Chris MacIntosh and Brad McFadden believe the path to real wealth isn’t in chasing trends, it’s in finding what the crowd ignores.

Their Capitalist Exploits Insider strategy takes an unconventional approach to investing aimed at delivering results well above the benchmark.

Does this approach hold up, or is this another service to leave on the table?

In this Capitalist Exploits review, I break down how their platform works and whether it truly delivers on its bold performance record.

What is Capitalist Exploits?

Capitalist Exploits is a global investment research and portfolio service built for people who want to think differently about wealth creation.

Overview of the Capitalist Exploits Newsletter

Through the company’s flagship program, Capitalist Exploits Insider, members gain access to the same portfolios and strategies that the team manages with over $360 million in real capital.

The service includes three complete model portfolios, weekly updates, trade alerts, education modules, and access to a private investment community.

It’s designed for anyone who wants a clear approach and gurus who put their money where their mouths are.

Who Runs Capitalist Exploits?

Capitalist Exploits was founded by Chris MacIntosh and Brad McFadden, two seasoned investors who built their reputations far from the hype of Wall Street.

Both men started in institutional finance but became disillusioned with the short-term, trend-chasing culture that dominates the industry.

Their goal was simple: to create an investment research platform that mirrors how professionals with real money actually operate, but designed for private individuals who want direct access to the same level of insight.

Together, they manage over $360 million in assets through their insider strategies, focusing on deeply undervalued sectors most investors overlook.

Their background spans investment banking, venture capital, private equity, and entrepreneurship, which gives them a rare macro-level perspective.

Simply put, they’re investors who share every trade they make with members, bringing true transparency to a space where that’s often missing.

What Markets Does Capitalist Exploits Focus On?

Instead of following Wall Street’s herd mentality, founders Chris MacIntosh and Brad McFadden focus on identifying “asymmetric opportunities”; trades where the potential upside far outweighs the risk.

For folks like me who are tired of abstract advice or chasing hot stocks, Capitalist Exploits offers a grounded, professional approach to compounding wealth through undervalued global assets.

>> Get Started With The Newsletter for $1 Here <<

Is Capitalist Exploits Legit?

Yes, Capitalist Exploits has earned a solid reputation as one of the most transparent and data-backed investment research platforms available today.

The company boasts an impressive 4.8 out of 5 Trustpilot rating, supported by verified subscriber feedback.

That alone impressed me, but their track record is equally telling: since 2019, the Asymmetric Gains portfolio has delivered +166% total returns, while their Dividend Income strategy has returned +66% with a 7.8% yield since 2021, outperforming traditional benchmarks by a considerable margin.

These numbers reflect actual results from the team’s managed portfolios, all tracked in real time.

I appreciate how transparent they are with their analytics, so it doesn’t surprise me that so many people gravitate toward the service.

How Capitalist Exploits Works

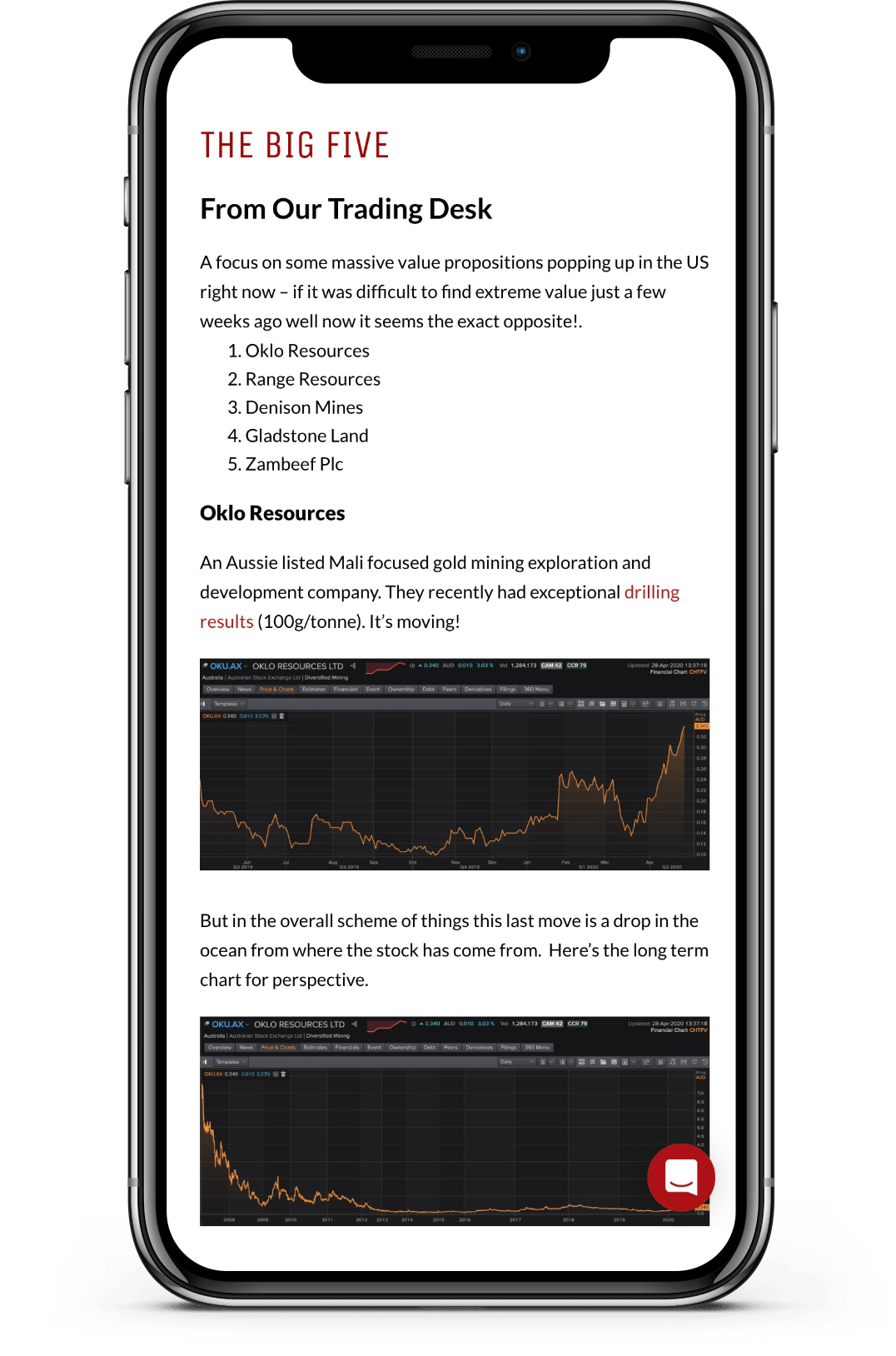

Capitalist Exploits’ strategy focuses on asymmetric trade opportunities and sectors that appear to be on the “cusp of a bull market.” The team also targets the potential for at least a 300% return.

They zero in on sectors because they have the potential to be much more stable and predictable than individual companies.

This could also spread risk.

How Investment Ideas Are Selected

Capitalist Exploits doesn’t leave any stone unturned in its recommendations, but there are some investments it’s very critical of.

What’s off the menu:

- Overvalued tech darlings

- Startups

- Growth stocks

- Stocks listed on the S&P

The team wants members to have the chance to make the most of their dollars. This is why they avoid speculative investments or stocks that could be positioned to only see small growth.

What’s on the menu:

- Emerging markets

- Shipping

- Energy

- Agriculture

Once you get into the team’s research material, it becomes crystal clear why they prefer these sectors over some of the more conventional stock picks you might find online.

And the variety here could be a great basis to build a diversified portfolio around.

It’s a bit of a unique approach to selecting stocks, but it’s definitely one I can get behind. Most services throw obvious picks at you, and here you’ve got a fighting chance at some long runways for gains.

>> Tap into the team’s latest recommendations <<

Capitalist Exploits Review: What’s Included with CapEx Insider?

Capitalist Exploits Insider offers a wide range of features designed to help you succeed:

3 Complete Portfolios

At the core of Capitalist Exploits Insider are its three complete portfolios, each designed to serve a specific goal while maintaining the team’s strict focus on asymmetric risk-to-reward setups.

Here’s my take on each one:

Asymmetric Gains Portfolio

The Asymmetric Gains Portfolio is Capitalist Exploits’ flagship strategy, a global collection of deep-value plays built to generate outsized returns from highly mispriced sectors.

Chris MacIntosh and his team scour markets worldwide to find industries shunned by mainstream investors yet primed for massive rebounds once sentiment shifts.

This contrarian approach has delivered +158% total returns and 17.05% annualized performance since 2019, significantly higher than the ACWI global market benchmark.

The results so far are really good, but the number of picks included really surprised me.

It typically includes around 80 positions spread across commodities, energy, infrastructure, and frontier markets.

The idea is simple: take small, calculated positions in sectors where downside is limited, but upside could be exponential when markets correct.

U.S. Markets-Based Portfolio

While Capitalist Exploits is best known for its global approach, the U.S. Markets Portfolio gives members a chance to apply the same asymmetric philosophy domestically.

It focuses on undervalued American-listed companies that have strong fundamentals but are ignored due to sector rotation, regulatory fears, or short-term sentiment.

The goal here is owning quality businesses in out-of-favor niches before Wall Street comes back around.

I’ve found this portfolio to be a healthy bridge between the stability and liquidity of U.S. markets and the contrarian edge that defines Capitalist Exploits.

It’s designed to balance international risk while capturing upside from cyclical U.S. recoveries and structural shifts within key industries.

Diversified Income Portfolio

The Diversified Income Portfolio focuses on generating sustainable, high-yield returns through global dividend-paying assets.

It currently boasts a 7.8% yield and a +51% total return since inception, proving that income and growth don’t have to be mutually exclusive.

Why some services feel this is the case, I’ll never understand.

Rather than relying solely on traditional dividend ETFs or blue-chip stocks, the portfolio includes select energy producers, infrastructure plays, and commodity-linked companies offering both steady cash flow and capital appreciation potential.

They choose positions for both yield and their ability to withstand volatility and inflationary pressure.

You’re getting a solid play at consistent income here with some global diversification mixed in, which helps complement the other portfolios Capitalist Exploits offers.

Real-Time Alerts

Timing is critical, especially in contrarian investing, and that’s where Insider’s real-time alerts make a difference.

Whenever Chris MacIntosh and his team enter or exit a position, you’ll receive an immediate email notification detailing what was done, why, and how it fits into the broader portfolio strategy.

These alerts actually mirror transactions made within their live, funded accounts.

I get to follow along in real time, seeing exactly how seasoned professionals deploy capital in volatile or emerging sectors. That transparency is amazing, and it keeps me in the know of changes so I can react before it’s too late.

Regular Newsletter

Alongside the core research and portfolio access, Capitalist Exploits publishes its “Regular Newsletter”, formally known as Insider Weekly, which acts as a consistent touchpoint for subscribers.

You’ll get each issue via email, and itshares the team’s current thinking on macro trends and emerging global opportunities.

I’ve noticed this often happens before they filter into the larger portfolios, making this the best opportunity to plug in.

While not every idea becomes a formal recommendation, Insider Weekly keeps you in the loop on what the editors are watching, helping you stay ahead of market shifts.

It’s the kind of content that bridges between full portfolio trades and high-level education, offering timely insights, provocative commentary, and actionable ideas in a digestible format.

Weekly Commentary / Stock Tips

In addition to alerts and a newsletter, you’ll regularly receive a detailed market update from the Capitalist Exploits team.

These are in-depth analyses of global market shifts, sector breakdowns, and fresh asymmetric opportunities.

The commentary often dives into commodity cycles, energy trends, emerging market catalysts, and macroeconomic risks that most investors overlook.

I like that this is also an avenue for actionable trades or big sector news, given right to you in an easy-to-read format.

The weekly commentary acts as an ongoing mentorship, helping us understand not just what to buy, but why the team is buying it.

Over time, I can see this as a teaching for how to think like a professional investor rather than a follower.

Monthly Q&A Sessions

Once a month, members get direct access to Chris MacIntosh and his team through live Q&A sessions.

Unlike other platforms, these sessions are interactive discussions where subscribers can ask questions about open positions, new opportunities, or global macro events influencing the portfolios.

Most services show a canned video and write it off as something else, but you’re getting the real experience here.

In the time I’ve been watching, the team has covered clarity on trade timing, risk management, and long-term conviction.

These are insights you’d typically need to pay a fund manager for.

Having this direct access to the gurus behind the system is the cherry on top of an already impressive stack of tools.

I appreciate how it blends professional investment logic and real-world decision-making.

Complete Education

The CapEx Insider platform doubles as a deep educational resource for anyone looking to elevate their understanding of global investing.

Here, you gain access to step-by-step lessons covering capital allocation, position sizing, sector rotation, and risk management, the same principles used by professional portfolio managers.

The content is practical and experience-based rather than theoretical, which speaks to my method of analyzing data. It also helps bridge the knowledge gap for folks who want to build competence alongside profits.

Whether you’re a seasoned investor or just starting out, the team structures the material so you can learn how to recognize asymmetric setups and navigate complex markets with confidence.

Access to Global Opportunities

What truly sets Capitalist Exploits apart is its global reach.

Most retail investors focus narrowly on the U.S. market, but Chris and Brad actively hunt for value across continents, in regions and sectors where mainstream capital hasn’t yet arrived.

This could include natural resources in Africa, energy infrastructure in Asia, or commodity producers in emerging markets.

By diversifying geographically, the team exposes members to cycles and industries that don’t correlate with traditional stock indexes.

This global lens has helped Insider outperform benchmarks by 55%, proving that the biggest gains often lie outside Wall Street’s comfort zone.

Don’t let this scare you off if you like to focus domestically, because there are local opportunities too. I’d highly recommend embracing the international purview and letting Capitalist Exploits do what it does best.

Private Community

CapEx Insider members also join a private online community of globally minded investors that you can interact with.

It’s a space where participants exchange research, debate ideas, and discuss ongoing trades with the team.

Few platforms allow access to the pool of members who share similar mindsets to you, and I’ve unearthed more than one good tip here.

The discussions are insightful, often diving into geopolitical events, currency trends, and real-time market data that connect to current market themes.

It’s a great place to bounce ideas off others, gain some additional learning, and have some accountability along the way.

Capitalist Exploits Performance and Track Record

When evaluating an investment research service like Capitalist Exploits, performance and transparency are key, and in this case, the numbers tell a compelling story.

Claimed Returns and Performance Examples

Their flagship “Asymmetric Gains Strategy” has achieved a total return of +158% since 2019, which works out to an annualized return of approximately 17.05%.

Meanwhile, their “Dividend Income Strategy” reports a +51% total return and a current yield of 7.8%, as of September 30, 2025.

What adds credibility is that these returns are net of all fees and derived from over $360 million in real capital under management.

The firm also emphasizes its “no theory, no fluff” approach, aiming to mirror hedge-fund operations for individual subscribers.

While past performance doesn’t guarantee future results, this level of transparency, showing how much the service claims to have outperformed benchmark indices by some 55% in their communications, provides a solid basis for consideration.

Can Capitalist Exploits Results Be Independently Verified?

I’ve searched around for ways to verify the numbers Capitalist Exploits shares, and I haven’t found a place to independently verify them.

That said, I’m confident that a service of this caliber shares accurate numbers for its investments. There are so many positive comments on third-party sites that there’s just no way anyone could fabricate them all.

How Performance Compares to Traditional Index Investing

Based on the numbers I’ve seen, Capitalist Exploits severely outperforms returns from traditional indexes like the S&P.

Where indexes set themselves up to grow slowly over time, the portfolios here hunt for big opportunities that Wall Street misses and catches the upside potential as breakouts occur.

Pros and Cons of Capitalist Exploits

The Capitalist Exploits newsletter and premium service have a lot to offer, but there are some downsides. Here’s my full list of the pros and cons after a thorough Capitalist Exploits review.

| Category | Details |

|---|---|

| Pros |

• Asymmetric opportunities that focus on sectors over stocks • Led by ex-hedge-fund and money managers with a solid track record • Highly rated investment service • Transparent portfolios and alerts • Gives an extensive investment education • Targets opportunities for 300% returns • Founders invest their own money • 30-day money-back guarantee • Consistently outperforms benchmarks like the S&P 500 and dividend ETFs |

| Cons |

• Insider is on the pricey side • Political commentary could turn some away |

Perks of Joining the Capitalist Exploits Community

While I’ve already covered a lot of great features in this Capitalist Exploits review, the service goes one step further. Its cutting-edge approach to analysis and research offers a unique foray into investing, along with the following to further set it apart:

Expert Insights

Chris and Brad are highly lauded for their insights and stock recommendations, and you get access to both here. Furthermore, their connections among the financial elite allow a level of information that the rest of us simply can’t get our hands on.

Community Interaction

Capitalist Exploits is one of the few services with a thriving community presence. Its forum is the perfect place to share strategies, investigate stocks, and bounce ideas off similar-minded investors.

It’s also possible to plug into question and answer sessions, and the constant churn of information keeps things fresh.

Comprehensive Education

Beyond handing out stock recommendations, Capitalist Exploits has a comprehensive library of educational tools to boost your skills. Here, you can learn about how to improve your investment plan and look at opportunities like the pros do.

Investing Approach

Our gurus exploit asymmetric risk in their recommendations, a strategy often used by hedge fund managers. By focusing on differences between real and perceived values of stocks, it opens the door to higher returns while keeping risk at bay.

Capitalist Exploits Reviews by Members

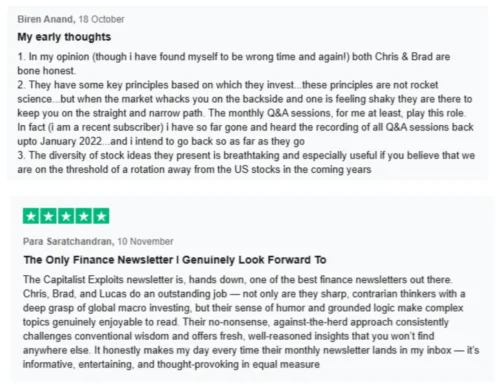

Capitalist Exploits has earned an exceptional 4.8/5 rating on Trustpilot.

That’s crazy impressive, considering the nearly 500 reviews.

It’s rare for services (in any industry) to reach a near-perfect score on an unbiased 3rd-party rating site.

Here are a handful of the five-star reviews I located:

There’s no shortage of praise for either The Insider Newsletter or Insider, and most Trustpilot users seem very satisfied with the quality of analysis on offer.

Given MacIntosh’s calculated asymmetric investment strategy, it’s no surprise that his service has earned such a positive reception.

There’s no guarantee that you’ll have this same level of results, but it’s encouraging nonetheless.

Who Is Capitalist Exploits Best For?

There’s something for just about everyone within Capitalist Exploits’ vast feature set. Its services really stand out among the following groups:

Seasoned Investors

Folks who have been playing the markets for years will likely feel right at home here. Both an asymmetric approach and high-reward opportunities speak to those looking to go big and have the chops to keep up. The community of like-minded individuals only adds to the draw.

Professional Fund Managers

Fund managers can turn here for up-to-date recommendations covering a swath of sectors that sometimes dip into elusive foreign markets. The weekly newsletter keeps topics fresh and allows for frequent adjustments that can send returns higher.

Newcomers to Investing

A rich pool of educational materials and training can be worth the cost of joining alone for anyone new to investing. These tools help individuals start off on the right foot and continue to grow in knowledge over time. Top-tier, carefully vetted picks on a regular basis with Capitalist Exploits’ track record offers a firm foundation to start a journey on.

Individuals Looking for Global Investment Opportunities

You won’t find many services with a global outlook on securities. Founder Chris MacIntosh has spent many years in different markets, giving him first-hand experience with how they work. This extra diversification can go a long way in a portfolio, especially when domestic markets are in rough shape.

Who Should Avoid Capitalist Exploits

There’s a ton of value for a lot of people here, but it’s not for everyone.

This is not a get-rich-quick approach, and no one should treat it that way. Recommendations here can be long-lasting, and you’ll want to hold on a while (typically, anyway) to get the biggest benefit out of the platform.

It also may not appeal to you if you’re dead-set on domestic investments. There are a lot of great international opportunities here, and not leaning into them would be a loss for sure.

Finally, this is not a service that does all the work for you. Sure, they share recommendations and offer research behind it, but it’s up to you to verify those findings and actually make an investment.

>> Join Insder Now Before Their Next Reccomendation<<

How to Get Started with Capitalist Exploits?

Follow these steps to set up a membership with Capitalist Exploits:

Step 1: Visit the Website

Head over to capitalistexploits.at and browse the site. Either click “Paid Newsletter”, “Insider”, or enter your email in the box on the screen to get the ball rolling on a free account.

Step 2: Account Details

If you chose to start a paid membership, you’ll need to type out pertinent information about yourself in the provided boxes. This includes the credit card you’ll be using to fund your subscription. The site accepts most cards alongside Apple and Google Pay.

You will need to verify your email address at the end of the account setup step. Look for a message in your inbox to this effect and complete the process. Keep in mind this message may appear in your spam folder.

Step 3: Check Out Your Service

Your first issue should hit your inbox once you’ve confirmed all your information. Be sure to navigate back to the website and, with your new account information, start exploring all the new features made available to you.

Depending on your plan, that could include reports, analysis tools, and a host of other tools to help you win big with stocks.

Step 4: Connect With Community

Capitalist Exploits has a host of like-minded investors on its forum. Take time to introduce yourself, ask questions, search for insights, and learn all you can. Some of the recommendations here could be just as fruitful as the platform itself.

Step 5: Don’t Stop Learning

Engage as much as possible with your plan and the free services Capitalist Exploits has to offer. Read blogs, watch podcasts, and glean as much information as you can from the experts here.

Do I Need To Use A Broker?

Yes, you’ll need a brokerage account to act on the ideas from the Capitalist Exploits service, especially if you want full participation in their global portfolios and trade alerts.

While many standard online brokers cover U.S. stocks, the strategy from Chris MacIntosh and Brad McFadden often involves international shares, commodity-linked equities and exotic markets, so a broker with broad global access is essential.

For that reason, I strongly recommend using Interactive Brokers (IBKR).

It’s the same platform the CapEx team uses to execute their trades, offering direct market access in 36 countries and 28 currencies.

By using the same broker, you avoid unnecessary steps, align with their execution model and ensure you’re equipped to follow the full strategy without limitations.

Capitalist Exploits vs Other Investment Newsletters

Capitalist Exploits may not be your cup of tea, I get that. Here are my thoughts on the service against a few other areas I’ve checked out in the past:

Capitalist Exploits vs Motley Fool

Motley Fool jumps out to me as a service that caters to the masses. It takes a heavy stance on long-term stock picks, but tends to focus on U.S. companies and the big growth stories that do move markets. The tone is very casual, but I’ve found it a challenge to play their opportunities before they go mainstream.

That’s where Capitalist Exploits feels like the total opposite. I’m not saying one way is better than the other, but you’re uncovering stocks few people are talking about, which I see as a bigger runway for gains.

Capitalist Exploits vs Other Macro Investing Services

A lot of macro services give you big-picture commentary—rates, inflation, geopolitics, charts everywhere—but then leave you hanging when it comes to what to actually do with your money. I’ve read plenty of smart macro takes that never quite turn into something I can act on.

What I like about Capitalist Exploits is that it connects the dots. It takes macro ideas and turns them into real setups with clear logic, risk awareness, and asymmetric upside. Instead of reacting to headlines, it helps me think ahead, focus on overlooked assets, and stay patient until the odds actually make sense.

Pricing and Subscription Options

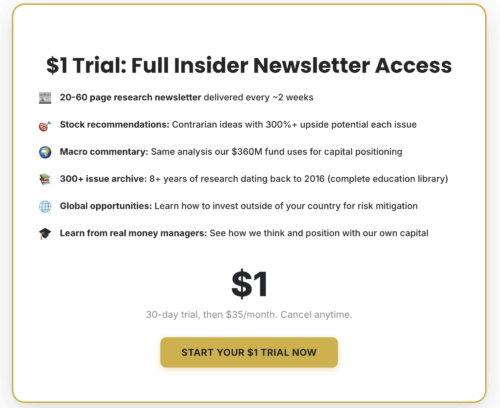

How Much Does Capitalist Exploits Cost?

Capitalist Exploits normally costs $2,499 per year, but new members can currently join for $1,499 annually, saving $1,000 off the regular rate.

That single subscription fee gives you unrestricted access to the same positions and strategies that Chris MacIntosh and Brad McFadden personally manage within their $360 million fund.

The price tag sits a little heavy at first, but the amount of content you’re receiving here honestly more than makes up for it.

My favorite part is that the discount continues into subsequent years, locking you into a great rate now and in the future.

When you compare the depth of research, global coverage, and transparency of real-money positions, Capitalist Exploits delivers strong value relative to the typical high-priced hedge fund model or the shallow insights of standard newsletters.

Refund Policy and Subscription Terms

Capitalist Exploits stands behind the quality of its research with a 30-day, full money-back guarantee on an Insider membership.

If you sign up and feel the service isn’t what you expected, for any reason, you can request a full refund within the first month, no questions asked.

The process is straightforward: members simply contact the support team by email, and refunds are typically processed within a few business days.

This policy reflects the company’s confidence in the value of its insights and its commitment to transparency.

You’re free to explore the portfolios, trade alerts, and educational materials risk-free before deciding if Capitalist Exploits aligns with your investment goals.

Is Capitalist Exploits Worth It in 2025?

After completing this Capitalist Exploits Insider review, it’s clear that the platform delivers exceptional value for what it contains.

You’re getting direct access to the team’s real $360 million portfolios, global trade alerts, and live strategy sessions, the kind of insight typically reserved for institutional clients.

Add in the 30-day money-back guarantee, and you can enter in with minimal risk while seeing just what the platform can do for you.

It may take a minute to get past the $1,499 price tag, but don’t look past the amount of value you’re receiving here from two gurus who truly know their stuff.

For anyone seeking data-backed, transparent, and global investing guidance, Capitalist Exploits stands out as a legitimate, high-value service built on real-world results, not marketing promises.

>> Ready To Get Started? Join Insider Here <<

Capitalist Exploits Frequently Asked Questions (FAQ)

What does “asymmetric risk” mean in Capitalist Exploits’ strategy?

Asymmetric risk refers to situations where the potential upside significantly outweighs the downside. Capitalist Exploits looks for investments where losses are limited, but gains can be substantial if the macro thesis plays out.

How long are Capitalist Exploits investment ideas typically held?

Most ideas are intended to be held for multiple years, especially when based on long-term macroeconomic or commodity-driven trends. Short-term trading is not the focus.

Does Capitalist Exploits only recommend stocks?

No. While stocks are often featured, Capitalist Exploits may also discuss commodities, special situations, and alternative assets, depending on where the best risk-reward opportunities exist.

How does Capitalist Exploits perform during market downturns?

The strategy often emphasizes defensive positioning and real-asset exposure, which can help reduce reliance on broad equity market performance during downturns.

Is Capitalist Exploits suitable for income-focused investors?

Capitalist Exploits is generally not designed for income seekers, as the focus is on capital appreciation rather than dividends or regular cash flow.

How detailed is the research behind each Capitalist Exploits recommendation?

Each recommendation typically includes extensive macro analysis, valuation context, and risk assessment, making it more research-heavy than many mainstream newsletters.

Does Capitalist Exploits provide clear downside scenarios?

Yes. A key part of the research involves outlining what could go wrong, including macro shifts or commodity cycle reversals, so readers understand both upside and downside cases.

Are Capitalist Exploits’ ideas appropriate for conservative investors?

Because of its focus on contrarian and macro-driven ideas, Capitalist Exploits may not be ideal for conservative investors who prefer stable, low-volatility holdings.

How often does Capitalist Exploits update existing recommendations?

Updates are typically provided when new macro developments or structural changes impact an existing investment thesis rather than on a fixed schedule.

Does Capitalist Exploits explain complex macro concepts clearly?

Yes. The research often breaks down complex macroeconomic themes into practical investment implications, making the analysis accessible to non-professional investors.

Can Capitalist Exploits be used alongside index investing?

Many subscribers use Capitalist Exploits as a satellite strategy, complementing index funds with targeted macro and real-asset exposure.

Does Capitalist Exploits focus on popular market narratives?

The service is often deliberately contrarian, aiming to identify opportunities before they become widely accepted market narratives.

How hands-on does an investor need to be when following Capitalist Exploits?

It suits investors who are comfortable reviewing in-depth research periodically rather than those looking for frequent alerts or daily trade ideas.

Are Capitalist Exploits’ recommendations impacted by interest rate changes?

Interest rates are a major consideration, particularly for commodities, real assets, and capital-intensive industries, and are often discussed in the analysis.

How does Capitalist Exploits fit into a diversified portfolio?

Capitalist Exploits is typically used to add macro diversification and non-traditional exposures, reducing reliance on traditional stock-and-bond portfolios.

Tags:

Tags: