Veteran investor Larry Benedict claims a number of forces are on a collision course that will rattle the market to its core.

It’s hard to believe, given how well the market is faring, but the last thing we want is to be caught on the wrong side of a major upheaval.

In this Financial Reckoning review, we examine what Benedict is warning us about, the logic behind his thesis, and whether it’s worth listening to from inside his One Ticker Trader service.

>> Get Larry Benedict’s Financial Reckoning <<

What Is One Ticker Trader?

One Ticker Trader is Larry Benedict’s ongoing trading research service designed around markets that don’t reward patience the way they used to. Instead of holding broad portfolios and hoping for long-term appreciation, the service is designed around strategies to actively trade a small group of highly liquid tickers that tend to move frequently in both directions.

The idea is to stay flexible and respond to what the market is doing right now, not what it’s “supposed” to do.

From where I’m sitting, it takes a lot of the stress out of knowing what and when to trade.

The narrow focus certainly helps, too, although Benedict isn’t afraid to pull from any sector where the action’s at.

Members receive trade alerts when Benedict’s system says it’s time to act, along with access to a model portfolio and a private member area where updates and commentary appear.

Without further ado, let’s see where Benedict’s focus lies right now.

>> Join Larry Benedict’s One Ticker Trader <<

What’s Driving the Financial Reckoning in 2026

The markets can be difficult enough to deal with on a normal day, but Larry Benedict warns the situation’s about to get much worse.

As we’ve been speeding along, four unique forces are on a collision course that could drastically shake up our investments.

He calls it a Financial Reckoning, and it has the momentum to push markets into a prolonged downturn rather than a quick reset.

That’s scary if your portfolio is built for steady growth, as those gradual increases may not materialize for several years.

I wish this were merely a rumor to brush off, but history all too often repeats.

>> Access Financial Reckoning By Larry Benedict <<

Going Back in Time

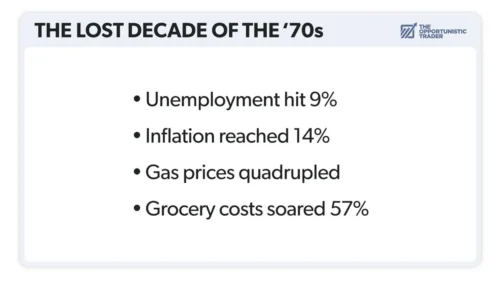

I wasn’t around for the 1970s, but I’m well aware that it’s known as “the lost decade”.

Folks trying to stick to a traditional buy-and-hold portfolio mindset saw wealth disappear in large chunks that took over 20 years to recover from.

Those trying times weren’t the result of a gradual downturn, either. There were patterns of high profits before it all came tumbling down.

We’ve had other blips on the radar since, like the dot-com bust and 2008’s housing crisis.

These are not trends most of us can predict, which is why Larry’s warning is ringing so clear.

He’s not shouting from the rooftops without data to back it up, either.

Four Powerful Forces Coming Together

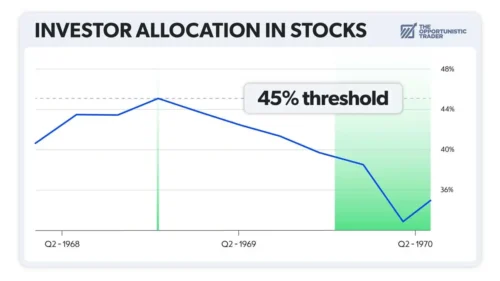

Many stocks fell hard in the 1970s, and Benedict sees the writing on the wall yet again.

That leads to a top-heavy market, especially with giants like Nvidia and the other Maginificent Seven sitting at the top.

The market can only support those heavyweights for so long.

Larry’s third force was a bit more surprising and involves the dollar’s waning value.

We’re already seeing weakness here, and that value could drop another 10% in the coming months.

What hit home for me is when Benedict mentioned the affordability crisis we’re all facing right now.

With so much stock action being driven by spending, the current landscape isn’t looking good.

>> Start One Ticker Trader With Larry Benedict <<

The Path Forward

I’m not really a gloom and doom kind of guy, but knowing about these potential storms on the horizon helps us prepare for them.

Benedict’s take, though, is that there’s a silver lining to it all, but it requires stepping a bit out of your comfort zone.

His motto right now is “trade it, don’t own it”, and that flies in the face of what a lot of us know.

Larry’s logic is sound though, and he’s also offering a way to learn and adapt to his strategy through his Financial Reckoning bundle.

You’ll learn the tips and tricks needed to make it out the other side if this scenario comes to pass or another way to earn wealth even if it doesn’t.

Next, I’ll dive into everything that comes with a membership so you can decide if it’s for you.

>> Explore Larry Benedict’s Market Strategy <<

Financial Reckoning Review: What Comes With One Ticker Trader?

Here are all the tools you’re afforded in a One Ticker Trader subscription:

A Full Year of One Ticker Trader

A Full Year of One Ticker Trader

A full year of One Ticker Trader gives members continuous access to Larry Benedict’s trading research, which is quite a bit different than other services I’ve seen. Instead of a generic monthly newsletter, you receive content precisely when it matters instead of at rigid times.

In my experience, these can be anything from updates on a rapidly increasing stock to something losing value hand over foot.

That said, you always need to be ready for a shift to take place.

The nice thing is that Benedict zeroes in on only the biggest opportunities, so you don’t have to juggle dozens of positions at a time.

Having a limited pool still allows for significant wealth generation opportunities without nearly as much of the stress.

Real-Time Trade Alerts

Real-Time Trade Alerts

Real-time trade alerts are what turn the strategy into something practical.

When Larry’s system signals an opportunity, you’ll receive alerts that clearly outline what to trade and when to act.

These alerts include both entries and exits, which helps during fast-moving markets.

Instead of general commentary, alerts are tied to specific setups based on mean reversion, where prices have moved too far in one direction.

This structure is especially useful for folks like me who don’t want to watch charts all day.

Having Larry watch over the market for you is an awesome way to stay engaged without eating up your life in the process.

>> See Financial Reckoning Before Markets Shift <<

Members-Only Website Access

One Ticker Trader includes access to a private members-only website that acts as the central hub for the service. Inside, you can view the current model portfolio, track open positions, and review past trades.

The site also houses updates, commentary, and supporting materials that help explain how trades fit into the broader strategy.

I spend the majority of my time here learning about past plays and strategies Larry likes to employ, so I’m ready when the alert hammer drops.

Being able to see active positions at any time is also a huge win and gives a lot of transparency to the service.

Access to “Ask Larry Anything”

“Ask Larry Anything” sessions give access to Larry Benedict’s thinking beyond individual trades.

These regular discussions focus on current market conditions, recent volatility, and how the strategy adapts as environments change.

While Larry doesn’t provide personalized financial advice, he does address common questions and explain how he interprets what’s happening in real time.

This added context helps me stay disciplined when markets feel unpredictable.

Hearing Larry walk through his reasoning can be just as valuable as the alerts themselves, especially if you want a deeper understanding of the strategy you’re following.

>> Learn Larry Benedict’s Trading Approach <<

Financial Reckoning 2026 Bonus Reports

Alongside the core service, Financial Reckoning 2026 includes several bonus reports that expand on Larry Benedict’s outlook and show how he plans to operate as this market environment unfolds.

Featured Report: The Lost Decade Playbook

Featured Report: The Lost Decade Playbook

The Lost Decade Playbook is the most important bonus tied to Financial Reckoning 2026 because it connects Larry Benedict’s warning directly to action.

Larry explains that when markets enter long periods of stagnation, most stocks stop offering consistent opportunity, but a small group of highly liquid tickers remains extremely active.

This report identifies the tickers Larry expects to play most frequently as the financial reckoning plays out.

Read this before you do anything else with the service so you know exactly what you’re dealing with before jumping in.

>> Try One Ticker Trader Risk-Free <<

BONUS REPORT #1: Larry’s Guide to Options

BONUS REPORT #1: Larry’s Guide to Options

Larry’s Guide to Options is a practical, no-frills introduction designed to remove hesitation around options trading.

It feels like a 101 course, but it’s still helpful to flip through if you’ve been around options for a while.

Inside, Benedict walks through the core terminology, basic mechanics, and risk considerations in plain language.

The guide also outlines the exact steps needed to place a trade, helping readers understand how his strategy is executed in real time.

It’s meant to get readers comfortable enough to follow along without feeling overwhelmed.

BONUS REPORT #2: The 3X Retirement Accelerator

BONUS REPORT #2: The 3X Retirement Accelerator

The 3X Retirement Accelerator focuses on an investment vehicle that, as I read through the report, feels very underutilized.

It’s a different approach to saving for retirement, and it fits perfectly into Larry’s narrative.

In addition to potentially amplifying your returns, it serves as a way to win even when the markets aren’t moving in the right direction.

Larry shares the full scoop here so you know exactly how to start and then take advantage of this rare system.

BONUS REPORT #3: The Great Wealth Shift

BONUS REPORT #3: The Great Wealth Shift

The Great Wealth Shift addresses what happens after dominant market leaders begin to lose momentum.

Capital invested into those falling firms doesn’t just simply vanish; it rotates into new companies rising to fill the gap.

The cool thing is that these transitions create defined profit windows as long as you’re looking for them.

Larry’s educational approach shines again here, allowing you to see how this strategy plays out with clear examples so you can put it to use in your own investment plan.

>> Prepare With Financial Reckoning 2026 <<

Pros and Cons

Check out the pros and cons I came up with while studying Financial Reckoning 2026.

Pros

- Comes with one full year of One Ticker Trader

- Clear focus on volatile, sideways markets

- Real-time trade alerts with entries and exits

- Concentrates on a small number of active tickers

- Weekly “Ask Larry Anything” market discussions

- Strong emphasis on risk control and flexibility

- Multiple bonus reports

Cons

- Only offers options recommendations

- Not designed for passive buy-and-hold strategies

- Results depend on following alerts consistently

Refund Policy

Refund Policy

One Ticker Trader comes with a straightforward 30-day refund policy, which gives you time to evaluate the service without long-term pressure.

After signing up, explore the model portfolio, read through the included reports, and follow trade alerts as they come in.

If at any point within those first 30 days you decide the service isn’t a good fit, you can contact customer support and request a full refund of your membership fee.

Importantly, even if you cancel, the bonus reports remain yours to keep, which helps reduce the risk of trying the service.

>> Follow Larry Benedict’s Trade Alerts <<

How Much Does One Ticker Trader Cost?

You can snag One Ticker Trader through a heavily discounted introductory offer tied to Financial Reckoning 2026 for a limited time.

New members can get 12 months of full access for $19, which is almost 98% off the standard $499 annual price.

This first-year subscription includes the core trading service, real-time trade alerts, access to the members-only website, weekly “Ask Larry Anything” sessions, and all bonus reports associated with the Financial Reckoning theme.

After the initial term, the subscription renews at $199 per year unless canceled in advance.

Given the length of access and the breadth of ongoing research included, you’re not going to find a better deal on a service of this caliber.

>> Discover Financial Reckoning 2026 NOW! <<

Is Financial Reckoning Worth It?

Is Financial Reckoning Worth It?

After a thorough Financial Reckoning review, the service stands out to me for a number of reasons.

Larry’s focus on ways to play the market no matter what it’s doing is a huge plus. Even if the catastrophe he anticipates doesn’t come to pass, there’s still a lot of potential here.

On top of that, you’re getting a ton of educational content on the current economic outlook so you actually know what’s going on.

Also, Benedict uses his alert system to keep us abreast of options opportunities from start to finish, taking out guesswork and a lot of stress in the process.

Finally, you just can’t beat that $19 price point right now. The service still sounds great at the renewal rate, but 20 bucks amounts to basically nothing for what you receive.

You’ve also got the 30-day money-back guarantee to fall back on if push comes to shove.

In all, Financial Reckoning is definitely worth trying out if you want my two cents.

Just be sure to grab it at discount and before the markets get any crazier so you don’t miss out.

Tags:

Tags: