We’re all looking for a straightforward way to boost your income without taking big risks, and Jim Pearce believes he has the answer.

Do his simple strategies that aim to create reliable cash flow actually work, or is this platform another dud?

This Investing Daily Personal Finance review will walk you through what Jim Pearce’s long-running service actually delivers – and whether you should take a closer look.

>> Try Personal Finance TODAY (Special Deal) <<

What is Investing Daily Personal Finance?

Investing Daily Personal Finance is a long-running service designed to give everyday readers a roadmap for building wealth and creating steady income streams.

In addition, members receive instant trade alerts when opportunities can’t wait, plus access to a members‑only site that houses model portfolios and every piece of research the team has published.

The real appeal here is that it doesn’t overwhelm you with complex trading systems. Instead, it focuses on practical, repeatable strategies aimed at producing reliable cash flow.

For anyone who wants to supplement retirement savings, reduce tax burdens, or simply generate extra monthly income, this service offers a simple framework backed by decades of expertise.

>> Get started with Personal Finance now <<

Who is Jim Pearce?

Jim Pearce is the Chief Investment Strategist behind Personal Finance with loads of experience under his belt.

Over time, Pearce shifted toward independent research and financial publishing, eventually becoming Director of Portfolio Strategy at Investing Daily.

In addition to his advisory work, Pearce has written extensively on retirement planning and income strategies, with his insights featured across financial outlets and Investing Daily publications.

Is Jim Pearce Legit?

Yes, Pearce is a seasoned analyst with a long track record.

His credibility rests on both his academic background and decades of hands‑on experience.

With more than $50 million in assets under management earlier in his career, he has proven that his methods can work in the real world, not just on paper.

As a contributing editor for numerous financial newsletters, Pearce has published hundreds of articles on personal finance and has been quoted in respected outlets for his views on retirement income and tax‑efficient investing.

His approach has consistently emphasized safety and sustainability over speculation, which is why thousands of subscribers have followed his guidance for years.

While no advisor can guarantee results, Pearce’s history, expertise, and published record position him as a legitimate and trusted figure in the personal finance space.

What is Investing Daily?

Investing Daily is a financial research publisher that has been around for nearly half a century.

Its services range from conservative income strategies to more specialized sector research, covering everything from dividend stocks to emerging trends like AI and energy.

What makes Investing Daily appealing is its balance of professional-level analysis with easy-to-follow recommendations for everyday readers.

For many, the attraction lies in having a trusted source that simplifies complex markets into practical strategies.

What is the “$2,105/Month Income” Presentation?

Most retirees know Social Security alone won’t cover the bills, and even younger savers worry about rising taxes and shrinking benefits.

That’s why the promise of collecting as much as $2,105 a month in extra income caught my attention.

It’s presented as a way to fill the gap without depending on government checks or risky speculation.

For anyone who wants more breathing room in their budget, this pitch feels immediately relevant.

Let’s take a look at how it all works.

The Problem Most People Face

Relying solely on Social Security or a pension can leave you stuck living on less than $25,000 a year, barely enough to stay above the poverty line.

Pearce highlights how many Americans are blindsided by possible cuts to benefits and rising retirement ages.

It makes sense to look for a solution that isn’t tied to Washington’s decisions, and the example stories of ordinary people collecting thousands each year made it relatable.

The Solution on the Table

Instead of chasing complicated investments, Jim’s focus is on a special type of company arrangement that legally requires payouts to its members.

What’s even more intriguing is that these companies are legally required to pay out a share of their profits to members.

That structure makes the opportunity different from typical dividend plays, and it’s pitched as something almost anyone can start with a modest investment.

The concept is crystal clear in my eyes, but what’s the ticket to getting involved?

The Buck Stops Here

The bottom line is simple: this strategy could provide the kind of monthly cash flow that makes life less stressful.

It won’t replace a job overnight, but it could help cover bills, fund travel, or pad a retirement account.

Jim’s presentation makes it clear that the chance to get in is time-sensitive, with payout deadlines tied to set schedules.

To see exactly how it works and how to put your name on the list, you’ll need to join Personal Finance.

That’s where the step-by-step guidance is laid out, and it leads directly into what comes with the service.

Investing Daily Personal Finance Review: What is Included?

Here’s everything you can expect as a Personal Finance subscriber.

> > Join Personal Finance to Access These Benefits Now <<

Investing Daily’s Personal Finance Newsletter

The Investing Daily Personal Finance newsletter is the crux of the service and where you can find the latest trade recommendations and the week’s biggest market-moving news.

Every week, the Daily Personal Finance Newsletter recommendations have the potential to lead you to regular gains in the options market.

Each issue is packed with market insights and step-by-step strategies aimed at generating safe, consistent income.

Unlike many competitors that simply follow the latest trends, Personal Finance scours the market for diamond-in-the-dirt opportunities on the options market.

Jim Pearce and his team explain opportunities in plain language so you know exactly why a move makes sense and how to take action. It’s designed to help you build confidence while growing your portfolio.

Weekly Updates

Subscribers receive three updates each week that go beyond surface-level market commentary.

Each one highlights the most important developments shaping stocks, interest rates, and broader economic conditions, and then connects those events to practical investment steps you can take right away.

For example, one update might explain how rising interest rates create opportunities in high-yield income plays, while another breaks down why a specific sector is positioned to deliver double-digit returns.

What makes them especially valuable is the timing. They arrive quickly enough to help you act before the window of opportunity closes.

Flash Trade Alerts

Markets don’t wait, and neither does this service.

These alerts provide clear, step-by-step instructions so you know exactly what action to take and why it matters.

They’re designed to be quick and easy to follow, even if you’re checking your phone during a busy day.

This feature ensures you’re never left wondering how to respond when conditions change.

I’ve found that these can be the difference between capturing gains and missing out, making them one of the most practical benefits of the membership.

Private Website Access

Your subscription also unlocks a members-only website that serves as the central hub for everything Personal Finance.

It acts as a central dashboard, bringing together every tool and resource in one place.

The site also houses an archive of all newsletters, flash alerts, and research reports, making it easy to track past recommendations or revisit strategies whenever you need.

It’s designed to be simple enough for new members to navigate, yet comprehensive enough for seasoned readers to rely on daily.

Direct Team Access

One of the standout features of Personal Finance is the ability to interact with Jim Pearce’s research team through the Stock Talk message boards.

This isn’t just a static FAQ page; it’s a forum where subscribers can post questions about recent recommendations, market developments, or even general investing concepts.

The team responds directly, giving clarity and context that you won’t find in most financial newsletters.

While they can’t provide personalized investment planning, the back-and-forth dialogue makes you feel like part of a community instead of just a reader.

Having direct access to the editors who create the research helps build trust and gives you confidence when acting on recommendations.

First-Class Customer Service

Good customer support can make or break a subscription, and Personal Finance takes this part seriously.

The service includes access to a dedicated U.S.-based customer service team that focuses only on Investing Daily products.

When you call or email, you’re speaking with someone who understands the research and the resources available to you, not a generic call center.

They help with everything from website access issues to questions about receiving alerts, and they do so promptly.

It’s a feature that ensures members don’t just receive solid research, but also have the backing of a responsive team whenever they need assistance.

>> Make Your First “Easy-Start” Options Trade Now <<

Investing Daily Personal Finance Bonus Reports

Jim Pearce includes the following detailed bonus reports with every subscription to Personal Finance:

Bonus Report 1: How To Collect An Extra $2,105 A Month In Income

This report explains a government-linked arrangement that legally requires companies to distribute a large portion of their profits to members.

The information is laid out step by step, making it easy to understand how these payouts are generated, why they are consistent, and how to put your name on the list.

It’s aimed at anyone who wants a clear, practical path to adding meaningful cash flow to their monthly budget.

Bonus Report 2: The 9-Minute Secret To Consistently Making Extra Cash

In this report, Pearce shares a strategy that can be executed in less than 10 minutes per week and has produced consistent results for years.

It shows how everyday people have used it to average $185 a day, which adds up to more than $67,000 annually.

This is especially attractive for busy readers who want a straightforward, time-efficient way to generate extra money without taking on excessive risk.

Bonus Report 3: The Biggest Legal Loophole in the IRS Tax Code

Taxes can erode investment gains quickly, which is why this report focuses on a special type of account that allows income and gains to grow tax-free.

The report outlines how to set one up, what rules to follow, and how to use it to maximize income strategies shared in the newsletter.

For anyone concerned about rising taxes in retirement, this report offers a valuable tool for keeping more of what you earn

Bonus Report 4: How To Collect Up To $24,424 (or more) From the AI Superboom (Two-Year Subscription Only)

This report zeroes in on a company positioned at the center of the artificial intelligence revolution.

The report outlines how to invest, what the payout schedule looks like, and why these distributions could grow as AI adoption accelerates.

What makes this report especially compelling is that it frames AI not just as a high-growth industry, but as a reliable source of recurring income if you know where to look.

Bonus Report 5: Virtual Landlording: How To Profit From Real Estate For Pennies On The Dollar (Two-Year Subscription Only)

This report explores how to capture real estate income without buying property or taking on the headaches of being a landlord.

Pearce explains how Real Estate Investment Trusts (REITs) allow folks to benefit from property income streams with far less risk and upfront capital.

The report highlights case studies of how REITs have outperformed the stock market over long periods and provides examples of which types of REITs are best positioned now.

For readers interested in real estate but not the hassles that come with it, this guide lays out a practical alternative.

>> Try Investing Daily Personal Finance now <<

Refund Policy

Every subscription to Personal Finance comes with a clear and generous refund policy.

If during that time you feel it isn’t right for you, you can request a full refund with no questions asked.

Even after the initial 90 days, Investing Daily will refund the unused portion of your subscription if you decide to cancel.

Importantly, you also keep all of the bonus reports and research you received, making the trial essentially risk-free.

Investing Daily Personal Finance Reviews

We found a few Investing Daily reviews to give you a better idea of what customers are saying.

Hear what satisfied subscribers have to say about the service.

“Well, I am receiving an average of >40% return on my investment advised by investing daily experts. This is much improved over my previous adviser with less overall fees. Moreover, the information shared with the services provide excellent insight and tools to evaluate recommendations. Anything worth having does take some work.” –

— Anonymous Visitor, RepDigger

Another Personal Finance review reads:

“Jim Fink is extremely thorough in describing his recommended trades and the rationale for his recommendations. If an option is prematurely assigned, his people are very responsive in assisting his subscribers in “fixing” their problem. I am delighted with the service, support, and results.”

— Kenzo, StockGumShoe

>> Join Personal Finance now for as little as $49 <<

Is Personal Finance Right for Me?

Personal Finance is a respected member of the research community.

It has a lengthy track record of performance, and it’s earned a loyal following among its users.

A balanced research service like this has wide appeal, so it’s a good all-around fit for just about anyone.

However, it’s a particularly excellent option if you fall into the following categories.

Interested in Options

So, you want to learn how to trade options?

If so, this could be your best… option.

It’s a relatively simple system compared to some of the super-complicated strategies favored by less reputable competitors.

Personal Finance‘s system is so easy that even a total beginner can learn it comparatively quickly.

Seasoned Stock Pickers

Stocks are just the beginning of the investing rabbit hole.

Options give you access to a whole new world of sophisticated trading strategies.

Unfortunately, if you’re an advanced stock trader, you’re missing out on a lot by not trading options.

With Personal Finance, you’ll be slinging puts and calls in no time.

Calculated Risk-Takers

Options can be VERY risky if they’re not utilized properly.

It’s one of the reasons many people avoid them.

Fortunately, Personal Finance takes a balanced approach to options trading.

Instead of trying to knock the ball out of the park on every trade, Personal Finance shows you how to make consistent profits from predictable fluctuations in the stock market.

Beginners

The premium package includes a wealth of additional resources that are particularly valuable for beginners.

Fink’s reports give you an end-to-end introduction to options trading.

They also include information that can minimize your tax costs, sharpen your stock-picking skills, and more.

Pros and Cons

Like any service, Personal Finance has its ups and downs.

Here are the best and worst aspects we could find about the service in our Personal Finance Review.

Pros

- Affordable price point

- Robust educational component

- Includes weekly market updates and trade recommendations

- A balanced strategy that emphasizes small, consistent gains

- Provides a step-by-step walkthrough of the entire options trading process

- Includes five bonus reports

- 90-day risk-free guarantee

Cons

- Limited focus, options only

- It could be too tame for aggressive risk profiles

>> Take your trades to the next level with Personal Finance <<

Investing Daily Personal Finance Track Record & Past Performance

Personal Finance has a track record few newsletters can match.

Jim Pearce and the Investing Daily team highlight safe, income‑producing opportunities and have consistently focused on dividend stocks, REITs, and conservative strategies designed to preserve wealth while still growing it.

Many subscribers report double‑digit returns, steady dividend income, and the ability to fund retirements using Pearce’s recommendations.

The service now counts close to 20,000 members, which underscores the trust it has built over time.

While past performance never guarantees future results, the longevity of Personal Finance and the repeated positive feedback from long‑time subscribers demonstrate a strong history of helping readers achieve reliable financial outcomes.

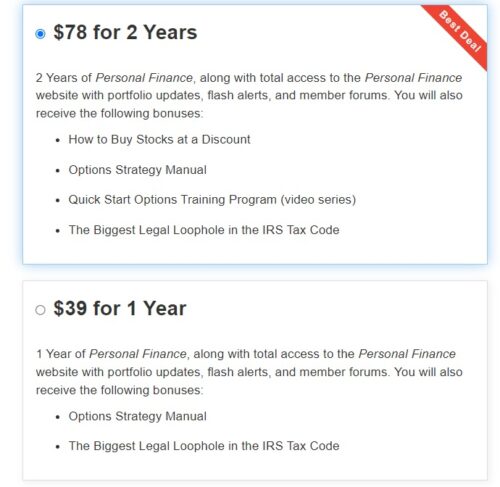

How Much Does Personal Finance Cost?

The cost of Personal Finance is surprisingly affordable compared to many other research services.

At the time of writing, the best deal available is a two-year plan priced at $78, which works out to just a little over 10 cents a day.

This option includes full access to the website, model portfolios, weekly updates, flash trade alerts, and all five bonus reports valued at more than $700 combined.

For those who prefer a shorter commitment, there is also a one-year plan available for $39.

While it comes with fewer bonus materials, it still provides the core newsletter and weekly guidance.

Considering the amount of actionable research, ongoing updates, and additional resources included, these plans deliver substantial value for the money.

>> Join Personal Finance today for as little as $39 <<

Is Investing Daily Personal Finance Worth It?

When weighing the overall value, the numbers speak for themselves.

For under $80, members receive two years of guidance, research, bonus reports, and access to a team of analysts with decades of experience.

Honestly, the service could quickly pay for itself if even one recommendation helps you secure a steady dividend or avoid a costly mistake.

The affordability, paired with a 90-day guarantee, makes it a low-risk way to explore income strategies that have been refined over nearly five decades.

In this Investing Daily Personal Finance review, what stands out most is the balance between credibility and accessibility.

Jim Pearce doesn’t promise overnight riches, but instead focuses on strategies that can realistically strengthen your finances month after month.

Sign up today to set yourself up for your chance at consistent income.

Tags:

Tags: