Check out our Stansberry’s Credit Opportunities review for a full breakdown of this elite newsletter service.

Stansberry Research is widely recognized for its family of stock market research services.

But few people know that the firm also has an advanced research newsletter focused on corporate-bond investing.

Tune into our Stansberry Credit Opportunities review to find out if it’s the real deal!

What is Stansberry’s Credit Opportunities?

Stansberry’s Credit Opportunities is a research service offered by Stansberry Research.

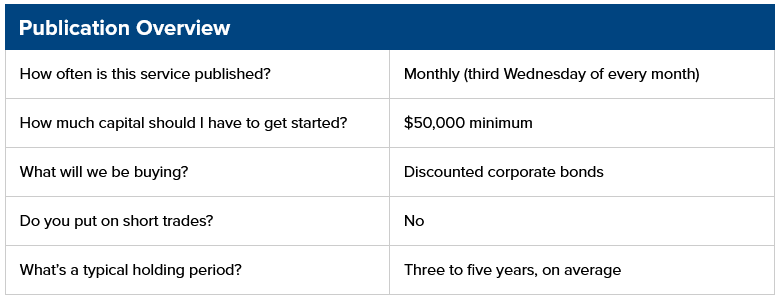

As an elite service, the strategies in Stansberry’s Credit Opportunities are suitable for people with bigger budgets.

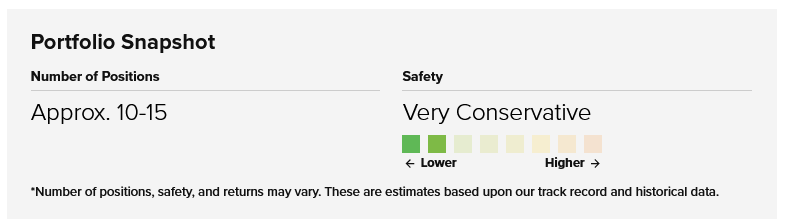

According to Stansberry, the Credit Opportunities trading strategy is “very conservative.”

This makes sense because a typical holding period can run from three to five years when it comes to bonds.

More on Credit Opportunities

Each Stansberry’s Credit Opportunities investment primarily targets lower-risk, discounted corporate bonds with the potential for huge returns.

Lead Editor and Stansberry Research veteran Mike DiBiase is the main writer, but Stansberry’s data analyst Bill McGilton also assists.

Stansberry’s Credit Opportunities model portfolio typically includes between six and 15 open positions at a time.

Once you join, you’ll get a list of all actionable open bond recommendations as well as new bond recommendations through the Stansberry’s Credit Opportunities newsletter on the third Wednesday of each month.

Each issue also includes:

- In-depth analysis and supporting research for each recommended bond

- Model portfolio updates on active positions

- An overview of the latest news and prices in the bond market

- Lists of bonds that Mike and Bill are watching in various risk categories based on their proprietary credit-scoring system

Is this research suitable for everyone?

The research firm recommends new members have $50,000 in capital on hand to get started, if they decide to invest.

That’s it for our general overview of this research firm.

Keep reading our Stansberry’s Credit Opportunities review to find out more about Mike DiBiase.

>> Already sold on Credit Opportunities? Click here to save 50% <<

Who is Mike DiBiase?

Mike joined Stansberry Research in 2014 and is a 28-year financial veteran.

He has an impressive resume that includes a long career with a large, publicly traded software company, where he last served as Vice President of Finance and Planning.

During his time at the software firm, Mike played key roles in the company’s mergers and acquisitions activities.

Earlier in his career, Mike spent five years working as a public accountant, including at one of the “Big Four” international accounting firms.

At that firm, he conducted audits of financial statements, tested clients’ internal controls, and prepared income tax returns.

As a former CPA with bachelor’s and master’s degrees in Accounting, Mike’s accounting knowledge and analytical abilities are top-notch.

Having worked for a publicly-traded company for nearly 15 years, he is very familiar with U.S. Securities and Exchange Commission (“SEC”) filings and rules.

In fact, Mike is such an ace with data analysis that he also crunches numbers for Stansberry Data, where he also serves as a contributor for Stansberry’s flagship research service, Stansberry’s Investment Advisory.

Who is Bill McGilton?

Bill McGilton, Mike’s “second in command” on Credit Opportunities, also joined Stansberry Research in 2014.

He’s an expert at analyzing legal documents and reviews the bond documents and credit agreements for publication.

Bill holds a bachelor’s and Juris Doctor degree and has been a lawyer since 2001.

Most of his experience is in corporate litigation and research.

He worked on behalf of large commercial banks and large publicly traded companies — and his background includes securities, contracts, and antitrust activities.

After an in-depth review of Mike DiBiase’s and Bill McGilton’s backgrounds and resumes, we can confidently say that they’re more than qualified to lead the service.

>> Get Mike DiBiase’s latest research <<

Stansberry Research Review

Stansberry Research is a leading financial research firm that brings professional-grade research to the public through a vast collection of publications.

Founded in 1999, Stansberry has since grown to be a research powerhouse with hundreds of thousands of readers across more than 100 countries.

The firm’s original flagship service is Stansberry’s Investment Advisory, and it remains one of the company’s most popular services to this day.

Stansberry also publishes many other retail research services, including Credit Opportunities and many more.

Credit Opportunities is the firm’s highly specialized corporate-bond research service, and it has developed a cult following over the years.

You should also know that Stansberry Research is a quality, U.S.-based company with an excellent customer support team.

You can trust Stansberry to “give it to you straight” and deliver high-quality research.

Credit Opportunities‘ latest presentation features a testimonial from an actual paid-up member of the service, and he lays out a compelling case for dumping stocks and going all-in on bonds.

>> Join now to get The Coming Credit Collapse special report <<

Who is Rob Lamoureux?

Rob Lamoureux is an actual Stansberry’s Credit Opportunities subscriber who has found tremendous success with the service.

Lamoureux has an incredible story.

With the help of the strategy involved in Credit Opportunities, he managed to retire at just 52 years old.

Better yet, he’s living his retirement stress-free thanks to his decision to drop stocks and transition to an all-bond portfolio.

Now, Lamoureux doesn’t worry about the market’s ups and downs.

He gets contractually obligated payments through his bond holdings, and he couldn’t be happier with his decision.

Stansberry Research paid Lamoureux to share his experience with Credit Opportunities to demonstrate the kind of results that users could achieve with this program.

Although his experience isn’t typical, incorporating bonds into his trading regimen was a game-changer for Lamoureux.

Bonds could make a big difference for you, too, and Stansberry’s Credit Opportunities‘ expertise and insights could help you find tremendous success in the credit markets.

“The Answer” to Retirement Presentation

Being able to retire requires something akin to a healthy source of consistent income or a nice nest egg you’ve set aside for those golden years. Given the up-and-down nature of our economy, these are harder than ever to pull off.

I know I’ve been stressing about my retirement accounts of late, especially after such a bad market year in 2022.

That’s where Rob Lamoureux comes in to share his success using Stansberry Credit Opportunities.

What is his “Answer” to the retirement riddle, and how can Stansberry Credit Opportunities help you? Read on to find out.

>> Get instant access to Stansberry’s bond insights when you join here <<

What is The Answer?

I’ve had the privilege to read about tons of retirement investment research over the years, and Rob’s “Answer” isn’t like anything I’ve ever seen before. In fact, it really has nothing to do with the stock market at all.

Earning income outside of the stock market has certainly paid off for Lamoureux. He sleeps like a baby at night because he doesn’t have to worry about whether the market’s on its way up or down.

That confidence in this system allowed him to retire at 52, and he hasn’t looked back. I found myself asking, “How can he be so certain about his investments?”.

“The Answer” is a unique strategy involving the bond market. Not just any bonds, mind you – individual bonds issued by some of the biggest companies in the world.

At a glance, it’s not much different than a loan with interest. Rob knows he’s getting his initial investment back, and when. It’s all backed by a legal contract.

Moreover, the company pays regular interest as thanks for letting it use your money.

I had no idea regular folks could do something like this – I thought it was reserved for banks and insurance companies.

These bonds turned out so good for Rob, he tossed his other investments to the curb.

>> Get started with distressed bonds here <<

Why Rob Quit Stocks Forever

Imagine lending a company a chunk of change for a set amount of years. It’s all documented, and the company legally has to pay you back that money after a set period of time.

It doesn’t matter how that company does on the stock market. Its shares can go up or down, but it still has to pay you back at the end of your contract.

That seems like a huge breath of fresh air to me. There’s very little that could prevent that business from paying you back, so you’re almost assured your money back with interest.

You get to pick the companies to invest in, so you have the power to avoid unscrupulous ones that could run their business into the ground before you get your money back.

Last year was a bad year for stocks, and I can clearly see why Rob researched alternatives for his retirement.

He’s decided to go all in with these individual bonds and rarely touch any other type of investment. It’s paid off amazingly well for him.

How Does The Answer Work?

Stansberry Credit Opportunities has unlocked a unique secret allowing you to buy these bonds at a fraction of their normal cost.

You could theoretically buy a $1,000 bond for far less than it’s worth and still collect the full face value when it matures. Talk about kicking your profit potential into high gear.

Don’t forget about the interest payments as well. It all adds up to what could be a very significant return down the line.

However, the only way to get the details of how this strategy works and access these savings is to sign up for this bundle.

In the next section, I break down all the features and materials you get for becoming a member.

Stansberry’s Credit Opportunities Review: Features

- Credit Opportunities monthly portfolio updates

- Model portfolio access

- Members-only website content

- The Stansberry’s Credit Opportunities Primer

- Your Complete Guide to the Coming Credit Collapse

- Special report archives

- 30-Day Satisfaction Guarantee

>> Get access to these perks and more when you join Credit Opportunities <<

Credit Opportunities Newsletter Review

The Credit Opportunities service revolves around a model portfolio selection of top distressed-bond opportunities, but the bond market isn’t static by any means.

Credit Opportunities wants to make sure you’re always up to date on where the model portfolio stands, so the team sends out monthly updates that include the latest news relating to the model portfolio’s holdings and the bond market at large.

Stansberry Research also uses these monthly updates to announce new recommendations and other changes to the model portfolio.

A new update comes out on the third Wednesday of every month.

Typically, the best opportunities appear when some level of fear exists in the credit market.

However, even during times when the market is expensive, you can usually find a few good mispriced bonds.

They’re safe bonds that are far cheaper than they should be, given their risk.

And if there are no good opportunities in a given month, Credit Opportunities is very selective and might not issue a new recommendation.

However, even in those cases, the monthly updates provide detailed financial analysis and other pertinent stock market news.

Model Portfolio Review

The Credit Opportunities model portfolio showcases the service’s active bond recommendations, and your membership includes unlimited access to the entire lineup.

The investment opportunities in the model portfolio also include pertinent information on each recommendation, so you can quickly find the info you need.

As an advanced research service, the Credit Opportunities team utilizes sophisticated strategies to make these picks, and they support every recommendation with extensive research.

Alerts and Updates

Big bond opportunities don’t always appear right before the next issue of Stansberry’s Credit Opportunities drops. Mike will send out alerts throughout the month as needed to make you aware of any breaking news on a new bond.

He’s also good about keeping you updated on his current recommendations should something change before the next newsletter rolls out. The last thing Mike DiBiase wants is for anyone to miss out on a chance to sell a bond for big gains or some similar scenario.

Special Reports and Bonus Extras

Credit Opportunities members also get a ton of bonuses when they sign up. These extras are included with the latest deal.

Stansberry’s Credit Opportunities Primer Review

For people new to buying corporate bonds, the Credit Opportunities Primer provides a step-by-step blueprint for buying bonds and explains every aspect of the process in detail.

You’ll learn how to buy bonds and how they work, and while the team can’t recommend individual brokers, they do suggest using a large reputable brokerage firm.

The Primer even explains what to say when you’re on the phone with a bond desk, so you can place your orders like a pro.

The Primer is a perfect accompaniment to Credit Opportunities because it provides the background you need to take full advantage of the service.

>> Sign up now for instant access to these reports <<

Your Credit Crisis Playbook: The Next Great Bond-Buying Opportunity

This is the playbook you absolutely have to have to get all of Mike’s research on bond-buying.

Inside, you’ll learn about how to get access to this unique niche and the potential for low-risk gains. There’s a detailed roadmap for this year and beyond so you know what to expect.

The guide also offers predictions on the economy at large. Spoiler alert: Mike DiBiase isn’t very optimistic about the future.

I appreciate how the guide is written in plain English. It goes a long way in building confidence in his service.

‘The Answer’: Three ‘Buy Now’ Bonds to Help You Get Started Right Away

If you subscribe to Credit Opportunities, I’m guessing you’ll want to get started right away. This special report shares three low-risk bonds you can buy immediately.

Each bond looks like a great entry point as you start to build your portfolio, and you’ll get to see for yourself how easy the process can be.

One particular opportunity comes from an innovative company that’s been around for over 50 years. You’re looking at 7.5% interest per year and an estimated 145% gain when all’s said and done.

Value Investing Panel Featuring Mike DiBiase

The Value Investing Panel is a recap of Stansberry’s gala in Boston, where the publisher’s world-class editors took the stage. One of these is Mike DiBiase.

Watching the content, you’ll get four actionable value-investing recommendations designed for this exact space. Don’t be surprised if bonds come up, but there are other strategies from the latest Stansberry research as well.

I feel like I would have conked out at the actual event, so I appreciate these bite-sized pieces of information I can put right into practice if I so choose.

Credit Opportunities Archives

Your subscription doesn’t end with these two research reports.

In fact, your membership includes unrestricted access to the Credit Opportunities archives, which feature every past issue of the monthly research report and every previous special report.

You’ll also get instant access to every additional research report that comes out for as long as you’re a member.

The next time Credit Opportunities puts out a report like the ones mentioned above, you’ll be among the first to access it.

You can also find additional trading ideas by perusing past reports and issues.

This could add significant value to your membership and lead you to even more bond-buying ideas.

>> Get instant access to Credit Opportunities research here <<

30-Day Satisfaction Guarantee

Stansberry Research offers a 100% satisfaction guarantee on Credit Opportunities, so you can buy with confidence.

You’ll have 30 days from your purchase date to request a refund if you’re not satisfied, and you’ll receive a 100% credit toward other Stansberry products.

Credit Opportunities doesn’t offer a cash-back guarantee because it gives members instant access to the entire model portfolio when they sign up.

It’s understandable why Stansberry Research has to stop short of offering its typical money-back policy for Credit Opportunities.

Doing so would undermine the company’s business model, and such a policy would be unfair to loyal members.

This advanced research service has a sophisticated model portfolio that’s extremely valuable as a research asset.

A 100% Stansberry Credit is an acceptable substitute, and it gives you the time you need to conduct your due diligence and determine if Credit Opportunities is right for you.

Stansberry’s Credit Opportunities Review: Pros and Cons

Credit Opportunities has a lot to offer, but it’s not perfect.

Here are the best and worst aspects of the service.

Credit Opportunities Pros

- Unique strategies for buying high-value bonds for cheap by targeting discounted corporate bonds

- Newsletter updates on the third Wednesday of every month

- Explores various classes of corporate assets

- The model portfolio includes 10 to 15 investment opportunities

- The Stansberry’s Credit Opportunities Primer gets you up to speed fast

- Includes research on so-called “junk” bonds and distressed credit, and more

- 100% satisfaction guarantee for 30 days

- Includes the Complete Guide to the Coming Credit Collapse report

- Access to past reports and newsletters through the archives

- Dork readers save 50%

- Conservative investing style

Credit Opportunities Cons

- May be price-prohibitive for some

- Bonds can sometimes be capital intensive (even discounted corporate bonds)

- No chat room or social component

>> Join now to access these benefits <<

Is Stansberry’s Credit Opportunities Right for Me?

Stansberry’s Credit Opportunities is a very appealing research service, but some people are better suited than others.

Here are a few types of people who seem like a great fit for the service…

Bond Bulls

If you like the outlook for the bond market, this is an excellent service for your goals.

Stansberry’s Credit Opportunities‘ research guides you to some of the best bonds on the market, so you don’t waste time and money when you’re ready to start buying bonds.

Conservative Returns

Stansberry’s Credit Opportunities takes a strategic and meticulous approach to the bond market.

According to its page on Stansberry’s site, the service has a conservative risk profile, so it’s a good option for people who want to avoid undue risk.

New to Bonds

Credit Opportunities include a wealth of educational resources that provide a quick and efficient introduction to the bond market.

The Stansberry’s Credit Opportunities Primer tells you everything you need to know to start, and you’ll constantly refine and sharpen your skills by following the service’s research.

Too Concentrated About Stocks

Many experts are starting to worry about the stock market.

And if they’re right, it could lead to disastrous consequences for people who aren’t diversified beyond stocks.

If you have concerns about your stock portfolio, Credit Opportunities‘ research will show you how to build out a bond portfolio that can deliver stock-like returns.

>> Sound like a fit? Join Credit Opportunities here <<

Credit Opportunities Track Record Review

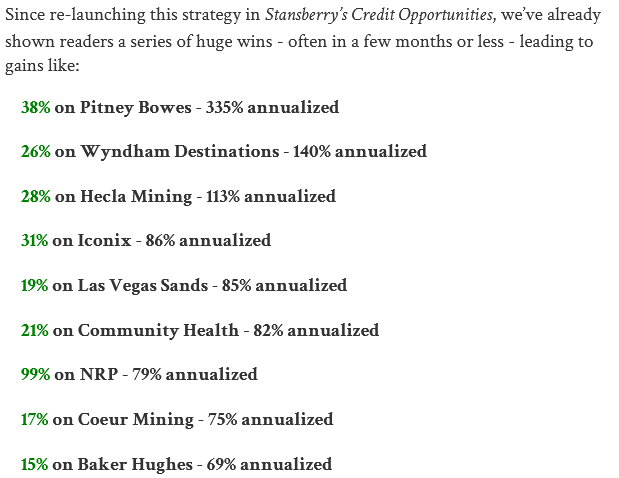

According to Stansberry, Credit Opportunities has seen some tremendous successes since its most recent relaunch.

Members have had the opportunity to see gains as high as 335% annualized, according to this Credit Opportunities breakdown:

Since launching the service in November 2015, Stansberry’s Credit Opportunities has closed 50 positions with an 86% win rate (43 were winners).

The average return of all 50 positions is 15.7%, with an average holding period of just 316 days.

That’s an annualized return of 18.2%.

That crushed the 8.1% annualized return of the high-yield bond market over the same holding periods.

And it came close to the stock market’s 21.1% annualized returns while taking on far less risk.

Those numbers are impressive, and Stansberry’s Credit Opportunities is clearly doing something right.

>> Join these satisfied Credit Opportunities subscribers here <<

Stansberry Research Subscription Cost for Credit Opportunities?

Stansberry’s Credit Opportunities is a specialized, highly advanced niche research service, so it costs more than most typical Stansberry offerings.

A one-year membership to Stansberry’s Credit Opportunities typically costs a hefty $3,000.

That price tag could put the service out of reach for many, but we managed to get a special discount for our readers who are interested in the service, including a special bonus worth $999.

Special Discount

You have the opportunity to save 63% on your first year of a Stansberry’s Credit Opportunities membership if you sign up with this deal.

The discount cleanly cuts the price in more than half.

You save $1,500 on the sticker price and get full access to the special bonus (Value Investing Panel Featuring Mike DiBiase) worth $999 for the year.

That rate comes out to just $125 a month, on average, and makes it much easier to get started with the service.

>> Claim your 63% discount here <<

Is Credit Opportunities Worth It?

Credit Opportunities is one of the more expensive offerings from Stansberry Research, but it provides a unique blend of research that you would be hard-pressed to find anywhere else.

The upfront cost required to join is somewhat steep, but the benefits could justify the added expense if you commit to taking full advantage of the service’s insights.

Corporate bonds can be very tricky for the uninitiated, so wading into the market on your own can be a risky move.

Fortunately, Stansberry’s Credit Opportunities is an all-in-one solution for people interested in bonds.

When you compare its price with competitors, Credit Opportunities falls right in line with what you’d expect.

Effective bond trading requires a higher level of expertise than stocks, so bond-focused services are often higher priced than their stock market counterparts.

Plus, you also get a 30-day, 100% satisfaction guarantee that gives you a bailout option in the event you don’t like the services.

With all that in mind, we can say with conviction that, yes, Credit Opportunities is worth the cost of admission.

>> That’s it for my Credit Opportunities review. Click here to join now. <<

Tags:

Tags: