The market is full of uncertainty, but the Weiss Ratings team claims that an old investment secret in their back pocket can turn the tide in your favor.

Do they really have the chops to pull off such a feat?

Well, I investigate in this Weiss Ratings Plus Investment Secret review, so that you can take an informed decision.

>> Try RPL Investment Secret Now! <<

Radical Shifts in the Stock Market Ahead

The Weiss Ratings team has been watching the market for nearly a century, detecting some of the biggest gains and losses before they ever took place.

Now, they believe a radical shift is just around the corner that would completely upend your savings if not careful.

Stocks that are currently up could come crashing down, while a number of silent companies could explode in ways we would never anticipate.

Folks caught unaware are undoubtedly at the mercy of these fickle markets, but anyone using these tools to predict change has a real shot at dodging the minefield.

Better yet, it’s possible to weather this storm and actually come out on top if you’re in the know.

What is this secret Weiss Ratings holds close to its chest?

Building a Long-Lasting Foundation

Thinking back 100 years, the market was in a somewhat similar situation to today.

Technological advances from cars to airplanes were the norm, and the market was expanding faster than the world had ever seen before.

All the excitement burst on Black Monday in 1929, a dark day that many people of the time were never able to recover from.

A young Irving Weiss saw the impending crash coming and was able to sidestep it completely, but his story doesn’t end there.

He went on to make a fortune from its aftermath, using formulas and systems that make up the base of Weiss Ratings’ platform today.

With his son Martin’s help, Weiss Ratings modernized and became more successful than ever before.

It’s this very service that we can all take advantage of today.

The Power of Weiss Ratings

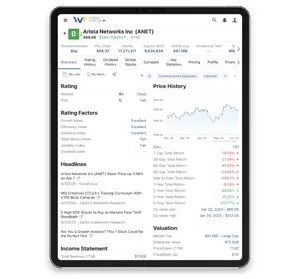

I’ve been able to play with the platform for some time and remain blown away by how easy it is to use.

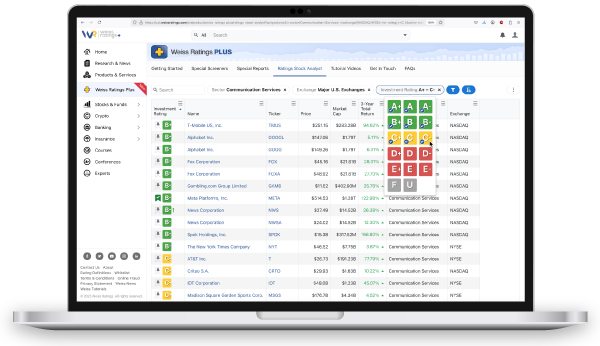

Weiss Ratings pores over more than 15,000 publicly traded stocks each day, running billions of calculations to assign each one a letter score.

These stocks receive a ranking from A to E in obvious fashion, indicating if each one is a buy, hold, or sell.

That’s all you need to know which way the platform predicts a stock is trending, but you can find way more information on these opportunities if you so choose.

You can use Weiss Ratings for both bull and bear markets as a way to avoid sinking stocks that appear to be destined for nothing other than parting you from your money.

Given all the market bumps Weiss Ratings sees on the horizon, there’s likely no better vessel to be on when it comes to bear.

How to Get Weiss Ratings to Work for You

This is your chance to harness the power of Weiss Ratings ahead of what could be a cataclysmic change to the stock market.

It’s proven effective during the Dot-Com bust, 2008’s financial crisis, and the crash of 2020, so why would it stop now?

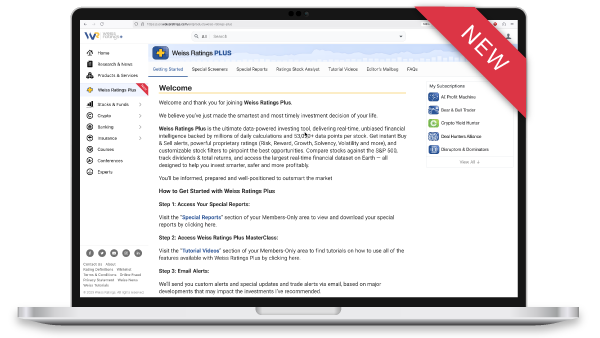

Your timing couldn’t be better, since Weiss Ratings revamped its entire platform not all that long ago.

You’ll get instant access to this and a slew of other powerful materials by signing up for Weiss Ratings Plus today, so you can start protecting your wealth before it’s too late.

Without further ado, let’s take a look at everything that comes with a membership.

Weiss Ratings Plus Investment Secret Review: What’s Included?

Check out all the features built into a Weiss Ratings Plus secret investment subscription:

Weiss Ratings Plus: America’s Most Advanced Stock Rating System

This special deal comes with full access to Weiss Ratings Plus, the most advanced tool the team has ever created designed to maximize your shot at gains.

It’s here that you’ll see and sift through all the recommendations coming from the platform right now, and which stocks have a less-than-stellar rating.

Clicking on stocks you’re interested in will allow you to gather more information about each one, such as why they’re on the list and how high (or low) you can expect them to go.

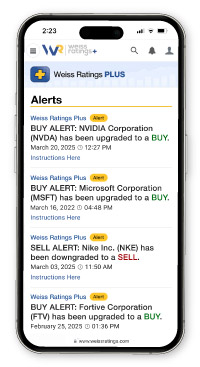

Instant “Buy & Sell” Alerts

Weiss Ratings Plus comes with a lightning-fast alert system that notifies you as soon as a stock moves into buy or sell range.

Having this info at your fingertips allows you to get into or out of a position at precisely the right time with the potential for growing wealth or minimizing loss.

I’ve got mine set up to come via email, and you can set limits on how many notifications you want to see.

The platform identified 272 new buy stocks last year alone, meaning a new opportunity could come your way nearly every single day.

Custom Reports

Besides browsing a curated list of buy and sell stocks, you’re free to run your own custom reports any time you choose.

Weiss Ratings keeps its scores up to date every day, so you’re free to search up any company by name or ticker to see how it fares.

I love looking at past momentum and making assessments based on that, and you can go as deep as you want with information.

Have a specific metric that interests you? Build it into your own custom report, whether you’re focusing on areas like dividends or growth.

My favorite part is that the system updates my reports automatically whenever there’s new data, saving me tons of time.

Comprehensive Stock Mart Insights

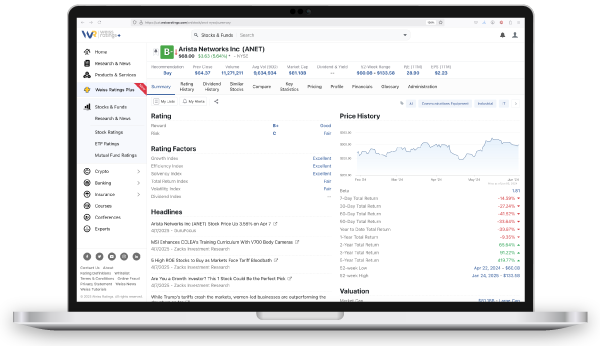

I alluded to this earlier, but Weiss Ratings Plus catalogs the rating history of any stock on the market.

It shows every single time that the stock went up or down in rank and all the reasons why, so you can look for patterns on your own.

These tools also serve to view how companies compare to the rest of the market, a particular index, or other tickers from the same sector, depending on your interest.

You can further filter assets by pertinent topics like cash flow, returns, and even the effectiveness of its management team to help you make informed decisions about your next investment.

>> Click here to get started <<

Weiss Rating Plus (RPL) Investment Secret Special Reports

These special reports come with a Ratings Plus membership if you act now:

Sell Alert: 5 Popular Stocks You Should Avoid Like the Plague

It doesn’t surprise me in the least that a pending market share-up would send some well-known stocks into a downward spiral.

The problem is, we’re not always sure which ones those are.

Weiss Ratings is one step ahead of all of us, cramming into this report five companies we should drop from our portfolios immediately.

I had to look twice at the list, as there were some names on there that definitely caught me off guard.

These ticking time bombs could erase any gains you make on Weiss Ratings and otherwise, and the team offers clear explanations of why each one is on its way down.

The Best 10 Stocks to Own in 2025 and Beyond

On the flip side, Weiss Ratings has identified ten hidden-away stocks that appear to be primed to explode when this big shift makes itself known.

The crew pulled together the names and ticker symbols of these companies in this special report, offering concise but clear reasons why each one made the list.

Since they were only just elevated to buys, this is also the perfect chance to invest before big money potentially starts pouring in.

You can see these in the Weiss Ratings Plus system too, but it’s nice to see them called out specifically here.

Top 3 Cryptos to Own in this Market

Weiss Ratings actually handles way more than just traditional stocks, and is the only platform I know of that ranks cryptocurrencies in much the same way.

Inside this guide, you’ll get to read about three digital currencies offering plenty of upside potential in the coming year.

These are entirely separate from the big names we’re already aware of, and being lesser-known, have a longer runway for growth.

You’ll receive the names and symbols for these coins, why they made the list, and information on where to buy them if dabbling in crypto is not yet your thing.

The Weiss Ratings “X Lists” Bundle

Individuals who act fast can also get their hands on an exclusive “X Lists” Bundle not up for grabs anywhere else that I’ve seen:

- The World’s Weakest and Strongest Banks

- America’s Weakest and Strongest Stocks and ETFs

- The World’s Weakest and Strongest Cryptos

This digital content allows you to quickly look up your own bank, ETFs, cryptocurrencies, and the like so you can quickly discern which to check out and which to avoid.

There’s nothing quite like this bundle anywhere else that I’m aware of, making this a solid addition to an already strong service.

“Ratings Plus MasterClass” Video Series

In a rare twist, the Weiss Ratings team put together an entire set of video tutorials showcasing how to use all the features jam-packed into the platform.

It explains in detail how the ratings system works, walking you through the steps and clicks needed to get the most out of it.

The video format is so much better than reading text, and you can follow along on your own device along the way.

I appreciate having these videos to fall back on any time I need a refresher or want to draw out more of what Weiss Ratings can do, since there’s just so much here that can work for you.

Refund Policy

The Weiss team wants to make its products as accessible as possible, and there’s no exception here.

You’re free to cancel at any time as long as you opt for Weiss Ratings Plus’s annual subscription, and you’ll get a prorated refund for the amount left on your membership.

Keep in mind that if you purchase any of the reports without a subscription, you won’t be able to return them.

How Much Does Weiss Ratings Plus Investment Secret Cost?

Adding up each of the materials in Weiss Ratings Plus, you’re looking at $465 in value.

As part of this special deal, you can have it all for just $99 per year. That’s 79% off the cover price!

That means you’re getting unlimited access to Weiss’s epic rating system for under $2 per week.

This of course comes with all the content I covered above as well, but it gets even better.

By signing up now, you can lock in the $99 yearly price point for as long as you’re a member, and that’s tough to beat.

It is possible to get only the report set for a one-time $49, but the amount of content you miss out on makes it a little hard for me to stomach.

>> Get access to Weiss’ Investment Secret NOW! <<

Is It Worth It?

Weiss Ratings Plus isn’t the first service I’ve reviewed from the Weiss Ratings team, but it carries the company’s banner exceptionally well.

Most platforms give you limited access to their most powerful tools (or at least hide the best behind an even bigger paywall), but that’s not the case here at all.

You can search up stocks or check ratings any time you want, taking a surface-level view or diving deep into analysis based on your needs in the moment.

The bonus materials make Weiss Ratings Plus even more appealing since they draw immediate attention to actionable moves you can make to counter upcoming market shifts.

Getting all this for just $99 per year is a total steal, and I love that you never have to worry about that fee going up as long as you remain a member.

Sign up to tap into the power of Weiss Ratings Plus Investment Secret and keep your investments moving in the right direction.

Tags:

Tags: