There are a ton of strategies for building wealth on the stock market, and a few actually work.

The time-tested method of owning strong companies for the long haul is still my go-to, and I’m not the only one.

The Motley Fool has built its reputation around that idea, with its Stock Advisor service positioned as a way to simplify potential long-term wealth building through focused stock recs rather than frequent trading.

In this Motley Fool Stock Advisor review, I examine whether that philosophy still holds up today and if this approach truly stands out among modern stock research services.

>> Join Motley Fool Stock Advisor Today <<

What Is The Motley Fool?

What Is The Motley Fool?

Company Background

The Motley Fool was founded in 1993 by brothers Tom and David Gardner. What started as a small investing newsletter has since grown into one of the most recognizable names in personal finance.

Today, the company operates a large financial media platform that includes free educational content, premium research services, podcasts, books, and investing tools.

As a long-time user, I’m drawn to the plain-English analysis and a long-term investing mindset.

Unlike publishers that focus on trading or market timing, I also like that The Motley Fool’s approach centers on owning great businesses and letting time do the heavy lifting.

Purpose of the Service

At its core, The Motley Fool exists to help folks like you and I make smarter investing decisions.

You won’t find much in the way of uneducated decisions here; instead teaching the fundamentals and proper discipline.

I like that this info comes in different formats, from regular recommendations to stock reports and investment research. There are also game plans that help you scale for certain goals like retirement.

Instead of flooding us with daily alerts though, the Fool leans into fewer, higher-conviction ideas backed by research and context.

Who the Motley Fool Is Best For

The Motley Fool tends to resonate most with people who:

- Want a long-term, buy-and-hold strategy

- Prefer guidance without needing constant activity

- Appreciate educational explanations behind stock ideas

- Are comfortable with volatility in pursuit of growth

It’s less appealing for those seeking fast trades, income-focused strategies, or frequent market timing signals.

>> Learn How to See David Gardner’s Top Stock Picks <<

What Is Motley Fool Stock Advisor?

What Is Motley Fool Stock Advisor?

Motley Fool Stock Advisor is the flagship subscription service from The Motley Fool, created for people who want a more structured way to invest in stocks without turning it into a second job.

The service centers on long-term stock recommendations backed by research, context, and a clear investing philosophy focused on owning strong businesses over time.

As a member, you get regular stock recommendations, access to a short list of starter ideas, and updates that help you understand how new recommendations fit into a broader portfolio.

There’s also ongoing commentary from the analysts, performance tracking on past recs, and tools that let you review earlier recommendations so you’re not investing in the dark.

What makes Stock Advisor appealing is its clarity. It doesn’t try to cover every market move or trend.

Instead, it gives you a repeatable framework for long-term wealth building, which can be especially attractive if you want guidance, conviction, and simplicity without constant decision-making.

>> Get Started With Stock Advisor Now <<

Motley Fool Stock Advisor Review

How Stock Advisor Works

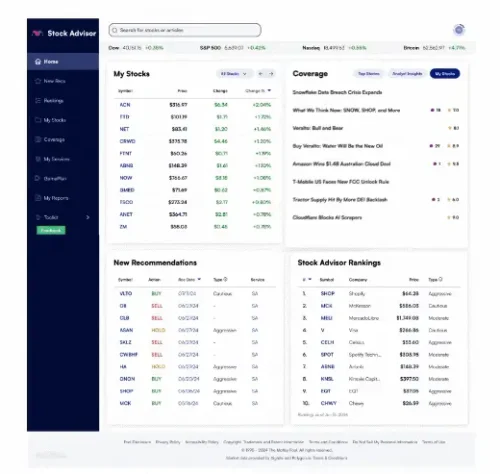

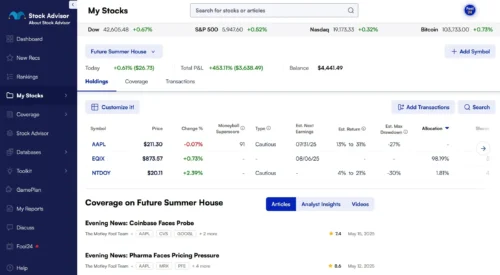

As a Stock Advisor subscriber, I have access to a sleek dashboard where the service’s recommendations and research live.

There’s no earth-shattering format here, which is actually a good thing. I feel like a secret agent handed a dossier with all the info I need, and it’s up to me to act.

That said, feel free to act if you want, and when you want. You can pass if you’re not keen on a setup or wait until the timing’s right for you, but just know that usually means missing out on some of the ramp.

Types of Stock Picks You Receive

The stocks featured in Stock Advisor tend to be expert selected, growth-oriented businesses with durable competitive advantages.

Many are well-known market leaders, while others are earlier-stage companies positioned to benefit from long-term trends.

You’ll often see exposure to technology, consumer brands, healthcare innovation, and platform-style businesses. The common thread is quality and scalability rather than short-term catalysts.

One of Stock Advisor’s top selling points is that you’re not limited to a particular niche, like some services force you to do.

Frequency of Recommendations

Stock Advisor delivers two new recommendations per month, which is intentional. The service isn’t trying to overwhelm you with ideas. Instead, it emphasizes selectivity and conviction.

>> Unlock Motley Fool’s Best Stock Ideas <<

The Motley Fool’s Performance & Track Record

Historical Returns

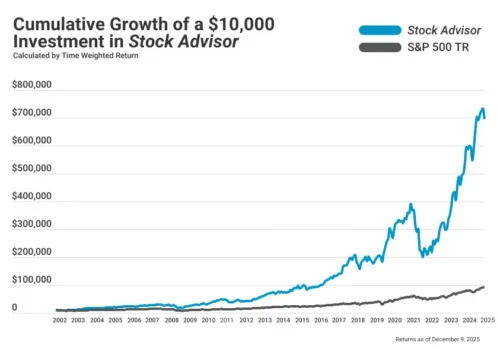

Since launching in 2002, Motley Fool Stock Advisor has built its reputation largely on long-term performance.

According to figures I’ve seen on The Motley Fool site, as of date, the service’s cumulative returns have nearly reached 1,000%, compared with roughly 200% for the S&P 500 over the same period.

While results vary and not every recommendation wins, the historical data underscores why patient, long-term ownership has been central to the service’s appeal.

Best Past Stock Picks

Some of Stock Advisor’s most well-known winners include early recommendations in companies like Amazon, Netflix, and Tesla.

Not every rec turns into a massive winner, but the outsized gains from a handful of successes have historically outweighed the losers.

>> Start Long-Term Wealth Building Goals Today <<

How Much Does Motley Fool Stock Advisor Cost?

Motley Fool Stock Advisor is priced as an annual subscription, with the standard rate typically set at $199 per year.

That full-price plan includes access to everything the service offers, from monthly stock recommendations to starter stocks, research tools, and the full archive of past recs.

There are no tiers within Stock Advisor itself, so once you’re subscribed, you get the complete experience.

Discounts and Promotions

The Motley Fool regularly runs promotions for new members, especially during major market events or holidays.

In most cases, you can scoop up your first year for just $99, making it easier to try the service without committing to the full rate upfront.

Occasionally, The Motley Fool also offers bundle deals that package Stock Advisor with one or more of its other services at a reduced combined price.

These offers usually apply only to the first year as well, but I’ve found that a standard process among services. Depending on your strategy, this route could add extra value, but don’t bite off more than you can chew. Stock Advisor on its own remains the most popular and accessible entry point.

>> Try Motley Fool Stock Advisor Today <<

Refund Policy

Refund Policy

Motley Fool Stock Advisor is backed by a 30-day membership fee-back guarantee, which gives new members time to explore the service without feeling locked in.

It’s full access; so you can peruse one round of stock recs, delve into the research, and see how the platform’s goal setting works.

If you decide within the first month that Stock Advisor isn’t the right fit, you can request a full refund of your membership fee, and your subscription will be canceled with no further obligation.

The process is straightforward and handled directly through The Motley Fool’s customer support team.

>> Follow David Gardner’s Investing Playbook <<

Features Included With Motley Fool Stock Advisor

Stock Advisor revolves around a small set of core features designed to support long-term decision-making without overwhelming you:

Monthly Stock Picks

Monthly Stock Picks

Each month, Stock Advisor delivers two new stock recommendations selected by the research team at The Motley Fool and sent straight to my inbox.

These recs come with clear explanations that focus on the business itself and why it made the cut so, in theory, you don’t have to shop elsewhere for more info.

It’s a somewhat slow but consistent approach that’s easy for me to handle, even with all the chaos life throws at me.

You’ll want these recs to make up the backbone of your portfolio if you plan to use the service, giving you consistent shots at the long-term gains Stock Advisor is known for.

Monthly Rankings

Monthly Rankings

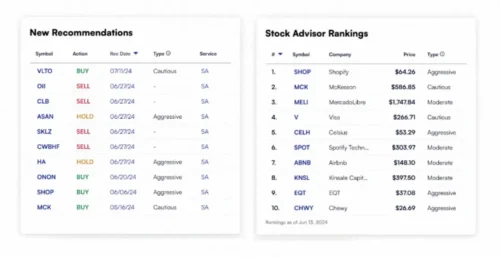

Stock Advisor also includes monthly rankings featuring the 10 best stocks the platform has to offer.

I visit this as soon as the new list pops so I’m among the first to uncover (and invest in) the biggest opportunities Stock Advisor supplies, all conveniently located in one place.

These go great alongside the two monthly recommendations, and you’ve given a detailed look at each one, too.

It also sheds some insight into trends developing in the larger economic scope. If several tech stocks appear on the list, I know to focus my monthly research there.

>> Access Stock Advisor’s Proven Strategy <<

Community & Research Tools

Community & Research Tools

Members get access to a private platform that houses all current and past recommendations, performance tracking, and ongoing commentary.

You’ll find everything from articles to videos and strategic reports. I admit there’s a ton of content here, so take your time going through it.

While it’s not a social forum in the traditional sense, the tools are built to help you research decisions at your own pace.

Being able to revisit older recs, review updates, and see how ideas have played out over time adds depth and transparency to the experience.

Portfolio Strategies

Motley Fool Stock Advisor recognizes that not everyone approaches investing the same way, which is why it outlines three clear entry strategies: Cautious, Moderate, and Aggressive.

These styles are meant to help you decide how and when to allocate capital based on your comfort level, experience, and market conditions.

A cautious approach spreads investments over time to reduce timing risk, while the moderate strategy balances steady entries with conviction.

The aggressive style is geared toward anyone comfortable deploying capital quickly into high-conviction ideas.

I like that you have the option to change up your strategy as you go, something you won’t find in most other services.

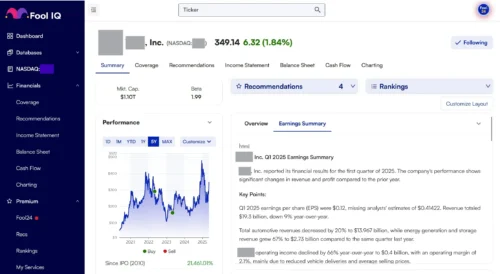

Access to GamePlan and Fool IQ

This is another Stock Advisor high point, since it shows you through articles and insights how to set and accomplish goals.

Fool IQ adds in financial data on companies and predictions on events that can propel them upward or cause them to fall.

These tools focus on building better habits, understanding risk, and improving long-term outcomes rather than chasing returns.

I find this data just as valuable as Stock Advisor’s stock recs, as it helps develop a long-term mindset and ways to potentially grow your wealth over time.

Stock Reports

The Motley Fool has several experts at its disposal, and they shine in a number of stock reports you can read at your leisure.

They usually go pretty deep, but don’t let that scare you. You can scrape off surface level info or go into a lot more detail if you’re ready.

It’s just one more source of recommendations that add variety to an already stacked service.

>> Discover Motley Fool’s Historically Winning Stock Picks <<

Pros and Cons of Motley Fool Stock Advisor

Here are my biggest takeaways after seeing what Stock Advisor can do:

| Category | Details |

|---|---|

| Key Benefits |

• Long-term, disciplined investment philosophy • Two new recommendations each month • Multiple rankings and reports • Strong historical performance record • Simple structure with clear guidance • Educational explanations behind each rec • Beginner-friendly without being shallow |

| Potential Downsides |

• Requires patience and emotional discipline • Limited appeal for short-term strategies |

>> Work Towards Building Wealth With Stock Advisor Today <<

The Motley Fool vs Competitors

Choosing a stock research service often comes down to how much guidance you want, how hands-on you plan to be, and the time horizon you’re investing for.

Here are my thoughts on how Motley Fool Stock Advisor stacks up against three of its most well-known alternatives.

The Motley Fool vs Zacks

Zacks Investment Research takes a very different approach from Motley Fool, thanks to its earnings-based ranking system.

By focusing on estimates and short-term performance signals, it jives with folks looking for frequent updates and who are comfortable reacting to changing data.

Stock Advisor, by contrast, is built with the long game in mind. Instead of reacting to quarterly earnings shifts, it emphasizes business quality and long-term growth potential.

If you enjoy data-driven rankings and more frequent decision points, Zacks may be more of a win for you.

The Motley Fool vs Morningstar

I know Morningstar well for its deep fundamental research and valuation-focused analysis.

Its strength lies in detailed reports, fair value estimates, and tools designed to help us assess whether a stock is over- or undervalued.

It’ll speak your language if you’re big on numbers and making your own financial calls, as there’s less ado about what to pick here.

Motley Fool Stock Advisor has that much more direct approach. Instead of leaving you to interpret valuation models, it offers clear buy recommendations with plain-language explanations.

The trade-off is depth versus simplicity. Morningstar excels as a research library, while Stock Advisor functions more like a guide.

The Motley Fool vs Seeking Alpha

Seeking Alpha offers breadth that few platforms can match. It combines quantitative ratings, financial data, and thousands of independent opinions covering nearly every stock imaginable.

This variety can be powerful, but it also means you have to filter through conflicting views.

If you’re not ready for all that knowledge, Motley Fool Stock Advisor takes the opposite route by limiting choice.

Instead of presenting many opinions, it delivers a small number of high-conviction stock recs backed by a consistent philosophy.

>> Start Investing With The Motley Fool Today <<

Is Motley Fool Stock Advisor Worth It? (Final Verdict)

Is Motley Fool Stock Advisor Worth It? (Final Verdict)

After reviewing the service from top to bottom, Motley Fool Stock Advisor still makes sense for people who want guidance without overcomplication.

It isn’t built for short-term moves or constant activity. Instead, it rewards patience, consistency, and a willingness to think in years rather than weeks through a steady stream of recommendations.

That alone helps it stand apart from many stock research services that push frequent decisions.

My final verdict here ultimately comes down to expectations. If you’re looking for clear stock recs backed by a long-term philosophy, historical results, and a simple framework you can stick with, the value is there.

The service won’t eliminate risk, but it does remove much of the guesswork.

I’m happy with the price point and membership fee-back guarantee, too, as these seem to fit what you receive.

For long-term wealth building in 2026, Stock Advisor remains a practical and well-established option.

Tags:

Tags: