Nvidia has been reshaping the tech landscape for years, and its reach into quantum computing and robotics is creating rare openings like nothing we’ve ever seen.

Michael Robinson believes the next big opportunity won’t come from the tech giant, but rather from companies working alongside it in quiet but powerful ways.

Is the guru onto something, or is he way off base?

In this review of the Unauthorized List of Nvidia’s Silent Partners, I take a closer look at those claims so you can decide whether the research inside Disruptors & Dominators deserves your attention.

>> Join Michael Robinson’s Disruptors & Dominators today <<

What is Disruptors & Dominators?

Disruptors & Dominators is Michael Robinson’s tech-driven research service built around fast-moving innovations and the companies leading them.

He’s constantly looking for the biggest breakthroughs from large and small tech companies that are reimagining the space in big ways.

I’ve seen time and again how new technology leads to massive stock moves, so this service already resonates with me.

Each month, you get a new issue with his latest analysis and a fresh stock recommendation backed by the Weiss Ratings system, which reviews more than 53,000 stocks, ETFs, and mutual funds.

There are also 24/7 flash alerts, full access to every past issue and tech report, the Weiss Ratings Daily e-letter, and exclusive online briefings.

I’ll dive deep into each of these features in a bit, but first, I want to take a closer look at the guru behind it all.

>> Unlock Nvidia’s Silent Partners Research Now <<

Who Is Michael Robinson?

Michael Robinson has spent more than forty years working around breakthrough technologies, first as an investigative journalist in Silicon Valley and later as an advisor to venture firms and high-growth startups.

Over the years, he gained a front-row view of emerging innovations by interviewing founders, touring labs, and watching early ideas evolve into real businesses.

That mix of field work and industry access eventually shaped his transition into tech research, which he now brings to his role at Disruptors & Dominators.

Is Michael Robinson Legit?

Absolutely. Michael Robinson has built credibility through repeated early calls on technologies most people overlooked.

He highlighted Nvidia when it traded near 80 cents, a move that later turned into a massive 23,000 percent surge, and he pointed readers toward Bitcoin around three hundred dollars in 2013, long before it went mainstream.

His research has produced 120 triple-digit winners since 2013, along with standout gains on companies like Novavax and Shopify.

What sets him apart is how those results come from decades of studying new technologies up close and analyzing them with the same investigative approach he used throughout his journalism career.

This consistency really resonates with me, since it shows he’s not an investor with a few lucky picks.

>> See Michael Robinson’s Latest Tech Picks <<

What Is Inside the “Nvidia’s Silent Partners” Presentation?

Michael Robinson believes a quiet turning point is taking shape inside the tech world that most of us are still oblivious to.

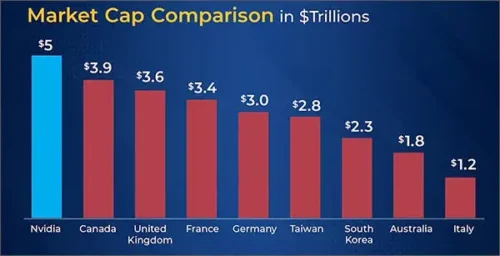

Nvidia is now so big (over $4 trillion market cap!!) because of its AI chips that it’s working on a bunch of “secret” projects behind the scenes.

These are two areas he says are starting to influence how businesses make decisions, how data gets processed, and even how millions of people go about their daily routines which makes it crazy that none of us saw this coming.

The Technology Behind the Change

In the promo, Robinson spends time showing why the traditional view of computing is no longer enough.

Companies are running into problems that current systems can’t solve efficiently.

That is why organizations like UPS, the Mayo Clinic, and NASA are already experimenting with quantum-powered tools.

What ties all of this together is Nvidia’s move to anchor itself inside this shift. Robinson highlights Nvidia’s own Quantum Day and the development of new platforms aimed directly at quantum researchers.

He believes Nvidia isn’t just preparing for the future, but actively building the infrastructure for it now. If that is true, then the companies enabling this transition may be positioned far earlier in the cycle than most people realize.

The Rise of Intelligent Machines

Quantum computing is already light-years over my head, but Robinson furthers the connection to sci-fi by bringing up robotics.

He believes robots are about to enter mainstream life in a meaningful way and that Nvidia is quietly at the center of this shift as well.

Robotics could influence sixty-five million Americans in the coming year, so we may see the fruit of this trend whether we’re ready for it or not.

All I hear are dollar signs – there’s clearly something for me with that much adoption and market potential.

Move Over, Nvidia

In the end, my key takeaway is this: Nvidia cannot carry quantum computing or robotics into the next decade alone.

I can’t reveal those names here lest I get in trouble, but Robinson hints that they’re already gaining traction.

If you want to explore these companies before the broader market fully catches on, you can find the details inside Disruptors & Dominators.

The next section explains exactly what comes with a membership and how Robinson shares these opportunities as they develop.

>> Get full access to Disruptors & Dominators <<

What Comes With Disruptors & Dominators?

Here’s everything you can get your hands on as a Disruptors & Dominators member:

12 Months of Disruptors & Dominators Newsletter

12 Months of Disruptors & Dominators Newsletter

The service revolves around a monthly newsletter that hits your inbox on the first Friday.

Inside, Robinson breaks down an emerging tech trend and reveals details on a new stock idea tied to it that you can immediately take action on.

He explains why the opportunity matters, what’s driving it, and how it fits into the larger direction of the market.

I love that you get the full story on an opportunity that even I can understand, which makes it super easy to decide whether to play or not.

24/7 Flash Alerts

24/7 Flash Alerts

Markets move fast, and lightning-fast alerts are Robinson’s way of making sure you never miss something important.

You’ll receive one whenever conditions change around one of his recommendations, or when he sees a development worth acting on.

Sometimes it’s a buy window, sometimes it’s a protective move, and sometimes it’s simply a meaningful update on the trend itself.

The value here is timing. You aren’t waiting a full month for guidance. You’re kept in the loop as things unfold.

Complete Research & Report Library Access

Complete Research & Report Library Access

From the moment you join, you can unlock every past issue, special report, and research note Robinson has released through the service.

This includes older deep dives on technologies, early-stage themes, and companies he has covered before.

I like that the info here is fuel for the entire service, offering insights into why Michael chooses what he does and how you can make similar assessments on your own.

It’s an educational hub to say the least, and it also shows how earlier predictions lined up with where the market ultimately moved.

Access to 53,000 Weiss Ratings

Access to 53,000 Weiss Ratings

This is one of the strongest parts of the subscription because it gives you access to an independent rating system that evaluates more than 53,000 stocks, ETFs, and mutual funds.

It’s your backstage pass into the system that makes Weiss Ratings the powerhouse it is, and it’s super easy to use.

All I have to do is type in a ticker and immediately receive a “Buy”, “Sell”, or “Hold”.

When I use it, I treat it as a quick filter to verify that a company isn’t just exciting on paper.

It helps you avoid weak positions before you ever consider them, which is something most services don’t provide.

Lifetime Access to Weiss Ratings Daily E-Letter

Lifetime Access to Weiss Ratings Daily E-Letter

You also receive lifelong access to the Weiss Ratings Daily e-letter, which arrives three times a week.

These updates give you ongoing insight into market conditions, emerging risks, and trends that could influence the stocks Robinson covers later.

While the main newsletter focuses on individual recommendations, these daily notes help you stay centered between big issues.

Over time, they create a steady rhythm of education and awareness, which makes the monthly research easier to follow and apply.

Confidential Online Briefings

Confidential Online Briefings

Robinson occasionally hosts private video briefings to talk through big developments that don’t fit neatly into the monthly issue.

These sessions usually focus on major tech shifts or updates too important to wait for the next release. He explains what’s happening, why it matters, and how it might influence the opportunities inside the model portfolio.

There’s nothing better in my opinion than hopping on a call with a guru and seeing how he processes events in real time. Not only is it a test of their ability, it’s a great way to learn how to do the same.

>> Discover Robinson’s Top Nvidia Partner Stocks <<

Nvidia’s Silent Partners Bonuses

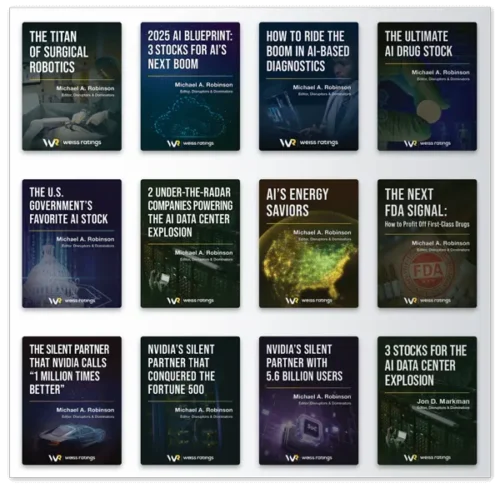

You’ll receive the following bonuses when you sign up that play right into the Nvidia trend:

This report focuses on three companies Robinson believes are quietly helping Nvidia push deeper into quantum computing and robotics.

If he’s right, these little firms are helping pave the way to breakthrough technologies valued at over $24 trillion.

They’re honestly just starting out, meaning there’s a huge runway for growth if you hop on board right now.

Word on the street is that these companies are still under the radar, so it would be difficult to track them down right now.

Not sure about you, but I’d love to get a piece of that action myself.

In this report, Robinson highlights two companies he believes are playing essential roles in Nvidia’s dominance in high-performance computing and AI data centers.

Nvidia’s growth in this area has been enormous, and these smaller firms appear to be supplying the infrastructure and specialized capabilities that help Nvidia scale.

Robinson explains how their technology fits into the broader hardware stack that supports AI workloads, and why these firms could benefit as the demand for accelerated computing surges.

He ties each one back to Nvidia’s strategy of expanding its reach beyond chips into complete data center ecosystems.

BONUS REPORT #3: Nvidia’s Top 3 “Official” Partners for 2026

BONUS REPORT #3: Nvidia’s Top 3 “Official” Partners for 2026

This report shifts the focus to companies Nvidia officially recognizes as part of its partner network.

Earlier Nvidia partners like TD Synnex and Dell delivered strong, sustained gains once their collaborations deepened, and that history is enough for me to believe he’s right about the next wave.

These might be lower risk/reward than some of the fresher picks from what I can tell, but they’re still solid opportunities.

Robinson makes the case that partnerships like these often begin quietly and strengthen over time, creating opportunities for those of us who want exposure to Nvidia’s broader ecosystem.

BONUS REPORT #4: The User’s Guide to Disruptors & Dominators

BONUS REPORT #4: The User’s Guide to Disruptors & Dominators

This guide acts as a welcome map for new members. Robinson walks you through how the service works, how to navigate the research library, and how to read his recommendations without feeling overwhelmed.

He explains how to use the Weiss Ratings system as a filter when evaluating new ideas, and how to follow updates as market conditions shift.

Everything is very clear and sets the stage for quick immersion in the platform, especially if you haven’t used a research service before.

Since you’ll have it forever, you can even flip back to it any time you need a refresher on something.

>> Claim your Disruptors & Dominators membership <<

Refund Policy

Refund Policy

You’re given a full year to try Disruptors & Dominators with no pressure attached.

Robinson’s team offers a 365-day, 100 percent money-back guarantee, which means you can explore every issue, alert, and bonus report and still receive a complete refund if the service doesn’t feel like the right fit.

The refund applies any time during the first twelve months, and the order form notes that you can cancel by phone or email without needing to justify your decision.

It’s a simple policy that removes the risk and lets you judge the research on your own terms.

Pros and Cons

After a thorough review, here are my top pros and cons:

Pros

- Strong track record highlighted by Nvidia and Bitcoin early calls

- Full year of newsletter service

- Alerts and updates as needed

- Multiple bonus reports

- Full library access adds depth

- Unlimited access to Weiss Ratings

- One-year refund window

Cons

- Focus on emerging tech may not suit everyone

- Requires active engagement to follow alerts and research

Disruptors & Dominators Reviews by Members

One thing that stood out to me while exploring Disruptors & Dominators was how often subscribers praise the clarity of the research and the steady pace of updates.

The service sits inside the broader Weiss Ratings ecosystem, which consistently earns high marks from its user base with a 4.7 rating on Trustpilot.

The score lines up with my own experience. The layout is clean, the guidance is easy to follow, and the alerts arrive when they’re most needed rather than flooding your inbox.

You also get the sense that many long-time readers rely on this research as part of their routine, which speaks to the trust the service has built over the years.

>> Explore Nvidia’s Silent Partners before prices rise <<

Disruptors & Dominators Track Record and Past Performance

Robinson’s track record is one of the clearest strengths of Disruptors & Dominators.

My obvious nod is to the 120 triple-digit winners delivered to readers over the past decade, such as 312 percent on Novavax and 345 percent on Shopify.

That’s not to mention the platform’s early calls like Nvidia at 80 cents, which later climbed 23,971 percent, and Bitcoin near three hundred dollars, which went on to soar 41,484 percent.

How Much Does Disruptors & Dominators Cost?

You can pick up Disruptors & Dominators in one of two discounted options.

The best play by far is the Premium membership for $99, which is more than 80% off the cover price.

You get all the material I covered above and an actual print version of the newsletter you can refer to at any time.

It’s possible to get just a digital print of the newsletter for $49, which is an excellent price, but you lose out on so much content going this route.

When it comes time to renew, the price point jumps to $129, which I still feel is very fair for everything included.

Is Disruptors & Dominators Worth It?

Is Disruptors & Dominators Worth It?

After going through all the research materials for this Nvidia’s Silent Partners review, the service stands out as a strong fit for anyone who wants a clearer view of where Nvidia’s next phase of growth may come from.

Robinson does a good job breaking down complex ideas like quantum computing, robotics, and AI infrastructure in a way that feels practical rather than overwhelming, and the ongoing alerts make it easier to stay connected as these trends unfold.

He distributes this knowledge through the newsletter, alerts, archive, and bonus reports, but you’ll have plenty of time to digest those with a year-long membership.

Top that all off with unlimited access to Weiss Ratings, and the value here is unquestionable.

With the full year refund window, the service feels worth trying if you want structured guidance while exploring long-term opportunities tied to Nvidia’s broader ecosystem.

I’d recommend getting started now while Nvidia’s partners are still babies so you can jump on them early.

Tags:

Tags: