Angel Publishing’s Energy Investor has made a name for itself as one of the best research services for energy stocks, but does it live up to its reputation? We’re going to take a close look at this service in our Energy Investor review to find out, so keep reading to find out if it’s worth your time.

Energy Investor Review: Overview

Energy Investor is a once-monthly newsletter from Angel Publishing and editor Keith Kohl that leads readers to the top energy companies on the market.

The service’s recommendations are organized into a model portfolio and monitored closely. Members receive timely updates whenever circumstances change and it’s time to make a move.

Each month, Energy Investor also sends out a new stock recommendation every month, so you’ll always have new trade ideas to explore.

A subscription also provides access to a vast collection of special research reports examining up-and-coming investment trends, including an archive containing all of the team’s previous briefs.

You get all this at a relatively affordable cost, and it’s covered with an air-tight money-back guarantee.

Energy Investor certainly seems like it has a lot to offer, but we’re going to dig much deeper before this Energy Investor review is through. First, who is Keith Kohl, and is he worth listening to?

>> Ready to get started with Energy Investor? Join now <<

Keith Kohl Review

Keith Kohl is a stock market veteran and one of the lead analysts for Energy Investor. He also leads several other services for Angel Publishing, including Technology and Opportunity and others.

Kohl is one of Angel’s chief investment publishers and the company’s resident energy-tech sleuth. He’s well regarded for his ability to pick ahead-of-the curve tech and energy trends for his readers.

During his time with Energy Investor, many of the service’s recommendations went on to produce substantial returns.

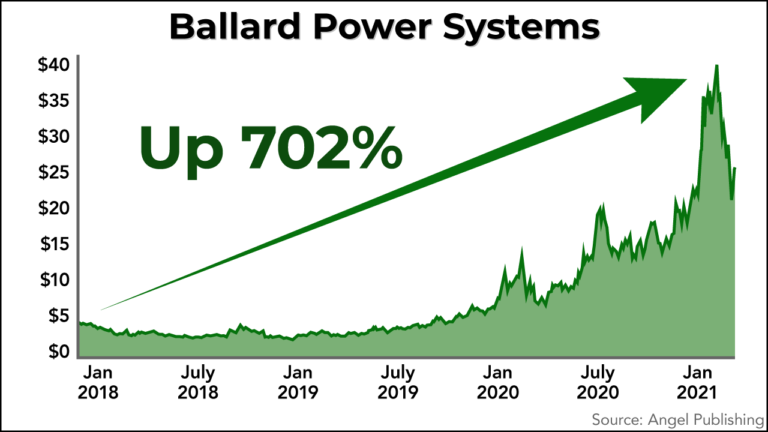

For example, he recognized the potential in fuel cells early on, and his followers had a chance to nab a 702% gain on Ballard Power Systems as a result of one of his related recommendations.

Kohl regularly beat the mainstream market to the punch on breakout trends like these, and it’s become a common theme in the services he oversees.

Although Kohl might not have the instant name recognition some gurus enjoy, he has an excellent track record and a keen eye for tech and energy trends. He’s extremely qualified to lead Energy Investor.

Angel Publishing Review

Angel Publishing is the research publisher behind Energy Investor and several other advisory services. Altogether, the firm’s services cater to almost 50,000 readers across the globe.

The ‘about’ page on the Angel Publishing website shows the company holds a strong commitment to leveling the playing field between Wall Street and Main Street.

The company is an advocate for the proverbial little guy, and its ultimate goal is to show everyday people how they can build wealth through the stock market and other assets.

Angel is a US-based company with a good reputation, and many of its services, including Energy Investor, include robust money-back guarantees. Members also have access to a top-rate VIP customer services team if there’s ever an issue.

Angel Publishing checks all the boxes for a qualified, trustworthy publisher. You don’t have anything to worry about when you’re doing business with this company.

>> Sign up now to access exclusive Angel Publishing research <<

Energy Investor Review: TriFuel-238

Keith Kohl’s latest presentation for Energy Investor focuses on an emerging energy technology that could transform the world and generate huge gains for early investors.

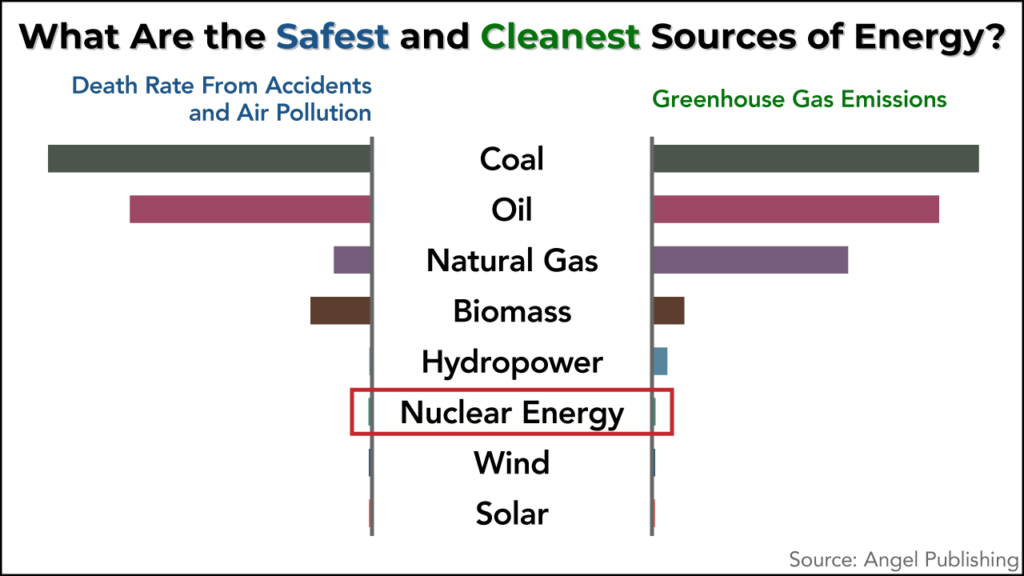

He calls it TriFuel-238, and it has the potential to totally overhaul the global economy and break the world’s dependence on fossil fuels for good.

Just two pounds of this revolutionary new fuel could keep a Ford F-150 pickup truck running for 249,180 miles, and it would only take 0.4 ounces to go across the US, coast to coast.

TriFuel-238 is like nothing we’ve seen before. It’s not a sophisticated battery, liquid gas, a hydrogen fuel cell, or anything of that nature. It’s in a class all its own.

This new fuel could be the key to powering the next era of human advancement without the climate change risks that come with fossil fuels.

Next, we’ll take a close look at this game-changing compound and what it means for your portfolio.

What is TriFuel-238?

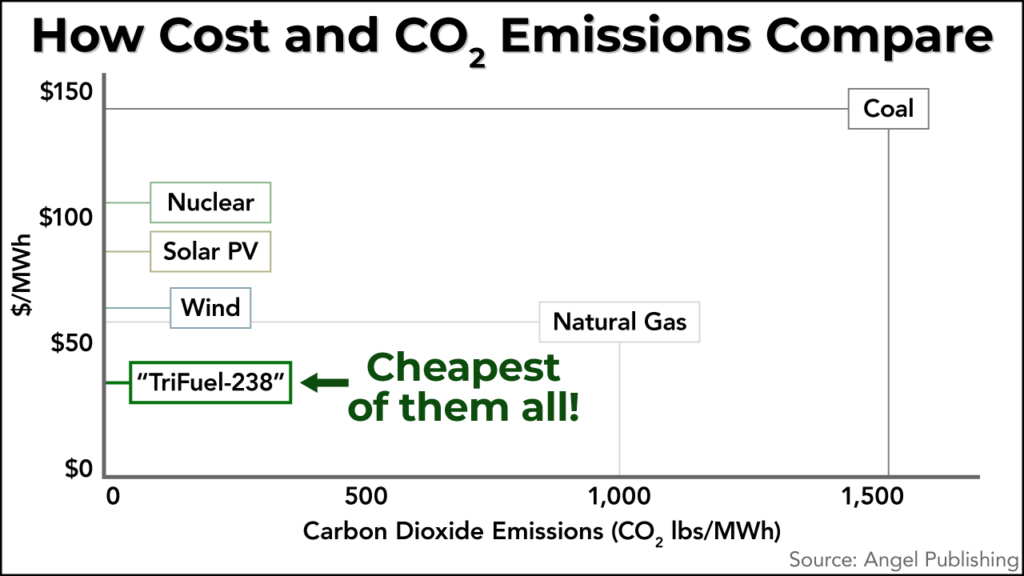

TriFuel-238 is a special, patented compound that could replace traditional nuclear fuels and make energy production cleaner, safer, and more efficient than any technology we’ve seen previously.

It’s a special kind of “contorted metal fuel” that’s been specially developed by one tiny firm, and the same company also holds exclusive patents for this proprietary technology.

The fuel has the potential to completely replace existing nuclear fuels and ease the global transition away from dirtier fuels like coal and oil.

Existing nuclear reactors can upgrade to the new fuel almost effortlessly, making them a natural market for this company to pursue.

France’s nuclear power industry is estimated to be worth $5.84 billion on its own, and the company has already landed a deal with Framatome, the country’s sole nuclear power supplier. It’s also eyeing additional markets for further expansion.

However, retooling existing nuclear reactors is only the beginning. TriFuel-238 has the potential to spur a new wave of investments into new reactors and clean energy infrastructure.

But, what makes TriFuel-238 so special? Let’s take a close look at what this fuel has to offer.

>> Get access to Kohl’s research on TriFuel-238 with Energy Investor <<

The Benefits of TriFuel-238

Nuclear energy is cleaner than fossil fuels in some respects and largely reliable, however, it’s also expensive and cumbersome. Disposal of used nuclear fuel is also a major concern for anyone considering deploying nuclear power.

Despite nuclear power’s drawbacks, demand for reactors has steadily increased in recent years as countries push to meet ambitious carbon emissions targets in the years ahead.

However, TriFuel-238 could be an excellent alternative to traditional nuclear fuel that solves many of the problems associated with traditional nuclear fuels.

First and foremost, TriFuel-238 is substantially cheaper to source, manufacture, deploy, and dispose of than the compounds typically used to produce nuclear power.

It’s also much more efficient and safer. TriFuel-238 runs 1,632 °F cooler than old nuclear fuel, and its energy output is much greater than the cumbersome nuclear fuels used today.

TriFuel-238 Growth Markets

Many companies are already seeing massive potential in TriFuel-238, and the company behind the compound has already landed several major supply contracts totaling billions of dollars.

One of the company’s most notable partners, Exelon, has facilities in 48 U.S. states, and the company could see as much as $1.73 billion per year in additional sales if Exelon switches its facilities to TriFuel-238.

A major coal energy supplier in the southern U.S. is also eyeing a changeover to TriFuel-238. The company supplies power for more than 9 million customers, and a switch to TriFuel-238 could generate an additional $590 million per year for the company behind the fuel.

This is just a small sample of the huge growth opportunities available for this fuel and the tiny company that’s producing it.

Despite so much potential, the stock has flown under the radar so far, but Keith Kohl predicts that could all change very soon.

However, Kohl believes it won’t take decades or even years for this trend to take off. Instead, he thinks this company could see a dramatic growth trend begin to develop within the next few months.

>> Get started with Energy Investor to get ahead of the TriFuel-238 curve <<

The Outlook for TriFuel-238 Stocks

Kohl conducted an extensive analysis to determine exactly how much growth potential could be at stake for ground-floor TriFuel-238 investors, and his findings were dramatic, to say the least.

Although he warns that past performance is no guarantee of success, Kohl says believes the company behind TriFuel-238 could see gains as high as 460x in the best-case scenario based on an analysis of previous trends.

Less ambitious estimates place the potential growth at 109x the original position, and even his most conservative projections still call for a potential gain of 74x.

If the estimates prove accurate, it could be an epic growth opportunity. Most people would be happy with returns totaling a fraction of those estimates from any of their investments.

And, it all comes down to one tiny company in Virginia that holds the patents for TriFuel-238. If the fuel achieves mainstream acceptance, this obscure stock could see tremendous growth.

Kohl has assembled all his research relating to TriFuel-238 into a special report that he’s including with the current Energy Investor promo.

It includes more details on the fuel’s growth prospects, the name and ticker symbol of the company that stands to benefit the most from the trend, and much more.

Next, our Energy Investor review will take a deep dive into all the features this service has to offer. Keep reading to find out what else you get with the TriFuel-238 package.

Energy Investor Review: Features

- Energy Investor newsletter for 12 months

- Flash alerts and portfolio updates

- 24/7 Model portfolio access

- FEATURED REPORT: The Undiscovered Tech Company Behind the Coming ‘TriFuel-238’ Revolution”

- The Energy Cloud’s Financial Plumbing

- The Billionaire’s Battle: How to Invest in the Next Phase of the Lithium Revolution

- Access to the Energy Investor archives

- Bonus subscription to Keith Kohl’s Energy and Capital e-letter

- Dedicated customer support

- 100% Money-back guarantee for six months

Energy Investor Newsletter

The Energy Investor newsletter is your primary source for the latest research and stock recommendations from Keith Kohl and his team.

Each issue also includes detailed analyses of the latest market-moving trends and other valuable research.

You’ll get a total of 12 issues of the Energy Investor newsletter over the course of a one-year subscription, and each one features a promising new energy stock opportunity.

The newsletter will keep you busy with a steady stream of new stocks to explore every month, so you’ll always have fresh research to act on for your entire subscription period.

>> Get instant access to the Energy Investor newsletter now <<

Flash Alerts and Portfolio Updates

Kohl and his team closely monitor their recommendations and keep readers informed on the latest happenings surrounding each company.

Sometimes, new information will lead the team to change their view on a stock. If something changes, you’ll receive a flash alert detailing the new circumstances and a recommended course of action for responding.

The Energy Investor team sends out flash alerts and portfolio updates as needed to keep you in the loop, so you can go about your day without worrying about what the market is doing

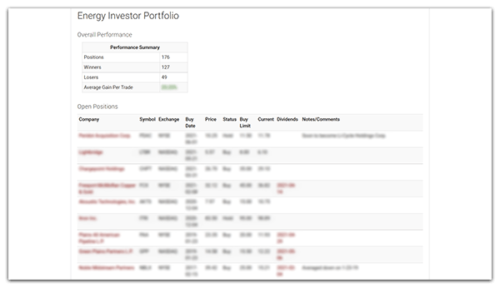

Model Portfolio

The Energy Investor model portfolio includes all of the service’s active stock recommendations and detailed information on each holding.

Just a quick glance can tell you which stocks are currently recommended, the team’s current position on each stock, company name, ticker, current price, and much more.

You can access the model portfolio as soon as you join and immediately see which stocks Kohl and his team are recommending. Having all that information at your disposal makes it easy to hit the ground running with Energy Investor.

Your Energy Investor membership includes unlimited access to the model portfolio, so you can check up on this valuable resource whenever it suits you.

>> Join now for instant access to the model portfolio <<

Energy Investor: TriFuel-238 Special Reports

Kohl has put together an excellent collection of supplementary research materials for his latest Energy Offer deal. The reports include in-depth research into TriFuel-238 and other promising trends.

The Undiscovered Tech Company Behind the Coming ‘TriFuel-238’ Revolution

This report features the bulk of the research into TriFuel-238 and the company behind it. Inside, you’ll find everything you need to know to take full advantage of this potentially explosive opportunity.

You’ll learn the name and ticker symbol of the company behind TriFuel-238 and much more. It also includes extensive research that could lead you to even more opportunities.

We already discussed TriFuel-238’s potential in detail in previous sections, so we won’t get too deep in the weeds here. Just know that this report will get you fully up to speed on TriFuel-238.

The Energy Cloud’s Financial Plumbing

In today’s modern economy, everything is going digital, including the country’s energy infrastructure. A new type of cloud-based energy network could disrupt the energy industry.

Kohl calls it the Internet of Energy, and it could completely transform the entire energy grid.

The technology is expected to be rapidly adopted by consumers with electric vehicles, solar panels, or home-based battery storage solutions.

Each of these technologies could see huge spikes in demand in the coming years, and it could translate into massive growth for the Internet of Energy.

Some of the world’s most prominent investors already see this technology’s potential. Bill Gates, Jeff Bezos, and Michael Bloomberg have each invested as much as $1 million into technology that could advance the Internet of Energy to mainstream adoption.

This special report includes Energy Investor’s number-one stock to take advantage of this potentially disruptive technology and in-depth research into the market opportunities surrounding the trend.

Kohl’s estimates predict this stock could soar as much as 5,000% by the time it’s all said and done, so this could be a huge growth opportunity if the cards fall the right way.

The Billionaire’s Battle

It’s no secret that lithium will play a key role in the future of the global economy. This valuable resource is integral to the production of the high-energy batteries required to power electric vehicles and other key pieces of technology.

The global demand for lithium could eventually surpass the available supply by a wide margin, and the resultant supply imbalance could send prices soaring.

Fortunately, it could produce a major growth opportunity for early investors in this vital resource.

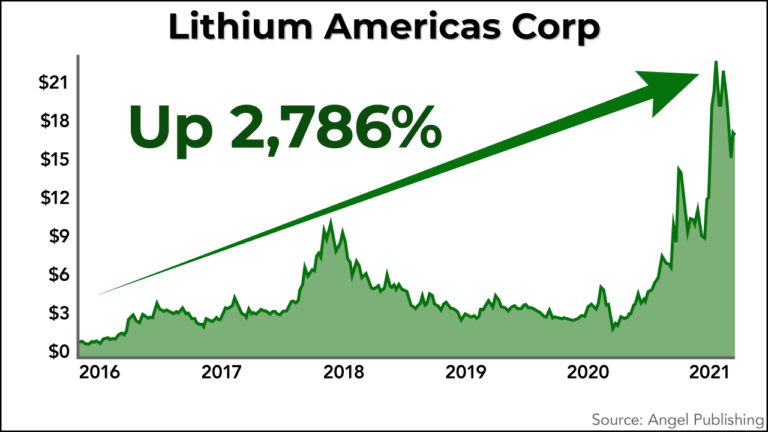

Many lithium stocks have already seen sharp gains. In fact, Kohl’s previous lithium stock recommendations gave his followers the chance at gains as high as 2,786%. Better yet, Kohl believes his picks have the potential to outperform those

According to Kohl; Elon Musk, Tim Cook, and Warren Buffett are all clamoring to build positions in lithium stocks like these.

If those legendary investors see lithium’s potential, safe to say it’s definitely worth looking at. This report includes some of Kohl’s top strategies for investing in the lithium explosion.

>> Sign up now to access these three reports <<

Energy Investor Review: Bonuses

An Energy Investor subscription also includes a few additional goodies worth mentioning. Here’s what else you get:

Energy Investor Archives

Every time Energy Investor puts out a special report like the ones included in this package, it gets stored in the research archives, where members can access them at their leisure.

You get full access to the archives as soon as you join, so you can peruse all of Energy Investor’s previous special reports plus exclusive research from Keith Kohl and his time.

If Energy Investor publishes any additional special reports during the course of your subscription, you can also access them here, so you’ll never miss an opportunity.

The archives add a lot of value to this package. The included resources could lead you to dozens of new investment ideas and greatly expand your investment know-how.

Bonus subscription to Keith Kohl’s Energy and Capital e-letter

Energy Investor members also get access to Kohl’s Energy and Capital e-letter examining the latest news and trends in the energy industry.

If you’re interested in keeping up with the energy sector, you’ll appreciate having this resource at your disposal. Kohl has unique insights into the industry that will help you make better sense of the market.

The e-letter adds yet another wrinkle of value to an Energy Investor subscription, and it could shave hours off your morning research routine.

>> Get two bonus newsletters when you join now <<

Dedicated customer support

If there’s ever an issue with your Energy Investor subscription, a dedicated support team is available to assist you.

The support team keeps regular office hours and they can help you resolve any issues you’re having. They can also answer any questions you might have about your subscription.

Nothing beats being able to talk to an actual human being when you need help. Energy Investor’s support team is helpful, courteous, and efficient, so you can rest easy knowing someone will be there to help if you ever run into a problem.

Energy Investor Money-Back Guarantee

Every new Energy Investor subscription is covered with a robust six-month money-back guarantee that covers 100% of your subscription cost.

If you’re not satisfied for any reason within the first six months of your new subscription, you can contact customer support to cancel and get a full cash refund.

It’s refreshingly simple. There’s no fine print or gimmicks, just a straight-up guarantee that goes well above and beyond what competing services typically offer.

The six-month guarantee gives you plenty of time to test drive Energy Investor and decide if it’s right for you. With such an extensive guarantee, you can forget about buyer’s remorse with this deal.

Energy Investor Review: Pros and Cons

Energy Investor looks like a great service, but nobody’s perfect. Here are the most notable ups and downs to signing up with this service:

Pros

- New stock recommendations and updates every month

- Full access to the Energy Investor model portfolio

- Talented guru and research team

- Respected US-based publisher

- Flash alerts and portfolio updates

- VIP Member service team

- Detailed insights into Kohl’s number-one TriFuel-238 stock

- Archives include an extensive collection of exclusive research materials

- Affordably priced

- Industry-beating six-month guarantee

- Two bonus reports featuring breakout tech trends

- 12 issues of the Energy Investor newsletter

Cons

- No community chat room or forum

- Limited to stocks

>> Join Energy Investor to access these perks now <<

Energy Investor Review: Track Record

Keith Kohl and the Energy Investor team have had some noteworthy successes in the past. Here is a brief sampling of some of their previous winners:

Kohl’s insights into the lithium revolution led him to recommend Lithium Americas Corp. to his readers, and the stock went on to produce a 2,786% gain.

Energy Investor readers also had the opportunity to get into Ballard Power Systems early, and the recommendation gave them the chance to earn gains as high as 702%.

This is just a small example of Energy Investor’s winning recommendations, but it’s enough to demonstrate that this team knows the energy market.

Energy Investor Reviews by Real Members

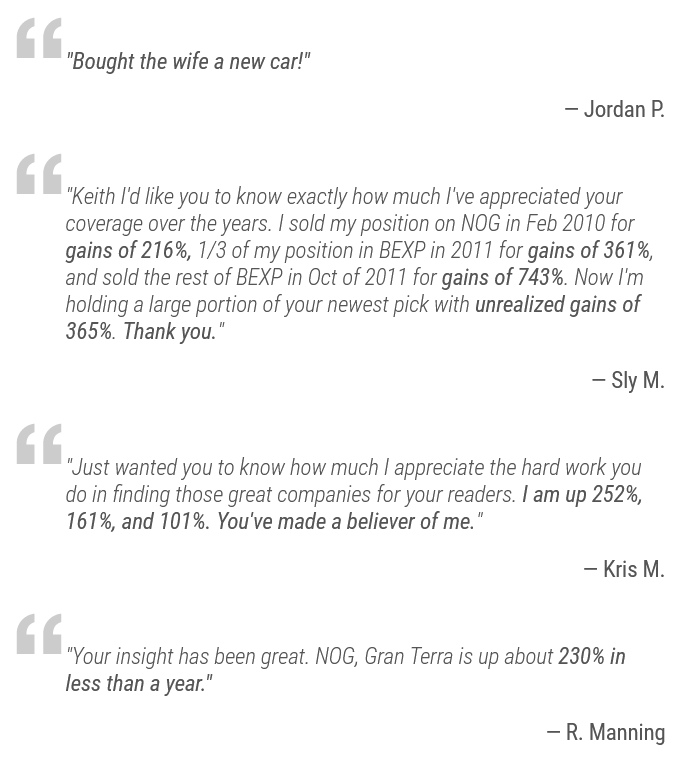

These Energy Investor reviews come from real members who’ve used the service. Here’s what they have to say about their experience with the service:

It’s worth mentioning that these Energy Investor reviews were featured in Energy Investor’s TriFuel-238 presentation, and you should take that into consideration. That being said, it’s still good to see that these members reported such impactful results from the service.

>> Sign up now to join these satisfied readers <<

Energy Investor Review: How Much Does It Cost?

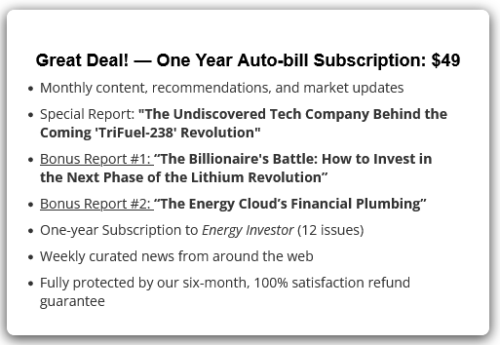

A one-year subscription to Energy Investor typically costs $249 per year, but Stock Dork readers can get the TriFuel-238 deal at a steeply discounted rate.

For a limited time, you can sign up for a one-year Energy Investor subscription for just $49 per year, saving you more than 80% off the sticker price.

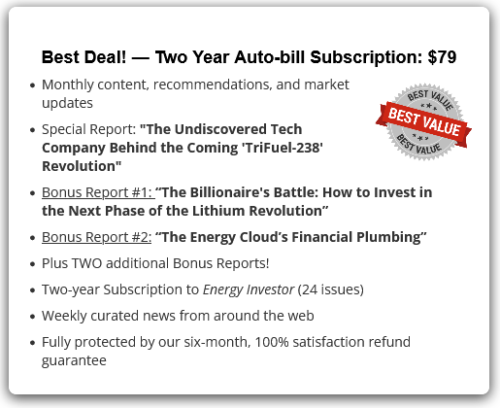

If you decide to upgrade to a two-year subscription, you can get an even better deal. A two-year subscription costs $79, just $30 more than the one-year deal, and includes two additional bonus reports.

You get the additional “The Hidden Grid Giant for 10X Gains” and “5G-Volta: Retire Rich on the Power Grid’s Upgrade of the Century” bonus reports with a two-year deal.

Altogether, you’ll pay just under $40 for each year of your subscription with the two-year deal, plus score more exclusive research from the Energy Investor team.

>> Join Energy Investor now for as little as $49 per year <<

Energy Investor Review: Is It Worth It?

An Energy Investor subscription offers substantially more value than what you typically see with competing services. Plus, the TriFuel-238 package is particularly enticing.

Kohl’s number-one TriFuel-238 stock could see huge growth in the coming months, and the featured bonus report explains exactly how you can take advantage of the opportunity.

You also get the newsletter, model portfolio, and everything else you’d typically get with a regular subscription, including an exhaustive six-month guarantee.

The TriFuel-238 deal also includes several additional bonus reports and full access to the Energy Investor archives, where you can find even more investing ideas.

At just $49 per year, it’s hard to beat a deal like that. You’ll have plenty of stock recommendations to explore as soon as you join, and Energy Investor will keep you busy with new stock picks every month for a full year.

The cost of a one-year subscription averages out to just over $4 a month. That’s a small price to pay for expert stock market guidance. We say Energy Investor is definitely worth it.

Energy Investor Review: Final Verdict

If you’re interested in capitalizing on the growth expected to come out of the energy sector, then Energy Investor is an excellent option.

The service includes a robust collection of exclusive research and insights from proven experts at a price that’s accessible for even the most modest budgets.

With a six-month, 100%, money-back guarantee included with every new subscription, you’re virtually guaranteed to walk away from your purchase satisfied.

Energy Investor provides all the tools you need to succeed in the energy sector and take full advantage of the TriFuel-238 opportunity. At just $49 per month, you will have a hard time finding a better bargain.

An Energy Investor subscription could be the final push you need to cash out huge returns from the green energy revolution, and you can get on board now at an excellent price.

If you’re interested in energy investing, Energy Investor is one of the best options on the market. We recommend you give this Angel Publishing service some serious consideration.

>> That’s it for our Energy Investor review. Join now for just $49 <<

Tags:

Tags: