Doing hours of research only to end up with the wrong stocks is frustrating. That’s exactly the problem Ticker Nerd set out to solve.

It’s designed for anyone hunting for long-term gains who want reliable insights without spending endless time sifting through noise by combining algorithmic screening, professional analysis, and clear reports.

In this Ticker Nerd review, I’ll look at how the service works and if it actually delivers.

>> Join Ticker Nerd Now At A Special Deal <<

What is Ticker Nerd?

Ticker Nerd is a subscription-based research service created for everyday folks who want to find promising companies without spending hours digging through financial statements and stock forums.

The coverage is centered on the U.S.-listed companies across the NYSE and NASDAQ, making it easy to follow along. Subscribers get structured analysis, rankings, and curated insights that cut through the noise.

What makes it appealing is the way it combines algorithm-driven screening with professional human research, ensuring you don’t just get stock names but also the reasoning behind them.

For anyone looking to save time and still keep an eye on high-quality opportunities, Ticker Nerd offers a straightforward, data-backed starting point.

How Does Ticker Nerd Work?

Ticker Nerd’s research is built on three clear stages, each designed to filter out weak picks and highlight companies with serious growth potential.

Algorithmic Screening

The process begins with a proprietary algorithm that scans thousands of U.S.-listed stocks daily. It looks for growth signals, unusual trading activity, and early momentum that might indicate a stock is ready to break out.

This automated filter helps narrow the field to a smaller set of promising candidates.

Human Research and Due Diligence

From there, the research team, led by ex-Goldman Sachs trader and CFA charterholder Aslam Ghouse, digs deeper.

The team reviews each candidate for fundamentals like revenue growth, profitability, competitive advantages, and potential risks. This ensures the picks aren’t just data anomalies but real businesses with long-term promise.

The team also reviews sentiment data to see if market optimism or skepticism is justified, giving a clearer view of how the stock is perceived.

This sentiment analysis helps gauge whether enthusiasm or skepticism is justified, adding an important dimension to the financial review.

By combining numbers with market psychology, the team ensures the picks aren’t just data anomalies but real businesses with long-term promise.

Dynamic Ranking System

Finally, every stock ends up with a ranking that gets updated daily. This feeds into their Top 10 Portfolio, which is rebalanced every four weeks.

Subscribers get a notification whenever Ticker Nerd makes changes, giving them a clear, structured view of what the research team currently considers its strongest ideas.

Is Ticker Nerd Legit?

Ticker Nerd has built a reputation as a credible research platform.

It isn’t run by anonymous bloggers; it’s led by Aslam Ghouse, a former Goldman Sachs systematic trader and CFA charterholder, which speaks volumes about the professionalism behind the analysis.

What also boosts its authenticity is the structured process behind every report: algorithmic screening, thorough human research, and a continuously updated ranking system.

>> Already sold on Ticker Nerd? Click HERE to sign up! <<

What’s Unique in Ticker Nerd Premium?

Ticker Nerd Premium sets itself apart by focusing on depth, structure, and usability rather than chasing volume.

Each month, members receive two full-length research reports that not only introduce new stock opportunities but also explain the logic behind them.

The service also maintains a Top 10 Portfolio that is rebalanced every four weeks using their proprietary ranking system, giving subscribers a clear picture of the team’s highest-conviction ideas.

Additionally, Premium members can track daily updates through a dashboard and each of the platform’s researched stocks..

All this folds nicely into the company’s 85/15 portfolio approach of 85% “safe” investments and 15% higher-potential opportunities.

For long-term investors seeking a consistent process and professional-level insights, Premium delivers a structured advantage.

Ticker Nerd Review: What’s included?

Ticker Nerd has some great features that will help you improve your investing game. Keep reading our Ticker Nerd review and learn more about them.

Monthly Reports

Each month, subscribers receive two detailed reports focused on high-potential growth stocks.

These reports include in‑depth breakdowns of the company’s business model, financial health, competitive landscape, and industry outlook so you can make an accurate assessment on whether to jump in without having to look elsewhere for more info.

For investors who want a clear picture of why a stock stands out, these reports provide a structured framework that goes far beyond a ticker symbol and a price target.

Top 10 Portfolio

The Top 10 Portfolio is the centerpiece of Ticker Nerd Premium. This portfolio is driven by the proprietary Ticker Nerd Rank, which is updated daily and ensures only the highest‑conviction ideas make the cut.

Every four weeks, the team rebalances the portfolio based on its unique criteria, and members receive notifications explaining the changes.

It’s a great way to stay on the pulse of what Ticker Nerd is uncovering, and you can track how recommendations are faring for better or worse.

This structure helps subscribers follow a systematic approach rather than guessing when to buy or sell, giving them a transparent way to see the team’s current best opportunities.

Report Archive

Ticker Nerd maintains an extensive archive of every research report they’ve ever run.

This feature is useful for anyone who wants to look back at how previous picks were presented, track how they’ve performed, or simply study the team’s research process.

Some of these picks may have already had their moment in the sun, but it’s a great way to catch up on the platform’s current top portfolio rankings.

Having access to this library turns the service into an educational resource as well as an investing tool, letting members revisit older analyses to sharpen their own decision‑making skills.

Daily Rankings & Updates

Instead of waiting for the monthly or weekly reports, members can log into their dashboard to see how more than 150 tracked stocks are currently rated.

These rankings are refreshed every single day through the proprietary Ticker Nerd Rank system, giving subscribers an up‑to‑date view of which companies are moving up or down in priority.

This continuous feedback loop is especially useful for those who want to monitor changes between portfolio rebalances.

It means you’re never in the dark about how the team’s conviction is shifting and can use the information to stay ahead of market moves.

Bi-Weekly Newsletter

In addition to the premium research, members—and even free subscribers- receive the Market Radar Newsletter every Monday and Thursday. This digest shares top and bottom movers, highlights ongoing market trends, and includes insights from the top 3% of Wall Street analysts.

Having a window into the minds of the analytical elite is a win on its own, but you’re also getting coverage on the top “strong buy” stocks and those with some real momentum in the works.

The fact that it comes twice per week means you’ve got additional insight into events that you may not see otherwise, and I highly recommend checking the newsletter out whether you become a Premium Ticker Nerd member or not.

Stock Forecast Pages

A newer addition to Ticker Nerd’s offering is its stock forecast pages. These pull together consensus ratings and price targets from some of Wall Street’s top analysts.

For each stock, such as Apple (AAPL) or Reddit (RDDT), members can see buy, hold, and sell recommendations along with high, median, and low price targets.

It’s also an excellent place to view a company’s market cap, value changes, and more throughout the year without having to scour the internet.

This feature blends external credibility with Ticker Nerd’s in‑house research, giving subscribers another perspective to validate their decisions.

>> Like all that Ticker Nerd has to offer? Sign up HERE! <<

Is Ticker Nerd Reliable?

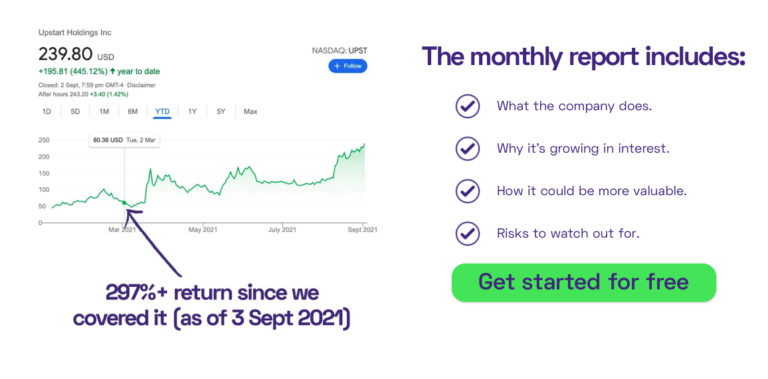

Without getting too much into Ticker Nerd’s portfolio, the platform boasts several recommendations that have doubled or more since being chosen.

Companies like AppLovin are doing even better, up over 400% since first chosen in mid-2021.

Cancellation Policy

Ticker Nerd makes its cancellation policy straightforward and user-friendly. Every subscription is backed by a 30-day money-back guarantee, meaning new members can test the service with very little risk.

If it’s not the right fit, refunds can be requested without the need to justify the decision. In addition, memberships are not tied to long-term contracts, so users maintain full control.

Cancellation can be done directly through the dashboard or by contacting the support team via email, which gives flexibility depending on personal preference.

This no-strings approach reflects confidence in the product’s value and lowers the barrier for anyone curious about trying the service.

How Much Does Ticker Nerd Cost?

Ticker Nerd offers two straightforward subscription options to fit different preferences.

The Monthly Plan is priced at $29 per month, giving members the flexibility to try the service without committing to a full year.

It includes access to everything: two detailed stock reports each month, the daily-updated Top 10 Portfolio, 150+ archived reports, the research dashboard, and the bi-weekly Market Radar newsletter.

That effectively cuts the cost in half, bringing the monthly equivalent down to just over $8.

The annual plan offers the best value, especially for long-term investors who want consistent research at a lower price point.

>> Ready to get started with Ticker Nerd? Click HERE to sign up! <<

Pros and Cons

Ticker Nerd takes a unique approach to searching for breakthrough stocks.

Here in our Ticker Nerd review, you can take a look at our pros and cons before making a decision.

Pros

- Monthly reports sent straight to an email inbox

- Proprietary software that scrapes the internet for breakout stocks

- Team of expert analysts to filter through data

- Top 10 Portfolio that’s rebalanced every month

- 150+ archived stock reports

- Bi-weekly newsletter included

- 30-day money-back guarantee

- Reasonable yearly subscription fee

Cons

- Service is relatively new

- Focused only on U.S. stocks

Is Ticker Nerd Right for Me?

Ticker Nerd is designed for investors who want to build wealth steadily through long-term growth stocks rather than chasing short-term speculation.

It appeals to busy professionals and everyday investors who don’t have time to sift through endless market data but still want access to well-researched, actionable insights.

Because the service emphasizes algorithmic screening combined with professional analysis, it is especially useful for those who value a structured approach and want to understand the reasoning behind each pick.

The inclusion of detailed reports, an actively managed Top 10 Portfolio, and tools like sentiment analysis and forecast pages make it a comprehensive companion for anyone serious about improving their research process.

On the other hand, it won’t suit people looking for rapid-fire trade alerts, penny stock tips, or high-risk strategies.

If your goal is to save time while gaining access to curated, high-quality opportunities, Ticker Nerd is a strong match.

Ticker Nerd Customer Reviews

Subscribers have a lot of good things to say about what Ticker Nerd has done for them.

Take a look at some of these recent reviews:

These reviews did come straight from Ticker Nerd, so do take them with a grain of salt. That said, it’s really encouraging that at least some folks hold the platform in such high regard.

Is Ticker Nerd Worth It?

In my experience, the answer is yes, but it depends on what you’re looking for. If you want a service that spoon-feeds you dozens of short-term trades, then this probably isn’t the right fit.

But if you value quality research, structured analysis, and a clear process, Ticker Nerd delivers on those fronts.

The affordability of the plans is another reason it stands out.

With a monthly option at $29 and an annual plan currently discounted to $99, the cost is reasonable compared to competing services that can run into the hundreds or even thousands per year.

Add in the 30-day money-back guarantee, and you have very little to lose by giving it a try.

Where it shines most is in the educational value. Each report doesn’t just point you to a stock; it explains the rationale, highlights the risks, and helps you learn how to think through investment opportunities.

This makes it as much a teaching tool as a research service, which is rare in this space.

For long-term, growth-oriented investors who want to save time while building confidence in their decisions, Ticker Nerd is well worth considering.

Final Verdict: Ticker Nerd is a legitimate, systematic, and cost-effective stock research tool that can strengthen your investment decision-making process while also helping you become a smarter investor over time.

>> Ready to save time looking for hot stocks? Sign up for Ticker Nerd TODAY! <<

Tags:

Tags: