Our Finviz review covers the Elite version, breaking down everything you need to know about this top-rate stock screener.

Finviz is one of the most popular stock screeners on the market, but the basic version only provides a fraction of the screener’s full capabilities

This is why most traders opt for Finviz Elite.

Finviz Elite is the platform’s premium version and includes a wide array of features that aren’t available in the free plan.

But is Elite worth your time and money?

Read our Finviz Elite review to find out!

What Is Finviz?

If you’re a stock trader and you haven’t heard of Finviz, you’re missing out.

Finviz’s web-based stock screener allows you to search through stocks through several filters.

You can filter stocks based on sector, industry, market capitalization, etc.

There are even some extra features, including stock charts and insider trading alerts that cue you in on suspicious market activity.

Is Finviz Free to Use?

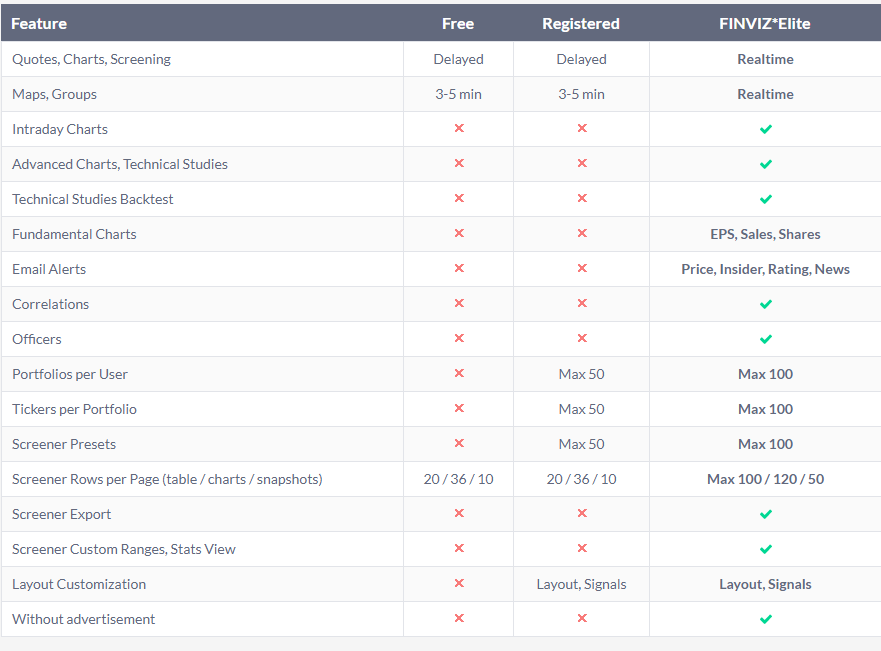

There are two versions: Finviz (a completely free stock screener) and Finviz Elite — the paid version.

Both versions provide leading top-tier research tools to help boost profits with access to in-depth stock data at a moment’s notice.

Finviz Elite is especially useful for active stock traders who need stock market price data on the fly.

Is Finviz a Good Stock Screener?

In our Finviz stock screener review, we found that we liked the free version but loved Elite.

The free Finviz screener is surprisingly robust, but it falls short of meeting the needs of more advanced investors and traders.

That’s why so many traders become Finviz Elite subscribers.

This paid subscription plan removes the limitations of the free account so you can tap into the platform’s full potential.

As far as stock screeners go, this one has all the bells and whistles you’d expect, but you get so much more.

Is Finviz Good for Day Trading?

While the free Finviz stock screener can be used to find stocks, its results lack real-time data, and free users can’t customize screener settings.

So it wouldn’t be helpful for day traders, who need immediate market data to execute effective timing.

Finviz elite, on the other hand, is the complete package and will keep you in the loop with intraday charts (more on that later).

Does Finviz Elite Scan Premarket?

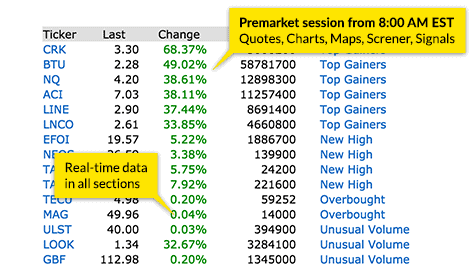

Finviz Elite does provide you with premarket data.

We’ll dig deeper into this later in our Finviz stock screener review.

Finviz Elite Review: What Does It Offer?

The Finviz Elite stock screener turns the basic stock screener into a powerful, professional-grade trading tool.

Elite users can access all of Finviz’s basic features, plus real-time trading info, additional stock screener settings, advanced charts, and much more.

These are Finviz Elite’s core features:

- Advanced screener

- Real-time data

- Advanced charting

- Backtesting

- Correlations

- Custom alerts and notifications

- Finviz news

- 30-day money-back guarantee

Stay tuned to our Finviz Elite stock screener review for a breakdown of each one.

Advanced Screener Review

Finviz earned a stellar reputation over the past few years for giving investors and traders free access to its basic stock screener

However, it’s nothing compared to the Finviz Elite advanced stock screener.

The free Finviz allows you to sort stocks based on a range of screener presets, but it doesn’t let you fully customize your screen settings.

On the other hand, Finviz Elite users can completely customize searches to fit exact selection criteria.

And it’s this in-depth customization that makes the Finviz Elite screener really shine.

Search the Stock Market on Your Terms

Just like the basic stock screener, Finviz Elite allows you to search for stocks using various attributes, including:

- Technical indicators

- EPS growth

- Market cap

- And more

However, you’re not limited to the preset search settings, and you can customize each filter based on your preference.

Search for Any Market Cap Size

With the Finviz Elite plan, you’re not limited to the basic version’s choppy presets, and you can type in whatever value you want to screen stocks.

That means you can search for companies, whatever numbers you want to target, such as EPS growth above 13.5% in stocks with a market cap lower than 7.8 billion.

The ability to fully customize each setting maximizes your stock screening capabilities by helping you identify the best stock picks.

Finviz Advanced Screener Benefits

The Finviz Advanced Stock Screener can help you conduct more precise stock market searches so you can find new trade opportunities more quickly and efficiently.

You can use it to identify stocks that have a high chance of breaking out soon by using a combination of technical indicators and chart patterns.

Once you master the Finviz Elite Advanced Screener, you’re fully equipped to take the market by storm.

>>Click here to start finding new opportunities with Finviz right now<<

Real-Time Data

Finviz Elite incorporated streaming data feeds throughout Finviz, and it really brings the platform to life.

Better yet, you have data coverage in an extended hours trading session, so you can access up-to-the-minute trading data starting at 8:00 am on days the market is open.

Elite includes live data on your homepage, heat maps, charts, quotes, and more.

You can also review historical data for each stock, including both technical and fundamental metrics.

Thanks to the real-time data, Finviz Elite provides a seamless experience with streaming market data integrated into all of its trading resources.

Does Finviz Free Use Real-Time Data?

Like many stock screeners, Finviz’s free plan doesn’t use real-time feeds.

You have to upgrade to Finviz Elite to access live quotes.

Finviz Real-Time Data Benefits

If you’re a day trader, live data is an absolute game-changer, as it lets you access accurate, up-to-date market data during your sessions.

With the free service, quotes are delayed 24 hours, making it — to be frank — useless for day traders.

With Finviz Elite, however, you’ll really have your finger on the pulse of the market.

You can go to the Finviz page as early as an hour and a half before the trading session opens to get an immediate idea of which way the market is going.

Best of all, the live data funnels right into charts and other research.

Advanced Charts

Charting is vital for technical analysis — unfortunately, Finviz basic’s chart features are limited.

Finviz Elite’s advanced charts allow users to conduct deeper technical studies with tools that draw on years of historical data.

You can also utilize additional features to help you conduct more accurate research in less time.

Finviz Elite’s advanced candlestick charts include the following features:

Intraday Charts

Elite’s live data feed allows users to access intraday trading charts.

Intraday charts aren’t available in the free version because it only offers delayed quotes.

Day traders will certainly appreciate this feature because it allows them to monitor stocks throughout the session.

Finviz Heat Maps

The heat map allows you to quickly assess the market’s mood with a quick glance.

It uses squares to represent different stocks, and it sizes each stock’s square proportionately to its market capitalization.

The map colors each stock green or red to indicate the current trading activity surrounding each stock.

Green represents buying and red represents selling.

You can have all the data in the world, but it doesn’t mean a thing if you can’t interpret it.

Finviz is well-aware of this and provides an easy-to-follow visual aid that gives you an immediate idea of where the market is heading.

Overlays and Indicators

You can impose technical indicators onto your charts so you can spot developing trends more easily.

These visual aids can help you identify trade opportunities you might have otherwise missed, and they give you better insights into prevailing trends.

Drawing Tools

You can draw on your charts to keep a record of your technical analysis findings.

Users can draw lines to highlight trends, support levels, resistance barriers, and more

Fullscreen Layouts

You can blow up every chart to fill your entire screen, which makes it easier to focus on the research at hand.

Performance Comparison Charts

Perhaps one of the most useful advanced chart features is the performance comparison option.

You can put together charts that include multiple stocks and immediately see how they perform in relation to one another.

Finviz Advanced Charts Benefits

These advanced charting features are extremely useful for technical-focused trading.

Charts can help you discover trends you wouldn’t see if you were just looking at raw data, so they’re an important part of your research.

Finviz Elite’s upgraded charting features are a significant addition to any trading arsenal.

>> Join Finviz elite now to discover the best stocks to trade <<

Backtesting

If you want to skyrocket your strategy fast, the name of the game is backtesting.

Without backtesting, you’re risking your hard-earned cash on a hunch without any indications that it could pay off.

Finviz Elite has 16 years of historical market data, more than 100 technical tools, and S&P 500 comparison data that you can use to evaluate your strategies.

For example, maybe you notice a certain stock whose price increases whenever a MACD crossover occurs.

You can use Finviz Elite to backtest this theory with its built-in historical data and gauge its performance in relation to the S&P 500.

This immediately tells you whether the strategy is viable and whether it returns significantly more than the SPY benchmark average.

From there, you can take these settings to the stock screener and use them to help you identify new trade ideas.

Finviz Backtesting Benefits

Backtesting is one of the most powerful features included with Finviz Elite; and if you use it properly, you can find countless stock trading opportunities.

Best of all, you don’t have to risk any capital to test your theories.

Past performance isn’t necessarily a guarantee of future results, but backtesting adds a powerful new wrinkle to your trade strategy.

Incorporating backtests into your research can help you determine whether your hunch is legit so you can move forward with more confidence in your plan.

>>Upgrade your trading game with Finviz Elite’s advanced tools now<<

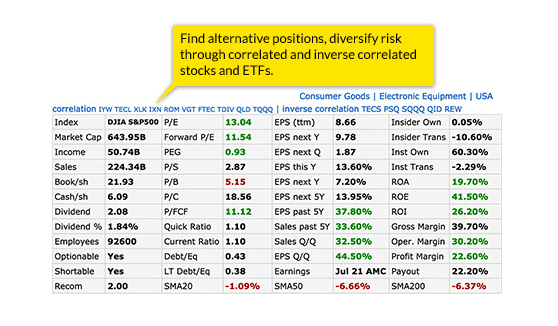

Correlations

Sometimes different stocks tend to consistently move in relation to one and other.

This phenomenon is called correlation, and identifying these trends can help you significantly improve your trading strategy.

Finviz Elite uses proprietary algorithms to help you identify these trends so you can use them to your advantage.

Finviz Correlation Benefits

Identifying correlations can help you develop precise hedging strategies to insulate your portfolio against potential losses.

You can also use correlations to diversify risk by fine-tuning your portfolio allocations.

With a little planning, the Finviz correlation engine can help you bolster your positions and minimize potential losses.

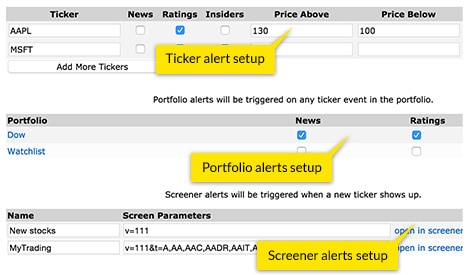

Price Alerts and Notifications

Finviz premium users can set up email alerts based on stock price movements, news, rating changes, and much more.

It can also tell you when new stocks fall within the range of your preferred screener settings.

Whenever an event triggers a Finviz alert, you’ll receive instant e-mail notifications so you can act immediately.

They’re especially effective when used in conjunction with the Finviz stock screener and charts.

You might have to pay a hefty price in the form of losses if you’re slow-footed in the stock market, but Finviz alerts ensure that you’re ready to react quickly to any emerging trends.

>>Sign up for Finviz Elite now and never miss another trade opportunity<<

Finviz Price Alerts and Notifications Benefits

Finviz Elite email alerts help you stay on top of price moves without checking your positions every few minutes.

No one wants to be the person that constantly checks stock prices on their phone, but it’s hard to take your eye off your portfolio when you have a big trade on the line.

Setting up alerts will help calm your nerves while you’re watching ticker movements.

You can rest easy knowing you’ll receive an alert if something important needs your attention, so you can relax and focus on the rest of your day.

You don’t need to miss out on life to be a successful trader.

Let go of the day-to-day stress of trading with Finviz notifications.

Finviz News Review

Finviz provides an extensive news feed right inside the platform.

It includes breaking updates organized by ticker symbol and more.

Every stock quote includes a section with the latest press releases for the company, and Finviz’s main menu also has a section with the latest market-moving news from across the market.

This feature is available with both the free and elite plan, but it’s worth mentioning because it’s very useful.

Finviz News Benefits

The news feed makes it easy to follow the most important stories from across the market without flipping through dozens of different sites.

The free version of Finviz provides the news feed for users, too, but it’s even more powerful when you use Finviz Elite.

Combined with the platform’s other advanced features, the news feed makes the premium service a one-stop shop for all your pre-trade research needs.

Finviz Miscellaneous Extras

Finviz also has some extra features included with the paid version, including the top insider trading alerts on the market.

Real-Time Insider Trading Transactions

From the main screen, you can gain important insights about stocks by monitoring the latest insider buy or sale transactions.

Insider transactions are worth keeping an eye on because no one knows more about the company than its board of directors and corporate officers.

If a company’s CEO is selling stock like crazy, there’s good reason to believe the company is in trouble.

Monitoring the latest insider trading transactions can help you find new trade ideas and identify up-and-coming stocks.

Finviz includes extensive data on insider transactions, including relationships, dates, transaction costs, and more.

>>Start exploring Finviz Elite’s premium features now<<

Finviz Futures

Finviz’s future data is available on the free version, but you can tap into live streaming market data with Finviz Elite.

Simply click the futures tab to see the latest prices for the most popular types of futures contracts on the futures market.

The futures section includes the price of oil and other commodities, plus index contracts, and much more.

Ad-Free Layout

Finviz uses ad revenues to support its free version, but the ads can be annoying if you use the platform regularly.

However, when you upgrade to Elite, the ads disappear.

Finviz respects its paying customers enough to not bombard them with ads.

Fundamental Charts

The basic version of Finviz doesn’t have a lot of charting features, and you can only view price charts.

Elite includes access to charts of important fundamental data, such as EPS, shares, and sales growth.

These charts allow you to analyze the business’s true performance instead of just looking at the stock price, which is based on market perception more than underlying fundamentals.

Fundamental charts show you the true health of the business so you can make better trading decisions.

Screener Exports

There are a lot of screeners on the market, and some traders like using more than one.

Finviz Elite allows users to export their screener settings into a CSV file so they can take them outside of the platform.

You can also export your screen settings to share with your friends or online trading community.

The free version of Finviz doesn’t have this feature, so pulling your settings out of the screener is much more tedious.

Additional Screener Presets

You can save up to 100 preset screens with Finviz Elite, and that’s more than almost anyone needs.

The free version doesn’t allow you to save any screen settings unless you register.

Once you register, you can save up to 50 screener presets, but Finviz Elite doubles the limit to 100.

Finviz Elite Pros and Cons

During our thorough review, we’ve uncovered the top pros and cons of the Finviz service:

Pros:

- Incredible, easy to use screener

- Nearly 70 built-in metrics

- Shows market hotspots and insider trading feeds

- Backtests and performance tracking with correlations

- News tailored to each stock

- Can track trades or watchlist picks with a free account

- Covers stocks, futures, forex, crypto

- Many features available for free

- Reasonable pricing

Cons:

- Data only covers US exchanges

- Free and registered plans have delays

- No pre-built screeners available

Finviz Elite Review: Pricing

Finviz has three levels of access.

Free, registered, and Finviz Elite.

It costs nothing to register and access some additional features, but you’ll have to upgrade to premium to tap into the platform’s true power.

A monthly subscription to Finviz elite costs $39.50 per month, which is a pretty good value for professional-level trading software.

However, you can really save if you purchase an annual subscription for $299.50.

Paying for the whole year nets you a savings of $174.50 over 12 months at the monthly rate.

If you’re an active trader, this is an excellent value.

It could easily pay for itself in a few weeks if you take full advantage of the software.

>>Sign up for one year of Finviz Elite now<<

Finviz Money-Back Guarantee Review

If you’re unsure about upgrading to Finviz Elite, you’ll be happy to know that Finviz covers your subscription with a solid satisfaction guarantee.

Finviz will pay you a full refund if you’re not satisfied with your purchase within 30-days.

Finviz Elite Review: Is It Worth It?

Finviz Elite is an excellent value for the price, as you gain access to an arsenal of advanced features for less than $40 per month.

Competing stock screeners can cost much more — some even have price tags that stretch into the thousands.

A Finviz Elite membership only costs a fraction of that price.

The real-time data feeds allow you to monitor the market and potentially identify trades as they develop.

Free Finviz only has delayed quotes, so it’s practically useless to day traders.

All and all, we think Finviz Elite is one of the best stock screeners on the market, and it’s an excellent value for the price.

Finviz Elite Review: Is It for Me?

Here’s a recap and breakdown of what Finviz Elite offers traders:

- Great for active traders of all skill levels, but it’s especially useful for experienced traders that deal in a high trading volume

- Access to technical filters, fundamental filters, daily charts, stock charts

- The latest news features media from outlets like Bloomberg, Vantage Point Trading, Market Watch, Wall Street Journal, and much more

- Insider trading indicators

- Tools and resources are excellent for swing trading, active trading, and more

- Charts display key figures that include P/E, dividend yield, and other performance indicators

- Proprietary correlation algorithms can help you find stocks that are related to one another

- View stock maps to get a moment-to-moment pulse on the market through an easy-to-navigate user interface

Finviz Elite Review: The Final Verdict

You can tap into a wealth of rich features with Finviz Elite, and it’s one of the most affordable screeners available.

It’s perfect for active traders and beginners looking to take their game to the next level.

Once you check out the free version, you’ll have a better idea of how the Elite features will upgrade your user experience.

Properly using Finviz Elite’s professional-grade features can take your trading to the next level.

Stop missing out on the hottest growth stocks and up your trading game today with Finviz elite.

Tags:

Tags: