Alpha Picks is touted as a straightforward stock-picking tool that delivers two data-driven recommendations each month, aiming to outperform the market over the long haul.

If you’ve been looking for a disciplined way to cut through the noise and focus on high-quality growth opportunities, Alpha Picks is designed to do just that.

In this Alpha Picks review, I’ll break down what this Seeking Alpha service really offers and if it’s worth adding to your list of services.

>> Try Alpha Picks At A Special Price TODAY <<

What is Alpha Picks?

Alpha Picks is a relatively new service by the minds at Seeking Alpha. It launched in mid-2022 to identify stocks with the highest probability of capital appreciation through data-driven methodology.

Steve Cress leads the team with more than 30 years of experience in equity research and quantitative strategies.

At its core, Alpha Picks consists of a working portfolio and two new stock recommendations each month. Stock picks only make the list after analyzing company fundamentals, valuation, momentum, growth, and profit potential. The powers that be constantly juggle these assets to achieve the best possible outcomes.

Members are encouraged to invest in some or all of this portfolio and follow the recommendations within. This strategy takes a lot of time and guesswork out of investing that not all of us enjoy doing.

I’ll look more into Alpha Picks’ features in a moment. First, a look at Seeking Alpha.

>> Optimize your portfolio now! <<

What is Seeking Alpha?

Seeking Alpha is the publisher behind Alpha Picks and a myriad of analysis, news, and market data. The company uses this content to empower people to make the best investment decisions possible.

For all Seeking Alpha does, it does it surprisingly well. I’m always impressed with how organized their page and information is, from trending topics to the latest numbers from top indexes, exchanges, and assets.

Many articles and analytics are free to read, but the most valuable content is understandably tucked away behind subscriptions. Alpha Picks is just one of those areas.

Is Seeking Alpha Legit?

Everything within the Seeking Alpha toolbox is totally legit, and the company remains a leading source for market analysis.

It features a combination of experts and technology to deliver reliable stock reports and ratings. Many of those experts, including ones on the Alpha Picks team, carry at least ten years of experience.

Perhaps best of all, the platform isn’t skewed by anyone or anything. It stands completely independent of outside interference to supply the most objective analysis possible.

>> Explore Seeking Alpha’s comprehensive market insights <<

How Does Alpha Picks Work?

Alpha Picks uses Seeking Alpha’s proprietary Quant Ratings to surface the most promising opportunities, and then layers in oversight from its experienced analysis team to drive points home.

Each pick is based on fundamentals, valuation, momentum, earnings revisions, and profitability; the very same criteria that institutional investors pay close attention to.

This structure helps establish authenticity, and the team has backtested the model with over a decade of data.

Best of all, it continues to show real-world outperformance.

Subscribers can expect two new stock ideas every month, ongoing sell alerts, and access to an evolving portfolio that is fully transparent.

What makes people take notice is the consistency: the system isn’t guessing, it’s applying the same rules to thousands of companies, then narrowing them down to the best candidates.

The Team Behind Alpha Picks

Steven Cress

Steven Cress is the VP of Quantitative Strategies at Seeking Alpha and the architect behind the platform’s quant ratings.

Early in his career, he ran a trading desk at Morgan Stanley and later founded CressCap Investment Research, a hedge fund and analytics firm known for its data-driven insights.

His quantitative models have been tested against more than a decade of market history, with results showing consistent outperformance of the S&P 500.

That mix of academic grounding, Wall Street experience, and media recognition makes him a credible voice in quant-based investment strategies.

Joel Hancock

Joel Hancock is the Senior Director of Products at Seeking Alpha and plays a pivotal role in bringing quant research to everyday investors.

He earned his degree in accounting and information science before moving into product and analytics roles at Goldman Sachs and Morgan Stanley, where he focused on developing platforms that merged data science with practical investment tools.

At Seeking Alpha, he applies that background to ensure Alpha Picks delivers not just robust stock recommendations but also an accessible user experience.

Joel’s work plays an integral role in connecting people with the tools they use for success at Seeking Alpha and with Alpha Picks.

His blend of institutional training and product expertise gives Alpha Picks both technical rigor and real-world usability, which is why the service resonates with a broad audience of investors.

Alpha Picks Review: What Comes with It?

Here’s what you get with an Alpha Picks subscription:

Two Stock Picks Every Month

Members receive two data-driven stock picks from Seeking Alpha every month. Each stock pick is ripe with quantitative analysis so you know exactly what you’re getting into.

Alpha Picks requires each new recommendation to have a “Strong Buy” quant rating for at least 75 consecutive days and be a U.S. common stock. It must have a share price greater than $10 and a 3-month average market capitalization greater than $500M.

Stock picks can’t be REITs and must not have been recommended in the past year.

>> Start receiving two top-rated stock picks every month <<

Ratings Alerts

If you’re like me, you don’t always remember to watch for new stock picks to appear. Fortunately, Alpha Picks sends out a message whenever a new recommendation gets added. From there, it’s easy to hop over to the platform and invest.

You may also see an alert if stock ratings fall to “Hold” and remain there for 180 days or if a merger announcement takes place.

>> Stay updated with real-time ratings alerts <<

Over 20 Alpha Picks Stock Recommendations

As soon as a new member joins, they’re immediately awarded access to all current Alpha Picks stocks. There are typically 20 in the portfolio at any given time.

You’re free to grab any or all of these as you choose to meet your investing strategy. Each pick comes with a detailed investment analysis and reasons why the Alpha Picks team declares it a winner.

>> View top stock picks now! <<

What Should I Expect from Alpha Picks?

Alpha Picks‘ primary goal is to significantly outperform the overall market and bring in big gains for its members. Some stock picks will win and others will lose, but the crew constantly rebalances the portfolio and swaps in new positions to stay ahead.

You’re settling into a long-term strategy here, so expect to be in for some time. Alpha Picks bases its performance on its entire portfolio, which they recommend investing in for your best chance at optimal results.

Stocks are usually diverse, but don’t be surprised if picks come from a single sector for a while. It likely means that particular industry is witnessing the biggest growth.

>> Optimize your portfolio for the long-term now! <<

*Performance calculated from day of launch July 1, 2022, to September 7, 2025.. Past performance is no guarantee of future results.

What is Alpha Picks’ Performance Track Record?

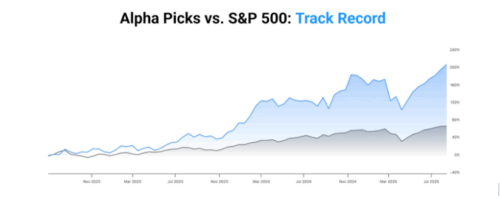

Alpha Picks has built an impressive track record since its launch in July 2022.

According to Seeking Alpha’s own reporting, its portfolio has returned more than 242% from 2022 through September 2025, compared with about a 75% gain for the S&P 500 over the same period.

This isn’t just a short-term win either, as the underlying quant strategy has been backtested across 12 years of data and has shown consistent annual outperformance.

The platform’s most notable picks are nothing to scoff at. AppLovin and Super Micro Computer both sit at quadruple-digit gains, and there are many triple-digit winners mixed in for good measure.

Importantly, Seeking Alpha is transparent with performance data, publishing live results and historical picks so members can track accuracy.

While not every pick succeeds, the service’s systematic approach and long-term bias mean overall results are driven by big winners outweighing the losers.

Is Alpha Picks Right for Me?

Alpha Picks could be an excellent option for individuals looking to get ahead in the market. Rookies and veterans alike are privy to two stock picks per month along with the quantitative analysis backing each one.

You’re also alerted to any changes in the portfolio as they happen. That means no more hesitation about when to sell or how long to keep winners.

Seeking Alpha takes a long-term approach to its selections, so traders need not apply. If all goes according to plan, there won’t be frequent buying and selling here.

>> Explore Alpha Picks now! <<

until April 17, 2024. Past performance is no guarantee of future results.

Who Should Actually Subscribe?

Alpha Picks is designed for individuals wanting a disciplined way to grow wealth without chasing trends or relying on guesswork.

It works best for those who are comfortable with a buy-and-hold approach, willing to follow clear entry and exit rules, and able to commit capital for the long term.

Because the service delivers two stock picks each month along with a transparent model portfolio, it appeals to readers who want structure and accountability built into their investment process.

It’s particularly useful for people with mid-sized to larger portfolios, since the annual fee becomes easier to justify when spread across meaningful investments.

However, it may not suit those seeking steady dividend income, short-term trades, or ultra-conservative strategies focused solely on capital preservation.

For growth-oriented individuals who value transparency and evidence-based results, Alpha Picks offers a strong balance of credibility, simplicity, and proven performance.

How Much Does Alpha Picks Cost?

Joining the ranks of Alpha Picks will cost you just $499 for an entire year.

Signing up through our link gets you $50 off the sticker price, reducing your rate to just $449.

At the end of the day, you’re paying just $37.40 per month for access to all the content here. One victory could cover the cost of admission and then some.

>> Sign up now and save 10% <<

Frequently Asked Questions

How Often Does Alpha Picks Release New Recommendations?

Subscribers receive two new stock picks each month, with clear analysis and ongoing guidance, making it easy to steadily grow a portfolio while reducing guesswork and emotional decision-making.

How Long Should I Hold Alpha Picks Recommendations?

Picks are designed for long-term holding, generally months to years, with clear sell alerts issued when conditions change, making it easy to follow without frequent trading or guesswork.

Is Alpha Picks Suitable for Retirement Accounts?

Yes. Since the strategy favors buy-and-hold growth investing, it works well in retirement accounts where long-term capital appreciation is the goal.

Is Alpha Picks Worth It?

I spent a lot of time reviewing all that Alpha Picks has to offer, and I’m quite happy with what I see.

Time is a premium for me, and I’ll gladly pay for a service offering expert-level research and data I’m unable to get to on my own. Alpha Picks definitely delivers.

Two new picks per month are enough to keep a portfolio fresh without being overwhelming. Several recommendations already in the pipeline greatly increase your options.

Perhaps my favorite feature is the analyst ratings with clear indicators of when to buy, hold, and sell. The last thing anyone needs is to lose money by getting in or out at the wrong time.

All that rolls up nicely into a package that’s honestly a steal for the price point it’s listed at. If Alpha Picks’ track record continues, it could pay for itself rather quickly.

Anyone looking to optimize their investments should give Alpha Picks a closer look. Act now to get access to immediate picks that could boost your portfolio.

>> That’s it for my review. Subscribe today for instant discount! <<

Tags:

Tags: