Veteran investor Jason Williams claims he’s found an incredible money-making tool in “DOGE Dividend Checks,” government-backed income streams that can provide steady quarterly payouts while helping to build lasting wealth.

Is this guru standing on solid ground, or does his income strategy actually fall flat?

In this The Wealth Advisory review, I take a deep dive into the service so you know whether it’s worth a closer look.

>> Check Jason Williams Top Stock Picks Here <<

What is The Wealth Advisory?

The Wealth Advisory is a research service from Angel Publishing edited by Jason Williams.

Each issue spotlights overlooked opportunities such as dividend stocks, government-backed payouts, and special income programs designed to grow income with minimal risk.

Subscribers also receive frequent alerts, weekly updates, video breakdowns, and full access to a running portfolio and past research.

What makes the service appealing is the mix of practical strategies and step‑by‑step guidance that aim to generate consistent, compounding income.

It’s positioned for readers who want a straightforward way to build lasting wealth with the kind of plays usually reserved for insiders.

Who is Jason Williams?

Jason Williams is the investment director of The Wealth Advisory and a veteran analyst with more than 15 years in the financial markets.

That early work gave him insider-level exposure to how large institutions build wealth, but over time, Jason shifted gears to focus on uncovering income opportunities for everyday readers.

Since joining Angel Publishing, Jason has written extensively about alternative income strategies and government‑linked programs.

His work has been published across Angel’s platforms and featured in financial media outlets that cover emerging investment ideas.

Is Jason Williams Legit?

Jason Williams’ credibility comes from both his professional background and his track record with Angel Publishing.

His insights have helped members of The Wealth Advisory build retirement portfolios in hopes of stepping away from full‑time work earlier than they expect.

Jason’s ability to spot under‑the‑radar opportunities shows he is more than a marketer; he is an analyst committed to finding income strategies that deliver.

With years of proven research and public recommendations, his work stands on a solid foundation of credibility.

>> Already sold? Click here to sign up now! <<

What is Angel Publishing?

Angel Publishing is a Baltimore-based independent financial research firm that produces newsletters and advisories designed for individual readers who want to take control of their own money.

Its team of editors includes seasoned analysts and former Wall Street professionals who bring insider-level insights to a broader audience.

Over the years, Angel Publishing has reached scores of readers through its services and free content like Wealth Daily.

The firm emphasizes independence, claiming to avoid conflicts of interest by not accepting payment from the companies it covers, which adds a layer of credibility to its work.

Is Angel Publishing Legit?

Angel Publishing has been in business for nearly two decades and has grown into one of the more recognizable names in the independent newsletter space.

While some of its marketing can feel bold, the firm has consistently delivered research-based recommendations that many readers have used to strengthen their portfolios.

Services like The Wealth Advisory, Technology Profits Confidential, and Energy Investor have helped subscribers capture gains in both mainstream and niche markets.

Angel’s longevity, wide subscriber base, and emphasis on transparent research practices point to a legitimate operation that offers real value for readers willing to act on its ideas.

What is the “DOGE Dividend Checks” Presentation?

For decades, the U.S. government has poured trillions into contracts, rent, and services that often benefit only insiders.

Most taxpayers never see a penny of it.

Jason Williams explains that a new shift in policy has turned this waste into a source of income for everyday people.

So how does it all work?

Following the Money Trail

As strange as it sounds, the government doesn’t own many of the buildings it operates in. Instead, it rents them, paying billions each year into one gigantic bucket called the Federal Buildings Fund.

What’s more, the government can’t cancel these leases, even if it wants to. That means consistent income is flowing somewhere all the time.

For years, billionaires and hedge funds captured these payouts. Finally, that same opportunity is available to anyone who knows where to look.

That’s fantastic news for us, but it gets even sweeter with a recent policy change coming from the top.

The Trump Supercharge

Love him or hate him, President Trump made a bold move this year to kick these DOGE payments into high gear.

As it turns out, the government has been spending billions on empty buildings all around the country.

That is, until now. Trump is putting an end to all that waste, opening the door for all that money to flow into more DOGE dividend checks than ever before.

While this is the start of something good, Williams teases that it will only get better with time.

The issue is getting in now while the opportunity’s at its hottest, and not waiting until it’s too late.

A Practical Path to Income

What makes this idea stand out is its simplicity. You don’t need political connections, complicated trading strategies, or a large starting investment.

Williams shows that getting started can take as little as a small stake and a few minutes of setup. From there, payments are designed to arrive every quarter, like clockwork.

For readers, the appeal is obvious: the chance to create a dependable stream of income that can support retirement, pay down debt, or even be passed on to family members.

If you want the step-by-step guidance to claim these payouts, the full details are available inside The Wealth Advisory.

Let’s check out what the service provides now.

>> Ready to get full access to The Wealth Advisory? Sign up today! <<

The Wealth Advisory Review: What’s Included in Your Subscription?

Here’s everything you receive with a The Wealth Advisory subscription.

Monthly Issues of The Wealth Advisory

Members receive an entire year of The Wealth Advisory newsletters, landing faithfully in inboxes month in and month out.

He explains the background of the opportunity, why it matters now, and how to position yourself to benefit. You’ll often see examples drawn from government programs, high‑yield companies, or sectors that most individuals ignore.

Each issue also ties the new recommendation back to the broader model portfolio, so readers understand where it fits into their long‑term plan.

Time-Sensitive Special Reports

From time to time, opportunities appear that can’t wait until the next monthly issue. These are moments when a new law, government program, or corporate announcement creates an immediate window to act.

That’s when Jason Williams releases a time‑sensitive special report so members know exactly how to move forward, from which company to target to how to execute the trade.

They are designed to help you capitalize on breaking developments while the upside is still on the table.

For readers, it feels like having a personal alert system that flags income opportunities the moment they surface.

Weekly Market Updates

The weekly updates act as a direct line of communication between Jason Williams and members.

When something requires action, Williams sends along quick recommendations explaining exactly what you need to do to maximize your shot at returns.

This rhythm of communication keeps readers informed and confident, and it helps turn complex market news into clear, actionable steps for protecting and growing income portfolios.

Video Series – Top 10 Most Profitable Stock Picks

The monthly video series adds another layer to the research by giving members a direct look at Jason Williams’ top 10 stock picks at that moment.

Unlike the written issues, the videos allow him to walk through charts, trends, and reasoning in real time. It feels like sitting in on a private briefing where he explains not just which companies he likes, but why they stand out right now.

The focus is always on the most profitable opportunities based on current market conditions, and Jason uses the sessions to highlight both income plays and growth potential.

Apart from being a window into Jason’s mind, you’ll have roughly a dozen additional plays each week to invest in as you so choose.

First-Class Member Support Team

Good research only matters if you can use it with confidence, and that’s why The Wealth Advisory includes a strong support system.

Members have direct access to a trained customer service team that can be reached by phone, email, or live chat during business hours.

Having responsive support makes it easier to focus on the recommendations without worrying about logistics.

It’s a small but important feature that helps subscribers stay engaged and get the most value out of the service.

Access to Private Wealth Advisory Members-Only Website

Every subscriber receives access to a secure members-only website that serves as the central hub for the service.

Members can log in at their convenience to track the model portfolio, revisit older research for context, or watch previously recorded sessions for additional insight.

Having everything in one streamlined dashboard makes it easier to act on opportunities quickly and to stay engaged with the recommendations without digging through emails or scattered files.

Free Subscription to Wealth Daily

On top of the core service, members also receive a complimentary subscription to Wealth Daily, Angel Publishing’s long‑running free newsletter.

This publication delivers daily commentary and insights from across the broader Angel research team.

While The Wealth Advisory focuses on income strategies, Wealth Daily covers a wide range of trends in technology, energy, real estate, and global markets.

For subscribers, this means staying informed about market shifts and new opportunities outside of the regular portfolio, making it a useful extra layer of research included at no added cost.

>> Sign up now to get these special bonuses! <<

The Wealth Advisory Review: Bonus Reports

You also get all of the following bonus reports just for signing up:

DOGE Dividend Checks – How to Collect $8,276 Courtesy of the U.S. Government

This report is the centerpiece of Jason Williams’ research and explains in detail how to tap into what he calls “DOGE Dividend Checks.”

Because of federal law, 90% of the profits from these companies must be distributed to shareholders.

By the time you finish reading, you’ll have a good idea how to position yourself to collect a portion of this money.

It also outlines how these payments can grow over time and be passed down to heirs, making them more than just temporary income.

I like to think of it as a roadmap for building long-term wealth through one of the most overlooked government-backed income streams available today.

Pentagon Payouts – The Secret to Getting Paid From the $895 Billion U.S. Defense Budget

In this report, Williams shifts focus to another massive pool of government spending: defense. The U.S. defense budget is close to $895 billion, and much of that flows to contractors and suppliers who own the facilities where critical work is carried out.

We can partake thanks to a real estate supplier that benefits from these Pentagon contracts to the tune of up to $2,000 each quarter.

It’s a practical way to align your income strategy with government defense spending, which historically increases regardless of political cycles.

America’s Tax Collector – How to Make Walmart, Starbucks, and General Motors Pay You Every Month

The third report highlights how corporate penalties and tax settlements can become an unexpected source of income for ordinary people.

Williams explains that the government has fined major companies like Walmart, Starbucks, and General Motors for anti-competitive practices, and the money collected is redirected back into programs that pay shareholders.

This report shows how to identify the companies positioned to receive those funds and how to set yourself up to collect recurring monthly payouts as a result.

The research is laid out step by step, making it easy to follow even if you’re new to income strategies.

In the end, it represents another way to diversify income streams while relying on payments funded by some of the largest corporations in the world.

>> Like all The Wealth Advisory has to offer? Sign up now! <<

Money-Back Guarantee

All subscriptions to The Wealth Advisory come with a 180-day money-back guarantee, which means members have a full six months to evaluate the service without financial risk.

If you decide it’s not for you, you can request a refund at any point within that window, no questions asked.

This policy makes it possible to explore all of the research, reports, and recommendations with confidence, knowing that your subscription is fully refundable if the service doesn’t meet your expectations

Pros and Cons

The Wealth Advisory is chock-full of great reports, recommendations, and other goodies to help you level up your investing game. Still, it has some drawbacks.

Here’s everything you need to know about it:

Pros

-

- One full year of The Wealth Advisory

- Weekly updates and frequent trade alerts

- Unlimited access to a members-only website

- Includes three bonus reports

- Six-month money-back guarantee

- Monthly video highlights

- Receive Wealth Daily e-letter at no extra cost

Cons

- The service is limited to stocks

- No access to community chat or forum

>> Is The Wealth Advisory right for you? Click here to get access NOW! <<

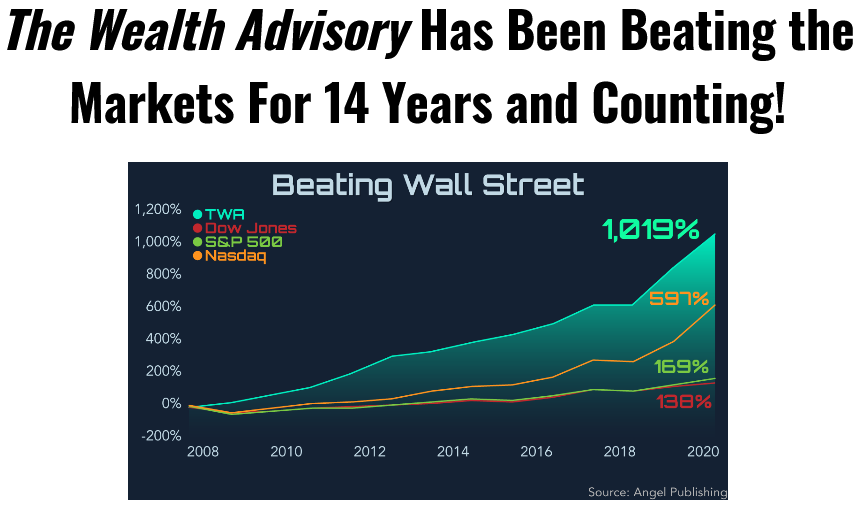

The Wealth Advisory Track Record

Jason Williams often points to a history of standout recommendations that demonstrate the potential of his research.

Members have shared stories of capturing multi-digit profits, with one testimonial highlighting a $22,000 return on a single recommendation.

Beyond the headline numbers, Williams emphasizes consistency, pointing to years where his model portfolio generated steady income even when markets were volatile.

While not every pick has been a winner, the track record suggests that following his strategies has helped many subscribers build reliable income streams and, in some cases, accelerate their retirement plans.

The Wealth Advisory Reviews By Real Members

There are tons of positive customer testimonials praising The Wealth Advisory and their stock recommendations. Here’s just a small sampling of glowing reviews:

You’ll want to take these with a grain of salt since they came off the website, but they’re still a clear indicator of what the service can do.

>> Join these happy customers and sign up today! <<

How Much Does The Wealth Advisory Cost?

At the moment, there are two subscription plans available for The Wealth Advisory, both offered at discounted rates.

It also comes with a six-month money-back guarantee, giving new members the ability to try the service without risk.

Alternatively, you can pursue a lifetime subscription for $249 that eliminates the need for recurring payments altogether. If you’re planning to stick around for a while, this quickly becomes an incredible deal.

In both cases, members also receive access to Wealth Daily, Jason Williams’ bonus reports, and ongoing customer support.

Is The Wealth Advisory Worth It?

After going through all the details, it’s clear that The Wealth Advisory offers more than a standard newsletter.

At its current price point, the amount of research, reports, and ongoing updates included represents solid value, especially with a six-month refund policy to fall back on.

With my two cents on the table, The Wealth Advisory makes a strong case for those who want to focus on reliable, repeatable income streams.

Sign up today to get going on DOGE dividend payouts before the best opportunities become mainstream news.

>> Sold yet? Click here to sign up now! <<

Verdict

The Wealth Advisory is worth it if you want a steady flow of income-focused strategies. With its blend of government-backed programs and dividend-rich opportunities, it provides a practical path toward financial freedom.

Given the positive track record and member feedback, this service earns a confident recommendation.

>> That’s a wrap on our review of The Wealth Advisory! Sign up now for just $49 <<

Tags:

Tags: