Keith Kaplan claims to have located secret patterns driving stock rises and falls during specific times of the year. Could all his hard work really lead to big payouts? I investigate in this Seasonality Investor review.

What is Seasonality Investor?

Seasonality Investor is a research service helmed by Keith Kaplan and produced by the team at TradeSmith.

It uses technical analysis to focus on seasonal trends that cause stock fluctuations that savvy folks can use to anticipate future results.

Kaplan showcases his findings through monthly trade recommendations and a regularly updated model portfolio.

The service’s crowning achievement is a seasonality scanner to highlight bullish and bearish patterns.

I’ll cover these features in more detail shortly, but first, let’s take a closer look at our guru.

>> Get 70% off when you join now! <<

Who is Keith Kaplan?

Keith Kaplan has more than 25 years of experience in the stock market, dealing with the ups and downs of bull and bear markets.

His frustration pushed him to use his skills as a software architect to develop tools for both himself and everyday folks like you and me.

The guru joined forces with TradeSmith to maximize his reach, eventually becoming the company’s Chief Executive Officer.

Since then, TradeSmith has been a beacon of light for sophisticated yet simple-to-understand tools that cut through the clutter and help folks make educated market decisions.

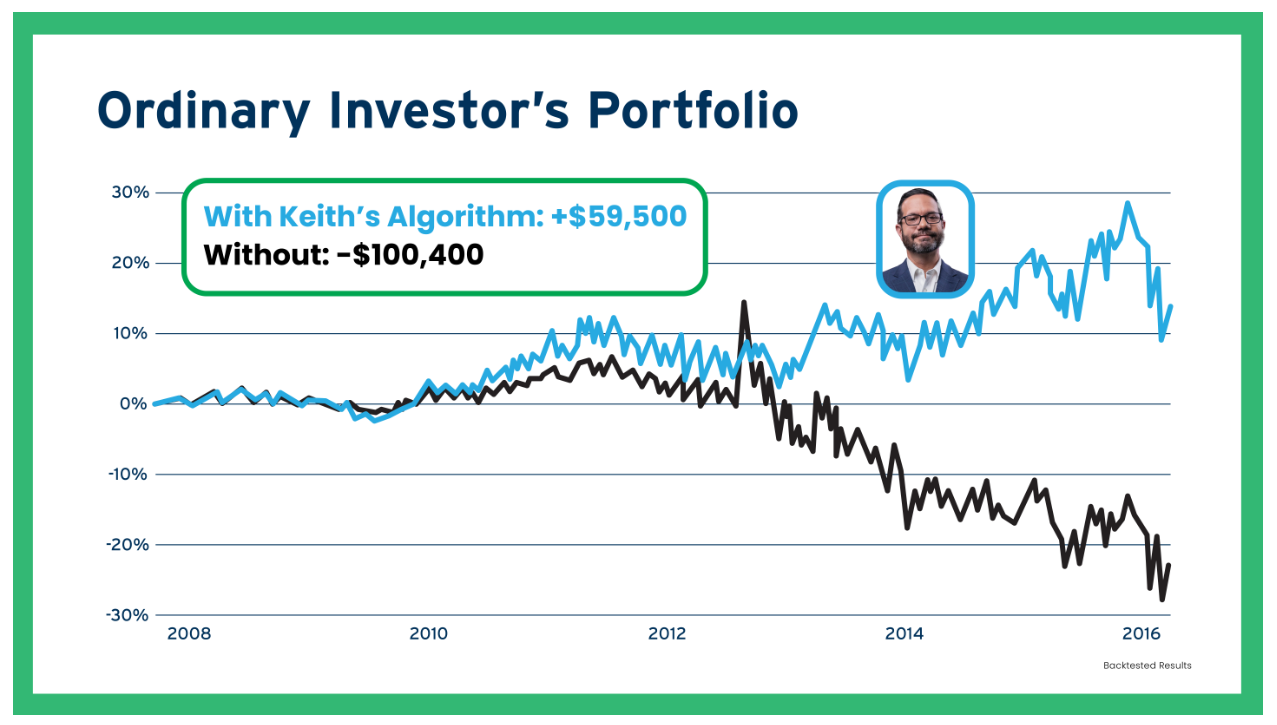

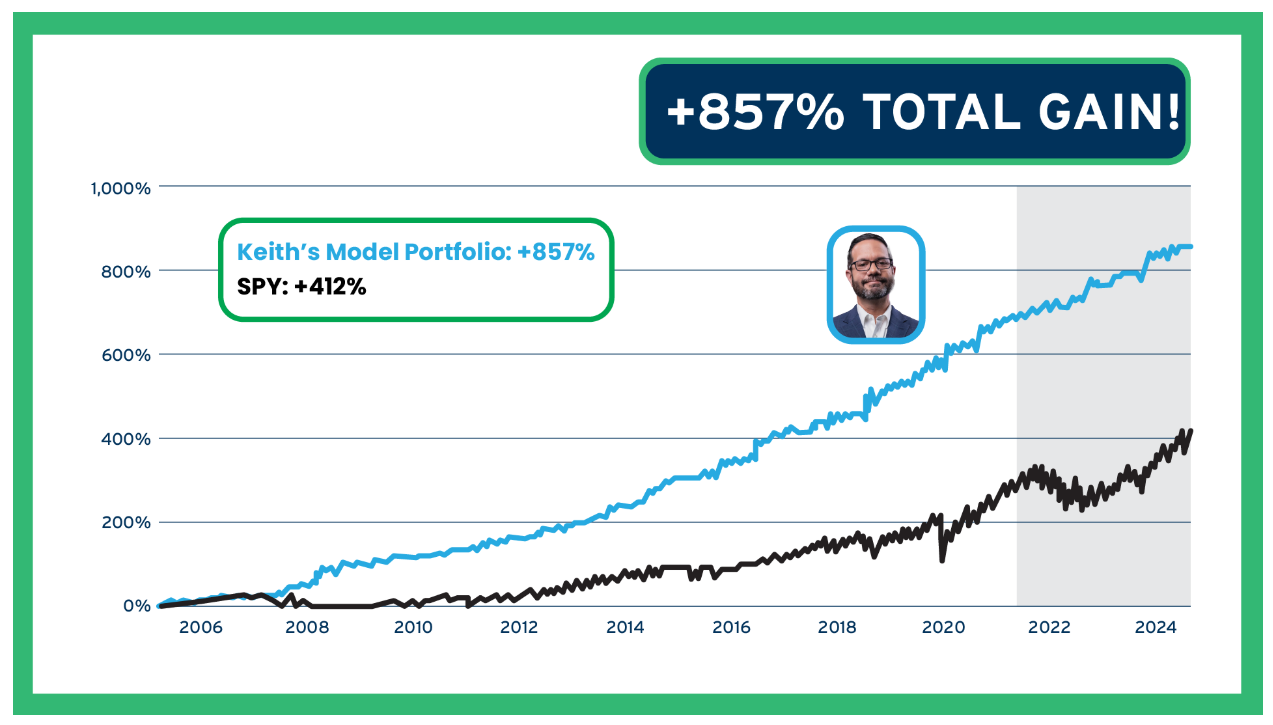

Kaplan’s most notable creation is an algorithm predicting the optimal time to enter and exit trades and how much to invest every step of the way.

Is Keith Kaplan Legit?

To gauge Keith Kaplan as an investor, look no further than the software he’s developed over the years.

His predictive software located the Covid crash months before it took place while also finding 2022’s slump in advance.

Readers were also made aware of the 2023-2024 bull market within just two months of its pivotal turning point that opened the door to massive gains.

Kaplan must be doing something right, as more than 72,000 individuals regularly turn to TradeSmith and its services.

>> Unlock Kaplan’s proven strategies now! <<

What is “The Greatest Financial Breakthrough in 20 Years”?

Keith Kaplan warns that we’re facing a huge market disconnect right now that’s opening the door to a rare financial breakthrough.

He believes it’s the key to huge gains in any market condition, and anyone can take advantage of it.

The key is a secret system few know about that Kaplan and his crew recently stumbled upon.

In fact, he shares that knowing this piece of insider information could spell the difference between big winners and losers this year as the stock market becomes more unpredictable than ever.

This all sounds amazing to me, but what exactly is Keith going on about?

The “Green Day” Phenomenon

Kaplan’s research led him to what he calls the “green day” phenomenon.

Having nothing to do with the band, he calls green days short periods of time when stocks are all but guaranteed to rise.

He says that each company jumps at different times of the year, but thousands of them follow this same pattern.

What’s even crazier is that these green days don’t seem to follow the logical patterns we’ve all come to know and look for when making investments.

I found the concept quite hard to believe, but Keith’s backtesting data going back some 15 years verifies his claim with an 83% success rate.

>> Catch the market on its best days—discover Green Days now! <<

That’s certainly enough to grab my attention.

The likelihood of success with these green days has the potential to double your portfolio if you’re willing to listen to the number.

Apparently, there is a way to pinpoint these outstanding moments for each stock, but how?

The Secret of US Markets

I’m always on the hunt for earnings beats, FDA approvals, and other key pieces of information so I can make more informed decisions on my investments, but Kaplan says these green days rely on none of that.

His secret is something he calls seasonality, where certain dates hold unusual weight for particular stocks.

As much as I wanted to chalk this up to chance, the thought of patterns in the stock market got me thinking.

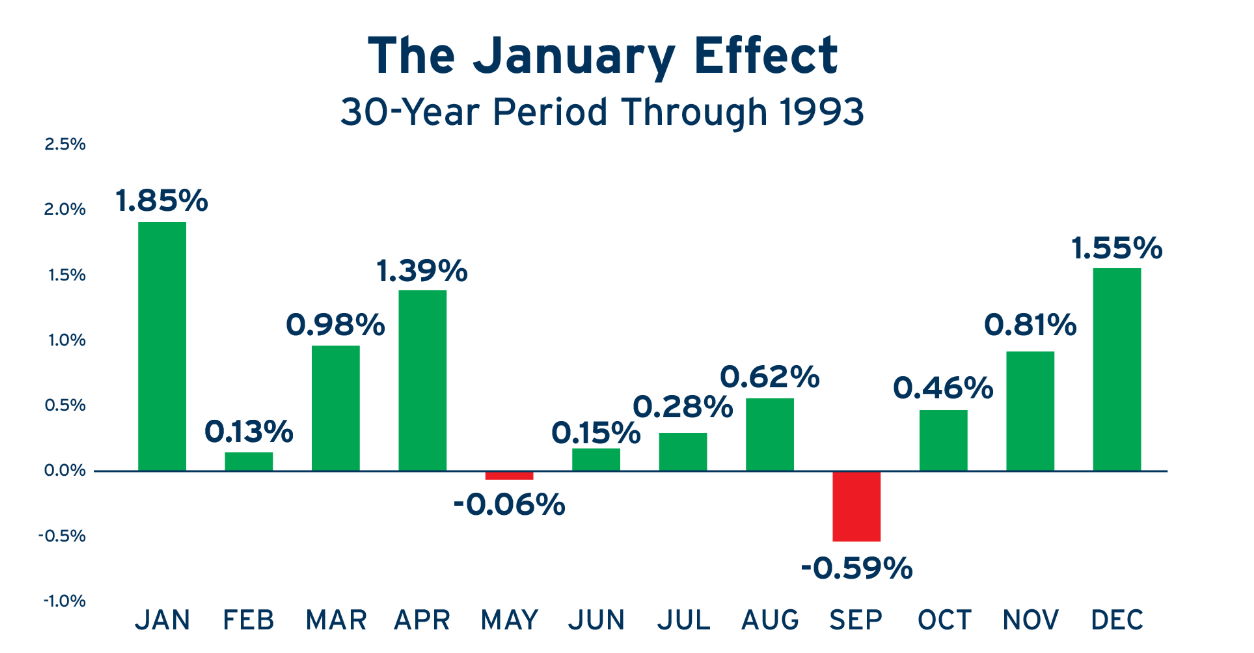

These seasonal trends are all around us, such as the “January effect” where managers dump positions at the end of December for tax purposes and buy them again at the beginning of the year.

The stock market is full of many other cycles, though. I’m reminded of the 7-year cycle where the market repeats itself.

We’ve seen crashes in 2001, 2008, 2015, and 2022 – events like these aren’t a coincidence.

It turns out that human emotion fuels these green day seasonal cycles – things like fear, greed, and excitement that drive market activity.

>> Discover why market crashes follow a pattern—and how to stay ahead <<

How to Profit from “Green Day” Rises

If someone told me with 83% confidence that a particular stock would rise on a certain day, I’d be all over it.

This is especially true given how topsy-turvy the market has been recently – uncovering winning patterns is more important than ever.

Unfortunately, the catalysts behind these seasonal trends remain hidden from the human eye.

That’s where Keith Kaplan comes in. He’s spent countless amounts of money to crack this secret code, and he’s finally sharing it with all of us.

You can get instant access to each of his green day recommendations by becoming a charter member of his new platform, Seasonal Investor.

For a limited time, he’s including several additional materials to make this deal even sweeter, so join me as I explore each one.

>> Unlock data-backed promising trades now! <<

Seasonality Investor Review: What’s Included With Your Subscription?

Here’s everything you’ll receive when you subscribe to the Seasonality Investor service:

Annual Subscription to The Seasonality Investor Review

Members get to enjoy a full year of The Seasonality Investor newsletter, offering a laser-focused view of some of the best green day opportunities in any given month.

In each issue, Keith shares his top two recommendations that could double your portfolio or more, carefully vetted by the guru himself.

You’ll be able to read in detail why he’s chosen each one, leaving you with a clear plan to get in on the action yourself.

There’s nothing complex about the content here, but Keith does an amazing job of cutting through the noise so you can make smart investment decisions with a minimal amount of work.

Model Portfolio

Alongside monthly recommendations in the newsletter, Kaplan compiles all of his favorite stocks right here in his model portfolio.

He adds those newsletter picks here after making them, so you can check the portfolio at any time for an up-to-date list of top opportunities.

When possible, Keith attaches entry and exit alerts to each position to keep you apprised of all the action.

It’s also a great place to check out the guru’s track record and keep tabs on your own investments.

I appreciate having this one-stop shop for checking green day recommendations, knowing I can add these to my own plan at any time.

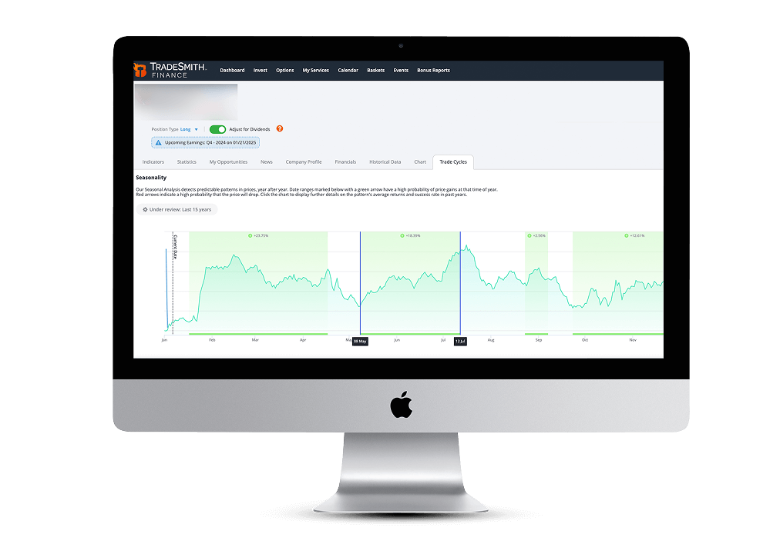

Seasonality Screener System

The Seasonality Screener System is possibly the star feature of Kaplan’s Seasonality Investor service.

This tool gives you complete access to the very system he uses to determine patterns that lead to green day opportunities.

While it’s free to use, you’re only allowed a total of ten searches a month, but you do get unrestricted analysis on any of the 5,000 stocks you decide to look up.

The screener even reveals green zones and times of the year when these stocks plummet based on historical data.

That way, you’ll be able to invest with confidence, knowing accuracy rates and average gains over the last 15+ years.

>> Try the seasonality screener system now! <<

Special Report: The Seasonality Secret: A New Way to Double Your Portfolio Over the Next 12 Months

In this special report, Kaplan details the science behind his investment strategy and why he’s so excited about it right now.

You’ll discover the seasonal algorithm that effectively makes the system work, so you’re not relying on some software you know nothing about.

Furthermore, Keith reveals his insights on knowing when to buy or sell these stocks and ways to significantly boost your gains using options.

There are also a ton of tips and tricks sprinkled in so you can maximize your potential here.

I consider it a kind of training manual for the Seasonality Screener that you can have on hand any time you’re going to make a trade.

>> Unlock the proven strategy to grow your portfolio fast! <<

The Seasonality Investor Master Class

This master class is a behind-the-scenes look at how the seasonality system works through carefully crafted videos you can watch time and again.

It shows how to spot green and red zones in the thousands of stocks the system services and how to combine this information with historical data to determine where it’s likely to go next.

Going above and beyond, Keith also walks viewers through options and how they can boost their success rate by up to a factor of ten.

The entire series is laid out in crystal clear English, meaning anyone can tune in and gather insights that will help their trading strategy.

>> Sign up now and join the master class <<

Bonuses

Check out these additional bonus materials Kaplan’s handing out now to new subscribers:

Blue Chips in the Green Zone: How to Profit on the Best Companies Over and Over Again

It comes as no surprise that Kaplan’s system works on blue chip stocks as well, and that there are ways to repeatedly profit from these giants.

The guru’s own research led him to three blue chips that appear unusually receptive to the green day investment strategy and reveals a way to play them in a new way.

Instead of the traditional buy-and-hold, this report shows how to utilize seasonal trends to buy in based on green zones, snag a profit, and get out before the next dip.

Having the insight to avoid drops that we typically ride out can lead to massive amounts of additional wealth that you may not have thought possible.

Top 3 “Green Zone” Stocks

In a really cool twist, Keith got permission to use his Seasonality Scanner on all active recommendations by InvestorPlace, one of the top stock pickers out there right now.

This test led to some incredible green zone opportunities that Kaplan couldn’t help but share with his readers.

You’ll find his absolute top three opportunities based on recurring patterns that the system uncovered, and all the reasons why each one made this list.

By the time you’re done reading this short guide, it will be clear just how much these investments could pay off.

>> Get the details on top 3 “Green Zone” stocks <<

Top 3 Stocks To Avoid Right Now

Keith’s system is also adept at finding seasonal patterns resulting in significant losses for certain companies that you’ll clearly want to avoid.

Each of the three stocks in this bonus report has at least an 83% historical accuracy of hitting multiple red zones throughout the year and show no signs of stopping any time soon.

Kaplan takes the time to explain the logic behind each one, educating readers in a clear but concise manner about the dangers these stocks bring.

You’ll want to remove these from your portfolio as quickly as possible to avoid them pulling down your green day gains.

>> Uncover the top 3 stocks to avoid right now! <<

Roadmap 2025

2025 looks to be a bumpy year, and we’ve seen trillions of dollars disappear seemingly overnight due to stock shifts.

Times like these can be incredibly frustrating unless you’ve got a roadmap to help navigate them.

As it turns out, the Seasonality Scanner has a knack for predicting the rises and falls over a calendar year through a wide but surprisingly accurate view.

You can see at a glance certain industries slated to do well and areas about to hit a few bumps in the road.

This very system analyzed the 2023-2024 bull market to within a few months and successfully called the 2020 and 2022 crashes.

>> Get all these bonus reports in your inbox now! <<

60-Day Money-Back Guarantee

As part of his Seasonality Investor launch, Keith Kaplan is giving new members a full 60 days to try out the service for themselves.

You’ll have complete access to the guru’s recommendations, along with the bonus reports and scanner to play around with before making any sort of commitment.

If there’s anything you don’t like about the platform, simply reach out for a complete cash refund of your subscription fee.

All the materials you’ve collected up to that point are yours to keep.

Kaplan’s clearly taking all the risk here, which speaks volumes to me about the legitimacy of his service.

>> Try risk-free under the 60-day moneyback guarantee <<

Pros and Cons

After giving The Seasonality Investor a thorough review, here are the top pros and cons I came up with for the service:

Pros

- One full year of The Seasonality Investor newsletter and model portfolio

- Tips and insights from guru Keith Kaplan

- Free access to the Seasonality Scanner

- The Seasonality Secret handbook

- Four bonus reports

- 60-day money-back guarantee

- Included master class

- Heavily discounted price for charter members

Cons

- Only ten scanner searches per month

- Requires use of options for the biggest gains

>> Save 70% when you join now! <<

How Much Does Seasonality Investor Cost?

Admission to The Seasonality Investor normally comes in at $499, but Kaplan’s marking the price down to $149 as part of this special offer. That’s a 70% savings on the sticker price!

For less than $3 each week, you’re getting access to a game-changing strategy that could ratchet your earnings up to new heights.

You’re getting all the extra features lumped in there too, making this an exceptional deal for the cost.

In other good news, Keith will honor this discounted price when it comes time to renew at the end of the year.

Is Seasonality Investor Worth It?

I’m a numbers guy, so it’s always exciting to me when a service or strategy comes along that connects the stock market with cycles and patterns that you can clearly follow.

The science did feel a little far-fetched at the beginning, but I’m glad I took the time to dive into Kaplan’s educational materials which actually make sense out of his system.

With that in mind, the entire package, along with monthly picks and use of the scanner, makes this deal a slam dunk at $149 for the year.

That’s not even factoring in all the bonus information included here that offers actionable investment opportunities right out of the gate.

Having 60 days to test the service out is just icing on the cake, considering that even a single successful recommendation could earn your membership fee back and then some.

If you’ve been trying to make heads or tails of market activity for some time, Seasonality Investor is definitely worth a closer look.

Sign up right away so you can take advantage of this special deal before it’s gone forever.

Tags:

Tags: