I’d give anything for a crystal ball telling me which upcoming stocks will rise to the heights of an Amazon or Google. The team at Investors Alley believes they’ve done just that. I investigate their claims and service in this Investors Alley Small-Cap Alpha review.

What is Small-Cap Alpha?

Small-Cap Alpha is Investors Alley’s newest service, adding to an already well-stocked research portfolio.

Believe it or not, the service spends all its time hunting for small-cap stocks with off-the-charts upward momentum. While its picks may not be names you currently recognize, Small-Cap Alpha predicts you soon will—whether you invest in them or not.

It uses artificial intelligence (AI) and a detailed algorithm to uncover small-caps waking up from post-pandemic slumber. Any one of them could be the next Google or Microsoft, just waiting for the perfect moment.

Members get uninhibited access to all of Small-Cap Alpha’s picks via monthly email. It’s also known for in-depth research, news, and educational materials.

I’ll do a deep dive into Small-Cap Alpha’s top features in just a moment. First, let’s take a closer look at what Investors Alley is all about.

>> Sign up here for a BIG discount <<

What is Investors Alley?

Investors Alley is a financial publishing company dedicated to helping investors succeed. It boasts daily free articles and over a dozen premium research services, covering topics ranging from building a retirement nest egg to making fast money on the market.

No matter your financial goal, chances are you’ll find a platform that meshes with your strategy here.

Is Investors Alley Legit?

The company first opened its doors back in 1998. If 25 years of deciphering top stocks doesn’t speak to its legitimacy, I don’t know what does.

Its editors are all accomplished veterans in their respective niches, with over 50 years of experience between them. They all have an impressive track record when it comes to stock picks and are sought after for their skills.

>> Get the latest research when you join now <<

The Bull Case for Small Cap Stocks

Small-cap stocks have remained dormant in the years following the COVID pandemic, largely due to economic burps and surging interest rates. The beginning of 2024 hasn’t been much kinder, with the Russell 2000 tracking pretty flat year to date.

Meanwhile, large caps are basking in the glow of success. These poster children for investors are doing very well right now, if the NASDAQ 100 is any indication. The value gap between the two categories is quite noticeable.

We’re left with small caps trading at a considerable discount. Because these stocks are at such lows, investors are finally starting to take notice. While there are additional risks with small-cap stocks, someone looking for potentially higher returns from less known securities will feel right at home here.

Word on the street is the Fed is done raising interest rates, and recession clouds seem to be dissipating. Should the crushing weight on small caps abate as anticipated, we could be on the cusp of a stellar comeback.

>> Uncover discounted small-cap stocks NOW <<

How Does Small-Cap Alpha Pick Stocks?

Small-Cap Alpha looks beyond the current top-tier companies like NVIDIA, Tesla, and Apple. Instead, it hunts for the next big small-cap stocks with the potential to do just as well—if not better.

The platform takes advantage of recent breakthroughs in AI to screen the market for those exact assets. Thousands of stocks flow through the algorithm to pinpoint any with all the signs of incredible future growth.

I’m not saying there’s anything wrong with owning shares of the big dogs, but their value is already high. Any gains you receive there will likely pale in comparison to an up-and-comer with big momentum.

Imagine how you’d feel if someone told you about Amazon before it went big. Those are the opportunities you’re looking at here.

>> Discover how AI can help you find the next big small-cap stocks <<

What’s Included with Small-Cap Alpha?

Check out everything you get when you sign up for Small-Cap Alpha:

5 New Stock Picks Every Month

Every month, the team sends five small-cap stocks straight to your inbox. These recommendations have gone through Small-Cap Alpha’s rigorous algorithm and made it out safely on the other side.

The platform does more than just feed you names, too. You’ll get a full rundown on each of the stocks and in-depth research into why it made the list.

Because they’re still small-cap, you’re effectively getting a chance to get in before upcoming trends start to take shape. In my experience, that’s the perfect place to maximize the amount of gains you can collect.

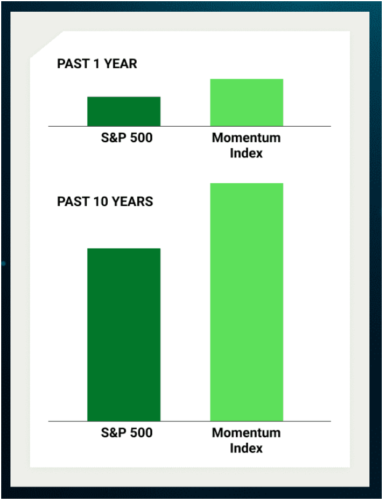

Each stock is well-positioned to outperform the S&P 500 due to the momentum they have. Perhaps best of all, you can add them to your portfolio without spending an arm and a leg.

>> Get started no to get the next picks. <<

Expert Market Analysis

Alongside a detailed list of stocks, expect to receive high-quality analysis from the pros at Investors Alley. These gurus pick apart the stock market and share their findings so you’re as informed as possible about what’s happening.

I’ve never been a fan of investing blindly, even if it’s from a trusted source such as Investors Alley. Therefore, it’s incredibly helpful for me to know as much as I can about upcoming trends and what’s leading them toward the spotlight.

The last thing I want is to get burned by a fad because I didn’t study up enough on the factors behind it.

In addition, the team offers insights and explanations based on questions folks like you and I send in. Few research services take the time to listen to their customer base, let alone answer them.

In-Depth Educational Resources

Small-Cap Alpha sets you up with opportunities to win with its stock selections, but it doesn’t stop there. The service contains in-depth educational services for you to actively learn from.

You can pick from a portfolio of materials explaining just about everything from finding the best small-cap stocks to avoiding pitfalls with your hard-earned money.

How you utilize these resources is entirely up to you, but taking the time to learn from masters will only help you now and down the line.

Some of my favorite sections include tricks for identifying how the market is moving and its relevance in determining stock picks.

>> Access these bonuses NOW <<

Trading and Research Tools

You don’t need an intricate knowledge of the market to capitalize on all that Small-Cap Alpha has to offer. A subscription comes with the trading and research tools you’ll need to take full advantage of these small-cap opportunities.

When looking into potential stocks, the platform provides a detailed snapshot of how it’s trending in the form of charts and graphs. You can filter performance by a number of metrics to boost your confidence about its potential.

That in-depth research extends to key stats such as returns and risk so you don’t have to chase that info down yourselves. This is just the tip of the iceberg, and I’ve found having all that data in one place saves a lot of time.

BONUS One Year of Magnifi AI

If you sign up right now, you’ll also receive access to Magnifi AI for an entire year.

As a companion service, Magnifi embraces the power of AI to help locate the top investment opportunities from across the spectrum. Its database contains more than 15,000 stocks, ETFs, and mutual funds.

In the same vein, the software can work wonders for portfolio management. The assistant has the chops to remove bloat and help you create a more diversified approach to your investments with nothing more than a few prompts.

Magnifi stands out in its use of AI. You can ask anything from “How should I invest $1,000?” to “Is NVIDIA still a good buy?” and the software crunches through innumerable data points in seconds to provide you with the best answer.

Furthermore, the platform has tons of built-in analytics and serves as a brokerage where you can invest directly. Being able to do it all from one location is a game-changer for me.

12-Month Warranty

A membership to Small-Cap Alpha comes with the famous Investors Alley 12-month warranty.

You’re free to use the entire service for one full year, from the stock picks to the free Magnifi access and everything in between. If you’re not satisfied with even a single part of it, reach out any time during those 365 days for a complete refund of your purchase price.

All the materials you’ve received up until that point are yours to keep.

Of all the research services I’ve reviewed over the years, few have come close to a warranty like this. The Investors Alley team is clearly holding all the risk to get this service in your hands.

>> Join now under this airtight guarantee <<

Pros and Cons of Small-Cap Alpha

After a thorough review, here are the top pros and cons I’ve come up with for the service:

Pros

- Up to 60 small-cap stock picks each year

- Focuses on momentum stocks with clear paths to rise

- Guided regular market analysis from the team

- Tons of research and educational materials

- Free year of Magnifi AI

- Unprecedented 12-month warranty on the service

Cons

- Doesn’t deal with options or futures

- No community chat or forum

>> Take advantage of these benefits when you JOIN NOW <<

How Much Is Small-Cap Alpha?

One year of Small-Cap Alpha normally retails for $129. As part of this special deal, you can score a subscription for just $79. That’s almost 40% off the sticker price!

You’ll receive five small-cap stocks each month for right around $6.50. Any one of them could end up being the next Tesla or Apple.

The fact that Small-Cap Alpha gives you the keys to get in on the ground floor sweetens the pot that much more.

>> Save 40% with this limited-time deal <<

Is Small-Cap Alpha Worth It?

I had the chance to play around with Small-Cap Alpha quite a bit, and I’m thoroughly impressed with what I see.

The service is remarkably easy to use from a time standpoint, sending you five stocks each month and the reasoning behind each one. While there’s no issue with taking those recommendations at face value, Small-Cap Alpha offers the tools you need to go much deeper.

I like researching as much as I can before investing, so it’s a huge win for me to have so much data at my fingertips. You don’t often find that in a research service.

Adding in the free year of Magnifi AI takes this deal to a whole new level. Being able to seek out personalized responses to your investment questions and analysis for over 15,000 stocks and funds is amazing, even if the source is AI.

Having 12 months to try Small-Cap Alpha out with the money-back guarantee is just the icing on the cake. At just $79 bucks, there’s a good chance you’ll earn back the membership fee in record time.

Be sure to sign up before this special deal and all its perks vanish forever.

>> That’s it for my review. Claim your discount HERE! <<

Disclaimers:

Investors Alley and Small Cap Alpha are maintained by Magnifi Communities LLC. Information contained in these publications is provided for educational purposes only and are neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Magnifi Communities LLC and its affiliates may hold a position in any of the companies mentioned. Magnifi Communities LLC is neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. Any one-on-one coaching or similar products or services offered by or through Magnifi Communities LLC does not provide or constitute personal advice, does not take into consideration and is not based on the unique or specific needs, objectives or financial circumstances of any person, and is intended for education purposes only. Past performance is not necessarily indicative of future results. No trading strategy is risk free. Trading and investing involve substantial risk, and you may lose the entire amount of your principal investment or more. You should trade or invest only “risk capital” – money you can afford to lose. Trading and investing is not appropriate for everyone. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial adviser or investment broker before making any investment decision.

Investors Alley is affiliated with Magnifi LLC via common ownership. Views expressed by Investors Alley, Small Cap Alpha, and other Magnifi Communities LLC divisions may not reflect the views of Magnifi LLC. Magnifi LLC is an SEC-Registered Investment Advisor. See terms & conditions at Magnifi.com.

Smaller capitalization securities involve greater issuer risk than larger capitalization securities, and the markets for such securities may be more volatile and less liquid. Specifically, small capitalization companies may be subject to more volatile market movements than securities of larger, more established companies, both because the securities typically are traded in lower volume and because the issuers typically are more subject to changes in earnings and prospects.

Securities of small and medium-sized companies tend to be riskier than those of larger companies. Compared to large companies, small and medium-sized companies may face greater business risks because they lack the management depth or experience, financial resources, product diversification or competitive strengths of larger companies, and they may be more adversely affected by poor economic conditions. There may be less publicly available information about smaller companies than larger companies. In addition, these companies may have been recently organized and may have little or no track record of success.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

Mutual Funds and Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

The Stock Dork will receive compensation for referrals of clients who open accounts with Magnifi Communities LLC.

Tags:

Tags: