Dan Ferris’ 2025 predictions warn that we could soon see an event that slows the growth of the US markets for years to come. But is he really on to something, or is his projection premature?

I’m going to do a deep dive into his latest presentation and his namesake newsletter, The Ferris Report, to find out about Dan Ferris’ predictions and warnings for upcoming years.

Overview of Dan Ferris’ Latest Predictions

Based on my research, these are the areas Dan’s most worried about right now:

The Coming “Dead-Zone” Period

Dan Ferris predicts that US markets could slip into a cataclysmic “Dead-Zone.”

A “Dead-Zone” is an extended period where securities more or less could trade sideways or suffer a gradual decline for years or even decades.

And some markets that have drifted into one have never fully recovered — even after 30+ years.

Also, a “Dead-Zone” impacts more than stocks. The effects could ripple into a large swath of investment classes.

This is also much different from typical bear markets or crashes.

Here’s what Dan has to say on the matter:

“Most Americans are totally unprepared for a multi-year bear market, let alone a market “Dead-Zone” that could last a decade… or two… or three or longer.

But that’s exactly what we could be entering right now.”

Key Data Points and Signals He Cites

This sounded a little ambiguous to me at first, but his presentation digs into some historical analysis to illustrate his point.

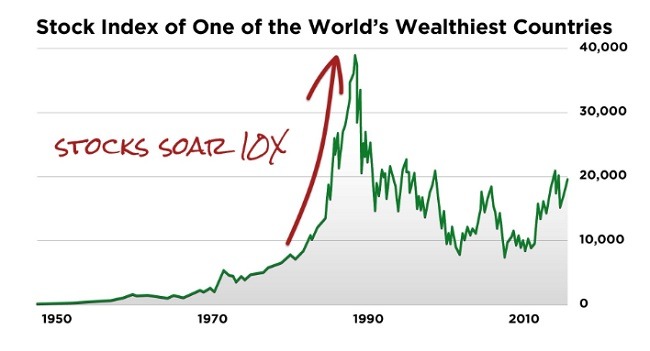

As mentioned, Dan Ferris points out that “Dead-Zones” have persisted on and off the stock market for decades.

He touches on a few examples in his presentation, but emphasizes an important event that occurred back in the late 80s and early 90s.

An economic bubble popped in one of the world’s wealthiest countries, and a wavering market stretched across decades.

Here’s the relevant chart:

The market didn’t completely flat-line, but it definitely took a hit.

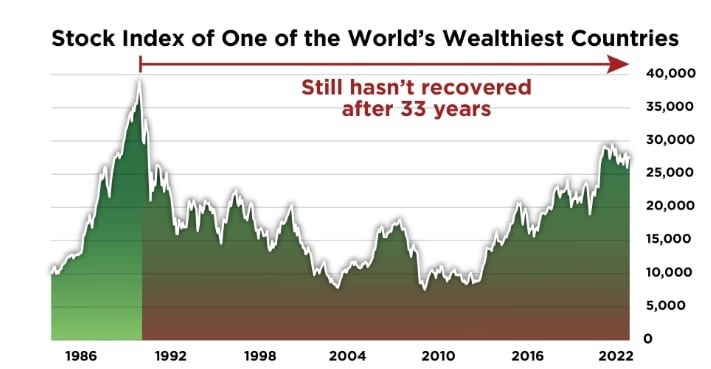

When you zoom out of this graph further, the picture grows even grimmer:

Thirty-three years after its market crash, its economy hasn’t even fully recovered.

Like I said, this isn’t some developing nation. What you’re seeing right now is Japan’s stock index from 1986 to 2022.

Why Ferris Believes a Slowdown Is Inevitable

Dan projects that a similar event might hit the US sooner than we think.

This wouldn’t be the first time America’s been caught off guard, either.

“Dead-Zones” have plagued US markets for decades since the 1920s.

Though, to be fair, not to the same extent as Japan. The “Dead-Zone” following the Great Depression took 25 years to recover from.

And a similar event in the US occurred between 1965 and 1990.

During this period, the market took about 30 years to break even when adjusting for inflation.

It’s concerning that we may be overdue for the next “Dead-Zone” and few of us are taking the necessary steps to prepare.

Dan says that we could be on the bad end of one of the biggest bubbles in history, and there’s no telling how long the “Dead-Zone” might last.

But what is the catalyst for this downturn?

Let’s see what Dan has to say.

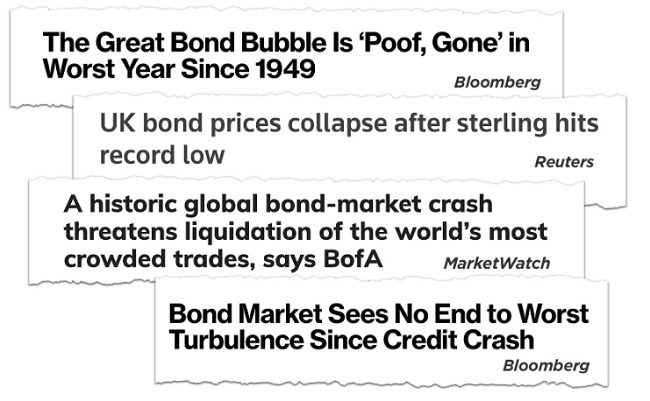

What Dan Ferris Says About the “Everything Bubble”

You may already be familiar with the “Everything Bubble.”

The term itself isn’t new, which tells me experts have been concerned about this for some time.

I remember the Dot-Com bubble, but “The Everything Bubble” comprises more than tech investments. It can cover the spectrum of sectors, bonds, and even housing.

Because it has bloated the value of many asset classes, it could take a large swath of portfolios with it when it pops.

That means none of your investments are safe.

Why He Expects a Severe Repricing of Risk

If you’re wondering what’s inflating this bubble, Dan’s answer is… inflation.

He says the Fed has been feeding the beast with fresh stacks of greenbacks and has refused to raise interest rates adequately…at least until now. This has culminated in the immense inflationary cycle we’re seeing today.

I know that no one likes rising interest rates, but they play a vital role in maintaining the health of the markets.

The problem is that, instead of using them strategically over time, the Fed is throwing the kitchen sink at them.

Basically, the only thing left in the tank is to use interest rate increases to pop the inflationary bubble that’s been building for years.

Trust me when I say we don’t want to be anywhere near that when it happens.

Remember my Japan example earlier?

Guess what they did to pop their bubble – poked it with a sharp incline in interest rates.

So if the “Everything Bubble” explodes and is tied to a slew of asset classes, how could someone protect their portfolio?

Buying the dip, maybe?

Major Risks Ferris Warns About

Dan Ferris is warning that buying the dip could spell trouble for portfolios down the road.

Despite the commonly held belief that a bear market is an excellent opportunity to buy the dip, he says that this might not be ideal during a “Dead-Zone.”

This makes sense because growth could slow to a literal crawl. It may take decades for a rebound to take place.

Also, in the case of Japan, getting the timing right for buying the dip wasn’t easy: It took some serious searching to find the actual floor.

If they bought right at the peak or shortly after the pop, it would have taken decades to recoup the following loss.

Fortunately, The Ferris Report team has a plan to navigate a “Dead-Zone” in the US.

And the full details are in their latest research service.

Before I dive into the package, let’s look at Dan’s credentials.

Who Is Dan Ferris?

Who Is Dan Ferris?

His Background and Investing Philosophy

Dan Ferris is a talented analyst with a lengthy background in investment research.

As a value investor, his goal is to find opportunities that could provide safe, cheap, and profitable stocks.

You might know him from his appearances on Money with Melissa Francis and The Willis Report on Fox Business News, as well as The Street with Paul Bagnell on Business News Network.

He joined Stansberry Research back in 2000 and has been dishing out valuable insights ever since.

Why Folks Follow His Warnings

During this time, Dan has displayed his predictive prowess.

Some of his past forecasts include:

- The collapse of Lehman Brothers in ‘08

- 80% Bitcoin fallout of ‘18

- The peak of the Nasdaq in ‘21

There’s no such thing as a stock market crystal ball that can foresee the future, but Dan’s uncanny ability to spot trends before the broader market catches on has earned him the respect of many.

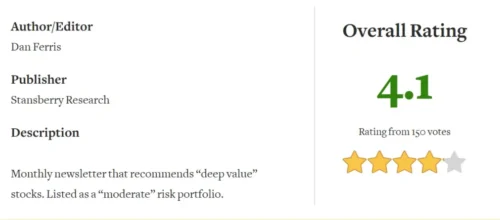

His other Stansberry Research newsletter, Extreme Value, has cultivated a strong following over the years. It’s also well-rated on Stock Gumshoe, locking in a 4.1/5 rating.

Here’s a quick look:

Keep in mind that this is a third-party site, so I can’t verify the veracity of these ratings.

Still, given that he started Extreme Value in 2002, it’s a good sign that Dan’s analysis appears to have had a positive reception over the years.

I’m optimistic that his newest venture, The Ferris Report, will reach those same heights.

Join Ferris Report Today for 75% OFF

What Is The Ferris Report?

The Ferris Report is an investment newsletter led by Dan Ferris and published by Stansberry Research.

Its key features include a monthly stock recommendation, bonus reports, and market forecasts from Dan and the team.

For the newsletter, the team pinpoints mid to long-term investments that provide the opportunity to profit from micro and macro market trends.

Recommendations revolve around both stocks and ETFs, and I for one appreciate the variety.

Stock picks lean into large and liquid companies with at least a $1 billion market cap, so you’re walking into more stable plays.

The team also casts a wide net to make the most out of what Dan believes could be the biggest mega bubble in stock market history.

One month, a trade idea could be in semiconductors; the next, it could be a basket of stocks in a foreign country.

It means a lot to me that Ferris goes where the action is instead of staying in one particular niche.

What Comes with the Service?

As mentioned, the service provides much more than a newsletter and a monthly stock pick.

Read on to find out everything on offer.

Annual Subscription to The Ferris Report

Each issue presents members with one carefully vetted recommendation, which in my experience has been either a stock or an ETF.

There’s no deliberate rotation between the two; Dan simply goes where the biggest opportunity is.

I prefer this approach over the team deliberately sidelining an investment idea because they need to drop a stock to meet an arbitrary quota.

The recommendation also comes with supporting research, market commentary, and everything you need to make a move.

Once the team makes a rec, it’s logged into the model portfolio, which members are free to check out whenever they want.

The general tilt of the trade ideas puts the safety rating of the investments into the moderate range. This could change over time, however.

Special Alerts and Updates

Special Alerts and Updates

You’re not left to your own devices after Dan sends out an opportunity, which is awesome.

I often get alerts when I need to know something about an open position that I need to do something with, like adding a few shares or selling what I have.

These updates can also cover a developing market event that could affect my portfolio with an indicator of what to keep an eye on.

They’re sent via email, so they’re a breeze to follow.

This means I don’t have to look for these details on my own, which I don’t always have a good track record of finding.

Archives of Special Reports

You’ll also receive ongoing access to Dan’s special report archives throughout your subscription.

This means that every current and past report is available throughout the entire year that you can go back to at any time.

If you’re looking for deep dives into investment opportunities, the archives are a serious bonus.

I’ve watched the market follow a cyclical pattern before, so reading up on the cause and effect of previous predictions helps me look for recurring patterns.

The Stansberry Digest

Around 6 pm each market day, I receive a complimentary newsletter to the Ferris Report called Stansberry Digest.

Dan Ferris is a contributor, but other analysts hop into the fold to offer a wide variety of perspectives.

These frequent insights could also hold you over until the monthly newsletter drops.

Topics tend to hover around big financial stories and their potential impact, so this is one more way to stay in the know.

Something to keep in mind is that the daily newsletter does not send out recommendations, so you’ll need to rely on the Ferris Report for that.

Access these features and more HERE

New Member Bonuses

Dan sweetened the deal with five special reports that deliver additional recommendations and market warnings.

Let’s take a look.

Avoid at All Costs: These Stocks Will Never Trade This High Again in Your Lifetime

Typically, bonus reports offer additional trade ideas or trading education.

This one is a little different, though.

Dan Ferris is predicting that 11 stocks might not make it out of the big bubble, going so far as calling them “dangerous companies.”

Also, the report shares some insights into sectors and investment classes that could fall by the wayside, as well.

It’s a must-read if you’re trying to protect that portfolio.

The Best of the Best: The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone”

This report is essentially the polar opposite of Dan’s 11 companies to stay away from.

He and the team identify what they believe are the only stocks that could “safely” provide 8X potential — even in a devastating bear market.

According to them, these stocks have persevered through the recent market turmoil and have been up.

These companies are already growing based on my research, but Dan believes there’s plenty more upside potential to go.

Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver

Given current market conditions, it’s no surprise that the team is recommending precious metals as a potential hedge against inflation.

This goes beyond buying just bullion, though. The report reveals another way to tap into profits from precious metals.

I will say that, unlike the recommendations’ moderate risk profile, this is a more speculative play.

Even a small position could have tremendous upside if their thesis plays out as they expect.

The Recession Haven That Could 7X Your Money in 10 Years

Dan Ferris has dialed in on a sector that he is especially bullish on to make it through America’s “Dead-Zone.”

He claims that this could be one of the most financially stable havens to invest in on the stock market.

The draw is that while other companies might flounder during the inflationary cycle, the government could grow heavily dependent on this sector.

As the name of the report suggests, the team anticipates that these stocks could see strong growth throughout the decade.

It’s not an area I necessarily would have thought to pursue, but that’s what makes Dan’s research so valuable.

The World’s Two Most Valuable Assets in a Time of Crisis

Dan and the team are letting the cat out of the bag on two opportunities they anticipate could be the most important assets to hold during a downturn.

The first asset has been up 1,700% over the long term and has not had a down year for decades.

The second has provided the opportunity for about 12% to 14% income for around 30 years.

It’s no wonder these assets made Dan’s shortlist, given how many downturns they’ve survived.

These are the kind of numbers I like to see from big plays, and I am curious to see if these trends continue.

30-Day 100% Money-Back Guarantee

New memberships to The Ferris Report come with a 30-day money-back guarantee.

So you have about a month to take the service for a spin. If Dan Ferris’ insights don’t live up to your expectations, you can opt for a full money-back refund on the subscription cost.

Even better, you still get to keep all the special reports, recommendations, and other bonuses.

It’s a solid guarantee that shows the Stansberry Research team stands by its services.

Join under Dan’s guarantee TODAY

How Much Does The Ferris Report Cost?

The Ferris Report usually costs $499 for an annual subscription. However, the team is providing new members with an 85% discount.

This means you can sign up today for just $79.

Given all the bonuses, it’s an incredible deal.

There’s also no trade-off for opting for the discount. You’ll receive the monthly newsletter, bonus reports, and a 30-day refund period.

It’s important to note, however, that this is an introductory deal. The newsletter renews at its original rate of $199 per year.

Even at this higher price point, I feel like you’re still getting an amazing rate.

Final Thoughts: Should You Listen to Dan Ferris?

Only time will tell if Dan Ferris’ predictions come to fruition. There are no guarantees that events will unfold as he anticipates they could.

That said, he does build a strong case.

Regarding his thesis, something I appreciate is that he taps into historical analysis to draw parallels between previous events and now.

He’s a big believer in studying historical market patterns, which is precisely how Dan predicted past black swan events.

Also, if the bubble does burst, he and the team have assembled a well-rounded blueprint for a chance to make the most of this opportunity.

The newsletter has a lot going for it, as well.

The Ferris Report’s recommendations follow a moderate risk level, focus on liquid companies, and tackle a broad range of industries. So this service could help set a strong foundation for a starter portfolio.

Plus, some of the special reports tap into opportunities outside the stock market.

The 85% discount on the first year and 30-day money-back guarantee provide even more value.

Thirty days likely won’t be enough time to see a position to its conclusion. However, it does offer a fair window to gauge the quality of insights.

All in all, the package is solid. And if you’re looking for careful and competent analysis, I recommend giving The Ferris Report a close consideration.

That’s it for my review. Sign up and SAVE 85% HERE

The Ferris Report Frequently Asked Questions (FAQ)

How does Dan Ferris evaluate long-term market risk differently from other analysts?

Ferris emphasizes structural economic weaknesses—like credit cycles, historical mean reversion, and valuation extremes—rather than focusing solely on short-term indicators such as earnings reports or Fed statements.

Does Dan Ferris use specific historical models to form his predictions?

Yes. Ferris frequently references long-term market cycles, past speculative manias, and multi-decade valuation trends to create parallels with today’s environment. His predictions often stem from these historical frameworks.

How often does Dan Ferris update or revise his market outlook?

Ferris typically revises his outlook when major macro shifts occur—such as policy changes, liquidity shocks, or significant earnings reversals. He is not known for rapid, short-term forecasting.

What type of investor is most aligned with Dan Ferris’ approach?

His style resonates most with value-oriented investors, conservative allocators, and those who prioritize capital protection over high-risk growth strategies.

Does Dan Ferris believe investors should fully exit the market during extreme risk periods?

Not typically. Ferris generally advises reducing risk exposure, increasing safety margins, and reallocating toward assets with lower valuation risk—not abandoning equities completely.

How does Ferris view central bank policy within his predictions?

Ferris often sees central bank intervention as a contributor to asset inflation and distorted market signals. He views prolonged low-rate environments as catalysts for systemic fragility.

What role does inflation play in Ferris’ long-term warnings?

He considers persistent inflation or stagflation a major risk factor, especially if it compresses margins, raises borrowing costs, and weakens consumer demand simultaneously.

Does Dan Ferris make sector-specific predictions?

While not always the centerpiece of his commentary, Ferris often highlights overvalued sectors—especially tech, speculative growth, and high-leverage industries—as areas of disproportionate risk.

How does Ferris think individual investors should approach high volatility periods?

He recommends maintaining ample liquidity, avoiding panic moves, and focusing on fundamentals rather than momentum-driven trading behavior.

What indicators does Dan Ferris monitor for early signs of market stabilization?

Ferris typically watches for credit spreads tightening, improved corporate earnings quality, healthier balance sheets, and normalized valuations before shifting out of defensive positioning.

Who Is Dan Ferris?

Who Is Dan Ferris?

Tags:

Tags: