Keith Kohl claims he’s uncovered a legal and profitable way for everyday investors to tap into $5.42 billion in what he calls “AI Equity Checks.”

Through his newsletter, Technology and Opportunity, Kohl promises the chance to earn passive income from AI companies legally compelled to share their data-fueled profits.

This sounds amazing to me, but is this offer legitimate? Join me as I explore the facts in this AI Equity Checks review.

>> Click Here To Subscribe Now <<

What is Technology and Opportunity?

Technology and Opportunity is an investment research newsletter published by Angel Publishing, designed to help us gain early access to high-potential tech opportunities.

Each month, subscribers receive detailed reports spotlighting one or more emerging tech stocks that typically trickle from key sectors like AI and autonomous vehicles.

It speaks to me because it’s all about capitalizing on speculative tech plays that offer real chances at astronomical gains.

Since these picks don’t usually make mainstream financial news, it’s a rare window into what Kohl calls a “first-mover advantage”.

I won’t lie, the approach here is a bit more risky than some of the conservative newsletters I’ve seen out there, but that’s also the appeal.

Who is Keith Kohl?

Keith Kohl is the Investment Director at Angel Publishing and the primary editor of Technology and Opportunity. With over 18 years of experience in researching and recommending breakthrough technologies, Kohl has built a reputation as a forward-thinking analyst in sectors such as energy, biotechnology, and artificial intelligence.

He’s known for spotting trends before they become mainstream and guiding retail investors into companies positioned to ride these waves of innovation.

>> Explore Keith Kohl’s AI Income Strategy <<

Is Keith Kohl Legit?

Yes, Keith Kohl is a legitimate financial analyst with a long-standing track record at Angel Publishing, a Baltimore-based investment research firm known for producing niche financial newsletters.

His track record includes, to name a few:

- 6,700% gains on Kodiak Oil & Gas

- 4,991% on Universal Display Corporation

- 2,319% on Ethereum

Plus, I’ve seen Kohl’s insights in publications like Energy and Capital and Wealth Daily.

From what I’ve seen, he does quite well at timely calls in the energy and tech spaces, where his reputation as a small-cap tech investor gives weight to his bold claims.

While past performance doesn’t guarantee future results, he has real credentials, verifiable picks, and a professional background that sets him apart from typical internet “gurus.”

>> Click Here To Access The Ai Equity Checks Blueprint <<

What is “AI Equity Checks: The Lifelong Artificial Intelligence Income Stream”?

How AI Equity Checks Works

“AI Equity Checks” is the central hook of the current Technology and Opportunity promotion, and Keith’s current focus.

The guru uses the term to describe income-like payments tied to investments in companies profiting from artificial intelligence.

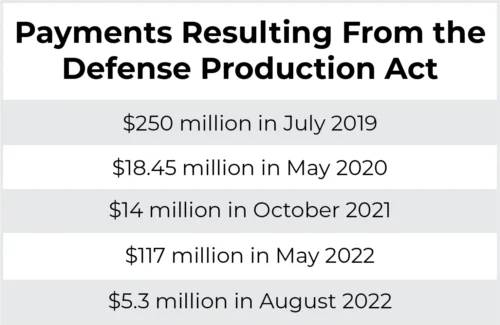

These payouts are possible due to a unique interpretation of the Defense Production Act that requires AI companies to compensate for the use of public and private data in training their models.

I tested it out, and it works just like receiving dividends multiple times a year.

You Deserve a Cut

Unless you’ve been on the run from technology, I’m sure you’ve witnessed AI’s exponential growth.

It’s already everywhere in our lives when we’re shopping, investing, or even trying to have a conversation online.

In each instance, AI thrives because of a somewhat controversial reliance on personal data.

Kohl argues that AI companies have enriched themselves using data from social media, online content, and even smart devices—often without consent.

Due to public and governmental backlash, we’re now able to get paid for that usage, even if only by somewhat obscure (but perfectly legal) means.

Where the Money Comes From

We currently have no control over how AI takes and interprets our data, which is as frustrating as it is scary.

To that end, I love the thought of getting paid for my part in making artificial intelligence even…smarter.

The key lies in select firms—what Keith calls “special companies”—that act as conduits for AI revenue.

These firms supposedly receive contractual payments from major AI developers and pass some of that income to shareholders.

Through these avenues, you and I can unlock consistent passive income.

AI isn’t going anywhere, and I don’t expect these income sources to dry up either, making this a really promising opportunity.

My question is simple, though: How do we partake?

How to Cash In On AI Equity Checks

To access these AI Equity Checks, Kohl outlines a three-step process:

- Learn how the Defense Production Act is being used to oversee AI firms and redirect their income.

- Identify and invest in specific “special companies” partnered with major AI players.

- Become a shareholder in these firms (investments can start from as little as $10) to receive recurring payments.

This is all well and good, but it causes me a deer in the headlights situation. Where do I actually start?

Luckily, Keith has the answer to that in his Technology and Opportunity service that he’s making available right now, and he lays out the solution very clearly.

Check it out with me as I do a deep dive into what’s included.

>> Join Now And Get Started <<

AI Equity Checks Review: What Comes With the Technology and Opportunity Offer?

Technology and Opportunity provides a comprehensive suite of research, updates, and portfolio tools aimed at identifying early-stage technology investment opportunities.

Here’s a breakdown of what you can expect to receive:

12 Monthly Issues of Technology and Opportunity

12 Monthly Issues of Technology and Opportunity

Every month, I receive a full-length newsletter featuring at least one cutting-edge tech stock recommendation.

These issues are rich with analysis and research, often highlighting companies involved in artificial intelligence, biotech, green energy, or other emerging sectors.

These newsletters are thorough, but I want to make it clear that Keith makes them very easy to follow.

By the time I put down my digital issue, I have a clear plan in mind for next steps.

Monthly Investment Updates

Before I forget, each newsletter issue contains updates on previous recommendations.

That means you’re always kept in the loop on whether it’s time to hold, buy more, or exit a position.

These are deep dives into each opportunity, and while I don’t read through every single one every month, I always zero in on the stocks I currently have positions in.

It’s a breath of fresh air to get this information regularly from the guru himself, so you don’t have to babysit picks or second-guess the right time to cash in. Urgent Special Reports

Urgent Special Reports

When major technological developments arise or when a new opportunity is too time-sensitive to wait for the next issue, Keith Kohl issues special reports.

These are comprehensive documents released outside the regular publication schedule to ensure that you can capitalize on breaking opportunities.

I’ve seen everything from shifts in trends to rising companies that show explosive potential here, and Keith explains precisely why they’re worth a closer look.

“This Week in Tech” Research Series

This weekly digest is crammed full of tech-related news, curated and analyzed by the Technology and Opportunity team.

It provides timely insights on breakthroughs, mergers, regulatory changes, and tech market trends before they hit the mainstream media.

The win here is that you’re hearing information before everyone else, giving you a rare window into certain opportunities before they go big.

Not every insight leads to a slam dunk, but from my experience with tech, starting at the bottom can lead to some amazing returns down the road.

Unrestricted Access to the Report Archives and Real-Time Tech Portfolio

As a member, you’ll also gain full access to all back issues and previously released special reports.

This archive includes a wealth of historical data, past stock picks, and long-term market insights that may still present investment value.

Worst-case scenario, you’re learning about how past plays shaped the current atmosphere and gleaning insights along the way.

If that wasn’t enough, the real-time tech portfolio displays all open and past recommendations, complete with entry prices, stock tickers, and performance metrics, allowing for full transparency and strategic planning.

Angel Publishing’s VIP Member Service Team

Angel Publishing’s VIP Member Service Team

Angel Publishing offers dedicated support to all subscribers through its VIP member services team.

Available Monday through Friday via phone or email, this team assists with subscription issues, account questions, and general customer service needs.

I need this process to be as smooth as butter for every service I’m a part of, and Angel Publishing delivers in a big way.

You’ll get someone on the phone quickly so you’re not stuck in a lull, and while email isn’t instantaneous, I’ve never had to wait more than a day for a response.

>> Click Here To Start Your Journey <<

AI Equity Check Bonus Materials

Check out all the extra content you’ll receive for signing up under this AI Equity Check bundle:

This handy guide is your ticket to accessing the AI income Kohl is gung-ho about right now.

He lays out the three-step process I touched on earlier in clear and concise detail that you simply have to follow to the letter. Think of it as a roadmap to what could be one of the best ways to tap into the biggest technological breakthrough of our time.

I’m not sure he could make the process any easier, which someone like me without a lot of time can appreciate.

In as little as five minutes, you could be set up to receive your first AI Equity Check.

This report explores opportunities that allow you to take advantage of global AI Equity Check plays.

You heard that right – why limit yourself to domestic payments when the entire world is buying into AI?

Kohl claims that foreign governments (EU, UK, China) are adopting similar policies to regulate AI companies, leading to a global pool of over $8 billion in potential income.

Inside, you’ll learn how to gain exposure to this global stream, regardless of nationality, and potentially receive up to $15,840 annually.

Special Bonus Report 3: Two “Secret” AI Titans for Maximum Gains

AI companies will continue to collect your data whether you like it or not, so you might as well make some money off your info in the process.

Two Secret AI Titans showcases two ways to do just that, including one firm that hands out upfront payments as compensation every time your data passes through an AI company’s hands.

You’ll also receive info on a second AI titan providing the “ears” for AI software with tons of explosive potential.

Keith includes the name and ticker symbol for these opportunities, so all you have to do is head over to your broker once you’re finished reading.

Special Bonus Report 4 (Available in 2-Year Plan Only): The Nvidia Killer

Special Bonus Report 4 (Available in 2-Year Plan Only): The Nvidia Killer

Standard chipsets are struggling to keep up with the computing demands of AI, creating bottlenecks—and opportunities—for new companies to emerge.

Available only with the two-year subscription, this report presents a small chipmaker Kohl believes could challenge Nvidia’s AI dominance.

This firm reportedly has a close relationship with OpenAI and is at the forefront of AI-specific chip development.

You’re looking at more of a speculative play here, but I was impressed with what this little company has been able to do in a short amount of time.

>> Start Your Ai Income Membership TODAY <<

Refund Policy

Refund Policy

Technology and Opportunity comes with a 180-day (six-month) money-back guarantee.

That means you’re free to try the service risk-free for half a year, and if you’re not satisfied, just reach out for a full refund. There are no cancellation fees or hidden charges.

Since most services offer 30 or 60 days at most to test the waters, this is one of the most generous refund policies in the investment newsletter space.

Pros & Cons of AI Equity Checks

Here are the top pros and cons I came up with after uncovering every nook and cranny:

| Category | Details |

|---|---|

| Pros |

|

| Cons |

|

AI Equity Checks Performance & Accuracy

The service really stands out in my mind for several high-profile wins:

- 6,700% on Kodiak Oil & Gas

- 4,991% on Universal Display Corporation

- 2,319% on Ethereum

- 1,696% on iRobot

- 65,400% on Bitcoin (recommended at $30)

I’m really impressed with the gains produced from speculative plays, even if not every opportunity scores this well.

As with all high-upside investments, not every recommendation is a winner. Losses can occur, especially with early-stage companies.

Who Should Use AI Equity Checks?

It shouldn’t be too much of a shock that AI Equity Checks speaks to anyone interested in technology and the potential for consistent income therein.

The service behind it is all about pointing to stocks like Microsoft and Nvidia before their big breaks, significantly adding to the intrigue for me.

Dividend-seekers are also a shoo-in here, since these AI equity checks pretty much work the same way. Since I’m all but certain AI is here to stay, I’d argue they have excellent long-term potential.

When it comes down to proficiency, Keith sets his service up in a way that makes it accessible to anyone.

Even if you don’t know the first thing about any of these topics, the way he explains everything using simple terms make it as easy as it can get to participate.

AI Equity Checks Pricing & Subscription

You can currently choose from two pricing tiers, both of which offer the newsletter, updates, archive access, and tech briefings.

The difference lies in the duration of the plan and the number of bonus reports you receive:

- 1-Year Plan: $99 – includes three bonus reports

- 2-Year Plan: $179 – includes a fourth bonus report (The Nvidia Killer)

Technology and Opportunity promises to bill you at the lowest renewal rate available for whatever plan you choose at the end of the year, but keep an eye on what that cost may be when the time comes.

Is Technology and Opportunity AI Equity Checks Worth It?

Is Technology and Opportunity AI Equity Checks Worth It?

If you’re seeking early-stage tech plays with the potential for big upside and can handle the risks of speculative investing, Technology and Opportunity offers good value.

Tech continues to be a solid source for massive returns, and Keith doesn’t disappoint with his research.

I’ve been really pleased with the content from the newsletters and frequent updates, and not having to watch my positions all the time relieves a lot of stress.

The refund policy gives you a risk-free trial, and the research could lead to lucrative discoveries.

But keep expectations grounded. AI Equity Checks are a clever branding device, not government-issued payments. Your earnings will depend on your investments and the market’s performance.

If you’re ready to receive your recompense for what AI has taken from you, I see no better way than right here.

>> Subscribe to Keith Kohl’s Technology and Opportunity <<

AI Equity Checks Frequently Asked Questions (FAQ)

Are “AI Equity Checks” guaranteed payments or just potential dividends?

No — “AI Equity Checks” are not guaranteed income. They are potential payments tied to how much money certain companies make from licensing data or technology to AI developers. If those companies generate revenue and choose to distribute a portion of it, shareholders may benefit — but there is no legal obligation for them to issue ongoing, predictable checks.

How stable or risky are the companies behind these AI Equity Checks?

Most of the companies Kohl teases are small or emerging tech firms, which can be volatile. Their revenue streams depend on securing and maintaining AI-related licensing or data-supply contracts. If those deals slow down or fail, potential “equity checks” may shrink or vanish. Investors should expect higher risk and sharp price swings — not stable income.

How much money would I realistically need to earn meaningful “AI Equity Check” income?

You can technically participate with as little as $10, but to receive income that feels noticeable, you’d likely need a much larger position size. The returns scale with how many shares you own and how much revenue the company generates. For many investors, this will function more like a speculative tech play than a dependable income strategy.

No. The AI Equity Checks thesis is just one promotional theme to attract subscribers. Inside his service, Keith Kohl covers a wide range of high-growth tech sectors such as biotech, batteries, autonomous vehicles, and next-gen computing. So even if the AI Equity Checks concept disappoints, members still receive multiple unrelated tech recommendations.

How often does Keith Kohl update or revise his AI Equity Check picks?

Keith issues updates whenever major developments occur — such as new licensing deals, changes in revenue outlook, or breakdowns in the underlying thesis. There’s no fixed schedule. Members typically receive alerts instructing whether to hold, add, or sell positions. Because many picks are high-volatility, it’s important to read updates quickly to avoid missing time-sensitive moves.

Tags:

Tags: