CoinRabbit introduces a new way for crypto users to get quick access to cash when you need it most, without having to sell your assets.

The platform allows users to borrow against their holdings without credit checks or complicated paperwork, all within a matter of minutes.

In this CoinRabbit review, I’ll share my honest take on whether its crypto loan service actually delivers the flexibility and reliability it promises, and if it’s truly worth trusting with your digital assets.

What is CoinRabbit?

CoinRabbit is an all-in-one crypto lending platform designed for people who want instant liquidity for needs without having to part ways with digital coins and tokens.

What makes it stand out is how seamless the experience feels. Everything happens on a single platform that also includes a built-in wallet, an integrated exchange, and even an interest-earning program for those who prefer to grow their holdings passively.

With support for over 300 cryptocurrencies, flexible loan-to-value ratios, and 24/7 customer support, CoinRabbit aims to make borrowing against crypto both accessible and practical.

It’s ideal for anyone looking to free up funds for new opportunities while keeping long-term positions intact, and that’s exactly where it starts to get interesting.

Is CoinRabbit Legit?

When it comes to trust, CoinRabbit checks several important boxes that make it a legitimate player in the crypto lending space.

I’ve seen the platform covered in several noteworthy media outlets, and its ever-growing partner list speaks very loudly about how CoinRabbit operates.

CoinRabbit also inspires confidence through its operations. Loans are over-collateralized, stored in cold wallets, and protected by an automated liquidation notification system.

Users receive funds within minutes, and most importantly, the service does not require credit checks, meaning it’s accessible while still maintaining strict collateral control.

Multiple reviews on platforms like G2 and Trustpilot mention smooth experiences, fast payouts, and professional support, which reinforces the impression that CoinRabbit delivers on what it promises.

From a practical perspective, it’s a functional, transparent, and well-maintained platform that’s earned its legitimacy by consistently doing what it says it does, providing reliable crypto loans to users who need quick access to liquidity without selling their holdings.

>> Experience Smooth Earning from CoinRabbit NOW <<

CoinRabbit Review: What Comes With It? (Key Features)

Join me as I walk through each of the service’s core features so you know precisely what you’re signing up for:

Crypto Loans

With CoinRabbit, taking out a crypto loan is fast and user-friendly.

The platform lets you pick your loan-to-value (LTV) ratio, which determines how much you can borrow against your collateral.

Two loan options give you the ability to set a fixed period to pay back the loan and interest, or pursue an open-ended loan that you can take care of at any time.

What’s more, the system continuously monitors collateral value for one of three risk zones.

You’ll get an immediate notification if you need to take action, such as repayment or adding more collateral.

In any case, once you’ve met the terms of your loan contract, CoinRabbit returns your collateral in full.

Wide Collateral Support

One of CoinRabbit’s strongest advantages is the breadth of collateral eligibility.

You can use many altcoins you already hold to back loans, instead of first swapping into “major” coins.

In addition, CoinRabbit claims it does not use your collateral for any of its loans, helping to reduce counterparty risk around how your collateral is handled behind the scenes.

Crypto Savings

If you’d rather sit back and let your crypto work for you, CoinRabbit’s “Earn” feature is built for that.

You deposit assets into a savings-style vehicle and begin earning daily interest.

This allows CoinRabbit to fund its loans using the same format that traditional banks do, serving as a win-win for both sides.

The flexibility is a highlight: there are no fixed lock-ups, and you’re allowed to withdraw at any time.

Because there’s no long commitment, this is useful for those who might want to redeploy their crypto quickly when market opportunities arise.

>> Get Crypto Savings Today <<

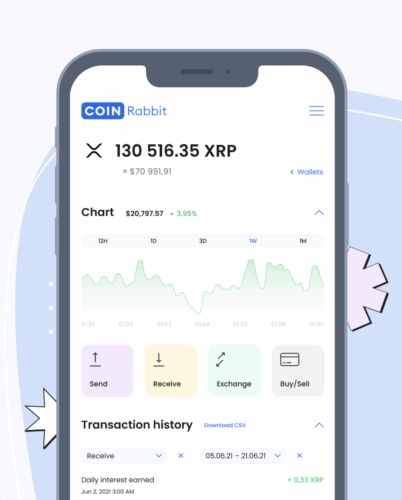

Integrated Wallet + Exchange

One of CoinRabbit’s more subtle yet powerful features is its integrated wallet and exchange that serve as a live hub for managing every part of your crypto life.

When you open your CoinRabbit wallet, you can view balances of over 270 assets in one interface.

You can deposit from external exchanges like Binance or Coinbase directly, so there’s no need for extra transfers back and forth.

The exchange, or “swap” function, works seamlessly inside the wallet to convert your assets between 270+ cryptocurrencies without hidden fees.

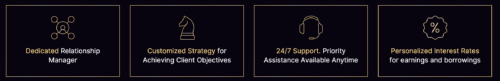

VIP Program

For users who rely on CoinRabbit regularly or manage larger portfolios, the VIP Program adds another layer of convenience and control.

While you’re paying a premium, CoinRabbit rewards you with a dedicated relationship manager and 24/7 support for any issues you encounter along the way.

Furthermore, this elevated platform affords personal interest rates for both earnings and borrowings that could honestly cover the cost of admission in the long run.

It’s an approach that mirrors traditional private banking, where loyal users are rewarded with better terms and exclusive service, but adapted for crypto.

API / B2B Lending Integration

CoinRabbit’s API and B2B lending integration is one of its most forward-thinking features, built for companies that want to offer crypto loan services without creating the infrastructure from scratch.

Essentially, CoinRabbit acts as the back-end engine, while businesses can fully brand the front-end experience as their own.

Through this integration, partners can embed CoinRabbit’s borrowing and lending framework into exchanges, wallets, or fintech apps, allowing their users to access instant crypto loans directly from their platforms.

Businesses can set custom parameters for loan limits, LTV ratios, and accepted assets while leveraging CoinRabbit’s liquidity network and risk-control mechanisms.

Refund / Repayment / Exit Terms

CoinRabbit keeps the repayment process simple and transparent, whether you’re jumping into a fixed-timeframe loan or something more open-ended.

For folks using crypto to earn interest, you can take out funds at any time without lock-ups or hidden fees.

While traditional “refunds” don’t apply to lending products, CoinRabbit’s flexible exit options make it easy to close your position, reclaim your assets, and move your funds freely

>> Risk-Free with CoinRabbit <<

Pros and Cons

Upon checking every nook and cranny of what CoinRabbit can do, here are my top pros and cons:

Pros

- Fast access to liquidity without selling crypto

- Many collateral options (300+)

- Flexible repayment with open-ended loans

- No credit checks

- Integrated wallet + exchange

- Earn interest on idle crypto with flexible terms

Cons

- Interest rates appear high

- Liquidation risk if collateral price drops

Final Verdict: Is CoinRabbit Worth It?

After going through every aspect of this platform, it’s clear that CoinRabbit stands out for one main reason: it keeps crypto borrowing simple.

The ability to borrow against your crypto without selling it, and without credit checks or complex onboarding, gives users a real sense of financial freedom.

That said, CoinRabbit is not without its risks. Like any crypto lending service, it operates in a volatile market where collateral values can fluctuate quickly.

So, is CoinRabbit worth it? For anyone looking for a reliable way to unlock liquidity without giving up their crypto holdings, the answer leans strongly toward yes. It’s fast, easy to use, and offers more transparency than many of its competitors.

As long as you understand the inherent risks of crypto lending and take basic precautions, CoinRabbit delivers on what it promises: a straightforward and dependable crypto loan experience.

Tags:

Tags: