If you’ve ever felt like the market moves in random directions, you’re not alone. But what caught my attention while researching Jim Fink is his claim that many stocks actually follow recurring seasonal patterns year after year.

In this Seasonal Stock Alert review, I’ll share what this service is all about, who Jim Fink is, and why his approach to trading these seasonal “profit windows” might deserve a closer look.

I’ll also weigh the strengths and weaknesses so you can decide whether this strategy makes sense for you.

>> Join Jim Fink’s Seasonal Stock Alert<<

What is Seasonal Stock Alert?

Seasonal Stock Alert is Jim Fink’s premium trading advisory built around one concept: seasonal profit windows.

Because Jim combines this data with both fundamental and technical analysis before recommending any trade, readers get to act on vetted opportunities.

Each month, members receive two brand-new trade setups with three different ways to approach each one.

This flexibility is a big reason why people are drawn to the service, letting you choose what fits your comfort level.

And since every alert comes with clear, step‑by‑step instructions, it doesn’t feel overwhelming.

In short, it’s a structured, data‑driven way to tap into recurring market moves without having to reinvent the wheel each month.

>> Claim Seasonal Stock Alert Now <<

Who is Jim Fink?

Jim Fink is known in many circles as one of the nation’s top traders, but his origin story is rather unique.

Early in his career, he worked as an attorney at a top Chicago law firm, but he quickly realized his real passion was in the stock market.

Taking a bold step, he left law behind and devoted himself to trading full-time. Within just a few years, he transformed $50,000 of savings into $5.3 million, a milestone that cemented his reputation.

Over the past three decades, Jim has regularly shared insights through books, online articles, and appearances in respected outlets such as Barron’s and The Wall Street Journal.

Today, he channels that experience as editor of Seasonal Stock Alert at Eagle Financial Publications.

Is Jim Fink Legit?

Jim Fink’s credibility is built on more than just bold claims.

His strategies have been publicly tracked, and since launching his service in 2023, the average gain per trade has been 18.5% over a 55‑day holding period.

Beyond his performance, he has spent years educating readers on options strategies through webinars, newsletters, and detailed write‑ups that simplify complex ideas.

His background as both an attorney and trader gives him a rare blend of precision and discipline, and his work has been cited in multiple financial media outlets.

With a proven history of turning modest investments into significant gains and a decades‑long track record, I’m satisfied Jim has established himself as a legitimate and trustworthy figure in the trading world.

>> Start trading with Jim Fink Now <<

Inside the Seasonal Stock Alert Presentation

According to Jim, far too many individuals treat the market as if it were completely random.

However, his research shows that some stocks move in predictable patterns based on the time of year.

Think of it like knowing when holiday shopping will boost retail stocks, or when colder months affect energy demand.

If you can anticipate these moves before they happen, you’re no longer guessing; you’re planning.

That’s the core of his approach, and it immediately stood out to me as something both logical and practical.

How Seasonal Profit Windows Work

In the presentation, Jim demonstrates how small but recurring moves in well‑known companies can be turned into much bigger opportunities.

For example, Amazon has a consistent stretch where it tends to climb about 22% in a matter of weeks.

While I don’t typically attribute this concept to the stock market, it does make sense – after all, it happens elsewhere.

We expect summer days to be hot and dry where I live, and I can count on Black Friday sales around Thanksgiving time every year.

In fact, I’d argue that they’re almost impossible to perceive unless you carefully study trends week in and week out for years at a time.

What really blows me away about this service is that Fink takes things a step further.

Sure, investors could invest in these companies before predictable growth and ride these profit opportunities up a few percent.

Jim says there’s a much better way to do it.

Instead, he uses strategic options plays to maximize the potential profit opportunities from these seasonal changes, whether they move up or down.

In some cases, we’re talking about upwards of quintuple-digit gains. That caught my attention.

Let’s not forget this is a one-time thing: these are repeatable patterns you can turn to year after year.

What’s more, companies see their moves at different times of the year, paving way for significant returns just about every week

Turning Patterns Into Profits

Jim’s concept sounds great, but it only works if you know how to partake of it.

The way I see it, that kind of clarity is invaluable if you’ve ever second‑guessed a trade before clicking the button.

To that end, you can get access to his recommendations when you sign up for his Seasonal Stock Alert service.

If you want to put yourself in a position to benefit from these repeating patterns, the next step is to see exactly what you get when you join Seasonal Stock Alert.

>> Turn Patterns into Profits NOW <<

Seasonal Stock Alert Review: What Comes With It?

Join me as I investigate everything that comes with a Seasonal Stock Alert subscription:

Monthly Trade Alerts

On the fourth Wednesday of every month, members receive two brand‑new trade alerts covering a pair of stocks with seasonal profit windows about to open.

You’ll get a close look at three ways to play each one, allowing you to adapt these opportunities to whatever strategy you prefer.

That means you’re not limited to one approach; whether you want to simply buy shares, try an options move for bigger upside, or collect upfront income, you’ll know how to do it.

With six potential opportunities each month, that’s 72 trade setups over the course of a year.

This research comes with specific buy instructions and target prices, so you know precisely how to act.

24/7 Access to the Seasonal Stock Alert Members‑Only Website

The membership also unlocks access to a private online portal where you’ll find a library of resources designed to get you up to speed quickly.

Included within are two exceptional additional features you should digest right away. They’re designed to give you the best chance at maximizing the service’s potential.

The site also hosts a full model portfolio that tracks every recommendation Jim has made, wins and losses included, so you can see the track record for yourself.

And if you prefer learning visually, the also-included 3‑part video boot camp shows you, step by step, how to find seasonal setups and execute the three trade types.

>> Get Jim Fink’s Members-Only Website <<

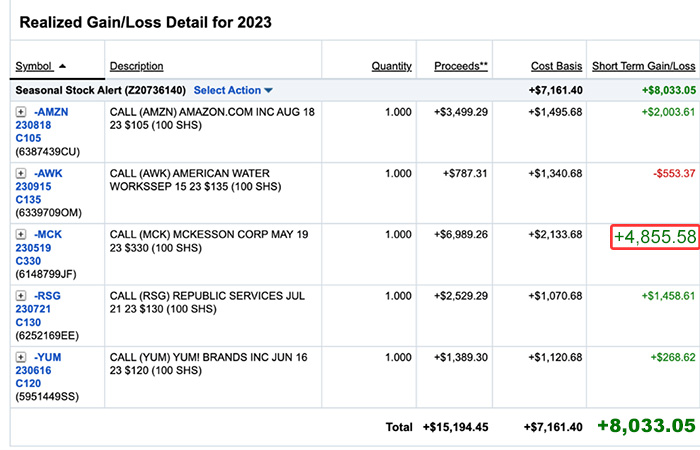

Full Access To Stock Talk

Unlike many services that leave you on your own, Seasonal Stock Alert includes access to Stock Talk, a members‑only discussion board.

Instead of just reading Jim’s alerts in isolation, you’re stepping into a community where other members are walking the same path.

That kind of direct access is rare in the newsletter world and makes it feel more like you’re part of a group effort rather than trading on your own.

Stock Talk is a great place to get clarity on trade instructions, share how they approached an alert, or simply check in to see how others are doing with the same positions.

Premium Concierge Service

Finally, members get personal support through the Premium Concierge Service.

The U.S.-based team is familiar with the service and can quickly help you if you have trouble accessing the website, locating an alert, or even just need clarity on how to use the materials.

Many services drop the ball when it comes to support, but here the promise is that you’ll never be left waiting days for a reply.

That peace of mind matters, especially when you’re dealing with time‑sensitive trade alerts.

It shows that the publisher is serious about making sure members feel supported every step of the way.

Refund Policy

The subscription is backed by a 30-day money-back guarantee, making it less intimidating to try the service.

If at any point during those 30 days you feel the service isn’t living up to expectations, you can simply contact customer support and receive a prompt refund.

What’s important is that you’re not asked to return any of the guides or training materials; you get to keep them as a thank-you for giving it a try.

This safety net shows confidence in Jim Fink’s strategy and makes it easier for new members to test the waters without worrying about wasting money.

>> Trade Risk-Free with Jim Fink’s Guarantee <<

Pros and Cons

Pros:

- Clear, beginner-friendly trade instructions

- Multiple ways to trade each opportunity each month

- Jam-packed website with bonus materials

- 30-day refund guarantee

- Active community and support line

- Proven strategy with real-world track record

- Discounted price

Cons:

- Options trading may intimidate some newcomers

- Requires monthly attention to alerts

Seasonal Stock Alert Reviews by Members

Hearing directly from members is often one of the best ways to gauge how a service performs in the real world.

In the case of Seasonal Stock Alert, there are several testimonials that shed light on what people have experienced.

Not every trade will be a big winner, and losses are possible.

Still, the consistency of positive feedback suggests that many people have found real value in applying Jim’s strategy, particularly when they follow the alerts as laid out.

For someone considering the service, these testimonials provide a taste of what’s possible without promising guaranteed outcomes.

>> Trade Smarter with Jim Fink <<

Seasonal Stock Alert Track Record/ Past Performance

When it comes to performance, Jim Fink doesn’t shy away from sharing the numbers.

Since the launch of Seasonal Stock Alert in 2023, the advisory has averaged an 18.5% return per trade, factoring in both winners and losers.

What makes that figure even more striking is the time frame – on average, the holding period is just 55 days.

Compare that to the broader stock market, which struggles to deliver that kind of return in an entire year, and it’s easy to see why members find this appealing.

The presentation highlights real examples to back up these statistics.

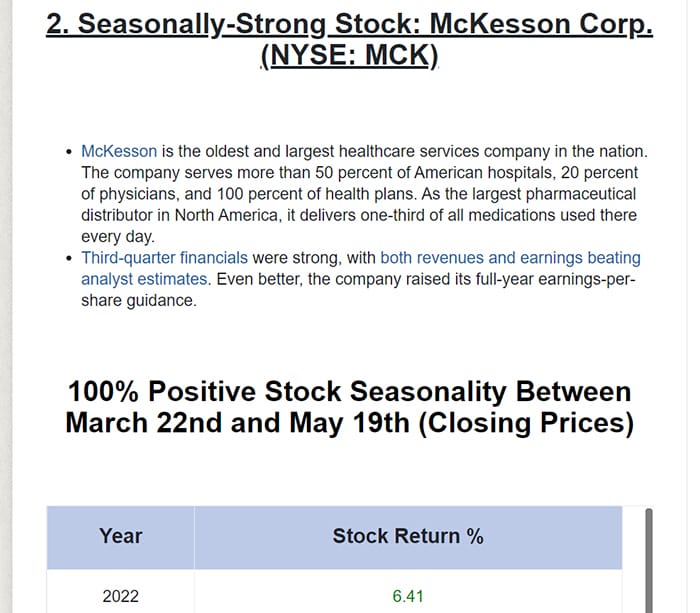

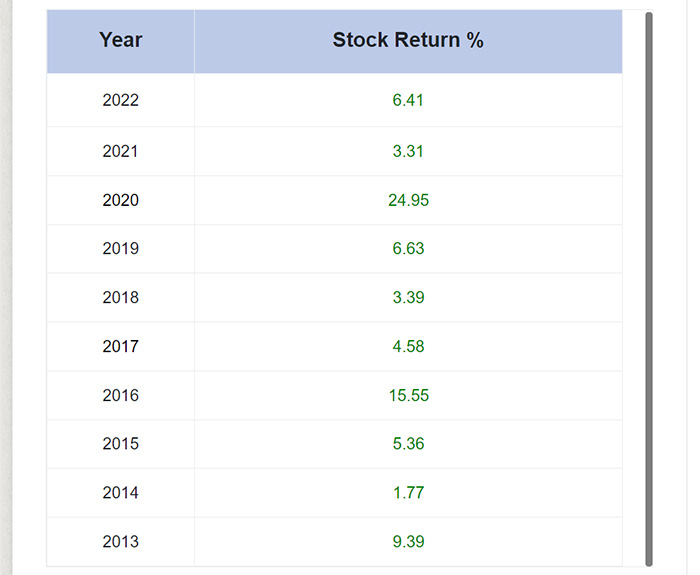

Seasonal profit windows identified in companies like Amazon, Republic Services, and McKesson have historically delivered gains of 20% or less on the surface, but with Jim’s trading approach, those moves translated into triple-digit returns.

The model portfolio inside the members’ site also tracks every call option recommendation Jim has made, offering full transparency into both successes and setbacks.

>> Activate Seasonal Stock Alert <<

How Much Does Seasonal Stock Alert Cost?

The standard subscription price for Seasonal Stock Alert is $599 per year, but new members are currently being offered a steep discount that cuts the cost in half.

Right now, you can lock in a full 12 months of membership for just $299.

That one-time payment gives you access to every feature, monthly trade alerts, the members-only website, Jim’s video boot camp, the Stock Talk forum, and the concierge service.

Considering that each alert alone provides six possible trade setups, the value quickly adds up.

For less than a cup of coffee per week you’re getting an entire year’s worth of education, actionable strategies, and ongoing support.

Even if you take advantage of only a handful of alerts, the potential upside can outweigh the membership fee.

Is Seasonal Stock Alert Worth It?

Looking at all the details in this Seasonal Stock Alert review, there’s no doubt in my mind that the service demands attention.

Members receive clear monthly trade alerts, access to training materials, a model portfolio, and direct community support.

For those who have struggled with complicated trading strategies, Jim Fink’s step‑by‑step instructions are straightforward and easy to act on.

The flexibility to choose between stock trades or options also makes it suitable for different comfort levels.

Performance adds weight to the offering. Since launch, the average gain per trade has been 18.5% with a holding period of under two months.

That doesn’t mean every alert is a winner, but it does show consistency and transparency.

With the current discount and a 30‑day refund policy, the risk is limited, and the potential rewards make the service worth considering.

I’d definitely recommend giving Seasonal Stock Alert a closer look. Sign up to start capitalizing on these exclusive trades right away.

Tags:

Tags: