Since 2009, cryptocurrencies have revolutionized the capital market and upended the financial system. Today, over 20,000 digital coins are circulating on over 500 crypto exchanges, a huge jump from a decade ago.

However, volatility and transparency issues continue to surround the market. Some examples are the 2017-2018 crypto bubble burst and the 2022 price plunge. With about five times the historical volatility rate of stocks, cryptocurrencies have always been a high-risk investment. That’s why investing in crypto should be done with caution.

In addition, security threats and data breach issues remain prevalent. These raise caution and scrutiny among traders, businesses, and policymakers. Hence, we will discuss the increasing market appeal of cryptocurrencies. We will also cover the common security challenges in the crypto market and how traders and businesses can protect their digital assets from these threats.

The Increasing Appeal of Cryptocurrencies

Volatility has always been a challenge in the market. Despite being in the market for less than two decades, bubbles and bursts have happened many times.

In February 2011, for instance, the price of BTC reached $1.06 before falling to $0.67 in April. Two months later, it spiked to $29.58 but plunged to $2.14 in November. All this happened due to market sentiments driven by posts on Slashdot and the attention given by Gawker.

In December 2017, the market experienced a series of booms. BTC reached its highest price of over $19,000. But after a few days, its value eroded and dropped by 45%. This downtrend continued to the fourth quarter of 2018.

The last instance happened from 2021 to 2022. The stakes were much higher as BTC surpassed $60,000 for the first time since its inception. After nearly reaching the $70,000 level, it started to drop. Its value has already fallen by at least 70% in only seven months. This drop showed that volatility could offset gains in just a snap.

Despite all these, cryptocurrencies remained attractive. The extreme volatility driven by market sentiments was seen as a force that made them effective inflation hedges. The increasing appeal of blockchain technology and the fintech revolution also became new growth catalysts.

Most importantly, extreme volatility can help risk-loving investors build a fortune quickly. Price troughs are seen as opportunities to take a buy position and reap the rewards in the long run.

More interestingly, the increasing predictability of cryptocurrencies relative to inflation is getting the attention of more investors. While doubts about their effectiveness as inflation hedges falter, the higher predictability makes them as appealing as stocks. We saw their inverse correlation, wherein crypto prices fell as inflation rose.

It was more visible from the latter part of 2021 to 2024. As inflation started to gain momentum in 4Q21, the increase began to decelerate until the trend reversed. In 2022, inflation accelerated and set a new all-time high at 9.1%. Meanwhile, Bitcoin dropped below $20,000. The pattern continued as interest rate hikes were implemented.

In 2023, prices rebounded amid the inflation drop and the interest rate hike pause. There were some price troughs, particularly in mid-2023, during inflation upticks. Today, the trend remains visible.

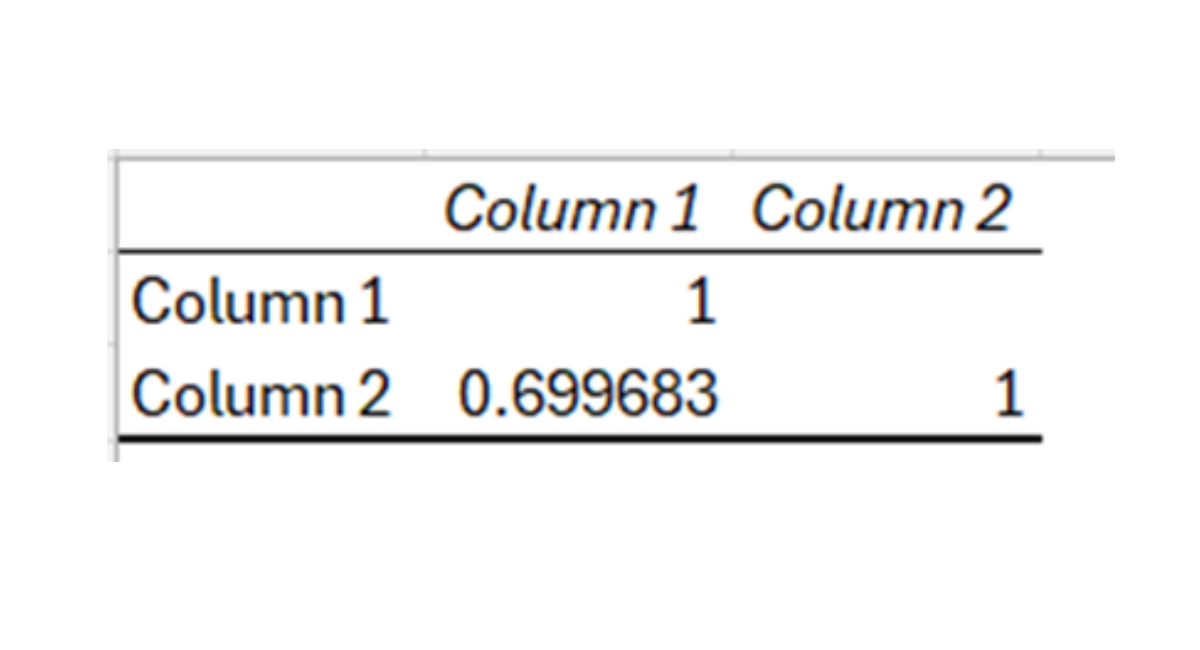

To further support this observation, we correlated Bitcoin price as the dependent variable and inflation as the x variable.

The 69.96% or 70% value shows a strong inverse correlation between inflation and Bitcoin price. This means that inflationary changes can substantially influence Bitcoin price swings.

Lastly, the cumulative returns of cryptocurrencies are far higher than the risks. From 2017 to 2024, returns were at least 300% for large cryptocurrencies, about four times their standard deviation. As such, these risky investments come with enticing rewards. The table below shows how the value of the three leading cryptocurrencies has changed over the years.

| Bitcoin (BTC) | Ethereum (ETH) | Binance (BNB) | |

| Seven-Year Returns | 6,649% | 354.48% | 6,753% |

| Average Annual Returns | 82.25% | 24.20% | 82.95% |

| Standard Deviation | 72.24% | 96.48% | 167.92% |

Common Crypto Security Threats

Like other investing platforms, cryptocurrencies are no exception to security threats. Crypto thefts are rampant in the market. With over 500M global crypto owners, hacking risks are more rampant today.

In 2023, the total amount of money involved in crypto theft reached $1.55B, a 51% decrease from $3.55B in 2022. However, incidents rose by 42%, from 199 to 283. This year, about $17B of crypto was stolen in January versus $8.4B the same month in the previous year.

Here are some common cyber security risks in the crypto market.

Crypto Phishing Attacks

Crypto phishing attacks or scams often involve an attempt to trick users into revealing their respective private keys or recovery phrases to their crypto wallets.

Like the typical phishing trick we know, attackers pretend to be a reliable person, like a representative of a crypto exchange platform or app. That way, they can quickly gain their victims’ trust. Note that crypto transactions are irreversible. So, you can never retrieve your crypto if the phishing attempt is successful.

Phishing can also appear as a fraudulent email or website to steal your login credentials. They can also appear as fake exchanges, wallets, and apps. If you’re not that observant, these can appear real.

For example, you can receive an email containing a download link from an unknown sender or a fake crypto trading app. Once you click the download link, phishers can obtain your private keys. Then, they can transfer your crypto to their wallets. If you have a linked payment method, they can also use it to buy more cryptocurrencies for themselves.

Crypto Malware and Ransomware

Crypto malware or ransomware encrypts data on and demands a ransom to restore it. This malware attacks individual traders and businesses.

Like a phishing scam, malware can be delivered as a link in an email or a hacked social media account. Once clicked, the device will be infected by malware, affecting the overall functionality and efficiency of a system, program, or device. You can’t use the device until you pay the ransom amount.

Then, victims will see a ransom note on the device, leaving the attackers’ contact details and instructions. This is often found in the encrypted file, which can appear as a desktop wallpaper or a display in the browser. The attackers may restore a small file for free to prove their decryption key. Ransom payments are typically demanded in cryptocurrency to maintain their anonymity.

Social Engineering

Social engineering in crypto can be similar to phishing and malware or ransomware attacks. It manipulates victims into revealing sensitive information, such as wallet keys and login credentials. They may also be tricked into taking action, such as clicking links in an email or opening a fake website. Both can compromise the security of their device and crypto networks.

This usually consists of four fundamental steps. First, attackers study their potential targets to gain essential information. They may use social media websites as their entry points.

Second, they will connect with their victims by sending messages or calling until they gain their trust.

Third, they will provide stimuli to trick victims into taking actions that may violate safety practices. They do this by representing themselves as trustworthy individuals so victims will disclose their sensitive information and allow attackers to access crypto wallets and bank accounts.

Fourth, they will retreat once the victim has taken the desired action. Most often, victims can never track them.

Steps To Protect Your Crypto Security

These are some practical ways to protect your security.

Use VPNs

In today’s world, even the largest business may not be spared by the trickiest attacker. That is why it is important to maintain secure online activities. A VPN is an essential tool that helps prevent other people from tracking your device. However, many individuals and businesses have overlooked the benefits provided by VPNs.

A VPN will help you thwart attempts to track your browsing activities, particularly mobile banking and crypto trading. If someone hacks a website you’ve recently visited, he can never track your device. With a VPN enabled, your internet traffic will be redirected or transferred to the VPN’s internet connection provider. So, even if someone from your internet provider tries to watch your online activities, he will only see the details of your VPN provider’s internet connection, not your data.

Enable two-factor authentication (2FA) or multi-factor authentication (MFA)

Activating 2FA or MFA on your device is wise to strengthen your wallet’s or app’s security. This safety practice is essential to secure your accounts and coins in hot or cold wallets. It is already common since it is used as an additional precaution.

Even if your attackers gain your password keys, they can’t easily log into your account. They will still need a one-time PIN sent to your device as a message or email. Hence, you can prevent them from stealing your account and coins.

Trade on trusted crypto exchanges

With over 20,000 cryptocurrencies in the market, many crypto exchange platforms and wallets are appearing today. To keep up with the tight competition, smaller platforms may provide deals you can’t refuse.

However, these platforms may be new to the market and have yet to enhance their security as they emerge. As the number of traders and transactions increases, crypto theft risks may also increase.

That is why you have to study all your options and be meticulous. Choose the trusted ones, as the market has already experienced many crypto theft incidents. That way, you will not be added to the crypto theft victim list.

Aside from that, choose a liquid wallet or exchange platform. Take note of the FTX fallout in 2022 as a lesson. The ones with diverse token allocations are often the safest during price corrections.

Avoid answering calls from unknown numbers

Hackers do not want to be tracked by their victims and security agencies, so they will try to remain anonymous. Many SIM cards are unregistered in many countries, allowing malicious individuals to do fraudulent activities.

As a safety precaution, do not just answer calls from unknown numbers. If they hang up, they may message about their reason for calling. You can also send a message to verify if the number is registered. If they reply, confirm their validity. If not, don’t bother.

Beware of public Wi-Fi

Public Wi-Fi has weak security; even amateur hackers can easily break into it. Avoid connecting to them even if you have an urgent crypto transaction. This may put your device and crypto wallet at risk. Access your mobile data instead.

Takeaways

Price stability and returns can be more attractive as the crypto market heats up. It may be a viable investment to help you build your wealth. Even so, volatility and security risks must be taken with extra caution. Doing so will help you protect your assets and security.

Tags:

Tags: