Weiss Ratings has released a new research package for Safe Money Report. But is it worth your time? Check out my Safe Money Report review for the full story.

What Is Weiss Ratings’ Safe Money Report?

Safe Money Report is an investment newsletter published by Weiss Ratings featuring editor Mike Larson.

Some of the member perks include monthly trade ideas and special bonus reports. There’s a lot going on under the hood, so we’ll put a pin in the features for now.

As the name suggests, the team exercises a more conservative investment strategy or a “safer” investment profile. They target stocks, ETFs, and select commodities, such as physical bullion.

The special sauce of this service is its advanced rating system, Weiss Ratings.

The rating system evaluates stocks and ETFs based on key indicators. Depending on how a security fares, it’s issued a grade from A to E, with plus or minus grades.

Even better, members receive direct access to this proprietary system.

Before I dig into the full suite, let’s put the lead editor and publisher under the microscope.

>> Sign up NOW and SAVE 92% off <<

What Is Weiss Ratings?

Weiss Ratings is an investment research publisher with a strong catalog of newsletters under its umbrella.

The company was founded by Dr. Martin Weiss in 1971, which gives it 51 years of credibility.

Weiss Research, Inc. also has an A+ rating on the Better Business Bureau’s website and a 4.18/5 rating.

Here’s a quick look:

Some investments the team targets involve stocks, crypto, commodities, ETFs, etc. These services provide a signature blend of expert analysis with safety ratings (more on that later).

I’ve previously reviewed Weiss Crypto Investor and can say that this publisher offers quality analysis.

>> Get the team’s latest recommendations <<

Martin Weiss’ Warning: Digital Lockdown Is Coming

Martin Weiss believes we’re at the dawn of a new era for America, and it’s not going to be a pleasant one.

If he’s right, the government is on the verge of implementing a new form of money management that could leave many Americans in bad shape.

These changes could wipe out your savings and completely destroy everything you’ve worked so hard to achieve in the process.

What’s worse, we could see all this go into effect before the election in November.

Luckily, the guru has a plan to keep our finances and sanity safe.

First, what is this crisis that Weiss is so worried about?

Massive Crisis Coming Soon

Weiss’s fears stem from a new form of government overreach he predicts is on the horizon.

As it turns out, the government needs money. Inflation, surging interest rates, and a slew of failing banks make that evident.

It’s not a far stretch to think they’ll come after ours. After all, the top brass have no issue trying to control the people.

I’d love to think our government wouldn’t do such a thing, but the writing on the wall doesn’t look good.

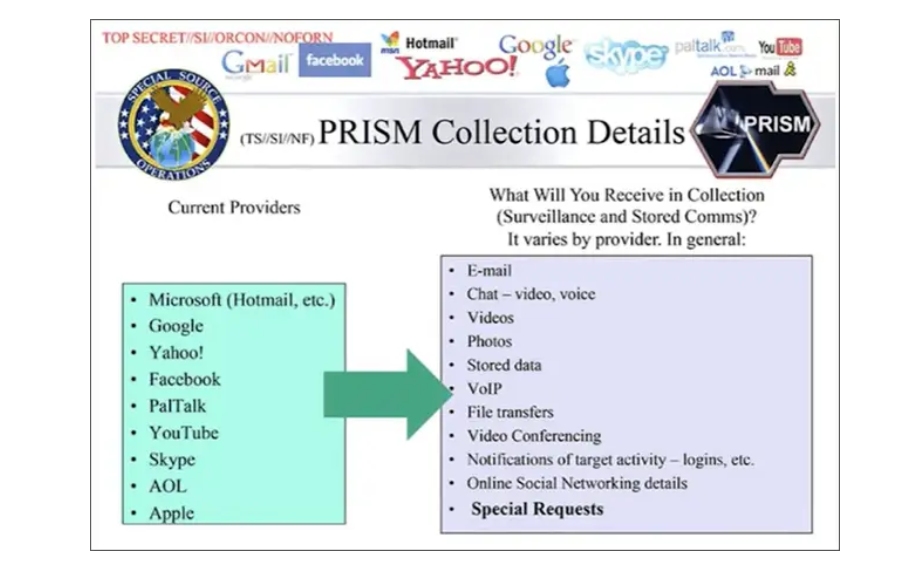

In response to the 9-11 terrorist attacks, the NSA illegally collected phone records from millions of Americans for years.

Chances are, none of us will forget the Covid lockdown any time soon either. Now, your money is on the line thanks to a program called FedNow.

>> Prepare against “Digital “Lockdown” – Get Weiss’s predictions now! <<

What is FedNow?

FedNow is a new money system developed with a new Central Bank Digital Currency (CBDC) at its core.

As the name implies, it would give the government central control over your money whether you like it or not.

They could monitor every transaction as it happens, which is way too personal for my liking. Unfortunately, it could get even worse.

This system gives those in power the ability to impose a financial lockdown for any reason if they see something they don’t like.

Imagine having funds frozen for shopping at the “wrong” store or voting for a particular candidate. The thought is unnerving.

Don’t assume this is just sci-fi. It already happened in Canada, where people were protesting the Covid lockdown a few years back.

If Weiss is right, there’s no way to prevent FedNow from happening. You can protect yourself, however, with the right steps.

How Can Americans Prepare?

If Martin Weiss’ prediction comes true, you’ll want to shield your finances as quickly as possible. It’s very realistic to expect these changes to take place no matter who makes it into office this fall.

Perhaps most importantly, you’ll want to get your money away from the government’s prying eyes as quickly as possible.

Weiss teases that cryptos are an excellent way to do this due to their decentralized nature. Gold could potentially function much the same way, since it’s not tied to a currency.

He even advises to pull your funds off Wall Street, where it could be easy pickings for government edicts.

While these are all great tips, you’ll need to pick up a subscription to Weiss’ Safe Money Report to eke out all the details.

Let’s look at what comes with a membership.

>> Worried about your assets? Get Weiss’ expert strategies now! <<

Safe Money Report Review: What’s Included With A Subscription?

The latest Safe Money Report package from the team is loaded with features. Here’s what you get when you join.

One-Year Subscription to Safe Money Report Newsletter

Each issue of the monthly newsletter dials in on one trade idea vetted by Mike Larson and members of the Weiss Ratings’ team.

These trade ideas can either be stocks, commodities, or ETFs. There’s no deliberate rotation.

I appreciate that the newsletter doesn’t follow a strict pattern for its recommendations. It lets you know the team focuses on finding real opportunities and not trying to meet an arbitrary quota.

Members also receive “Buy” and “Sell” alerts as well as market commentary.

Lastly, the newsletter provides a print edition, which is a nice touch in an endless sea of email-based research services.

>> Subscribe now for 92% off! <<

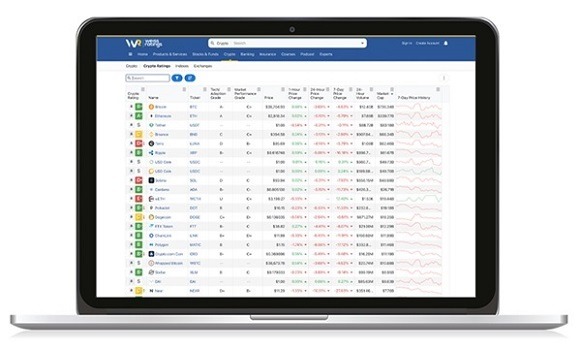

Premium Access to 53,000 Weiss Ratings

A Safe Money Report subscription grants unlimited access to the Weiss Ratings database. It’s a valuable addition for anyone looking to do some self-directed investing.

Here are some of the investments you can track:

- 10,000 common stocks

- 2,400 ETFs

- 26,000 mutual funds, and

- 1,600 cryptocurrencies

The ratings grade investments and financial institutions, like a report card. The grades range from A to E. The system does not typically issue F ratings (except for certain industries).

If a security receives a U grade, it means the stock does not have the necessary info to produce an accurate rating.

Keep in mind that, although the system can spot securities with potential, there are no guarantees.

>> Unlock unlimited access to the Weiss Ratings database <<

Weiss Ratings Daily e-Letter

The daily email newsletter provides daily analysis and commentary.

One month can be a lifetime in the stock market, which is why the team supplies supplementary trade recommendations.

They alert members of huge shakeups on the horizon, including potential black swan events.

This feature also includes other handy resources, such as video interviews, webinars, and much more.

It’s a great resource for folks who want to stay on top of the latest market-making news day to day.

>> Get daily market updates and insights <<

FedNow Bonus Reports

The current Safe Money Report package also offers several premium bonus reports featuring valuable stock picks and strategies.

Digital Lockdown: How to Protect Your Money from Government Control

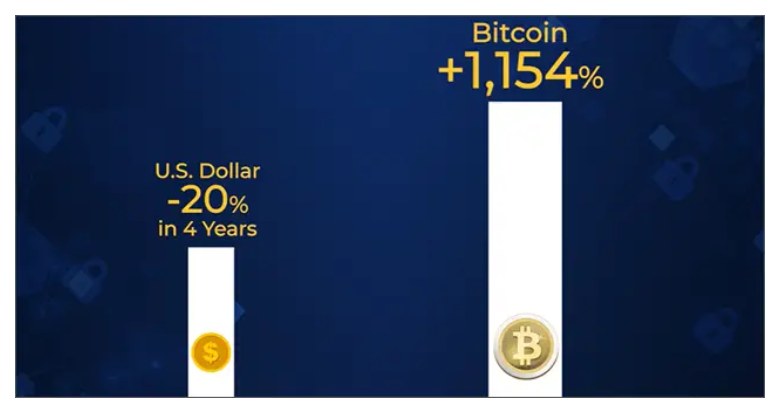

We’ve all seen the kind of profits Bitcoin can generate as an asset class. Moreover, it’s completely decentralized – the complete opposite of CBDCs.

This one crypto increased some 1,150% over the last four years, where the dollar has lost 20% of its value. That alone is a compelling reason to invest.

Owning Bitcoin is just the first step to protecting your funds, though. Other, less popular coins have the potential to produce even more profits.

In this special report, you’ll read about the names of these under-the-radar digital currencies and the tools you need to add them to your portfolio.

The Ultimate Gold War Chest

Historically, it’s been a smart move to own at least some gold. While the dollar has a history of losing value, gold has enjoyed a relatively steady increase for the last 5,000 years.

That said, there are right and wrong ways to purchase gold. With FedNow coming, this is more true than ever.

Inside The Ultimate Gold War Chest, Weiss shares how to get the best deals in gold and how to avoid scams along the way.

You’ll also learn about the best storage methods for keeping your gold where it belongs.

>> Get gold investment tips now! <<

How to Protect and Grow Your Wealth Off Wall Street

Wall Street may be the poster child for investing, but it’s not immune from the effects of FedNow.

Transactions flow through brokers, exchanges, and banks that are all susceptible to its effects.

Inside this guide, Weiss uncovers other areas to place your money that the elite use to keep their funds safe.

Best of all, you’re not just preserving your money here. These opportunities are ripe for growing your wealth in just about any market condition.

Even if FedNow doesn’t come to pass, these are still excellent options for growing your nest egg.

>> Unlock Weiss’s latest research and strategies <<

The Weiss Ratings “X Lists” Bundle

This secret “X lists” bundle contains three incredible reports not available anywhere else: The World’s Weakest and Strongest Banks, America’s Weakest and Strongest Stocks and ETFs, and The World’s Weakest and Strongest Cryptos.

At a glance, these guides showcase the strongest and weakest options in each category so you can safely navigate the current financial climate.

Additionally, they contain additional tips and insights for keeping your money safe while generating some healthy profits at the same time.

>> Get exclusive access to the “X Lists” bundle when you join NOW <<

100% Satisfaction Guarantee

Under the latest deal, Safe Money Report members can access a 365-day money-back guarantee.

This means you have a year to test out the service. If you feel that it isn’t a good fit for any reason, the publisher will provide a full cash refund on the price of your subscription.

The industry standard for refunds falls somewhere in the ballpark of 30 days. So, the team is going above and beyond with their refund policy.

This 365-day window could give ample time to see the quality of analysis of this offer.

That said, the team does target long-term investments, so this still might not be enough time to see a position all the way through if everything goes well.

Even if you do ultimately decide that the service isn’t right for you, there’s plenty to learn from Mike.

>> Sign up risk-free under the team’s guarantee <<

Is Weiss Ratings’ Safe Money Report Legit?

Weiss Ratings’ Safe Money Report is a legit newsletter.

Mike Larson is a talented analyst who knows his way around the markets. He’s worked closely with Martin Weiss and is one of the publisher’s brightest minds.

The safety-oriented Weiss Ratings mesh well with his more cautious approach.

In short, he’s the real deal and a good match for the publisher.

Pros and Cons

Safe Money Report has plenty of ups, but there are some downs to keep in mind.

Pros

- 92% discount on current bundle

- Utilizies sophisticated, data-focused research strategies

- Unlimited access to Weiss’ proprietary ratings system

- Features several premium bonus reports

- Industry-leading money-back guarantee

- Backed by respected publisher and guru

Cons

- No community forum or chat

>> Save 92% when you join now! <<

How Much Does It Cost?

The team values the current Safe Money Report bundle at $545 per year. However, Weiss Ratings offers new members an introductory rate of just $49 for an annual subscription.

This shapes out to a roughly 92% discount, and puts the total cost of the product in range of many of its competitors.

Unlike other services, you’ll be locked into the discounted rate for as long as you’re a member, so you don’t have to worry about a bait-and-switch mark up at the end of your first year.

At $49 for the entire year, your average cost breaks down to just $4 a month.

Is Safe Money Report Worth It?

Safe Money Report is a great service that’s worth the sticker price. It provides a lot of value, including stock picks vetted by a team of experts, the Weiss Ratings system, and bonus reports.

The cautious approach could be an excellent fit for folks interested in a more conservative lineup of trade ideas. Many portfolios are underwater right now, and not everyone wants to swing for the fences.

Also, if you’re a fan of self-directed investing, there’s a lot to like about the Weiss Ratings. The service recommends various assets, including stocks, ETFs, mutual funds crypto, and more.

Plus, the Safe Money Report team backs the entire package with an impressive 365-day refund policy, so it’s virtually impossible to walk away from this deal unsatisfied.

All in all, this is a fantastic deal that merits a closer look — especially with the 91% discount. After a thorough Safe Money Report review, I highly recommend you take a closer look at this Weiss service.

Tags:

Tags: