Wide-Moat Research Review

Real estate has long been at the center of America’s wealth story, and Brad Thomas believes that trend is entering a new chapter thanks to new government regulations.

He says this shift could create rare openings for everyday people if the assumptions behind it play out as expected.

In this Wide-Moat Research review, I break down his perspective so you can decide whether it offers a financial newsletter worth taking seriously.

What is Wide-Moat Research?

Wide-Moat Research is Brad Thomas’ real-estate-driven financial newsletter service built around helping all of us understand where long-term opportunities are forming.

At the heart of this offer is The Wide Moat Letter, where Brad shares the same type of research he’s used throughout his career as an analyst for major commercial deals.

It goes way beyond real estate, though, locating companies with long-term competitive advantages (which Brad calls wide moats).

Services that go where the money is instead of focusing on some arbitrary niche are always a win for me, as long as I can put them to good use.

Opportunities appear in the form of a monthly newsletter and a stack of other tools with actionable insights you can put to use with just a bit of effort.

It’s great for clear guidance, ongoing updates, and access to ideas shaped by someone who has spent decades inside the real estate world, spotting advantages that I’d likely never notice on my own.

>> Save 74% when you join now! <<

Who is Brad Thomas?

Brad Thomas started in real estate, building a booming empire for himself and his family. It all came to an abrupt end in the 2008 crash.

Climbing out from the ashes, Brad turned to a more long-term mindset to secure his finances both now and down the line.

His comeback story was nothing short of miraculous, building back everything he’d lost and then some.

Needless to say, Brad’s success caught the eye of several high-level individuals wanting the same security for themselves.

He’s even put his skills to the test with some of the most powerful people in our country.

President Trump invited Thomas in to serve on a Presidential Advisory Board during his first term.

Now, Brad funnels his experience and passion into Wide Moat Research, where he reaches more people than ever.

>> Get Brad’s latest research and insights <<

Is Brad Thomas Legit?

Thomas is as legit as they come, having served first-hand some of the top-ranking officials in our country.

His work has appeared in a number of popular publications, including Kiplinger, MSNBC, GlobeStreet, Forbes, CNN, Fox, and more.

His reliable investment strategies have also earned him top billing on Seeking Alpha, where more than 100,000 followers check out his insights regularly.

Brad’s accolades don’t stop there. He’s authored three investing books while serving as a podcast host and public speaker.

Thomas also teaches at NYU and has given guest lectures at Penn State, Georgetown, and Cornell.

Wide Moat Research Review: Are They Legit?

Founder of Wide Moat Research Brad Thomas has more than 30 years of investing experience under his belt, speaking volumes about the company’s credibility.

Wide Moat Research keeps most of its wins close to its chest, but Thomas’s riches-to-rags-to-riches story is incredible in itself.

The guru used the same strategies he now shares here to build back his personal wealth into the multimillions.

If that’s not someone worth listening to, I don’t know who is.

>> Access the team’s latest strategies now! <<

What Is Inside Brad Thomas’s “Trump’s Real Estate Deal for America” Presentation?

Brad Thomas begins by pointing to something I honestly think little about: how much land the federal government controls and how little of it has ever been available for meaningful economic use.

There aren’t many of these pockets in the Midwest where I live, but from coast to coast there are more than 259 million hectares held back for decades due to previous policies.

Why the Federal Land Unlock Matters More Than It Seems

History has a habit of repeating itself, and I’m okay with that when it comes to locating investment patterns.

It seems like whenever America is in times of duress (like we are now), tapping into our vast landscapes have saved the day time and again.

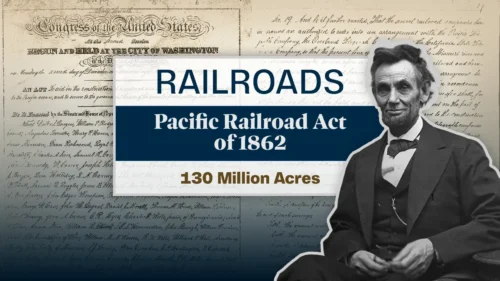

Think back to Lincoln’s Pacific Railway Act and how the release of federal land fueled massive expansion across the country.

There was even Roosevelt’s use of federal land during the Manhattan Project, a decision that played a role in the rise of companies like GE and DuPont.

The point is simple: each time the government made strategic land available, it reshaped industries and long-term wealth creation.

I know a lot of people got very wealthy from each of those initiatives, and we could be right at the cusp of another one.

How AI Turns This Land Unlock Into Something New

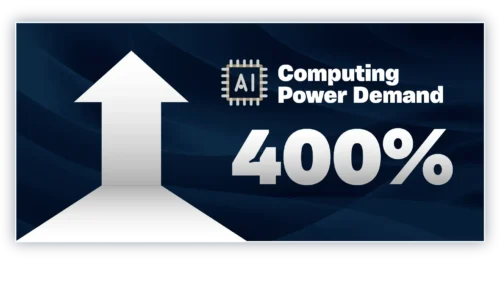

What really stood out to me is Brad’s explanation of why artificial intelligence changes the equation.

AI isn’t just algorithms; it requires large physical footprints: data centers, power capacity, transmission lines, and specialized infrastructure.

Last I checked, you need land for all of that.

Here’s the real kicker: Brad argues that the federal government cannot build this alone, which means private companies will play a central role in supporting this transformation.

As he lays it out, the demand for land suited for energy, storage, and AI-driven development could accelerate faster than people realize.

There’s No Better Time to Profit Than the Present

A lot of this remains firmly under the table: moments like this rarely announce themselves.

The government shifts policy, companies begin positioning, infrastructure plans form, and the impact slowly compounds before many of us even know what’s going on.

That means we usually miss these opportunities to cash in completely, but Brad gives us a rare tunnel to participate in the present, before anyone even breaks ground.

He believes several publicly traded businesses are aligning themselves with this transition, and he outlines a straightforward path for readers who want to understand where he thinks the strongest advantages may develop.

If the ideas in his presentation make sense to you, the full breakdown is inside Wide-Moat Research, where he continues sharing the companies and themes he believes stand to benefit most.

The next section explains exactly what comes with a membership and how Brad helps readers put this information to work.

>> Access Brad’s top AI stock picks now! <<

The Wide Moat Letter Review: What’s Included?

Here’s everything you’ll receive should you become a Wide Moat Letter member:

One Full Year of The Wide Moat Letter

One Full Year of The Wide Moat Letter

A full year of The Wide Moat Letter gives you access to Brad’s monthly deep-dive issues, where he breaks down the long-term real estate trends he’s following and the companies he believes are positioned to benefit.

I love that each issue reads like a conversation from someone who has spent decades inside the industry, explaining not just what is happening but why it matters in practical terms.

Brad walks readers through analysis tied to the U.S. land unlock and other economic shifts that influence the demand for data centers, grid upgrades, and large-scale development.

You’re only getting one or two investment ideas per month, but they’re carefully vetted and set on a firm foundation for success that you can tap right into.

Model Portfolio

The model portfolio is where Brad brings his research together in a clear, manageable format.

I can log in at any time to see any and all active recommendations, including the companies tied to the AI-driven land demand and the broader infrastructure themes highlighted in the presentation.

What stands out is how the portfolio serves as an ongoing reference point, giving you a snapshot of how each idea fits into the larger strategy.

It’s the best way to stay aligned with the platform’s long-term outlook, and I admittedly spend a lot of my time here between newsletter issues.

Complete Archive of Past Issues and Research

Complete Archive of Past Issues and Research

Access to the full archive is more valuable than I expected.

It lets you look back at Brad’s earlier work, see how themes developed, and understand how he approaches shifting real estate conditions.

His past issues include commentary on interest rate cycles, REIT valuations, infrastructure spending, and the kinds of economic environments where certain companies tend to outperform.

I found it useful to read older issues alongside newer ones because it highlights which patterns Brad considers durable and which ones adapt as new policies or economic pressures emerge.

You’ll go crazy trying to read all the content here, but it’s easy for me to find the topics I want to read about.

Wide Moat Daily

Wide Moat Daily

Wide Moat Daily adds a steady rhythm to the service by giving members quick, timely insights between the longer monthly issues.

Since you get a new issue daily, these updates reflect what Brad is watching in real time.

It could be news tied to federal land decisions, movements in key REIT sectors, or developments around energy and infrastructure companies.

I appreciate that these are quicker notes than the monthly newsletter, so I can get through them without taking too much time out of my day.

They help you stay connected to the bigger themes without feeling overwhelmed.

What makes them valuable is how Brad filters out noise and focuses on changes that could influence the companies he tracks inside the model portfolio.

>> Access all these features and special reports now! <<

The Wide-Moat Research Bonuses

Brad includes several bonus reports that build on the ideas he introduces in the presentation, and you get them for free here.

Bonus Report #1: Trump’s Real Estate Deal For America: Three REITs to Profit From The Federal AI Land Rush

Bonus Report #1: Trump’s Real Estate Deal For America: Three REITs to Profit From The Federal AI Land Rush

This report focuses on three real estate investment trusts Brad believes are aligned with the federal land unlock and the rising demand for AI-ready infrastructure.

These REITs are set to benefit from increased need for data center expansion, power-intensive development, and large parcels of usable land as new facilities come online.

I love seeing Brad’s approach shine here with his background in commercial real estate.

He shows how location quality, tenant strength, and long-term lease structures can further influence stability during periods of technological change.

Bonus Report #2: Powering the AI Age: Three Energy Stocks Set To Soar Under President Trump’s Deal

Bonus Report #2: Powering the AI Age: Three Energy Stocks Set To Soar Under President Trump’s Deal

Here, Brad shifts from real estate to the energy systems that support the AI buildout.

He highlights three companies he believes are positioned to benefit from rising electricity demand, expanded grid requirements, and modernized transmission networks.

We all know that AI growth isn’t possible without enormous power capacity, and that reality places certain utilities and energy-focused businesses at the center of the next phase of development.

You’ll get the inside story on why particular ventures stand head and shoulders above the others so you have a firm foundation to stand on as part of this real estate AI initiative.

Bonus Report #3: Red State REITs: Profit From America’s Pro-Growth Migration

Bonus Report #3: Red State REITs: Profit From America’s Pro-Growth Migration

This handy guide explores an ongoing demographic trend Brad believes is reshaping parts of the real estate market: the movement of Americans toward lower-tax, pro-growth states.

He explains how this shift has strengthened demand for industrial facilities, housing, logistics space, and service-oriented properties in certain regions.

With any shift, certain companies (in this case, REITs) avail themselves to benefit from population inflows that drive higher occupancy, rental growth, and new development activity.

It’s a clear portrait of why businesses operating in these states are set for long-term momentum, and you’ll finish reading with ways you can invest directly into that space.

Refund Policy

Refund Policy

The refund policy for Wide-Moat Research is straightforward and designed to take the pressure off anyone testing the service for the first time.

Brad offers a full 30-day money-back guarantee, giving you time to explore the monthly research, model portfolio, daily updates, and all bonus reports without feeling locked in.

If you decide the approach isn’t the right fit, you can request a complete refund during the first month, no questions asked.

I appreciate this because it opens the door to try everything with no real risk, especially if you want to see how Brad’s analysis and pacing match your own decision-making style.

>> Join risk-free under Brad’s 100% money-back guarantee <<

Pros and Cons of The Wide-Moat Letter

After reviewing all that The Wide Moat Letter has to offer, here are my top pros and cons:

Pros

- One year of Wide Moat Letter newsletter

- From renowned analyst Brad Thomas

- Access to Brad’s model portfolio

- Three bonus reports

- Daily newsletter with additional insights

- 30-day money-back guarantee

- Heavily discounted price

Cons

- No community chat or forum to connect with

- Focuses mostly on long-term gains

Wide-Moat Research Track Record / Past Performance

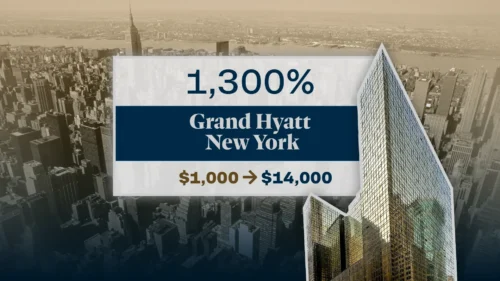

Brad Thomas leans heavily on his decades in commercial real estate, and that history shows up throughout the presentation.

He highlights that The Wide Moat Letter has delivered an average gain of 38.6% since inception, which gives a useful snapshot of how his ideas have performed over time.

What stood out to me, though, were the real subscriber examples he referenced.

Several members reported notable outcomes after following his guidance, such as Bill H., who went from $25,000 to more than $136,000 while collecting $8,500 a year in dividends, and Neal K., who now collects $10,000 per month in income.

Other members like Norma G. shared gains of 87%, 92%, and 199%, while Randy R. said he used Brad’s research to build a seven-figure portfolio.

**The investment results described in these testimonials are not typical. Investing in securities carries a high degree of risk; you may lose some or all of the investment.

None of these results are presented as typical, and Brad himself makes a point to note that all investments involve risk and past performance never guarantees future profits.

Still, the blend of documented average returns and real-world testimonials paints a picture of a research service with a meaningful track record.

How Much is The Wide-Moat Letter?

Wide-Moat Research normally retails for $499, an understandable price point given all the content you receive.

As part of this special bundle though, you can get everything I covered in my review for just $79.

That’s nearly 85% off the cover price, making this opportunity a steal in my book. You’re paying just $6.60 per month for what could be some of the biggest real estate opportunities in the books right now.

The cost jumps to $199 when it comes time to renew next year, but even that feels like a fair price should you choose to continue with the service.

Is The Wide-Moat Letter Worth It?

Is The Wide-Moat Letter Worth It?

I’ve checked out every nook and cranny of The Wide Moat Letter, and I’m really pleased with what I see.

I’ll take monthly insights from Brad Thomas any day, considering his past success and reputation for working with some of this country’s top representatives.

That alone could steer someone away from financial ruin, but the guru also makes a habit of sharing his top recommendations via newsletter in hopes of adding to the funds you already have.

The platform’s bonus reports sell me even more as they address a potentially catastrophic scenario our nation faces right now.

He ties everything up nicely with a 30-day money-back guarantee and a significantly discounted membership rate to remove what could be some big barriers to entry.

If you’re at all concerned about your financial future, The Wide Moat Letter is well worth a closer look.

Sign up as soon as possible to maximize the amount of time you have to safeguard yourself from anything the economy might throw our way.

Refund Policy

Refund Policy

Tags:

Tags: