Prop firms can be enticing for all types of traders, as they provide access to larger sums of money for a small amount of capital upfront.

Since you’re playing with someone else’s cash, though, they often impose heavy rules and restrictions to protect what’s theirs.

This often comes at the cost of the ability to trade as you see fit since you’re constantly navigating mines sprinkled by the company claiming to have your best interests in mind.

Enter TickTick Trader, a relatively new prop trading firm striving to make the system simple, logical, and easy to understand once again.

Join me as I investigate how well they succeed in this TickTickTrader review.

>> Explore top trading opportunities today <<

What is TickTickTrader?

TickTick Trader is a prop trading firm designed to offer users access to large amounts of cash for a minimal buy-in.

Founded in 2022, it seeks to provide a way for folks to become financially independent through carefully articulated trades.

The platform has several platforms available for trading, each with unique facets to consider before signing up.

These programs have specific rules individuals must follow, and failing to do so can result in the termination of your account.

Focusing solely on futures, the company prides itself on accessibility and a well-equipped customer service team to deal with issues should they arise.

Is TickTickTrader Legit?

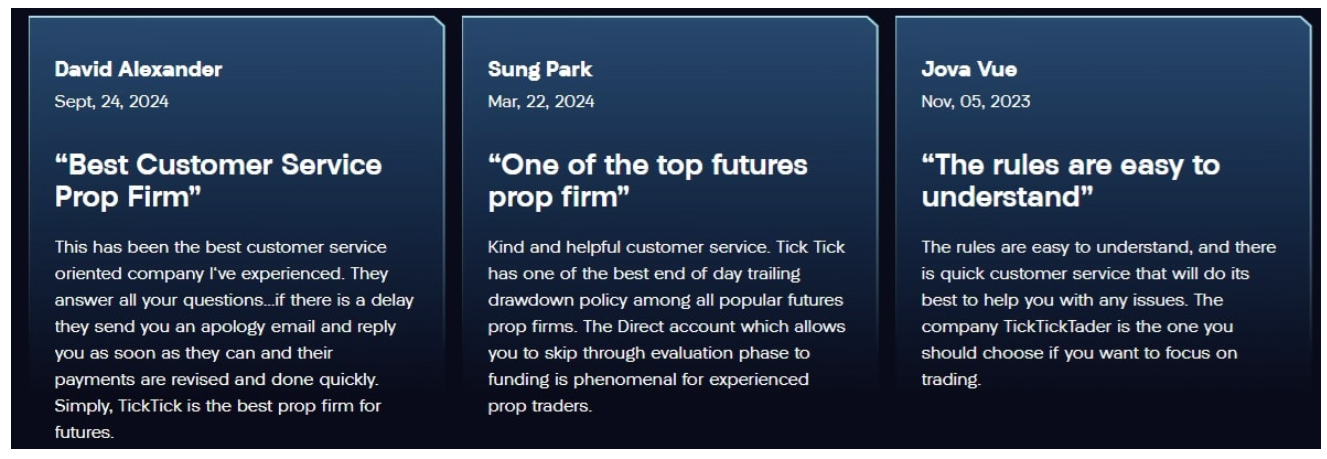

TickTick Trader is indeed a legit platform, even if it’s only been around for a few years.

Its team has been actively involved in trading for over two decades, learning the ins, outs, and limitations of other prop firms out there.

The company uses a regulated broker but doesn’t function as a financial provider in itself.

It does have a 4.6 out of 5-star rating on third-party site TrustPilot, with more than 6,300 reviews.

Furthermore, the company has an A rating with the Better Business Bureau as an accredited business.

>> Trade futures with minimal upfront cost—Start today! <<

What Can You Trade With TickTickTrader?

The only vehicle for TickTick Trader is futures trading, but the company allows the use of CME, NYMEX, COMEX, and CBOT.

Available instruments include metals, agriculture, energy, currencies, micro, and equity futures.

You’re welcome to focus on a specific niche within the futures market or pursue multiple areas at the same time.

>> Access top futures markets now! <<

TickTickTrader Account Types Explained

TickTick Trader has two opportunities for folks to get involved: evaluation accounts and direct accounts. Let’s look at each now.

Evaluation Accounts

Evaluation Accounts are likely where you’ll begin on the platform, and TickTick Trader has four options to choose from.

Each offers a different funded account with a specific price target you’ll want to navigate to, from $1,500 to $6,000. Limitations vary from one to the next, including the daily loss limit, tick drawdown, and the maximum number of contracts you can hold at any time.

While you have as long as you need to hit those goals, the system’s set up to charge you a monthly rate until you get there.

Funded account fees start as low as $87 per month for a $25,000 account size, culminating in a $100,000 plan for $171 monthly.

Despite no maximum or minimum trading days, you’re somewhat locked in a battle to complete your trading journey as quickly as possible without breaking a rule in the process.

Express Plan

If you feel a bit on the risky side, it’s also possible to try your hand at the platform’s one express account.

Here, you’re paying $99 for just 15 days of use, promoting an even greater sense of urgency to reach the $6,000 price target with a $100,000 funded account size.

That said, there’s no daily loss limit to deal with, giving more leeway should you have a steep drop in an attempt to clear your evaluation phase even faster.

Direct Accounts

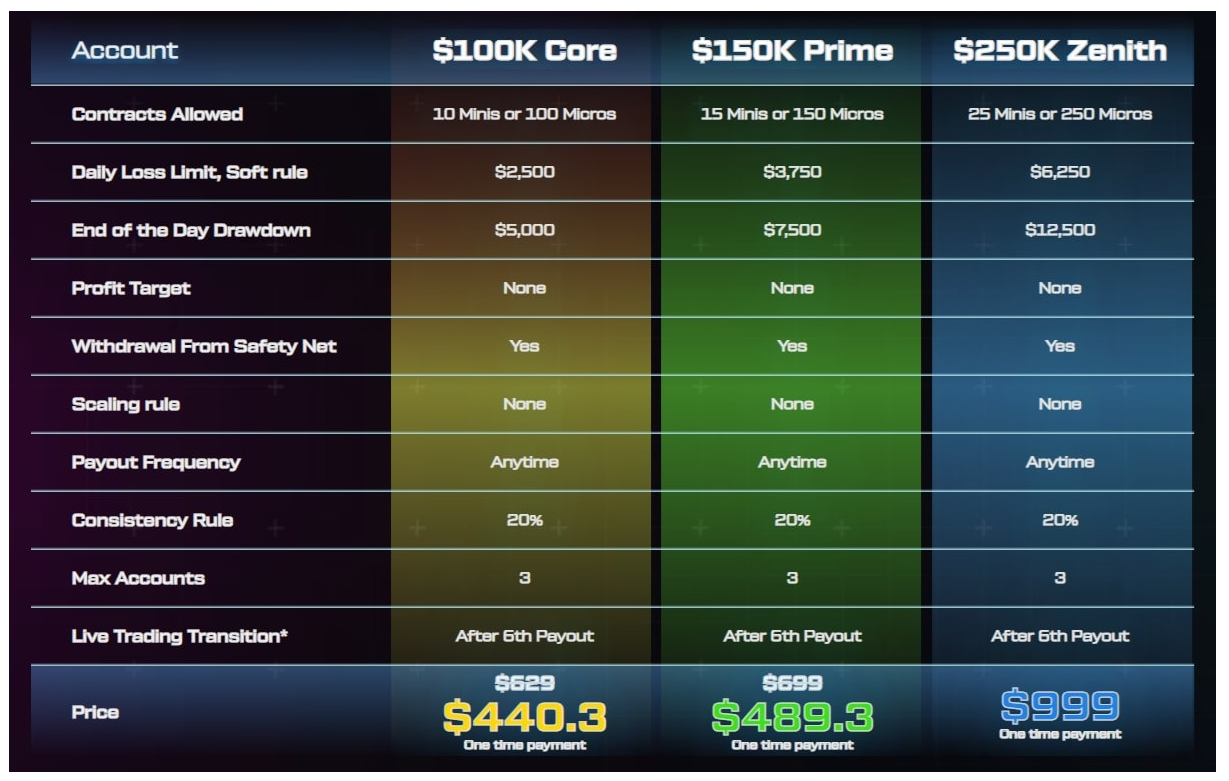

Direct accounts provide a somewhat unique approach to the prop firm where you can cut out the evaluation phase entirely.

The funded account size for these plans starts at $100,000, climbing all the way to $250,000 if you think you can handle the pressure at the top.

As with evaluation accounts (other than express), each tier has a specific daily loss limit and end-of-day drawdown you’ll want to avoid at all costs.

The benefit here is that there’s no profit target to shoot for, meaning you have unlimited potential to earn your keep time and again as long as you don’t stumble.

Since you’re immediately handed a funded account without an upper limit, you instead pay one-time activation fees to begin trading.

Right now, the lowest-tier direct funding plan will set you back $440, with costs climbing as high as $999.

>> Choose an affordable plan to get started <<

What Are TickTickTrader Trading Rules?

Anyone wishing to create a Ticktick Trader account will want to engrain these rules into your mind. Failing to abide by them can have serious ramifications.

Drawdowns

No matter which trading account you decide to try out, you’ll have to ensure you never touch the plan’s drawdown.

It trails with your account balance, with the calculation always taking place at the end of the trading day.

The calculation takes into account only profits you’ve realized until that point, never factoring in unrealized amounts you were trying to reach.

If ever your tick drawdown exceeds that upper limit at the end of the trading day, the prop firm will liquidate your account.

Daily Loss Limit

TickTick Trader sets a daily loss limit for nearly all its trading platforms that you’ll also need to avoid.

This number varies from one plan to the next and helps safeguard against incredibly risky plays.

Should you breach a daily loss limit as an evaluation trader, the prop firm will close all open positions you have and deactivate your account.

TTTDirect accounts get a little more leeway here, with violations resulting in a suspension for the rest of the trading day.

Only the Express Plan allows trading without a daily loss limit in effect.

Overnight Positions

It’s also against TickTick Trader’s policy to leave positions overnight.

As with other rules, doing so renders your trading account subject to immediate deactivation.

In a recent update, the prop firm now allows accounts and balances to be reinstated a single time should you make this error.

Note that a second violation will result in permanent closure.

Scaling Plan

Former TickTick Trader direct accounts had scaling plans that put limitations on the number of positions you could have open at a time.

Its new offerings came with a refresh that no longer have scaling rules in place.

>> Understand the rules in details and trade smarter <<

TickTick Trader’s Leverage

TickTick Trader doesn’t make use of leverage in any way, so you won’t be able to access a position worth more than your initial deposit.

While not a huge deal, it’s worth keeping in mind when looking at profit targets in the prop firm’s evaluation plans.

Each program does have a maximum numbers of contracts you can have open at any time, going as low as four if you’re a TickTick Starter.

TickTickTrader’s Payouts

One of TickTick Trader’s most remarkable features is that you’re entitled to 100% of the profits you earn during your first three months with the service.

After that initial window, you’re still able to keep 90% of what you bring in, with just 10% of the profit split going back to the futures prop firm.

Honestly, that seems like a very reasonable ask, considering how much they float you to work with. You can request what’s yours at any time of the month.

There are a few things of note here, namely a safety threshold that you’ll need to clear before being able to remove any cash from your account.

The amount you have to overcome varies from plan to plan, but don’t seem too arduous.

In that same vein, you’ll need to request a minimum withdrawal of at least $250 any time you pull out funds.

Direct Accounts Payout Policy

There’s nothing all that unusual about the payment policy for direct accounts other than its consistency rule.

To avoid issues with payments, you’ll need to make sure your daily earnings are at or below 20% of your overall profits.

Going above this limit can delay payout approvals until you’re able to get your profits back down.

>> Cash out in crypto or ACH—keep 100% profits for your first three months! <<

TickTickTrader Coupon Code/Promo

TickTick Trader often has coupon codes for its various plans, so it’s worth checking in often even if you’re already enrolled to uncover new deals.

Right now, we’ve been able to locate two such codes you can put to use when you go to sign up.

Use JVDKUKFU to get 30% off a Project X $100K Core Direct account or Tradovate $150K Prime Direct account.

Use X5MAJGS7 to get $250 off a Tradovate or Project X $100K Core Direct account or Tradevate or Project X $150K Prime Direct account.

>> Unlock discounts for top-tier accounts today! <<

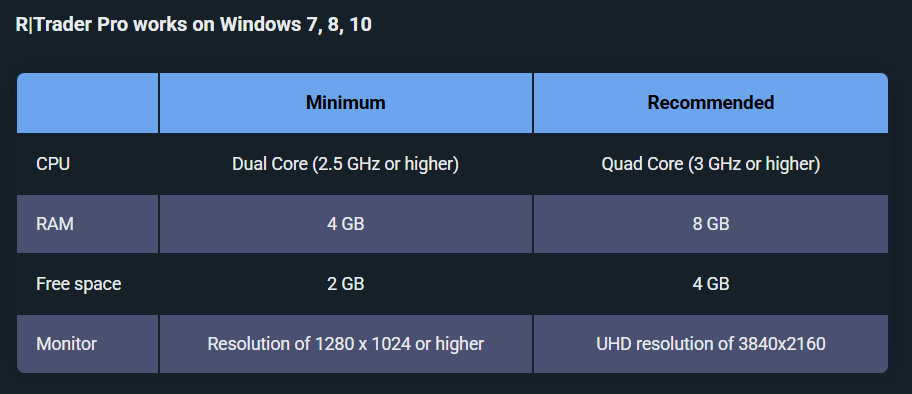

What Tools Are Needed to Trade with TickTick Trader?

To get the most out of TickTick Trader, you’ll need to utilize the following tools:

Data Feed Provider

Because you’re out there trading, you’ll need a data feed provider that collects and transmits as close to real-time information as possible on market conditions.

Having such a tool that focuses on futures trading allows you to make informed decisions in a pinch while working hard to avoid breaking one of the prop firm’s rules.

TickTick Trader is known to have two reputable data feed providers you’re welcome to use: Rithmic Pro and CQG.

Each one pulls in real-time futures data with strict protocols to keep info flowing and up-to-date.

>> Get real-time market data for accurate trades <<

Trading Software

Obviously, you can’t get very far on a futures prop firm without being able to trade.

Therefore, TickTick Trader provides each user with one free license key for either Bookmap, NinjaTrader, or Jigsaw DayTrader.

Each software has its own pros and cons, so be sure to do your research before selecting the one best for you. You can’t go back on your decision once it’s made.

Alternatively, it’s possible to link an existing license from one of several other types of trading software if you already have a platform you’re fond of.

>> Pick your free trading software and begin today <<

TickTickTrader Review: What Makes it Unique?

TickTick Trader’s futures prop firm showcases a number of features that set it apart from the competition. Here are some of the most impressive:

Multiple Account Types

Most trading platforms I’ve experienced keep users locked in an evaluation phase, never really letting them stretch their wings.

While evaluations are still a big part of TickTick Trader’s platform, it’s entirely possible to dive into a direct trading plan right out of the gate.

Since these plans have no upper limit, they allow traders to continue to grow assets and build profits for as long as they see fit.

Advanced Trading Software

Despite the fact that TickTick Trader is less than three years old, it’s managed to make solid partnerships with some of the most advanced trading software out there.

Each tool has its nuances, but they’re relatively easy to use and function quickly so you don’t get caught in a bad situation due to slow performance.

The fact that you’re handed a free license to pick from one of three options really speaks to the quality of the service as a whole.

>> Claim your free software now! <<

Timely Payouts

The average processing time for payouts from the prop firm is just five days, meaning you’ll have funds in hand sooner than several of its competitors.

You can request funds through wire transfer, ACH, or even choose to get paid in cryptocurrency.

Quick Account Opening Process

Opening an account here is surprisingly easy, requiring users only to click the “Join Now” button at the top of the prop firm’s main page.

Once there, you’ll select the market data feed and account type you’d like to use before putting in all your pertinent information.

After your payment clears, you’re set to start trading. There’s no verification process that can gum up the works.

Professional Customer Service

I’m always leery of sites that hide their customer service numbers or have limited ways to get help.

Fortunately, TickTick Trader lists its phone number and email address clearly on its contact page, and responses come quickly.

There’s also a form you can fill out that functions much the same way as email and a chat option that tells you upfront it’s a bot.

Affordable Plans

Some prop firms can charge thousands of dollars for an attempt at making money in one lump sum. Making a mistake means you’re out of all that money without a chance to explain yourself.

TickTick Trader does have its direct plans that run as high as $999, but its lowest tier is significantly cheaper.

If you’re looking to prop trade without breaking the bank, evaluation plans are very affordable, albeit with a monthly rate.

However, if you complete your trial in a timely manner, you can save quite a bit of money this way.

>> Customize your trading experience and access funds quickly, hassle-free <<

Pros and Cons

After a thorough TickTick Trader review, here are my top pros and cons for the service:

Pros

-

Multiple account types to choose from

-

Free license to one of three trading software options

-

Reasonable daily loss limits

-

Downturns not calculated until end of the trading day

-

No profit split for the first three months

-

No minimum trading days on evaluation phase

Cons

-

Bot trading is not allowed

-

20% consistency rule

TickTickTrader Reviews by Real Members

I’m really digging this platform, but don’t just take my word for it. Here are some TickTick Trader reviews from actual members:

As you can see, subscribers rave about how simple and straightforward TickTick Trader’s programs are to use.

There’s also a common theme here that speaks to the customer service team and support, something most services don’t have.

>> Join thousands of satisfied users now! <<

Is TickTickTrader Worth It?

I’ve had the luxury of giving TickTick Trader a thorough review, and I’m really happy with what I see.

As its crew envisioned, it takes a lot of the hiccups of other prop firms and deals with them in exciting ways.

You’re free to consider an evaluation program or a direct trading account, speaking traders who prefer different approaches.

It’s such a blessing not to have to worry about maximum or minimum trading days here, allowing you to move at a pace that best fits your personality.

The rules and requirements here feel very reasonable to me, giving a lot of grace without completely throwing the platform’s scruples out the window.

Fees to participate are among the lowest I’ve ever seen, showing that TickTick Trader really does want to eliminate any barriers people face for getting involved.

Above all, you can keep all your profits for the first three months, and the vast majority from there on out.

If you’ve been tossing around the idea of a prop firm, sign up today for your shot at big payouts.

>> Pick your plan—secure advanced trading tools for free now! <<

Tags:

Tags: