Veteran investor Robert Rapier is laying the groundwork for a dividend map he believes can deliver significant yields for your pocketbook.

Are the 33% yields he boasts about really possible, or is this guru full of hot air?

In this Utility Forecaster review, I’ll give you the full breakdown of the presentation, the promise, and whether it’s worth your hard-earned cash.

>> Sign up NOW and SAVE 73% <<

What Is Utility Forecaster?

Utility Forecaster is a monthly investment advisory service dedicated to helping readers generate consistent and growing income from essential-service companies.

Published by Investing Daily, this research service stands apart because of its exclusive focus on sectors that provide products and services we can’t live without: electricity, water, gas, and telecom services.

What makes this publication particularly compelling to me, though, is its longevity.

The newsletter has been around since 1989, and I can count on one hand the number of services I know of with a similar track record.

It’s weathered all kinds of market turmoil — from the tech bust of 2000 to the global financial crisis of 2008 to the pandemic-driven volatility of 2020.

Subscribers get weekly email updates, safety ratings, model portfolio access, and in-depth guidance on how to manage and grow their income portfolios.

The core philosophy here is simple but powerful: focus on companies that enjoy legal monopolies, regulated pricing, and customer bases that will never stop paying.

Is Utility Forecaster Legit?

Utility Forecaster is a legit newsletter led by a real expert in utilities and income investing. Robert Rapier’s extensive insights into utilities and dividend stocks provide even more value to the analysis on offer.

There’s a lot to like about this dividend-focused service, but Rapier’s direct experience in energy is at the top of the list for me.

I mentioned it already, but the 35+ year history is nothing to laugh at. Utility Forecaster is not a fly-by-night operation but a quality newsletter led by big names from day one.

Who is Robert Rapier?

Robert Rapier is a seasoned energy executive, chemical engineer, and financial analyst with over 30 years of experience in the oil, gas, and utility industries.

He holds patents in synthetic fuel technology and has worked for several major energy firms around the world, and that’s just half his story.

On the investing side, Robert has attracted wealthy private investors and hedge fund backers thanks to his years of success.

The guru even stopped short of obtaining his PhD because he was having more fun and I can only assume making more money from his energy stock investments.

While he’s not a flashy media personality, Rapier’s appeal lies in his unique background and real-world experience in just about every facet of the energy industry.

Now, Rapier serves as the chief strategist for Utility Forecaster, where he’s been applying his methodical approach to build high-performing income portfolios.

Is Robert Rapier Legit?

Yes, Robert Rapier is legit, and refreshingly so. In fact, his credibility is grounded in data and duration.

It’s not often you find someone so rooted in one particular industry, making Rapier someone well worth listening to on energy matters.

The guru has contributed to major media outlets including Forbes, The Wall Street Journal, and Bloomberg, and is also the author of the book Power Plays: Energy Options in the Age of Peak Oil.

Despite being so knowledgeable, I’m a fan of his quiet demeanor and humility that more people should have.

The insights Rapier offers into cash cow dividend stocks are unlike anything I’ve ever seen and can resonate with just about any portfolio.

What Is Investing Daily?

Investing Daily is a reputable publisher that has been a long-standing force in the world of investment research for close to 40 years. Few firms in the industry have as much staying power or an eye for talent.

While Robert Rapier’s Utility Forecaster newsletter is one of its most popular offers, the company publishes many others that I highly praise.

With a reputation to write home about, folks know to rely on Investing Daily for providing high-quality stock market news and analysis.

What is The Incredible Dividend Map?

There are no certainties when it comes to the stock market, no matter who you ask.

As much as I hate to admit it, the old playbook no longer works, and uncertain periods like COVID-19 have completely derailed many of us.

Despite the turmoil, dividends can fare well even in troubling times, offering at least somewhat consistent payouts to folks with a buy-in.

The downside is that many of these stocks end up being lackluster in my experience and don’t yield nearly what I had hoped.

Imagine how much different your savings or retirement account would look if you could pull in 33% or higher yields on a regular basis?

That’s what Rapier’s Dividend Map seeks to do through a series of carefully selected plays.

Why These Stocks Deserve Your Attention

The Dividend Map’s secret lies in what Rapier calls “essential” businesses.

Think water, heat, and electricity; things we simply can’t live without, especially in parts of the country where temperature extremes (like here in Michigan) are bad enough to kill people outright.

I’ll be the first to admit that these industries aren’t glamorous, but they sure are lucrative in the long run.

They look great for dividends though, with regular payments they increase periodically to keep shareholders happy.

Sounds like a win-win to me.

Here’s where it gets even more interesting – Robert argues that the list of “must-haves” keeps getting longer.

I may not entirely agree with the assessment, but there’s an increase in the number of folks who simply can’t live without smartphones, streaming services, or even music.

Customers set up auto-pay and even stick around when prices increase year after year, making these industries feel just as essential as the air we breathe.

How You Can Tap Into This Strategy

These sectors may change over time, but the payouts remain the same.

The trick is simply staying apprised of what these industries are and when the timing is right to get involved.

Rapier’s Incredible Dividend Map is an apt solution to that conundrum, painting a complete picture of where the top dividend payouts are no matter the season we’re in.

You can get complete access to this powerful tool and a whole lot more by signing up for Utility Forecaster right now.

Next up, I want to take a thorough look at everything that comes with the Incredible Dividend Map bundle so you can decide if it’s right for you.

>> Get Robert’s top picks today! <<

Utility Forecaster Review: Key Features & Functionality

52 Utility Forecaster Newsletter Issues

The load-bearing pillar of your subscription is the Utility Forecaster newsletter, which is delivered weekly via email.

Each issue includes timely updates on portfolio holdings, new buy or sell recommendations, and in-depth research on relevant economic and sector-specific trends.

Having read through several of these, it’s way more than a PDF summary — this is a full investment strategy blueprint tailored for income-focused readers.

The Friday updates aren’t limited to written reports, which is awesome for folks like me who get distracted easily.

I’ve also seen my share of bonus issues and video briefings, where Rapier breaks down market activity and portfolio strategy.

Model Portfolio

I like to live inside model portfolios, and Robert keeps a really impressive one.

While it certainly contains a list of his active stocks, Rapier makes sure to include live buy/sell guidance so you’re always in the know.

The portfolio currently features 41 high-yield essential service companies selected from a universe of over 200.

Each of these stays up to date with detailed data so you can decide your next step, and the team watches for factors like dividend safety, price appreciation potential, and sector balance as well.

Alerts & Updates

In addition to the weekly newsletter, I receive real-time alerts whenever major shifts occur.

If a company’s fundamentals change, if there’s a new buying opportunity, or if macroeconomic factors impact the portfolio, an email comes right to my inbox.

That way, I can make timely decisions without emotion as long as I’m somewhere with internet access.

There are also performance updates, quarterly reports, and deep dives into upcoming sectors that help you shore up which opportunities to lean into.

>> Join now to unlock top retirement opportunities <<

Access to the Full Archive of Past Issues and Reports

When you become a subscriber, you gain full access to a treasure trove of research dating back a number of years.

The archive includes past newsletters, special reports, stock ratings, and portfolio updates.

This allows you to see how past picks performed, how recommendations evolved over time, and understand the methodology behind each selection.

Some of the content here gets outdated over time, but there’s plenty of relevant topics to chew on.

I use it as an educational library for learning about topics I don’t know in hopes of becoming better at this investing game.

Password-Protected Website Dashboard

The Utility Forecaster website provides a clean, user-friendly dashboard where you can find all the resources I talked about earlier.

That means the latest newsletter issue, model portfolio, safety scores, trade alerts, and member-only research are all in one place.

Whether you’re logging in weekly or monthly, it offers a central hub for managing your investments with ease.

This dashboard also makes it easy to track dividend reinvestment strategies, portfolio diversification, and performance metrics in real time.

Everything is organized and accessible, removing the guesswork from income investing.

First-Class Customer Service with U.S.-Based Reps

Support isn’t an afterthought here. Utility Forecaster’s customer service is handled by a dedicated U.S.-based team trained specifically to work with investors.

Whether it’s help logging in, understanding a recommendation, or managing your subscription, these reps are known for being patient, responsive, and knowledgeable.

You can reach the team via a toll-free number from 8:30 a.m. to 6:00 p.m. EST, Monday through Friday.

They’ll help with any questions you have, and they’re consistently praised for their professionalism and speed.

I say this in most of my reviews, but having live agents on the other end of the line is a must-have for me, and Utility Forecaster delivers.

>> Access Robert Rapier’s Latest Research and Recommendations now! <<

The Incredible Dividend Map Bonuses

These bonuses help connect Robert’s points and tie the bundle together in a big way:

The Incredible Dividend Map: 33 Cities Where Stocks Are Paying Us 33%

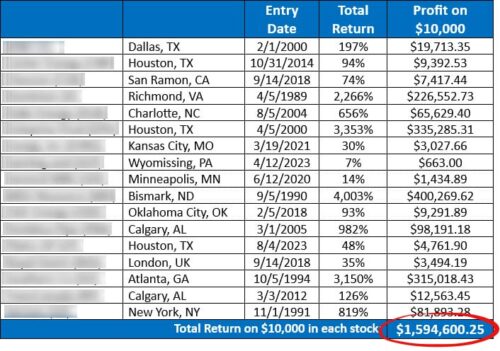

This flagship bonus is the centerpiece of the entire offer. It profiles 41 companies in 33 cities across the U.S. and abroad that are delivering average yields of 33% on cost.

Let that sink in for a moment – 33 cents on the dollar.

The report is packed with research, including company profiles, historical performance, and insights on future growth potential.

Rapier also explains the mechanics behind why these yields are possible, such as consistent dividend growth, reinvestment, and price stability.

The highlight of this report is a detailed look at five standout stocks, including a Minneapolis-based utility with a 60.9% yield, a Philadelphia water supplier yielding 99.5%, and a New Orleans firm yielding 101.6%.

Old School Stars: 4 Unstoppable Back-to-Basics Utility Stocks (2-Year Subscribers)

This report dives into four legacy utility companies that have built wealth for investors for decades.

You’ll rarely hear about these types of companies in the headlines, but they silently deliver uninterrupted dividends and price growth.

That’s the best kind, if you ask me.

Rapier highlights their regulatory advantages, long-term contracts, and recession-resistant earnings.

Each company goes under the magnifying glass for income and safety, and the report explains why these “boring” businesses may be the best place to build sustainable, multi-generational wealth.

The Gatekeepers: Three Companies That Control the Future of Natural Gas in America (2-Year Subscribers)

In this report, Rapier identifies three firms that dominate the natural gas supply chain in the U.S.

These companies own the pipelines, processing facilities, and distribution networks that keep gas flowing to millions of homes and businesses.

This infrastructure advantage translates to steady cash flow and the ability to pass on costs to folks like us who stick our feet in the door.

You’ll get the full scoop on each one in detail, but in Robert’s clear way of communicating.

With natural gas playing a bigger role in global energy, these companies are poised to benefit from long-term tailwinds.

Broadband Billions: These Three Powerhouses Are Here to Stay (2-Year Subscribers)

This bonus report shifts the focus to telecom, a rapidly growing utility sector.

Rapier outlines three companies with entrenched market positions in broadband, cable, and 5G benefiting from high customer stickiness and consistent price increases.

The report sheds light on how these companies are expanding their infrastructure, rolling out faster networks, and locking in subscribers through bundled services that keep those juicy dividends flowing.

These aren’t your typical growth stocks — they’re cash flow machines hiding in plain sight.

I may not think of telecom as an essential sector, but that doesn’t matter when so many other people do.

>> Get the Team’s Latest Insights Now! <<

Refund Policy

One of the most compelling aspects of this offer is the generous refund policy.

When you subscribe to Utility Forecaster, you have a full 90 days to try out the service.

If, at any point during those first three months, you decide it’s not for you, you can cancel and receive a 100% refund.

What makes it even better is that you can still keep the reports you received, including The Incredible Dividend Map.

Even after the initial 90 days, Rapier offers a prorated refund for the remainder of your subscription if you choose to change your mind later on.

There’s absolutely no risk in trying the service, and the refund policy adds a strong layer of trust to the offer.

>> Don’t miss out on this massive income opportunity—Join now! <<

Pros and Cons

I’ve done the digging for you, and here are the top pros and cons I’ve found:

| Category | Details |

|---|---|

| Pros | • Essential-service stock focus adds long-term safety • 33% yield on cost achievable with patience • Strong track record (803.9% average total return) • Weekly issues and updates • Up to four bonus reports • 90-day no-risk refund • Reports are data-driven, not hype-based • Affordable price point for new members |

| Cons | • Not ideal for short-term traders • Starting yields may feel low until compounding kicks in |

>> Save 73% when you join now! <<

Utility Forecaster Member Reviews

Member testimonials that I’ve seen for Utility Forecaster are overwhelmingly positive:

We’re not all going to see these exact results, but it’s clear that the system can work wonders for those who stay the course.

>> Enjoy these benefits and much more when you join <<

Utility Forecaster Accuracy & Reliability

The newsletter’s model portfolio has delivered an average return of 803.9%, with one standout pick returning as much as 4,003%.

These numbers are supported by real data, including dividend records, price appreciation, and reinvestment performance that you can look up yourself.

Rapier doesn’t rely on hype or speculative plays. Instead, his returns come from slow-and-steady compounding, dividend hikes, and stocks that rarely miss a payment.

That’s a rare track record in the world of financial newsletters.

Who Should Use Utility Forecaster

Robert makes Utility Forecaster incredibly low-hanging fruit for anyone interested in income, whether you’ve been chasing dividends for years or have yet to claim a single one.

He lays out the entire groundwork for his system so you can learn from square one if you’re not sure what you’re doing, and weekly newsletters plus active alerts mean you’re never alone.

Folks who have been around the block a few times (like me) will find a healthy respite from trying to track these consistent income-givers down on your own.

The opportunities and research literally show up in your inbox every Friday, and I just have to pick through the notes to decide if I want to partake or not. No more grueling searches.

Plus, Robert keeps us in the know when we need to make changes, freeing me up to actually have a life away from the computer.

Alternatives to Utility Forecaster

If Utility Forecaster isn’t your cup of tea, here are a few others I’ve tested that you might like:

Stansberry’s Income Intelligence

Income Intelligence stays true to income-focused investment recommendations that factor in total returns much like Utility Forecaster does. Many of its picks come from “safe” and discounted stocks that few people think about.

Weiss Investor Signals

A step adjacent to Utility Forecaster, Investor Signals shares a dozen categories including “best high-income stocks” that you can plug and play. It taps into the powerful Weiss Rating System that catalogues more than 50,000 stocks and mutual funds.

Motley Fool Stock Advisor

Another long-standing service, Stock Advisor gives, among other things, access to solid equity picks that go beyond the utility space. It’s also known for quality growth picks to help round out a portfolio.

Pricing and Plans

The cost of subscribing to Utility Forecaster is incredibly reasonable, especially given the quality and depth of the research provided.

A one-year subscription is priced at just $39, a 74% discount from the regular rate of $149.

If you’re ready to go all-in, the two-year plan is an even better deal at $78 because it gives you four bonus reports instead of one.

These rates break down to just 11 cents a day. And with a 90-day refund policy backing the subscription, there’s zero risk involved.

It’s one of the most affordable income strategies available to the public today.

You don’t get a price lock guarantee that some other services offer when it comes time to renew, so keep an eye on what the current rate is at that time, so you don’t get surprised.

>> Get the Income Blueprint Now! <<

Final Verdict: Is Utility Forecaster Worth It?

Final Verdict: Is Utility Forecaster Worth It?

If you’re looking for a get-rich-quick scheme, move along.

But if you’re serious about building long-term wealth through dividend compounding, The Incredible Dividend Map and Utility Forecaster could be your new best friend.

Rapier’s data is strong, the strategy is time-tested, and there’s a ton of content for you to chew on.

The Dividend Map itself is worth the cost of admission, but weekly newsletter issues, instead of the normal monthly fare, sweeten the pot further.

Speaking of pricing, what you get here is more than fair at just $39 per year. I’d highly recommend going the two-year route for the additional bonus reports.

Once you add in the refund policy, there’s really no reason not to test it out.

If you’re looking for a shot at some consistency in a topsy-turvy stock market, sign up for Utility Forecaster right away.

>> Sign up for Utility Forecaster NOW! <<

Utility Forecaster Frequently Asked Questions (FAQ)

How does the “safety rating system” used by Utility Forecaster work?

Utility Forecaster uses a proprietary safety-rating methodology to evaluate dividend-paying companies, looking at factors like regulatory exposure, balance sheet strength, cash flow stability, and dividend payout history. The goal is to filter for utility stocks that are not only high-yielding, but also resilient — companies that can maintain or grow their dividends even in economic downturns.

How frequently are new stock recommendations made in the service?

Subscribers receive weekly email issues, which include model portfolio updates, new buy/sell calls, and deep research. This frequent cadence ensures you’re kept up to date, allowing you to act on timely opportunities.

Is there a real, trackable model portfolio that utility forecaster subscribers can follow?

Yes — one of the key benefits of the service is a model portfolio. Robert Rapier tracks a live set of 40+ “essential-service” stocks (utilities, telecoms, water, etc.), and provides guidance on those holdings on a regular basis.

Can I access past issues and reports after I subscribe?

Yes, you get access to the full archive of past issues and special reports, which helps you review how previous recommendations performed and understand the methodology behind Rapier’s selections.

Are there real-time or alert-style updates included in the subscription?

Yes — in addition to regular newsletter issues, Utility Forecaster offers alerts when major changes happen (e.g., a company’s fundamentals shift or a new buy opportunity arises).

What kind of bonus reports or extras come with a subscription?

The subscription includes bonus reports such as “The Incredible Dividend Map” and other deep dives into top utility companies. These bonus reports provide actionable, high-yield ideas and thematic research on regulated, monopoly-style businesses.

How long is the refund window for Utility Forecaster?

Utility Forecaster offers a 90-day money-back guarantee. If you decide it’s not for you during that period, you can cancel and receive a full refund.

Who is the target audience for Utility Forecaster?

This service is ideal for income-focused investors, especially those interested in dividend stocks from regulated or essential-service companies (utilities, water, gas, telecom). It’s less suitable for very short-term traders; the strategy is built around long-term, stable income rather than fast growth.

Are the recommendations limited to U.S.-based utility companies?

While many of the companies highlighted are U.S.-based regulated utilities, the focus is broadly on “essential service” companies. That said, it’s quite rare to see a recommendation come from anywhere but domestically.

Does Utility Forecaster provide guidance on dividend reinvestment or “yield-on-cost” strategies?

Yes — part of the appeal of the “Incredible Dividend Map” and the model portfolio is in building long-term yield-on-cost by reinvesting dividends. Rapier’s strategy favors compounding through consistent dividend growth, rather than chasing high-yield yield traps.

How credible is Robert Rapier as a utility/energy analyst?

Robert Rapier is very experienced: he has a background in chemical engineering and decades of energy-sector experience. That deep industry knowledge and disciplined research approach give added credibility to his picks.

What happens to my access if I cancel after the refund window?

Because Utility Forecaster gives 90 days for a full refund, cancelling after that period may allow for a prorated refund depending on their policy. (Always check the terms when you sign up.)

Final Verdict: Is Utility Forecaster Worth It?

Final Verdict: Is Utility Forecaster Worth It? Tags:

Tags: