Artificial Intelligence (AI) is essential for analyzing and predicting financial market movements. But before you delve into how AI predicts stock market trends, why not take a break and have some fun exploring PlayAmo?

Understanding AI in Stock Market Prediction

AI algorithms are essential in predicting stock market trends. They use large datasets that include financial statements, market trends, and past price movements. These algorithms use machine learning to study the data and identify patterns that could indicate future stock prices.

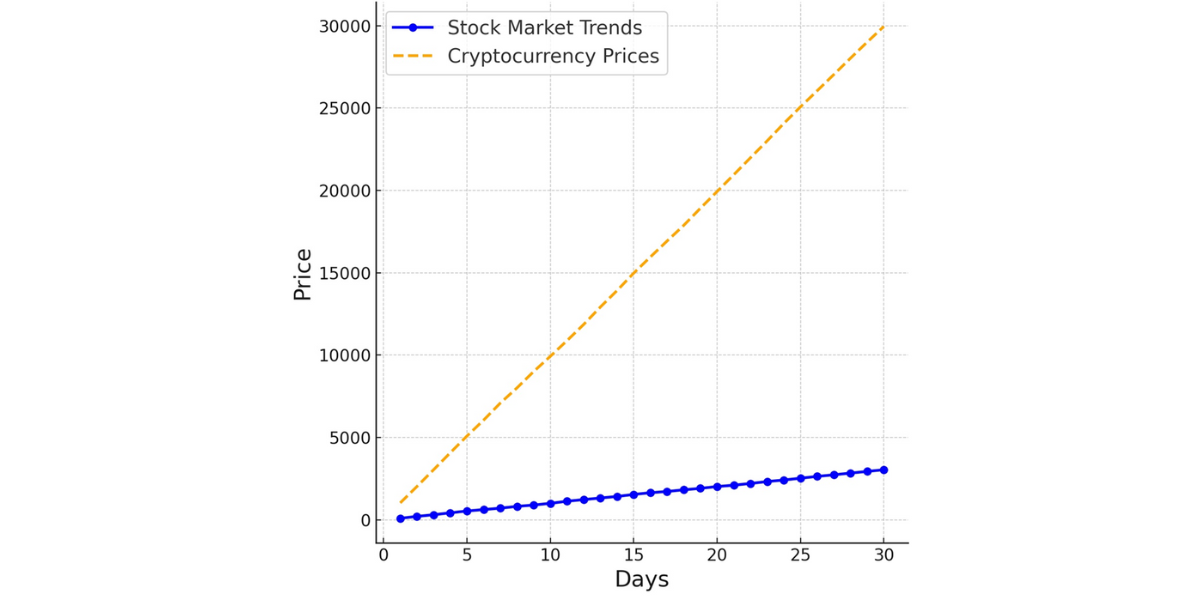

AI uses historical data, which may have biases. Cryptocurrency markets are unique—they trade around the clock, unlike traditional stocks. This constant activity creates high volatility, causing prices to change rapidly. Predicting these price movements is tough.

AI’s Application in Cryptocurrency Price Forecasting

Cryptocurrency markets are unlike traditional stocks because they trade non-stop. They operate 24/7, with constant activity every day of the week. The continuous trading creates high volatility, where prices can swing dramatically in short periods, making predictions challenging.

They study vast amounts of real-time data, such as transaction volumes, social media opinions, and macroeconomic indicators. This helps them find patterns and trends specific to cryptocurrencies. With this real-time analysis, investors can take advantage of sudden price changes and new market trends, giving insights that traditional methods might miss.

Cryptocurrency markets change rapidly, so AI must adapt quickly. Cryptocurrencies trade non-stop and are influenced by numerous factors, requiring quick analysis. Unlike traditional stocks with set trading hours and strict rules, cryptocurrencies need immediate attention.

Accuracy and Challenges in Stock Market Predictions

AI has changed the way we predict stock market trends by using large amounts of data to find patterns. However, predicting the stock market is still difficult. Even with AI’s power to analyze data, factors like political issues, new regulations, and changes in market mood can quickly affect stock prices in unexpected ways. These factors create volatility that AI models may not always be able to foresee.

Investors should be cautious with AI-generated forecasts. While the data is helpful, it’s important to also consider other factors that numbers can’t capture. By blending AI insights with human judgment, investors can better understand the market. This approach helps manage risks from unexpected market changes.

AI-driven stock market predictions provide helpful analytical tools. However, their reliability depends on understanding both numbers and market trends. Combining AI’s computing power with human expertise is crucial for making smart investment choices in the fast-changing world of global finance.Dynamic Nature of Cryptocurrency Price Predictions

Using AI to predict cryptocurrency prices means dealing with a landscape full of fast changes and lots of factors. Cryptocurrencies are different from regular financial assets because they’re affected by things like speculative trading, new technology, rules from governments, and even what people say on social media.

AI algorithms are key to understanding and predicting cryptocurrency prices. They can process large amounts of real-time data and spot patterns in a volatile market. By learning from ongoing market activities, AI models quickly adjust their predictions for sudden price changes. Investors take advantage of new opportunities and reduce risks from quick market shifts.

AI adapts quickly to the changing cryptocurrency market, making it crucial for predicting price trends. It uses machine learning to update predictions with new data, keeping up with market changes. This helps AI notice small signals, like changes in investor mood or new rules, which can greatly affect cryptocurrency prices.

Integration of Machine Learning in Financial Analysis

Machine Learning (ML) helps AI predict stock market trends and cryptocurrency prices better than older methods. ML algorithms are good at finding patterns and trends in lots of data, making predictions more accurate.

This continuous learning process improves the accuracy and reliability of predicting financial trends. By adapting and learning from real-time data, ML provides valuable insights to financial analysts and investors, helping them make informed decisions in fast-changing markets.

Machine learning (ML) makes AI more effective at predicting financial trends by analyzing more data and using advanced analytics. This is crucial in unpredictable cryptocurrency markets where traditional methods struggle. As ML algorithms get better, they transform how financial experts forecast market shifts, offering clearer guidance on investments and risk management.

Limitations and Risks in AI-Powered Predictions

Artificial Intelligence (AI) has revolutionized financial forecasting by analyzing vast datasets to predict stock market trends and cryptocurrency prices. However, these AI predictions come with risks that investors should approach carefully.

One significant risk is over-reliance on historical data, which may overlook new trends or sudden events like global crises or policy shifts that disrupt markets unexpectedly. These surprises, called black swan events, can reduce the reliability of traditional prediction models.

To wisely use AI insights in investing, understanding its risks is crucial. AI excels at analyzing vast data, but it still needs human intuition to grasp context. This blend helps investors handle AI’s limitations, making better decisions with detailed market insights and adjusting strategies swiftly. As AI progresses, integrating these advancements with human knowledge will likely define the future of financial predictions, bolstering robust strategies for both traditional stocks and digital assets.

Future Trends: AI and the Evolution of Financial Forecasting

As AI algorithms improve, they will use more data sources and advanced analysis methods. This means AI will understand market behaviors better by analyzing everything from financial reports to real-time market feelings. This will make predictions more accurate for stocks and cryptocurrencies. As AI keeps getting better, it will become crucial for investors, helping them make smarter decisions in a complicated market.

AI is revolutionizing how we invest by swiftly analyzing massive amounts of data. This makes it a powerful tool for predicting market trends across various asset types. This advancement not only improves predictions but also helps understand the complexities of markets better. As AI algorithms get better at predicting, investors can make smarter decisions that consider both numbers and market conditions.

FAQs

How does AI predict stock market trends?

AI algorithms analyze big sets of data like financial reports, market trends, and past prices. Using machine learning, they find patterns that might show future stock or cryptocurrency trends.

What makes cryptocurrency markets different from traditional stocks?

Cryptocurrency markets trade non-stop, unlike traditional stocks, causing high volatility and fast price changes. AI models help predict these fluctuations by analyzing real-time data, despite the challenges posed by constant trading.

What data does AI use to predict cryptocurrency prices?

AI algorithms analyze real-time data like transactions, social media feelings, and economic indicators. This helps find special patterns in cryptocurrencies, showing when prices might change suddenly or new trends might appear.

Why is AI crucial in the world of cryptocurrency trading?

AI algorithms analyze big datasets with financial info, market trends, and past prices. Using machine learning, they find patterns that might show future stock or crypto trends.

What are the drawbacks of AI predictions in finance?

AI relies on past data, which might miss unexpected events or market changes. Combining AI with human judgment is essential to grasp the market and adjust investment strategies wisely.

Tags:

Tags: