Many of us are willing to put in the effort to win at the stock market, but our strategies ultimately cause us to fail.

That’s where investment guru Marc Chaikin steps in. He’s built his flagship research service around a rules-based rating system that he claims offers the right tools to succeed.

In this Power Gauge Report review, I examine whether Chaikin’s approach truly gives everyday investors a clearer edge.

>> Get Marc Chaikin’s Top Stocks Now <<

What Is The Power Gauge Report?

The Power Gauge Report is a monthly investment research service that aims to provide subscribers with stock recommendations, bonus reports, and actionable insights based on the proprietary Power Gauge Rating system.

Wall Street legend Marc Chaikin is the lead editor, and his namesake company, Chaikin Analytics, serves as publisher.

This newsletter targets top-performing stocks through rigorous data analysis, aiming to utilize more than 50 years of Marc’s knowledge to deliver significant gains for readers.

Each issue meticulously breaks down stock selections, offering clear and well-supported recommendations that allow followers to capitalize on the current bull market while strategically preparing for future volatility.

I’m going to dig into the entire package, but let’s start with a close look at the ratings software, as it’s the star of the show.

>> Sound like a good fit? Sign up now and SAVE 70% <<

How Does the Power Gauge Report Work?

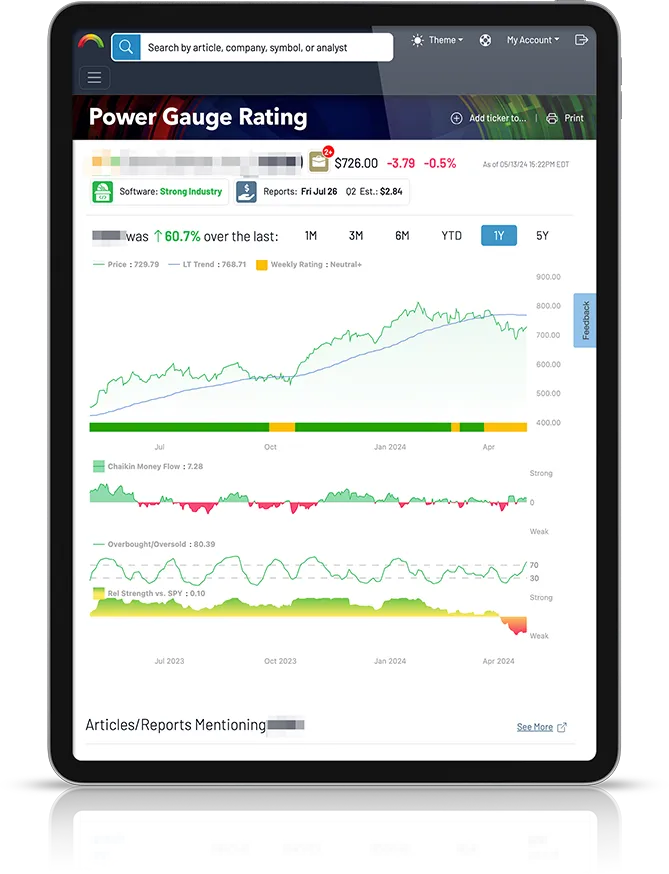

The Chaikin Power Gauge is a proprietary stock rating system that leverages 20 fundamental and technical factors to gauge the future outlook of more than 4,000 stocks.

The system’s ratings are the cornerstone of the newsletter’s recommendations, looking at 20 different factors—like financials, earnings trends, price movements, and analyst opinions—to give each stock a simple rating from “very bearish” to “very bullish.”

I often think of it as a report card for stocks, helping you spot potential winners and avoid risky picks.

In my experience, the Chaikin Power Gauge can be a helpful tool for making more informed decisions, whether you’re doing a quick check on a stock or digging deeper into your portfolio.

>> Join Power Gauge Report Today <<

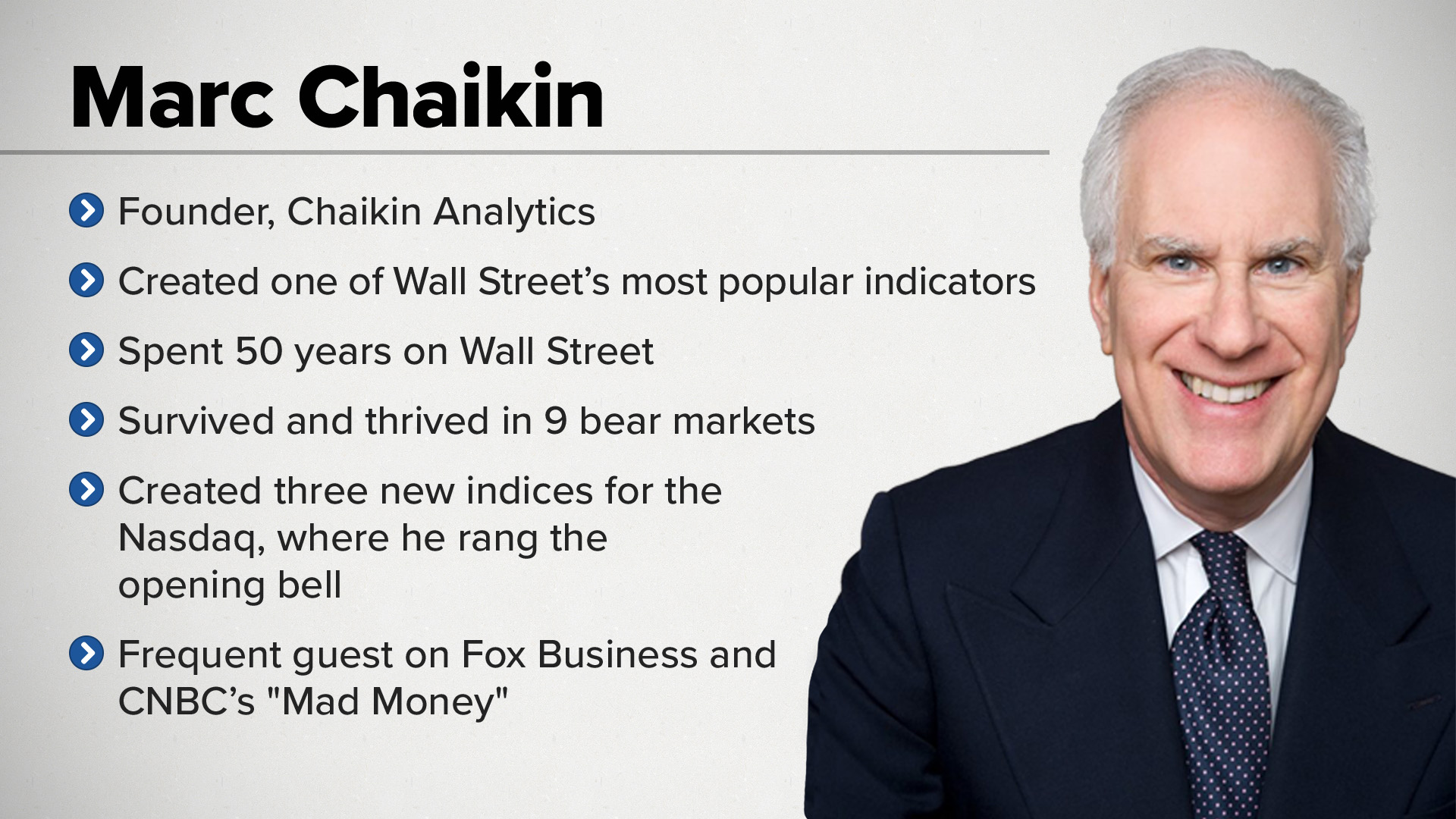

Who Is Marc Chaikin?

Marc Chaikin is an excellent researcher who’s renowned as a quantitative analyst (quant) with over 50 years of experience.

Having begun his career in 1966, Marc created groundbreaking financial systems and indicators widely adopted by major brokerage sites.

Three of his most popular research services include Power Gauge Report, Power Gauge Investor, and the Chaikin Analytics system.

He’s also well-known on The Street for his Chaikin Money Flow indicator and Power Gauge, and he collaborated with Nasdaq to create three new indices.

Chaikin has even been given the honor of ringing the Nasdaq opening bell in 2018.

All in all, Marc Chaikin is a solid stock picker and a living legend on Wall Street.

He’s also one of the few gurus I’ve seen whose technical indicators have seen use in professional finance circles, and that speaks volumes.

>> Discover Marc’s LATEST recommendation <<

Is Marc Chaikin Legit?

Yes, Marc Chaikin is unquestionably legit. With a track record spanning multiple market cycles, Chaikin’s insights are highly respected.

He has a deep understanding of the market, and the respect he’s earned on The Street is a testament to his effectiveness.

Chaikin’s ability to develop custom indicators demonstrates a deeper understanding of the market than most gurus can muster.

Even Jim Cramer, host of CNBC’s primetime hit show Mad Money, once raved about Marc’s stock-picking prowess:

“I learned a long time ago not to be on the other side of a Chaikin trade… I want to explain why I love Marc’s stuff. It’s simple, it’s understandable, it’s rational, it’s not emotional, and I use it constantly and I almost never want to go against it.”

— Jim Cramer, host of CNBC’s Mad Money

I’ve reviewed plenty of noteworthy figures in the research space. However, Marc is easily one of the most impressive of the bunch.

He’s developed computerized stock selection models and technical indicators that have become industry standards.

Marc Chaikin Track Record

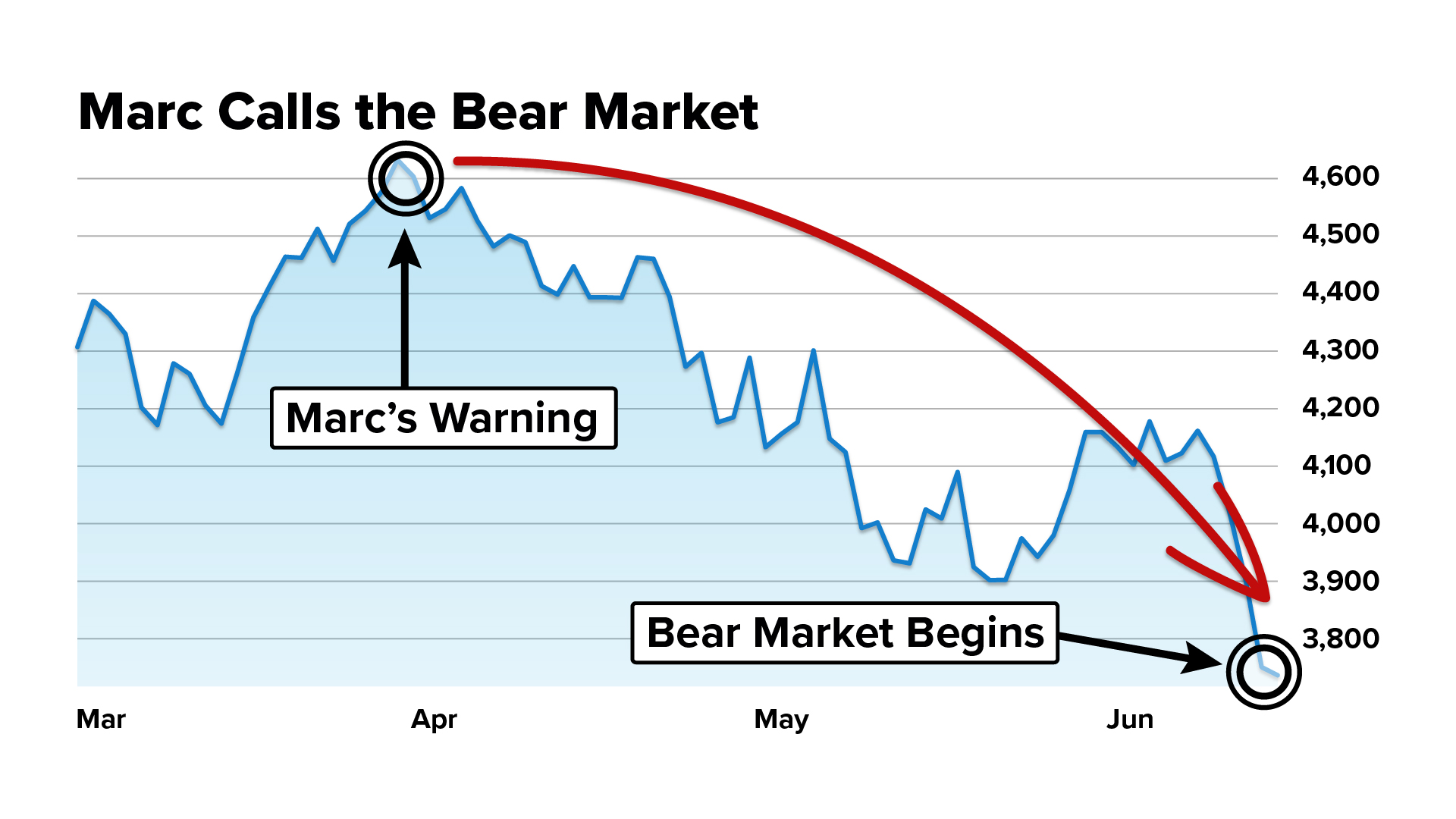

Marc Chaikin’s track record in financial markets is impressive by any standard.

Having started his Wall Street career in 1966, he has over half a century of experience navigating multiple economic cycles, recessions, and market crashes.

That alone is noteworthy. You don’t stay in a space like this for long without making some good calls.

Over the years, Marc and his Power Gauge have spotted several stocks with potential, as well as market-moving events.

Recently, the system placed a bullish rating on Nvidia just before the stock soared 128%.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history, including Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

In all honesty, I can count on one hand the number of investors out there who can stand shoulder to shoulder with Marc.

>> Explore Marc’s strategies here <<

What Is Chaikin Analytics?

Chaikin Analytics, founded by Wall Street legend Marc Chaikin, is a sophisticated investment research advisory offering proprietary tools and analytics designed to help individuals navigate complex market dynamics.

At its core, Chaikin Analytics utilizes quantitative analysis, combining fundamental, technical, and sentiment-based indicators, to evaluate stock performance and potential investment opportunities.

The platform’s hallmark, the Power Gauge Rating system, has earned acclaim for its uncanny ability to pinpoint lucrative investment opportunities.

It may sound convoluted at first glance, but I’ve found these tools extremely helpful for streamlining research, making educated decisions, and staying ahead of market happenings.

No one can provide a stock market crystal ball, but it’s clear that Chaikin Analytics’ research & indicators have earned the Street’s respect.

>> Access Chaikin Analytics tools <<

What Is Marc Chaikin’s “Average Investor” Presentation About?

Marc Chaikin believes the biggest issue facing us today isn’t a sudden crash or dramatic headline, but something far quieter.

We get into the habit of following old systems, owning familiar stocks, and holding through volatility. Although these methods have worked in the past, I’ve seen firsthand where they can fall short now.

Portfolios feel less responsive, losses hit harder, and recoveries just don’t feel the same.

The rules haven’t vanished, but they’ve shifted in ways most of us don’t notice until damage is already done.

Why Familiar Strategies Keep Letting People Down

Let’s face the music here: It’s very hard to react to big or small market swings before it’s too late.

By the time we hear about something on the news and go to make a move, the money’s already gone elsewhere.

This hurts just as much when widely held stocks drop quickly and we’re left wondering what happened.

On the surface, nothing looked broken. The businesses were still recognizable, and the narratives hadn’t changed much. But beneath that calm exterior, conditions had already weakened.

Without a way to see what’s under the hood, we don’t get to see those warning signs before losses set in.

Everything moves faster now than it used to, which is why we can’t rely on strategies that have worked in the past.

Tapping Into the Power

Don’t worry, I’m not here simply to preach gloom and doom. Chaikin says he has a way to identify market strength (and weakness) even when things look fine on the surface.

He calls it his Power Gauge, carefully crafted from years of experience and a keen insight into how the market works.

There’s no other way I know of for us “outsiders” to get access to this type of information, making the Power Gauge a rare window into the information we need to generate income in an ever-changing market.

It sifts through more than 5,000 stocks and ETFs every day to find these patterns, issuing a clear “Bullish, Neutral, or Bearish” rating depending on findings.

Not only does it allow us to research more than we could on our own, it gives clear insight that can save a ton of time in the process.

How to Profit From the Power Gauge

Timing is everything when it comes to market execution, and there’s finally a tool at our disposal to give a clear advantage here.

For me, the best part is how simple it is to use, and how much time you can save through obvious indicators and daily scans.

No one I know can work that quickly, and if you’re not embracing what software can to do help you invest in this day and age, I believe you’re really missing out.

The only way to get access is right now though is through Chaikin’s Power Gauge Report, but the fun doesn’t stop at the scanner.

Join me next as I explore all the features that come with the service.

Power Gauge Report Features Breakdown

You can access Marc’s complete research on the election cycle opportunity when you join Power Gauge Report for one year. As a member, you’ll enjoy these core perks:

Annual Subscription to Power Gauge Report Newsletter

The main entrée of your membership is Chaikin’s monthly newsletter, The Power Gauge Report.

It also includes a new mid or large-cap stock recommendation, market analysis, and tons of other insights.

Marc doesn’t just list stocks; he explains precisely why each selection was chosen, providing clear, easy-to-follow reasoning backed by his proprietary Power Gauge Rating system.

I read several issues as part of my research for my Power Gauge Report review, and I found the writing to be very accessible, even for a beginner.

What I particularly appreciated was how Marc integrates fundamental, technical, and sentiment analysis into each recommendation.

This approach has helped me better understand the nuances driving stock prices, turning complex data into straightforward, actionable guidance.

Plus, every newsletter comes with detailed entry and exit points, removing guesswork and making it simple to execute trades confidently.

Marc lays out a compelling bull case for each featured stock, but he’s also very upfront about potential risks as well.

Power Gauge Rating System

At the heart of this service is Marc’s acclaimed Power Gauge Rating System, a tool so powerful and intuitive that it quickly became my go-to resource for stock evaluations.

This proprietary system condenses complex analytics into a straightforward rating: Bullish, Neutral, or Bearish.

What sets it apart is its comprehensive blend of fundamentals, market sentiment, insider activity, and technical indicators.

You can use this tool to evaluate your own trading ideas, so you won’t be limited to Marc’s stock picks.

It’s especially helpful during uncertain market conditions, clearly signaling which stocks to buy or avoid.

It even allowed me to sidestep potential losers by identifying overvalued stocks that could soon drop.

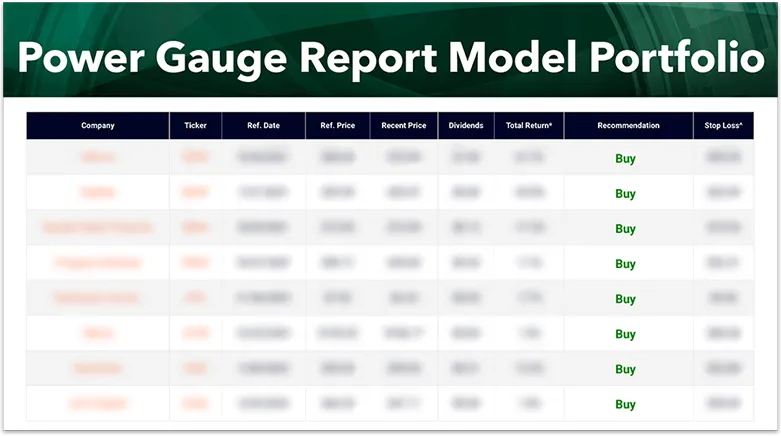

Model Portfolio

Exclusively available to members, the model portfolio tracks every open position featured in Power Gauge Report.

Updated regularly, this portfolio is essentially Marc’s investment roadmap, listing the exact stocks he recommends, along with target buy prices and sell alerts.

It covers the ticker, reference date, reference price, dividend yield, and much more, with updates every Wednesday.

Marc keeps his focus here trim, highlighting roughly eight to ten really viable stocks at a time.

Each position is strategically chosen based on precise data-driven indicators, ensuring you’re not merely following blind recommendations.

Other model portfolios may have dozens of actionable plays, but I personally prefer a select few offerings that I can confidently invest in.

Daily Email Alerts

Subscribers also receive daily email alerts designed to ensure you never miss critical market developments.

These emails aren’t overwhelming or filled with jargon; instead, they offer succinct, actionable insights I can quickly digest over my morning coffee.

I appreciate how Marc carefully filters market noise, only sending relevant information that directly impacts investment decisions.

The alerts also reinforce key concepts discussed in the monthly newsletters, ensuring you’re always aligned with Marc’s latest strategy.

Market Updates

Given Marc’s prediction of a significant market downturn in 2026, this feature couldn’t be more timely or valuable.

Whenever critical shifts occur, Marc sends detailed analyses outlining exactly what’s happening, why it matters, and, most importantly, how you should respond.

During my experience, these updates provided reassurance, removing anxiety about sudden market drops by offering clear strategies to preserve capital and secure gains.

Marc leverages the Power Gauge Rating to identify warning signals early, ensuring subscribers have ample time to reposition their portfolios with lower risk.

If you’re concerned about market volatility (and who isn’t?), these proactive updates are a lifeline, empowering you to make informed, confident decisions even amid uncertainty.

Bull and Bear Updates

Bull and Bear updates focus on broader market conditions rather than individual stock picks, giving you a wide-angle lens on big shifts that drive stock changes.

In my experience, these updates zero in on sectors with big potential or areas you should completely avoid.

Since they come fairly often, I’m never left guessing if I missed a change or a particular industry is seeing rebirth.

I never realized how much this sector knowledge can save stress in the long run, making these updates an essential addition to your toolkit.

Special Reports Library

Finally, you’ll gain exclusive access to the Special Reports Library, an extensive resource I’ve frequently turned to for deeper investment insights.

Each report offers rigorous, data-backed analysis, complete with actionable stock recommendations so followers can stay on top of current market conditions.

I found these reports invaluable for staying ahead of mainstream investors, uncovering hidden opportunities before they become widely recognized.

Marc regularly updates the library with fresh insights, ensuring subscribers remain at the forefront of investing trends.

Whether you’re looking to diversify your holdings or explore entirely new investment opportunities, the Special Reports Library is an exceptional resource that enhances your market understanding and could boost your overall profitability.

Chaikin Power Gauge Report: Special Reports and Bonuses

The Power Gauge Report also includes the following bonuses designed to sharpen focus and speed up decision-making:

Bonus Report #1: The 2026 Chaikin Buy List

Bonus Report #1: The 2026 Chaikin Buy List

To make live even easier, Marc recently put out this report of the top bullish stocks to buy right now, according to his Power Gauge.

I can still be skeptical of AI or algorithm-based outputs too, but Chaikin’s team double checks these recommendations for authenticity.

That ensures you’re really chasing after some of the biggest money-making opportunities of the new year.

These are companies that meet Chaikin’s highest standards across multiple factors, not just recent price performance. I see this report as a starting map rather than a to-do list.

It helps frame where strength is already forming so members can spend less time searching and more time evaluating opportunities that align with the system’s core signals.

Bonus Report #2: Top 5 Stocks to Avoid Right Now

Bonus Report #2: Top 5 Stocks to Avoid Right Now

This report focuses on an area many services overlook: what not to own.

I’ll admit, more than one name on this list surprised me. These aren’t unknown AI companies but enterprises you’ll likely recognize.

The Power Gauge helps you avoid these potential pitfalls as much as it works to find you winners, so I’d take this report very seriously.

By showing how internal conditions can deteriorate long before headlines turn negative, this bonus helps avoid holding onto stocks out of habit or familiarity.

Bonus Report #3: Tomorrow’s 10x Power Trends

Bonus Report #3: Tomorrow’s 10x Power Trends

Tomorrow’s 10x Power Trends takes a broader, forward-looking view of the market.

Instead of spotlighting individual stocks, this report examines emerging areas where the Power Gauge system is beginning to detect early strength.

It explains why certain sectors or themes may be positioned for long-term growth based on improving internal signals, and you’re getting the inside scoop now.

That means you could position yourself ahead of the curve and reap the benefits of a stock’s entire rise instead of picking up the scraps after the vultures come through.

This is the one item Chaikin keeps intentionally under wraps, but the positioning tells you what kind of value they’re aiming for.

I’m not allowed to share any details on the gift either, but Marc says people have paid up to $2,999 to get this in person at a Stansberry Las Vegas conference.

Although the service really shines without this, you’re getting yet another impressive tool at no additional cost just for signing up right now.

Refund Policy & Cancellation Terms

New Power Gauge Report members receive a 30-day money-back guarantee.

If you decide it’s not a match, simply cancel within the first 30 days to receive a full refund on the subscription cost.

This company stands by its products, and its refund policy is a testament to its commitment to quality service.

>> Sign up under Marc’s guarantee <<

Pros and Cons of Power Gauge Report

Chaikin’s Power Gauge Report is an excellent newsletter, but it does have some drawbacks. In our Power Gauge Report review, we prepared all the pros and cons.

| Category | Details |

|---|---|

| Pros |

• Great price with a 70% discount • Data-driven approach from a 40-year market veteran • A full model portfolio of recommendations • Reasonably priced introductory offer • Comes with a solid stock rating tool • Strong risk-management focus • Multiple bonus materials • Airtight 30-day, 100% money-back guarantee • Access to all back monthly issues and special reports on the website |

| Cons |

• No community chat room or forum • Not designed for short-term speculative plays • Limited to stock investment research (no coverage for options or crypto) |

Performance & Track Record

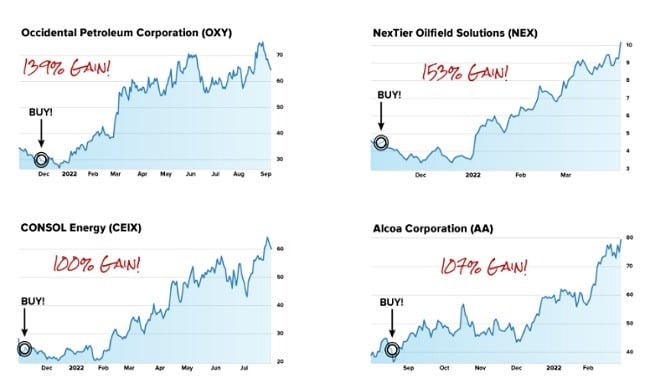

The Power Gauge has example after example of winning ratings that back up the power of its software.

It flagged Peloton’s rise in 2020 during the pandemic and its subsequent fall the following year, which would have saved a lot of people who held on for dear life.

The same pattern repeated with others like Fiverr and Etsy that could have delivered triple-digit gains and before flaggingwhen to sell before losses kicked in.

Some of last year’s big winners like Robinhood and AppLovin more than doubled following bullish ratings in the system.

Here are some examples from their backtested data:

Stock market veterans are no strangers to Marc Chaikin and his Power Gauge. Chaikin has become one of the most respected names on Wall Street.

Since launching the Power Gauge, countless Chaikin followers have told us about their tremendous success in the stock market by using our strategy and system.

The quote featured above is from trading guru John Carter, who’s best known for earning $1 million in two days by trading Tesla. As you can see, he’s an avid fan of the Chaikin Power Gauge, and he’s not alone.

Here are some more notable Chaikin Power Gauge Report reviews from actual users:

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Clearly, these users were impressed by the value that Marc Chaikin’s Power Gauge Report delivers.

I’ll be the first to tell you that not everyone will have this level of success, but I did want to showcase how tell the system can work.

>> Save 70% with limited time offer! <<

Power Gauge Report Pricing & Subscription Options

The Power Gauge Report is typically priced at $499 per year, reflecting its position as Marc Chaikin’s flagship research service.

Right now, you can join at a 70% discount, bringing the cost down to $149 for a full year of access.

That subscription includes the monthly newsletter, the model portfolio, full use of the Power Gauge Rating system, daily email alerts, market updates, and the complete research library.

You’ll also get all the bonus reports and mystery gift at no additional charge.

After the first year, the subscription renews at $199 annually, which is still well below the standard list price.

Is Power Gauge Report Worth It in 2026?

After a thorough Power Gauge Report review, I believe it’s an excellent service and a bargain at just $149. Plenty of newsletters are priced much higher and don’t offer a fraction of the value.

Between the newsletter and special reports, there’s quite a bit of investing insights to explore.

It’s a straightforward, disciplined way to navigate today’s fast-changing AI market.

You’ll also get access to the Power Pulse software, so you can evaluate your own stock picks using Chaikin’s game-changing Power Gauge ratings database.

Last but not least, your purchase is covered with Chaikin’s rock-solid money-back guarantee, so you can test drive the service with confidence.

Final Verdict: Should You Subscribe?

Chaikin’s Power Gauge Report is a great service, and I adamantly recommend it for anyone looking to expand their stock market skills.

I’d recommend taking action now to avoid the volatility that 2026 is sure to bring and lock in your bonuses before they disappear from shelves forever.

Otherwise, you may find yourself in the same rut for another year and nothing to show for it when the ball drops at the start of 2027.

>> That’s it for my review! Claim your 70% discount HERE <<

Power Gauge Report FAQ

What is the Power Gauge Report?

The Power Gauge Report is a stock market newsletter created by Marc Chaikin that uses a proprietary quantitative system to rate stocks as bullish, neutral, or bearish based on multiple fundamental and technical factors.

How does the Power Gauge system rate stocks?

The Power Gauge system evaluates stocks using a multi-factor model that includes financial metrics, earnings performance, technical trends, and relative strength. Each stock receives an overall bullish, neutral, or bearish rating rather than a traditional buy or sell recommendation.

Is the Power Gauge Report suitable for beginners?

The Power Gauge Report can be used by beginners because the ratings are simple to interpret. However, the newsletter does not provide personalized investment advice or portfolio construction guidance.

How often does the Power Gauge Report provide updates?

Subscribers typically receive regular market updates and alerts when stock ratings change. The frequency varies depending on market conditions, but updates are generally issued multiple times per week.

Does the Power Gauge Report provide specific buy and sell alerts?

Marc issues buy and sell guidance for stocks in the model portfolio based on his interpretations of Power Gauge signals. While changes in ratings may signal potential buy or sell decisions, subscribers must decide when and how to act on the information.

What types of stocks does the Power Gauge Report cover?

The Power Gauge Report primarily covers U.S. stocks across various sectors and market capitalizations. It is not limited to one industry and may include growth stocks, value stocks, and momentum-driven names.

Is the Power Gauge Report based on fundamental or technical analysis?

The system combines both. It incorporates fundamental data such as earnings and financial strength, along with technical indicators like price trends and relative performance, to produce its ratings.

Does the Power Gauge Report have a strong track record?

The Power Gauge system has been marketed using historical back-tested results. As with any investment model, real-world performance can differ, and subscribers should not assume future returns will match past results.

How much does the Power Gauge Report cost?

Pricing for the Power Gauge Report can vary depending on promotions and subscription terms. The standard subscription is typically offered at an annual rate, which is disclosed at the time of signup.

Is there a refund policy for the Power Gauge Report?

Yes. The Power Gauge Report generally offers a money-back guarantee within a specified refund period. Subscribers should review the current refund terms at purchase, as conditions and timeframes may change.

Are there upsells after subscribing to the Power Gauge Report?

Yes. Subscribers may receive offers for additional Chaikin Analytics products or premium services. These upgrades are optional and not required to use the core Power Gauge Report.

Who is the Power Gauge Report best suited for?

The Power Gauge Report is best suited for self-directed individuals who want systematic stock ratings to support their own research and investments. As a research tool, it does not provide fully managed portfolios or personalized advice.

Is the Power Gauge Report worth it compared to free stock screeners?

The value depends on whether you prefer an automated, pre-built rating system over manual screening. While similar data can be found using free tools, the Power Gauge Report consolidates multiple metrics into a single rating framework.

Tags:

Tags: