Ian King’s Strategic Fortunes newsletter is making waves by revealing tipping-point trends. But is Ian King really onto something? Buckle up and stay tuned, because I’m going to find out if Ian King’s latest presentation on Trump’s first executive order is the real deal in my Strategic Fortunes review.

What Is Strategic Fortunes?

Strategic Fortunes (formerly Automatic Fortunes) is a monthly newsletter and research service brought to you by Ian King and publisher Banyan Hill. Members can access exclusive investment analysis and other great features, including bonus reports, trade alerts, a model portfolio, and more.

The newsletter focuses on emerging opportunities in small-cap stocks in innovative companies with the potential to post 10x returns over the course of the next year.

In short, King targets high-octane growth plays, and you get access to all of them with a Strategic Fortunes subscription.

His specialty is “uncovering big trends before the herd rushes in.” This is easier said than done. Fortunately, King has a four-step system to identify companies or industries that could be on the verge of a “tipping-point trend.”

Some examples of industries that King focuses on are disruptive technologies, such as 5G, blockchain, augmented reality, and artificial intelligence (AI).

Strategic Fortunes subscribers get a direct line to King’s research in real time so they have a chance to make the most of these investment opportunities.

How Does Strategic Fortunes Work?

Strategic Fortunes works by tapping into the biggest trends breaking through the market before mainstream media ever catches wind of them. This gives members the prime position of investing before the elites dive in and drive the share price up.

The service doesn’t focus on any particular sector, scouting the best opportunities from wherever conditions are right.

It’s no surprise though that, at least concerning today’s market, most of these come straight out of the latest tech.

However, you won’t see recommendations for big names such as Amazon or Google, as the team feels those stocks are too crowded. Expect promising midcaps in the low billions that’s set to make waves.

King takes things one step further, sifting opportunities through a system that identifies those with an “X factor” that’s vital to an industry or could disrupt the world as we know it.

He shares these picks through his flagship newsletter, categorizing each of them in a model portfolio members are free to view at any time. Subscribers can also find daily briefings, weekly webinars, and trade alerts any time they need to take immediate action.

Is Strategic Fortunes Legit?

A thorough review proved that Ian King’s Strategic Fortunes (previously known as Automatic Fortunes) is a legit research service helmed by impressive talent. While it sets its sights high, each of Ian King’s stock picks is grounded by careful calculation.

Best of all, the subscription aims to provide you with all the tools you need to identify your own tipping-point trends by letting you in on its four-step system.

Plenty of investment services like to keep their cards close to their chest, but this one really goes out of its way to teach you to think like a pro stock picker.

We’re going to put this service under the microscope. But first, who is Ian King, and should you trust him to help you navigate financial markets?

>> Save up to 93% when you sign up now! <<

Who Is Ian King?

Ian King is the mind behind the Strategic Fortunes newsletter, and he’s also an established investment research publisher with a lengthy track record of success.

In addition to Strategic Fortunes (formerly, Automatic Fortunes), King also leads:

- New Era Fortunes

- Next Wave Crypto Fortunes

- Investopedia Academy

- Profit Point Alert

He’s also a contributor to Winning Investor Daily.

As you can see, King is no stranger to the world of investing. His credentials are exceptional, and his ability to tackle so many niches is impressive, to say the least.

We’re going to dig a little deeper, though, because his background is quite fascinating.

At age 21, Ian King started in the mortgage bond trading department at Salomon Brothers. Later, he made stops at Citigroup and as a hedge fund manager at Peahi Capital in New York City.

In 2008, King’s team generated a 339% return, and he’s one of the top resource contributors on Investopedia. Suffice to say, one Ian King stock pick could go a long way.

King finally settled into his role at Banyan Hill Publishing in 2017. Now, he spends his days helping folks spot solid investment opportunities and identify tipping-point trends.

Is Ian King Legit?

Ian King is a legit investing analyst that provides genuine insights into the stock market. As a professional trader, he’s earned the respect of many publishers and outlets during his 20-year career.

In fact, Ian King has been featured on a number of prominent financial news networks, including Fox Business News, Investopedia, Zero Hedge, and Seeking Alpha.

Few folks in the industry have managed to maintain such a strong track record for two-plus decades.

>> Get the scoop on Ian King’s latest research <<

What Is Banyan Hill Publishing?

Banyan Hill was founded during the peak of the Dot Com boom back in 1998.

It wasn’t long before the tiny investment firm established itself as a premier global asset protection and investment powerhouse.

In 2016, Banyan Hill Publishing was born.

The company shifted its focus away from the asset management business and dove headfirst into publishing research for everyday people.

The company has a number of on-staff specialists that conduct extensive research into U.S.-based investment opportunities in commodities, small- and mid-cap stocks, income investments, options, and more.

Nearly 670,000 subscribers read Banyan Hill’s research newsletters every day, and the company has developed a loyal following among its members.

>> See why Banyan Hill is a respected voice in research <<

Ian King’s Presentation: “Trump’s Executive Order 001”

The nation expects a massive turning point for our country when Donald Trump resumes the presidency.

I’m no politician, but I think it’s pretty safe to say that Trump wants to make America the best nation on the planet.

As part of that initiative, Ian King believes his administration will funnel some $113 billion into small tech companies to reaffirm our dominance over the outside world.

Where that money goes, there are usually returns for folks in the right place at the right time.

Big-name investors are already pouring money into the sector, so it’s clear they think something’s about to happen.

With the right information, a piece of that pie could be yours as well. That said, just what is Trump up to?

The New Secret Arms Race

According to King, there’s a new secret arms race afoot to bring about the next wave of AI called Super Artificial Intelligence (ASI).

This tech goes way beyond anything ChatGPT can do, actually thinking and learning on its own.

In theory, it can do everything a human being can do – just 100 times better.

It would be so revolutionary that it could discover in mere moments what would take the brightest minds millions of years to even scrape the surface.

Imagine the impact of such thinking on our military prowess. AI pilots can perform dangerous maneuvers and handle nerve-wracking missions without emotions, fatigue, or even the need for food.

Whoever wins the race will likely be able to claim superiority in just about every aspect of war and defense.

To the Victor Go the Spoils

You see, we’re not the only ones interested in developing super artificial intelligence.

China’s working on its very own ASI, and I’m not thrilled thinking about what would happen if they get there first.

King equates that scenario to the Nazi regime unlocking nuclear power before we did. World War 2 would have ended a lot differently.

Fortunately, President Roosevelt did the impossible and assembled a team of scientists to give us the edge we needed, and the rest is history.

Economically, the companies playing a part in developing a nuclear weapon greatly benefitted. Many of them were worth pennies at the time and went on to quadruple-digit gains.

The same trend took place at the height of the Cold War and even the Space Race.

America chose to win at all costs, and our businesses profited immensely as a result.

How to Profit From Trump’s Executive Order 001

Love him or hate him, Trump does not like to lose, so I envision him taking the same initiative for this new arms race as well.

It will take several companies with brilliant breakthrough tech to make it happen, and Trump will do whatever it takes.

Should history repeat, the ventures leading the charge in today’s arms race stand to grow immensely as well.

After all, the $113 billion King expects Trump to funnel into the project has to go somewhere.

Ian has located seven companies he predicts will soar the highest from Trump’s Executive Order 001, and you can get instant access to all of them by signing up under this special deal.

Let’s take a look at everything you receive with a membership.

>> Find out the story behind Trump’s Executive Order 001 <<

Strategic Fortunes Review: What’s Included With a Subscription?

The service is packed with top-tier insights and analysis.

Keep reading our Strategic Fortunes review and take a look at everything you get.

Strategic Fortunes Newsletter

Research reports are great, but the market moves fast, so it’s good to have someone in your corner for the long haul.

The Strategic Fortunes monthly newsletter keeps you supplied with a steady stream of high-potential stock picks.

You’ll receive a new stock recommendation from Ian King in each issue, along with the latest stock market news, analysis, and updates on the model portfolio.

You get a new issue of Strategic Fortunes every month, so you’ll end up with multiple stock picks from the newsletter alone by the time your subscription runs out.

It’s a must-read for anyone who’s serious about stocks.

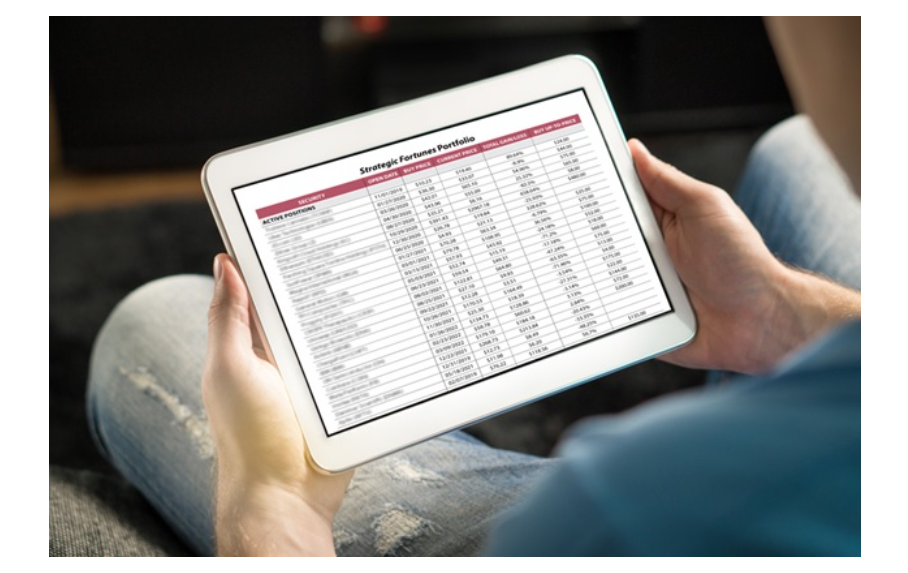

Model Portfolio

Strategic Fortunes maintains a model portfolio where it keeps track of all its currently active recommendations that have a “buy now” rating.

It includes the current recommendation for each position, their price targets, and other pertinent information so you can make an accurate decision about how to proceed.

You’re effectively getting a bird’s-eye view of the Strategic Fortunes portfolio that instantly tells you how each position is performing.

It’s a blessing to have all these stocks available at a glance, especially as a new member. While the opportunities from the newsletter are solid, I was able to snag some extra investment ideas from here.

Trade Alerts and Weekly Updates

A month is an eternity in the stock market, so a monthly newsletter alone isn’t going to cut it. You need more frequent updates to navigate the waters effectively.

Fortunately, Strategic Fortunes doesn’t sell its subscribers short. In addition to the monthly newsletter, you get weekly updates on the latest market-moving news and much more.

The company also sends out as-needed trade alerts that let you know whenever it’s time to make a move, so you’ll never miss a fast-moving opportunity again.

With so many updates and alerts, Strategic Fortunes does an excellent job of keeping its members informed.

The Daily Disruptor

A Strategic Fortunes subscription also includes access to King’s daily e-letter.

It’s toted as your source for breakthrough investment research, covering the most disruptive trends emerging from the world of big tech.

Inside, Ian reveals some of his personal investing strategies and philosophies, offering a rare glimpse inside the mind of one of tech’s most prominent gurus.

There’s really no better way to stay in tune with the rapidly-evolving tech landscape, helping to keep you informed and grow your wealth at the same time.

King also sprinkles in some additional recommendations here, so it’s well worth a daily read.

Customer Support

You can count on fast and friendly customer service if you ever have an issue with your Strategic Fortunes subscription.

The service has an attentive and responsive customer service team, so you can sort out any potential problems in a relatively painless fashion.

As we mentioned earlier, Banyan Hill scored a “great” rating on Trustpilot, and its dedicated support team is a big reason for the praise.

>> Get all the research, updates, and more NOW at 75% off! <<

Trump’s Executive Order 001 Bonus Reports

Ian King is also throwing in exclusive research reports covering promising tech opportunities as part of his Trump’s Executive Order 001 bundle. Here’s what you get:

Trump’s $113 Billion ASI Portfolio

This incredible report contains Ian King’s complete research on the next arms race toward artificial super intelligence.

You’ll receive the names and ticker symbols of each of the seven companies he expects to skyrocket in the United States’ bid for dominance.

King explains each pick in detail, so you’re not investing in something without the full scoop.

It’s incredibly rare to get so many companies in one special report, making this an absolute must-have.

The guru even shares his thoughts on how to play them step by step so you’re never on your own at any point along the way.

Three Trickle Down Stocks Set To Power The ASI Economy

Although the government plans to use artificial super intelligence to buff up our military efforts, there’s little doubt that the technology will trickle down into other areas as well.

It could have an indelible impact on just about every industry, from retail to energy, healthcare, and robotics.

Of course, that means other companies stand to benefit from the initiative too.

This guide shares three ASI firms that each of the above sectors will need to rely on in order to bring ASI into their systems.

King provides the names and ticker symbols of these organizations too, along with his full buying instructions so you can grab hold of the $15.7 trillion ASI revolution from multiple angles.

The Tiny Crypto Set To Power ASI and Create Enormous Wealth For You

Trump has been very vocal about wanting to be America’s crypto president, and he’s fully embraced that market.

We’ve already seen cryptos make big moves, like Bitcoin reaching $100,000 for the first time within a month of the election.

Several smaller coins got in on the action too, climbing to new highs themselves.

Ian’s research led him to one digital currency slated to benefit both from Trump’s crypto agenda and the rise of ASI.

It’s still a tiny altcoin today, but it’s already in use by data centers to rent out GPU space that powers AI.

King shows readers exactly how to purchase this coin for a shot at what could be enormous profits.

>> Access all these bonus reports and more now! <<

Money-Back Guarantee

Strategic Fortunes provides a solid money-back guarantee, giving you peace of mind with your purchase.

While some research services and newsletters offer limited refund policies with numerous conditions and fine print, Ian King’s Strategic Fortunes now offers a straightforward 30-day guarantee.

This means you have a full month to evaluate the service and request a refund if you’re not satisfied. With a guarantee like that, you can subscribe to Strategic Fortunes with confidence.

If you do end up bowing out, you’re able to keep all the materials you’ve already received as a thank you.

I appreciate King taking on the risk here, as that’s not something he has to do. This speaks volumes to the credibility of his service.

>> Join risk-free under Ian’s guarantee <<

Strategic Fortunes Performance Track Record

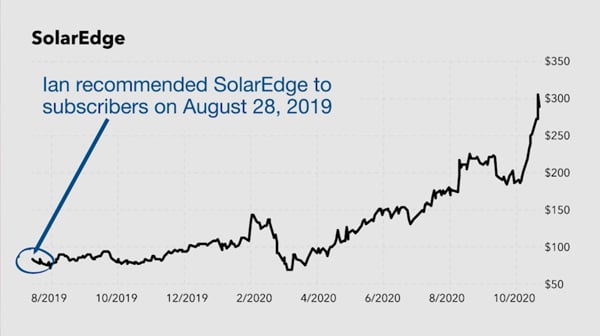

During our review, we found out that Strategic Fortunes‘ stock recommendations have performed pretty favorably.

In recent years, the service hit two home runs with Solar Edge and Tesla. SEDG ended up gaining 228%, and TSLA rallied by 919%.

If you also count Ian King’s performance as a former hedge fund manager, the people behind this service have a long track record of success.

King has a record that speaks for itself.

You can listen to their recommendations with confidence and rest easy knowing you’re getting your advice from a credible source.

>> Get the latest recommendations now! <<

Pros and Cons

Based on our Strategic Fortunes review, here’s where this newsletter service scores high and low.

Pros

- Track record of profitability

- Daily, weekly, and monthly alerts

- Monthly newsletter with regular stock picks

- Daily Disruptor e-letter

- Guru with decades of experience

- 30-day money-back guarantee

- 3 bonus reports

- Follows the hottest emerging tech tipping-point trends

Cons

- Speculative tech stocks can be risky

- No community chat room or forum

Who Should Subscribe to The Strategic Fortunes?

Strategic Fortunes has a low barrier for entry but plenty of content to feast upon, making it a viable option for most.

Beginners enter into an action-packed service with tons of great tips for getting started in the realm of midcaps. Between bonus reports, daily briefings, and weekly webinars, you’ll likely be feeling confident enough to invest in no time.

The lightning-fast alerts give you the precise moment you should buy or sell, removing the guesswork that can ruin profits.

Folks wanting to make money from investing with little time for research and analysis can find a home here too.

King does an amazing job of identifying the best opportunities at any given time, considering his track record for picking wins. What you pay for up front can earn you much more down the line should Ian’s foresight stay on point.

You won’t find much here if you’re looking for quick turnarounds, though. While some of these big tech opportunities can grow quickly, each investment is more of a long-term strategy you may end up holding for a while.

Strategic Fortunes Reviews by Members

Don’t just take my word for how impressive Strategic Fortunes is. Check out these reviews from actual members:

As you can see, members love the profit potential of the coins Ian recommends. These are best-case scenarios, but each of these folks turned a small sum into major gains in surprisingly short timeframes.

I pulled these comments from King’s presentation, so please take them with a grain of salt. They’re certainly no guarantee of success with the service, but it’s exciting to think of the outcomes you could have.

>> Join now at a special limited-time discount! <<

How Much Does It Cost?

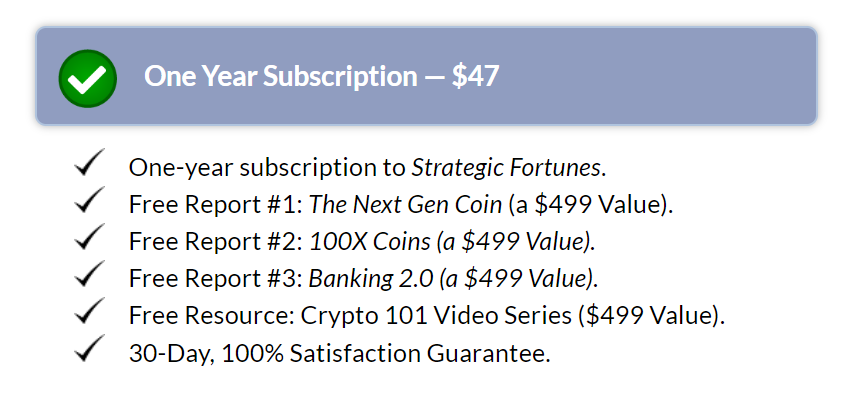

King formally sets the cost of his bundle at $199, a three-month membership is only $49 right now as part of this special deal. That’s 75% off the cover price!

You can have all the content I covered above for just 54 cents per day. The bonus reports add even more value to an already stacked service.

Alternatively, you can shell out $79 for a three-month membership that includes three additional bonus reports above and beyond the base package. Since they’re each valued at $399, this might be the way to go.

Do keep in mind that, no matter which plan you pick, this bundle renews quarterly at $99. It’s still a fair price, but something you’ll want to be aware of.

Is Strategic Fortunes Worth It?

Our Strategic Fortunes review found Ian King’s latest offer to be an excellent deal at just $49 for three months.

Given what we’ve seen from the team and satisfied subscribers, we’re confident that this service is the real deal.

The Trump’s Executive Order 001package adds even more value. It includes three bonus reports featuring valuable ASI research you won’t find anywhere else.

Top it all off with a 30-day 100% money-back guarantee, and you’ve got a ton of high-value research for cents per day..

Considering the impact these emerging tech stocks could have on your portfolio, you can look at Strategic Fortunes like an investment in yourself.

With a wide array of bonus research, regular market updates, and an iron-clad satisfaction guarantee, Strategic Fortunes has everything you’d expect from a top-tier research newsletter service.

Tags:

Tags: