In this ever-evolving economic environment, knowing which stocks to hold and which to ditch isn’t just smart, it’s essential.

Eric Fry’s answer is a clear, pragmatic approach to investing with a distinctive “Sell This, Buy That” strategy designed to help readers sidestep riskier stocks while uncovering emerging winners.

>> Check Eric Fry’s Top Stock Picks Now <<

What Is Fry’s Investment Report?

Fry’s Investment Report is a research-driven monthly newsletter focused on identifying overlooked growth opportunities and warning signs in the stock market.

Unlike many conventional investment services that either chase hot trends or provide overly broad recommendations, Eric Fry zeroes in on specific stocks he believes are either poised for explosive growth or at significant risk of decline.

The hallmark of his most recent briefing is its “Sell This, Buy That” framework, which challenges readers to re-evaluate their portfolios critically by cutting out investments that have become liabilities and reallocating capital to stocks better suited to thrive in today’s changing economic landscape.

Subscribers receive weekly updates and trade alerts that keep them informed of critical portfolio moves, alongside a model portfolio that tracks Fry’s current recommendations.

A blend of deep fundamental research, timely market insights, and practical advice aims to empower readers to make confident investment decisions amid uncertainty.

So does Fry’s Investment Report deliver? Let’s find out, starting by looking at the mastermind behind the service.

Who Is Eric Fry?

Eric Fry is an investment analyst with over 30 years of experience navigating complex markets.

Those experiences set him up to work at the Wall Street-based publication operations of James Grant, where Fry helped produce content for money managers.

His exploits don’t stop there, as Eric won Wall Street’s prestigious Portfolios with Purpose competition back in 2016.

Fry is known for his contrarian, data-driven approach, combining macroeconomic trends with stock-specific analysis.

Now, as editor of Fry’s Investment Report, Fry distills his decades of knowledge into clear, practical advice for subscribers.

>> Join now to get Fry’s latest stock recommendations <<

Is Eric Fry Legit?

Eric Fry’s extensive track record, media presence, and track record performance confirm his legitimacy.

His ability to foresee market moves and pick stocks that generate substantial gains is well documented.

Many know Fry for his long-term track record, which includes numerous 10-bagger calls over the years. He was even once named “America’s Top Trader”.

Eric has a good eye for stocks. He can read the market like a book, and he’s proven it on several occasions in the past.

These are exactly the types of credentials you want in your corner when scoping out big-picture trends in tech.

All in all, I think Eric is a solid lead for his namesake newsletter, and his background fits the bill.

What Is InvestorPlace Media?

InvestorPlace Media is a publishing company with many solid stock market analysis services in its portfolio.

Founded over 40 years ago, it had a change in ownership in 2017.

Essentially, the company is a hub for top-tier investment gurus who target specific niches to help folks corner a new angle of the market.

InvestorPlace is a legit publisher that has been cranking out hit after hit for over 40 years.

And the firm houses some of the brightest minds in the investing space.

What is the “Sell This, Buy That” Presentation?

Eric Fry’s Sell This, Buy That presentation kicks off with a compelling premise: in today’s rapidly shifting economy, clinging to outdated or overhyped stocks can quietly erode your wealth.

Yet, hidden in plain sight are better, often overlooked opportunities poised to outperform significantly.

He teases a critical investment crossroads where making the right choices between selling and buying could mean the difference between stagnation and substantial gains.

It invites readers to rethink their portfolios with a fresh lens, cutting losses and reallocating capital toward future leaders in technology and infrastructure.

For anyone serious about growing wealth while managing risk, this opportunity demands attention.

Why Many Popular Stocks Are No Longer the Safe Bet

The core issue Eric Fry highlights is that some of the market’s former giants now carry significant “bad risk.”

Stocks like Amazon, Tesla, and Nvidia, once viewed as unstoppable growth engines, face mounting challenges that threaten their long-term returns.

Take Amazon, for example, its heavy reliance on Chinese imports exposes it to tariffs and trade war fallout that could squeeze profits.

Tesla’s premium pricing and competition from affordable Chinese EV makers like BYD put its market share at risk.

Nvidia’s dominance is threatened as its largest customers start developing their own chips, eroding its moat.

Fry goes beyond headlines, showing how these risks compound quietly, and why holding onto these stocks without question could lead to missed opportunities or losses.

Where the Real Growth Lies Today

While the “bad risk” stocks falter, Fry points to a new generation of companies capitalizing on emerging megatrends.

For instance, AI data centers need exponentially more optical fiber cables, positioning suppliers for massive growth.

Robotics companies, unlike Tesla’s futuristic humanoid robots, are already delivering practical warehouse automation solutions that are transforming industries right now.

Even traditional energy sectors tied to powering these data centers offer solid, often overlooked, opportunities.

Fry carefully explains how these businesses benefit from real, measurable market forces, setting them up as “good risk” investments that could reward savvy users over the next few years.

Turning Insight into Actionable Investing

At the end of the day, you still have to know the right places to put your money in. Unfortunately, mainstream media rarely leads us to that place.

That’s what makes Fry’s Sell This, Buy That approach so appealing. It’s effectively a strategic roadmap for transforming your portfolio amid economic uncertainty.

By systematically identifying which stocks to sell and which to buy instead, you position yourself to avoid losses while capturing growth in sectors driving the future economy.

Subscribers to Fry’s Investment Report gain immediate access to Fry’s carefully curated recommendations, updates, and market insights that enable them to act quickly and confidently.

If you’re ready to move beyond guesswork and take control of your financial future, this service offers the tools and expertise to do just that.

Next, let’s explore exactly what you get when you join Fry’s Investment Report.

>> Get Fry’s Top Stock Recommendations NOW <<

Fry’s Investment Report Review: What’s Included?

Here’s everything you get for becoming a member:

6 Months of Fry’s Investment Report Newsletter

Subscribers receive six months of continuous access to Eric’s flagship newsletter.

On occasion, the team will release up to two promising plays if they are especially bullish on an additional investment idea.

The newsletter format is designed to be accessible yet comprehensive, giving readers a clear understanding of why certain stocks are being bought or sold.

Fry covers a range of sectors but keeps a sharp focus on emerging trends like AI, robotics, and energy infrastructure.

Beyond specific picks, the newsletters provide readers with actionable guidance on when to enter or exit positions, helping to manage risk dynamically.

Eric’s writing style is straightforward and educational, offering both the what and the why behind each recommendation that enables readers to follow along regardless of their investing experience.

Model Portfolio

Subscribers gain full access to a model portfolio hosted on a members-only website.

This portfolio tracks all of Fry’s current stock recommendations, showing entry points, price targets, current valuations, and suggested exit strategies.

Having this resource allows readers to monitor their own holdings against Fry’s advice and see performance metrics updated in real-time.

This means you don’t have to wait for the next newsletter to drop to get started.

It serves as both a practical tool for portfolio management and an educational guide, illustrating how Fry’s “Sell This, Buy That” approach plays out in real market conditions.

Past issues of the newsletter are also accessible, so you can explore the team’s analysis and why a particular stock made the cut.

The portfolio transparency builds trust, as subscribers can see which stocks are held, sold, or recommended over time, enabling them to follow Fry’s investment philosophy with confidence.

Access to Eric Fry’s Research Archives

Memberships to Fry’s Investment Report also include access to the team’s past stock picks and research reports.

Some of Eric’s past research reports scope out hidden gems off the beaten path, so it could be a good place to look for investments outside the mold.

Some reports cover ETFs and precious metals.

I recommend checking out these resources if you’re interested in even more recommendations to fill out a portfolio.

Another benefit of the team’s investment style is that it centers around long-term holding periods.

This means that an investment idea from a year back could still hold tremendous value today.

Timely Trade Alerts and Market Updates

Fry and his team keep close tabs on all their active recommendations in between newsletters and will send out periodic updates so you can stay ahead of emerging opportunities before they take place.

When it comes time to buy or sell, they’ll follow up with an instant alert so you can move quickly on the position and secure your standing.

It may not seem like much, but knowing when to get in and out is more than half the battle, so I appreciate Eric not leaving us out to dry here.

In addition to urgent alerts, Eric Fry sends out market updates that provide a broader perspective on ongoing portfolio positions, macroeconomic developments, and key sector shifts.

These updates help subscribers stay informed without needing to track the market themselves, acting as a trusted filter for critical information.

Customer Support

Fry’s Investment Report employs a team of experienced customer support agents to help you with any questions or issues you have during your time as a member.

You can reach out to them from 9 am – 5 pm during the work week via phone, and it’s a breath of fresh air to me that they actually treat you like a person in our ever-expanding world of automated assistants.

It’s also possible to shoot over an email at any time, and I’ve never had an issue receiving a response in a timely manner.

>> Join now for instant access to these resources at 80% OFF! <<

TradeStops Basic (6 Months of Complimentary Access)

Beyond core newsletter content, trade alerts, and portfolio access, Fry’s Investment Report subscribers also benefit from a complimentary six-month membership to TradeStops Basic.

TradeStops Basic helps remove emotion from selling decisions, which is often the hardest part of investing.

The tool’s customizability and easy-to-use interface make it a practical companion to Fry’s research, reinforcing disciplined investing habits.

Fry’s Investment Report Bonus Reports

Under Fry’s “Sell This, Buy That” deal, you can get five additional bonus reports that offer additional opportunities for gains.

BONUS REPORT #1: Optical-Fiber Fortune: The 10X AI Infrastructure Play Wall Street Is Missing

This bonus report uncovers a highly underrated company that’s quietly dominating the backbone of the AI revolution: optical fiber cables.

As AI data centers expand rapidly, their demand for optical fibers skyrockets, requiring up to 10 times more cables than traditional data centers.

Unlike well-known chipmakers facing stiff competition, this company’s essential product is irreplaceable and critical to keeping AI servers connected at lightning speeds.

It recently inked a groundbreaking deal with Broadcom to develop technology enabling data to flow as light signals throughout AI networks.

With factories in North Carolina, Arizona, and a nearly $1 billion plant underway in Michigan, this U.S.-based firm avoids tariffs and supply disruptions.

On top of rapid growth, it offers a steadily increasing dividend, providing income alongside capital appreciation potential.

>> Get this report free when you join now! <<

BONUS REPORT #2: Sell This, Buy That: The $24 Trillion Rise of Robotics

The robotics industry is on track to grow into a $24 trillion market, and this report dives into the best ways to capitalize on that surge.

Eric Fry highlights three leading companies that are driving real-world automation solutions, especially in warehouses and distribution centers.

Unlike futuristic humanoid robots still struggling to find footing, these businesses deploy practical, AI-powered robotic systems that move goods faster and more efficiently than humans, meeting urgent demand fueled by labor shortages and inflationary pressures.

Alongside these buys, the report identifies one industrial automation stock insiders are abandoning, signaling caution.

This balanced analysis helps readers focus on companies with strong growth prospects while steering clear of risky bets.

BONUS REPORT #3: Sell This, Buy That: The Race to AGI

Artificial General Intelligence (AGI) represents the next frontier of AI, promising machines with human-level thinking capabilities.

This bonus report identifies three companies uniquely positioned to benefit from AGI breakthroughs, spanning sectors likely to see revolutionary shifts as AGI technologies mature.

Fry explains how AGI will disrupt industries far beyond today’s narrow AI applications, creating massive new markets and transforming existing ones.

At the same time, he cautions against one company he believes is too exposed to this transition and at risk of severe decline.

This report offers crucial insight for readers wanting to stake claims early in the AGI revolution and avoid being caught on the wrong side of the transformation.

BONUS REPORT #4: Sell This, Buy That: Energy’s Swan Song

Powering the AI-driven economy requires vast amounts of electricity, with individual data centers consuming energy comparable to entire cities.

This report focuses on three “legacy” energy companies well-positioned to profit from this exponential demand growth.

Fry provides a nuanced take on energy’s future, explaining why traditional power generation still matters and how certain firms stand to benefit from the rapid scaling needed to keep the grid stable.

Conversely, he warns against a risky renewable energy stock that looks cheap but faces structural headwinds threatening its viability.

This report guides readers through the complexities of energy investing during a period of massive transition, helping them target resilient winners while avoiding risky green plays.

BONUS REPORT #5: Insider Exodus: 5 Stocks C-Suite Execs Can’t Dump Fast Enough

Insider selling patterns often reveal warning signs invisible to everyday folks like you and me.

This report uses a proprietary screener to pinpoint five companies where executives are rapidly unloading shares, signaling a loss of faith in the firm’s prospects.

Fry explains how these patterns aren’t just random. Corporate insiders have access to information the public doesn’t, and when they sell heavily, it can foreshadow declines.

This bonus report equips subscribers with a crucial risk management tool, helping them avoid potentially disastrous investments by paying attention to insider behavior.

Knowing which companies top executives are fleeing from can save individuals from steep losses and preserve capital in turbulent markets.

> Get Fry’s #1 stock for the upcoming AI data center boom NOW! <<

Eric Fry’s Money-Back Guarantee

Eric’s so confident in his research that he’s offering an incredible 90-day money-back guarantee.

This risk-free trial period allows subscribers to evaluate the service without financial worry.

Best of all, subscribers keep all reports and materials they’ve received during their membership.

This policy reflects strong confidence in the value provided by Eric Fry’s research and removes barriers for new readers considering the service.

>> Join risk-free under Fry’s guarantee <<

Eric Fry’s Track Record: Stock-Pick Performance

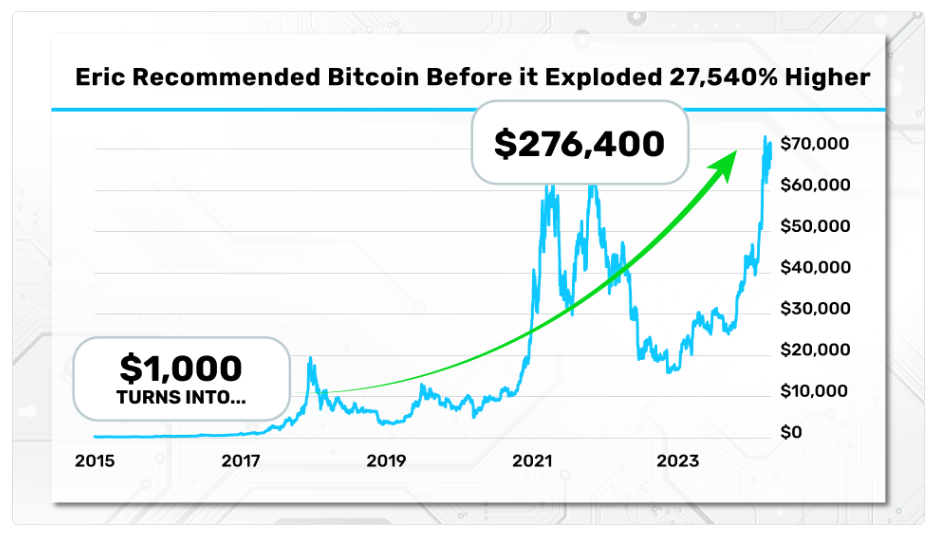

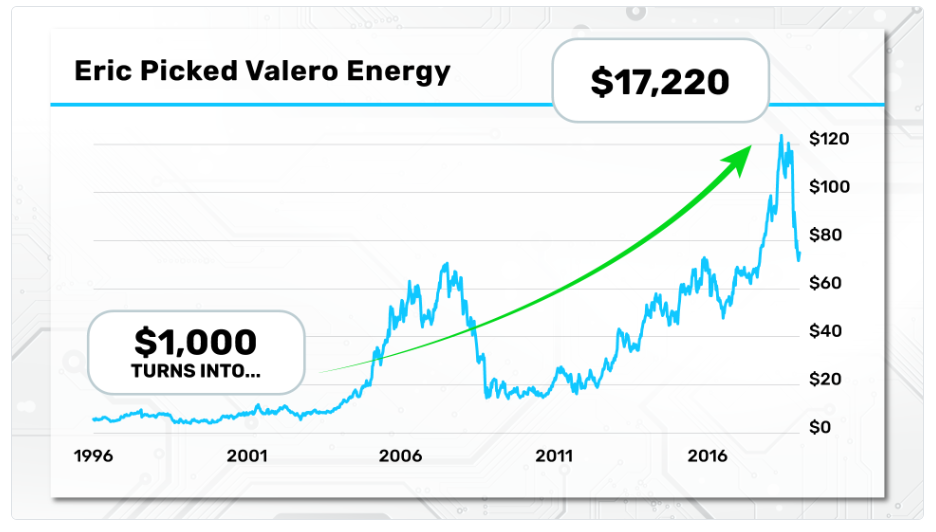

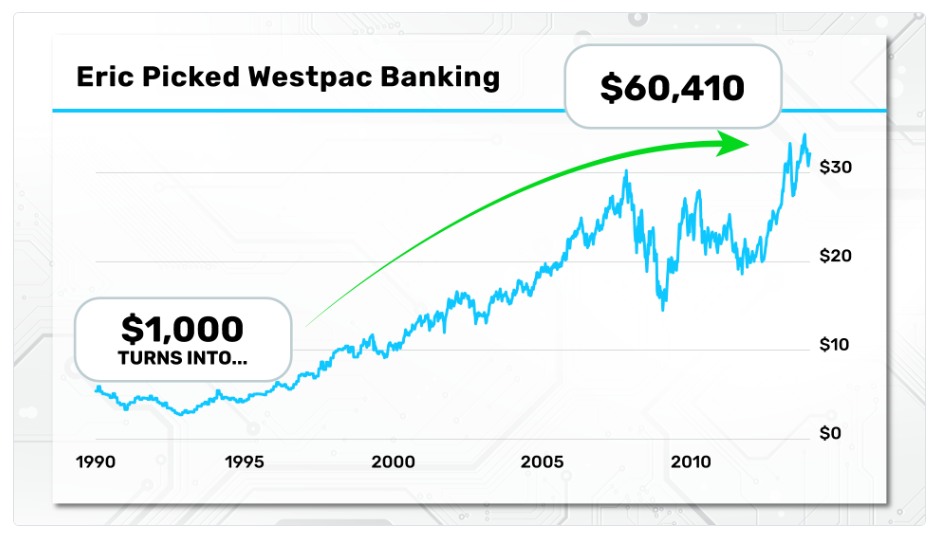

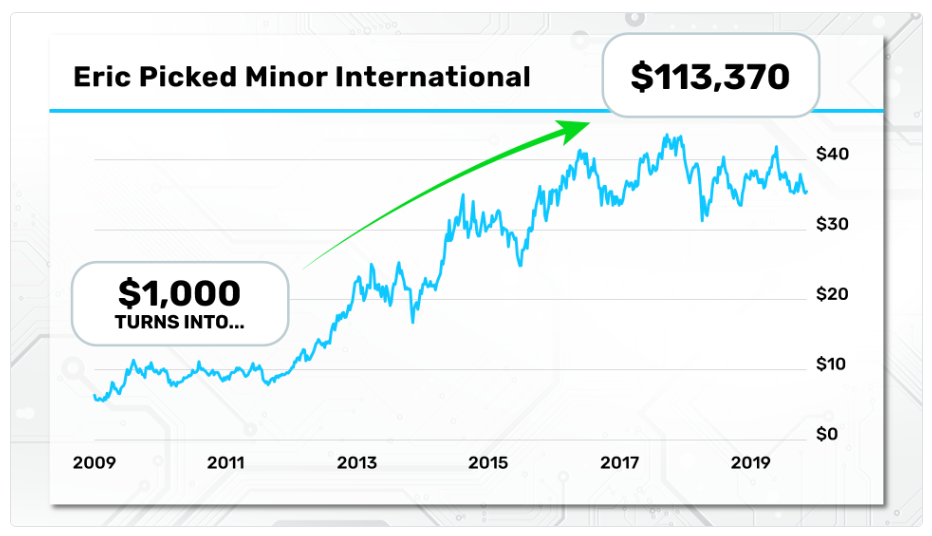

While working on our Fry’s Investment Report Review, we’ve found out that Eric Fry has led his readers to dozens of promising stocks over the years, and 41 of his picks went on to deliver potential gains exceeding 1,000%. Check out the chart above for the complete list.

He recommended Bitcoin back in 2015, and its value soared shortly after. Eric’s readers had a chance to generate as much as 200X returns from this single recommendation.

These were major trends that shook the financial world to its core. Many missed out on these opportunities, but Fry saw them coming a mile away.

Some of his most successful recommendations include:

It’d be next to impossible to find a more qualified research guru than Eric Fry. He has demonstrated his investing ability time and time again, and he’s shown his readers several massive winners in the past.

You can’t argue with results, and that’s exactly what Fry delivered with the recommendations mentioned above.

If you’re interested in high-quality stock picks, you’d have a hard time finding a more qualified guru than Eric Fry.

>> Get Fry’s latest research when you join now! <<

Pros and Cons

We found a lot to like during our Fry’s Investment Report review, but it does have a few rough edges.

Pros

- Strong emphasis on AI, robotics, and high-growth sectors

- Great price with an 80% discount

- Excellent 90-day money-back guarantee

- At least one recommendation a month

- Five detailed bonus reports included

- Free portfolio tracking tool (TradeStops Basic)

- Eric Fry is a reputable guru with a track record for success

Cons

- No active community forum or member chat

- Doesn’t cover options or short-term trading

Who Should Subscribe to Fry’s Investment Report?

Fry’s Investment Report takes a somewhat conservative approach to investing, looking for big-picture trends that push the market forward.

His goal is to identify the best stocks moving within that mess, a skill that just about anyone can take advantage of. After all, there always seems to be way more losers than winners when it comes to breakouts.

You’re only ever dealing with a trade or two per month, coming hot off the presses with every new issue of the newsletter. Folks not in this line of work full-time should find that manageable, while others may need to look elsewhere to fill a portfolio.

I am impressed by the amount of educational material Fry supplies here in the form of bonus reports.

These guides often share secrets into the market that apply to more than just recommendations currently on the table. Plus, the entire vault of previous reports is made available to all members.

Fast-paced traders probably aren’t going to find a whole lot here, since these picks can last for years at a time.

>> Save 80% when you subscribe now! <<

Frequently Asked Questions

Here are some common questions I get from readers about Fry’s service, along with my answers to them.

Is Fry’s Investment Report Good for Day Trading?

Eric Fry’s Investment Report isn’t the best choice for day trading, since the platform only rolls out one or two picks per month. They’re definitely not designed for purchase and sale on the same market day.

Instead, the team takes more of a long-term approach to these recommendations, covering positions that you could potentially hold for years at a time. In theory, you could ride out these gains for as long as the AI industry continues to grow.

Folsk with Swing trading strategies may stand to benefit from these opportunities, given the inherent rise and fall of the markets over days or weeks. Trade cautiously though, knowing that this is not what these securities are intended to do.

Does Fry’s Investment Report Offer Personalized Financial Advice?

No, Eric Fry and his Investment Report team do not offer any kind of personalized financial advice.

The recommendations you receive here are solely based on research reports from the latest happenings in the tech world. Whether they’re the right fit for your portfolio is not a decision anyone at Fry’s Investment Report is qualified to make.

If you are looking for investment advice, turn to a certified financial planner near you, so they can study your unique circumstances. They’ll be able to offer personalized recommendations based on your goals, risk tolerance, and budget.

What Can I Expect From Eric Fry’s Stock Picks in the Investment Report?

Past Eric Fry stock picks have handed readers 41 unique chances to see 1,000% gains or more over the years. These big wins come from Eric’s ability to forecast upcoming trends before they take off.

This is Fry’s goal for each new recommendation in the Investment Report, but of course the guru suffers losses too. Even his past wins are in no way an indication of future gains.

The market is by nature uncertain, and there’s never a sure thing when investing. Like any other opportunity, you’ll want to weigh the pros and cons of an investment before buying in.

That said, Eric Fry’s stock picks for 2025 look like some really promising opportunities.

Is Fry’s Investment Report Right for Me?

Fry’s Investment Report is best suited for people looking for steady growth in tech-focused stocks.

You’ll get a total of 12 monthly picks throughout your subscription, which is plenty to keep most readers busy.

However, the AI stock picks included in the bonus research is the real crown jewel in this deal.

If you’re on the hunt for the next big AI stock, Eric Fry can help you get there. His picks are sure to lead you to some promising stocks.

This service has broad appeal, but based on our review, Fry Investment Report is an especially excellent fit for anyone interested in macroeconomic trends, long-term growth, and groundbreaking tech opportunities.

>> Sound like a match? Get started TODAY <<

How Much Does Fry’s Investment Report Cost?

Fry’s Investment Report typically costs $499 for six months.

However, the new deal knocks the price down to $49, which shaves nearly 80% off the cover price.

In the end, you’re paying less than two bucks per week for an incredible amount of content.

When it comes time to renew, the Fry’s Investment Report crew will honor the $49 price tag for the next six months.

I’m thrilled that the service shies away from annual subscriptions, so I have more flexibility should I ever want to jump ship.

Given the comprehensive research, multiple special reports, portfolio tools, and frequent updates included, the cost is reasonable for those looking to protect and grow their wealth strategically in today’s markets.

Is Fry’s Investment Report Worth It?

After a thorough Fry’s Investment Report review, I have to say that the jaw-dropping track record is a testament to Fry’s skill.

Eric Fry is one of the most talented gurus in the game, and his research really stands apart from many others in the industry.

The “Sell This, Buy That” strategy provides clarity and discipline, encouraging folks to avoid value traps and capitalize on emerging growth.

With frequent updates, an accessible model portfolio, and a strong risk-free guarantee, this newsletter offers both educational and practical value.

It’s well-suited for folks seeking to position their portfolios for the next wave of market leadership.

If you want a research service that goes beyond hype and delivers real-world, tested investment insights, Fry’s Investment Report is worth serious consideration.

Subscribe today before these rare opportunities for wealth slip through your fingertips.

Tags:

Tags: