Keith Kohl believes a major economic shift is about to take place within our shores that could boost America’s industrial strength to a whole new level.

He says a $10 American company could be the key to restoring U.S. dominance in critical resources, and those of us getting in early have a shot at winning big..

The premise sounds promising, but can Kohl really deliver?

In this Energy Investor review, I investigate these claims and share what I found.

>> Join Energy Investor Now At A Special Deal <<

What Is Energy Investor?

Energy Investor is a premium research service led by Keith Kohl and published by Angel Publishing, built for readers who want to profit from the seismic shifts happening in global energy and resource markets.

I love the prospect, given that power is something we all need to survive.

Every month, Keith shares a new investment opportunity tied to emerging trends like critical minerals, oil, uranium, renewables, and the clean energy transition.

Subscribers get in-depth research reports, market updates, and access to a model portfolio where Keith tracks his open positions.

He also sends timely alerts whenever new developments arise, helping readers act quickly on opportunities most of Wall Street overlooks.

I promise to do a deep dive into all these features in a bit, but let’s first focus our attention on the guru behind it all.

>> Ready to get started with Energy Investor? Join now <<

Energy Investor Review: Who Is Keith Kohl?

Keith Kohl is a veteran energy and natural resources analyst with more than two decades of hands-on market experience.

He currently serves as the Energy Investment Director at Angel Publishing, where he’s spent years researching oil, gas, uranium, and critical minerals.

Throughout his career, Keith has built strong connections within the energy sector, from mining engineers to government geologists, giving him access to insights that most analysts never see.

His research and commentary have appeared across leading financial outlets, and his track record includes multiple triple- and quadruple-digit stock gains from companies tied to America’s energy independence story.

Now, Keith reports to over 300,000 active readers through his publications, including Energy Investor, to share his insights on such a lucrative niche.

Is Keith Kohl Legit?

Keith Kohl’s credibility in the investment research space is well-earned. With nearly 20 years at Angel Publishing, he’s developed a reputation for spotting major energy shifts long before they hit mainstream news.

His early calls on the U.S. shale boom, fracking technology, and uranium resurgence delivered exceptional returns, including documented gains like 6,700% on Kodiak Oil & Gas and 540% on Diamondback Energy.

Beyond his performance record, he’s contributed to respected publications like Energy and Capital and Wealth Daily, where his deep-dive reports reach hundreds of thousands of readers.

Unlike flashy market commentators, Keith’s analysis is grounded in data, field research, and first-hand industry access, making him one of the most trusted voices in energy investing today.

Energy Investor Review: What is Angel Publishing?

Angel Publishing is the research publisher behind Energy Investor and several other advisory services. Altogether, the firm’s services cater to almost 50,000 readers across the globe.

The ‘about’ page on the Angel Publishing website shows the company holds a strong commitment to leveling the playing field between Wall Street and Main Street.

The company is an advocate for the proverbial little guy, and its ultimate goal is to show everyday people how they can build wealth through the stock market and other assets.

Angel is a US-based company with a good reputation, and many of its services, including Energy Investor, include robust money-back guarantees. Members also have access to a top-rate VIP customer service team if there’s ever an issue.

Angel Publishing checks all the boxes for a qualified, trustworthy publisher. You don’t have anything to worry about when you’re doing business with this company.

>> Sign up now to access exclusive Angel Publishing research <<

What Is Keith Kohl’s “The American Miner” Presentation?

Keith Kohl begins by unfolding a dire truth to us all – the United States relies too heavily on other nations for the critical materials we need.

We rely on these for everything from weapons of war to economic staples that keep our economy in check, areas we simply can’t function without.

Even worse, some of those countries holding all the cards don’t have our best interests at heart of late.

This growing lack of control has finally left us with no choice but to look at the very ground beneath our feet.

Where new opportunities surface, there come new changes at big gains for those in the know.

Energy Investor Review: The Global Metals Crisis No One Is Talking About

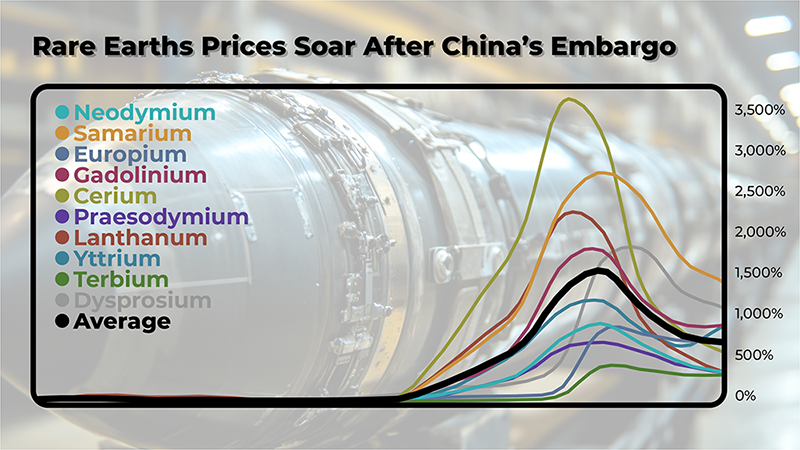

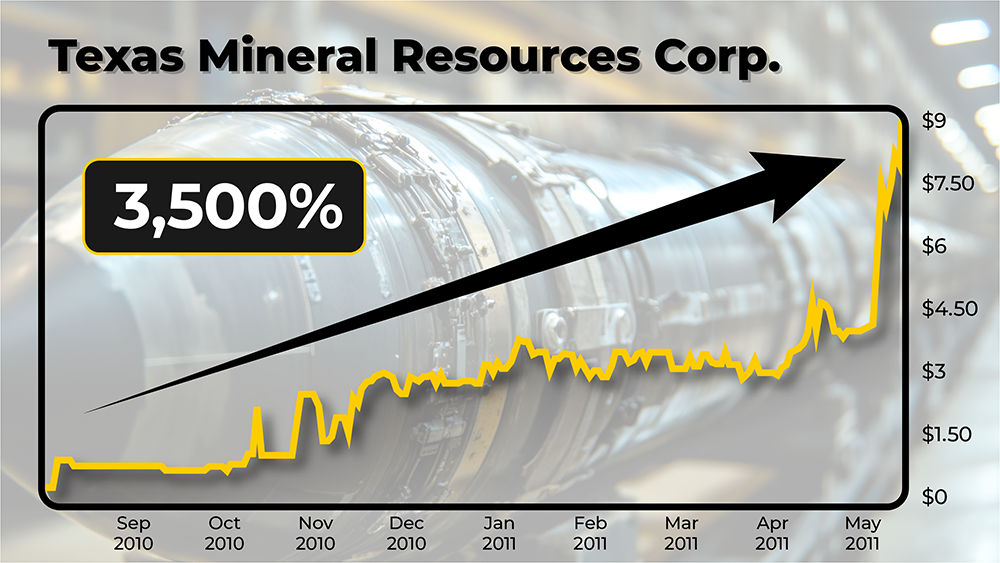

According to Kohl, the warning signs have been flashing for years.

China currently dominates the world’s production of vital materials like gallium, germanium, antimony, lithium, and cobalt, metals essential to national defense, technology, and clean energy.

When China recently restricted exports of gallium and germanium, global prices spiked overnight.

Even worse, if conflict ever broke out, the U.S. could literally run out of missile components within days.

That chilling scenario has already caught the Pentagon’s attention, sparking new emergency measures to rebuild domestic mining capabilities.

Now, as the U.S. tries to regain its footing, we’re starting from a position of weakness. The result is a race against time, and one small company might hold the advantage.

Energy Investor Review: The Cry for Mineral Independence

America is at a critical juncture, but our current administration brings a renewed focus on tapping into the resources that remain dormant underground.

President Trump himself is pushing to overturn bans from 30 years ago that upset this balance in the first place and bring domestic mining back.

Steps include a focus on modernizing mining procedures that allow us to keep up with Chinese production and bringing back expertise in the field.

If Keith is right, this revival is already in the works, and it will quickly come to fruition.

That, of course, means several companies will need to step up in big ways to meet this new demand, which is the perfect time for us to get involved.

Energy Investor Review: Why This Moment Matters

At the end of the day, The American Miner isn’t just about a single company, it’s about the United States reclaiming its industrial backbone.

The energy transition, AI expansion, and defense modernization all depend on one thing: access to reliable metals.

Kohl has done the groundwork, analyzed the data, and laid out how we can align ourselves before that floodgate opens.

To see exactly how he’s positioning his readers, and which U.S. company he believes could lead this historic resurgence, you’ll need to join Energy Investor.

Inside, you’ll find the full details and step-by-step guidance on how to take advantage of what he calls America’s greatest resource revival in decades.

Next, I’ll break down exactly what you get when you become a member.

>> Get started with Energy Investor to get ahead of the TriFuel-238 curve <<

Energy Investor Review: Features

Here are all the features you’ll receive the moment you join Energy Investor:

Energy Investor Review: 12 Monthly Issues of the Energy Investor Newsletter

Every month, Keith Kohl delivers a fresh, in-depth issue of Energy Investor packed with actionable insights.

Editions focus on one major investment opportunity within the energy and resource markets, whether it’s a breakthrough in uranium production, a new lithium discovery, or a small miner ready to win major U.S. contracts.

Keith dives into the underlying trends, explains the political and economic forces driving the opportunity, and shows how readers can position themselves before the broader market catches on.

His research blends technical analysis with real-world context, drawing from two decades of fieldwork, industry contacts, and firsthand energy-sector experience.

I appreciate the straightforward, practical tone, so even readers new to this space can easily follow his reasoning and act with confidence.

>> Get instant access to the Energy Investor newsletter now <<

Energy Investor Review: Access to the Energy Investor Model Portfolio

The model portfolio is where members can track all of Keith’s open recommendations in one organized dashboard.

Each listing includes the company name, ticker symbol, current price, recommended buy range, and his rationale for the position.

As market conditions shift, Keith provides regular updates on whether to add, hold, or take profits. It’s a living document that evolves alongside the market, a clear reflection of Keith’s research in action.

This transparency allows members to see not just what he’s recommending today, but how his past calls have performed over time.

I find myself leaning on the model portfolio as a central guide, using it to balance long-term holds with new opportunities across oil, gas, rare earths, and clean energy plays.

>> Join now for instant access to the model portfolio <<

Energy Investor Review: Weekly Energy Updates

Every week, Keith sends a short but information-rich update covering breaking developments that could impact active recommendations.

These insights often touch on policy shifts, new mining discoveries, government contracts, or macroeconomic moves affecting energy demand.

Rather than just repeating headlines, he distills what truly matters and how it connects to positions in the model portfolio.

These weekly updates are crucial for staying one step ahead of the market, as they keep you engaged, informed, and ready to act without spending hours researching or second-guessing market noise.

Energy Investor Review: 24/7 Access to the Members-Only Website

Subscribers receive private login access to the Energy Investor members’ portal, a central hub for all your materials.

Inside, you can read or download current and past newsletter issues, explore the entire archive of special reports, and monitor portfolio performance.

The platform is well-organized, making it easy to revisit older research any time you need to.

This is also where the model portfolio lies, meaning you can access Kohl’s picks at any time.

For anyone who wants a structured, reliable system to manage their research and stay organized, this feature alone adds substantial value.

Energy Investor Review: Free Subscription to Energy and Capital

Along with your Energy Investor membership, you’ll also receive a free subscription to Energy and Capital, Angel Publishing’s e-letter that reaches hundreds of thousands of readers worldwide.

Edited by the same experienced research team, this newsletter keeps you up to speed on major trends shaping the energy markets, from breakthroughs in nuclear and hydrogen power to policy moves affecting oil and renewables.

While Energy Investor delivers premium, stock-specific research, Energy and Capital provides a broader industry perspective, giving you both the micro and macro view of what’s happening in the global energy economy.

It’s a great complement to the core service and helps round out your understanding of the forces shaping Keith’s recommendations.

Energy Investor Review: A Friendly Customer Service Team

Angel Publishing backs every subscription with a responsive and helpful customer service team.

Whether you need help logging into your account, managing your subscription, or requesting a refund under the six-month satisfaction guarantee, the team is easy to reach by phone, email, or live chat.

They’re based in the U.S. and operate during standard business hours, providing the kind of human support that’s increasingly rare in today’s digital landscape.

Many members appreciate how quickly issues are resolved, reinforcing the publisher’s reputation for integrity and transparency.

It’s a small but meaningful assurance that you’re not just buying a newsletter, you’re joining a company that stands behind its research and respects its subscribers.

Energy Investor Review: Bonus Reports

Subscribers to Energy Investor also get the following bonus materials just for signing up:

Special Report: “The American Miner Breaking China’s Metals Monopoly”

This is the cornerstone of Keith Kohl’s research, where he identifies a little-known American mining company sitting on deposits of 19 critical minerals.

These minerals, including gallium, antimony, and rare earths, are indispensable for everything from fighter jets and smartphones to EV batteries and clean energy systems.

Kohl walks readers through how this company secured its place in the National Strategic Rare Earth Element Inventory, making it one of the few producers eligible for U.S. government contracts and subsidies.

You’ll get its name, ticker symbol, and exactly how to get involved in clear language that doesn’t require an engineering degree to understand.

Bonus #2: “The #1 Nuclear Stock Fueling the AI Arms Race”

In this bonus, Keith highlights a groundbreaking intersection between artificial intelligence and energy infrastructure.

He argues that as AI technologies expand, the world’s data centers will require more power than ever before, power that must be clean, efficient, and consistent.

Nuclear energy, long dismissed by mainstream investors, is quietly re-emerging as the most viable solution.

The report zeroes in on a single company that Keith believes could become a cornerstone of this AI-driven power revolution.

He details how this firm’s nuclear technology is already being deployed to supply energy-hungry tech operations, including those supporting AI computing and national defense.

Bonus #3: “Buffett’s Escape Plan: 4 Canadian Oil Stocks Ready to Skyrocket”

This report examines how Warren Buffett is quietly redirecting a portion of his energy portfolio north of the border, and how we can follow that move.

According to Keith Kohl, Canada is emerging as one of the most stable and profitable oil regions in the world, with vast reserves, favorable trade relations, and growing infrastructure investments.

You’ll learn about four specific companies operating in the Canadian oil sector that align with Buffett’s classic investment strategy: financially sound, cash-flow strong, and positioned for long-term growth.

Keith analyzes each firm’s production assets, balance sheets, and dividend yields while outlining how ongoing energy shortages and North American supply chain shifts could propel their valuations higher.

>> Sign up now to access these three reports <<

Energy Investor Review: Money-Back Guarantee

One of the most reassuring aspects of Energy Investor is its straightforward six-month, 100% money-back guarantee.

You can try the service for a full 180 days, explore every issue, trade alert, and bonus report, and still request a full refund if you’re not satisfied, no questions asked.

Angel Publishing’s in-house customer service team handles the guarantee directly, which ensures prompt processing and courteous support.

Even if you cancel, you keep all the research materials and profits earned along the way. It’s a simple, risk-free way to test Keith Kohl’s work and see if his research truly fits your goals.

Energy Investor Review: Pros and Cons

Energy Investor looks like a great service, but nobody’s perfect. Here are the most notable ups and downs to signing up with this service:

Pros

- Veteran energy analyst with 20+ years of experience

- New stock recommendations and updates every month

- Full access to the Energy Investor model portfolio

- Respected US-based publisher

- Flash alerts and portfolio updates

- VIP Member service team

- Archives include an extensive collection of exclusive research materials

- Affordably priced

- Industry-beating six-month guarantee

- Three bonus reports featuring breakout tech trends

- 12 issues of the Energy Investor newsletter

Cons

- No community chat room or forum

- Limited to stocks

>> Join Energy Investor to access these perks now <<

Energy Investor Review: Track Record

Keith Kohl’s Energy Investor has built an impressive history of identifying powerful, wealth-building opportunities across the energy and natural resource sectors.

Over the years, Keith has guided tens of thousands of readers to major wins by uncovering overlooked companies before they hit the mainstream.

Past recommendations have generated extraordinary returns, including 6,700% on Kodiak Oil & Gas, 574% on Brigham Exploration, 540% on Diamondback Energy, 450% on Gran Tierra Energy, and 200% on Dajin Resources.

These consistent, documented successes have earned Keith Kohl a loyal following and established Energy Investor as one of the most respected research advisories in the energy space.

This track record demonstrates not only an ability to spot early trends in oil, gas, and critical minerals but also a long-term commitment to helping everyday folks profit from America’s shifting energy landscape.

Energy Investor Reviews by Real Members

The feedback shared by Energy Investor subscribers paints a strong picture of satisfaction and tangible success:

As you can see, these testimonials highlight how Keith’s insights translate into actionable results.

While outcomes may vary, the consistency of praise suggests that Energy Investor has earned the trust of many who seek credible, profitable guidance in the energy markets.

>> Sign up now to join these satisfied readers <<

Energy Investor Review: How Much Does It Cost?

Right now, Energy Investor is available at a heavily discounted rate designed to make the service accessible to a wide range of readers.

A one-year subscription costs just $79, while a two-year membership runs $139, both representing significant savings compared to the regular retail price.

Each plan includes full access to 12 monthly newsletter issues, Keith Kohl’s continuously updated model portfolio, weekly energy briefings, and the complete collection of special reports, including “The American Miner Breaking China’s Metals Monopoly.”

The two-year plan offers the best overall value, effectively lowering the cost per month to less than $6 while extending access to every new report and portfolio update Keith publishes during that time.

>> Join Energy Investor now for as little as $49 per year <<

Is Energy Investor Worth It?

After carefully evaluating Keith Kohl’s research, past performance, and the quality of insights provided, it’s clear that Energy Investor offers exceptional value for its price.

What stands out most is Keith’s ability to merge deep industry knowledge with practical, easy-to-follow guidance.

It’s all available in streamlined monthly newsletters and multiple bonus resources, along with the model portfolio to back everything up.

The six-month refund policy takes away a lot of the risk, and the potential upside from Keith’s research easily outweighs the modest subscription cost.

For anyone who wants exposure to America’s booming energy transformation, from rare earth metals to nuclear power, this service provides a balanced mix of education and opportunity.

Sign up today to capitalize on America’s future mining boom before it’s too late.

>> That’s it for our Energy Investor review. Join now for just $79 <<

Tags:

Tags: