Tim Plaehn claims his Daily Dividends strategy could help you build a strong foundation for your income investing portfolio. Is his plan on point, or is he just blowing smoke?? In this Dividend Hunter review, I investigate the ins and outs of his service so you don’t have to.

What Is The Dividend Hunter?

The Dividend Hunter is an investment newsletter that dials in on dividend stocks. It’s led by stock picker Tim Plaehn and published by Investors Alley.

As the name suggests, this newsletter focuses on companies that could pay steady dividends and income investing strategies.

This isn’t the only name in the game for income investing, but the team’s strategy has a unique twist.

Tim does more than just target stocks that pay dividends. He also looks to build a portfolio with a careful selection of companies that collectively could pay monthly dividends.

It’s all a part of what the team refers to as its #1 High-Yield Dividend Newsletter.

Let’s take a quick look at dividends as an investment to see how this all fits into The Dividend Hunter’s recommendations.

>> Access the team’s top recommendations now! <<

The Dividend Hunter Investment Strategy

Plaehn’s Dividend Hunter investment strategy forgoes rough and tumble day trading or timing the market for a much more regimented plan.

Since the guru focuses on dividends, many of the trades he recommends are long-term buy-and-hold stocks you can collect on indefinitely.

While not a perfect science, it’s, in my opinion, a much more laid-back approach to growing wealth.

He shares exactly which dividend stocks to own, and how long to carry them for. Most of the time, you’ll have up to 30 in your portfolio.

That said, you can’t expect massive gains overnight with this approach. Dividend Hunter’s strategy is set to net you small daily gains that can add up to around $3,000 per month.

Are Dividends Actually Worth It?

Dividend investing comes with a whole host of advantages including, the opportunity for passive income, tax benefits as well as the potential to reduce portfolio risk.

With the right stocks, it’s even possible to build a steady income stream to live off of. However, this typically requires a large investment.

While there are many pros, there are also some cons to consider.

Most dividends are paid out quarterly or semi-annually, which could leave some long stretches between payments.

Also, companies can cut payouts at a moment’s notice.

Sometimes a business can fall on hard times. In other cases, a yield might be so high, it’s not sustainable in the first place.

This is why many income-focused strategies, including Tim’s, pay very close attention to a company’s history and the sustainability of business practices.

>> Access Tim Plaehn’s latest research and insights now! <<

Who Is Tim Plaehn?

Tim Plaehn is an excellent stock picker who pens some solid research.

Investors Alley made him lead research analyst for a reason. His unique blend of mathematical analysis and income investing expertise puts him a cut above many of his peers.

He studied mathematics when he was in the US Air Force, and his education served him well during his time as a financial advisor.

After serving in the military, Tim launched his finance career, which includes a stint as a financial advisor.

Given his strong analytical background, I feel the need to emphasize his deep understanding of market trends and his ability to pick stocks effectively in my Tim Plaehn review. His expertise in combining mathematical analysis with income investing really sets him apart in the financial world.

He began applying his education in mathematics to his investment strategy, and the results were groundbreaking.

Tim quickly realized he was onto something big and made a personal commitment to bring his findings to the public.

In addition to his flagship newsletter, his other popular services include.

- Monthly Dividend Multiplier

- Weekly Income Accelerator

- ETF Income Maximizer

- ETF Income Edge

He was also the mind behind the Automatic Income Machine, but it looks like that might be discontinued.

>> Unlock Tim’s latest recommendations now! <<

Is Tim Plaehn Legit?

Tim Plaehn is legit.

Instead of following the hype and chasing hot stocks, he targets reliable dividend stocks that have the potential to generate predictable income.

If you’ve checked out the Investors Alley website, you’ve probably seen the wall of reviews left by subscribers to his research services.

I snagged a small screengrab, but this is a fraction of the positive press Plaehn has received.

Here’s what Investors Alley subscribers have to say about him:

I did some digging for reviews of Tim Plaehn on Stock Gumshoe, but there were only reviews of The Dividend Hunter.

That said, what I found appears to be largely positive, which could put some folks’ minds at ease. I’ll cover this in more detail later.

Tim Plaehn Track Record

Tim Plaehn has helped spot some solid stock market opportunities.

Let’s take a look at some of his previous calls.

In 2015, he recommended selling Oaktree Capital Group when it had just hit one of its highest price points ever at $54.14.

Over the next 11 months, it sold off for nearly 25% and never recovered to the $50 mark. It was eventually bought out and taken private at $49 per share.

In another example, he accurately called a top in shares of Ventas, Inc. twice in two years, and he was right in both cases.

This chart shows the timeline for each “sell” call and subsequent price action in the stock:

Another of Tim’s more recent calls, CyrusOne Inc., saw an opportunity for solid gains in the first 10 months following his recommendation.

This is in addition to paying an excellent dividend yield.

This chart shows how CyrusOne shares performed following his alert:

Even though the service primarily focuses on dividend payouts, these dividend stocks have the potential to increase in value as well.

These are just a few examples of his accurate calls. You shouldn’t expect results like these with every trade, but they provide a useful example of this service’s ultimate potential.

Tim Plaehn Net Worth

Tim Plaehn has come a long way in the last 20 years when he went broke while living overseas.

He learned from his failure to secure a nest egg for himself, using passive income to provide a means to support himself day by day.

Despite my best efforts, I wasn’t able to track down what Plaehn’s net worth might be. It seems he keeps that information close to his chest, and I can’t say I blame him for it.

He does spell out in his presentation that he’s not worth millions, but he is able to invest roughly $250,000 at a time to keep his monthly income palatable. That says something right there.

I’m sure the fact that he has more than 100,000 readers doesn’t hurt his overall wealth either.

>> Get Tim’s #1 High-Yield Dividend Newsletter here <<

What Is Investors Alley?

Investors Alley is a great publisher that has many solid services under its umbrella.

The company is dedicated to bringing everyday people high-caliber investment research and analysis.

It’s based in the US, and it has a strong track record for customer satisfaction.

Investors Alley has several prominent gurus under its banner, including Tim Plaehn and more.

And each of the firm’s services targets a different angle. The Dividend Hunter service is one of its leading options for dividend income strategies.

>> Discover Tim’s LATEST recommendation <<

Tim Plaehn’s #1 ETF for Monthly Payouts

We live in a shaky economy at best, where fears of inflation and a weakening dollar leave many wondering about their wealth.

That paycheck doesn’t stretch as far as it used to, bills are higher, and even the stock market seems less predictable than ever.

No matter how you shake it, the concept of retirement always seems just out of reach.

This is where gurus like Tim Plaehn come in. He’s looked outside the box we’re all familiar with and found an under-the-radar ETF with the potential to alleviate those fears about the future.

Let’s look into his secret, stable income stream and see how to take advantage of this rare opportunity.

>> Join now to get Tim’s #1 ETF! <<

Following Warren Buffett’s Lead

Warren Buffett recently made a big bet into the energy sector in anticipation of what’s happening with oil.

A few months back, OPEC reduced production on its supply in hopes of pushing the price of a barrel back to $100.

With nearly 6% less oil in circulation, it’s only natural for the price to rise. More production cuts could be on the horizon, raising the cost of oil even more.

I can see why Buffett would assume shares of oil company stock would increase, prompting him to invest heavily in Occidental Petroleum and Chevron.

What’s particularly interesting is that most of these companies are income stocks as well.

We may not be able to bring in the $247 million Buffett already made from oil, but there are definitely some potential income streams for us there as well.

The question is, what’s the best opportunity to take advantage of right now?

Tim Plaehn’s #1 ETF Pick

Luckily, Tim Plaehn has the answer, and he’s thinking even bigger than Buffett. Occidental and Chevron only pay out small single-digit dividends, which isn’t much for an income investor.

After all, higher yields could double your money at a much faster rate.

More dividends may not be as big of a deal for the legendary Warren Buffet, but it could be life-changing for a lot of us.

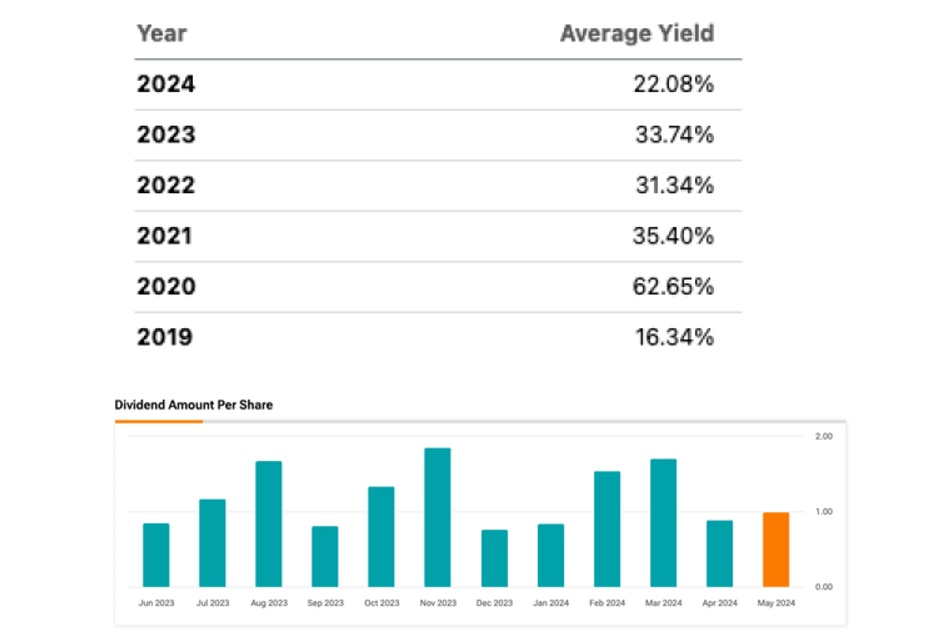

Plaehn’s big ETF energy play actually pays out a massive 22% dividend every month! That’s not once per year or quarterly, but a steady income stream every 30 days as long as the stock maintains that payout.

You can get immediate access to this incredible stock pick by signing up for Plaehn’s latest deal. Join me as I unpack everything the service has to offer.

>> Access Tim Plaehn’s #1 ETF pick now! <<

Dividend Hunter Review: What Comes with the Service?

The service offers much more than a monthly newsletter.

Follow along for a breakdown of each feature.

Annual Subscription to The Dividend Hunter Newsletter

This is Tim’s flagship newsletter and is the centerpiece of this deal.

Each month, you’ll get a new issue of The Dividend Hunter with updates on the latest market action, one trade idea, and much more.

The stock picks also come with extensive supporting research and the team’s buy case.

This includes the company’s background, and why it could make for a strong addition to an income-investing portfolio.

All in all, the team’s writing is clear and to the point.

Something I also like about this newsletter is that Tim also occasionally sprinkles in general tips about income investing that could apply outside his recommendations.

So it could be a great place for someone with little experience to start building up their knowledge base.

The Dividend Hunter newsletter provides insights on the outlook for the stock market. For example, the November 2022 issue previewed promising ex-dividend opportunities for the month ahead.

Each issue focuses on different opportunities, but the central theme remains the same. In any given issue, you’ll typically find Plaehn’s current market outlook, one or two promising recommendations, and in-depth analysis of dividend trends.

Model Portfolio

The Dividend Hunter features the portfolio of all 33 dividend stocks Plaehn is currently recommending. Each has the potential to pay out a nice yield.

Tim’s taken the time to vet each stock personally with his stamp of approval. He’s so confident in these picks that he has his own money invested in most of them.

You’ll want to visit here often to check the status of securities. Plaehn chops struggling tickers from time to time and posts new recommendations here.

New Member Webinar

New members aren’t wished good luck and thrown to the curb. Every month, recent Dividend Hunter subscribers get an invite to a comprehensive training session via video.

It’s a totally optional tool you can take advantage of to get the most out of your package.

In the webinar, Tim walks you through the immersive Dividend Hunter portal and shows you how each feature works. You’ll also learn about which stocks to buy first, hear answers to common start-up questions, and more.

Weekly Updates

A month is a long time in the market, so the service doesn’t leave you hanging between issues.

Every Tuesday, Tim sends out a new alert showcasing the best buys in The Dividend Hunter portfolio, with supporting research explaining each call.

The weekly reports give followers regular chances to add to their positions if a particularly enticing opportunity catches their eye.

The weekly updates also fill the gaps between each monthly issue and keep readers informed on the latest events surrounding the model portfolio.

Let’s face it, we’re all adults with busy day-to-day lives. Few people have the time or energy to focus on the stock market every hour the market is open.

Fortunately, Tim’s updates make it easy to keep up on the latest Dividend Hunter recommendations. You don’t have to worry about missing an opportunity as long as you regularly read the updates.

Best of all, when it’s time to make an important trade, you’ll receive an alert right away, so you’ll never miss another potential trading window.

Between The Dividend Hunter newsletter and weekly updates, readers have all the support they need to take on the stock market with confidence.

>> Access all these features and more <<

The Monthly Dividend Paycheck Calendar

Tim Plaehn‘s Monthly Dividend Paycheck Calculator hashes out key dates for all the dividend stocks in the service’s model portfolio, including their dividend payment dates, ex-dividends, and more.

It also lists how much each dividend will pay out, so you can find out exactly how much you’re getting months in advance.

The calendar looks something like this:

As you can see, it lays out each important date in a straightforward format that’s easy to follow. You can quickly identify which stocks are paying when, how much they’re paying, and more.

Just a quick glance at the calendar will tell you exactly how much dividend income to expect in a given month.

Weekly Mailbag Video

Tim Plaehn takes your questions to heart. Every week, he’ll record a video called the Weekly Mailbag, answering the more pertinent questions from the last seven days. Only members get the chance to pose questions and watch Tim share his thoughts.

His responses could come from any number of topics. Plaehn may answer a question about your portfolio, the stock market, or opportunities in a specific sector.

It’s worth watching every week since the content’s always so different.

Weekly Buy Recommendations

Tim’s always watching his model portfolio for good deals. He’ll alert you the moment one of his stocks goes on sale so you have a chance to grab some shares at a nice discount.

You’ll get the lowdown about why it’s on sale and what makes it a good investment. I’m all about saving money while making some at the same time.

>> Get weekly buy recommendations <<

NEW Artificial Intelligence App

Dividend Hunter subscribers get special access to a new investing tool called Magnifi at no extra charge.

The AI app works alongside you to help you uncover the best stock market opportunities out there based on your unique investment style from a pool of more than 15,000 stocks and funds.

Whenever I use it, I think of it like a Siri or Alexa with access to a ton of crucial market info.

Not only does it help you make decisions, but Magnifi can work with you to plan goals or manage your portfolio.

Best of all, it actually learns about you while you invest and adjusts its preferences and recommendations accordingly.

If that wasn’t enough, the app can analyze any existing investments you have at other brokerages and share its thoughts about them as well.

FEATURED REPORT: My #1 Energy ETF

This short but sweet report showcases Plaehn’s big energy ETF play in all its glory.

Inside, he shares the name and ticker symbol of this pick with instructions on exactly how to get plugged in.

Don’t worry if you’re not familiar with ETFs or dividends; Tim uses clear language to simplify the entire process. It’s honestly quite simple, in my opinion.

You’ll also get the exact dates of each dividend payout you can jot on your calendar and information on the options strategy that makes these 22% dividends possible.

He even explains why this ETF’s dividends could climb even higher than 22% before the year ends.

I’m never a fan of investing in something I don’t know much about, so I really appreciate Plaehn taking the time to explain why this strategy works. It definitely boosts my confidence in him and the ETF.

12-Month Money-Back Guarantee

Under the latest deal, new members signing up are covered by the team’s 365-day money-back guarantee.

This means you have the entire first year to review the service. If it doesn’t live up to your expectations, you can opt for your money back on the cost of the subscription.

Most investment newsletters I’ve seen only offer one month for refunds, so this is definitely a step-up.

A big plus is that it provides ample time to see how a position performs.

One month is usually enough to gauge whether a stock picker provides great analysis, but it’s rarely a long enough window to actually see how a position performs.

So I’m giving The Dividend Hunter extra points here.

>> Sign up under Tim’s guarantee <<

The Dividend Hunter Performance

Plaehn demonstrates just how his Dividend Hunter strategy works through some of his breakthrough plays over the last few years.

In late 2020, as the world still battled against the Covid virus, Tim recommended Ralph Lauren and Tanger Outlet to his subscribers.

Not only did these stocks significantly grow during the drought, they kicked in dividends to add to the overall pot.

Historically, he’s been able to map out payouts down to the day so you know exactly what you’re receiving, and when.

Some of his biggest returns were 8.35% on AAL, 6.71% on TUP, and 7.99% on UNG all within the course of a few weeks.

In one month, with a $250,000 portfolio, the guru calculated that anyone following the system could have collected $2,970.73. That adds up to over $35,000 for the year.

With those returns, it’s possible to double your account in just six years. Even if it takes a little longer, those numbers are nothing to laugh at.

>> Tap into the High-Yield Daily Dividends TODAY <<

Pros and Cons

The service has many pros, but there are some cons to consider.

Pros

- Features innovative income-generating investment opportunities

- Led by one of the world’s foremost dividend investors

- Ironclad 365-day money-back guarantee

- Monthly and weekly stock picks and updates

- Jam-packed model portfolio

- Comes with 3 bonus reports featuring additional stock picks

- Positive reviews from members

- Excellent value for the price

Cons

- No community chats or forums

- Somewhat niche focus

The Dividend Hunter Reviews by Real Members

Tim Plaehn has an impressive track record and the credentials to back it up, but what do his readers think of him?

These Dividend Hunter reviews by real members will shed some light on what you can expect with the service.

As you can see from these testimonials, Tim Plaehn is legit. These satisfied customers clearly had a positive experience with the service.

However, you should know that I pulled these reviews from the latest presentation. They came directly from Tim, so take them with a grain of salt.

>> Sign up now to join these satisfied members <<

Who Should Subscribe to The Dividend Hunter Newsletter?

The Dividend Hunter has a very specialized investing approach that’s an excellent fit for anyone interested in income investing. That said, I believe there are some people that could get more out of the service than others.

High-Yield Dividend Hunters

Planning an income portfolio requires a very different approach than a traditional growth-focused portfolio.

If you’re serious about building income, you might want to consider a service specifically designed for that goal.

And the service fits the bill perfectly with high-yield dividend stocks for a purpose-built strategy.

Retirement Planners

This deal includes several resources that can help you plan out your retirement with greater certainty.

You can see all your upcoming dividends with the Monthly Paycheck Calendar, so you’ll always know what to expect..

Business Fundamentals

Tim doesn’t chase the latest “here today, gone tomorrow” fad stocks.

While most gurus are fixated on price action and short-term gains, he prioritizes stocks with strong business fundamentals and dividend growth to ensure each pick has the best possible chance of long-term success.

Monthly Income Chasers

Dividends are great, but most companies only make quarterly payouts.

That might work for some, but if you want consistent retirement income, you might be better off with more regular payments.

The service prioritizes stocks with monthly payouts, so you have as much income flexibility as possible during your golden years.

>> Sound like a match? Sign up TODAY! <<

How Much Does The Dividend Hunter Cost?

Under the latest deal, members can sign up for an annual subscription to The Dividend Hunter for just $49.

Given that the team values the reports at $99, this is an excellent deal.

Your purchase also includes an outstanding 12-month guarantee, so you’re still covered if you’re not satisfied with the service for any reason for the first year.

At that rate, your overall cost comes out to slightly more than $4 for every month of your The Dividend Hunter subscription. This is a solid discount and offers loads of value at a very affordable upfront price.

It’s also worth noting that the discount only applies to your first year of service. If you renew your subscription, you’ll pay $99 for the second year.

However, The Dividend Hunter team will give you a heads up before your subscription cancels so you’ll have time to change your mind before they bill you.

Is The Dividend Hunter Worth It?

The Dividend Hunter stands out as an exceptional newsletter and an incredible value at just $49 for an entire year of service.

Tim Plaehn presents a distinctive approach to dividend investing that has the potential to establish a consistent passive income stream for your portfolio. The added advantage of a 365-day money-back guarantee makes it an opportunity that’s difficult to overlook.

Within this #1 High-Yield Dividend Newsletter, you’ll find a comprehensive compendium of cutting-edge strategies for dividend investing. Moreover, the newsletter ensures you stay up-to-date with the latest research throughout an entire year.

The package also includes a wealth of supplementary valuables for new members, including several bonus reports, and much more. These resources greatly amplify this deal’s value.

Given that income investing commonly aligns with retirement planning, having an array of tools to chart your future is undeniably advantageous.

Furthermore, the Paycheck Calendar and other free upgrades enhance the already substantial benefits.

After a thorough Dividend Hunter review, I can confidently say this $49 deal is hard to beat. I highly recommend you give this Tim Plaehn research service some serious consideration.

![Is Tim Plaehn Legit? [Tim's recommendations vs. Big name blue chips]](https://www.thestockdork.com/wp-content/uploads/2023/06/dh6.png)

Tags:

Tags: