For more than a decade, the cryptocurrency market has been plagued with controversies and criticisms by nonbelievers.

It is the modern version of the Tulip Mania in the 16th century for the skeptics. Its decentralized nature and seemingly immeasurable volatility are only some concerns that have persisted today. Bubbles, fraudulent activities, and data breaches are still notable, making it hard for many to embrace cryptocurrencies.

But for true believers, the market is a digital stepping stone to achieving financial freedom. Its goal of creating a decentralized financial system captured the imagination of millions of individuals. So, it’s no wonder the market has thrived over the years and still shows potential to expand. As most countries become open, an influx of new traders and holders continues to be seen.

As the market heats up, the price of a single cryptocurrency appreciates. The high-risk-return rewards become more appealing for crypto users as macroeconomic indicators stabilize. Volatility remains evident, but returns may outweigh it this FY24. Even so, crypto traders must not rush to buy any crypto they want.

Given this, it is essential to check all areas of consideration before adding any type of cryptocurrency to your investment portfolio. To make it easier, we will cover the top five cryptocurrencies to watch this FY.

Why Invest in Cryptocurrencies

Before we list our top picks, we will discuss why cryptocurrencies are worth the risk. These are some factors investors should consider.

High-risk, high returns

We can’t blame the skeptics for still doubting the cryptocurrency market despite the substantial increase in its value. It has always been notorious for its high level of risk. Volatility is the main enemy of risk-averse investors, given its standard deviation of about 100%. It is much higher than bonds and equities. It also exceeds the risk level associated with the Forex market.

Even so, volatility has always been no match for the returns the market continues to offer. Crypto returns have always outweighed standard deviation over the years. These are at least 300% higher than primary stock indices, namely the S&P 500 (SPX) and the NASDAQ Composite (IXIC).

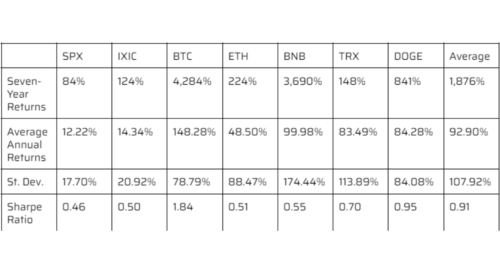

We can use the Sharpe Ratio to confirm how their returns and volatility have varied in the past seven years. We decided to make it seven years to include the changes before and after the crypto bubble burst in 2017-2018.

The details above confirm our view of the stock and cryptocurrency markets using their returns and volatility. Bitcoin (BTC) and Binance (BNB) were the champions, with 4,284% and 3,690% returns, respectively. Ethereum (ETH) had the smallest value increase since 2017. Yet, it was still much higher than SPX and IXIC, with 84% and 124%, respectively.

Regarding volatility, the selected cryptocurrencies’ standard deviation has been at least four times higher than the two stock price indices in recent years. This figure proves the high levels of risk associated with the crypto market.

Nonetheless, cryptocurrencies are still worth investing in as returns outweigh risks, given the positive Sharpe Ratio.

In addition, all cryptocurrencies have higher Sharpe Ratios than SPX and IXIC. Hence, their average is also much higher than the two stock price indices, making them attractive to investors with an increased risk appetite.

High correlation with inflation

Over the past decade, news and market sentiments have been identified as the sole drivers of crypto price swings. This is why cryptocurrencies are often considered inflation hedges in the making.

Yet, we saw them in a different light as their values plunged amid the skyrocketing US inflation in 2022. They hit rock bottom and stayed low in the subsequent months as interest rate hikes persisted.

In 2023, things started to get better for investors as crypto prices rebounded. This occurrence coincided with the notable inflation deceleration. Note that during the fourth quarter of 2022, inflation dropped to about 6.0% from its 9.1% peak. The increase sped up during the first half of 2023 as inflation dropped further from 5.0% to 3.0%.

But in 3Q23, inflation inched up, which put a downward force on crypto prices. But since 4Q23, crypto prices have regained momentum and established their respective bullish breakout. Again, we can attribute it to the slowing inflation that raised investor confidence.

As of today, the crypto market is heating up and is poised to exceed its 2021 highs. Expectations of faster inflation deceleration can support this. The most recent report shows that inflation is back to 3.1%, indicating spending normalization after Christmas. Hence, inflation may keep decreasing, and the Fed may achieve the goal of three interest rate cuts in FY24.

To illustrate it better, you can check the photos below to see how inflation changes BTC, ETH, and BNB prices. They dropped when inflation rose, stayed still when inflation was almost unchanged, and rebounded when inflation decreased.

Image Source: Trading Economics

Image Source: Yahoo Finance

Image Source: Yahoo Finance

Image Source: Yahoo Finance

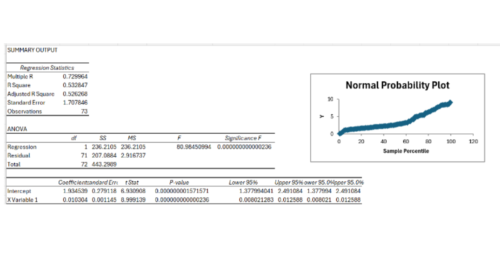

To prove it statistically, we can use the regression analysis on MS Excel. We can take BNB as an example.

Image Source: MS Excel-Data Analysis-Regression Analysis, Author’s Calculation

The Multiple R or correlation of 72% shows a high inverse correlation between the two variables, inflation as the X Variable and BNB price as the Y Variable. The standard error of only 1.7 shows manageable dispersion, increasing the consistency of the data array.

Moreover, the P-value is much lower than the standard 0.05, so the observation is significant.

Lastly, the normal probability plot shows a minimal scattering of data points on the graph. Hence, we can confirm the inverse correlation between inflation and cryptocurrency prices.

Real-world purpose:

It is not a secret that many business owners have joined the crypto trading world. It has thrived in recent years, driven by the prevalence of online stores and the fintech revolution.

Moreover, crypto transactions have become much easier today as cashless payments take flight. Even unbanked individuals can participate using e-wallets offering crypto transactions.

Many banks now cater to crypto traders as part of their expansion strategies. This approach is to cope with the digital revolution and capital market boom. It’s no wonder many banks have checking account offers with cryptocurrency trading, allowing clients to save while investing.

Top Picks

The five crypto in the table above are our top picks. BTC, ETH, BNB, TRON (TRX), and Dogecoin (DOGE) have the best potential to rise further this FY.

Bitcoin (BTC)

Bitcoin, one of the crypto trailblazers, is on top of the list, which should no longer be surprising. With returns of 4,248% from 2017 to 2023, it has increased by 148% per year on average.

Moreover, it has the lowest volatility among the cryptocurrencies on this list at only 79% versus the 107% average. This makes BTC the safest and least dispersed cryptocurrency in the world.

It is also the largest cryptocurrency in terms of value, circulating supply, and market capitalization. At $65,000, it is approaching its 2021 peak of $68,000. As inflation decreases, BTC value may exceed $70,000 for the first time in many years.

It is logical since it is the most widely accepted cryptocurrency in the world. Business establishments are familiar with Bitcoin since it has already proven its real-world purpose.

Now, over 30,000 merchants accept cryptocurrency payments, and nearly 50% are purely Bitcoin payments. Even better, there are already thousands of Bitcoin ATMs across the US. Hence, BTC has the most extensive market presence, making it the dominant industry player.

Ethereum (ETH)

Ethereum will not be the second-largest cryptocurrency for nothing. It is valued at $3,500 today, more than twice its value in the same period last year. Its cumulative and average annual returns are much lower than the other crypto on this list, but its standard deviation is manageable. It has a Sharpe Ratio of 0.51, which is still better than SPX and IXIC.

Currently, ETH is underperforming relative to the market. But this allows us to buy ETH at a discount relative to the crypto in the market. So, it has one of the highest upside potential this FY24.

Note that the ETH has a 69% inverse correlation with inflation, so the latter’s deceleration will have a considerable upside impact on the ETH price.

It has the second-highest correlation, following Binance. Bitcoin only has 51%, Tron has 53%, and Dogecoin has 54%. These are still reasonable since a correlation between 40% and 60% is moderately strong.

Meanwhile, ETH, with 69%, and BNB, with 72%, strongly correlate with inflation.

In addition, government agencies have started to adopt Ethereum as payment for their services. In Singapore, government agencies take payments in the form of ETH contracts. DAOs, or Decentralized Autonomous Organizations, are deeply tied to ETH. It is because they are founded on blockchain technology, often used to track ETH transactions.

Binance (BNB)

Binance is one of the most promising cryptocurrencies today. It also operates as the largest cryptocurrency exchange in the US. Its standard deviation may be high at 174%, but its cumulative returns since 2017 have already reached 3,690%.

Its average annual return of 99.98% is the second-highest on this list. At $418, it is already 45% higher than the previous year’s price on the same day.

But what makes it extra special is its resilience. In 4Q23, it was involved in a controversy after pleading to pay a $4B fine for violating the US Anti-Money Laundering Act. But with its digital assets of over $100B, BNB can pay it in a snap, even if it doesn’t have to.

Even more interesting is that its token allocation portfolio is well-diversified. Bitcoin comprises 32% of the total token reserves, while BNB coins are only 5%.

This makes it incomparable to the former largest crypto exchange FTX. It collapsed in 2022, mainly due to its heavy reliance on its tokens. As such, it can sustain its increasing circulating supply and value. Given its high correlation with inflation, the decelerating trend of the latter can support the BNB price increase.

Tron (TRX)

Tron entered the Singapore crypto market in 2017. It was originally planned to serve as a decentralized blockchain. But things changed when it expanded to other regions, allowing it to go head-to-head with larger altcoins. Today, it is already part of DAOs.

Currently, Tron is valued at $0.141100, 56 times its $0.0025 launch price.

In addition, it has shown a dramatic appreciation in the past seven years, giving cumulative returns of 148%. But the largest increase of 76% started in mid-2023. It rose from $0.08 to the current value.

It increased by 109% for the whole year, much higher than the average annual return of 84%. With that, we can say that the price growth has sped up in the past year. It also makes Tron one of the fastest-growing altcoins globally.

Given the improving macroeconomic environment, the price rally may be supported. We can verify it in its 53% correlation with inflation, very low standard error of 0.026, and a P-value lower than 0.05.

Dogecoin (DOGE)

Initially intended as a meme token in 2013, Dogecoin has evolved into a popular altcoin globally. Thanks to its community, which has continuously created witty memes. It rose to popularity, attracting more meme coin users and allowing it to become an official cryptocurrency.

Despite this, its critics still compare its risks to Bitcoin. Price swings, which could go to extreme crests and extreme lows, have been notable. However, the market apprehension is reasonable since DOGE has to prove its real-world scenario uses.

On a lighter note, it has the third highest correlation with inflation. Its moderately strong correlation with inflation means the decreasing rate may support this FY’s price rally. Also, if inflation increases again, the downward drive will be lower than in BNB and ETH.

Key Takeaways

The cryptocurrency market continues to heat up as the market environment becomes more favorable. The primary drivers are increased investor confidence, higher crypto demand, and stabilizing macroeconomic indicators.

With that, trading crypto can be viable this year, especially now the market is poised to exceed its 2021 highs. It is an excellent time to get one, but watching out for some dips or pullbacks to buy it at a discounted value may be better.

Tags:

Tags: