If you’ve ever tried logging trades in spreadsheets or clunky apps, you know how quickly things spiral out of control.

That’s where Trademetria comes in. Its trade journaling software is designed to help boost your future performance by helping you identify errors and successes in your past trades.

While the platform sounds great on paper, how does it actually stack up against the competition?

In this Trademetria review, I’ll walk you through how everything works and provide a clear insight into whether you should add it to your list of tools.

What Is Trademetria?

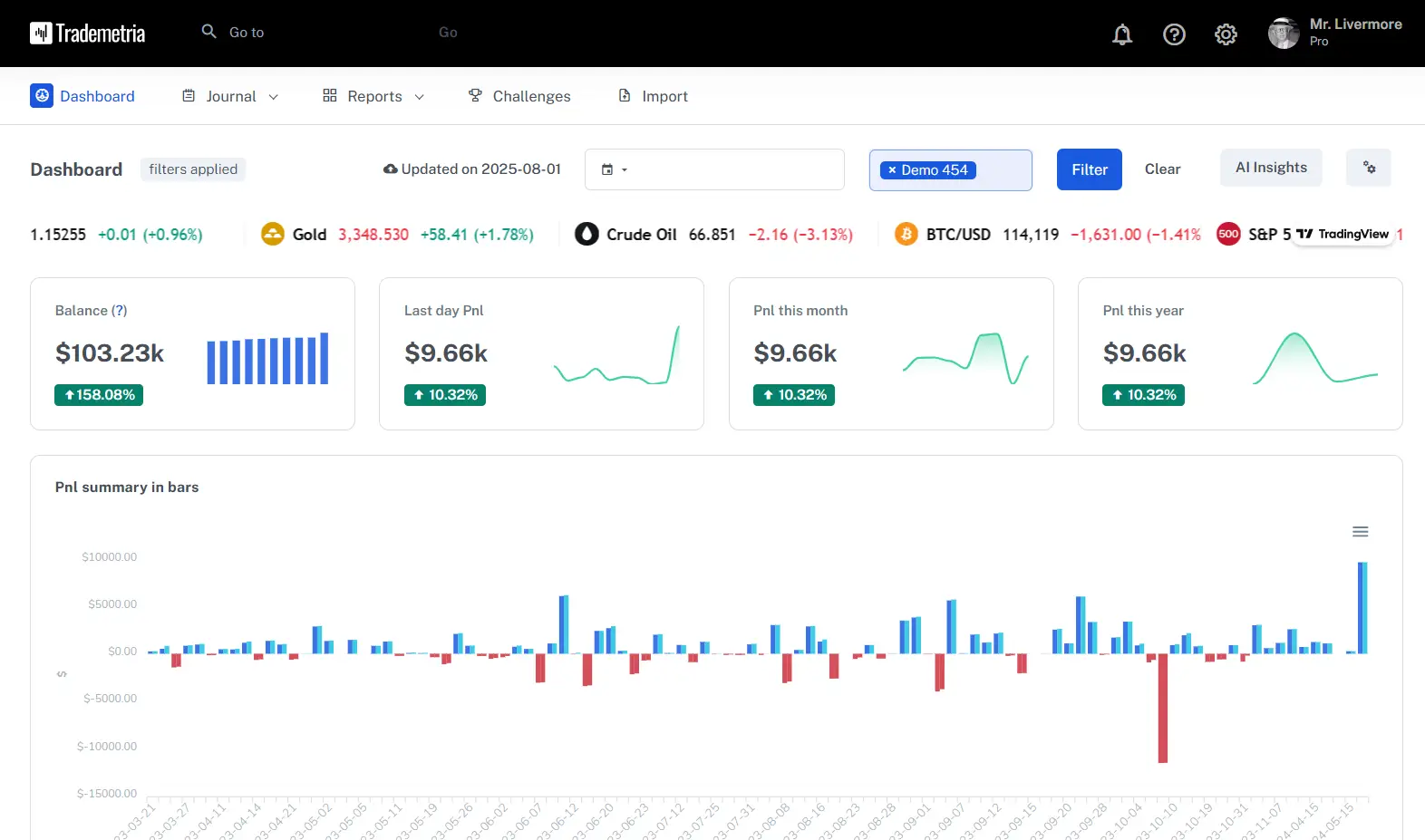

Trademetria is a performance tracking platform that helps you see your trading with a level of clarity most tools don’t offer.

From the top down, it’s a fully loaded analytics engine designed to help you spot what’s working, what’s not, and how to fix it.

While silhouetting as a smart trading journal, it also lets you simulate trades, track portfolios, sync with over 140 brokers, and even test out ideas using its built-in risk tools.

The platform quietly nudges you toward better habits and decision-making without being overwhelming.

And with newer additions like the AI Coach and advanced performance metrics, it’s easy to see why both new and experienced users are sticking around.

>> Already sold on Trademetria? Click here to sign up for an account TODAY! <<

Who Founded Trademetria?

Thiago Ghilardi is a computer science major and professional trader who went on to found Trademetria after learning the ins and outs of the stock market.

Ghilardi started trading during his college days back in 2001 and quit his job after graduating to pursue trading full time.

He even moved to New York in 2006 as a prop trader to get closer to the action.

In 2008, Ghilardi started his trading firm and rode out the stock market recession.

After discovering the key to his success was analyzing trades and past performance to improve future results, Ghilardi founded Trademetria.

Since then, his goal has been to help traders and investors improve trading results by teaching them what they are doing right and wrong through trade tracking and analysis tools.

Trademetria Review: What’s Included?

Trademetria offers a comprehensive suite of interconnected tools so your trading data, analysis, and decision process are all in one place.

Our Trademetria review continues with a deeper look into each major feature, how it works, what you gain, and real constraints or caveats based on its implementation.

Trade Tracker

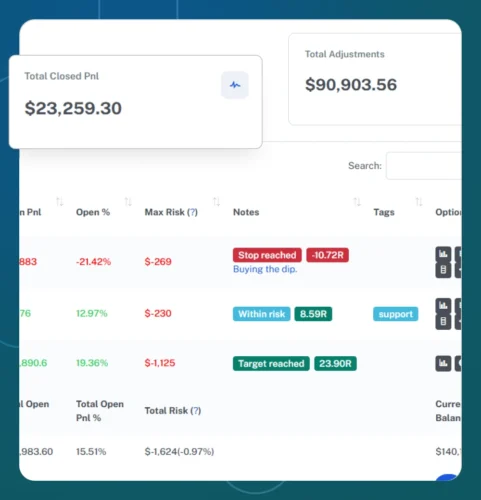

The trade tracker lies at the heart of Trademetria. It allows you to import either individual executions or grouped “combined” trades.

Once your trades are in, you can filter by strategy, instrument type, date ranges, or tags, and view buys and sells overlaid on price charts across multiple timeframes.

The system also lets you customize what columns you see so you can tailor the view to your style.

Because the tracker handles cashflows (deposits, withdrawals, commissions, fees), your net results reflect real costs, not just ideal profits.

It supports multi-account tracking, letting you analyze trading performance per account or aggregated, all in a very visual format that makes the entire setup easy to follow along.

Trading Journal

The trading journal is where qualitative reflection meets quantitative data.

You can tag trades with custom tags (mistake types, strategy, emotional state) and search your past entries by those tags or keywords.

Because the journal is integrated with performance analytics, your notes live side by side with metrics so that when you write “I felt rushed” or “ignored my rules,” you can immediately see how that correlated with results.

The journal also supports bulk editing, allowing you to merge option spreads for clarity and add custom commissions or adjustments on a per-trade basis.

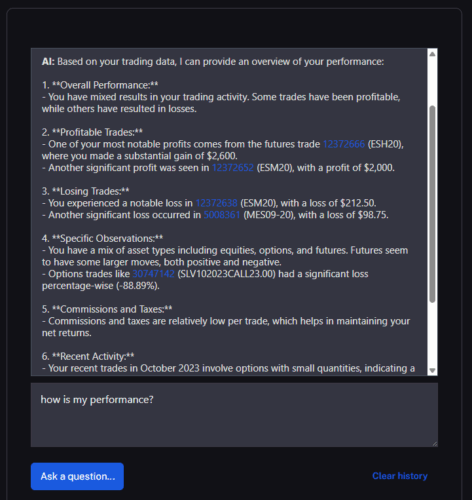

AI Coach

Trademetria’s AI Coach (also labeled “AI Insights”) is a diagnostic assistant built on your trading history.

When you enable it, it scans for patterns such as trades where stops weren’t respected, odd distributions of winners vs. losers, shifts in holding times, or inconsistent sizing.

It’s even possible to query the AI (via chat or prompts) to generate a journal entry or ask for insights (“Which days do I underperform?”).

Do keep in mind that it’s not a black-box signal generator; rather, it amplifies what your data already shows, offering nudges toward better discipline.

Portfolio Tracker

This module consolidates all your open and closed positions across accounts into a unified interface. You can view cost basis, unrealized P/L, open risk (in R multiples), allocations by asset class or strategy, and exposure per ticker.

The tracker also lets you benchmark your performance against indices like the S&P or Nasdaq to see whether your edge is beating the market or just riding trends.

Pie charts and breakdown visuals help you see where your weight is concentrated, and the system flags when your portfolio is overexposed to a few names.

Because it centralizes everything, you no longer need separate broker logins to monitor your net exposure.

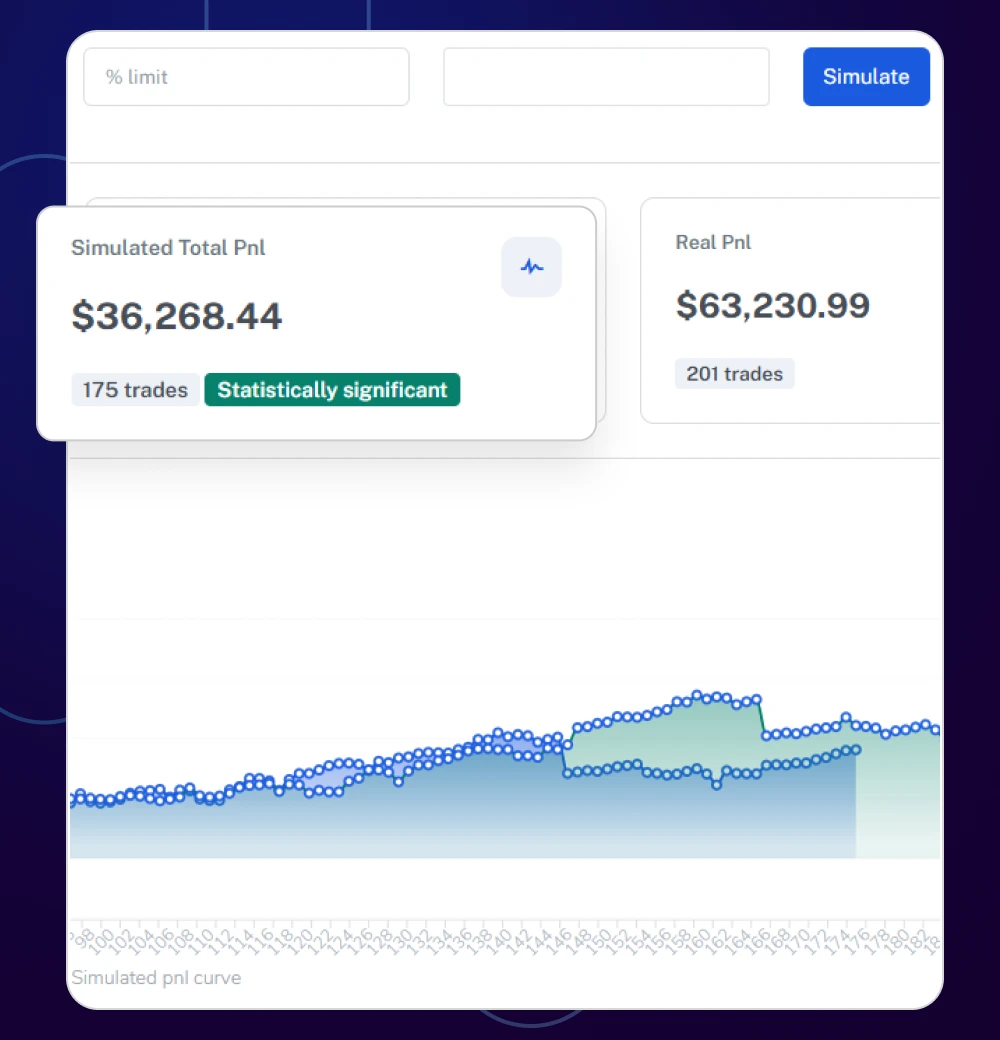

Trade Simulations

With the simulation feature, you can run “what-if” tests on your actual trade history. You might pick a subset of trades (e.g. “all breakouts in Q1”) and adjust parameters like stops, profit targets, holding duration, or strategy filters.

You can save simulations for later review and even compare simulation outputs side by side.

While you can’t infinitely backtest your strategies,

it’s powerful for refining your real trades and validating hypothesis tweaks without risking live capital.

Fundamental Research

Built into Trademetria is a research module covering over 20 global exchanges. You get company profiles, earnings dates, basic financial metrics, and interactive charts (powered by TradingView) all without leaving the platform.

You can go as deep or as surface-level as you want here, giving you the flexibility and freedom to pull in only what you need.

Research overlays are also useful when planning future trades or reviewing missed opportunities.

Broker Sync

To minimize manual data entry, Trademetria supports auto import or sync from over 140 brokers and platforms worldwide.

You can connect via API or upload broker-specific CSV files. During setup, Trademetria provides import instructions tailored to your broker.

When sync is available, your trades flow into the system automatically, keeping your journal current with minimal effort. For unsupported brokers, support may engage with you to add compatibility.

The idea is to reduce friction so you spend less time managing entries and more time reviewing performance.

However, not all brokers support full API depth, and as with any sync, occasional mismatches or missing field mappings may require brief manual edits.

Risk Management Metrics

This feature set gives you insight into how well you control risk. Trademetria provides r-multiples, expectancy, win/loss ratios, profit factor, maximum drawdown, average holding times, and distribution by market condition.

You can analyze trade quality via multiple exit style comparisons, examine how tight or loose your stops are relative to returns, and see which strategies consistently deliver positive expectancy.

It also supports multi-exit analysis (how different exit approaches would have changed outcomes) and visual plots of drawdowns or adverse excursions.

These metrics empower you to understand not just whether you win, but how reliably and under what conditions.

Watch Lists

While lighter than a full screener, the watch list feature lets you monitor symbols of interest alongside your active portfolio.

You can add tickers to your list, view real-time quotes, and have them displayed within Trademetria’s interface. This keeps idea generation, alerting, and your trade activity in the same environment, so you’re less likely to bounce between apps and miss setups.

When paired with the portfolio and trade modules, your watch list helps you track potential trades seamlessly in context with your performance.

Multi-Asset Coverage: Trade Everything in One Place

One of the best parts about Trademetria is how versatile it is. You’re not limited to a single asset class, as the platform seamlessly supports equities, options, futures, forex, cryptocurrencies, and CFDs, all under one roof.

This makes it ideal for active users who trade across markets or switch between instruments depending on volatility and opportunity.

Each trade type is imported, tracked, and analyzed with the same precision, giving you a unified view of your performance across every market you touch.

Whether you’re managing stock swing trades, short-term forex positions, or leveraged CFD setups, Trademetria consolidates everything into one clean, data-driven dashboard.

Customer Support

Trademetria has a team ready during trading hours to help users through any issue they may encounter.

The company also has a YouTube channel with several videos containing information on how to get the most out of the website.

>> Like all that Trademetria has to offer? Click here to sign up now! <<

Importing Trades into Trademetria

Trademetria works with more than 150 platforms and brokers from all corners of the world to import trades. It also offers several different methods to do so.

First, you’ll need to navigate to your dashboard within the app. After clicking the “Import Trades” button, you’ll see all the available options for your account. Let’s take a quick look at them now.

Manual

Although not advisable for large quantities of trade, Trademetria does have a manual import option. You’ll need to type out all the info for your trade into the appropriate boxes. Required entries include ticker symbol, quantity, date, and price. Several other fields can help you distinguish similar purchases or sales.

Broker CSV

As I mentioned, Trademetria has support for a large number of brokers. Once you select yours from the list, import instructions pop up to guide you through the rest of the process.

No matter which brokerage you currently deal with, they’ll need to provide a CSV file of your trade history. Keep in mind that formats and rules may be different from one brokerage to the next.

Template CSV

If your brokerage didn’t make the list, you’re not out of luck. Trademetria has a template you can download and adjust with the information you collect from your brokerage on your past trades. You will need to modify Trademetria’s document precisely as explained for everything to work.

Adjustments

It’s possible to import adjustments as well. If you withdraw funds or make a similar small change, this tab lets to capture it within Trademetria’s system. This way, you can document every cent flowing into or out of your account; you’ll want to list notes for each adjustment for future reference.

Auto Sync Via API

Saving the best for last, Trademetria allows automatic synchronization with several brokers via API. This means all your brokerage data flows to Trademedia without you having to lift a finger once you’ve set it up.

The exact process depends on the broker, but it typically requires grabbing an API key and loading it into Trademetria. Once set up, the two systems communicate seamlessly.

Is Trademetria Safe?

Yes, Trademetria is absolutely legitimate and trusted by thousands worldwide.

Founded in 2016 and operated by Trademetria Inc., a registered U.S. company based in Wyoming, it has grown into a reliable platform with over 80,000 users and more than 15 million trades tracked.

Founder Thiago Ghilardi has been trading for over 20 years.

The company runs a transparent model where its revenue comes purely from subscriptions, not from selling or sharing user data.

Security-wise, all data is encrypted, and users retain full control over their trade history.

Independent reviews on Capterra and Trustpilot consistently praise its responsive support team, accurate analytics, and constant feature updates.

For anyone looking for a data-driven way to refine performance through an intelligent trading journal and built-in AI Coach, Trademetria stands out as a safe, credible, and professional choice.

Trademetria Cancellation Policy

Trademetria makes it easy to sign up, and you don’t need to use a credit card for their Free Tier service.

Trademetria states it’s easy to cancel at any time.

However, the platform also spells out very clearly that they offer no refunds on any of their services.

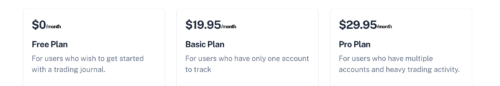

Trademetria Review: Pricing

Trademetria has three pricing options for traders to consider: Free, Basic, and Pro.

Free

The Free Tier service offers a lot to traders, even though it costs zero dollars per month.

At this tier, the platform only allows a trader to import 30 orders a month.

Anything from equities to options to futures and forex can all be brought in.

Free users are also limited to 3 real-time quotes per month and can only track one account.

Basic

The Basic Tier is a clear step up from the Free Tier.

It offers more reports and a P&L simulator to analyze trading performance more thoroughly.

This tier also introduces fundamental research, strategy rankings, and the ability to export trade data to another source.

As with the Free Tier, a day trader can still only track one account but can now obtain unlimited real-time quotes and import up to 100 trades per month.

Pricing details vary depending on the length of the subscription.

The monthly rate is $19.95, but members can save 30% by purchasing the annual plan for $169 per year.

Pro

While the Pro Tier doesn’t add any new features, it gives you unlimited trade imports.

In addition, the Pro Tier allows users to track multiple accounts, up to 50 in total.

This plan costs $29.95 per month.

As with the Basic Tier, there’s a 30% discount for signing up for a year at a time.

This lowers the annual price to $249.

>> Ready to sign up for Trademetria? Don’t wait, just click HERE to get started! <<

Trademetria Review: Pros and Cons

It’s hard to find much fault with a journaling site that gives away many of its top tools and features for free.

But during our Trademetria review, we spotted areas where the service can improve.

Take a look at the pros and cons of this service.

Trademetria Pros

- Broker import feature for over 140 brokerages

- Broad multi‑asset support (stocks, options, futures, forex, cryptos, CFDs)

- Easy-to-use analyzer software for traders of any experience level and type, including swing traders, options traders, and more

- Several tools to track and filter trades, including fully featured customizable charts

- Effortlessly import and export trade data to track trade history

- Trade journaling as well as an individual trade journal to track select trade data with custom strategy tags

- Track every detail of your trading business

- Key metrics trade tracking to track a particular trade or multiple trades

- Reporting features with several key metrics

- Three tiers of service, including a free account

- Competitive platform pricing options

- Pro users can track multiple accounts

- Excellent customer support team

- P&L simulator for swing traders and active traders

Trademetria Cons

- No mobile app

- Not a trading platform or trading firm, unlike some all-in-one services, though Trademetria trade journal’s quality far exceeds those that you would find on all-in-one solutions

- Lack of trading community

- Not all brokers are supported; API sync may have limits or edge cases

Trademetria Review: Is Trademetria Right for Me?

Almost any trader can benefit from what Trademetria has to offer.

Its trade journal alone is one of many key features that should be in any trader’s repertoire.

If you’re a novice or part-time trader, you can get plugged into Trademetria’s free tier at no cost and start journaling your trades easily.

Additional features such as reporting and trade tracking to analyze your trades only serve to sweeten the pot.

If you’re an investor with a little more experience, you’ll find the advanced features of the Basic Plan right up your alley.

The P&L simulator and ability to research trades may have you rolling in dividends.

Upping the import limit to 100 trades also opens up many more possibilities.

Full-time investors with more than 100 trades per month who want to track several accounts can benefit from the Pro Tier.

By going Pro, you’re only limited by the amount of time you have in front of the computer.

Trademetria Reviews by Members

Investors who have subscribed to Trademetria have a lot of good things to say about the platform.

The service has a 4.7 out of a 5 rating on Capterra, with many positive reviews.

Here are just a few of the recent reviews from the site:

Very good. Grateful for the free trial option… Everything is very intuitive, no entry barrier really. This is the only app that felt less painful than a handmade excel sheet. Most amateur users prefer excel not because its flexibility but because it starts very simple and you can make it more complicated on the go, this makes us feel safe and not too silly. Trading platforms tend to show charting and data as a sort of pseudo-science the more complicated it looks the better. – Carlos, on Capterra

Another Trademetria review reads:

Excellent customer service, I switched from another logging software because I trade in Europe and my trading software uses a comma for decimals instead of a period. In my old logging software I had to switch comma for a period for every trade and then import – after contacting customer support they were not able to do anything. With trademetria I contacted customer support and explained the situation, the issue was fixed in 5 minutes so my import is flawless and takes seconds. – Tim, on Capterra

Here’s one more Trademetria review:

I get a very clear breakdown of my trades and support is available for any help I need. They even worked with a fellow trader from Australia to make sure date formats were usable for his country. This was very nice to hear, because it means they are motivated to make changes to their software as needed to accommodate everyone and all needs. – Dana, on Capterra

Trademetria Review: Is It Worth It?

After spending time testing the platform for this Trademetria review, I can confidently say it’s one of the most complete trading journals available today.

Whether you’re tracking a few swing trades a month or managing multiple accounts across brokers, Trademetria brings order and insight to what’s often a chaotic process.

The AI Coach adds another layer by highlighting behavioral tendencies that quietly shape outcomes, with insights going beyond what you can do on your own.

Overall, my experience with the software feels very polished, and there’s a ton of value tucked inside each feature.

If you’re serious about improving your consistency and decision-making, Trademetria is absolutely worth the investment.

Tags:

Tags: