Tim Sykes claims to have found a way to use the weekend for monumental stock gains and he’s ready to share his secret. Does his strategy really stack up, though, when push comes to shove? Check out my Tim Sykes’ Weekend Trader review to find out.

What is Tim Sykes’ Weekend Trader?

Weekend Trader is a new service from penny stock trader Tim Sykes and is honestly quite a bit different from platforms I’ve seen in the past.

It focuses on action happening over the weekend, which made no sense to me at first glance. After all, the markets aren’t even open.

Yet time and again, Tim uses this windfall strategy to grab big gains when all else seems quiet.

The cool thing is that Tim teaches his platform from the ground up, so you don’t need to know much about day trading before jumping in.

With as hard as flipping stocks is, I’ll take all the help I can get.

We’ll get into the details of the service and Tim’s strategy in just a bit. First, let’s take a closer look at the guru.

>> Join now for the latest stock picks! <<

Who is Tim Sykes?

Timothy Sykes started from humble beginnings in Connecticut, but had his eye on the stock market from an early age. He convinced his parents to let him invest his $12,415 in bar mitzvah gift money, and a penny stock trader was born.

By his senior year of college, Sykes became a self-made millionaire from that modest sum. He hasn’t stopped trading since.

Now, 20 years later, Tim has shifted his focus slightly. He’s out actively sharing his knowledge and insights with the world to give folks like us and me a shot at success.

Sykes has ownership over a number of services, such as Investimonials.com and StocksToTrade, to teach what he knows.

Is Tim Sykes Legit?

Tim is indeed a legit stock trader with over 20 years of experience.

His rise to millionaire status while in college is well-documented.

He’s truly achieved what many of us desire to do with day trading, stating that he’s made $7.9 million on his official page.

Sykes is well sought after for his successes and unique approach to teaching, and he’s helped multiple students become millionaires through his strategies.

There’s a good chance you’ve seen him on popular outlets such as CNN, Forbes, Fox Business, or CNBC as well.

Tim also gives back a lot through his charity Karmagawa, which also speaks volumes about his character.

>> Get Tim’s latest insights & strategies here! <<

What is Tim Sykes Weekend Windfalls Strategy?

Tim Sykes is known for his short trading game, but even he grew tired of being under the thumb of the large hedge funds or billionaires controlling the stock market with their big money.

Not too long ago, he discovered a trading strategy that gives us little guys a fair chance at profits. It’s conveniently called Weekend Windfalls thanks to growth happening over the weekend.

I know what you’re thinking – the stock market is closed on the weekend! That’s all part of Tim’s unique plan.

What’s the method behind his madness?

How Does It Work?

The Weekend Windfalls concept is actually quite simple. Tim Sykes has discovered a loophole most folks don’t know about and is exploiting it in a big way.

It boils down to this: Big-name stocks like Tesla, Apple, and Google are always under the careful eye of mainstream media. They’re so high-profile that the media’s all over even the smallest story, which almost immediately affects the share price.

That’s not the case for stocks not closely watched by mainstream media. Lesser-known companies can fly under the radar for a few days before news, big or small, catches up with the share price.

This is where Tim Sykes strikes.

He hunts for this exact scenario on a Friday before the stock market closes, making a trade and letting the news work its magic over the weekend.

You can’t see what’s happening to that position on Saturday and Sunday, but that circulating news is building momentum.

The buzz from Friday’s news takes effect Monday morning, which could result in a much higher share price. Weekend profits, baby.

>> Sound like a good fit? Get started now! <<

Does It Live Up to the Hype?

Weekend Windfalls totally works, and I’ve seen trade after trade to prove it. Tim Sykes used Parametric Sound to test out his theory after news broke about a deal with mega franchiser McDonald’s.

Monday morning, he walked away $9,518 richer.

Sykes didn’t do a whole lot more than buy a key stock on Friday afternoon and sell Monday morning. The key ingredient is knowing which stocks to trade.

This is just one of many successful trades Sykes and his students have made since implementing the trading strategy. His biggest win? $69,962 in a single weekend.

What I love most about the strategy is that I don’t have to watch my trade like a hawk, trying to find the right moment to sell. There’s no way to, even if I wanted to!

The whole weekend’s mine to do whatever I want with, and I pick up where I left off Monday morning. It’s almost upsetting, considering how much time I’ve obsessed over trades in the past.

Fortunately, Tim’s ready to share his Weekend Windfalls strategy with all of us as part of a new special deal. Let’s check out what’s inside.

>> Try Tim’s Weekend Trader strategy now <<

Tim Sykes’ Weekend Trader Review: What’s Included?

Here’s what you get when you join now.

The Weekend Windfall Video Training Series

This video training series contains everything you need to capitalize on Tim’s Weekend Windfalls trading strategy. It’s literally the exact same method he’s used to bank thousands of dollars over a single weekend.

You’re definitely getting what you pay for here. There’s a total of ten videos chock full of content to get the absolute most out of weekend trading.

It takes more than a few minutes to get through, but it’s worth it. By the time you’re finished, you’ll have an innate knowledge of how this system works.

Tim Sykes explains his technique for identifying the most promising low-priced stocks to trade. If you know Tim at all, he loves to hang out in the penny stock range.

>> Unlock Tim’s secret to weekend trading success. Watch now! <<

You’ll also learn what types of news stories are most likely to trigger the big weekend moves that bring about the best profits.

And, perhaps most important of all, Sykes reveals how he knows when to exit a trade and collect those massive gains.

No worries if you’re not already heavy into trading or penny stocks. Tim’s videos are super simple to understand, and you can always return to areas that were hazy the first time around.

You don’t need a huge stack of cash to use this strategy, either. Even a few bucks is enough to get started.

Tim’s Trader Checklist

Tim’s Trader Checklist is a nearly 12-hour guide designed to teach you how to locate and make trades. It covers a bunch of material Sykes had honed over eight years of hard work.

The star feature of the checklist is the Sykes Sliding Scale. It’s effectively a grading system for trades that Tim always uses before making a move.

In addition, you’ll get to witness Tim use technical analysis to determine when a pattern looks good and what to avoid. It’s not luck that he’s had so many wins over the last 20 years.

That’s just scraping the surface of what’s inside. You’ll want to watch the checklist again and again to pull out all the nuggets and use them before you trade.

>> Access the complete trader checklist now! <<

Tim Sykes’ Complete Penny Stock Course

As you can surely guess, Tim Sykes’ Complete Penny Stock Course teaches the ins and outs of trading penny stocks.

The content here is especially important in a market sector where folks usually lose money. We all know what the profits here can look like with the right penny stocks.

You’ll hear directly from Tim Sykes his proven strategies for penny stock trading and the best ways to generate consistent gains. When you’re ready, he shows off some advanced techniques as well.

Tim also tempers your expectations about the penny stock market and how to take the safest positions.

I love that he mixes in some great real-world examples to show that the strategy is more than just a concept.

>> Sign up and start learning now! <<

The Weekly Windfall Trade Guarantee

Tim Sykes doesn’t want anything standing in the way of you trying out his new service. That’s why he’s added in a 30-day money-back guarantee.

Feel free to use the first 30 days of your membership to test everything out. Read the information, watch the videos, and decide if Windfall Trader is right for you.

If you don’t like what you see, call Tim’s Salt Lake City-based headquarters for a full refund of your purchase price. Take with you everything you’ve learned up until that point.

>> Try Weekend Windfall Trade risk-free for 30 days <<

Pros and Cons

Here are the most notable pros and cons of Weekend Trader.

| Category | Details |

|---|---|

| Pros |

• Guru with more than 20 years of experience as a day trader • Immediate access to the Weekend Windfalls video series • Tim’s Trader Checklist • Complete Penny Stock Course • 30-day money-back guarantee • Heavily discounted price |

| Cons |

• No community chat or forum • No long-term strategies |

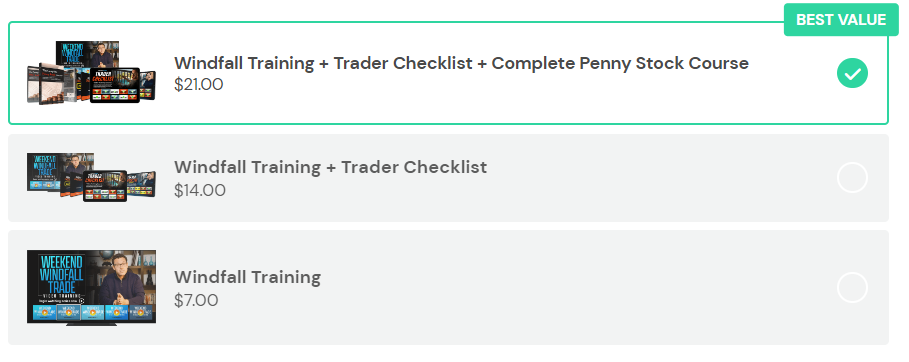

How Much Does Weekend Trader Cost?

To kick off the Weekend Trader service, Tim’s making his entire Windfall Training video set available for just $7. That’s all the knowledge you’ll ever need to implement this trading strategy for the price of a cup of coffee.

You’ll need to sacrifice two cups of coffee if you want to get your hands on the Trader Checklist as well. The checklist and video series bundle come in right at $14.

Finally, adding the penny stock course to the list brings your grand total to just $21. I can’t believe how much content Sykes is including for such a low price, and it’s yours forever after you make the purchase.

Tim Sykes’ Weekend Trader Review: Is It Worth It?

After a thorough Weekend Trader review, I can honestly say this is an excellent service.

The amount of information in the Weekend Windfalls video trading series alone is off the charts. Tim’s made thousands in a weekend using this strategy multiple times, and he spares no detail in teaching us how to do the same.

Sykes isn’t trying to string you along with weekly or monthly stock picks like so many services do. He’s literally teaching you how to do it all yourself.

My mind is still blown that it’s available for $7 right now. Sykes must really just want to get the word out there.

I’d highly recommend spending just a few dollars more get the Trader Checklist and Penny Stock Course, since they offer additional ways you could make serious bucks from trades.

Don’t forget about the 30-day money-back guarantee. There’s virtually no risk in trying the service out when it’s a breeze to get your membership fee back.

If you’ve been wanting to get into day trading but don’t know where to start, Tim’s Weekend Trader is undoubtedly worth a look. Sign up before he takes this offer off the table for good.

>> That’s it for my review. Get started with Tim’s Weekend Trader for just $7 TODAY! <<

Weekend Trader Frequently Asked Questions (FAQ)

Does Weekend Trader require you to trade penny stocks exclusively?

No — while Tim Sykes is known for penny stocks, Weekend Trader focuses on his “Weekend Windfalls” pattern, which can apply to a range of tickers under specific conditions.

How much screen time does Weekend Trader realistically require each week?

Most users report spending 1–2 hours per week reviewing setups, with minimal weekday monitoring. The system is designed specifically for part-time traders with limited availability.

Does Weekend Trader work in both bull and bear markets?

Yes — the strategy is based on recurring weekend price patterns, not long-term market direction. However, the number of potential setups fluctuates depending on overall volatility.

Is Weekend Trader suitable for absolute beginners with no trading experience?

Beginners can use it, but the strategy includes chart analysis, risk management, and pattern recognition. It’s helpful to have some foundational training before fully jumping in.

How much capital do most people start with for Weekend Trader?

There is no minimum requirement, but many students begin with $1,000–$5,000. Smaller accounts can still follow the strategy as long as position sizing is adjusted responsibly.

Can you automate any part of the Weekend Trader strategy?

While trade execution is manual, some individuals use stock screeners or alerts to automate pattern detection. However, full automation isn’t supported and would conflict with Sykes’ risk rules.

Does Weekend Trader include community support or peer groups?

Tim Sykes often provides private groups for some programs, but Weekend Trader may not always include a dedicated community. Access varies depending on the version purchased.

How often does Tim Sykes update the Weekend Trader strategy?

The core concept rarely changes, but updates occur when market conditions shift or when new teaching materials are added. Students typically receive updated videos or notes when revisions are made.

Are there any restrictions for traders outside the United States?

International traders can follow the strategy, but broker availability, settlement rules, and pattern day trading regulations vary by country. Some may need different platforms or fee structures.

Does the strategy require pre-market or after-hours trading?

No — one of the main appeals is that trades are typically placed during regular hours, making it accessible to people with full-time jobs.

What kind of learning curve should you expect with Weekend Trader?

Most users report that it takes 2–4 weeks to fully understand the pattern and risk rules, though mastering the strategy can take longer depending on experience.

Can you use Weekend Trader inside a retirement account (IRA, TFSA, etc.)?

Some retirement accounts allow short-term trading, but it depends on the broker and country. You should verify whether your specific account type allows active strategy execution.

Does Weekend Trader provide trade alerts or signals?

Unlike some of Sykes’ premium programs, Weekend Trader is primarily education-focused, so signals are not guaranteed. Students are expected to identify setups themselves.

Is the Weekend Trader strategy compatible with mobile-only trading?

Yes — many users successfully manage the strategy from their phones. However, initial setup analysis may be easier on a desktop charting platform.

Tags:

Tags: