Whitney Tilson is back at the helm of one of Stansberry Research’s most notable commodities-focused research services, but does it live up to the hype? I took a deep dive into Whitney Tilson’s latest AI prediction in my Commodity Supercycles review to find out if it’s worth your time.

What Is Commodity Supercycles?

Commodity Supercycles is a research service and monthly newsletter published by Stansberry Research and led by stock market veteran Whitney Tilson.

Despite a vast portfolio of research publications, Commodity Supercycles is a stand out on the Stansberry roster as one of only a few entry-level options for beginner-friendly commodity research.

The services offers annual subscription option that provide reader’s with access to monthly reports featuring Tilson’s latest stock picks, in-depth research resources, and other Perks.

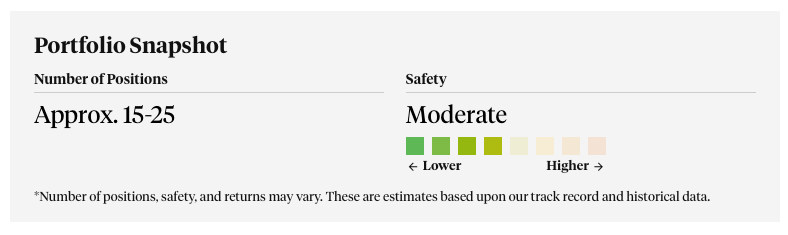

On its website, Stansberry Research lists the service as “moderate” on the risk-reward ration and says Tilson typically carries 15 to 25 open positions at any given time.

According to Stansberry, the service aims to “help you understand and take advantage of the world’s most promising investments in the energy and natural resources space.”

Some of the sectors Tilson’s picks target include oil, gas, coal, precious metals, and other natural resource companies.

I’ll cover the perks of a Commodity Supercycles subscription in more detail a bit later in my review. For now, let’s tale a closer look at the head honcho in this outfit, Whitney Tilson.

Who is Whitney Tilson?

Whitney Tilson is the lead guru for Commodity Supercycles and one of the most respected analysts on Stansberry’s roster.

When I first heard about Whitney, I was curious about his background and what drives him. It turns out, he has an impressive resume.

Tilson graduated from Harvard College and Harvard Business School. He quickly made a name for himself by growing his hedge fund from $1 million to over $200 million.

Beyond his financial career, Tilson co-founded Teach for America and is deeply involved in educational and philanthropic efforts. His dedication to education reform and supporting schools in Africa highlights his commitment to making a difference.

Additionally, his adventurous spirit, seen in his passion for mountaineering and obstacle course racing, adds another fascinating dimension to his life.

But, what really intrigued me about Whitney was his knack for spotting market trends and predicting major financial events.

I knew I recognized his face when I first saw his picture, but I wasn’t sure from where. Turns out, he’s been featured on CNBC, CNN, Bloomberg, the Wall Street Journal, and other major publications.

Is Whitney Tilson Legit?

Tilson’s track record underpins his credibility. He predicted the dot-com bust, the housing bubble, and the 2008 financial crash. Plus, he’s got a knack for picking stock winners.

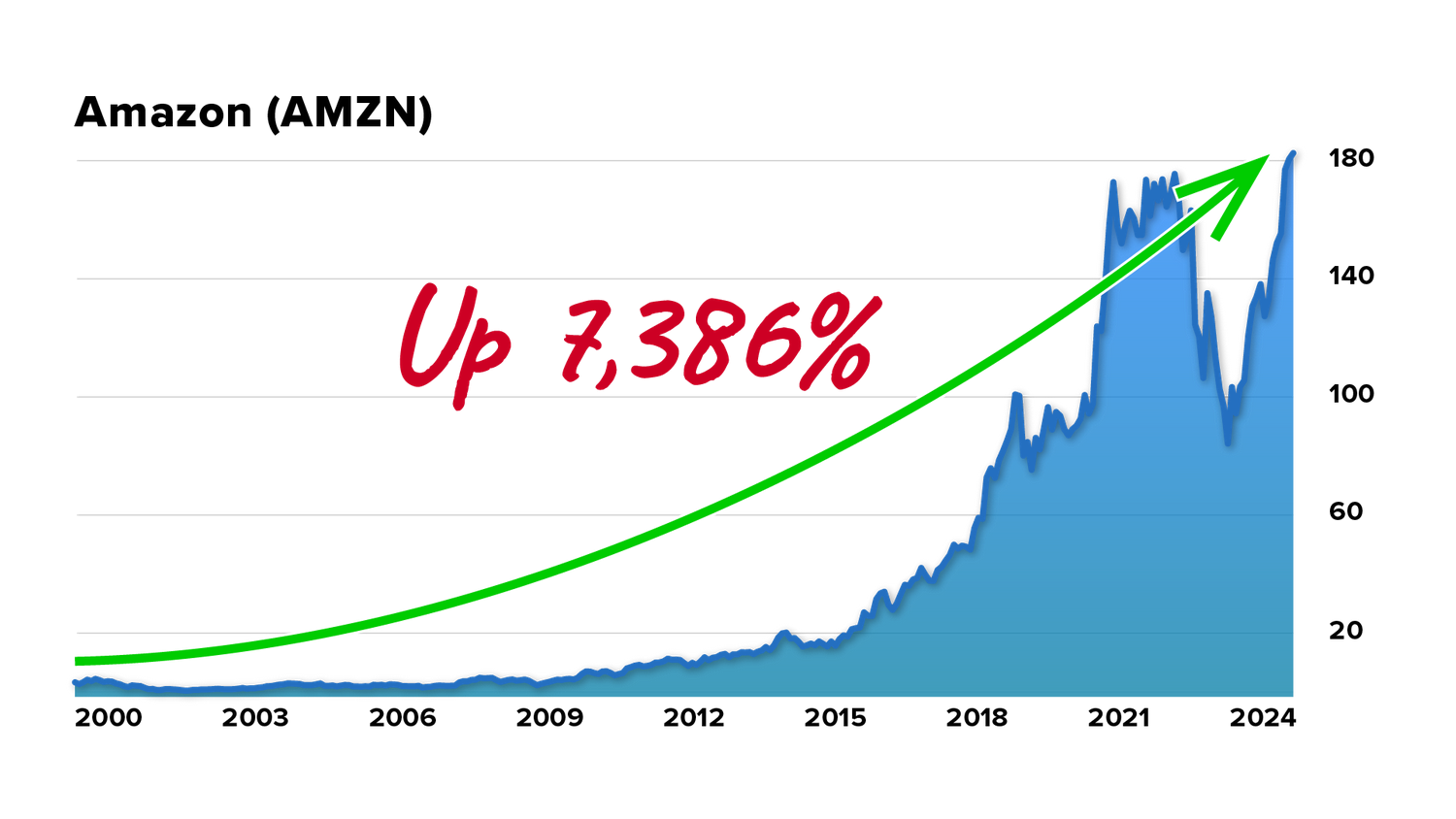

Tilson snagged Amazon at $2.41 per share, Apple at 35 cents, and Netflix at $7.78. Talk about impressive gains!

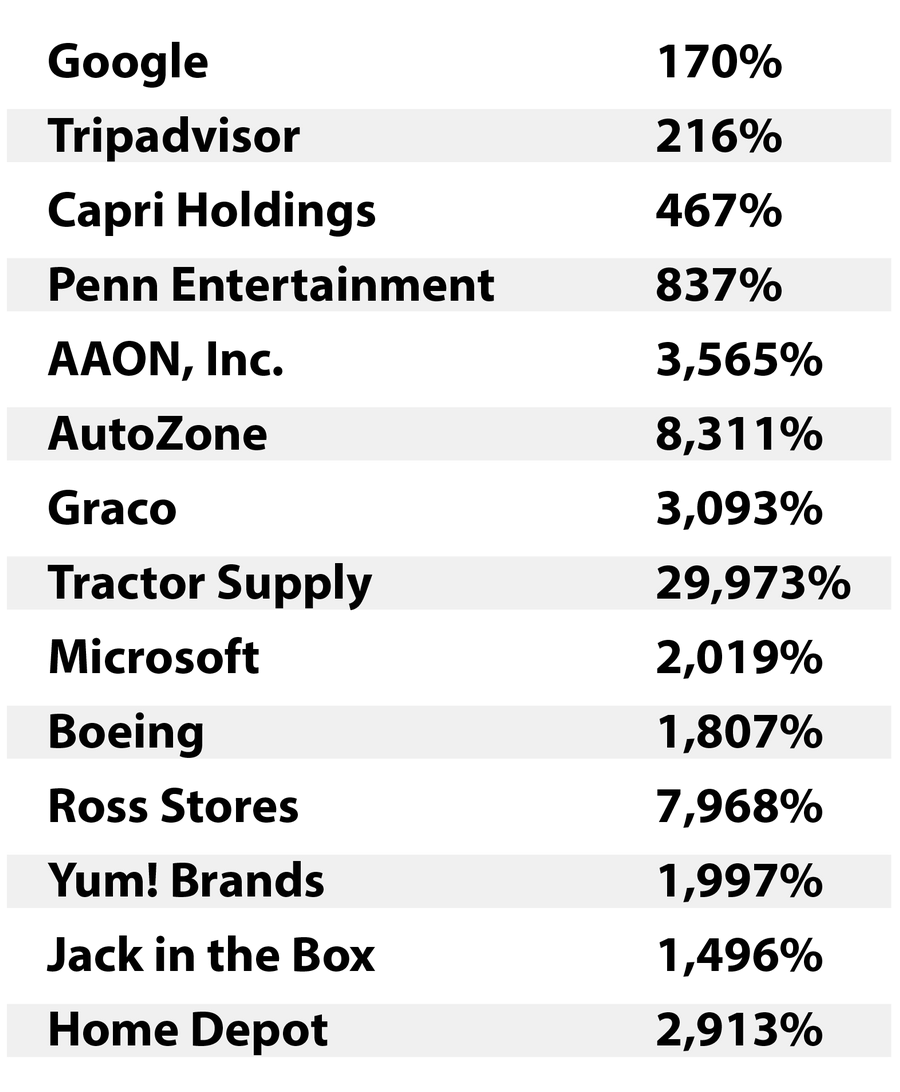

He also previously helped his followers see peak gains as high as:

Most impressively, his research has earned endorsements from finance heavyweights, like Bill Ackman and Joel Greenblatt. That’s a rare accomplishment for an analyst with a public research service.

After an extensive review of Tilson’s credentials, I think he is the real deal. He has everything I like to see in an analyst.

>> Get Whitney Tilson’s latest recommendations <<

What is Stansberry Research?

Commodity Supercycles is published by Stansberry Research, one of the leading names in the investment research industry.

Stansberry has several popular services under its banner, but Commodity Supercycles is one of its main offerings for commodity plays.

Based in Baltimore, the U.S.-based research firm has been bringing professional-grade invesment insights to the public for decades.

Stansberry’s services have thousands of subscribers, and they extensive experience watching the markets.

Stansberry is one of the most credible and trustworthy research firms around, so you can rest assured that Commodity Supercycles is the real deal.

Is Stansberry Research Legit?

Stansberry Research is one of America’s most established financial research publishers. With dozens of publications under its banner, Stansberry is an absolute powerhouse in the financial publishing space.

Based in Baltimore, the U.S.-based research firm has been bringing professional-grade invesment insights to the public for decades.

Thousands of subscribers in dozens of countries across the world regularly read Stansberry content, so the firms research is extremely influential and even consequential, at times.

My experiences with Stansberry have always been positive. A quick online search will reveal some criticism about some of their more aggressive marketing practices, but their tactics have become more user-friendly as of late.

However, I have noticed that most negative reviews complain about service issues, NOT research quality. Their research is widely read and respected, so you can trust the research coming from a Stansberry publication.

>> Access the team’s latest research <<

Whitney Tilson’s Latest Presentation

Whitney’s latest presentation, “This is the Biggest Untold Story About AI in 2024,” has got everyone buzzing.

He’s talking about a surprising technology that could soar 12,679%, and no, it’s not Nvidia.

Tilson digs into the energy needs of AI and how nuclear power could be the key to keeping the lights on. It’s a fascinating look at the future of both AI and nuclear energy, and I think it’s definitely worth exploring further.

So, let’s break down the key points and see what all the fuss is about.

AI’s Biggest Untold Story

When it comes to AI, there’s one thing that often gets overlooked: just how much energy it consumes.

Tilson drops some mind-boggling examples, like the world’s fastest supercomputer needing 21 megawatts to run (that’s enough to power 15,000 homes) and Intel’s upcoming supercomputer requiring a massive 500 megawatts.

But here’s the thing: OpenAI’s Sam Altman admits that their tech is only possible with tons of cheap energy.

In fact, ChatGPT alone could cost a staggering $700,000 a day without a more affordable energy source.

That’s why Microsoft has already spent $800 million to keep their data centers running and another $10 billion into nuclear power to fuel their AI projects.

Tilson’s presentation really drives home the essential link between AI and nuclear energy. It’s clear that we need a reliable, cost-effective, and scalable energy solution to keep the AI revolution going strong.

Whitney’s Bull Case for Nuclear Power

Whitney is betting big on nuclear power, and he’s got some pretty compelling reasons why.

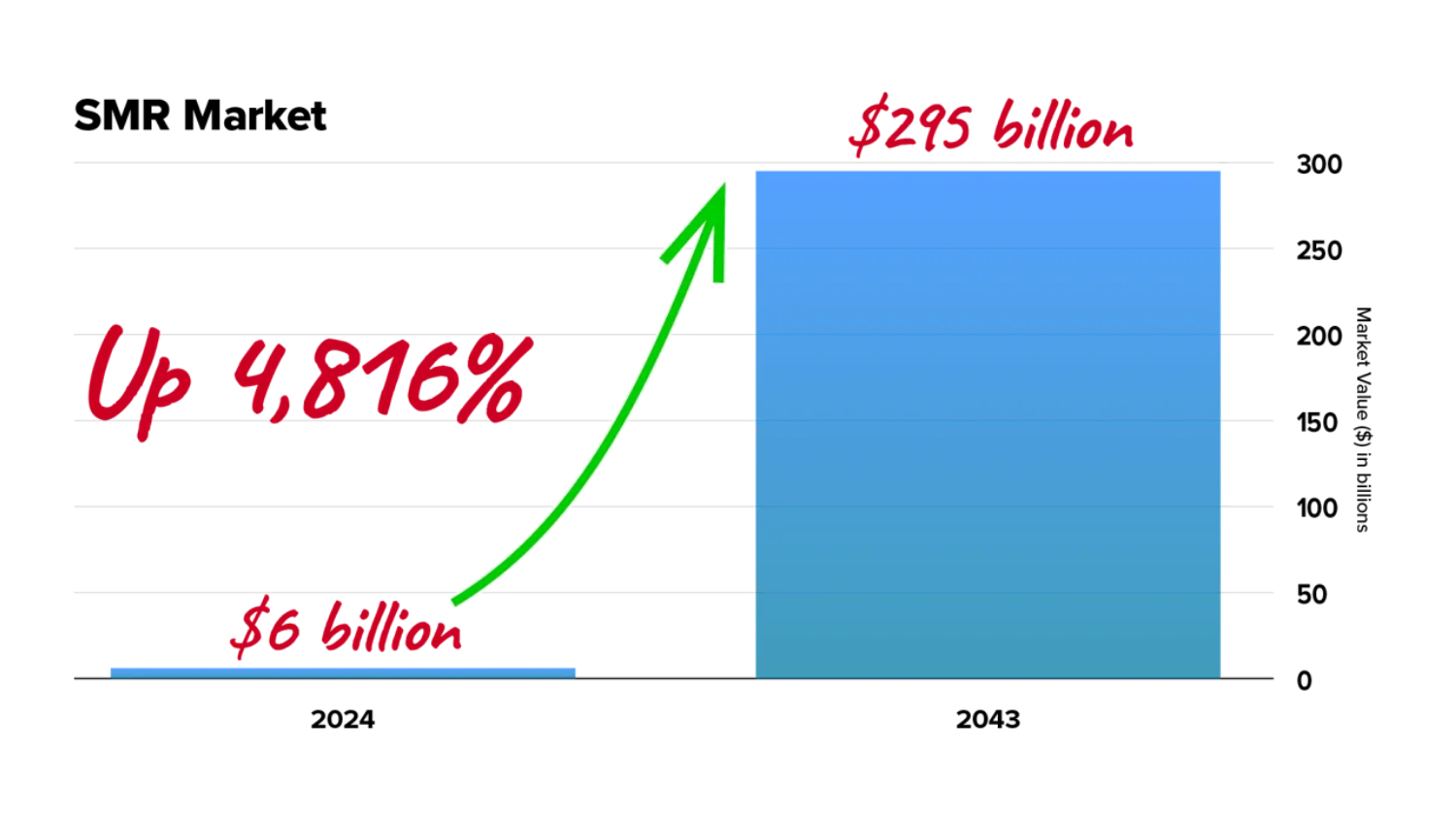

He’s particularly excited about small modular reactors (SMRs), which he sees as a game-changer for the industry. Tilson expects the SMR market, currently sitting at $6 billion, to explode by 4,800% in the coming years.

The U.S. Department of Energy has already identified nearly 400 coal plants across the country that could be transformed into nuclear plants using SMRs. These compact reactors can crank out almost half the energy of a traditional nuclear plant at a fraction of the cost and time it takes to build.

Even Bill Gates is getting in on the action, backing the transition of a Wyoming coal plant into a nuclear facility that will power 400,000 homes and create over 1,600 jobs.

With the government throwing its weight behind the sector and billions in investments pouring in, early adopters in the nuclear industry could be set for some serious growth.

>> See why the team is so bullish on nuclear <<

Is Whitney Tilson’s Uranium Prediction Legit?

I believe Whitney Tilson’s uranium prediction is spot on, and it’s a topic that deserves our attention.

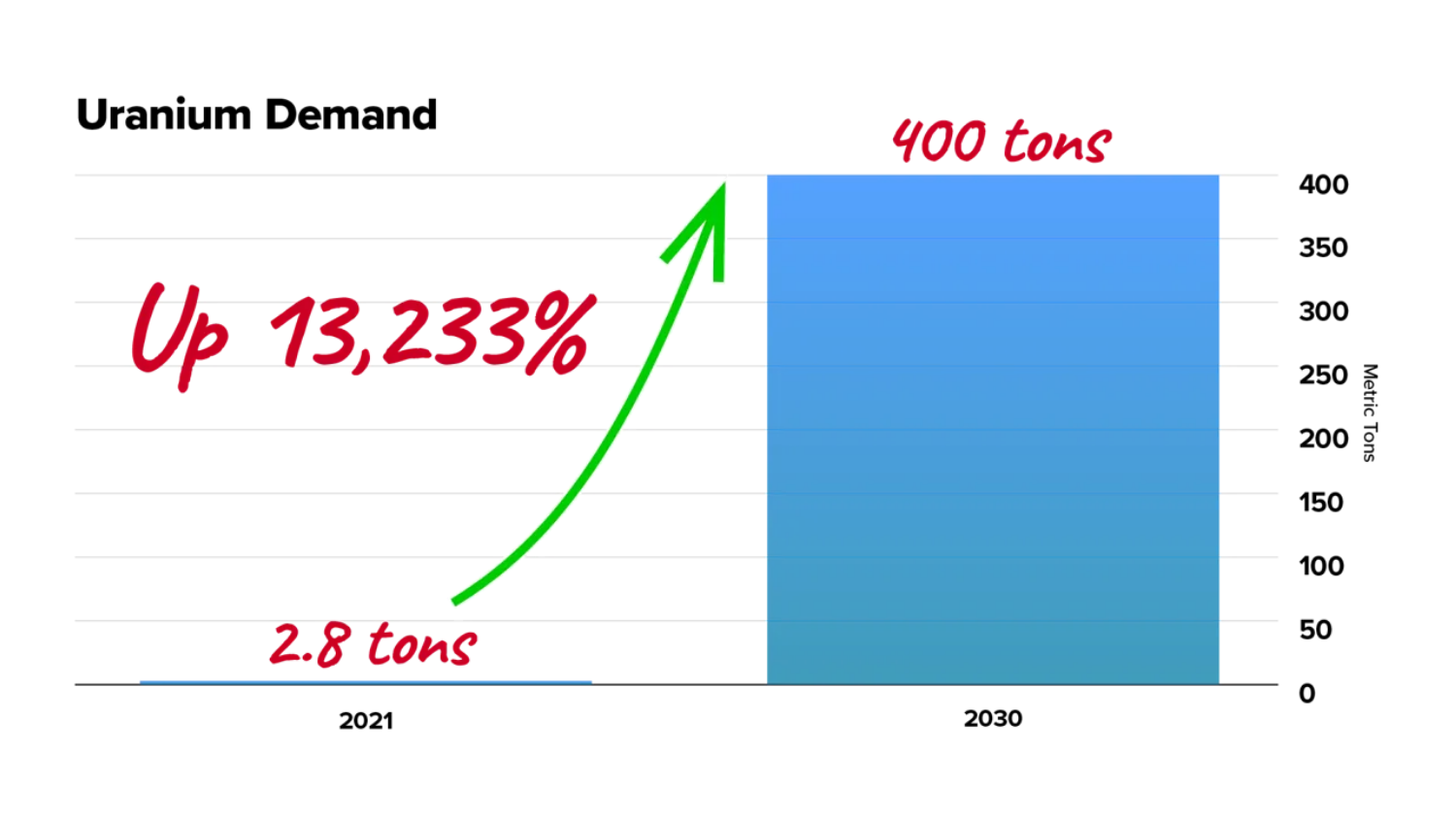

As more countries turn to nuclear energy, Tilson believes uranium demand will soar. The U.S. currently needs about 3 metric tons of uranium annually, but – by 2030 – the government expects demand to reach an astonishing 400 metric tons.

That’s a staggering 13,000% increase.

However, the U.S. faces a significant challenge in meeting this demand, as it heavily relies on imported uranium, particularly from Russia.

The White House has taken initial steps to address this issue, approving $2.7 billion in emergency funding for domestic uranium and banning Russian imports. I agree with Tilson that the U.S. needs more action to prevent a potential 40-million-pound annual shortfall over the next decade.

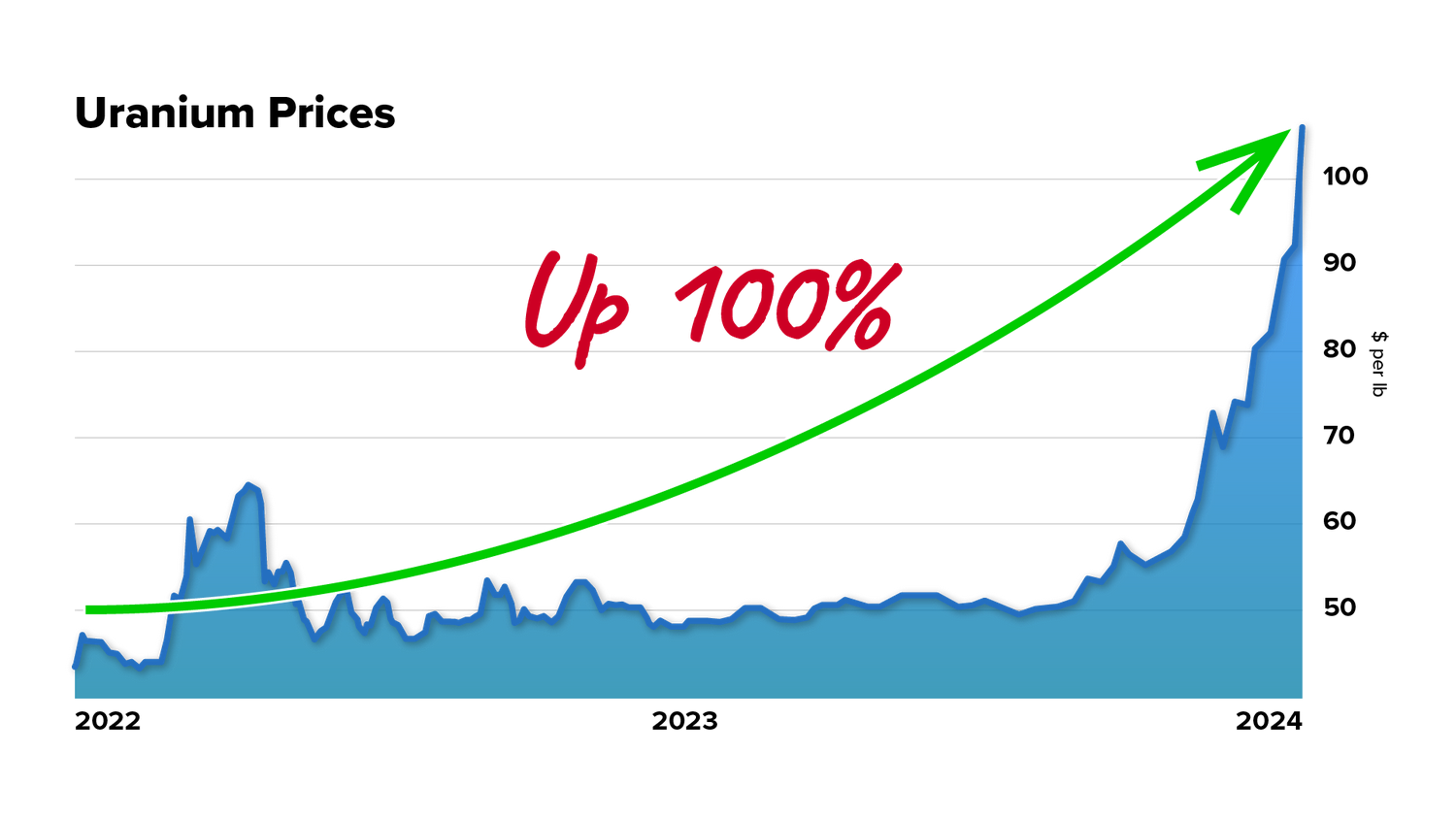

In recent months, uranium prices have doubled, with the price exceeding $100 for the first time since 2007.

This surge, growing AI energy demands, government support and more make Tilson’s case for the growth of nuclear power and the uranium market all the more compelling.

Let’s explore how Stansberry Research’s Commodity Supercycles can help you capitalize on this opportunity.

>> Sign up now to access the #1 gold stock <<

Commodity Supercycles Review: What comes with It?

You can get access to all of Tilson’s research on this opportunity if you sign up for a subscription to Commodity Supercycles. Here’s what you get when you join.

Commodity Supercycles Monthly Newsletter

Each month, you’ll receive a new issue of the Commodity Supercycles namesake newsletter.

Inside, the team shares its insights on the biggest opportunities among popular commodities such as metal, natural resources, and energy.

Each pick is carefully vetted to provide the best shot at considerable gains against market conditions and all other tickers on the market.

I love how everything’s laid out so cleanly. You don’t need much time to locate and read up on recommendations so you know precisely how to invest.

To top it all off, you can quickly glean portfolio updates you may want to move on affecting your open positions.

Trade Alerts and Updates

Throughout the month, you’ll get trade alerts and updates sent directly to your inbox whenever the team sees something big on the horizon.

These crucial insights come when they’re needed most, a total blessing when newsletters only drop once a month.

Possible notifications include when it’s time to buy or close a position or lock in gains.

Missing out on these actions could spell the difference between a big win and a devastating setback.

Make sure to set up your email or SMS to receive these messages as soon as they take place. This might mean ensuring your email provider doesn’t accidentally drop them into spam.

Model Portfolio

The team at Stansberry keeps an up-to-date model portfolio with some of the best commodity-based investment recommendations inside.

It’s an excellent place to visit often, especially when you first join Commodity Supercycles. You’ll find a number of buy opportunities and an up-to-the-moment list of their current standing.

For me, it’s also a great place to gauge the track record of the guru and his service. I pop over here right away to study past stock picks and how they ultimately fared.

Keep in mind that changes are often reflected in the monthly newsletter or through trade updates popping up throughout the month.

>> Join now to see Commodity Supercycles’ latest picks <<

Whitney’s Nuclear Power Bonus Reports

You also get these bonuses when you join Commodity Supercycles under the nuclear power deal.

The Top Stocks for the Nuclear Renaissance

Tilson’s groundbreaking report uncovers the companies spearheading the exciting nuclear energy revival.

One frontrunner has already secured a staggering $400 million in government contracts, while another landed an impressive $120 million to ramp up uranium production.

The report also shines a light on a company operating nearly half of America’s nuclear power plants with a war chest worth hundreds of millions of dollars.

Additionally, Whitney’s analysis reveals the nation’s top competitive power generator, which recently made waves by acquiring a major nuclear fleet.

This move caught the attention of Wall Street giants like Ray Dalio and Steve Cohen, who eagerly invested in the company’s vision.

With comprehensive profiles of these nuclear energy leaders, Tilson’s report provides you with the vital insights needed to understand and potentially profit from this rapidly expanding sector.

The Secret Currency: How to make 500% from the U.S. government’s second, secret currency

Most are unaware of a little-known investment method many of the world’s wealthiest families use.

The Secret Currency shares information about a form of gold and silver that has nothing to do with conventional strategies. It’s similar to gold and silver, but with the potential for much higher gains.

This little-known investment has been a closely guarded secret of the ultra-rich for generations, from the Rothschilds and DuPonts to iconic figures like Jackie Onassis and J.P. Morgan.

Despite its incredible potential, this alternative form of gold and silver remains largely unknown to the average American investor.

With historical returns reaching as high as 500% to 1,000%, even during market downturns, now could be the perfect time to explore this secret currency.

The Silver Trade

Gold isn’t the only major player in the commodities market.

The Silver Trade ebook looks into the gold-to-silver ratio and how trends show a positive outlook for silver.

You’ll learn how silver could outperform gold and receive trade ideas about stocks that could be prepped to take off.

>> Get the top silver stock when you join now <<

The #1 Gold Stock to Buy in 2024

This special report calls out one gold stock that the team believes belongs in every portfolio.

Within its pages, you’ll discover the number one gold royalty investment opportunity that’s flying right under the radar.

At around $6 per share, anyone can grab a piece of this budding business while prices are low.

The experts at Stansberry Research anticipate the share price could rise as time presses on.

BONUS Access to Stansberry’s Investment Advisory

When you join Commodity Supercycles today, you’ll also get a complimentary 12-month subscription to Stansberry Research’s flagship newsletter – Stansberry’s Investment Advisory.

This bonus – usually costing $499 – includes monthly issues featuring stock recommendations and market analysis from the Stansberry Research team, as well as trade alerts.

It’s a pretty amazing deal, if you ask me. You’re saving $499, and getting some expert insights in the process.

Whitney Tilson’s Daily

In this daily email, you’ll find valuable insights you won’t get anywhere else.

Whitney shares his take on current market trends, like parallels to the dot-com bubble. He also opens up about his wins with Netflix and his thoughts on the “Roaring Kitty”-driven GameStop frenzy.

It’s a must-read for every subscriber.

Stansberry Digest

Each day the markets are open, the team at Stansberry Research sends out a digital copy of the Stansberry Digest.

You can peruse everything the firm has been up to and their most exciting investment suggestions. The newsletter also discloses current research topics and expectations for the coming months.

>> Get Stansberry Digest free when you JOIN NOW<<

Whitney Tilson’s 100% Money-Back Guarantee

Orders placed for the Commodity Supercycles package come with a 30-day 100% money-back guarantee.

You just have to call the Stansberry Research US-based team to get a full refund of your purchase.

The firm even lets you hold on to the bonus materials as a “thank you” for trying out the service.

Commodity Supercycles Track Record

The team holds a number of accolades, including 27 MBAs, 15 CPAs, Juris doctorates, and a handful of PhDs.

And in Commodity Supercycles, they have predicted big gains for companies such as Northern Dynasty, Seabridge Gold, Silver Wheaton, ATAC Resources, and others.

Each of these recommendations provided the potential for hundreds of percent gains for folks who were quick to the draw.

Pros and Cons

Commodity Supercycles is a great service, but nobody’s perfect. Here are the pros and cons.

Pros

- Veteran guru in Whitney Tilson

- Commodity-focused research

- Extensive collection of bonus reports

- In-depth research on the Whitney Tilson’s nuclear prediction

- Free subscription to Stansberry’s Investment Advisory

- Includes Complimentary access to several daily e-letters

- 100% money-back guarantee for 30 days

- Proven track record

- Legitimate, U.S.-based publisher.

Cons

- No community chat or forum

- Doesn’t cover shorts or options

>> Get started now for instant access to these benefits and more <<

How Much Does Commodity Supercycles Cost?

Commodity Supercycles normally costs $998 for a year’s worth of newsletter content. However, you can save 80% if you get started now.

You’ll pay just $199 if you take advantage of the limited-time introductory discount. At that rate, the total cost breaks out to just over $16 per month.

Just remember, the subscription will renew at the original price unless you cancel. The discount is only good for your first year.

However, the discounted deal includes access to everything I covered in my Commodity Supercycles review, so you’ll get the full package at a fraction of a price for the first year.

Is Commodity Supercycles Worth It?

After a thorough Commodity Supercycles review, I found that this is a solid service that’s well worth the price.

The $199 cost is a small price to pay for the wealth of information you receive in a 12-month Commodity Supercycles newsletter subscription.

You’ll have access to the team’s top stock picks in the commodities sector, along with company profiles and lightning-fast trade alerts.

Your subscription also includes an excellent money-back guarantee, and you get to keep all the bonus resources if you decide the service isn’t for you.

I think this is an excellent service backed by a stellar team. Whitney Tilson is one of the best in the business, and his nuclear prediction bundle is a particularly good deal.

If you want to take your commodity trades to the next level, you should give Commodity Supercycles a shot.

Tags:

Tags: