickly on the position and secure your standing.

It may not seem like much, but knowing when to get in and out is more than half the battle, so I appreciate Eric not leaving us out to dry here.

Choose the update and alert options that work best for you so you don’t miss them when it matters most.

Customer Support

Fry’s Investor Report employs a team of experienced customer support agents to help you with any questions or issues you have during your time as a member.

You can reach out to them from 9 am – 5 pm during the work week via phone, and it’s a breath of fresh air to me that they actually treat you like a person in our ever-expanding world of automated assistants.

It’s also possible to shoot over an email at any time, and I’ve never had an issue receiving a response in a timely manner.

>> Join now for instant access to these resources at 80% OFF! <<

Bonus Reports

Under Fry’s Apollo 2.0 deal, you can get four additional bonus reports highlighting promising artificial intelligence stock recommendations and other opportunities.

FEATURED REPORT: Winning the AI Race for America: The Company Behind Elon Musk’s Supercomputer

Elon Musk’s Apollo 2.0 wouldn’t be possible without the help of numerous companies, each with their unique strengths in the AI space.

While it’s not possible to invest in Musk’s initiative directly, it is possible to pursue these undervalued opportunities positioned for substantial growth as AI really takes off.

In this special report, Fry reveals the details on one venture partnering with Elon in a big way that you can invest in just as you would any other stock.

He lays out its name, ticker symbol, and valuable insights as to why this company has all the makings of a winner.

>> Get this report free when you join now! <<

How to Become Elon Musk’s Partner in SpaceX

SpaceX’s future looks very bright, seeing monumental growth through partnerships with NASA over the past few years.

It’s now America’s premier space exploration company and has plans in place to send astronauts to Mars as early as 2030.

If that wasn’t enough, its Starlink program provides internet services from space to more than 114 countries around the world.

The downside is that SpaceX is still a private company, meaning it’s nearly impossible for regular folks to invest.

Eric has found a way to grab a piece of SpaceX without any special system or connection, and he shares all the details in this stellar guide.

The Next Trillion-Dollar AI Opportunity: How Agents Will Change Everything

Our current administration being pro-tech helps our battle for AI dominance against China, but we’re seeing AI upticks in other areas too.

One area is something Eric calls “AI agents”, personal assistants that can help with travel planning and even book flights for you – without your help.

I’d have no issue with software taking away the stress of booking travel, but there could be other perks as well.

The entire industry could reach the multitrillion-dollar mark as it expands, creating some intriguing money-making opportunities along with it.

Fry draws attention to one company with a key role in the industry, and you can find all the details here.

The #1 Stock for the Coming AI Data Center Boom

The big names in tech, like Microsoft, Google, and Amazon, are all betting big on artificial intelligence.

They’re adding a combined $325 billion into the mix this year alone into the data centers needed to make complex AI calculations a reality.

According to Fry, these data centers require a very specific type of cable to function, and it’s possible to invest directly in the company that makes them.

As with all his other special reports, Eric provides his comprehensive analysis of this venture in a clear and concise manner, so you have everything you need to take part in what could be phenomenal growth.

>> Get Fry’s #1 stock for the upcoming AI data center boom NOW! <<

Eric Fry’s Money-Back Guarantee

Eric’s so confident in his research that he’s offering an incredible 90-day money-back guarantee.

If you’re not satisfied with Fry’s Investment Report at any point during your three months of membership, you can get a full refund with no questions asked.

As thanks for trying out the service, you’ll get to keep all the newsletters and bonus materials you’ve received up to that point.

>> Join risk-free under Fry’s guarantee <<

Eric Fry’s Track Record: Stock-Pick Performance

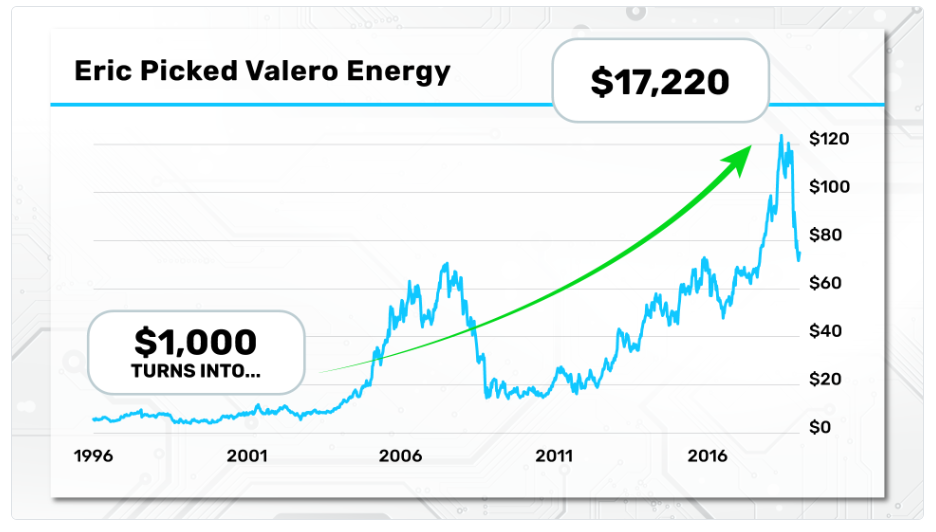

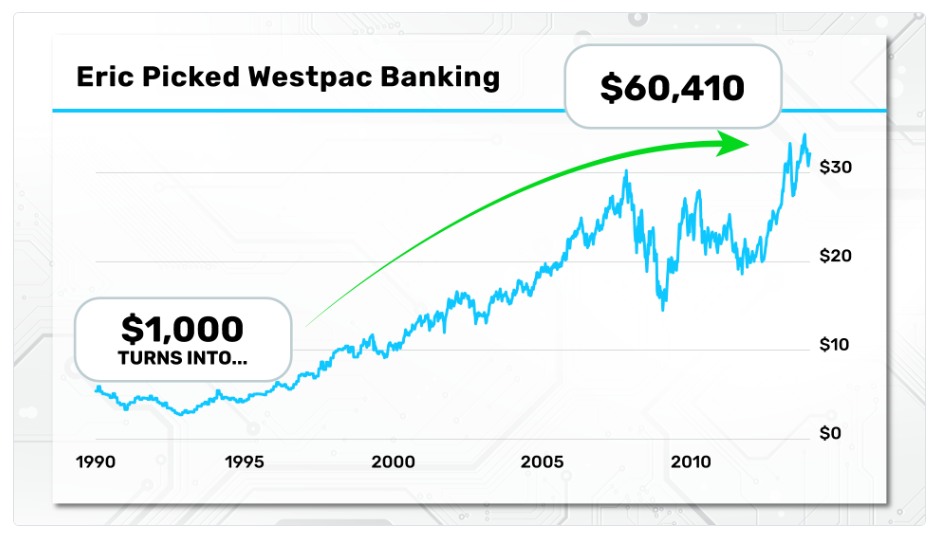

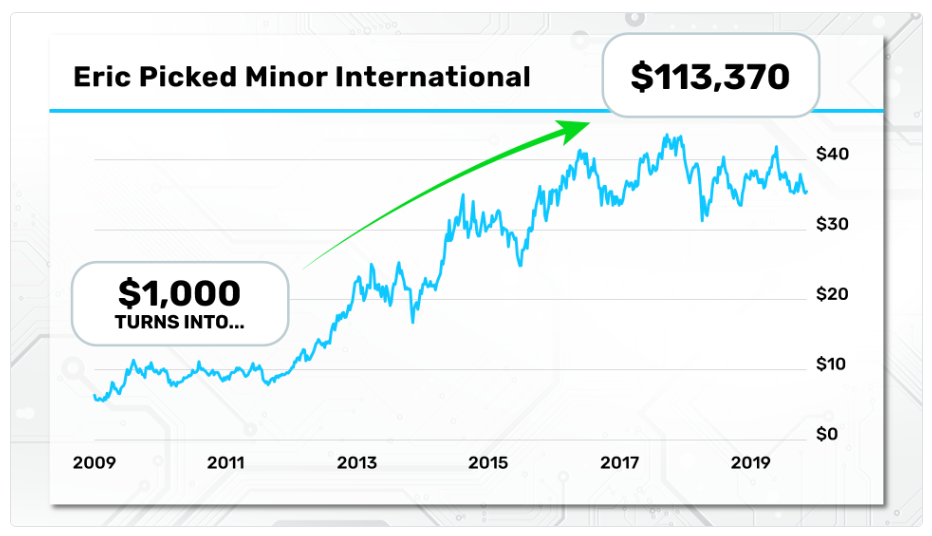

While working on our Fry’s Investment Report Review, we’ve found out that Eric Fry has led his readers to dozens of promising stocks over the years, and 41 of his picks went on to deliver potential gains exceeding 1,000%. Check out the chart above for the complete list.

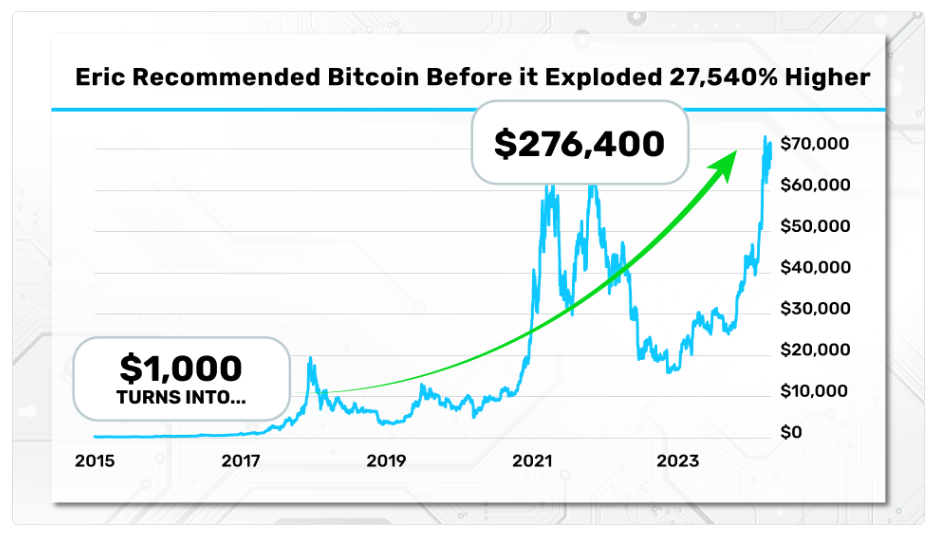

He’s also been ahead of the curve on some of the most promising investment opportunities in the modern era, including the rise of Bitcoin, the dot-com collapse, and others.

He recommended Bitcoin back in 2015, and its value soared shortly after. Eric’s readers had a chance to generate as much as 200X returns from this single recommendation.

When he called the top of the dot-com boom, it wasn’t long before the booming tech sector collapsed in spectacular fashion.

These were major trends that shook the financial world to its core. Many missed out on these opportunities, but Fry saw them coming a mile away.

Some of his most successful recommendations include:

As you can see, each of those recommendations gave readers the chance at extraordinary gains. Although these results aren’t typical, they give you a good idea of Eric Fry’s forecasting ability.

It’d be next to impossible to find a more qualified research guru than Eric Fry. He has demonstrated his investing ability time and time again, and he’s shown his readers several massive winners in the past.

You can’t argue with results, and that’s exactly what Fry delivered with the recommendations mentioned above.

If you’re interested in high-quality stock picks, you’d have a hard time finding a more qualified guru than Eric Fry.

>> Get Fry’s latest research when you join now! <<

Pros and Cons

We found a lot to like during our Fry’s Investment Report review, but it does have a few rough edges.

Pros

- Great price with an 85% discount

- Excellent 90-day money-back guarantee

- One to two recommendations a month

- Archive access with special reports

- Eric Fry is a reputable guru with a track record for success

- Average annual gain of over 20% since its inception (as of time of presentation)

- Comes with extensive research on several promising AI stock picks

Cons

- No community forums

- Only covers stocks

Who Should Subscribe to Fry’s Investment Report?

Fry’s Investment Report takes a somewhat conservative approach to investing, looking for big-picture trends that push the market forward.

His goal is to identify the best stocks moving within that mess, a skill that just about anyone can take advantage of. After all, there always seems to be way more losers than winners when it comes to breakouts.

You’re only ever dealing with a trade or two per month, coming hot off the presses with every new issue of the newsletter. Folks not in this line of work full-time should find that manageable, while others may need to look elsewhere to fill a portfolio.

I am impressed by the amount of educational material Fry supplies here in the form of bonus reports.

These guides often share secrets into the market that apply to more than just recommendations currently on the table. Plus, the entire vault of previous reports is made available to all members.

Fast-paced traders probably aren’t going to find a whole lot here, since these picks can last for years at a time.

>> Save 80% when you subscribe now! <<

Frequently Asked Questions

Here are some common questions I get from readers about Fry’s service, along with my answers to them.

Is Fry’s Investment Report Good for Day Trading?

Eric Fry’s Investment Report isn’t the best choice for day trading, since the platform only rolls out one or two picks per month. They’re definitely not designed for purchase and sale on the same market day.

Instead, the team takes more of a long-term approach to these recommendations, covering positions that you could potentially hold for years at a time. In theory, you could ride out these gains for as long as the AI industry continues to grow.

Swing traders may stand to benefit from these opportunities, given the inherent rise and fall of the markets over days or weeks. Trade cautiously though, knowing that this is not what these securities are intended to do.

Does Fry’s Investment Report Offer Personalized Financial Advice?

No, Eric Fry and his Investment Report team do not offer any kind of personalized financial advice.

The recommendations you receive here are solely based on research reports from the latest happenings in the tech world. Whether they’re the right fit for your portfolio is not a decision anyone at Fry’s Investment Report is qualified to make.

If you are looking for investment advice, turn to a certified financial planner near you, so they can study your unique circumstances. They’ll be able to offer personalized recommendations based on your goals, risk tolerance, and budget.

What Can I Expect From Eric Fry’s Stock Picks in the Investment Report?

Past Eric Fry stock picks have handed readers 41 unique chances to see 1,000% gains or more over the years. These big wins come from Eric’s ability to forecast upcoming trends before they take off.

This is Fry’s goal for each new recommendation in the Investment Report, but of course the guru suffers losses too. Even his past wins are in no way an indication of future gains.

The market is by nature uncertain, and there’s never a sure thing when investing. Like any other opportunity, you’ll want to weigh the pros and cons of an investment before buying in.

That said, Eric Fry’s stock picks for 2025 look like some really promising opportunities.

Is Fry’s Investment Report Right for Me?

Fry’s Investment Report is best suited for people looking for steady growth in tech-focused stocks.

You’ll get a total of 12 monthly picks throughout your subscription, which is plenty to keep most readers busy.

However, the AI stock picks included in the bonus research is the real crown jewel in this deal.

If you’re on the hunt for the next big AI stock, Eric Fry can help you get there. His picks are sure to lead you to some promising stocks.

This service has broad appeal, but based on our review, Fry Investment Report is an especially excellent fit for anyone interested in macroeconomic trends, long-term growth, and groundbreaking tech opportunities.

>> Sound like a match? Get started TODAY <<

How Much Is It?

Fry’s Investment Report typically costs $299 for six months.

However, the new deal knocks the price down to $49, which is nearly an 85% discount.

You’ll also get all the bonuses mentioned in my review.

In the end, you’re paying less than two bucks per week for an incredible amount of content.

When it comes time to renew, the Fry’s Investment Report crew will honor the $49 price tag for the next six months.

I’m thrilled that the service shies away from annual subscriptions so I have more flexibility should I ever want to jump ship.

Is Fry’s Investment Report Worth It?

After a thorough Fry’s Investment Report review, I have to say that the jaw-dropping track record is a testament to Fry’s skill.

Eric Fry is one of the most talented gurus in the game, and his research really stands apart from many others in the industry.

This opportunity around Elon Musk’s Apollo 2.0 is especially compelling, so now is an excellent time to get on board with the service.

You’ll get six months of Fry’s monthly newsletter at roughly 85% off the normal rate if you join now, plus tons of in-depth research on the rise of the AI revolution and bonus stock picks with big investment potential.

If that’s not enough, it’s also covered with a 90-day guarantee that ensures you’ll walk away from your purchase satisfied.

This is a great deal — It has everything I want to see in a high-quality, entry-level research service at an excellent price.

If you want to capitalize on the AI boom, check out Fry’s Investment Report. It could be the final ingredient you need to strike it rich on AI stocks, especially if you sign up in time for the Apollo 2.0 investment deal.

Tags:

Tags: