Long-time energy sector veteran Robert Rapier claims to have some new intel on hidden payments you can tap into for big gains. Is the guru onto something, or is his latest advice something to steer clear of? Check out my Utility Forecaster review for a full breakdown of this dividend-focused newsletter service.

What Is the Utility Forecaster?

Utility Forecaster is an income investing newsletter that delivers stock picks, weekly updates, The Incredible Dividend Map, and much more. It’s led by utility investor Robert Rapier and published by Investing Daily.

Some of the newsletter’s income investing recommendations include oil, natural gas, solar energy, telecommunications as well as electricity. It’s essentially a one-stop shop for dividend stocks backed by a large sector that many consider exceptionally stable for income investing.

This service has been around for nearly 30 years, and it has been led by a range of top-tier talent, including analysts with direct experience in the energy industry. One of Utility Forecaster’s most popular editors was Roger Conrad.

Robert Rapier took up the torch in 2018 and continues to carry on the long-standing tradition of providing dividend-focused trade ideas. His most popular insights are dividend safety ratings and The Incredible Dividend Map.

Rapier’s investment strategy could also be an excellent option for retirees looking to stretch out their nest eggs as far as they can.

Before we dive into our Utility Forecaster review, let’s dig a little deeper into why utility companies typically provide a strong foundation for dividends.

>> Sign up NOW and SAVE 73% <<

Are Utilities a Good Investment in 2025?

Utility stocks have unique characteristics that could make them a good investment in 2025 — especially for income investing.

For one, utility stocks have produced historically high dividend yields compared to other industries. Also, utility companies often have reliable revenue streams. And last but not least this industry has low-demand elasticity, which could be especially good during a recession.

All of these factors are vitally important for dividend investing, as companies can cut payouts when they experience a market downturn.

While nothing is certain, utility companies’ general predictability and consistent income make them solid targets for income investing.

What Sectors & Stocks Is Utility Forecaster Bullish On?

As you might guess from the name, Utility Forecaster hones in on utility stocks offering juicy dividends and a stress-free approach to making money.

That way, the service doesn’t have to dance around potential pitfalls coming from bull or bear markets that are known to upset other strategies.

Generally speaking, utilities remain crash-free even during troubling times, as humanity needs things like water and power to survive. Some might argue the portfolio is straight up boring, given a reasonably low risk.

Still, the potential gains from some of Utility Forecaster’s picks are nothing to scoff at. Some of its most stellar returns brought in as high as 2,100% when it came time to sell.

Utility Forecaster‘s Previous Editors

During its 30-year run, the Utility Forecaster newsletter has been led by a range of exceptional talent, including Robert Rapier, Roger Conrad, Ari Charney, Richard Stavros, and David Dittman. Aside from Rapier, Conrad is possibly the most recognizable out of the bunch.

Roger Conrad is an acclaimed utility investor and the original editor for the Utility Forecaster service. He helmed the newsletter between 1989 and 2013, and his insights appear to be well-received during his time.

Fast-forward to 2018, and Robert Rapier took the reins. He had a long-standing role as an analyst for Investing Daily, which made him a natural fit for the dividend stock subscription.

But who is Robert Rapier? Keep reading to find out.

>> Get the team’s latest insights now! <<

Who Is Robert Rapier?

Robert Rapier is a great analyst who pens excellent income investing research. He comes into the picture with undergraduate degrees in both chemistry and mathematics, adding a master’s in chemical engineering for good measure.

These skills allowed the guru to pursue a career in the energy sector for more than two decades.. His background as a chemical engineer includes work in the oil, gas, and renewable energy industries.

Investing Daily’s bio on Rapier puts it best:

“Robert is no armchair analyst—he has two decades of in-the-trenches experience in a wide range of fossil fuel and biofuel technologies, including refining, natural gas production, gas-to-liquids, ethanol production, and butanol production.”

— Investing Daily

If you read any of Rapier’s articles or investment research on energy or fossil fuels, it’s clear he knows his stuff.

>> Access Robert Rapier’s latest research and recommendations now! <<

Is Robert Rapier Legit?

In addition to his time serving in the utility field, Rapier has several years of experience as an investor.

I appreciate that Rapier has direct experience with the industries that he’s providing stock recommendations on. Many gurus tackle a niche that they don’t have first-hand knowledge of, and it can be difficult to tell if they really know what they are talking about.

In fact, Robert Rapier’s energy expertise has earned him interviews with several major networks over the years, including CNBC, Christian Science Monitor, PBS, Business News Network, Wall Street Journal, Washington Post, History Channel, and many more.

Rapier’s experience in the energy sector and oil and gas makes him a natural pick to lead Utility Forecaster. His background gives unique insights, and he has a knack for picking high-quality stocks, including ones that pay dividends.

What Is Investing Daily?

Investing Daily is a reputable publisher that has been a long-standing force in the world of investment research for close to 40 years. Few firms in the industry have as much staying power or an eye for talent.

While Robert Rapier’s Utility Forecaster newsletter is one of its most popular offers, the company publishes many others with high praise.

Investing Daily has been around for over four decades, and it’s earned a reputation for providing high-quality stock market news and analysis.

Utility Forecaster’s Bank of Biden Presentation

Many investment services chase after huge gains from the latest craze. The profits may be great, but they’re often short-lived.

From where I’m sitting, consistent cash flow month after month I can count on would better serve my family of four. Having a bit of extra stable cash sure goes a long way in uncertain times such as these.

Long-time guru Robert Rapier recently uncovered an opportunity from an unlikely source with the potential to put thousands into your bank account every month like clockwork.

Where’s all that money coming from? The reserves from the “Bank of Biden”.

>> Join now to unlock top retirement opportunities <<

Massive Income Opportunity

In 2020, Congress approved a mind-blowing $5.6 trillion for COVID relief. As you can imagine, the amount was overkill by a long shot.

Only $814 ended up going out to Americans for pandemic relief. The other $4.8 trillion sat in wait for years burning a hole in politicians’ pockets.

Now, they’ve finally started spending. For better or worse, it seems they’re done with the free hand-outs.

So, where is all that money going now? I’m glad you asked.

The answer’s pretty simple, at least according to Rapier. Any initiative that helps boost their approval ratings.

That could mean anything from public programs to statewide improvement efforts. Follow that money, and you’re going to find some amazing opportunities for profit.

After some extensive research, Robert Rapier believes a huge chunk of that leftover cash is headed toward the infrastructure market. I’m talking funds to the tune of $1.4 trillion.

Best of all, it’s super easy to claim your stake.

>> Don’t miss out on this massive income opportunity—Join now! <<

“So Easy It Feels Like Cheating the System”

Rapier targets this particular initiative for two very specific reasons. First, it captures over 25% of the government’s remaining relief budget.

Second, the beauty of infrastructure is that it’s essential to our well-being. We can no longer live without electricity, water, or even the internet. This sector isn’t going to simply buckle over during the next economic downturn.

Many of the companies holding up our infrastructure are already cash-rich utility stocks with zero debt. The extra money they’re about to receive is a recipe for even more revenue.

As those profits explode, they pay bigger and bigger dividends. Payouts could easily reach 12x higher than they are today.

Just about anyone is able to partake. Investing Daily and the Utility Forecaster team make it surprisingly easy.

All you have to do is log into a password-protected site and punch in the details they provide. Once you’ve done that, you’re set to reap the rewards.

How to Piggy Back off Government Spending

We’re looking at a once-in-a-lifetime loophole brought to life by a multi-trillion-dollar spending spree that’s about to take place.

To be clear, this opportunity isn’t some government program. The powers that be are literally investing more than $1 trillion into utility companies you can buy right on the stock market.

The avalanche of political turmoil could hand you up to $23,000 in extra cash each year. All you have to do is know where to invest.

That’s where Robert Rapier comes in. As soon as he caught wind of the government’s spending plan, he assembled a crack team of analysts to find the absolute best dividend stocks.

They’ve narrowed down the field to only utilities with both consistent dividend payments and the right moves to make serious profits from the government’s $1.4 trillion windfall.

You can get instant access to this list of dividend stocks with a Utility Forecaster subscription. Join me as I perform a deep dive into the service’s top features.

>> Get Robert’s top picks today! <<

What’s Included with Utility Forecaster?

Here’s what you get when you sign up under Rober Rapier’s Power Payers deal:

Utility Forecaster Newsletter

The Utility Forecaster newsletter is the primary vehicle for the service’s recommendations and stock market analysis. The monthly investment newsletter contains a ton of valuable information, and there are new Robert Rapier stock picks in every issue.

While each month is different, you’ll likely find featured information on how stocks are trending or a closer look at a particular stock.

The newsletter primarily covers utility stocks, but it also includes investment insights from Investing Daily and portfolio-building strategies.

If that wasn’t enough, the Utility Forecaster newsletter provides regular updates on Robert Rapier’s recommended utility stocks so you’re always in the know. This section also offers dividend safety ratings that measure the reliability of each stock’s dividend payouts.

>> Save 73% when you join now! <<

Weekly Updates

Along with the monthly newsletter, Utility Forecaster subscribers also receive weekly updates on the service’s recommended stocks.

These updates include up-to-date stock market analysis and detailed coverage of events that could impact the utility sector. This is a great feature for someone who wants to do more than set-it-and-forget-it investing.

So if you’re looking to take a more active role in your investments, you’ll definitely want to keep an eye out for these updates. They’re also great if you’re keeping tabs on other happenings in oil and gas or energy outside Utility Forecaster‘s recommendations.

Members Portal and Model Portfolio

Investing Daily’s password-protected members portal allows you to access all of your Utility Forecaster membership perks in a centralized location.

You can find past issues of Utility Forecaster, up-to-date model portfolios, and even a complete archive of previous special reports. Each growth portfolio also has 20 bond recommendations, as fixed-income investments can be a powerful hedge against volatility.

The members portal is your go-to for all the research you’ll need to navigate the stock market with confidence.

>> Join now to unlock all these features and more <<

Bank of Biden Bonus Reports

You’ll also get these in-depth research reports when you join Utility Forecaster.

Bank of Biden: How to Claim Up to $1,915 per Month in the Government’s Post-Pandemic Spending Spree

If you’re ready to claim your piece of the $1.4 trillion opportunity, the Bank of Biden is the place to start. Inside, Rapier meticulously records the details of three utility stocks perfectly positioned to win big from all that government spending.

Of these dividend stocks, the first has increased its shareholder payout yearly for 17 years straight. The second is run by a former politician who knows how to take full advantage of incoming funds, and the third is a Fortune 150 company set to receive billions in government spending.

It stands to reason that the additional intake from the government will only bolster the output to shareholders.

You’ll need to read the guide to get the rest of the story, including the names and ticker symbols of these stocks.

The Incredible Dividend Map: 27 Cities Where Stocks Are Paying Us 26%

Rapier’s hunt for dividend stocks led him to 27 opportunities in cities around the country that average a 26% effective yield.

He drills down on five in particular that have already been generating nice payouts for some time, but this report goes so much deeper. It becomes clear very quickly why these companies are so profitable.

You may not make a ton right out of the gate, but they’re primed to be excellent long-term income stocks to add to your portfolio. Rapier even spells out exactly how to start the money train rolling.

Better yet, each one is currently listed as a buy.

>> Join now to access hidden opportunities in the market <<

Liquid Gold Rush: How To Profit From the “Safest Stocks in the World”

One often-overlooked utility slated to win big from the Bank of Biden is water. That’s right – the very stuff we absolutely cannot live without.

Our reliance on H2O is the very reason why so many experts consider water stocks among the safest in the world.

More than $1 trillion dollars could pour into this sector over the next 25 years, with more than $50 billion already on the way. It’s no surprise water is on the list for top-rated buys.

In Liquid Gold Rush, Rapier and team identify the two companies set to grow the most.

The Dividend Dominators: How to Get a Double-Digit Dividend Raise Every Year

The kinds of payouts I’ve been talking about aren’t limited to just the utility sector. That opens the door to even more routine payouts from top dividend stocks if you know where to look.

Luckily, the Utility Forecaster team has done the research for you – and listed all their favorites right in this special report.

One dividend stock has nearly tripled payouts in its first five years, while another historically doubles every three. Two of the picks have grown their dividends more than 1,000% since first turning them on.

>> Sign up now to access these exclusive reports now! <<

The Income Blueprint

Robert doesn’t leave anything to chance while hunting for dividend stocks. He actually created a proprietary system to evaluate each one.

In essence, it works like a “credit check” to verify a company has the financial backbone to keep up with and grow payouts over time.

For the first time ever, Rapier’s sharing this income blueprint with all of us. You’ll learn how his system works and the criteria each dividend stock must pass before receiving his seal of approval.

If you don’t want to wait on the Utility Forecaster team’s recommendations, you could use this software to track down securities all on your own.

>> Get the income blueprint now! <<

Utility Forecaster Customer Service

If you need a bit of help along the way, there’s a team of customer service experts standing by to assist. They are available to answer all questions about your Utility Forecaster membership.

Even better, the team provides actual phone support. Genuine customer support is something of a rarity in this space, so we’re going to give this investment research service extra points here.

The team is available Monday through Friday (8:30 am to 6:00 pm EST), so you can conveniently contact them during typical office hours.

I find it reassuring whenever I know I can pick if the phone and speak to a real human if there’s a problem. I give Utility Forecaster credit for going above and beyond to take care of its members.

90-Day Money-Back Guarantee

Robert Rapier believes so much in Utility Forecaster that he offers a 90-day no-questions-asked money-back guarantee.

If you decide that the service isn’t for you within that 90-day period, you’re free to request a refund. This means there’s absolutely no risk to doing your due diligence and at least trying the service out, as you have nothing to lose.

To take the guarantee one step further, you can cancel any time after those first 90 days to receive a prorated refund for the remainder of your subscription.

>> Take advantage of 90-day guarantee when you sign up now <<

Pros and Cons

Utility Forecaster has many fantastic features worth mentioning.

Here’s a list of the pros and cons of the service.

Pros

- Monthly issues of Utility Forecaster newsletter

- New stock recommendations every month

- Weekly updates on recommended stocks

- Guru has a 30-year track record of success

- Multiple bonus reports

- Unlimited archives access through the member’s portal

- 90-day money-back guarantee

- Stellar customer support

- Affordably priced

- Unique focus on dividend stocks

Cons

- No community chat or forum

- Dividend stocks may be too slow for aggressive traders

>> Enjoy these benefits and much more when you join <<

Is Utility Forecaster Legit?

Utility Forecaster is a legit newsletter led by a real expert in utilities and income investing. Robert Rapier’s extensive insights into utilities and dividend stocks provide even more value to the analysis on offer.

There’s a lot to like about this dividend-focused service, but Rapier’s direct experience in energy is at the top of the list for us.

Something that also gives the service another level of credibility is its 30-year history. Utility Forecaster is not a fly-by-night operation.

This is a quality newsletter that has been backed by big names in income investing from day one.

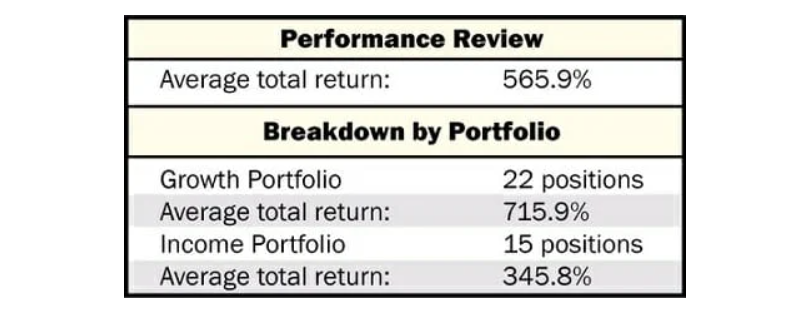

Utility Forecaster Track Record

Here are some notes on Utility Forecaster‘s recent performance from Robert Rapier’s latest presentation.

There’s no arguing with results, and most people would be very pleased to see returns like that in their portfolio. Clearly, Robert Rapier is doing something right with Utility Forecaster.

However, it is important to note that past results are not an indicator of future success.

Utility Forecaster Reviews by Real Members

I think this service has a lot going for it, but you don’t have to take my word for it.

Here are some Utility Forecaster reviews by real members that we could find online:

Remember, the results discussed in these reviews may not be typical, so take them with a grain of salt.

Nonetheless, these Utility Forecaster reviews demonstrate that some users have had excellent experiences with the service.

Is Utility Forecaster Right for Me?

Utility Forecaster could be a good fit for you if you fall into one of the following categories.

Long-Term Strategies – Utility stocks offer steady growth and dividend payments, making them an ideal choice for anyone interested in long-term investing strategies.

Income-Focused – Utility stocks tend to pay hefty dividends, so Utility Forecaster is a natural fit for people with an interest in income investing.

Low-Risk – Utility companies provide essential services and enjoy substantial governmental support. These types of stocks typically face fewer business risks than stocks with more conventional business models.

Sector Plays – Rotational sector investing has become a popular trend over the past few years, and Utility Forecaster‘s focus on one specific area makes it an excellent option for anyone who favors this approach.

>> Access the complete bundle now at 73% off! <<

How Much Does Utility Forecaster Cost?

Utility Forecaster has two subscription options for added flexibility. A one-year subscription gets you 12 months of the Utility Forecaster newsletter and all perks that come with it.

This deal includes flash alerts, member forums, and any portfolio updates, plus several bonus reports, for $39 per year. That’s a 73% discount off the cover price.

You can also opt for a two-year subscription priced at $78 a piece. There are no cost savings for switching to the two-year plan, but you’ll get the The Dividend Dominators report, which isn’t included in the one-year deal.

Is Utility Forecaster Worth It?

After an extensive Utility Forecaster review, I can attest to this service’s benefit and value. It offers a treasure trove of resources and information the can kick your portfolio into high gear.

A subscription comes with a new issue of the Utility Forecaster newsletter each month, along with new stock recommendations and frequent updates on how they’re faring.

That alone is worth the $39 membership fee per year.

Right now, Rapier’s throwing in details on five ‘Power Payer’ dividend stocks that have earned him hundreds of thousands of dollars over the years. They’re just as good now as they were back then, and you’ll learn the names of each one.

The fun doesn’t stop there. This bundle features a number of special reports containing even more opportunities to make some series income from dividends.

Rapier’s double-barreled guarantee ensures you’ve got nothing to lose. You have 90 days to try the service out for yourself before making any sort of commitment.

The best dividend stocks should be around forever, but you won’t make any money just twiddling your thumbs. Get started today to start racking in the dividends with Utility Forecaster now.

>> That’s it for my review. Claim your 73% discount BEFORE IT’S GONE! <<

Tags:

Tags: