I sometimes dream of what it would have been like to invest in companies like Microsoft or Nvidia before their IPO.

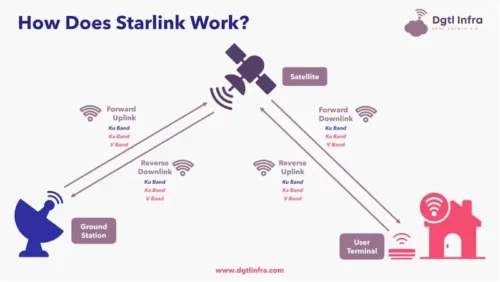

We may have missed that boat, but James Altucher believes the Starlink IPO could follow that familiar pattern, shaped by Elon Musk’s ability to turn ambitious ideas into massive businesses.

This is a rare opportunity to position yourself early, but I had to know how likely it is for the scenario to actually play out.

In this Super IPO 2.0 review, I break down Altucher’s thesis so you can decide whether his approach is worth a closer look.

>> Start Super IPO 2.0 With James Altucher <<

What Is Super IPO 2.0?

Super IPO 2.0 is a special investment research offer bundled with a subscription to Altucher’s Investment Network.

Led by James Altucher, the bundle focuses on identifying ways we can take advantage of publicly traded stocks that sit close to potential blockbuster IPO events.

The current research centers on the Starlink IPO narrative, along with a related technology company Altucher believes could benefit from the same long-term shift.

I like that it goes much deeper, covering ongoing market commentary and regular research updates while giving access to Altucher’s broader investment framework.

At the end of the way, it’s all designed to help you follow the story as it unfolds rather than forcing us to react after the fact.

Before I get into the nitty-gritty, I want to take a closer look at the guru behind it all.

>> Join Super IPO 2.0 By James Altucher <<

Who Is James Altucher?

Who Is James Altucher?

James Altucher is an author, entrepreneur, and market commentator who has spent much of his career at the intersection of technology, business, and finance.

He studied computer science at Cornell University before it was cool, which allowed him to have early insight into breakthrough tech trends that made him so successful. The very strategies he unveils here made him a millionaire, but the guru is still a master of breakout trends today.

I don’t know of anyone else who purchased a multi-million dollar home with crypto earnings alone.

He’s also widely known for his writing, publishing more than 20 books and contributing articles to major outlets like The Wall Street Journal and Forbes.

Today, he serves as the editor of Altucher’s Investment Network, where he channels that experience into structured market research.

Is James Altucher Legit?

There’s no doubt in my mind that James Altucher is as legit as they come.

He has been actively involved in early-stage investing for more than two decades, backing startups that were later acquired and participating in technology trends well before they became mainstream topics.

Altucher has also managed money professionally and has been open about both wins and losses, which adds realism to his track record.

Beyond theory, he has worked directly with founders, advised growing companies, and evaluated opportunities at the ground level.

That hands-on experience, combined with a long history of publishing forward-looking research, is what makes his judgment worth taking seriously.

>> Get James Altucher’s Pre-IPO Strategy <<

What Is the Super IPO 2.0 Presentation About?

I like to be timely, but James Altucher believes many people feel permanently late when it comes to major market opportunities.

A company goes public, the story dominates the news, and by the time most people act, the upside already feels limited.

History repeats with a number of notable companies, but this time, Starlink is in full view.

Along with a potentially game-changing IPO comes a rare opportunity to get involved now, before the company goes public, and all the potential for gains therein.

What makes this moment so important, and how can we actually play it?

Why Buying IPOs Often Feels Disappointing

We all know that most well-known IPOs reach the public eye only after multiple private funding rounds.

Each round rewards early backers and pushes valuations higher, leaving less room for growth once shares finally trade openly.

By the time an IPO hits the market, insiders, venture funds, and institutions have already captured much of the upside.

That’s why so many people feel like they followed the rules, paid attention, and still ended up late.

What sucks is that it’s not bad judgment on our part; there’s just no way for us to get into that space before the stock’s already taken off.

The biggest gains tend to happen quietly, years earlier, when companies are still private and valuations are far lower.

Traditional IPO investing simply focuses on the moment of public excitement rather than the years of value creation that come before it, and that’s little help to us.

The Overlooked Way Early Positioning Still Happens

Purchasing stock pre-IPO still requires a lot of clout, money, or, most likely, both.

There’s little chance of us entering into that space, but rather than relying on private deals or exclusive access, Altucher points to a less discussed path.

Some publicly traded companies already sit close to major private businesses that haven’t had an IPO, but trade on major exchanges right now.

These companies often operate quietly, with little attention, until a larger event brings them into focus.

They’re already brewing in the background and, as their still-private partners receive notice, they’re positioned to rise as well.

It’s happened numerous times in the past, but there’s still a small interval you need to react to.

If James is right about Starlink, we’re in that perfect storm right now.

How to Connect to Starlink for Large Profits

How to Connect to Starlink for Large Profits

Altucher has identified a way to get a pre-IPO stake in Starlink before it goes public through a unique partnership that most of the world doesn’t know exists.

With Musk’s venture forecast to be the latest IPO valuation in history, having any point of access now could be a huge win before news breaks.

You can get James’s findings as part of his Super IPO 2.0 strategy he’s making available right now if you’re interested in the prospect.

There’s quite a bit more material stuffed into this bundle as well, so join me as I explore it all.

This next section breaks down exactly what’s included and how the research helps you readers put this approach into practice.

>> Get James Altucher’s IPO Research <<

What Comes With Super IPO 2.0?

Joining Super IPO 2.0 unlocks access to James Altucher’s broader research ecosystem that follows early-stage opportunities as they develop over time:

Six Monthly Issues of Altucher’s Investment Network

Six Monthly Issues of Altucher’s Investment Network

The core of the service is the monthly issue of Altucher’s Investment Network, which goes way beyond just Starlink.

Each issue focuses on a specific market theme Altucher believes is still early, often tied to technology shifts, emerging business models, or structural changes in how money flows.

You’re not going to find a ton of ideas here, but that’s the entire point. I’ve found each recommendation so far to be a truly rare opportunity to invest ahead of the curve.

Altucher spells out the reasons why he likes each pick, but you won’t need a technical background to follow along. I appreciate being able to get straight to the point so I can decide how to proceed.

Weekly Email Alerts

Weekly Email Alerts

Markets don’t move on a monthly schedule, which is why weekly email alerts play an important role.

These updates share timely commentary, clarify changes in outlook, and address major news that could impact existing recommendations you have.

They pop up in my inbox with context that really matters, so you’re not bombarded with junk or a bunch of items to sort through.

In my opinion, it’s an excellent way to stay aligned with the research without feeling pressured to react to every headline or market swing.

Occasionally, situations develop that require faster communication.

Urgent trading alerts are designed for those moments when Altucher believes action or awareness is time-sensitive.

These messages cut straight to the point, explaining what’s happening, why it matters, and how it fits within the broader strategy.

While they’re not frequent, they serve as a safeguard so you’re not caught off guard during sudden market developments tied to the themes being tracked.

>> Unlock Altucher’s IPO Playbook <<

Access to the Special Members-Only Website

Access to the Special Members-Only Website

You’ll find all of the Altucher’s Investment Network research, updates, and communications in a secure vault that only members have access to.

This portal acts as a central hub where subscribers can read current and past issues, review alerts, and track ongoing ideas in one place.

I admittedly spend a lot of time here catching up on topics I still find pertinent today, as Altucher’s wisdom transcends the decades to whatever breakthrough trend is happening right now,

Plus, the layout is straightforward, making it easy to revisit research without digging through old emails.

Quarterly Q&A Calls

Quarterly Q&A Calls

Should you sign up, you’ll also receive access to quarterly Q&A calls, where Altucher addresses questions directly from subscribers.

He usually starts the Zoom session with a snapshot of where he’s looking and opportunities (like Starlink) currently in view.

These sessions provide additional clarity around current ideas, broader market conditions, and how he’s thinking about risk and timing.

I wish more services offered time with a guru like this. Although I wouldn’t call it personal, it’s amazing to hear directly from James in a conversational tone that you’d miss out on otherwise.

Professional Customer Service Team

Professional Customer Service Team

Behind the scenes, members have access to a dedicated customer service team that handles account questions, technical issues, and general support.

This may not sound exciting, but it matters immensely to me when accessing time-sensitive research.

Having responsive support ensures members can focus on the content itself rather than dealing with login problems or billing confusion.

It adds a layer of reliability that helps the overall experience feel smooth and professional.

>> Discover Altucher’s Pre-IPO Strategy <<

Super IPO 2.0 Bonus Featured Report

Don’t forget that you also receive the special report on Starlink as part of this bundle:

Special Report: Elon’s Big Buyout – The #1 Starlink IPO Stock to Buy Now

Special Report: Elon’s Big Buyout – The #1 Starlink IPO Stock to Buy Now

This featured report is designed to connect the dots behind the broader Starlink narrative and highlight a specific publicly traded company Altucher believes is strategically positioned alongside it.

It’s a thorough read about why this smaller firm could play a critical role if Starlink’s expansion continues as expected.

Altucher explains the business relationship, the market opportunity, and why timing matters for early positioning.

I love how Altucher makes this opportunity accessible, even sharing how to invest through your regular brokerage account.

By the time you put this digital guide down, you should have a clear path to Starlink’s pre-IPO opportunity even if you’re not tech-savvy.

>> Explore James Altucher’s Market Strategy <<

Refund Policy

Refund Policy

Super IPO 2.0 is backed by a straightforward money-back guarantee, which gives new members time to review the research without pressure.

After joining, you can read through the materials, explore the member portal, and decide whether Altucher’s approach fits your expectations.

If it doesn’t, you can request a full refund within your first 90 days of membership by contacting customer support.

There are no complicated conditions or hoops to jump through, and you’ll get to keep any materials you’ve received up to that point.

I’ve found 90 days to be ample time to try everything out and make an educated decision on the service before you’re locked in, which is a huge win in my book.

Pros and Cons

Here’s my balanced take after reviewing everything:

Pros

- Six months of Altucher’s Investment Network

- Focuses on early-stage market positioning

- Special Starlink pre-IPO bonus report

- Detailed yet easy-to-follow research

- Frequent updates and alerts

- Uses publicly traded access points

- Includes a risk-free refund policy

Cons

- Can require patience and long-term thinking

- No guaranteed timelines for results

Super IPO 2.0 Track Record / Past Performance

Super IPO 2.0 is not built around a traditional performance table, and James Altucher is transparent about that.

I wasn’t able to find any actual track record data, but we’ve all seen this same pattern emerge in the past.

In fact, James references real-world examples of companies where the majority of value creation occurred long before an IPO ever reached the public.

AOL, Comcast, and Earthlink are just a few that come to mind.

He also draws from his own experience backing early-stage businesses and tracking technology shifts well ahead of mainstream attention.

Results will naturally vary, and no outcomes are guaranteed, but the emphasis here is on process and positioning rather than timing headlines.

That long-term, early-entry mindset is what defines the track record behind Super IPO 2.0.

>> Learn Altucher’s Early IPO Approach <<

How Much Does Super IPO 2.0 Cost?

How Much Does Super IPO 2.0 Cost?

At the time of writing, Super IPO 2.0 is offered through a heavily discounted entry into Altucher’s Investment Network.

The standard price for the service is listed at $299, but you can currently join for just $49, which covers a six-month subscription.

At 80% off the cover price, this reduced rate includes access to all the core research, ongoing updates, and the featured bonus material tied to the Starlink theme.

There are no multiple tiers or complicated plan options to sort through, removing the stress of trying to find that “perfect” plan for you.

Keep an eye on pricing when it comes time to renew, as I wasn’t able to find a clear answer on what the price might jump to.

>> Read Altucher’s IPO Thesis <<

Is Super IPO 2.0 Worth It?

Is Super IPO 2.0 Worth It?

If you want my two cents, Super IPO 2.0 is undoubtedly worth it if you want to maximize your return potential on new and emerging opportunities.You won’t find fast trades or instant gratification here, but the service can work amazingly well for long-term potential as innovations move from the shadows to center stage.

This comes full circle with the current Starlink opportunity that you can take advantage of immediately if you become a member.

Don’t forget that you’re getting tons of additional content, from Altucher’s Investment Network to regular updates that carry continuous value.

At just $49 for 6 months, I challenge you to find a better deal for unearthing a roadmap for gains like this bundle does.

I’d suggest acting now though, as Starlink is already making lots of noise. Its quiet partners won’t stay hidden for long, and then it will be too late.

Tags:

Tags: