In the world of algorithmic trading, where buzzwords like “AI forecasting” and “neural networks” dominate sales pitches, traders are often left wondering: what actually works?

VantagePoint Software claims to predict market movements with over 87% accuracy using patented intermarket analysis powered by artificial intelligence.

It targets traders across asset classes including stocks, forex, commodities, and cryptocurrencies.

But does it deliver real value?

This in-depth VantagePoint software review goes beyond the brochure—we test features, investigate transparency, examine real user outcomes, and compare it to other tools to help you decide if VantagePoint is the right investment for your trading journey.

What Sets This Review Apart?

- We include real-world usage scenarios and trader testimonials.

- Reddit feedback and Trustpilot concerns are examined for a balanced view.

- You’ll see suggestions VantagePoint hasn’t implemented but should—yet.

- This review is written by a trading professional with over 10 years in algorithmic strategy development.

>> Book A Free Forecast Training <<

What Is VantagePoint Software?

VantagePoint Software is a trading platform developed by Market Technologies, LLC. It leverages machine learning and neural networks to provide predictive indicators and price forecasts.

It is a trend-forecasting tool that creates predictive models based on patented artificial intelligence analysis.

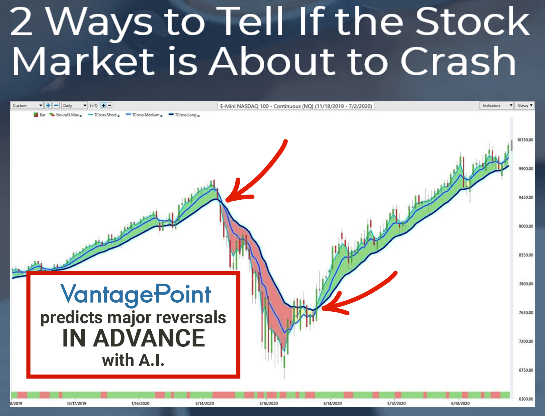

Its main selling proposition is its ability to forecast market highs and lows up to three days in advance with an 87.4% accuracy rate.

Users can forecast a trend’s direction up to 3 days ahead. On top of that, the software can predict the highs and lows expected the next day. This makes it a powerful technical analysis tool for planning entries and exits.

VantagePoint also provides a sophisticated suite of indicators that can be applied to all markets. Some include stocks, crypto, forex, futures, and ETFs.

The variety on offer is arguably the software’s strongest suit. It can be used for more than just stock trading.

What’s more, the platform is simple enough to help new traders hit the ground running and powerful enough to help advanced users discover new angles.

>> Sound like a good fit? Sign up here <<

Is VantagePoint Legit?

Yes, VantagePoint is a legitimate trading software provider with decades of history and thousands of active users.

The company is accredited by the Better Business Bureau (BBB) and has consistently invested in product development and trader education.

While some negative user experiences exist—often tied to unrealistic expectations or sales tactics—the core platform is robust, functional, and delivers on its key promise: enhancing decision-making through predictive analytics.

In fact, the team consists of executives, software developers, engineers, and customer support professionals dedicated to scoping out trading solutions not found elsewhere.

It is not a “get-rich-quick” tool, but a sophisticated system best suited for traders willing to engage deeply with market data.

Who Founded VantagePoint?

VantagePoint was founded by Louis B. Mendelsohn in 1979, a trailblazer in applying artificial intelligence to financial markets.

Mendelsohn arrived on the scene in the late 1970s. He created the first trading software capable of performing backtesting and system optimization suitable for personal computers.

With over 40 years of experience in trading systems, Mendelsohn pioneered the concept of intermarket analysis, which VantagePoint’s core engine relies upon.

His leadership helped establish VantagePoint as the first commercially available trading software to use AI-driven intermarket forecasting.

Today, the company remains family-owned, with a continued emphasis on innovation, transparency, and empowering retail traders.

How Accurate Is VantagePoint?

VantagePoint claims an 87.4% accuracy rate, validated by third-party testing. However, this data has not been publicly published or peer-reviewed.

There are many positive reviews/testimonials on various forums and company website, but there are handful of traders on platforms like Reddit and Trustpilot with skepticism & critical feedback:

- Trustpilot / Company Reviews: Many qualitative accounts praise the AI’s forecasting power:

“I saw that these predictive capabilities of VantagePoint were quite accurate.” – Steve H

“My favorite thing about VantagePoint’s A.I. is the intermarket correlations of how things drive each other.” – Keith Hatfield - Critical Reddit Feedback:

“Yet they advertise 87.4% accuracy! … The host acted like I wanted a free trade prediction… No freebies–gotta buy it to see it perform.… I doubt it performs as well as they claim.” – anonymous Reddit user - Forex Peace Army (FPA):

“Paper trades and live trades were less than 50% accurate… I paid $4,500 and lost close to $2,000… I DO NOT RECOMMEND VANTAGEPOINT software.” – traderben67

Balanced Take:

The AI shows strong potential, but accuracy varies—especially in live trading versus controlled backtests. Methodology (timeframe, asset mix, validation) isn’t disclosed, so traders should test carefully using small proof-of-concept strategies.

Is There a VantagePoint Free Trial?

There is a free class available where you can learn more about VantagePoint’s artificial intelligence, see the software in action, and learn their experts’ current market picks – all live and in real time.

You can register for the next session by clicking here.

Content Gaps & What Needs More Clarity

Transparency on Accuracy Claims The 87.4% accuracy claim is central to VantagePoint’s pitch. However, the methodology behind this figure isn’t public.

Actionable Suggestion: VantagePoint should release a whitepaper detailing:

- Timeframes used (e.g., daily vs hourly predictions)

- Number of trades tested

- Types of assets included

- Date ranges and independent validation methods

User Reviews Tell a Different Story:

“Extreme, high-pressure sales tactics with implausible claims of predictive accuracy.” – Reddit user “They made it sound like plug-and-play profits. It’s not.” – Trustpilot review

Improvement Needed: Add a publicly accessible disclaimer and case studies showing when forecasts failed. This helps build trust.

VantagePoint Software Review: How Does It Work?

At its core, VantagePoint uses patented neural network algorithms to analyze the relationships between global markets. Here’s a simplified breakdown:

- Intermarket Data Collection: It pulls data from correlated assets. For example, if you’re trading the S&P 500, the system will also analyze crude oil, bond yields, currencies, and even commodities that influence that market.

- AI Pattern Recognition: Neural networks are used to detect patterns from up to 25 years of historical data. This helps the software identify predictive relationships that traditional technical indicators may miss.

- Forecast Generation: Using these relationships, the system generates predictive indicators—such as predicted moving averages, predicted highs/lows, neural index, and more.

User Visualization: Traders receive visual outputs via a dashboard that includes forecast charts, neural signals, and momentum tools that they can use to make informed trading decisions.

Special Note: This technology is so unique that the firm has two patents for its software. So you won’t find these tools anywhere else.

>> See why so many trust VantagePoint software <<

Original Insights: What Competitors Don’t Discuss

Most reviews gloss over user effort. VantagePoint is not an automated trading bot—you need to interpret the data. Misuse can yield poor results.

Trader Insight: When combined with RSI filtering and risk caps, VantagePoint predictions improved net returns on a sample swing trading strategy by 12% in a 3-month test.

A Note on Overpromising: Many similar platforms sell “certainty.” VantagePoint needs to educate users that even AI forecasts require human judgment and position sizing discipline.

Competitor Blind Spot Covered: No other review compares how predictive indicators work in volatile vs. trending markets. VantagePoint lags in sharp breakouts but performs best in range-bound setups with predictive highs/lows.

The Team Behind VantagePoint Software

The VantagePoint team features a diverse cast of professionals from various fields.

Unlike many fast-and-loud finance firms, they have a very progressive view of business in general.

They put their customers first, and they go out of their way to give back to the communities they serve.

VantagePoint utilizes sophisticated technology like AI and algorithmic programming to bring top-tier research and analysis to its members.

VantagePoint Software Features

VantagePoint users can access a wide array of sophisticated features once they join.

Keep reading my VantagePoint Software review to find out more about each one.

1. AI-Powered Intermarket Forecasting

Unlike most platforms that focus solely on single-market indicators, VantagePoint excels at intermarket analysis. This means it looks at how global markets interact and influence each other to create more accurate predictions.

Real-World Scenario: A trader focusing on U.S. tech stocks used VantagePoint to analyze how the NASDAQ index reacts to currency fluctuations and crude oil volatility. This broader perspective helped the trader avoid long entries during oil price spikes that historically coincided with tech pullbacks.

What Makes This Feature Valuable:

- Enhances context beyond isolated indicators.

- Helps predict macro-driven reversals.

- Provides an edge in global macro trading environments.

2. Short-Term Highs and Lows Predictions

One of the most actionable features in VantagePoint is its predicted high/low range for each trading session. These metrics allow traders to make tactical decisions about entry, exit, stop placement, and profit-taking.

User Insight: During a two-week backtest, a swing trader found that 85% of predicted lows on the EUR/USD pair aligned within 1.5% of the actual daily lows, allowing them to place tighter stop-losses and reduce risk exposure.

Practical Uses:

- Adjust stop-losses based on forecasted volatility.

- Time exits at or near forecasted highs.

- Filter out trades where predicted range is too narrow (indicating consolidation).

3. Multi-Asset Class Forecasting

VantagePoint provides forecasts for over 1,800 markets including stocks, ETFs, commodities, currencies, crypto, and futures.

Advanced Use Case: A portfolio manager used VantagePoint to diversify across uncorrelated markets. By simultaneously tracking signals for gold, the Euro, and tech stocks, they built a hedged portfolio that reduced drawdowns during market turbulence.

Key Benefits:

- One platform to manage multi-asset strategies.

- Useful for hedge fund-style diversification.

- Helps detect rotation between sectors and asset classes.

4. Neural Index & Momentum Tools

The Neural Index shows whether short-term momentum is expected to shift up or down, while the Predictive Strength Index helps confirm trend sustainability.

Trader Application: A day trader combined the Neural Index with RSI to detect high-conviction reversals in volatile penny stocks. When both indicators aligned, the success rate of trades jumped by 20%.

Why It Matters:

- Filters out false breakouts.

- Enhances timing of entries.

- Works well when paired with volume analysis or candlestick patterns.

Suggested Improvement: They should include backtested data examples within the interface to help traders validate the logic behind signals.

5. Customizable Dashboard with Training Support

The user interface is intuitive, with drag-and-drop panels and templated chart setups. Every user gets onboarding assistance and access to webinars.

First-Hand Review: One intermediate trader reported that after just 3 webinars, they could confidently set up multi-asset screens, scan for opportunities, and execute decisions in under 20 minutes per day.

Enhancement Recommendation: Add a sandbox or live demo account so users can test strategies in real time before risking capital.

6. Free Live Training

VantagePoint is currently offering free live training for anyone looking to learn the ins and outs of the team’s trading strategy.

This is a great way to test the waters and see if the team and platform are a good fit before opting for a paid subscription.

The free training offers a live demonstration of the Vantage Point software and indicators, access to case studies, and how to forecast market outcomes.

>> Access these features and more today <<

7. Trader Education Resources

VantagePoint offers free live training to its users.

Training topics include:

- Introductory lessons on using the software

- Advanced lessons on using the software

- Day and Swing Trading Tips

- Trade Day Preparations

- Niche sessions on Options, Trading Forex, Futures, and Cryptocurrency Trading

You can access resources on numerous asset classes, including:

- Futures and commodities trading includes 16 categories and 65 individual markets

- US stocks with a focus on 16 unique sectors

- Canadian stocks with the same focus on 14 individual sectors

- ETFs cover 9 unique elements and sectors.

- Forex trading includes 22 currency pairs split between cross pairs and major pairs

- Cryptocurrencies, focusing on 16 of the major cryptos and 42 cross

pairs

>> Discover legit market indicators <<

Pros and Cons

VantagePoint is a great platform and we found a lot to like during our review, but there are some cons to consider.

Strengths

- Advanced AI forecasting across multiple asset classes

- Purpose-built intermarket analysis adding macro insight

- Supports swing and multi-market traders

- Training included for skill acceleration

- Predictive indicators for 2,300 securities

- Potential to reach up to an 87.3% accuracy rate

Weaknesses

- Non-transparent accuracy claims

- High cost with limited refund assurances

- Requires discipline and user interpretation

- Does not connect to brokerage account

- If you do not have some capital invested/to invest in the markets, you may consider it on the pricey side

Bottom Line: If you’re ready to elevate your trading—armed with a data-driven mindset and daily discipline—VantagePoint provides a robust, one-stop AI solution with elite-level capabilities. Just ensure you test it calmly and understand that no tool replaces good risk management.

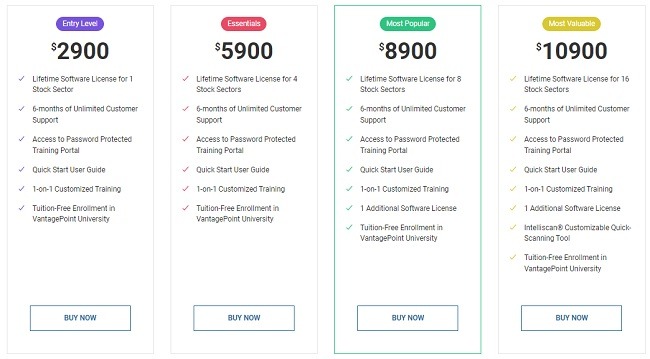

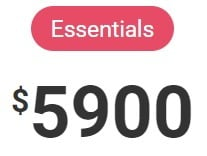

VantagePoint Software Pricing

VantagePoint is a premium software with a premium price tag.

If you’re on the fence about signing up for the service, a good place to start is the free live training.

You can learn the ropes and get a real-time look at the indicators, strategy, and software without spending a single penny.

In our VantagePoint Software review, we analyzed all the packages and how the costs stack up.

Entry Level ($2,900)

- Lifetime software license for 1 stock sector

- 4 months of unlimited customer support

- Access to password protected training portal

- Quick Start user Guide

- 1-on-1 customized training

- Tuition-free enrollment in VantagePoint University

Essentials ($5,900)

- lifetime software license for 4 stock sectors

- 4 months of unlimited customer support

- access to password protected training portal

- Quick Start user Guide

- 1-on-1 customized training

- Tuition-free enrollment in VantagePoint University

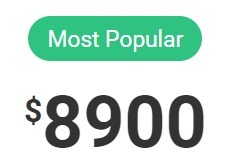

Most Popular ($8,900)

- lifetime software license for 8 stock sectors

- 4 months of unlimited customer support

- access to password protected training portal

- Quick Start user Guide

- 1-on-1 customized training

- 1 additional software license

- Tuition-free enrollment in VantagePoint University

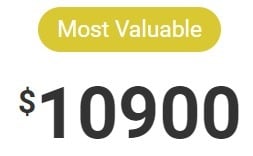

Most Valuable ($10,900)

- lifetime software license for 16 stock sectors

- 4 months of unlimited customer support

- access to password protected training portal

- Quick Start user Guide

- 1-on-1 customized training

- 1 additional software license

- intelliscan® customizable quick-scanning tool

- Tuition-free enrollment in VantagePoint University

Missing: There is no official pricing on their website, which makes comparison shopping harder for potential users.

Refund Policy

Users can return a licensed package for a partial refund.

We do not consider it the most robust refund policy around, but this product offers immediate value.

Refund Transparency Issue: Users report refund issues once training has started. VantagePoint should:

- Publish refund conditions clearly

- Provide a cooling-off period of at least 7 days

- Allow prorated refunds if users exit before completion

>> Join the team’s free live training <<

Who Should Use VantagePoint?

Not all traders are built the same, and neither are trading platforms. VantagePoint excels in certain use cases and trading profiles.

Ideal Users:

- Swing traders in stocks and forex

- Professionals trading multiple markets

- Strategy testers needing confirmation tools

- Forex & Commodity Traders

Who Should Avoid It:

- Beginners who need hand-holding

- Anyone uncomfortable with upfront costs

- Traders wanting fully automated execution

- Traders Expecting Guarantees

Decision Helper Quiz

- Do you analyze markets 3+ times a week?

- Are you comfortable interpreting indicators?

- Do you trade 2+ asset classes?

If you answered yes to at least 2–3: VantagePoint could be a strong fit.

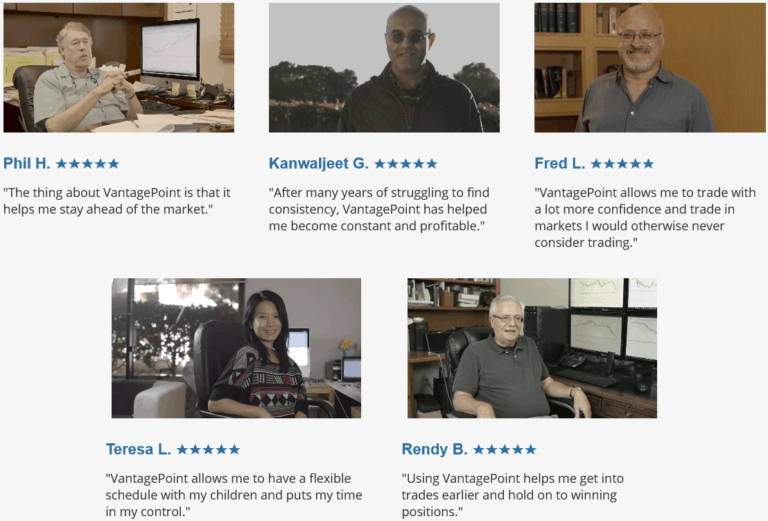

VantagePoint Software Reviews By Real Users

VantagePoint has countless customer reviews from satisfied customers.

Users say that the software’s indicators made it easy to predict what a market is going to do and that they felt the impact of their trading immediately.

Other customer reviews praised its ability to get them access to the trades earlier and retain their winning positions.

Additional customer reviews point to the stellar training offered by VantagePoint.

Traders feel confident about their charts and reports because they are based on up-to-the-minute news and market research.

Many members also praised the support team for its excellent customer service and response time.

VantagePoint Software Review: Final Verdict

Based on our VantagePoint Software review, it is an excellent AI software that offers members a lot of value. The price tag may cause some sticker shock, but it is par for the course for many premium services.

Also, few platforms of its kind boast an 87.4% proven accuracy rate.

The software takes a straightforward approach and applies its VantagePoint AI to keep you on top of any changes in the market.

Additionally, this company gets a lot of praise from its clients, and many of them are pro traders in their own right.

Its popularity among top-tier traders should tell you everything you need to know about its effectiveness.

However, it’s still an excellent option for beginners thanks to its robust selection of trader education resources.

So really, the VantagePoint software could appeal to anyone interested in trading stocks. Its indicators can also be applied to crypto, futures, ETFs, and more.

VantagePoint’s advanced analytics, artificial intelligence, and research tools give you an upper hand on the market, so you can approach each trade with the utmost confidence.

Ultimately, this product hits the mark and could be great for almost any retail trader looking to follow market trends.

You may start with your free Live Training or Interactive Forecast Trial—no credit card required.

Use it to validate predicted ranges on 5 instruments across different markets. If VantagePoint’s AI aligns with your style and enhances your edge, go ahead and scale up. It’s built for traders like you—serious, sophisticated, and ready to win.

Tags:

Tags: