Financial fraud presents a significant and evolving threat to investors, manifesting in various forms, from Ponzi schemes to unauthorized trading. These fraudulent activities can lead to substantial financial losses for unsuspecting individuals and undermine trust in the financial system.

Brokerages need to take a comprehensive approach to mitigate these risks. This includes robust security measures, strict regulatory compliance, and client education initiatives designed to empower investors to protect themselves.

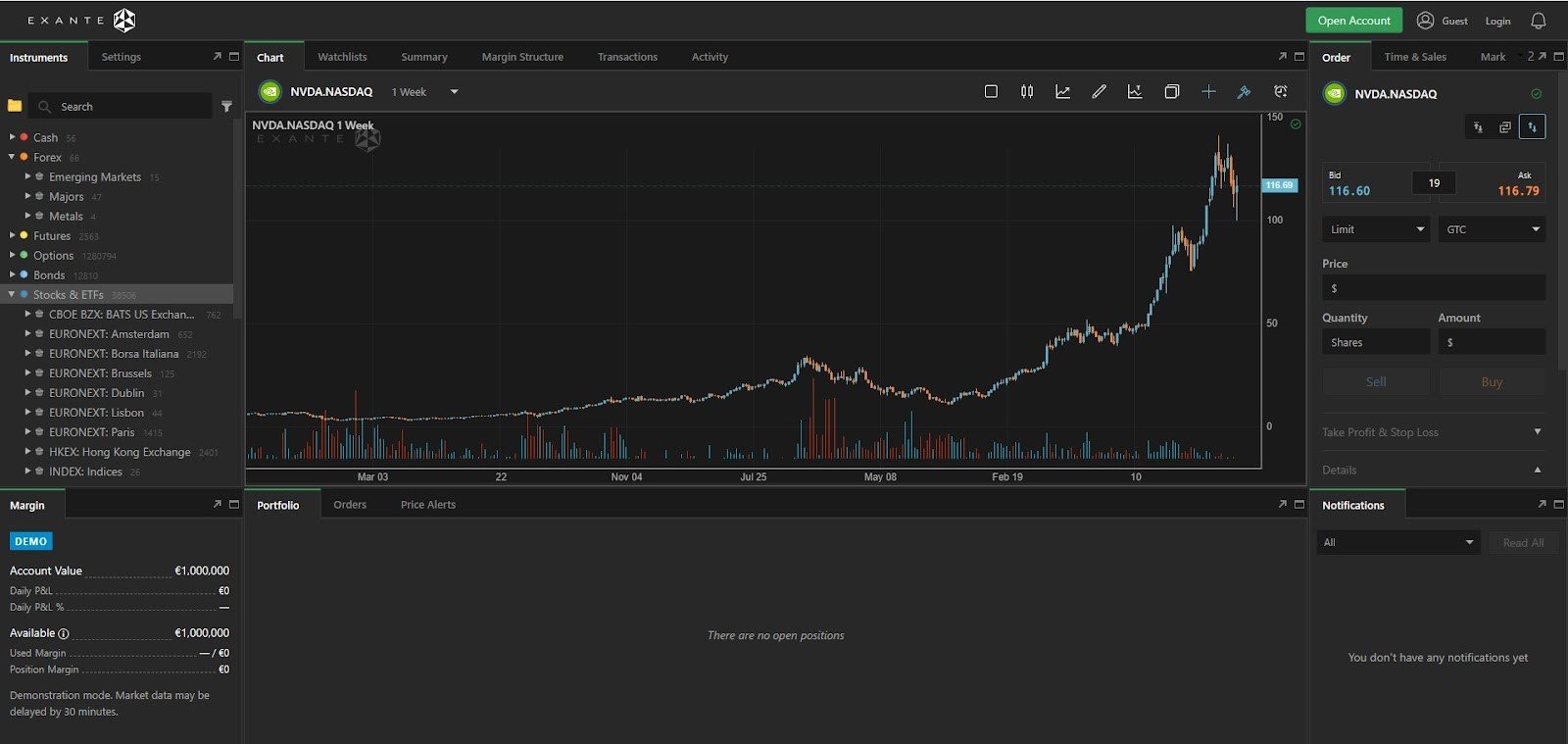

This article will explore financial fraud within the brokerage industry and detail the specific measures EXANTE employs to safeguard its clients and maintain a secure trading environment.

What is Financial Fraud in Brokerages and Trading Platforms?

Financial fraud in brokerages and trading platforms refers to illegal activities that deceive investors or manipulate financial markets to gain unfair advantage or financial gain.

Common types of financial fraud in brokerages include:

- Ponzi schemes: Fraudsters promise high returns and use new investors’ funds to pay earlier investors, creating the illusion of a profitable business.

- Phishing and identity theft: Scammers use fake emails or websites to trick investors into revealing sensitive personal information.

- Unauthorized trading: This occurs when someone trades on behalf of a client without their consent, often leading to significant financial losses.

- Market manipulation: Fraudsters may artificially inflate or deflate the price of a security to create a false impression of market demand.

- Fake brokers and platforms: Some scammers create entirely fictitious trading platforms to lure investors into depositing funds that are never returned.

The impact of these fraudulent activities can be devastating, leading to significant financial losses for traders and undermining trust in legitimate financial institutions.

Widespread fraud can also destabilize financial systems and economies, making it a critical issue for regulatory bodies and legitimate financial institutions to address.

Recognizing the Signs of Financial Fraud

To safeguard their investments, traders need to remain alert and identify the warning signs of financial fraud, including:

- Unsolicited offers and pressure tactics: Be wary of unexpected investment opportunities that come with high-pressure sales tactics.

- Promises of high returns with low risk: If an investment sounds too good to be true, it likely is. Genuine investments carry risks, and no legitimate opportunity guarantees high returns.

- Unclear or overly complex fee structures: If a broker’s fee structure is difficult to understand, it may be a tactic to hide costs.

- Lack of transparency in operations and transactions: Legitimate brokers should provide clear information about their operations and fees.

Real-world examples of financial fraud highlight the importance of these warning signs. For instance, many victims of Ponzi schemes were drawn in by promises of guaranteed returns and failed to conduct adequate research before investing.

Real-World Examples of Financial Fraud Cases

Bernard Madoff’s Ponzi Scheme

Bernard Madoff orchestrated one of the largest Ponzi schemes in history, defrauding investors of an estimated $64 billion over several decades.

Madoff, a prominent Wall Street investment advisor and former chairman of NASDAQ, attracted clients by promising extraordinarily high and consistent returns. His scheme relied on the classic Ponzi model, where returns to earlier investors were paid using the capital of new investors, rather than from legitimate profits generated through investments.

Madoff’s operation was deceptively simple yet effective. He created fictitious trading statements that showed impressive returns, convincing clients that their investments were thriving. In reality, Madoff had not executed any trades for years; instead, he deposited investor funds into his personal bank account and used them to pay off withdrawal requests from other clients. This fraudulent activity went undetected for years, despite multiple warnings to regulatory bodies like the SEC.

The scheme unraveled in December 2008 during the global financial crisis when a surge of investors sought to withdraw approximately $7 billion. Madoff was unable to meet these demands, leading to his arrest on December 11, 2008. He was subsequently sentenced to 150 years in prison in 2009.

The fallout from Madoff’s fraud was catastrophic, resulting in financial ruin for many investors and highlighting the critical need for skepticism regarding promises of high returns with little risk.

This case serves as a stark reminder of the potential dangers of trusting investment opportunities without thorough due diligence.

MF Global was a prominent brokerage firm that collapsed in 2011 due to unauthorized trading activities that led to massive financial losses.

The firm, led by former New Jersey Governor Jon Corzine, engaged in risky trading strategies, particularly in European sovereign debt, without proper oversight or authorization from its board of directors. As a result, MF Global incurred significant losses, ultimately totaling around $1.6 billion.

The firm’s failure was exacerbated by the misappropriation of customer funds, which were used to cover trading losses. This breach of trust not only led to the firm’s bankruptcy but also raised serious concerns about the regulatory framework governing brokerages and the importance of adhering to authorized trading practices.

The collapse of MF Global underscores the necessity for stringent compliance measures within brokerage firms and the critical role of regulatory oversight. Investors must ensure that their brokers operate within established guidelines and maintain transparency in their trading activities.

This case serves as a cautionary tale about the potential consequences of unauthorized trading and the importance of robust internal controls to protect client assets.

How EXANTE Protects Its Clients

EXANTE, a global trading platform established in 2011 and owned by XNT Ltd., is committed to protecting its clients through various robust measures:

- Regulatory compliance and licenses: The investment firms offering the EXANTE platform operate under strict regulations, holding licenses from the FCA (UK), CySEC (Cyprus), and SFC (Hong Kong). These regulatory bodies enforce high standards of conduct and ensure that client interests are safeguarded.

- Security measures: The EXANTE trading platform uses advanced encryption technology and two-factor authentication (2FA) to secure client accounts. Regular security audits and vulnerability assessments further enhance its defenses against potential breaches.

- Transparency and ethical practices: The platform maintains a clear fee structure with no hidden charges, allowing clients to understand the costs associated with their trades. Regular financial reporting and audits ensure that operations remain transparent.

- Asset segregation: The investment firms offering the EXANTE trading platform operate under the strict regulations of the Markets in Financial Instruments Directive (MiFID II). To comply with this directive, client assets are kept separate from the assets of the company.

Tips for Protecting Yourself Against Financial Fraud

To protect yourself from financial fraud, it’s essential to adopt proactive measures and stay vigilant. Here are some straightforward tips to help you safeguard your investments:

Verify Credentials

Check whether the brokerage is licensed and regulated by recognized financial authorities. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, enforce strict standards to protect investors.

Look for reviews and testimonials from other investors. Online forums, financial news websites, and social media can provide insights into the experiences of other traders. Be cautious of platforms with consistently negative feedback or unresolved complaints.

Verify Website Authenticity

Always check that you are on the official EXANTE website, which is https://exante.eu/. Do not trust any other URLs or websites claiming to represent EXANTE.

Email Safety

You will only receive emails from the exante.eu domain. Be cautious of any communications from other domains and avoid clicking on links in unsolicited emails.

Monitor Account Activity Regularly

If you have an account with a brokerage, regularly review your transaction history for any unfamiliar or suspicious activity. Look for trades you did not authorize or withdrawals that you did not initiate.

Many trading platforms offer alert systems that notify you of significant account activity, such as large withdrawals or changes to your account settings. Enable these alerts to stay informed.

Stay Educated About Common Fraud Tactics

Knowledge is one of the best defenses against financial fraud. Staying informed about the latest fraud schemes and tactics can help you recognize potential threats.

- Make it a habit to update yourself on common fraud tactics and how they operate. Scammers constantly evolve their methods, so being aware of the latest trends is crucial.

- Take advantage of educational resources offered by reputable financial institutions. Many organizations provide webinars, articles, and guides on identifying and avoiding fraud.

Download the Platform Securely

Only download the EXANTE trading platform and mobile app from the official exante.eu website. Avoid third-party app stores or links provided by unknown sources.

Be Wary of Strangers

Do not engage with strangers who approach you with unsolicited investment opportunities or offers. Legitimate brokers will not pressure you into making quick decisions.

Conclusion

The threat of fraud remains a significant concern for traders and investors alike. As a result, understanding the various forms of financial fraud, from Ponzi schemes to unauthorized trading, is essential for safeguarding your investments.

It’s also important for investors to adopt proactive measures, such as conducting thorough research on brokerage platforms, monitoring account activity regularly, and staying informed about common fraud tactics, to protect themselves against fraudulent schemes.

EXANTE stands out as a trusted trading platform, committed to client safety through rigorous regulatory compliance, advanced security measures, and a transparent operational framework.

DISCLAIMER:

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Tags:

Tags: