Seeking Alpha has earned a strong reputation for blending quantitative ratings with independent analysis and a large investing community.

Not content to just take everyone at their word, I wanted to perform a deep dive into the service and see how well it really delivers.

In this Seeking Alpha review, I’ll cover its features, pricing, membership plans, and performance track record so you can decide if Premium or Pro is the right fit for your research needs.

>> Try Seeking Alpha Premium Right Now <<

Limited-Time Promotion: Steven Cress’ 2026 Stock Picks

Seeking Alpha is currently running a standout promotion tied to one of its most anticipated annual events, making this the best opportunity I’ve ever seen to get plugged in.

Steven Cress, Vice President of Quantitative Strategy and the architect behind the platform’s Quant Ratings system, will reveal his 2026 stock picks during a live webinar on January 6.

The full list will then be released in a paywalled article on January 7, along with an on-demand replay for members who can’t attend live.

What really sets this campaign apart, though, is the pricing incentive tied to the event.

Seeking Alpha is offering a flat 10% discount across all major products, giving both new and existing users a rare chance to lock in savings.

The promotion applies to Premium, which includes a 7-day free trial and renews at $269 per year, as well as Alpha Picks at $449 per year.

There’s also The Bundle, priced at $689 per year, which combines multiple research products, and the top-tier PRO plan, available with an $89 one-month paid trial followed by $2,149 per year.

It’s hard to beat a free trial if you’ve been on the fence about joining, but this deal won’t stick around for long.

>> Get Your 7 Day Free Trial Right Now <<

What Is Seeking Alpha?

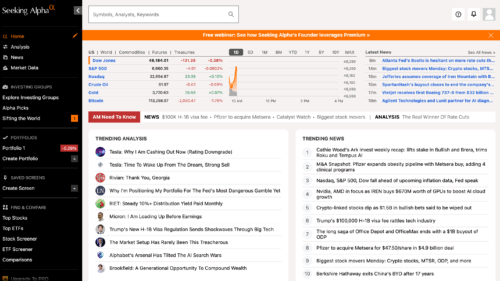

Seeking Alpha is a financial research and analysis platform that has been serving users for over 20 years.

In addition to releasing more than 5,000 articles per month, it boasts a massive investment community that helps blend Wall Street-style research with independent crowdsourced perspectives.

The platform is known for its stock market research, investor insights, and quantitative analysis on stocks, bonds, commodities, real estate, and more.

While you can’t find everything here, you’ll certainly come close.

A Breakdown of the Platform’s Core Features

Seeking Alpha has three membership tiers: Basic, Premium, and Pro, each with different features and resources.

Members get access to in-depth analysis on thousands of stocks, ETFs, and sectors, along with data-driven ratings and portfolio tools.

The exact content and access fluctuate depending on which route you go, but I wouldn’t expect anything less from a tiered plan.

What makes Seeking Alpha authentic is the scale and transparency of its community, as contributors share both bullish and bearish cases on companies big and small.

I love that it aggregates tons of third-party data for you into actionable intelligence with a team of expert contributors and analysts, so you’re really getting the best of both sides.

The site also features a robust news section covering market-moving news, along with independent research on how these stories will impact your investments.

All that’s great, but I’d be remiss if I didn’t mention Seeking Alpha’s excellent community.

Its forums are full of active users who are eager to share their experience and insights. It’s an excellent source for outside-the-box opinions on the market that you can lean into or ignore.

Seeking Alpha has a lot of resources in one place, but I’ve only scratched the surface of its functionality so far. Keep reading to see what else this popular platform can do.

Who Seeking Alpha Is Best Suited For

One thing is sure: based on my Seeking Alpha review, this platform proves to be an invaluable service for a wide range of individuals looking to get more out of their investments.

There are plenty of opportunities to deepen your understanding of the stock market and bring more depth to your portfolio, and you don’t need a wealth of experience to appreciate it.

Come as you are, and I believe the platform will meet you there while providing avenues to grow.

If you’re looking to conduct your own research, you’ll feel right at home here too. The plethora of tools, from stock screeners to Quant ratings, offer the type of analysis needed to enter into securities with the right amount of risk.

>> Access the latest financial news and developments with Seeking Alpha Premium <<

Who Is Behind Seeking Alpha?

David Jackson, a former Morgan Stanley technology analyst, created Seeking Alpha in 2004 as a way for everyday folks to access the type of insights typically reserved for institutions.

Today, the company is run by a team of finance professionals and data scientists, including Steven Cress, mastermind behind the Quant Ratings system.

I give it a tick for credibility based on how it seamlessly combines professional-grade tools with independent perspectives from thousands of contributors.

This mix of expert oversight and community input makes it appealing to anyone looking for trustworthy data, diverse viewpoints, and structured analysis all in one place.

Is Seeking Alpha Free?

Seeking Alpha is free for Basic members, but you have to upgrade to a paid package to take full advantage of the platform.

Free members get unlimited access to news, can check stock prices in real time, and create a portfolio with alerts, but the fun pretty much stops there. You can unlock more features with one of its paid plans, which I’ll talk about later in my Seeking Alpha review.

Is Seeking Alpha Legit?

Seeking Alpha is indeed a legitimate platform and one I often turn to for market research and news.

It has built a reputation as one of the most authentic and widely used investment research platforms anywhere.

More than 20 million people use Seeking Alpha every month, with some 18,000 analysts contributing ideas on a regular basis.

The platform went one step further after introducing its transparent Quant Ratings, which have been backtested and consistently shown to outperform the S&P 500.

Beyond ratings, you can get access to real earnings call transcripts, diverse viewpoints from contributors, and comprehensive financial data.

What makes the site really stand out to me is its crowdsourced approach to content. This not only allows for deeper forays into stocks but also allows inclusion into less-pursued investment opportunities such as commodities and cryptocurrencies.

Not every idea floating around is a banger, but I’ve heard plenty of winning plays from passing comments that only add to my overall experience.

Don’t just take my word for it. Reviews remain largely positive among third-party sites such as TrustPilot and Capterra, lending one more layer of credibility to its ability to meet the needs of its reader base.

Seeking Alpha Review: Key Features Reviewed?

Here’s just a taste of the tools you have at your fingertips when you join Seeking Alpha.

>> Get started now for instant access to these cutting-edge features <<

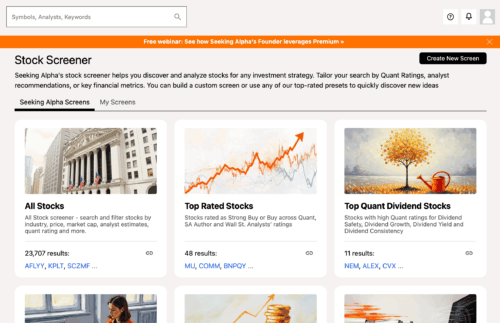

Stock Screener

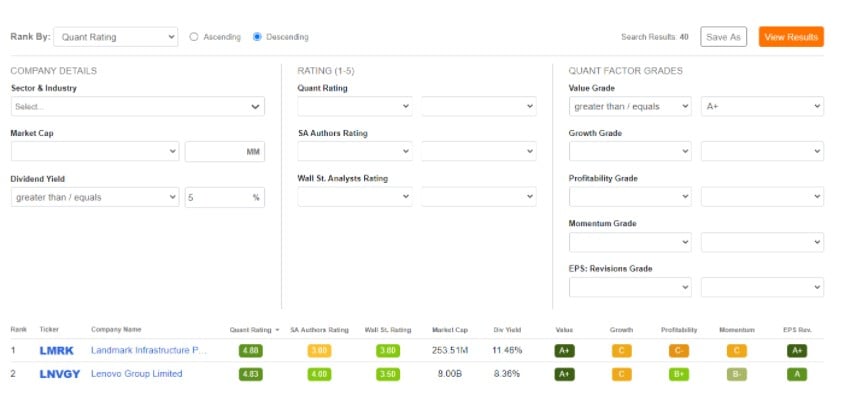

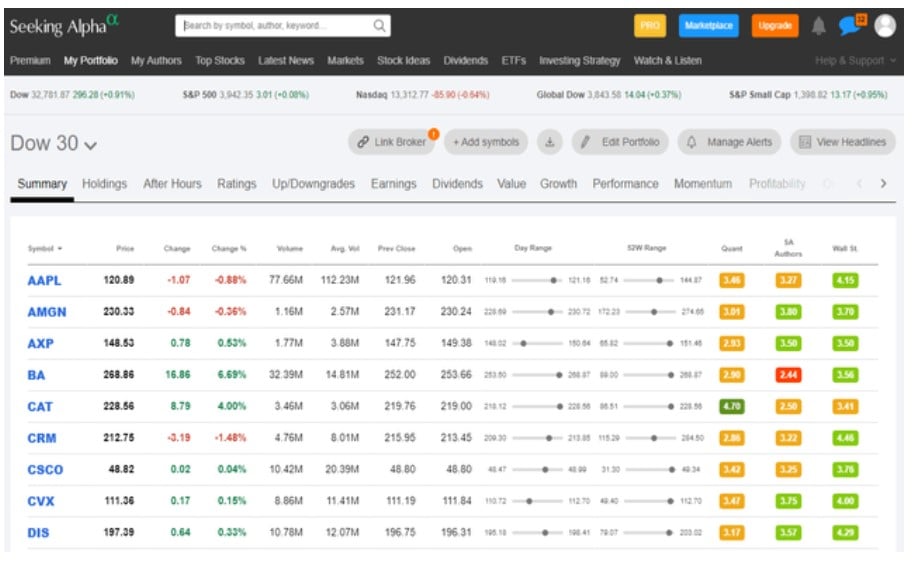

The stock screener is an incredibly valuable tool only available to Seeking Alpha Premium members.

It lets you filter popular stocks by quant ratings, author ratings, analyst ratings, and more, so you can organize your results according to your priorities.

Seeking Alpha quant ratings are produced by a computer algorithm that analyzes over 100 data points related to a stock. They’re purely objective and rooted in facts, cutting through a lot of the crap you get from other places.

On the other hand, Seeking Alpha’s author ratings are compiled by analysts and everyday investors.

Many Seeking Alpha authors are extremely qualified, and they spend hours conducting extensive research on each stock they write about.

If that wasn’t enough, the platform also boasts Wall Street ratings straight from Wall Street analysts and other finance pros.

Once you understand the differences between them, you can use each to create a complete picture of a stock with little more than a quick glance.

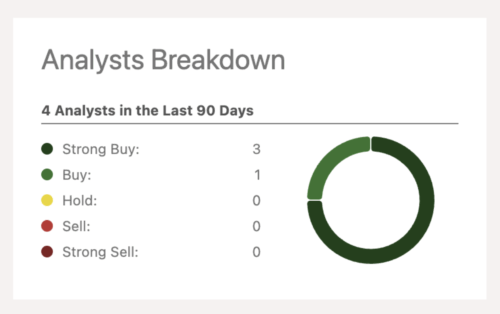

Wall Street Ratings

Wall Street Ratings are one of the few features available to Basic members. To access Quant and Author ratings, you’ll have to upgrade to Pro or Premium.

These ratings come straight from Wall Street analyst models and predict earnings forecasts, target prices, expected performance, and more.

That sounds like a lot, but the system takes that info and squishes it into an easily digestible snapshot.

I’ve gotten into the habit of taking these glimpses and comparing them to other Seeking Alpha ratings to determine if a stock’s worth pursuing.

>> Access Wall Street Rankings for thousands of stocks with Seeking Alpha <<

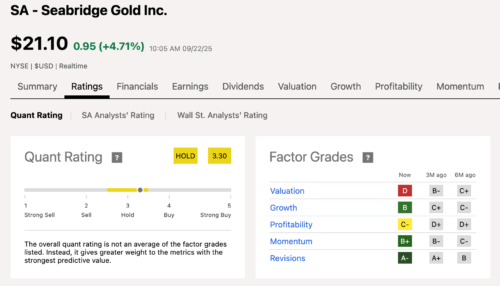

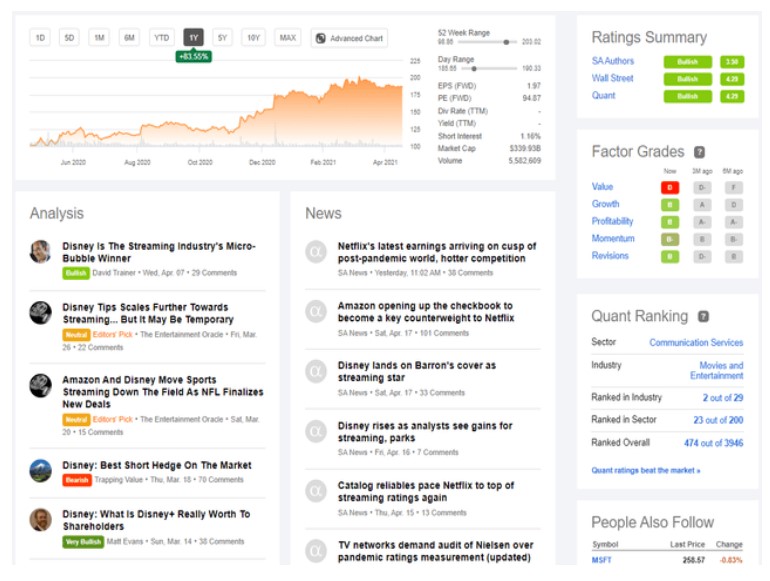

Factor Scorecard

Factor investing is an investment strategy that involves picking stocks based on specific characteristics, or “factors.”

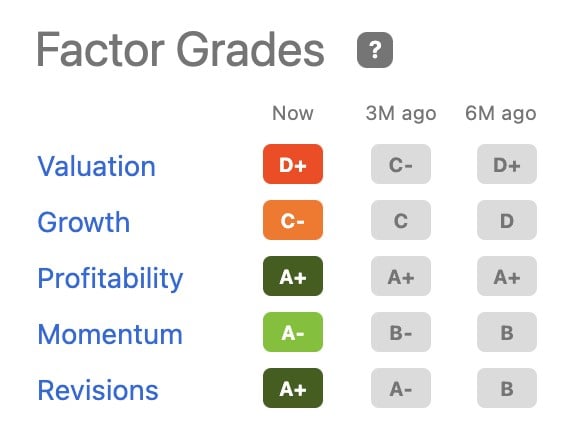

There are many factors that can be used when selecting stocks, but the five Seeking Alpha uses are Value, Growth, Profitability, Momentum, and EPS Revisions.

When all’s said and done, each category gets a grade from A+ to F.

What’s cool is that Seeking Alpha also has factor scorecards for REITs as well, adding in additional data that only applies to real estate, such as funds from operations (FFO) and adjusted funds from operations (AFFO).

There’s also a dividend stock scorecard that rates how good a company’s dividend is compared to its competitors.

Additionally, the dividend stock scorecard also highlights whether those dividends are predicted to stick around for the long haul, which I use to assess if a dividend will fizzle out.

Stock Comparison

I am the king of comparisons and love seeing my stocks side by side, and Seeking Alpha delivers in a big way.

It’s possible to list up to six stocks at once and see on one screen how they stack up.

This tool has limited functionality for Basic members, so you won’t be able to view a lot of the data it aggregates.

However, Premium and Pro members have access to the feature’s full functionality.

You can compare stocks across industries and sectors, or use some of the pre-made comparisons that Seeking Alpha has put together, such as FAANG Stocks or Big Pharma Stocks.

I like to do a little deeper, comparing things like how much these stocks are worth, how fast they’re growing, how profitable they are, potential dividend yields, and more.

And the best part is, you get to see the quant rating, author rating, Wall Street rating, and factor scorecard for every stock — all in one place.

You can also create your own filter that can be exported to a PDF or Excel for further analysis, truly putting all the power at your fingertips.

>> Get pro-grade research tools with Seeking Alpha Premium <<

Author Insights

There are thousands of Seeking Alpha authors who publish data and insights for the site, like active investors, analysts, hedge fund managers, or everyday folks who are passionate about diving into the latest investing ideas.

As crazy as it sounds, you get to read all those publications as a Seeking Alpha member.

If you find a contributor you really like, you can “follow” them to receive notifications every time they release new content, which is the best way I’ve found to cut through the noise.

Seeking Alpha contributors also give each stock they’re reviewing an “author rating,” so you can see their sentiments at a glance.

The authors analyze numerous factors to determine a final rating: Strong Sell, Sell, Hold, Buy, or Strong Buy.

Quant Ratings

Seeking Alpha’s proprietary Quant Ratings are one of the most talked-about features on the platform.

Updated daily, these ratings analyze thousands of data points on every stock and then grade them from Strong Buy to Strong Sell.

The system takes into account factors like valuation, growth, profitability, momentum, and earnings estimate revisions behind the scenes before casting a visible score.

This makes it much easier to quickly spot which companies are trending in the right direction and which ones may carry higher risks.

What sets it apart for me is the track record. Strong Buy stocks in the Quant system have historically delivered around 25% annualized returns since 2010, consistently beating the S&P 500.

Keep in mind, though, that past performance is no guarantee of future results.

It’s a great screening tool, but I also use it as a confidence check before committing to a new position.

Top Rated Stocks

The Top Rated Stocks feature is a favorite among Premium members because it takes the guesswork out of where to begin your research.

Instead of starting from scratch, you get curated lists built from three independent perspectives: Quant Ratings, Wall Street consensus, and Seeking Alpha analyst opinions.

These lists highlight companies with strong fundamentals, positive momentum, or rising earnings expectations. It’s not a set of stock picks telling you exactly what to buy, but rather a powerful starting point to uncover high-potential ideas.

It’s a huge help since I don’t have hours to sift through data, leaving me with a narrow field of quality candidates I can zero in on.

Research Capabilities

If I haven’t made it clear already, the research capabilities inside Premium give you a deeper look at a company beyond surface-level data.

You can visualize trends in revenue, margins, debt, and valuation over long timeframes with interactive charts that can be customized to fit your research style.

For example, tracking how debt ratios evolve over several years helps spot financial risks that aren’t always obvious on a surface level.

Ownership breakdowns show whether institutions, insiders, or retail investors are holding most of the shares.

These tools are practical because they turn raw numbers into visuals that highlight strengths and weaknesses quickly, helping you make more confident decisions.

>> See why traders everywhere trust Seeking Alpha <<

Earnings Call Transcripts and Audio

A Seeking Alpha Premium subscription also gets you access to past conference call recordings about earnings, forecasts, and more.

Conversely, basic members can only read transcripts of these calls.

If you’d rather listen to earnings calls than read them, you should go with a premium subscription.

Having direct access to earnings calls is a valuable feature. You’ll hear updates from top company executives, and you’ll also get to listen to them answer questions from top analysts.

Pro and Premium members get to listen in on these calls live, which is a huge advantage when earnings news can push up (or down) the price of a stock.

I have an earnings calendar that I can pull up at any time so I know when a call is coming that I want to check out.

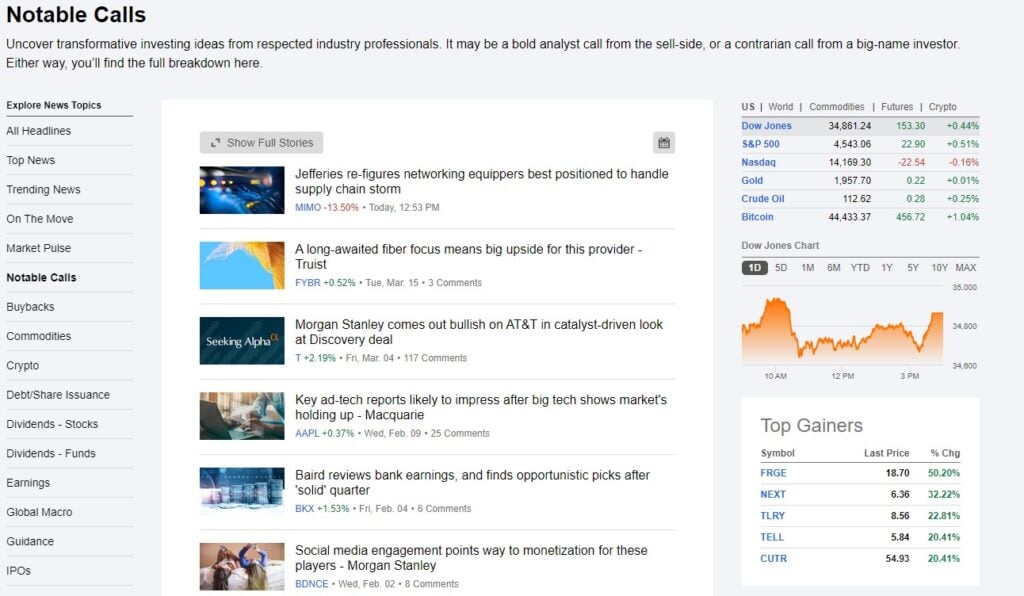

Other Notable Calls

Notable calls is another feature reserved just for Pro and Premium members.

It’s a curated list of the very best investment ideas from top Wall Street gurus and hedge fund managers.

These “notable calls” come from Seeking Alpha’s world-class analysts, and they’re a great way to stay on top of the latest Wall Street trends.

Some common things typically featured in the notable calls section are “state of the market” addresses, recaps of recent purchases by hedge fund managers, and more.

>> Get instant access to great resources like these when you JOIN NOW <<

Portfolio Tools

Seeking Alpha’s portfolio monitoring capabilities could be its most valuable feature.

This tool gives you the ability to connect and integrate your personal investment portfolio with the Seeking Alpha dashboard.

That way, you can track your holdings right on their platform, and laser in on which investing ideas you want to pursue next.

Once you connect your portfolio to the Seeking Alpha dashboard, you’ll begin to get custom tips and alerts about the ticker symbols in your account.

You’ll get notified when a new article is published about one of your holdings, and you’ll also get breaking news alerts relating to your portfolio.

I’m always thankful for anything that saves me time or eliminates stress, and this feature accomplishes both.

A Strong Investing Community

One of the most unique parts of Seeking Alpha is its massive community of more than 250,000 active contributors and members.

Unlike platforms that only deliver one-sided analysis, Seeking Alpha brings together investors with different styles and time horizons, so you’ll see both bullish and bearish arguments on the same stock.

This diversity of thought has helped me test my own ideas and avoid blind spots on numerous occasions.

I obviously don’t agree with everything that’s said, but I equate this to looking up reviews on a product before buying it.

Stock Upgrades and Downgrades

This feature helps you keep track of how Wall Street analysts are adjusting their outlook on specific stocks.

Premium members can see when analysts upgrade a stock from Hold to Buy or downgrade it after disappointing earnings.

Historical data is also available, so you can see whether a company has been consistently trending up or down.

Having this context matters because frequent downgrades may point to deeper issues, while steady upgrades can validate your own research.

It’s a straightforward but practical tool for anyone who wants to stay aligned with institutional sentiment and adjust strategies accordingly.

ETF Screener

The ETF Screener is especially useful for those who prefer diversified exposure but still want control over what they invest in.

Premium members can filter ETFs based on factors like momentum, expense ratios, dividend yield, risk, and liquidity.

Once that’s done, I often compare funds across sectors, themes, or geographies to find the ones that align best with my strategy.

Having access to this level of detail helps you avoid high-cost or underperforming ETFs and focus on funds with stronger performance records.

As someone who likes to consistently sprinkle ETFs into my portfolio, this tool saves me a lot of time and energy.

>> Enjoy these benefits and more with a subscription to Seeking Alpha Premium <<

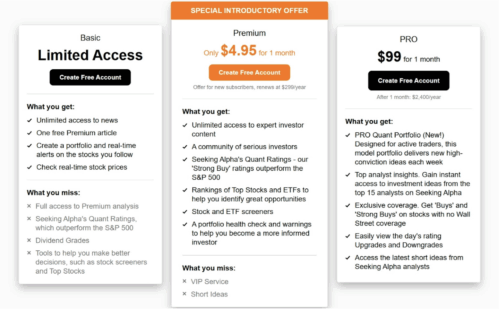

Seeking Alpha Membership Plans Explained

Seeking Alpha offers three different membership plans, and I analyzed all of them.

Seeking Alpha Basic (Free) Review

Seeking Alpha Basic is totally free, so you won’t pay a dime to use this service.

Register for an account, and you’ll gain access to these helpful features:

- Seeking Alpha Stock Analysis Alerts – Get email alerts whenever Seeking Alpha publishes news articles on stocks, EFTs, and more.

- Real-Time News Updates – See all the latest and trending news in your Seeking Alpha dashboard.

- Investing Newsletters – Subscribe to 15 different investment newsletters on topics ranging from “Wall Street Breakfast” to “ETF and Portfolio Strategy.”

- Stock Prices and Charts – The sidebar of the Seeking Alpha website contains all the key data, stock ratings, and chart information you need to know about a particular investment.

- Wall Street Ratings for Every Stock – See how Wall Street truly feels about a particular stock.

- Unlimited Access to In-Depth News and Quantitative Analysis – Get a taste of what it would be like to be a Seeking Alpha Premium or Pro member.

Seeking Alpha Premium Review

Seeking Alpha Premium costs $19.99 a month and comes with everything you see in the Basic plan, plus quite a bit more.

Premium Features Explained

- Premium Content – Unlock Seeking Alpha‘s full library of content and enjoy the best in financial news and analysis.

- Author Ratings – From “Strong Sell” to “Strong Buy,” see an author’s opinion of a particular stock at the time of publishing.

- Author Performance Ratings – View an author’s rating history to see how their track record has held up over time. See who’s hot and who’s not.

- Stock Quant Ratings – Helps you find the best opportunities in the market based on data-driven analyses and a hard-thinking computer algorithm.

- Dividend Grades – The proprietary dividend grades feature helps you choose the strongest, safest dividend investments.

>> Click here to save 20% on a Seeking Alpha Premium membership <<

Seeking Alpha Pro Review

As a Pro member, you unlock all the features of a Seeking Alpha Premium subscription, plus additional content.

Pro Features and Tools

- PRO Quant Portfolio – Receive high-conviction trade ideas each and every week that you can make moves on right away.

- Top Ideas – The best ideas from the top minds in investing. Seeking Alpha editors and analysts find the most compelling investment ideas and deliver them to you first.

- PRO Content & Newsletters – Get access to bonus Seeking Alpha content, including trading alerts, in-depth webinars, personal interviews, and more.

- Short Ideas Portal – Filter through thousands of short-selling ideas from Seeking Alpha‘s community of contributors — even share your own short ideas with the community!

- Stock Ideas Screener/Filter – Filter through thousands of stock ideas by theme, industry, market cap, group, or price range to find the best stocks for your portfolio.

- Refund Policy – Seeking Alpha’s Premium and Pro plans don’t offer refunds, but users can enroll in a one-month paid trial and cancel before signing up for a longer commitment.

Pros and Cons of Seeking Alpha

Seeking Alpha has built a community of over 20million like-minded people — but nothing’s perfect. Here are the top pros and cons of the service:

| Category | Details |

|---|---|

| Major Strengths |

• More than 20 years of history • Multiple proprietary features, such as Quant Ratings and the Factor Scorecard • Earnings call information from several companies all in one place • Built-in portfolio monitoring • Analysis from published, legitimate authors • Several tiers of service to choose from • Advanced stock and ETF screeners • Large, engaged community • Free option available |

| Potential Drawbacks |

• Top-tier plans can get costly due to the number of features • Can feel overwhelming at first to sift through all available information |

>> Get all these benefits at 20% discount when you join now! <<

Seeking Alpha Pricing (2025 Update)

Seeking Alpha has three pricing models designed to fit any budget.

Basic Pricing

Folks wanting to test the waters can sign up for a Basic membership completely for free. There’s limited access to Seeking Alpha’s plethora of tools, but it offers a chance to see stock analyses, read through charts, and check ratings.

Premium Pricing

A Premium subscription renews at $299 per year after an introductory month at $4.95. Anyone subscribing through our links can snag a free 7-day trial and $30 (10%) discount on the sticker price.

This tier allows unlimited expert investor content, an open door to Seeking Alpha’s amazing community, portfolio health checks, and Quant Ratings.

Pro Pricing

Finally, Pro members get everything the platform has to offer, from exclusive analyst coverage to key insights and short ideas from the team. At the top, expect to pay $2,400 annually after a $99 introductory month.

You can access this discount by clicking on any of the links in this review.

Is the Cost Justified?

It’s hard to beat free, but the features you unlock for becoming a Premium or Pro member absolutely outweigh the cost.

I settled on a Premium subscription because it best fits my needs. There’s so much there that I can dig into whenever I want, and you’ll get even more as you build out the platform in the way that makes the most sense to you.

Pro is well worth it if you spend most of the day trading, and it comes with stock picks that save even more time.

At the end of the day, you won’t want to miss at least the tools that a Premium membership gives you to get the most out of what Seeking Alpha can do.

Seeking Alpha Pro vs Premium

Both Pro and Premium members get access to a wide breadth of tools to help you find new investing ideas and monitor your portfolio.

For most, a Seeking Alpha Premium service is the best option. It costs just $269 for the first year and gives you access to Seeking Alpha’s full range of content, ratings, investing ideas, and more.

However, serious investors who need professional-grade market intelligence and state-of-the-art features should consider Seeking Alpha Pro.

Pro members get top analyst insights, the PRO Quant portfolio, exclusive stock coverage, upgrades & downgrades, and the latest short ideas for $200 a month.

If you are a pro investor who trades for a living, Pro might be the better choice, but Seeking Alpha Premium is generally a more suitable option for everyday investors.

>> Join now to save 20% on an annual subscription! <<

Seeking Alpha Recent Performance and Track Record

One of the strongest reasons investors choose Seeking Alpha is its proven track record.

According to Seeking Alpha’s published results, stocks with a Strong Buy Quant Rating have averaged about 25% annualized returns since 2010, compared to roughly 10% for the S&P 500.*Past performance is no guarantee of future results – any investment carries a potential for loss.

I attribute it to the groundbreaking quant ratings system and algorithmic approach to locating the best stocks to invest in.

It filters these down, rewarding only the top opportunities a “Strong Buy” based on metrics such as growth, value, EPS revisions, price momentum, and profitability.

Seeking Alpha’s specialized platform’s Quant Ratings have been independently backtested and shown to beat the market consistently for more than 12 years.

Similarly, aggregate analyst ratings with or without a Wall Street rating of their own returned roughly 100% since the beginning of the decade.

This consistent outperformance demonstrates how effective the quantitative system is at highlighting undervalued companies while signaling caution on weaker names.

Beyond backtests, many users credit the ratings with helping them avoid costly mistakes and identify winners earlier.

Keep in mind that these particular features are only available to members of Seeking Alpha’s Premium and PRO membership tiers.

Is Seeking Alpha Worth It? (Final Verdict)

After a very thorough Seeking Alpha review, the platform’s Premium and Pro services are undoubtedly an excellent value and well worth the price.

Basic members only get access to rudimentary stock analysis, news updates, and Wall Street ratings.

Some beginners may find this is enough, but they’re missing out on some of Seeking Alpha’s most valuable features, including Seeking Alpha’s quant ratings, screeners, and top-tier analysis.

If you’re serious about building wealth in the stock market, check out Seeking Alpha’s Premium or Pro membership.

Fortunately, our readers can access a 7-day free trial of Seeking Alpha Premium by signing up here.

If you’re still undecided, try the service for one week, risk-free, with no commitment, and see for yourself if it’s worth the cost of admission.

With over 6.5 million readers and 250,000 active Seeking Alpha subscribers, this rich community of serious investors is a testament to the platform’s quality and value.

Get started today with this special free trial offer for Stock Dork readers and see if Seeking Alpha is right for you.

>> That’s it for my review! Sign up now and claim your 20% discount <<

Seeking Alpha Frequently Asked Questions (FAQ)

Is Seeking Alpha free?

Yes, Seeking Alpha does offer a free version, but it comes with limited access. Free users can read some articles, view basic market data, and follow a small number of stocks or authors. However, most of the platform’s core value — including full articles, Quant Ratings, Premium insights, and advanced research tools — requires a paid subscription. If you’re just browsing for general market commentary, the free plan may be enough, but serious individuals will likely need Premium.

Is Seeking Alpha Premium worth it?

Seeking Alpha Premium is worth it for folks who rely on in-depth research, stock ratings, and data-driven insights. Premium unlocks unlimited access to articles, proprietary Quant Ratings, stock screeners, full author performance metrics, and detailed financials. If you are actively managing a portfolio or want to make more informed, data-backed decisions, Premium provides a strong value for its price — especially with long-term use.

What’s the difference between Seeking Alpha Premium and Pro?

Premium is designed for individuals who want advanced research, article access, and tools like Quant Ratings. Pro, on the other hand, targets professionals and high-net-worth investors. Pro includes everything in Premium but adds exclusive top-ideas lists, VIP author insights, priority support, and curated research recommendations. Pro is significantly more expensive and is most beneficial for users who need institutional-grade analysis or manage larger portfolios.

Can beginners use Seeking Alpha?

Yes — beginners can use Seeking Alpha, but the platform is more powerful when you understand basic investing terms. The free version is beginner-friendly, and Premium’s tools can actually accelerate learning by offering explanations, data breakdowns, and author commentary. New investors can benefit from reading analysis articles and using the stock screener to explore different investment ideas.

How accurate are Seeking Alpha’s Quant Ratings?

Seeking Alpha’s Quant Ratings have historically shown strong performance, as they’re based on algorithmic analysis of valuation, growth, profitability, momentum, and earnings revisions. While no rating system is perfect, Quant Ratings have outperformed many benchmarks when used consistently. They are best used as a research tool—not as a sole buy-or-sell trigger.

Does Seeking Alpha work for long-term strategies?

Absolutely. Seeking Alpha includes tools specifically designed for long-term holders, such as dividend ratings, long-term growth metrics, 10-year financial data, and author research that focuses on fundamentals. Investors who care about compounding, stable stocks, and long-term outlooks can benefit significantly from the platform.

Does Seeking Alpha provide stock recommendations?

Yes. Seeking Alpha provides stock recommendations through Quant Ratings, author picks, Top Rated Stocks lists, and curated research in Pro. These recommendations aren’t guaranteed, but they offer valuable insights backed by data, financial analysis, and crowd-sourced research. It’s smart to use them alongside your own due diligence.

Is Seeking Alpha better than Morningstar or Zacks?

It depends on what type of investor you are.

- Morningstar focuses more on fundamental research and long-term investing.

- Zacks is more earnings-driven and short-term oriented.

- Seeking Alpha blends quantitative ratings, expert commentary, and community insights, giving a broader perspective.

Many people use Seeking Alpha because it provides both data and human analysis — something most tools don’t combine as effectively.

Can Seeking Alpha help me pick dividend stocks?

Yes. Seeking Alpha has dedicated dividend tools, including dividend grades, payout safety metrics, growth trends, and high-yield stock lists. Premium users get detailed dividend analysis, which is extremely useful for income investors building a long-term portfolio.

Is Seeking Alpha safe and legitimate?

Yes — Seeking Alpha is a legitimate, well-established investment research platform used by millions of investors. It has been around since 2004 and is widely respected in the financial industry. While the platform provides analysis and data, users should always conduct their own research before making investment decisions.

Tags:

Tags: