Managing money has never been harder. Markets swing wildly, and emotions often lead to bad decisions that can cost us dearly.

Enter Keith Kaplan and his TradeStops Plus, a data-driven system from TradeSmith designed to give each of us a smarter way to protect profits and manage risk.

In this TradeStops Plus Review (Powered By Kinetic), I’ll share my thoughts on this math-based approach to investing so you can decide whether it’s right for you.

>> Join Keith Kaplan’s TradeStops Plus Today! <<

What is TradeStops Plus ?

TradeStops Plus is TradeSmith’s next-generation risk management and portfolio optimization platform built for folks who want clarity, control, and confidence in any market.

It combines behavioral science, data analytics, and automated tracking to show you when to take action and when to stay patient.

The platform continuously monitors your holdings, grades your portfolio’s health, and alerts you to critical changes in risk or momentum.

Users can connect their brokerage accounts, receive timely alerts, and access an at-a-glance dashboard that simplifies complex data into easy, actionable insights from one of three distinct packages.

Before I cover those in more detail, though, I want to uncover a bit about the guru behind it all.

>> Experience TradeSmith’s Math-Powered Edge Now! <<

Who is Keith Kaplan?

Keith Kaplan is the CEO of TradeSmith and has been in the trenches of investing and trading for more than 25 years.

That knowledge led him to be one of the driving forces behind TradeSmith’s data-first approach to investing, starting over 20 years ago with little more than a simple program to track fixed-percentage trailing stops.

TradeSmith isn’t even his only rodeo. Kaplan has enjoyed lead roles at several other finance-minded companies over the years.

His mission has always been clear: help individuals make smarter, calmer, and more confident decisions with their money.

Is Keith Kaplan Legit?

There’s no doubt that Keith Kaplan is the real deal when it comes to modern, math-based investing.

With over two decades of experience in financial technology and analytics, he has earned a reputation for creating systems that actually work in real-world portfolios.

Under his leadership, TradeSmith’s proprietary tools like the Volatility Quotient (VQ) have been backtested on millions of data points across decades of market behavior.

His work has been featured in financial media, and affiliate conferences focused on investor education and risk management.

Kaplan’s emphasis on discipline over hype and his track record of developing tools that have helped safeguard billions in wealth make him one of the most credible and forward-thinking figures in the financial technology space.

>> Secure Your Spot in TradeStops Plus! <<

What is in the TradeStops Plus Powered by Kinetic Presentation?

Even the best of us struggle with emotion when it comes to critical investment decisions.

Fear, greed, and indecision can quietly drain returns year after year.

That hit home for me. I’ve been there, watching gains slip away simply because I didn’t know when to sell or how much to risk.

With that realization in mind, I could envision Kinetic as a way to replace that emotion with data-driven confidence.

The Real Reason We Underperform

Kaplan reveals that many of us fall short due to poor position management, not the stocks we have in our portfolios.

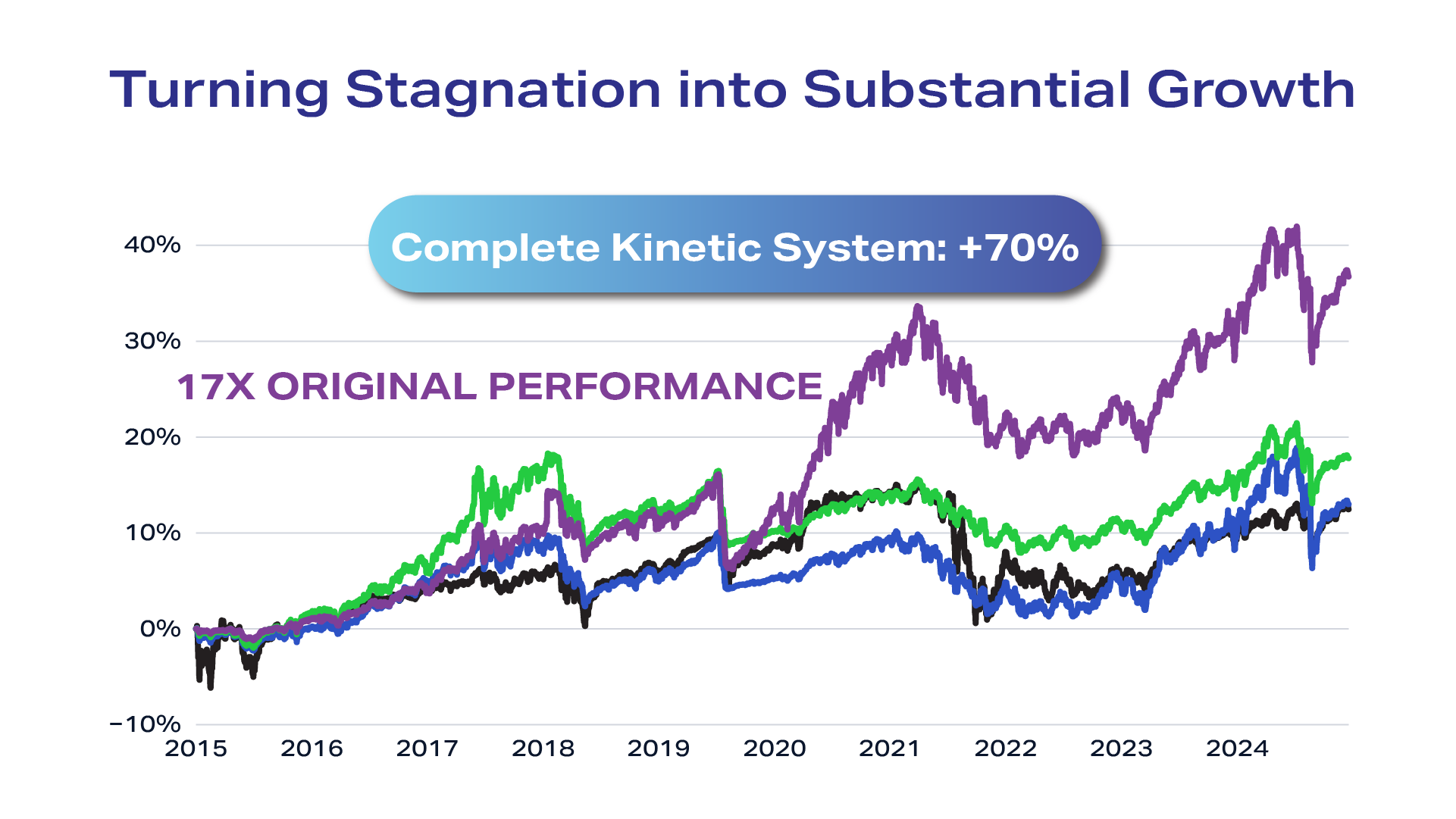

During the presentation, he showed how Kinetic could have transformed even the ten worst-performing S&P 500 stocks into profitable positions by applying precise mathematical rules.

Then he compared it to the “Magnificent 7”, Apple, Amazon, Tesla, and others, and demonstrated how those same stocks could’ve delivered 28% better results when powered by Kinetic’s algorithms.

The Turning Point: Three Pillars of Smarter Investing

Kaplan then unveiled Kinetic’s three-pillar system, which is the secret sauce behind its performance.

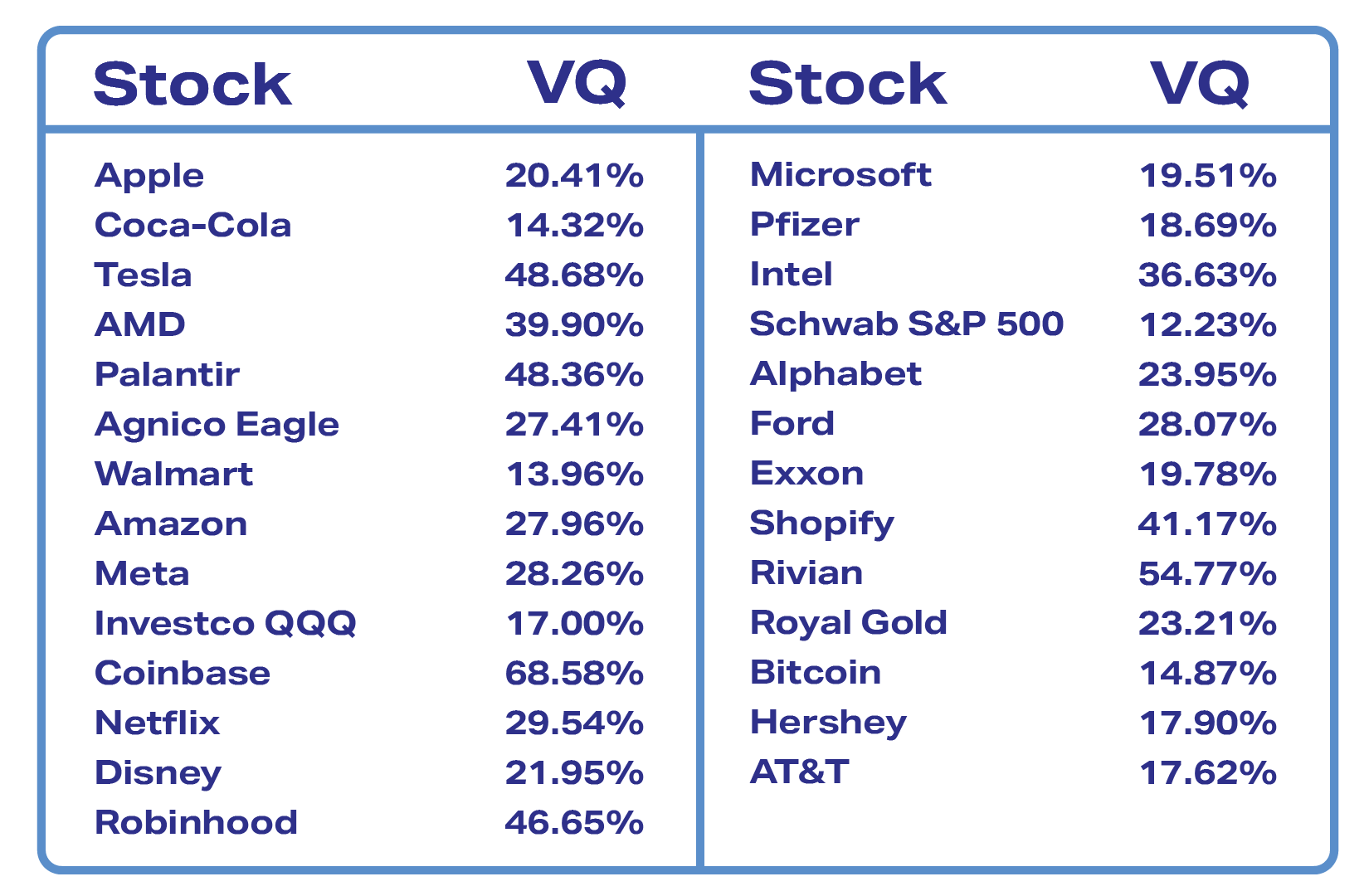

The first, the Volatility Quotient (VQ), identifies each stock’s unique volatility pattern, so you know when price swings are normal and when it’s time to exit.

Next, Intelligent Position Calibration helps you size your investments based on risk, not guesswork, ensuring you don’t overcommit to volatile assets.

Finally, the Stoplight System uses color-coded alerts to signal when to re-enter after a dip.

Together, they form a powerful framework that gives the same kind of discipline institutional traders use, without needing a finance degree.

For me, it felt like getting an investment co-pilot that keeps my portfolio steady while I focus on life.

How to Get Connected to Kinetic’s Energy

Markets today move faster than ever. One headline or algorithmic trade can swing stocks 5–10% overnight, which can bless or spell disaster for just about anyone.

If you’re ready to replace uncertainty with clarity, TradeStops Plus Powered by Kinetic offers exactly that.

You can see how each of these principles works and how to apply them to your own portfolio by joining the program today.

Next up, let’s discover what comes with this system and how it can start working for you.

>> Start Managing Smarter with TradeSmith Today! <<

TradeStops Plus Review: What Comes With It?

You get an entire slew of features at your disposal when you join TradeStops Plus powered by Kinetic:

Volatility Quotient (VQ)

The Volatility Quotient is the foundation of the entire platform, analyzing how much a stock naturally fluctuates and sets a unique threshold for each one.

For example, Netflix may swing 30% without breaking stride, while a 15% dip in Lockheed Martin could mean trouble.

TradeStops continuously tracks these volatility levels, alerting you when a stock crosses its threshold so you can decide whether to stay in or step aside.

It helps eliminate emotional decision-making by giving you clear, data-backed insight into your holdings.

Intelligent Position Calibration

This feature helps you allocate your capital more efficiently. Instead of spreading money evenly across investments, TradeStops calculates the mathematically optimal amount to place in each position based on volatility and potential risk.

That means you won’t overexpose yourself to a volatile tech stock or underinvest in a steady dividend payer.

The system runs real-time simulations using historical market data to help you keep your allocations balanced, helping you minimize drawdowns and improve your long-term gains.

In simple terms, it keeps your risk level consistent, no matter how unpredictable the market becomes.

Stoplight System

The Stoplight System adds timing precision to your strategy.

It monitors every stock you own and gives visual cues: Green means it’s in an uptrend, Yellow suggests caution, and Red warns a position could be falling out of favor.

The best part is that these signals also tell you when to consider re-entering after a stock stabilizes.

For instance, instead of panic selling during a dip, you can see the moment a stock starts recovering and rejoin at a stronger position.

It’s an intuitive tool that helps you catch the upside without getting caught in unnecessary losses.

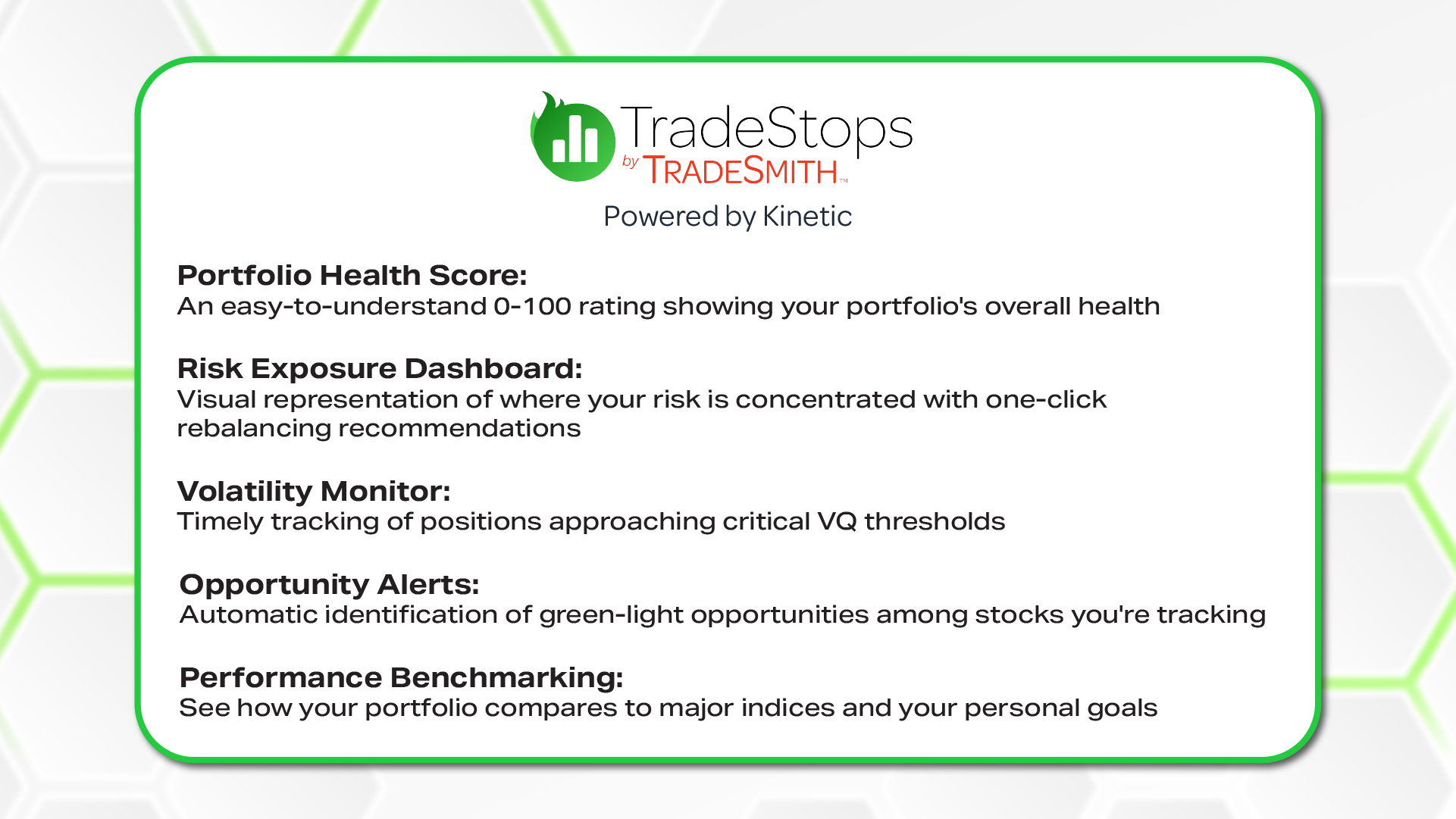

Portfolio Health Score

Think of this as your portfolio’s overall fitness tracker. The Health Score is a 0–100 rating that instantly shows whether your investments are strong, stable, or in need of attention.

It takes into account volatility, diversification, and performance trends, updating automatically as the market moves.

While the health rating is a guideline, you still get to set limits on when to invest and how much risk to allow in.

Ultimately, seeing that score climb over time gives a tangible sense of progress and reinforces good investing habits.

It’s one of the most helpful tools for staying focused on long-term performance instead of short-term noise.

Risk Exposure Dashboard

The Risk Exposure Dashboard dissects your portfolio by asset class, sector, and volatility rating to reveal exactly where your risk lives.

Using color-coded heatmaps, it visualizes how much capital is concentrated in high-risk areas, helping you see imbalances that might otherwise be hidden in a spreadsheet.

It’s updated in real time, giving you a living snapshot of your exposure as markets move.

For instance, you might discover that 40% of your holdings are in tech stocks with high volatility ratings, an imbalance that could magnify losses in a downturn.

With that insight, you can trim positions or rebalance into more stable sectors before problems escalate.

The dashboard makes complex risk analysis intuitive, empowering you to maintain a stronger, more balanced portfolio through clear visual feedback.

Volatility Monitor

Volatility Monitor is your early‑warning system for trouble. Running in the background on TradeSmith’s cloud servers, it watches every position you’ve synced and tracks intraday movement against each stock’s unique Volatility Quotient (VQ).

When a name drifts toward its critical threshold, or crosses it, the system queues a timely notification so you can act before small dips turn into damaging drawdowns.

You choose how to be notified (email, text, or mobile app), and alerts arrive with clear context so decisions feel straightforward, not rushed.

Because it’s always on, you don’t need to stare at screens all day. The Volatility Monitor does the scanning and surfaces only what matters, helping you prioritize exits, trims, or hedges while keeping your focus on the rest of your life.

Opportunity Alerts

Opportunity Alerts are where TradeStops gets proactive. Powered by TradeSmith’s advanced data models, this feature scans the market daily to identify stocks transitioning from red to green in the Stoplight System or trading within optimal volatility zones that you may not even have on your radar.

For example, it might spot a major index component stabilizing after a sharp pullback, signaling a strong rebound opportunity days before financial media catches on.

Each alert includes key context, current trend, volatility level, and timing insight, so decisions feel deliberate rather than rushed.

It’s like having a market analyst constantly monitoring opportunities on your behalf, helping you focus your attention where the odds are strongest.

Performance Benchmarking

Finally, Performance Benchmarking gives you the truth about how your portfolio stacks up.

It measures your returns against major indices like the S&P 500 and your personal goals, showing what’s working and what isn’t.

By tracking your performance in real time, you can see how data-driven decisions are improving your results.

Over time, this feedback loop turns every trade into a learning opportunity, reinforcing smart habits and keeping your investment strategy grounded in measurable progress.

Together, these features form a complete system that helps you manage your portfolio with discipline, confidence, and precision.

Now let’s look at the additional tools and bonuses that make this platform even more valuable.

>> Claim Your $79 TradeStops Plus Powered by Kinetic Deal <<

TradeStops Plus Bonuses

When you join TradeStops Plus, you’ll also receive four powerful bonus resources designed to accelerate your understanding and help you apply every tool inside the platform from day one:

Bonus #1: The Volatility Mastery Blueprint ($99 Value)

The Volatility Mastery Blueprint is the ultimate companion to understanding the Volatility Quotient (VQ) system.

Using real market examples, it explains how to differentiate between normal fluctuations and true red-flag movements.

The guide provides actionable exercises to help you build the confidence to make smarter sell decisions and stay invested through short-term noise.

It’s essentially your playbook for turning raw data into clear, profitable action, giving you a deeper grasp of how to apply TradeSmith’s risk metrics to your own portfolio.

Bonus #2: Crisis-Proof Your Portfolio ($99 Value)

Market corrections are inevitable—but they don’t have to be devastating.

It provides a clear framework for identifying early warning signals before a downturn escalates, and how to rebalance into stronger assets with minimal disruption.

The strategies here are based on decades of data from TradeSmith’s market research team, focusing on practical, defensive positioning rather than fear-driven reactions.

By following this playbook, you’ll learn to navigate volatility calmly and even uncover opportunities that often appear during chaotic markets.

It’s a must-read for anyone who wants their portfolio to survive and thrive through any economic cycle.

Bonus #3: The 30-Minute Portfolio Transformation ($99 Value)

This quick-start manual is perfect for anyone who wants to see immediate improvement. In just half an hour, it helps you evaluate your current holdings using TradeStop’s algorithms and suggests how to rebalance for optimal risk and return.

The result is a portfolio that’s cleaner, more balanced, and better aligned with your financial goals.

You can even go back and reapply this portfolio transformation as many times as needed down the road any time you feel a slip or aren’t seeing the reactions you’d hoped for.

Bonus #4: Mystery Gift

The Mystery Gift is a special addition that brings exclusive research from one of the most respected financial strategists of the last fifty years.

While I can’t give away much here, this individual is listed at the top of his game and has more than 50 years of experience to back that up.

Valued at $500, you’re getting a deep, forward-looking analysis of today’s markets and where the next opportunities may emerge.

Refund Policy

TradeSmith offers a 60-Day, 100% Money-Back Guarantee called the Sleep Well At Night Guarantee.

If during that time you don’t feel more confident, secure, and in control of your portfolio, you can request a full refund, no questions asked. The process is simple and handled directly through their U.S.-based customer support team via phone or email.

Beyond that, TradeSmith provides an additional safety net: you can cancel your membership at any time within the first year and receive a prorated refund for any unused months.

This policy reflects the company’s confidence in its platform and commitment to making sure every member feels protected and satisfied.

>> Start Your 60-Day Risk-Free Trial Now! <<

Pros and Cons

After checking out every nook and cranny of TradeStops Plus Kinetic, here are my top pros and cons:

Pros

- Built on tested, data-driven algorithms with over a decade of performance

- Focuses on the art of owning stocks rather than chasing new picks

- Clear visual tools and easy-to-read dashboards

- Features many proprietary tools

- Secure, cloud-based platform with timely alerts

- 60-day money-back guarantee

- Affordable pricing considering institutional-grade tech

Cons

- Doesn’t provide direct stock recommendations (it’s a management system)

- May feel data-heavy to absolute beginners

TradeSmith Member Reviews

TradeSmith has built a loyal community of users who consistently praise its ability to bring clarity and control to their investing.

Here are a few of the top comments:

These reviews speak to the peace of mind that TradeSmith products can bring, along with the potential for some really game-changing gains.

You’ll need to take these with a grain of salt since not everyone will experience the same level of success, but it’s still encouraging to hear just what the platform can do.

>> Get Keith Kaplan’s Investing Blueprint! <<

TradeStops Plus Powered By Kinetic Track Record

TradeStops Plus stands on a decade of consistent performance backed by TradeSmith’s extensive data science and real-market application.

According to information from the company’s own records the system tracks more than $30 billion in wealth.

Historical backtests presented by Keith Kaplan showed portfolios managed with Kinetic’s three-pillar approach outperforming unmanaged portfolios by as much as 90% on a risk-adjusted basis.

What makes these results even more compelling is that they were achieved without changing stock selections, only how those stocks were owned.

Over years of use, the technology has proven that disciplined, math-based investing can deliver steadier returns and help folks avoid the emotional pitfalls that lead to losses.

How Much Does TradeStops Plus Cost?

TradeStops Plus is offered through a simple, transparent pricing structure through three tiers that are designed to give flexibility.

The Basic plan will set you back just $49 per year and enable access to all the platform’s core features, from the Volatility Quotient to Portfolio Health Score.

Advanced tools such as Opportunity Alerts and the Stoplight System appear with the $79 Plus plan, and every bit of TradeStops Plus becomes available for $129 annually when you go Premium.

Considering the system monitors billions in wealth and has a track record of helping users reduce drawdowns and enhance returns, these represent exceptional value.

Is TradeStops Plus Worth It?

After spending significant time exploring the tools, features, and testimonials behind TradeStops Plus Kinetic, I can confidently say that it lives up to its promise of simplifying smarter investing.

What sets it apart is how seamlessly it blends behavioral discipline with mathematical accuracy.

The system works quietly in the background, monitoring every stock and alerting you when to act, removing the stress of guessing what comes next.

For me, that level of confidence is priceless.

As this TradeStops Plus Kinetic review shows, the platform’s real value lies in its ability to transform how you think about investing.

Instead of chasing the next big pick, you focus on owning your positions correctly, knowing when to buy, sell, and re-enter.

Combined with Keith Kaplan’s data-driven vision and TradeSmith’s technology, it’s an intelligent upgrade for anyone’s toolkit.

If you’re serious about protecting profits, reducing risk, and staying disciplined in volatile markets, then yes, TradeStops Plus Kinetic is absolutely worth it.

Tags:

Tags: