Serious market research has always separated average results from exceptional ones, and Seeking Alpha Pro aims to give readers that edge.

Its blend of institutional-grade research and elite analyst ideas promises a level of clarity most platforms simply don’t reach.

If the service truly delivers on that mission, it could be a powerful upgrade for anyone who relies on data to guide decisions.

In this Seeking Alpha Pro review, I take a closer look so you can decide whether this advanced toolkit deserves a place in your process.

>> Unlock Seeking Alpha Pro today <<

What Is Seeking Alpha Pro?

What Is Seeking Alpha Pro?

Seeking Alpha Pro is the highest-level membership offered by Seeking Alpha, built for people who want deeper, faster, and more structured research than what the regular Premium plan provides.

Instead of browsing thousands of articles or sorting through endless data, Pro pulls together the platform’s strongest insights into one streamlined experience.

It focuses heavily on high-conviction stock ideas, early signals, and curated research from analysts with proven track records.

The product line includes several advanced tools designed to help you work like a professional, exclusive Top Analyst Ideas, a fully managed PRO Quant Portfolio, real-time rating shifts, priority alerts, and deeper analysis you won’t find on the free or Premium tiers.

It surfaces opportunities backed by real data, transparent performance metrics, and analysts who consistently outperform benchmarks.

Having all this content at my fingertips saves an immeasurable amount of time while also giving laser-focused insights into where the market’s moving the most.

>> Get full access to Seeking Alpha Pro <<

Who Is Behind Seeking Alpha?

Seeking Alpha was founded in 2005 by David Jackson, a former Morgan Stanley technology analyst who wanted everyday readers to have access to the same high-quality insights institutions use.

Behind the scenes, the platform runs on a structured mix of expert editors, financial analysts, data scientists, and a massive community of over 18,000 independent contributors.

Steven Cress, head of Quantitative Strategies, maintains the Quant Ratings system that has become one of the platform’s most reliable tools for identifying stock opportunities.

This combination of professional oversight, data-driven systems, and broad market perspectives is a big part of why I’ve been drawn to the platform for so many years.

Is Seeking Alpha Pro Legit?

Yes, Seeking Alpha Pro is legitimate, and its credibility is rooted in its transparency and strong performance history.

All financial data comes from reputable sources and is updated constantly, while analysts are ranked by measurable results like success rate and average return.

Pro also builds on the platform’s widely respected Quant Ratings, a system that has been backtested and shown to outperform the S&P 500 over long periods.

Every rating, idea, and analyst recommendation comes with clear metrics, so you always know how the insights were formed.

Plus, Seeking Alpha has been around for more than 20 years, a further testament to legitimacy and success.

>> Try Seeking Alpha Pro now <<

What Makes Seeking Alpha Pro Different?

What Makes Seeking Alpha Pro Different?

What separates Seeking Alpha Pro from the platform’s other tiers is the level of focus and precision it brings to research.

Instead of searching through thousands of articles or running endless screeners, Pro filters everything down to the most actionable insights: high-performing analysts, data-confirmed signals, and model-ready ideas.

When you’re inside, it becomes very clear how the platform puts so much emphasis on making sure you get exactly what you need and nothing more.

Pro members get priority access to shifts in Quant Ratings, analyst upgrades and downgrades, earnings revisions, and market-moving news before they spread across the platform.

Add in the PRO Quant Portfolio, a rules-based model updated weekly, and you end up with a toolkit built for users who want to evaluate stocks the same way professionals do.

I’d sum it up by saying it delivers on three key metrics: speed, structure, and confidence.

Seeking Alpha Pro Review: All Features Revealed

The following section dives into the major features of Seeking Alpha PRO so you can see exactly what you get:

Top Analyst Ideas

This feature gives PRO members access to ideas from the platform’s 50 highest-performing analysts.

You can filter that pool down further by success rate, number of ratings, sector, and market cap to find the ones that align with your interests.

There’s no other way to get this data, and screening through the site’s 18,000+ analysts is no walk in the park. In my opinion, not all of them are worth following.

I think of it as a VIP entrance to just the elite performers that you can further assess one by one to find those that speak most directly to your style or goal.

PRO Quant Portfolio

PRO Quant Portfolio

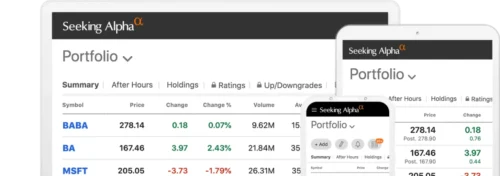

The PRO Quant Portfolio (PQP) is a model portfolio available exclusively to members of this exclusive tier.

It holds approximately 30 stocks, all equally weighted, and is updated weekly with fresh selections driven by Seeking Alpha’s proprietary Quant system.

The system follows very strict criteria for buying and selling, picking up only the hottest opportunities as they appear.

Rebalancing happens every week on a Monday, which is the prime time for me to tune in and see what the changes are.

No worries if you’re busy, because the team sends out an email that will catch you up to speed as well.

Professional-Grade Tools

Professional-Grade Tools

PRO subscribers benefit from tools typically used by institutional teams: advanced screeners, daily Quant rating updates, fast alerts on rating shifts, and portfolio health dashboards.

For example, the Upgrades & Downgrades tool shows changes in Quant ratings, analyst aggregate ratings, and Wall Street consensus in one place.

The system also pulls from niche market opportunities to reveal plays you might not even have thought of looking at.

You can get as much or as little from these tools as you want, but I challenge you to find institutional-grade research of this caliber elsewhere.

Unmatched Deep-Dive Research

Beyond the standard article library that so many services tout as amazing, PRO unlocks deeper research into stocks with little to no Wall Street coverage.

The platform is stacked with institutional-grade screeners and trackers that you can really sink your teeth into, enough to satiate even the most data-driven individuals.

Plus, you’re accessing ideas that may not yet be widely discussed, offering potential early-stage opportunities.

If you’re serious about uncovering “hidden gems,” this kind of research provides an edge over more common stocks.

Quant Ratings & Stock Scorecards

At the core of many PRO features is the Quant Ratings system.

It evaluates each stock across five core factors: value, growth, profitability, momentum, EPS revisions, and assigns a rating relative to its sector.

These ratings are visible to subscribers and form the backbone of ideas, portfolios, and upgrades tools.

Knowing a stock’s Quant profile (and how it compares to peers) helps users make more rational decisions rather than relying on gut feel alone.

Comprehensive Upgrades & Downgrades

One of the features many PRO members value is the dedicated dashboard for rating changes: Quant upgrades/downgrades, aggregated analyst rating changes, and Wall Street rating moves.

By filtering by date range, rating type, or change type, you can spot when a stock switches from “Hold” to “Strong Buy” in the Quant rating, or when analysts sharply shift their view.

It’s a breath of fresh air for those of us who juggle several positions at a time, and allows us to pick up on early warnings or new alerts.

Short Ideas

PRO is one of the rare retail services that offers a fully curated short-ideas stream, zeroing in on positions expected to decline.

Whether you’re already trying to look here or not, this feature gives a window into potential ways to make money outside of traditional growth methods.

These ideas go through a stricter editorial process, which means the quality tends to be higher.

It’s exclusive to PRO users too, and is one of the reasons why this upgrade looks so sweet.

I’d hang out here for a balanced overview or as a need to hedge existing holdings.

>> Upgrade to Pro for deeper insights <<

Additional Features Included in Seeking Alpha Pro

Beyond the headline features, Seeking Alpha Pro includes several upgrades that make the research experience noticeably smoother.

One helpful addition is priority access to rating changes and analyst revisions, which means you’ll often see important shifts before they spread to the wider platform.

These pieces often cover niche opportunities, complex valuation discussions, or overlooked sectors that rarely show up in mainstream analysis. Another feature that adds value is enhanced market alerts.

In a nutshell, you have faster visibility into market-moving news, rating movements, and fundamental changes while not waiting for delayed information.

Finally, Pro members get expanded access to earnings call transcripts, ETF and sector-level quant data, and richer portfolio monitoring tools.

It all works together to create a cleaner, more informed workflow for users who want deeper insight with less effort.

Seeking Alpha Track Record & Quant Performance

Seeking Alpha has built its reputation around data that actually holds up, and the PRO lineup reflects that.

The Quant Ratings system screens nearly 5,000 U.S.-listed stocks and ADRs every day, scoring each one on valuation, growth, profitability, momentum, and earnings revisions.

These updates roll in after the market close, so you see shifts in strength as they happen rather than days later.

The process is transparent, time-weighted, and includes dividend reinvestment to give a clearer view of long-term performance.

The PRO Quant Portfolio adds another layer of structure. It’s a model portfolio, not a real-money fund, but it follows a disciplined rule set with equal-weight positions, weekly rebalancing, and strict buy/sell criteria.

>> Tap into Seeking Alpha’s elite research <<

Who Is Seeking Alpha Pro Built For?

Seeking Alpha Pro is built for readers who want a deeper, more structured approach to research and prefer clarity over noise.

If you already use Seeking Alpha Premium and feel limited by the volume of content or the pace of updates, Pro fills that gap with curated insights and priority alerts.

It’s also a strong fit for people who prefer data-backed decisions. The combination of Quant Ratings, high-performing analyst ideas, and the PRO Quant Portfolio offers a steady framework to evaluate opportunities without relying on emotion or guesswork.

Whether you’re active across multiple sectors or you simply want more disciplined, repeatable insights, Pro delivers tools that make the daily workflow smoother and more informed.

How to Get the Most Out of Seeking Alpha Pro

The key to getting real value from Pro is using the system the way it’s designed.

I start my day by checking rating changes and Top Analyst Ideas, which quickly show where strength is building or fading.

It’s an easy way to spot opportunities without spending hours screening stocks manually.

Beyond that, tracking its weekly rebalances helps you understand how factors like valuation and momentum shift over time.

Pairing this with deeper reads, especially on undercovered companies, gives you a well-rounded perspective that’s hard to find elsewhere.

Finally, let the alerts do their job. Fast notifications on upgrades, downgrades, revisions, and breaking news save time and prevent you from missing meaningful moves.

>> Start with Seeking Alpha Pro now <<

Pros and Cons

Consider these pros and cons before making your final decision:

Pros

- Curated insights from the platform’s top-performing analysts

- Transparent Quant models with a strong long-term track record

- Faster access to rating changes and earnings revisions

- Weekly rebalanced PRO Quant Portfolio adds structure

- Deeper research on undercovered opportunities

- Excellent for users managing multiple sectors or positions

- Clean workflow that reduces research time

Cons

- Best suited for active readers rather than casual market watchers

- The depth of tools may feel overwhelming at first

- Annual pricing is higher than typical retail research services

Refund Policy

Refund Policy

Seeking Alpha Pro typically follows a strict policy, and refunds are not offered once you activate a membership.

This is consistent with most high-level research platforms, especially those that give immediate access to proprietary models, analyst rankings, and archived recommendations.

It’s important to review the plan details before subscribing, but it simply wouldn’t make sense for a service of this caliber to give people a free preview. If you’re testing the waters, starting with Premium before upgrading to Pro can be a smart way to confirm the fit.

How Much Does Seeking Alpha Pro Cost?

Seeking Alpha Pro is normally priced at $2,400 per year, but Stock Dork members can snag an exclusive discount that lowers the price to just $2,149.

The cool thing is that this special deal also includes a $89 one-month paid trial that allows you to partake for a month with minimal risk.

Members get uninterrupted access to all Pro features, including the PRO Quant Portfolio, Top Analyst Ideas, and advanced tools.

When your year comes to an end, the subscription renews annually at the standard rate.

While it’s a higher price point than most retail research platforms, it reflects the institutional-grade depth and priority access Pro members receive.

Is Seeking Alpha Pro Worth It? (Final Verdict)

Is Seeking Alpha Pro Worth It? (Final Verdict)

After spending a lot of time with the tools, it’s clear that Seeking Alpha Pro is built for readers who want sharper insights and a more disciplined research process.

The curated analyst ideas, real-time rating changes, and the structured PRO Quant Portfolio create a level of clarity that’s hard to find elsewhere, especially in a market where information moves fast and noise is constant.

If you already depend on Seeking Alpha for news, data, and analysis, this upgrade can streamline your workflow and elevate your decision-making.

For steady, data-backed research and a cleaner way to monitor opportunities, Pro delivers exactly what it promises.

With a rare promo in place, now is a good time to take advantage of the discounted annual pricing before it goes back to normal.

Tags:

Tags: