Most people believe you need a million-dollar nest egg to retire comfortably. Tim Plaehn says otherwise.

His nontraditional approach aims to flip that belief on its head, using Paycheck ETFs to potentially create steady, income-generating ETFs that can deliver monthly cash flow for now and the future.

Is he onto something, or are his claims way out in left field?

I dig up the answer in this Tim Plaehn Freedom Number review.

>> Unlock your Freedom Number with Tim Plaehn <<

What is Tim Plaehn’s Freedom Number?

The Freedom Number is Tim Plaehn’s way of showing that real financial freedom isn’t about piling up a massive nest egg, by creating consistent income that covers your lifestyle.

Instead of relying on the outdated 4% withdrawal rule, Plaehn teaches how to use a new wave of Paycheck ETFs to generate monthly cash flow directly from your brokerage account.

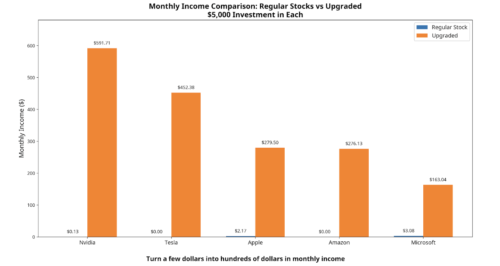

These are income-generating ETFs built around household names like Apple, Tesla, and Microsoft, companies that normally pay little or no dividends, but when used in Plaehn’s system, can potentially pay double-digit yields.

Through his ETF Income Maximizer service, members learn how to calculate their personal “Freedom Number” and see step-by-step how to reach it with 10X less money than they thought possible.

It’s designed for anyone who’s tired of chasing growth and ready to enjoy dependable income, month after month.

>> Start earning with Paycheck ETFs now <<

Who is Tim Plaehn?

Tim Plaehn’s path to becoming one of America’s most respected income analysts is anything but typical.

After his military career, he transitioned into finance, working as a stockbroker and financial planner before joining Investors Alley.

Over the past decade, Plaehn has built a reputation as a straight-talking income expert who simplifies complex strategies for everyday folks.

Now, Plaehn manages a number of Investor’s Alley’s newsletters in an attempt to help people reach their financial goals.

Is Tim Plaehn Legit?

Absolutely. Tim Plaehn has spent more than 25 years studying, testing, and perfecting ways to turn traditional investments into reliable cash flow.

His track record speaks volumes. He’s helped thousands of subscribers generate consistent monthly income through his Dividend Hunter and ETF Income Maximizer services.

Known for his no-nonsense approach, Plaehn avoids hype and focuses on data-backed strategies that prioritize safety and steady returns.

Some of his recommendations have delivered double-digit annual yields, even during volatile markets.

His credibility extends beyond his newsletters; he’s been cited by respected financial publications and interviewed by top investing podcasts for his deep understanding of income-generating ETFs and covered-call strategies.

Simply put, Tim Plaehn is the real deal, a professional who practices exactly what he teaches.

>> Claim your Freedom Number Blueprint today <<

What is the Freedom Number Presentation?

Tim Plaehn’s Freedom Number message starts with a simple but powerful idea that the standard retirement formula most people have been told their whole lives is wrong. If the guru’s right, you don’t need a million dollars to retire well.

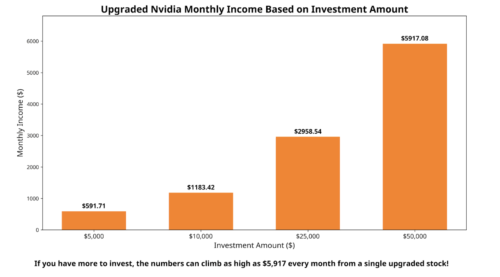

In fact, he says that you don’t even need half that. Plaehn shows how you can potentially replace your income using Paycheck ETFs that work with 10X less money than conventional plans require.

For once, we may have an opportunity to see retirement in a new light instead of a feeling of imminent darkness.

Why Traditional Retirement Plans Are Failing

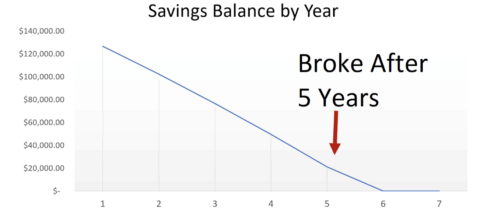

Plaehn doesn’t sugarcoat the problem. He breaks down why the 4% rule, the foundation of nearly every retirement plan, is outdated and unrealistic.

That formula assumes 10% annual returns, even though most analysts now expect less than half that over the next decade.

Boy, have times changed since then.

People are saving for a target that’s mathematically impossible to hit. Plaehn explains this with brutal honesty and simple examples, like how a $250,000 nest egg can vanish in just ten years if you’re pulling out $2,500 a month.

It’s disquieting because many of us are watching our savings shrink faster than they grow.

A Smarter Way to Generate Income

The shift Plaehn introduces feels almost too logical once you hear it: stop chasing capital gains, and start collecting cash flow.

Instead of waiting for stocks to go up, his strategy uses income-generating ETFs that turn big companies like Tesla, Apple, and Microsoft into monthly income machines, even though those companies traditionally pay little or nothing in dividends.

The real kicker is that the more volatile the market gets, the larger the potential payouts can be.

When everyone else is panicking about market swings, Plaehn’s followers are often collecting their biggest checks.

That, in my opinion, is one of the most beautiful things about this system: It doesn’t depend on perfect timing or a bull market.

Your Window to Reach Financial Independence

Retirement feels out of reach to so many of us, but Plaehn’s concept feels both refreshing and achievable.

He ties everything together by revealing how to calculate your personal “Freedom Number”, the exact income you need to never stress about money again..

The takeaway is clear: you might already have enough money for financial freedom; you just haven’t learned how to use it differently.

You can start unraveling the secrets of his system right away by signing up for his ETF Income Maximizer service that currently showcases just what Freedom Numbers have to offer.

Let’s next dive into everything the service entails so you can decide how it fits into your strategy.

>> Try Tim Plaehn’s system risk-free <<

Tim Plaehn Freedom Number Review: What Comes With ETF Income Maximizer?

Once you join, you’re handed each of these powerful features right out of the gate:

12 Monthly ETF Income Maximizer Newsletter Issues

Each month, Tim releases a new newsletter packed with his latest research and high-yield ETF recommendations.

Going deeper, every issue includes a detailed analysis of distribution yields, ex-dividend dates, and upcoming payout opportunities, all explained in plain language so anyone can follow along.

As a subscriber, you’re essentially following the same playbook he uses for his own retirement accounts, one that prioritizes consistent monthly income over speculation.

Tim Plaehn’s Full ETF Portfolio

Beyond his new monthly picks, members also get access to Plaehn’s entire live portfolio, a curated list of more than 20 income-generating ETFs he personally tracks.

Each position includes his notes on payout frequency, yield trends, and any changes in the fund’s covered call strategy.

The portfolio serves as a real-time example of how to balance risk and reward while collecting steady income.

I love how transparent Tim is here, too. You’ll see how his selections fare in thick and thin any time you want.

AI-Enhanced Investment Tools

Subscribers also receive complimentary access to the Magnifi AI platform, a smart investing tool that helps tailor ETF selections to your specific goals. Instead of relying on guesswork or cookie-cutter advice, Magnifi uses advanced data modeling to identify opportunities aligned with your desired level of risk and income targets.

You can run searches, compare yields, and even backtest different ETF combinations before committing capital. It’s a simple yet powerful feature that enhances Plaehn’s research, giving members a modern, data-driven way to personalize their strategy.

This integration of AI makes ETF Income Maximizer stand out among traditional newsletters by bridging expert human insight with machine precision for better-informed decisions.

Access to Members-Only Dashboard

All of Plaehn’s research, past issues, and real-time updates are stored inside a clean, intuitive members’ portal.

Many of the guru’s strategies still resonate today, and this dashboard is your ticket to all that knowledge.

Plaehn and team update everything automatically, and new alerts appear the moment fresh research goes live.

This convenience turns ETF Income Maximizer into a full online hub for managing your income journey.

LIVE U.S.-Based Customer Service

Something you rarely see in financial research services is genuine customer support, favoring chatbots or automated message systems.

They’re not financial advisors, but they’re trained to make sure every subscriber can access their materials and navigate recommendations with ease.

It’s a small touch that reinforces the professionalism behind the service. In a space where most publishers rely on chatbots or email-only replies, ETF Income Maximizer still offers real people who answer the phone.

>> Discover your Freedom Number now <<

Tim Plaehn Freedom Number Bonuses

Tim Plaehn includes several exclusive resources with ETF Income Maximizer that make it easier to put his strategy into action immediately.

Let’s check them out now:

The Freedom Number Blueprint: How to Speed Up Retirement with Paycheck ETFs

This guide is the foundation of Plaehn’s entire philosophy. Inside, he breaks down how to calculate your personal “Freedom Number”, the monthly income you need to live comfortably without relying on capital gains or Social Security alone.

He then walks readers through the three-step process of building a portfolio of Paycheck ETFs capable of delivering thousands of extra dollars each month in addition to what you make elsewhere.

The blueprint explains the mathematical logic behind Plaehn’s system and shows how small amounts can snowball into a dependable monthly paycheck.

I appreciate that Tim lays out every step in plain English, from selecting high-yield ETFs to setting up payouts through your brokerage account.

How to Spend Your First ETF Check (To Create Lasting Wealth)

Receiving that first ETF payment can be thrilling, but as Plaehn explains in this guide, what you do next determines your long-term success.

This bonus walks readers through the mindset and money management habits that separate short-term gains from lasting financial freedom.

Plaehn also introduces his “Income Snowball” strategy, a method of reinvesting part of your monthly income to steadily increase future payouts.

You’ll even hear about common mistakes new users make, like withdrawing too early or overextending into higher-risk ETFs, and how to avoid them.

Following this framework can mean the difference between just collecting dividends and actually compounding your income year after year.

My #1 Gold ETF for Monthly Income

In this bonus, Plaehn turns his attention to an asset most people associate with safety but not income: gold.

He introduces a specialized gold-based ETF that uses covered-call strategies to transform gold into a steady monthly payer, sometimes yielding more than 30% annually.

You’ll uncover the exact ticker, suggested position sizing, and how to time their entry for optimal returns.

The guide goes deeper, explaining how this ETF works, what makes it different from traditional gold holdings, and how to integrate it into a broader income portfolio.

Plaehn also shares insight into gold’s role as a hedge against inflation and market instability, making this ETF especially relevant in uncertain times.

>> Get Tim Plaehn’s income strategy here <<

Refund Policy

Tim Plaehn’s ETF Income Maximizer is backed by a 365-day, 100% money-back promise, one of the most generous guarantees in the financial publishing world.

There’s no fine print or hidden conditions; you simply contact the customer support team within that one-year window, and they’ll return your full $49 subscription fee.

Even better, you get to keep all the reports and research materials, free of charge.

This policy makes joining virtually risk-free and shows how confident Plaehn is in the long-term value of his work.

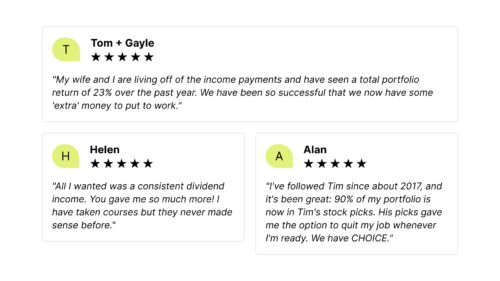

Member Reviews of Tim Plaehn’s Service

Feedback from real subscribers is one of the strongest proofs that Tim Plaehn’s ETF Income Maximizer delivers what it promises.

You’ll need to keep in mind that not everyone achieves this same level of success, but it’s still exciting that regular folks were able to work toward stable income strategies using Tim’s service.

>> Activate your ETF Income Maximizer access <<

Tim Plaehn “The Freedom Number” Track Record and Past Performance

Tim Plaehn’s track record with the ETF Income Maximizer and his broader body of work at Investors Alley speaks for itself.

Over the past decade, he’s guided thousands of readers through shifting markets with a clear focus on consistent, sustainable income rather than speculation.

His recommendations have produced impressive double-digit annualized yields, such as Apple at 27% and Microsoft at 41%.

Disney and Amazon shared payouts in the 40% range as well. Plus, Plaehn’s disciplined, data-backed approach has proven resilient through bull and bear markets alike.

By blending high-yield Paycheck ETFs with conservative risk management, he’s built one of the most trusted income systems available today.

Simply put, his results demonstrate that it’s possible to generate reliable monthly income, even in uncertain times, with 10X less money than traditional retirement plans demand.

How Much Does ETF Income Maximizer Cost?

One of the most appealing aspects of ETF Income Maximizer is its affordability compared to the depth of research and value it delivers.

Currently, new members can join for just $49 for the first year, a nice 50%discount from its regular price of $99.

That’s less than 13 cents a day for access to 12 monthly research issues, Tim Plaehn’s live ETF portfolio, and all three of his exclusive Freedom Number bonus reports.

After the first year, the membership renews automatically at $99 annually, which still makes it one of the lowest-cost income advisories in its category.

There’s also a one-time five-year extension plan available for $297, which effectively gives you two years free and locks in long-term savings while keeping uninterrupted access to future updates, research, and special reports.

>> Discover how Paycheck ETFs pay you monthly <<

Is Tim Plaehn’s Freedom Number Worth It?

After digging deep into this system for my Tim Plaehn Freedom Number review, it’s clear that Plaehn’s approach stands out in a sea of overpromised income programs.

What makes it genuinely different is how practical it feels. You’re learning how to use Paycheck ETFs to build a predictable monthly cash flow, regardless of market direction.

The entire framework revolves around making your money work immediately, using income-generating ETFs that can start producing results within weeks, thanks to the newsletter and multiple bonus reports.

The transparency in his recommendations, coupled with his 365-day refund policy, removes most of the guesswork that usually comes with financial newsletters.

And because you can test everything for just $49, it’s one of the lowest-risk ways to explore a proven income strategy.

Based on this Tim Plaehn Freedom Number review, the service has the potential to deliver exactly what it promises in a clear, math-backed plan to create financial independence with less money and stress than other options.

Sign up today to start setting the stage for the golden years of your life now.

Tags:

Tags: