Gold has been on a rampage, and many of us were caught on the sidelines during its recent historic run.

In his The Return of the King presentation, Goggin makes a strong case for a coming shift in the global monetary system that could create even bigger opportunities for the yellow metal in the near future.

This Golden Portfolio 10X Review breaks down what we found inside and whether the results truly justify the hype.

>> Join Garrett Goggin’s Golden Portfolio 10X Today <<

What is Golden Portfolio 10X?

Golden Portfolio 10X is Garrett Goggin’s premium research service built for anyone who wants to grow their wealth through the next major bull market in gold.

Inside the service, members get Goggin’s model portfolio, monthly deep-dive issues, and ongoing updates that track how each position performs as gold prices move higher.

What makes this different is the way it combines solid financial analysis with a practical, wealth-building approach.

Individuals who believe gold is reclaiming its role in the monetary system, and want leverage to that trend, will find Golden Portfolio 10X designed precisely for that purpose.

Who is Garrett Goggin?

Garrett Goggin is a seasoned financial analyst with one of the most respected backgrounds in the gold and precious metals sector.

Early in his career, he worked on the floor of the New York Stock Exchange, gaining firsthand experience in how real money moves through the markets.

Over the past two decades, he’s written extensively on metals, mining, and monetary policy, with his work featured in multiple news outlets.

He also served as an analyst under gold legend John Doody, helping manage research for one of the highest-performing gold stock advisories in the world.

Is Garrett Goggin Legit?

There’s no question about it, Garrett Goggin’s track record speaks for itself.With over 20 years in financial markets, he’s built a reputation for spotting undervalued gold and silver opportunities long before they hit mainstream headlines.

His earlier Gold Royalty Portfolio famously outperformed the S&P 500 by 183 times and beat physical gold’s return by more than 17,000% over a comparable period.

In fact, Garret cares so much about legitimacy that his portfolio and claims have been audited by Alpha Performance Verification Services.

Beyond the numbers, Goggin’s credibility stems from his disciplined, data-driven process, the kind typically reserved for institutional money managers.

He’s also been invited to speak at global mining conferences as keynote speaker and continues to garner attention from leading gold and silver developers to this day.

I’d argue there’s no one better to listen to about gold, which is why Garrett’s most recent presentation deserves special attention.

>> Access Garrett Goggin’s Top 30 Gold Picks <<

What is “The Return of the King” Presentation?

Something big is happening in the global financial system, and Garrett Goggin believes most people are missing it.

While that’s a shocker in itself, he goes one step further by pointing to a transformation that’s already begun.

His message is simple but urgent: this is a rare moment when average users can get ahead of the crowd before gold’s next major revaluation fully takes hold.

The Problem With Fiat and Why Gold Matters Again

For decades, the U.S. dollar has been all but untouchable, but that illusion is cracking.Central banks across the globe are now buying physical gold at record levels, while quietly cutting exposure to U.S. debt.

According to Goggin, this shift began after the West froze $300 billion in Russian reserves, a move that made nations rethink the safety of their dollar holdings.

The result? A wave of capital flowing back into gold, which has already surpassed the euro to become the world’s second-largest reserve asset.

To back it up, he shows how gold miners are now producing record profits while still trading as if gold were worth $1,300 an ounce.

That disconnect, what he calls the Golden Anomaly, is where the biggest opportunity lies.

It’s the gap between a company’s true asset value and its suppressed share price, and right now, that gap is wider than it’s been in half a century.

Why This Moment Could Be Historic

If you’ve followed gold cycles before, you’ll know they don’t come around often. Goggin draws parallels to three key turning points: 1933, 1971, and the early 2000s, every time fiat currencies were weakened by too much debt, gold soared.

We’re now in a similar setup. The U.S. is running trillion-dollar deficits, and the only realistic way out is to let inflation run hot.

What’s more, Goggin believes Trump’s renewed influence over the Federal Reserve will all but guarantee that outcome.

New appointees favor lower rates, more liquidity, and a weaker dollar —exactly the recipe that has historically sent gold prices to new highs.

I’m most intrigued by how Goggin connects the dots between monetary policy and specific companies positioned to benefit.

From what we’ve seen in his model portfolio, many of these miners are already gushing cash and could multiply several times over once institutional investors wake up to the disconnect.

The Opportunity Hidden in the Chaos

It’s easy to think you’ve missed the boat when gold pushes to new highs, but according to Goggin, the real money hasn’t been made yet.

The price of bullion may be elevated, but gold miners are still deeply undervalued. That’s the setup he calls “the easiest layup of your investing career.”

The takeaway from The Return of the King is clear: this is a generational chance to build long-term wealth from one of the simplest, oldest, and most reliable assets on earth.

Best of all, Goggin’s approach gives folks like us a way to position before the rest of the market catches on, but you’ll need to sign up for his Golden Portfolio 10X service first.

Without further ado, let’s look at what subscribers actually receive once they’re inside the service.

>> Unlock Garrett Goggin’s Golden Anomaly Strategy <<

Golden Portfolio 10X Review: What Comes With It?

Here’s a look at what’s all included once you join:

12 Monthly Newsletters for the Golden Portfolio 10X

Each month, members receive a full-length issue of Golden Portfolio 10X, a deep-dive research report that goes far beyond surface-level commentary. Every edition features Goggin’s lead article on major developments in the gold and silver markets, followed by detailed write-ups on five specific companies that meet his Golden Anomaly criteria.

There’s a beautiful balance here between education and action.

You’re not just told which stocks to buy, but why they’re undervalued, what catalysts are approaching, and when it may be time to take profits.

These newsletters read like a professional analyst briefing, clear, data-rich, and easy to follow, even if you’re not a seasoned metals enthusiast.

Access to the Golden Portfolio 10X LIVE Model Portfolio

Inside the members’ dashboard, you can see every active recommendation in real time, complete with ticker symbols, buy-up-to prices, current returns, and Goggin’s commentary on why he chose each position.

These are all profitable producers and near-production developers sitting on massive reserves of gold and silver that Garrett feels are poised to break out.

Each company is tracked for its free cash flow, balance sheet strength, and production timeline.

As market conditions shift, Goggin updates entries and exit points so members can adjust their exposure without guesswork.

It’s an evolving blueprint that shows exactly how his 30 core “Golden Anomaly” plays are performing, something very few advisories are transparent enough to offer.

Top Seven Silver Plays with 100X Upside Potential

While gold dominates the headlines, Goggin makes a strong case for silver as the metal with the most explosive upside.

He includes seven handpicked silver miners in Golden Portfolio 10X, all of which he believes could rise 100X as the gold-to-silver ratio normalizes.

These are companies sitting on vast, high-grade silver deposits, many still trading at incredible value. His analysis highlights how silver historically outpaces gold during late-stage bull markets, often doubling or tripling gold’s percentage gains.

Members get full access to these specific recommendations, complete with project locations, cost structures, and near-term catalysts.

News and Updates

No one wants to wait a month between insights, and that’s where Goggin’s updates come in.

These updates often include commentary on central bank activity, shifts in the U.S. dollar, or major policy news that could affect gold’s trajectory, such as Fed decisions or global debt events.

When one of his covered miners releases earnings, updates reserves, or secures a new production contract, Goggin breaks it down immediately, explaining what it means for the portfolio.

The goal is to make sure subscribers never feel out of the loop, even in fast-moving markets.

Access to the Complete GP10X Archive

Subscribers get instant access to every back issue, update, and model portfolio revision since Golden Portfolio 10X launched.

This archive is incredibly valuable because it allows you to follow Goggin’s thinking in real time.

Reviewing these archives feels like sitting in on a masterclass in precious metals investing, and it gives you context for how his strategy performs through different market cycles.

For anyone serious about learning his process, this section alone is worth the price of admission.

>> Get Garrett Goggin’s Latest Gold Profit Blueprint <<

Direct Feedback from Garrett Goggin

Unlike most analysts who remain distant, Goggin keeps an active presence in the Golden Portfolio 10X members area.

He regularly shares commentary and insights that expand on the monthly issues, offering a level of direct communication that’s rare in financial research.

Insights here are clear, data-driven, and often highlight new risks or opportunities that mainstream outlets overlook.

Having access to feedback directly from a CFA and CMT with decades of experience in gold equities gives the service a level of credibility that feels professional and personal at the same time.

It’s this kind of engagement that helps members stay confident during volatile markets and make informed, rational decisions instead of emotional ones.

Starter Guide: How the GP10X Finds 18,700% Returns

This foundational guide lays out the exact framework behind his Golden Anomaly strategy, a data-driven method for spotting the small group of miners that can multiply a portfolio’s value many times over. Where most services simply tell you which stocks to buy, Goggin chooses to educate his readers to the method behind his strategy and empower them to find opportunities on their own.

Real-world examples show how past setups like this have delivered staggering returns, as high as 18,700%, when gold revalued in prior cycles.

What makes this guide valuable is how actionable it is. Goggin breaks down complex valuation metrics into plain language, so even if you’ve never analyzed a mining stock before, you can follow along.

>> Join the Gold Revaluation Wave with Goggin <<

Refund Policy

The refund policy for Golden Portfolio 10X is straightforward and clearly stated before checkout.

Once enrolled, members receive full access to high-value financial analysis that cannot be retracted or resold, which is why refunds are not offered under any circumstances.

This policy helps maintain the integrity and exclusivity of the research for active subscribers.

However, members can cancel their renewal anytime by contacting customer support at least one business day before the renewal date to avoid being charged for the next term.

It’s a professional, transparent structure that reinforces the seriousness of the membership and the premium value of Goggin’s work.

Pros and Cons

These are the top pros and cons I encountered when putting the Golden Portfolio 10X to the test:

Pros

- Expert-led by CFA and CMT-certified Garrett Goggin

- One full year of actionable content

- Access to 30 handpicked miners with 10X upside potential

- Clear, educational guidance on gold cycles and valuation

- Includes high-leverage silver recommendations

- Frequent news and updates

- Regular feedback from Goggin himself

- Exclusive guide for starting off on the right foot

Cons

- Premium cost may be high for beginners

- No refunds

- Focused solely on precious metals — not a diversified strategy

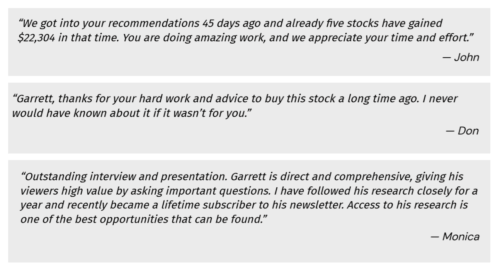

Golden Portfolio 10X Reviews by Members

One of the strongest validations of Golden Portfolio 10X comes directly from its subscribers:

I did pull these reviews straight from the Golden Portfolio 10X promo page, though, so they’re not reflective of every user’s experience.

>> Discover the Power of Golden Portfolio 10X <<

Golden Portfolio 10x Track Record / Past Performance

Garrett Goggin’s Golden Portfolio 10X has built a reputation on transparency and verifiable results, something rare in the investment research world.

His audited track record shows that the GP10X model portfolio has achieved remarkable performance, significantly outperforming both the S&P 500 and the GDX mining ETF since its inception.

In fact, since January 2024, the portfolio has delivered a combined gain of 298%, beating the S&P by 8.5x and nearly tripling the returns of the top gold mining ETFs.

His uncanny method has uncovered companies selling at discounts of up to 98%, with multiple positions returning between 110% and 854%, and only one showing a minimal loss.

Furthermore, the system has spotted historic plays like Silvercrest, which delivered 83x returns, and Newmarket, which gained 2,200%, proving the method’s potential for extraordinary upside.

>> Join Garrett Goggin’s 10X Gold Revolution <<

How Much Does Golden Portfolio 10X Cost?

The retail price for Golden Portfolio 10X is $3,500 per year, but the “Return of the King” offer provides a limited-time 50% discount, reducing the price to $1,750 annually.

This discounted plan includes full access to everything inside the service: all 12 monthly issues of Golden Portfolio 10X, the live model portfolio with over 30 active gold and silver recommendations, members-only updates, and Goggin’s detailed research archive.

Once subscribed, members are automatically locked into the discounted renewal rate of $1,750 per year, even if the retail price increases later.

This adds real long-term value, especially considering the quality of institutional-grade analysis and the historical performance of Goggin’s recommendations.

>> Unlock Garrett Goggin’s Proven Gold System <<

Is Golden Portfolio 10X Worth It?

After spending time inside the service, it’s fair to say that Golden Portfolio 10X lives up to its promise.

Garrett Goggin’s blend of CFA-level financial analysis and decades of real-world experience gives this service a depth that’s hard to find elsewhere.

Every pick is supported by real data, on-the-ground research, and a clearly defined entry and exit strategy.

For readers looking for a straightforward path to profit from gold’s resurgence, this Golden Portfolio 10X review found that the program offers both education and actionable value.

I also appreciate how Goggin takes the time to show why each buy matters and how to position with discipline.

The ongoing updates, transparency in performance tracking, and clear communication make the learning curve manageable even for newcomers.

For people who want to build wealth through the coming decade’s gold cycle rather than chase short-term trades, Golden Portfolio 10X is definitely worth a closer look.

Sign up today to capitalize on these Golden Anomalies while the metal is hot.

Tags:

Tags: